Step into the vast and vibrant world of cryptocurrency, where a revolutionary earning method is capturing the imagination of both seasoned investors and curious newcomers. This emerging trend is not just a financial evolution; it’s a captivating journey into the future of investment.

So what is crypto staking, in its simplest form, is like planting a seed and watching it grow, except here, the seed is your cryptocurrency. It’s a process that not only promises potential rewards but also plays a pivotal role in maintaining the efficiency and security of a blockchain network.

This article is your gateway to understanding everything about what is staking crypto – from its foundational principles to the intricate dynamics of earning through this method. Whether you’re a crypto enthusiast or a beginner drawn to the digital currency world, our journey through the intricacies of staking will equip you with the knowledge to navigate this exciting landscape confidently.

Table of Contents

- What Is Staking?

- How Does Staking Work?

- Understanding Proof of Stake Validation

- Types of Staking Methods

- How to Start Staking: A Step-by-Step Guide

- Popular Cryptocurrencies for Staking: Diverse Options for Earning Rewards

- What Are The Benefits of Staking Crypto?

- How Profitable is Staking?

- Conclusion: Embracing the Future of Finance with Crypto Staking

- FAQs

What Is Staking?

Credits: Freepik

In the expansive world of digital currencies, newcomers often ask what is staking crypto. Simply put, staking in crypto is a novel approach to earning rewards and participating in the digital asset ecosystem. It’s a concept that combines the thrill of crypto investment with the stability of earning passive income. Let’s dive deeper into this intriguing process to demystify what staking in crypto means for beginners.

Also Read: A Guide to the Best GPUs for Mining Bitcoin, Ethereum, and More

Understanding the Basics of Staking in Crypto

Let’s understand the basics of “what is staking crypto.” Staking crypto refers to locking up a certain amount of your cryptocurrency to support the network’s infrastructure and validate transactions. This mechanism is a part of the Proof of Stake (PoS) model, used by several cryptocurrencies like Ethereum (after its Ethereum 2.0 update) and Cardano. Here’s a step-by-step explanation:

Locking Up Your Digital Assets: The first step in staking crypto is choosing an amount of your cryptocurrency and locking it up in a digital wallet. Locking or ‘staking’ your assets is akin to a financial commitment to the network.

Participation in Network Validation: Once your crypto is staked, it’s used by the blockchain network to validate transactions and maintain network security. Your staked crypto acts as a trust signal, indicating your vested interest in the network’s well-being.

Receiving Staking Rewards: In return for staking your assets, the network rewards you with additional cryptocurrency, known as staking rewards crypto. These rewards can vary based on factors like the amount staked, the network’s rules, and the overall staking duration.

Breaking Down the Concept Further

To understand what does staking crypto mean in a more relatable context, imagine staking as a savings account for your digital assets. Like a bank paying you interest for holding your money, a blockchain network rewards you for staking your cryptocurrency. This is the staking crypto meaning in its most basic form.

Staking Rewards: Crypto Earnings

While comprehending what is staking crypto, let’s discuss the rewards. Staking rewards crypto are the incentives you receive for your staking efforts. These rewards vary depending on the network’s rules and your stake amount. Some networks offer a fixed percentage, while others might have a more dynamic reward structure.

Staking as an Investment Strategy

In conclusion, what is staking crypto mean for an average investor? It means a chance to earn rewards while contributing to the stability and success of your preferred blockchain networks. It’s a blend of earning potential and technological participation, marking a unique cryptocurrency investment strategy.

Also read 5 Tips for Keeping Your Wallet BTC Secure and Protected

Also Read: Automated Staking Scripts and Tools for Server-based Nodes

How Does Staking Work?

After we have discussed what is staking crypto? Now let’s take a look at how it works. Staking in cryptocurrency might initially sound complex, but it’s a straightforward process once you break it down. Let’s explore how staking works in a way that’s easy to understand, even if you’re new to the crypto universe.

Step 1: Choosing a Cryptocurrency for Staking

The first step in staking is selecting a cryptocurrency with staking capabilities. Not all cryptocurrencies support staking, so choosing one that does is essential. Popular choices include Ethereum (after its Ethereum 2.0 update), Cardano, and Tezos.

Each cryptocurrency has its rules and rewards for staking, which should be considered before making your choice.

Step 2: Staking Your Cryptocurrency

Once you’ve chosen a suitable cryptocurrency, the next step is to stake it. This means you’ll commit some of your cryptocurrency holdings to the network. This is done through a crypto wallet or a staking platform.

Staking your crypto is like placing a deposit. By doing so, you’re supporting the network’s operations and security.

Step 3: The Role of Your Staked Crypto

After staking your crypto, it plays an essential role in the blockchain network. It’s used to validate transactions and maintain the overall health and security of the blockchain.

Think of your staked crypto as a security deposit that gives you the responsibility and authority to participate in validating transactions.

Step 4: Earning Rewards Through Staking

One of the main attractions of staking is earning rewards. These rewards are given for your service in supporting the blockchain network.

The rewards typically come in the form of additional cryptocurrency. The amount you earn can depend on how much you stake, for how long, and the specific blockchain rules you support.

Understanding the Validation Process

In certain blockchain networks, especially those using a Proof of Stake (PoS) system, your staked crypto might make you eligible to become a validator. Validators play a crucial role in approving and adding new transactions to the blockchain.

Being a validator isn’t just prestigious; it also usually comes with the benefit of earning more significant rewards. However, not every stalker becomes a validator. This often depends on the amount of crypto you stake and the specific blockchain’s rules.

The Role of Crypto Staking Platforms

Credits: Freepik

In an age where digital assets are gaining prominence, many ask: What is staking crypto, and how do crypto staking platforms play a crucial role? For many users, participating in staking directly can be technical and challenging. This is where crypto-staking platforms come in. These platforms simplify the process, allowing you to stake crypto through them.

Staking platforms handle the technical aspects of staking and might offer additional features like staking pools, where users can combine their stakes for better chances of earning rewards.

Staking as a Passive Income Stream

In essence, staking is a way to earn rewards by locking up your cryptocurrency for a period, contributing to the security and efficiency of a blockchain network. It’s a popular method for earning passive income in the crypto world, as it allows your digital assets to work for you, generating additional crypto over time.

Understanding Proof of Stake Validation

Credits: Freepik

While going into the depths of what is staking crypto let’s discuss the major role of PoS. Imagine a group of friends keeping track of who owes what to each other. Instead of everyone constantly checking and re-checking each other’s notes, they choose someone they trust to be the “record keeper.” This record keeper, called the “validator,” has the important job of ensuring everyone’s records are accurate and up-to-date.

In Proof-of-Stake validation, the “friends” are the users of a blockchain network, and the “validator” is someone who has “staked” their cryptocurrency. This means they’ve locked up some of their coins as a deposit to show they’re serious and trustworthy.

The Basics of Proof of Stake (PoS)

Proof of Stake emerges as a greener and more efficient alternative to the Proof of Work (PoW) mechanism. Unlike PoW, which demands extensive computational power for mining, PoS operates on the principle of validators staking their cryptocurrencies. This system is pivotal in networks like Ethereum 2.0 and Cardano, which rely on staked assets to validate transactions.

Validator’s Role in PoS

Validators in a PoS system verify transactions and add them to the blockchain. They are selected based on the amount of cryptocurrency they stake, although the duration of holding and random selection can also influence this process. Their role is crucial for maintaining the integrity and security of the blockchain.

Rewards and Responsibilities

Being a validator comes with rewards and responsibilities. Validators earn rewards for validating transactions, usually transaction fees or new coins. However, they also face risks. Incorrect or fraudulent validations can lead to ‘slashing,’ where a portion of their staked coins is lost. This penalty system ensures validators act in the best interest of the network.

The Impact of Staking on Network Security

The security of a PoS network is directly tied to the amount of staked cryptocurrency. A higher stake translates to increased network security, making it difficult for malicious actors to compromise the network.

Advantages of PoS Over PoW

PoS offers several advantages over its predecessor, PoW. It is significantly more energy-efficient and doesn’t require the same computational resources. Additionally, PoS allows for broader network participation, contributing to a more decentralized and inclusive blockchain environment.

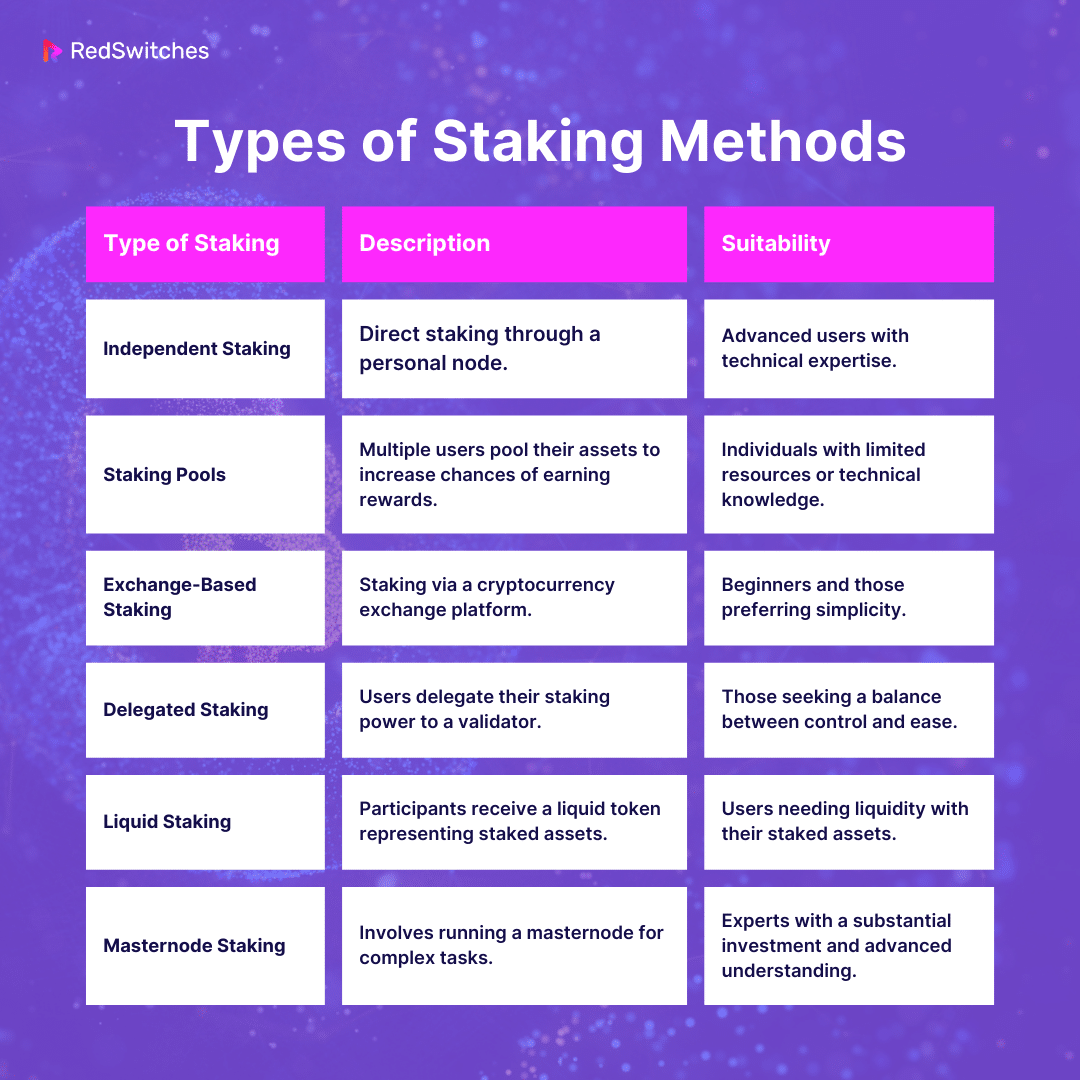

Types of Staking Methods

Staking in cryptocurrency can be approached in various ways, each with its unique characteristics and requirements. Understanding these different staking methods is crucial for anyone looking to delve into this aspect of the crypto world.

1. Independent Staking

What is staking crypto? This question is central when considering independent staking, a method allowing individuals to earn rewards directly through their crypto holdings. This is the most direct form of staking, where individuals stake their crypto assets independently.

- It requires setting up and maintaining a node, In crypto staking, a node is a computer that runs the blockchain software and participates in the consensus mechanism, validating new transactions and blocks.

- Independent staking is ideal for those with a significant amount of cryptocurrency and the technical know-how to manage a node.

- The main advantage here is complete control over the staking process, but it also comes with ensuring the node is always operational and secure.

2. Staking Pools

In the context of ‘what is staking crypto,’ staking pools emerge as a collective approach, pooling resources to increase reward potential and mitigate risks. Staking pools are a popular choice for those who don’t have the resources or desire to stake independently.

- In a staking pool, multiple participants combine their crypto holdings to increase their chances of being selected as validators and earning rewards.

- Rewards are shared among pool participants, usually in proportion to each one’s contribution.

- This method is less resource-intensive and offers a more hands-off approach to staking.

3. Exchange-Based Staking

Understanding ‘what is staking crypto’ leads us to explore staking on exchanges, a convenient option for many investors using popular cryptocurrency platforms. Many cryptocurrency exchanges offer staking services directly on their platforms.

- This method is user-friendly and accessible, even for beginners, as it removes the complexities of managing a node or joining a pool.

- Users simply need to hold their cryptocurrency on the exchange, and the exchange handles the rest.

- However, it’s essential to be mindful of the security and reliability of the exchange.

4. Delegated Staking

Understanding ‘what is staking crypto’ leads us to explore staking on exchanges, a convenient option for many investors using popular cryptocurrency platforms. Delegated staking involves delegating your staking power to a validator who runs a node.

- It’s a balance between independent staking and staking pools, offering a degree of control without needing to run a node personally.

- Delegators still earn rewards but also share a portion of these with the validator as a fee for their service.

- This method is suitable for those who prefer not to engage in the technicalities of node management.

5. Liquid Staking

The query ‘what is staking crypto’ unfolds further dimensions, like liquid staking, where investors can stake assets while retaining liquidity. Liquid staking is a relatively new concept where participants receive a token in exchange for their staked assets.

- These tokens represent the staked assets and can be traded or used, providing liquidity not usually available in traditional staking.

- This method addresses the issue of staked assets being locked and illiquid, offering more flexibility to the staker.

6. Masternode Staking

Masternode staking elevates the concept of ‘what is staking crypto’ to a more complex level, where participants not only stake their digital assets but also support the network infrastructure, offering enhanced rewards and responsibilities. Masternode staking is for more advanced users and requires a substantial amount of cryptocurrency to participate.

- A masternode is a special type of node that performs various tasks like transaction validation, participating in governance, and more.

- The rewards for running a masternode can be significant, but it also requires a higher level of commitment and understanding of the blockchain network.

Each staking method offers its own set of advantages and considerations. Whether it’s the control of independent staking, the simplicity of exchange-based staking, or the flexibility of liquid staking, understanding these methods can significantly enhance your approach to earning rewards through staking in the crypto world.

Also Read Crypto Industry Looking For New Options As Hetzner Bans Crypto Hosting

A concise summary table outlines the various types of staking methods:

How to Start Staking: A Step-by-Step Guide

Embarking on a journey to discover what is staking crypto? Can be both exciting and daunting, especially for beginners. This detailed guide is designed to walk you through each step of the process, ensuring you clearly understand how to start staking your cryptocurrency.

Step 1: Choose a Suitable Cryptocurrency

Research: Research which cryptocurrencies offer staking. Not all do, so it’s crucial to identify those that operate on a Proof of Stake (PoS) model.

Example: Ethereum (ETH), after its Ethereum 2.0 update, and Cardano (ADA) are popular choices for staking.

Considerations: Consider factors like the currency’s stability, historical performance, and community and developer support.

Step 2: Selecting the Right Wallet

Wallet Types: Choose a digital wallet that supports staking for your chosen cryptocurrency. Wallets can be software-based (like mobile or desktop apps) or hardware-based (like a physical device).

Security: Prioritize security in your wallet choice. Though more expensive, hardware wallets offer greater security for your staked assets.

Step 3: Deciding on a Staking Method

Direct Staking: If you have the technical know-how and a significant amount of cryptocurrency, you might consider setting up your own node for staking.

Staking Pools: For most beginners, joining a staking pool is a more feasible option. In a pool, you combine your stakes with others, increasing the chances of earning rewards.

Crypto Exchange Staking: Many cryptocurrency exchanges offer staking services, simplifying the process. It’s a convenient option, but be sure to research the exchange’s reputation and fees.

Step 4: Staking Your Cryptocurrency

Through a Pool or Exchange: Follow the specific instructions provided by your chosen staking pool or exchange to stake your cryptocurrency.

Keep Track: Regularly monitor your staking status and rewards. Stay informed about any changes in the staking terms or conditions.

Step 5: Managing and Utilizing Your Rewards

Reinvestment: You can reinvest your staking rewards to compound your earnings.

Diversification: Consider diversifying your staking investments across different cryptocurrencies to reduce risk.

Withdrawal: Understand the process and implications of withdrawing your staked assets and rewards. Some networks have a lock-up period or penalties for early withdrawal.

Maintaining Active Involvement

Stay Updated: Cryptocurrency markets and staking terms can change. Regularly update yourself on market trends and network updates.

Community Engagement: Joining forums and community discussions can provide valuable insights and help you make informed decisions.

Finding the depths of what is staking crypto? Starting with staking in cryptocurrency requires careful research and an understanding of various factors, from selecting the right currency and wallet to choosing a suitable staking method. By following these steps and staying informed, you can effectively embark on your staking journey, earning rewards while contributing to the security and efficiency of blockchain networks. Remember, each step in this guide is crucial for a successful staking experience.

Also, read What Is Cryptojacking: 11 Detection & Prevention Strategies

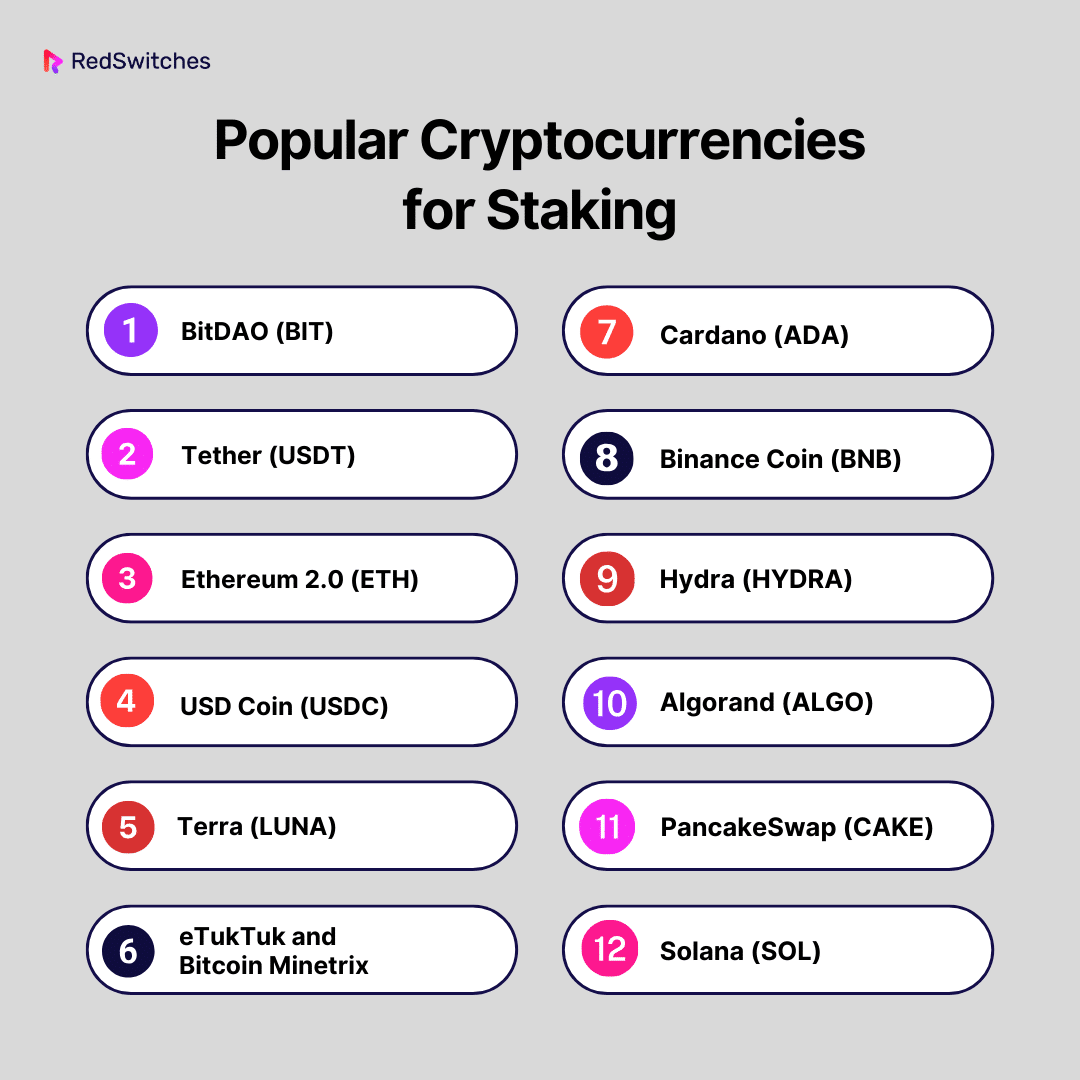

Popular Cryptocurrencies for Staking: Diverse Options for Earning Rewards

In the ever-evolving landscape of what is staking crypto?, staking has emerged as a lucrative avenue for earning passive income. With various coins offering unique benefits and rewards, it’s important to choose the right one for staking. Let’s explore some of the top cryptocurrencies popular for staking, each bringing something different.

1. BitDAO (BIT)

- Backed by Industry Giants: With support from influential figures like Peter Thiel, BitDAO is a major player in the decentralized finance (DeFi) space.

- Governance and Rewards: Holders of BIT tokens can actively participate in governance decisions and earn from a substantial prize pool, offering an average annual return of around 14.77%.

2. Tether (USDT)

- Stablecoin Advantage: USDT stands out as a stablecoin, making it a less volatile option for staking.

- Ease of Liquidity: Its vast trading volume enhances liquidity, allowing for easy conversion to other tokens. Bybit Earn flexible staking offers average annual rates of up to 3.5%, ideal for beginners seeking stability.

3. Ethereum 2.0 (ETH)

- Transition to PoS: Ethereum‘s shift from PoW to PoS has positioned it as a prime staking option.

- Substantial Staking: With a minimum of 32 ETH required for staking, it caters to more serious investors. Despite being in its early phase, Ethereum 2.0 promises a steady 2.5% APY( Annual Percentage Yield).

Credits: Unsplash

4. USD Coin (USDC)

- Audit Transparency: USDC is a stablecoin known for its monthly audits by Grant Thornton, LLP, ensuring transparency.

- Attractive Staking Rates: Offering up to 8.88% returns, USDC combines stability with transparency, making it a solid choice for risk-averse stakers.

5. Terra (LUNA)

- Innovative Stablecoin Creation: Terra’s approach to stablecoins, specifically TerraUSD (UST), is backed by LUNA coins.

- Profitable Swaps: The mechanism allows swapping UST below one USD for $1 of LUNA, creating a profitable opportunity. The annual staking reward for LUNA hovers around 12.10%.

6. eTukTuk and Bitcoin Minetrix

- High-Risk, High Reward: These projects offer extraordinary APYs (over 30,000% for eTukTuk and above 500% for Bitcoin Minetrix), but they come with high risks. Investors should proceed with caution due to their high reward promises.

7. Cardano (ADA)

- Smart Contract Capabilities: ADA, known for its efficient blockchain, offers flexible staking rewards without minimum requirements.

- Accessibility: It’s a user-friendly option available on multiple platforms like eToro, making it suitable for many investors.

Credits: Freepik

8. Binance Coin (BNB)

- Top Exchange Backing: BNB, backed by the Binance platform, offers an accessible staking option with no minimum stake required.

- Variable Returns: Annual returns range between 6–9% and potentially as high as 30%, depending on transaction fees.

9. Hydra (HYDRA)

- Unique Deflation-Inflation Model: Hydra combines deflationary and inflationary mechanics, offering protection against price degradation.

- Accessible Staking: With a minimum of 10 HYDRA required, it offers an initial high return rate of 60%, gradually decreasing to 20%.

10. Algorand (ALGO)

- Scalability and Instant Transactions: Algorand’s platform is known for its efficiency and low barrier to entry, with just a single ALGO coin required for staking.

- Diverse Staking Platforms: ALGO can be staked using various wallets, with 5–10% returns.

11. PancakeSwap (CAKE)

- Unique Staking Platform: As the leading platform on the Binance Smart Chain, PancakeSwap offers staking of CAKE coins.

- Flexibility in Rewards: Users can choose to earn additional CAKE or other cryptocurrencies, with annual returns ranging from 31–42%.

- User-Friendly Interface: Connecting a wallet to PancakeSwap is straightforward, and the platform’s lower transaction fees make it an attractive option for stakers.

12. Solana (SOL)

- Efficiency and Scalability: Known for its rapid transaction speeds and low fees, Solana offers an efficient staking experience.

- Validator Participation: While you can’t run your node, over 640 validators are available for delegating your stake, with annual returns of 7–11%.

Choosing the right cryptocurrency for staking, a key component of ‘what is staking crypto,’ involves balancing risk, reward, and personal investment strategy. The options are diverse, from the stable and transparent USDC and USDT to the high-reward potential of projects like eTukTuk and Bitcoin Minetrix.

Ethereum and Cardano offer more traditional staking opportunities, while innovative projects like Terra and Algorand bring unique mechanisms. Each cryptocurrency has its own features and potential rewards, making it crucial to research and understand your options before diving into staking.

Here’s a concise summary table for the 12 popular cryptocurrencies ideal for staking, highlighting their key features:

What Are The Benefits of Staking Crypto?

Staking cryptocurrency has become increasingly popular, offering a range of benefits for both the individual staker and the broader blockchain ecosystem.

While discussing in depth what is staking crypto? Here, we delve into the advantages of staking, providing an understanding of why many investors are drawn to this method.

Earning Passive Income

Regular Rewards: The most direct benefit of staking is the ability to earn rewards, often in the form of additional cryptocurrency. You can generate passive income by simply holding and staking your digital assets.

Attractive Returns: Compared to traditional savings accounts or other investment vehicles, staking can offer significantly higher returns, making it an appealing option for income generation.

Enhancing Network Security and Efficiency

Securing the Blockchain: Staking contributes to the security and stability of a blockchain network. The more individuals stake their crypto, the more secure the network becomes against attacks, as it becomes increasingly difficult for malicious actors to gain control.

Network Efficiency: In Proof of Stake systems, staking helps validate transactions and maintain the blockchain, leading to increased efficiency and faster transaction processing times.

Lower Environmental Impact

Eco-Friendly: Unlike Proof of Work (PoW) mining, which requires substantial energy consumption, staking is a more environmentally sustainable option. It requires significantly less computational power, aligning with growing concerns about the environmental impact of cryptocurrency mining.

Participation in Governance

Influence on Development: In some blockchain networks, stakers also gain the ability to participate in governance decisions. This might include voting on network upgrades or changes, allowing stakers to have a say in the platform’s future direction.

Easy Accessibility and Flexibility

User-Friendly: Many platforms make staking accessible and straightforward, even for beginners. With simple interfaces and easy-to-follow instructions, users can start staking without needing extensive technical knowledge.

Flexibility in Investment: Staking often allows for various levels of investment, accommodating both small and large holders. This flexibility makes it inclusive for a wide range of investors.

Staking offers a compelling mix of benefits, from earning passive income and influencing blockchain governance to contributing to network security and sustainability. Its growing popularity is a testament to these advantages, making it an attractive option for new and seasoned crypto investors.

Also Read High-Performance Computing: An Introduction, Overview, and Much More

Also Read: What Is the Minimum Lockup Period for Crypto Staking?

How Profitable is Staking?

Understanding the profitability while discussing what is staking crypto is crucial for investors exploring this avenue. While staking can indeed be lucrative, several factors influence its overall profitability. Let’s break down these factors to gauge the potential financial returns from staking.

Return on Investment (ROI)

Variable Yields: The profitability of staking varies significantly across different cryptocurrencies and platforms. Annual percentage yields (APY) can range from modest percentages in stablecoins to higher rates in more volatile assets.

Reward Calculations: Rewards are typically calculated based on the amount of crypto staked and the length of time it is held. Higher stakes and longer staking periods usually translate to more significant returns.

Market Volatility and Price Fluctuations

Impact on Earnings: The volatile nature of cryptocurrency markets means that the value of staking rewards can fluctuate widely. A drop in the price of the staked asset might offset a high staking yield.

Long-Term Perspective: For many investors, staking is a long-term strategy. While short-term market fluctuations can affect profitability, the focus is often on potential long-term gains.

Inflation and Coin Dilution

Network Inflation: Some cryptocurrencies introduce new coins into the system as staking rewards, which can lead to inflation and potential devaluation of the coin over time.

Dilution Effect: An increased supply of the staked coin can dilute its value. However, this needs to be balanced against the demand and utility of the cryptocurrency.

Operational Costs and Risks

Platform Fees: Some staking platforms charge fees, which can eat into your profits. It’s essential to consider these fees when calculating potential returns.

Risk of Slashing: In some PoS networks, stakers risk losing a portion of their stake (slashing) if the validator node they’re supporting acts maliciously or fails to meet network standards.

Staking Pools vs. Independent Staking

Pooling Resources: Joining a staking pool can offer more consistent returns, especially for smaller stakes, but may come with pool fees.

Independent Staking: Running a personal staking node might offer higher returns but requires more significant investment and technical expertise.

Various factors, including market dynamics, staking terms, and network policies, influence staking profitability in crypto. While it can offer attractive returns, especially compared to traditional savings vehicles, it’s essential to approach staking with a comprehensive understanding of these factors. As with any investment, the key to success in staking lies in thorough research, a clear strategy, and an awareness of the risks involved.

Credits: Unsplash

Conclusion: Embracing the Future of Finance with Crypto Staking

As we’ve navigated through the intricacies of “what is staking crypto” in the cryptocurrency world, it’s clear that this innovative approach to earning passive income is reshaping our understanding of investment and finance.

Staking not only offers the potential for lucrative returns but also plays a crucial role in enhancing the security and efficiency of blockchain networks. Whether you’re a seasoned investor or a newcomer to the crypto realm, staking presents an opportunity to be at the forefront of the digital finance revolution.

If you’re inspired to embark on your staking journey or expand your cryptocurrency endeavors, RedSwitches offers the perfect platform to elevate your experience. Our expertise in the digital landscape can empower you to make informed decisions and maximize your staking potential.

At RedSwitches, we’re committed to providing you with the knowledge, tools, and support you need to navigate the dynamic world of cryptocurrency staking. From choosing the right coins to understanding market trends, our guidance can help you make profitable and secure investment choices.

Embrace the future of finance by exploring your staking options with RedSwitches. Visit us today to discover how you can turn your crypto holdings into a steady income source while contributing to the growth and stability of the blockchain ecosystem.

FAQs

Q. What does staking crypto do?

Staking cryptocurrency involves locking up a certain amount of your digital currency in a network to support its operations and security. Doing so, you help validate transactions and maintain the blockchain’s integrity. You receive rewards for your contribution, usually through additional cryptocurrency. It’s crucial to many blockchains’ Proof of Stake (PoS) consensus mechanism.

Q. Is crypto staking worth it?

Whether staking is worth it depends on your investment goals, risk tolerance, and the specific cryptocurrency you choose to stake. Staking can offer higher returns than traditional savings, but it also comes with risks like market volatility and potential coin depreciation. For those who navigate these risks, staking can be a rewarding way to earn passive income.

Q. Is stake good for crypto?

Staking is beneficial for the crypto ecosystem as it enhances network security and efficiency. It can be a good strategy for individual investors to seek ways to earn passive income while contributing to the blockchain’s stability. However, it’s essential to research and understand the staking process and risks associated with the specific cryptocurrency.

Q. Which crypto staking is best?

The “best” crypto for staking varies based on individual preferences and market conditions. Popular choices include Ethereum (ETH), especially with its transition to Ethereum 2.0, Cardano (ADA), and Tezos (XTZ), known for their stable platforms and rewarding staking systems. It’s important to consider factors like potential returns, the stability of the currency, and your personal investment strategy.

Q. How much can I earn staking crypto?

The amount you can earn from staking crypto varies widely based on the cryptocurrency, the amount staked, the staking period, and the current market conditions. Some cryptos offer modest returns similar to a traditional savings account, while others can offer much higher rates. Researching and considering the potential rewards against the cryptocurrency market’s risks and volatility is essential.

Q. What is crypto staking?

Crypto staking is the process of actively participating in transaction validation similar to mining on a proof-of-stake (PoS) blockchain. Instead of miners, validators are responsible for processing transactions and creating new blocks in PoS systems.

Q. How does crypto staking work?

When a user decides to stake their cryptocurrency, they are essentially locking up a portion of their coins in a wallet to support the operations of a blockchain network. In return, they receive crypto rewards as an incentive for their participation.

Q. What are the risks of staking crypto?

The risks of staking crypto include potential economic losses due to network attacks, software vulnerabilities, or fluctuations in the value of the staked assets.

Q. How can I earn crypto rewards through staking?

By staking your crypto, you can earn rewards in the form of additional cryptocurrencies. These rewards are designed to incentivize users to participate in securing and validating the blockchain network.

Q. What is a staking program?

A staking program refers to a specific initiative or framework offered by blockchain networks or platforms that enables users to participate in staking cryptocurrencies and earn rewards for their contributions.

Q. What is the role of staking in a cryptocurrency portfolio?

Staking can be a beneficial addition to a cryptocurrency portfolio as it offers the opportunity to earn passive income through the accumulation of rewards from participating in blockchain network validation.

Q. How does staking let you earn more crypto?

Staking allows users to earn more crypto through the process of securing and validating transactions on a blockchain network, which in turn generates rewards in the form of additional cryptocurrencies.

Q. What are the types of crypto staking?

There are various types of crypto staking, including delegated staking, validator staking, and liquidity staking, each offering different methods for users to participate in the staking process and earn rewards.

Q. What are the benefits of staking for crypto investors?

Staking is a great option for crypto investors as it provides the opportunity to earn passive income, contribute to the security and stability of blockchain networks, and potentially grow their crypto holdings through reward accumulation.

Q. Is staking a good option for earning rewards on the crypto I hold?

Staking can be a great option for earning rewards on the crypto you hold, especially if you are looking for a way to actively engage with your investments and potentially increase your crypto holdings over time.