Key Takeaways

- Staking involves participating in a blockchain network by holding and locking up cryptocurrency.

- Staking works by users locking up their cryptocurrency to support the network and receive rewards.

- Different staking rewards include transaction fees, block, and inflation rewards.

- The benefits of staking rewards include passive income, enhanced network security, and participation in network governance.

- Factors influencing staking rewards include network participation, staking duration, and token value affect rewards.

- The easiest way to calculate staking regards is to use a staking rewards calculator.

Did you know that, according to stakingrewards.com, the global staking market cap reached $187.9 billion, with rewards totaling around $5.85 billion yearly in 2023? This number has increased ever since.

The increasing global staking market cap and reward amount show the growing attraction of staking rewards. Staking rewards act as an incentive for token holders to contribute to the network’s security and are also a way to make passive income via crypto investments.

This blog will take readers through the concept of staking rewards. It will also discuss how staking works and staking rewards’ benefits, types, and much more.

Table of Contents

- Key Takeaways

- What is Staking Rewards?

- How Does Staking Work?

- 7 Types of Staking Rewards

- Benefits of Staking Rewards

- Factors Influencing Staking Rewards

- How to Stake Your Crypto?

- How Do I Calculate Staking Rewards?

- Conclusion: Leveraging Staking Rewards with RedSwitches

- FAQs

What is Staking Rewards?

Credits: FreePik

Before we discuss staking rewards in crypto, it is important to go over what staking is.

Staking is the process of locking up a fixed quantity of cryptocurrency to preserve the function and safety of a blockchain network. In exchange, participants, or “stakers,” are compensated with rewards.

Staking rewards are incentives provided to cryptocurrency owners for engaging in network activities on a blockchain that implements a Proof of Stake (PoS) consensus method.

For instance, in the context of Polygon staking rewards, users who stake MATIC tokens may receive MATIC staking rewards as compensation. This approach improves network security and decentralization.

Staking rewards also help protect the network by incentivizing a large, distributed pool of validators. This makes the network more immune to attacks than networks secured by fewer validators, as in Proof of Work (PoW) systems. This method is also more energy-efficient than PoW, which demands immense electricity and computational power.

Do you want to learn about the types of crypto staking? Read our blog, ‘Guide To Types Of Crypto Staking: Risks, And Platforms 2024.’

How Does Staking Work?

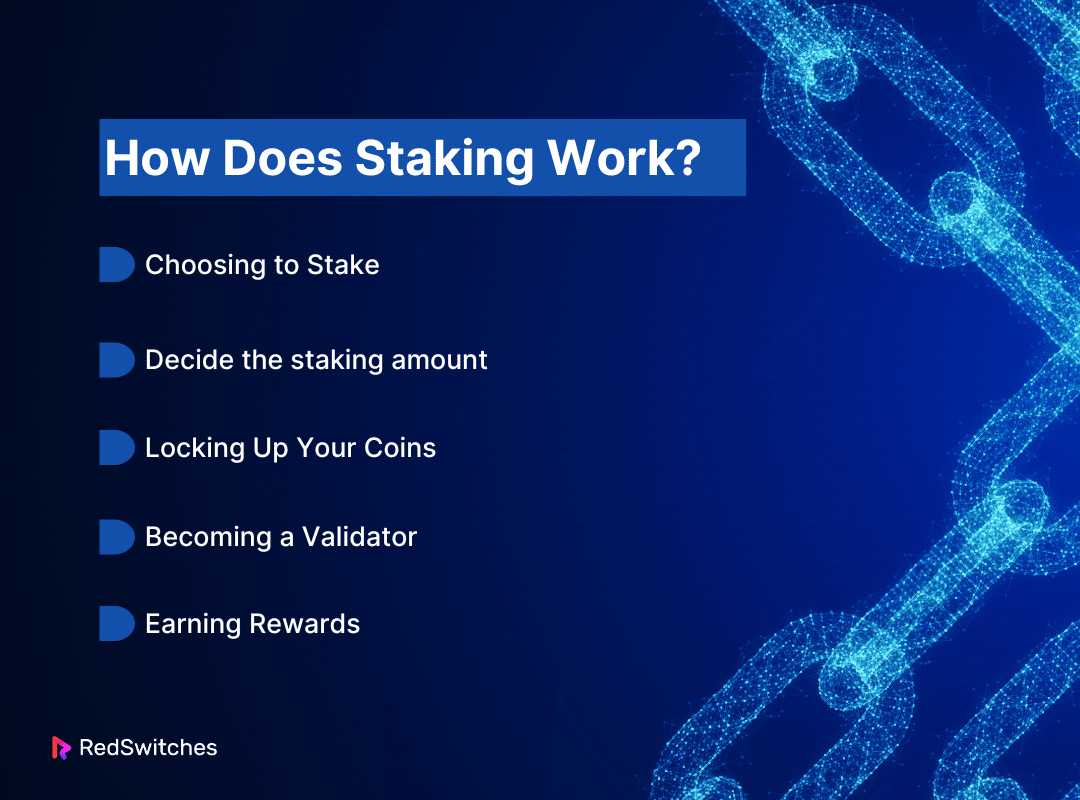

To further understand staking rewards, you must comprehend how staking works. Here is a rundown of the staking process:

- Choosing to Stake: The initial requirement for the staking process is to own a cryptocurrency using the PoS mechanism. You can choose from over 80 cryptocurrencies.

- Decide the staking amount: Next, decide how much cryptocurrency you want to stake. If you are a beginner, starting with a small amount and increasing as you gain experience is best.

- Locking Up Your Coins: You lock the coins in a cryptocurrency wallet after deciding the amount. This wallet should be linked to the blockchain to participate in the consensus process.

- Becoming a Validator: You can become a validator by staking your coins. Validators add new transactions to the blockchain. The possibility of being picked to validate transactions is often proportional to the cryptocurrency invested. The larger your stake, the better your chances of getting picked.

- Earning Rewards: As a validator, you get staking rewards once you verify and add new transactions to the blockchain. These incentives include coins or tokens added to your staked amount.

7 Types of Staking Rewards

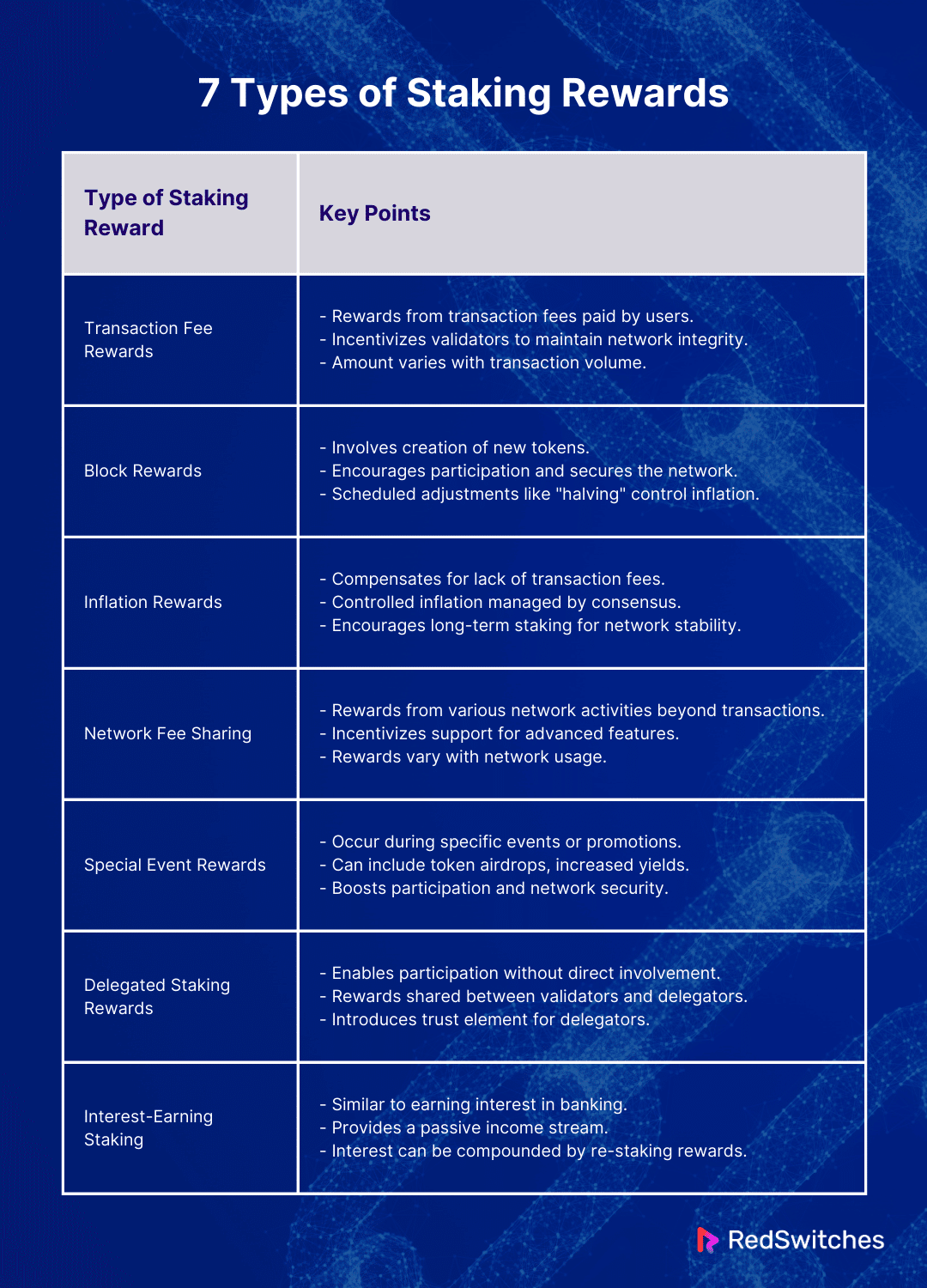

When starting in the crypto staking space, it is important to understand the different staling reward types. Here is a list of the 7 common staking reward types:

Transaction Fee Rewards

Credits: FreePik

Transaction fee rewards are one of the most direct rewards for blockchain networks. Every time a transaction is completed on a blockchain, the user contributes a fee to cover the computer energy necessary to process and confirm the transaction. In Proof of Stake (PoS) systems, transaction fees are collected and paid as incentives to validators who actively create and validate new blocks.

Key Points

- Reward Source: The rewards are generated directly from the cost paid by users conducting transactions.

- Incentive for Validators: Validators receive a part of transaction fees, incentivizing them to preserve network integrity and execute transactions effectively.

- Variable Rewards: The amount of these rewards can vary depending on the network’s transaction volume. Higher transaction volumes mean more fees and more rewards for stakers.

Block Rewards

Block rewards are another common form of incentive in PoS blockchain systems. These incentives comprise new tokens produced and granted to validators in return for their work in validating new blocks and sustaining the blockchain. Block payouts are similar to mining incentives in Proof of Work (PoW) systems but are tailored to the staking context of PoS networks.

Key Points

- Creation of New Tokens: Block rewards often involve creating additional tokens, which are given to validators as incentives.

- Motivation for Participation: These rewards motivate users to stake their tokens and become validators, improving the network’s security and robustness.

- Scheduled Adjustments: Many blockchains feature a preset timetable for changing block rewards over time. The reward size is often lowered occasionally, known as “halving,” to control inflation.

Inflation Rewards

Many PoS networks use inflation rewards to incentivize stakers and ensure network security without counting just on transaction fees. The intentional inflation of the network’s token supply produces these benefits. New tokens are produced and offered to compensate validators for their participation in the staking process.

Key Points

- Purpose of Inflation: The primary justification for inflation incentives is to compensate for the absence of transaction fees in some networks, ensuring that validators remain motivated to contribute to network security.

- Controlled Inflation: Unlike uncontrolled inflation, which may depreciate a currency, inflation in these networks is usually predetermined and regulated by consensus mechanisms. This enables the network to efficiently regulate the inflation rate, balancing it with growth and adoption rates to limit negative consequences.

- Encouragement of Long-Term Staking: By offering inflation incentives, networks motivate validators to stake their tokens for longer, thus boosting the blockchain’s stability.

Are you considering dedicated servers or the cloud for crypto staking? Read our blog, ‘Cloud Server Vs Dedicated Server For Staking: Differences,’ for informed decision-making.

Network Fee Sharing

Network fee sharing is a method that enables validators to get a part of different fees generated by network activities outside of basic transactions. These may include fees linked with smart contracts, data storage, token creation, and cross-chain operations. They are a way to reward participants for creating blocks, verifying transactions, and their complete contributions to the blockchain’s development.

Key Points

- Diverse Sources of Income: This incentive broadens stakeholder revenue sources beyond transaction processing and block validation. It links rewards to overall network use and its growth features.

- Incentivization of Advanced Features: By sharing fees from complicated activities like smart contracts or decentralized apps (dApps), validators are pressed to maintain and improve these features, which directly contribute to the functionality and appeal of the blockchain.

- Variable Reward Amounts: Similar to transaction fee rewards, network fee sharing can come with variable rewards. They reflect the current usage of the network’s advanced capabilities. Validators can enjoy increased rewards during high usage periods, aligning their incentives with the network’s activity and health.

Special Event Rewards

Credits: FreePik

Special event rewards in blockchain staking can be described as bonus incentives that appear during certain occasions or as a feature of promotional activities. These events are created to foster stakeholder participation and can greatly improve the appeal of staking as an investment option.

Key Features

- Occasional and Promotional: Special event rewards are rare. They usually occur during major upgrades, launches, or marketing efforts. The network or community carefully plans these events to boost participation and network exposure.

- Diverse Forms: The rewards from these events can take varying forms. They may include airdrops of new tokens to existing stakeholders, higher staking yields, or temporary drops in staking requirements. The nature of the reward usually depends on the event’s goals.

- Boost Participation: By offering more incentives, these events can attract new users to the network and motivate existing participants to raise their stakes. This increased activity helps secure the network and grow the overall token value due to elevated demand.

Delegated Staking Rewards

Delegated staking incentives are part of a system that allows token owners who do not want to engage directly in the staking process to turn over their holdings to a validator. This delegation does not transfer ownership of the tokens but allows validators to stake larger amounts, boosting their chances of being rewarded.

Key Features

- Accessibility: Delegated staking enables participation for people who lack the funding or technical skills to manage a full node. It makes staking incentives more accessible to casual users.

- Shared Rewards: The incentives made from this improved staking capability are generally shared between the validator and the delegators. The exact distribution ratio can change based on the network’s rules or the rules established by the validator.

- Risk and Trust: While delegated staking opens up opportunities for those with fewer tokens or less technical skill, it also introduces a trust element. Delegators must choose their validators carefully, as they depend on the validator’s reliability and honesty to get their share of the rewards and ensure their staked tokens are secure.

Interest-Earning Staking

Interest-earning staking is like earning interest in an ordinary banking environment but in the context of blockchain technology. Stakeholders store their cryptocurrency in a staking pool or wallet and receive interest over time according to the amount staked. This staking reward appeals to people seeking a passive return on investment.

Key Points

- Passive Income Generation: Interest-earning staking is a fantastic source of passive income for investors. Participants may receive regular returns by keeping and locking up their tokens in the system. This makes it an appealing component of long-term investment strategy.

- Variability Based on Network Conditions: The interest rate on staked tokens is not set and can fluctuate dramatically based on numerous elements inherent in the blockchain’s construction. These considerations include the total number of tokens staked by all players and the general demand for network bandwidth or computing capacity.

- Compounding Benefits: One of the most appealing elements of interest-earning staking is the prospect of compounding earnings. Stakeholders are free to re-stake their earned rewards, which increases their initial staking amount and can considerably boost future returns. This compounding effect lets their holdings expand rapidly over time.

Also Read: What Is Staking Crypto? How To Earn Crypto Rewards.

Benefits of Staking Rewards

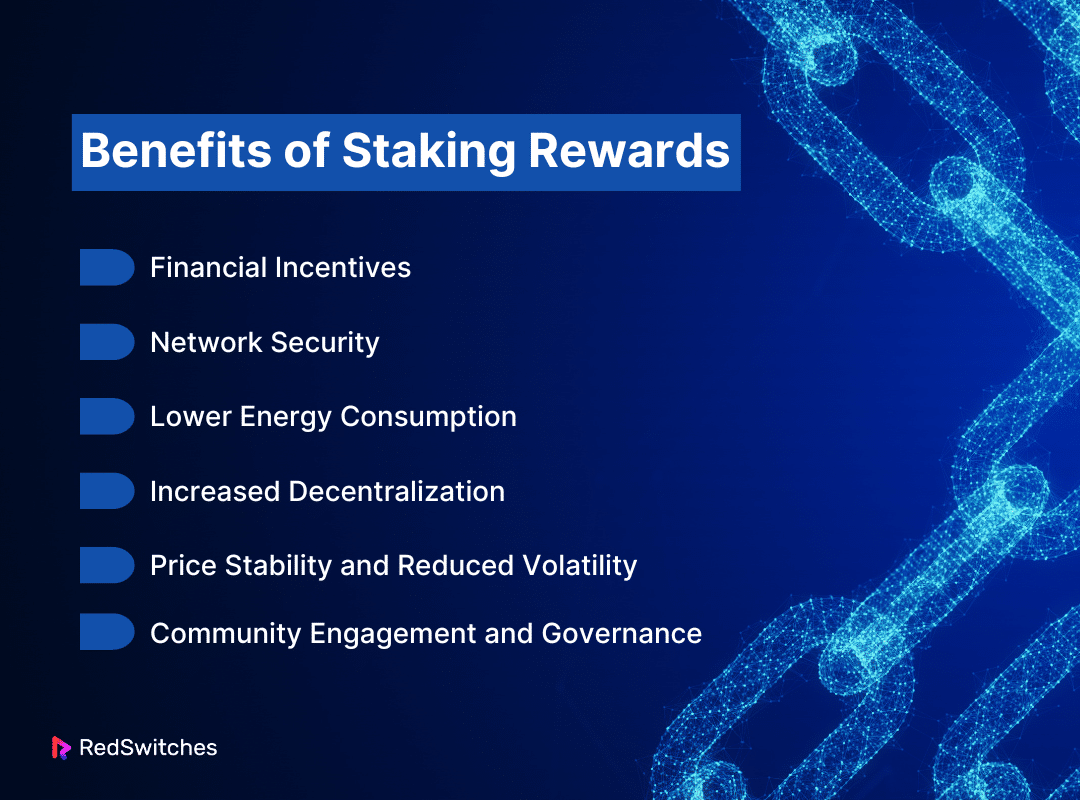

Staking rewards offer countless benefits that often go beyond only financial gains. Here are some benefits of staking rewards:

Financial Incentives

The most apparent advantage of staking rewards is monetary. Participants who stake their cryptocurrency in the network can generate passive income through transaction fees, block rewards, and other blockchain-based incentives. This can be especially appealing in a low-interest economic climate since it allows you to generate a return on assets that would otherwise be sitting idle or depreciating in value.

Network Security

Staking incentives contribute to network security. In PoS systems, the more digital currency members stake, the more secure the network is. Stakers contribute to validating transactions and creating new blocks, which strengthens the blockchain’s resilience against attacks. The benefits encourage more holders to stake their coins, therefore decentralizing and improving the network’s defensive mechanism.

Lower Energy Consumption

PoS blockchains mostly use less power than Proof of Work (PoW) systems. PoW requires notable computational energy and electricity to mine new blocks. PoS depends on staking, which is much less resource-intensive. By providing rewards for staking instead of mining, PoS systems encourage energy-efficient network maintenance, addressing the rising environmental sustainability concerns.

Increased Decentralization

Staking rewards can cause greater decentralization. By incentivizing more participants to lock their tokens and contribute to network operations, the control over the network spreads across a broader user base. This dispersal of power helps keep any single entity from gaining excess influence, improving the network’s resilience and fairness.

Price Stability and Reduced Volatility

When participants stake their digital currencies, they usually lock their holdings for a specific time. This lowers the circulating supply of the token, which can cause price stability and lower volatility. As more tokens are staked, the liquidity drops. This may reduce price swings caused by big, speculative trades.

Community Engagement and Governance

In many PoS systems, staking involves making governance choices, including voting on protocol updates or modifications. Staking rewards enable token holders to get more involved in community growth by connecting their financial motivations with the network’s long-term viability. This active engagement generates a more engaged and dedicated community, which is essential for the decentralized decision-making process seen in blockchain ecosystems.

Wondering how long crypto staking takes? Read our blog, ‘Crypto Rewards: How Long Does Crypto Staking Take?’, for answers.

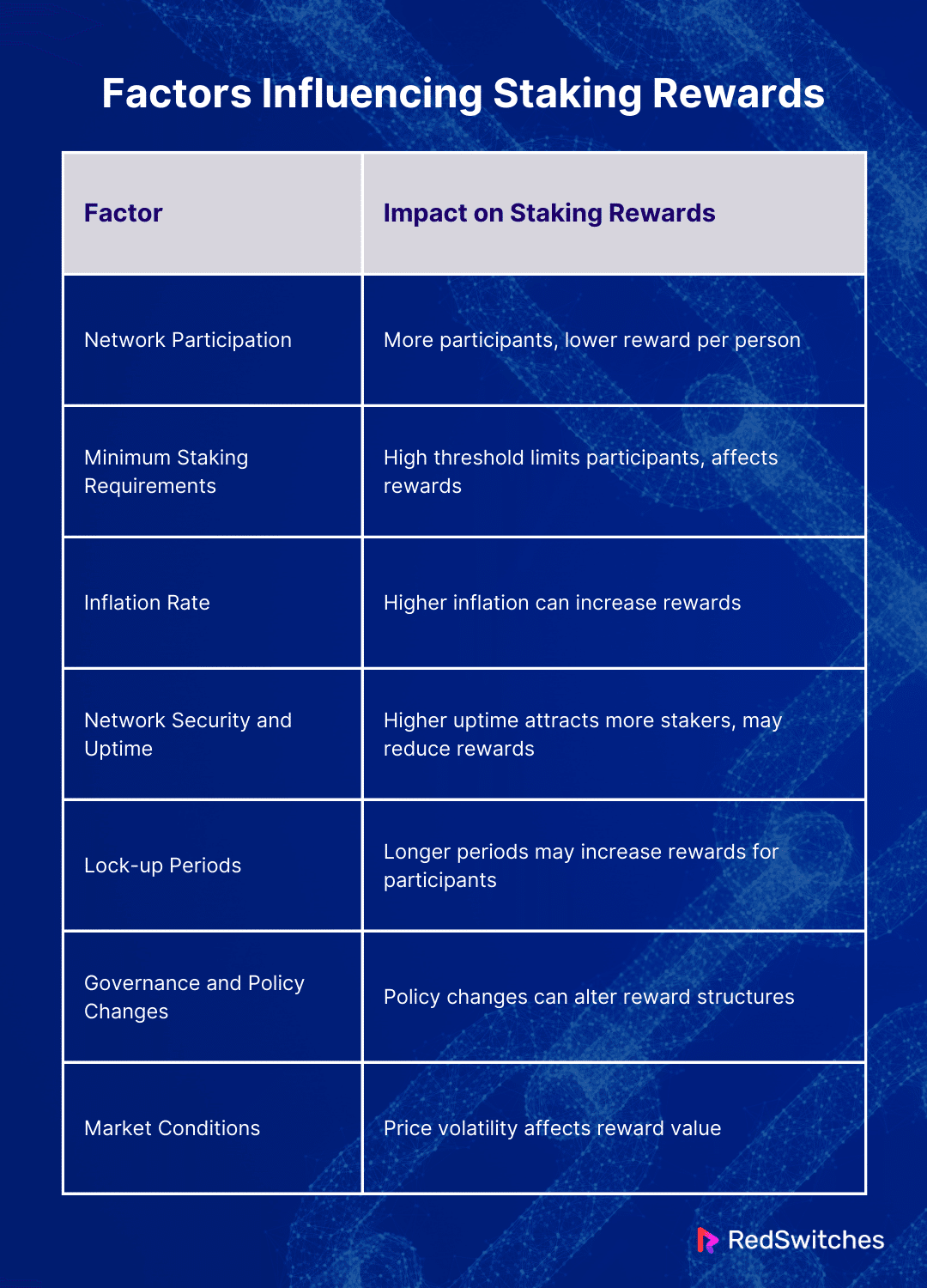

Factors Influencing Staking Rewards

Staking rewards are often seen as a simple way to earn. However, they are influenced by several factors that can greatly impact their profitability. Understanding these elements is important for any investor wishing to maximize their staking returns. Here are some of the factors that influence staking rewards:

Network Participation

The number of participants staking their tokens on a network can greatly impact individual rewards. Usually, as more individuals stake their tokens, the incentive per participant drops. This is because the fixed reward pool is divided among more stakeholders.

Fewer stakers mean an increased reward per participant, although this can often signal a less safe network.

Minimum Staking Requirements

Some blockchains require a minimum quantity of tokens to be staked to participate in the reward system. This threshold can impact investor accessibility and the general distribution of staking rewards. Higher thresholds can limit potential stakers, while lower thresholds can increase participation and reduce rewards per staker.

Inflation Rate

The inflation rate of a cryptocurrency can also impact staking rewards. A high inflation rate can cause more generous rewards in networks that generate new coins as staking rewards. However, this may also reduce the currency’s value with time counterbalanced by demand growth.

Network Security and Uptime

Credits: FreePik

Investors usually stake with nodes or services that provide more uptime to boost their reward potential. Networks that maintain strong security and consistent performance can attract more stakers, lowering individual rewards but delivering a more secure investment environment.

Lock-up Periods

Many networks demand that staked tokens be locked for a predetermined time. Longer lock-up periods can discourage participation from those unable or unwilling to commit their assets for extended periods potentially resulting in increased rewards for those who do stake their tokens.

Governance and Policy Changes

Decisions made by token holders and network governance can influence staking rewards. Changes in staking policies or reward distributions require active participation and understanding from investors to ensure that their staking strategy remains profitable under new conditions.

Market Conditions

Staking benefits are also heavily influenced by general market conditions and token prices. High volatility can affect the dollar-equivalent value of staking rewards. A rising token price might increase the real value of rewards, whereas a falling price reduces them.

Also Read: Infrastructure Requirements For Crypto Staking In 2024.

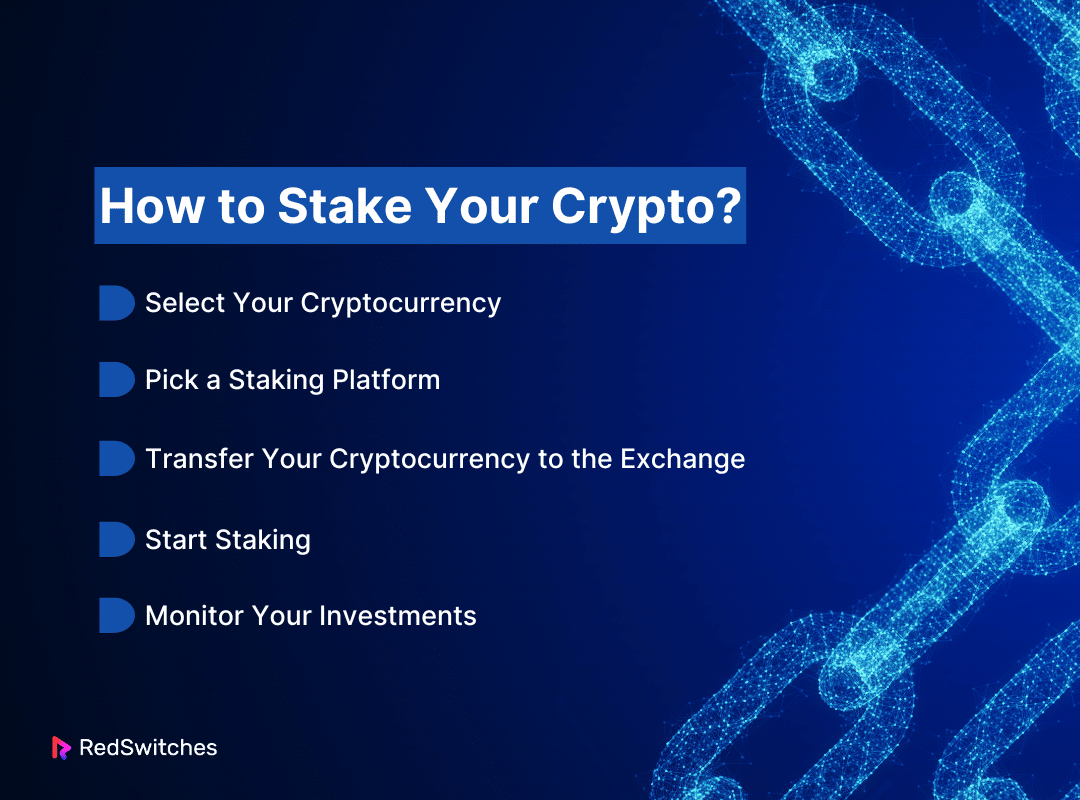

How to Stake Your Crypto?

Staking your cryptocurrency can be a great way to create a passive income stream. Here’s a simple guide on how to get started with staking:

Step 1: Select Your Cryptocurrency

The initial step in staking crypto is determining which currency you wish to stake. Due to their growth potential, Ethereum and Cardano are some of the most favored staking options. Both digital currencies use a consensus mechanism known as Proof of Stake (PoS), making them best for staking.

Step 2: Pick a Staking Platform

Once you’ve selected the digital currency you wish to stake, the next step is to choose a platform to conduct the staking. Renowned crypto exchanges like Coinbase and Kraken offer staking services directly via their platforms. Users can conveniently manage their investments. These exchanges offer a safe environment and simplify the staking process for both experienced users and beginners.

Step 3: Transfer Your Cryptocurrency to the Exchange

To stake your crypto, you need to transfer it to your chosen crypto exchange. Ensure that your chosen digital currency is stored in a wallet supported by the exchange. Both Coinbase and Kraken provide user-friendly instructions on how to deposit cryptocurrencies into your exchange wallet.

Step 4: Start Staking

You’re ready to begin staking with your digital currency in your exchange wallet. On platforms like Kraken and Coinbase, the process usually involves:

- Go to the staking section of the app or site.

- Pick the digital currency you want to stake.

- Following the on-screen instructions specify your desired amount for staking.

The interface mostly offers estimated returns and relevant information about the minimum staking amounts and time obligations.

Step 5: Monitor Your Investments

After you have staked your cryptocurrency, you must monitor your investments. Most crypto-staking platforms offer tools that help track the performance of your staked assets. Regularly reviewing your staking returns and the blockchain network’s health can empower you to make informed decisions about raising your stake, withdrawing a portion of it, or reallocating it somewhere else.

Key Considerations

- Lock-up Periods: Some digital currencies have a lock-up period during which you cannot withdraw your staked assets. This is why you must read the terms thoroughly before you commit.

- Network Fees: Transferring and staking digital currencies can involve fees varying based on the blockchain and network congestion.

- Security: Use advanced security practices, including enabling two-factor authentication on your digital currency exchange accounts.

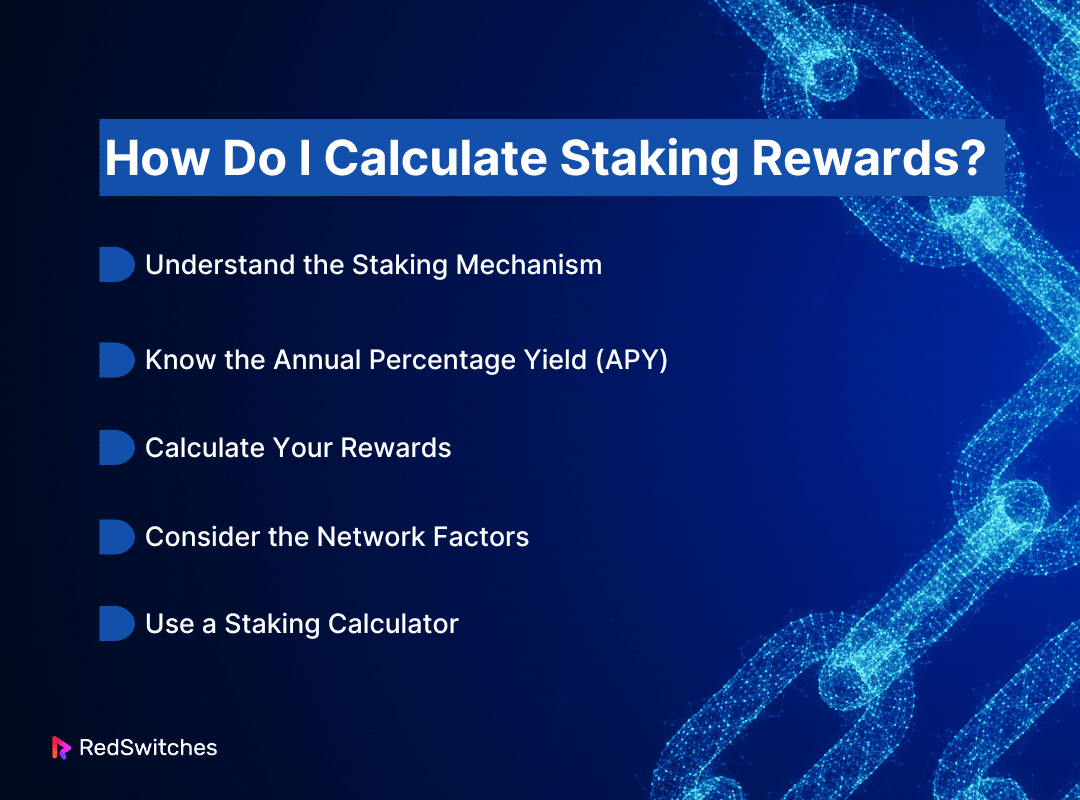

How Do I Calculate Staking Rewards?

So, how do I calculate staking rewards? This is a common query most individuals new to crypto staking may ask. Calculating staking rewards can vary greatly depending on the blockchain protocol you use. Here’s a general guide to help understand the process:

Understand the Staking Mechanism

Blockchains use consensus mechanisms, like (PoS) Proof of Stake, (DPoS) Delegated Proof of Stake, etc. Each has its own rules regarding how incentives are divided among those who stake their digital currencies.

Know the Annual Percentage Yield (APY)

Most staking platforms will list an expected Annual Percentage Yield (APY). This percentage shows the portion of rewards you can hope to make on your staked assets annually.

Calculate Your Rewards

You can use the following formula to calculate your rewards:

Staking Rewards = (Amount Staked x APY ÷ 100) x (Number of Days Staked ÷ 365)

Example: If you staked $9000 at an APY of 10% for 90 days, your calculation would be:

Staking Rewards = (9000 x 10 ÷ 100) x (90 ÷ 365) = 221.918.

So, you could make around $221.91 for 3 months of staking.

Consider the Network Factors

The actual incentive can also be impacted by numerous factors, including:

- Total staked: More staked funds typically mean reduced rewards for every staker as the incentive pool is split among more parties.

- Network inflation: Some networks improve the supply of their currency as part of staking rewards. This can impact the value of the rewards.

- Lock-up periods and penalties: Some networks demand funds to be locked for a specific period and may penalize withdrawals before this duration is up.

Use a Staking Calculator

Many blockchain projects and staking service providers include online calculators that automatically calculate rewards based on current network circumstances, reward rates, and other criteria. These tools can be quite useful for obtaining a more accurate estimate.

Also Read: Ultimate Guide To Node Staking On Dedicated Servers.

Conclusion: Leveraging Staking Rewards with RedSwitches

A trustworthy and robust infrastructure is important to maximize the advantages of staking rewards. RedSwitches provides top-tier solutions with affordable dedicated servers to ensure the best performance and optimal security for crypto activities.

With our dedicated servers, you can efficiently manage your staking operations without worrying about downtime or security breaches. So what are you waiting for? Visit our website today to find the best dedicated server that fits your needs and takes your crypto investments to the next level.

FAQs

Q. What does stake rewards mean?

Staking rewards are the monetary benefits cryptocurrency holders get for putting their funds in a wallet to support the functions of a blockchain network. These rewards can come in varying forms, like additional coins or tokens. They are provided in exchange for the protection and transaction processing services the staker delivers.

Q. Is crypto staking worth it?

Crypto staking may be worth it if you wish to make passive income on your cryptocurrency holdings. It offers rewards and adds to the safety and efficiency of the blockchain. However, it also comes with risks. These include market volatility and the risk of losing some or all of your staked coins if the network is hacked.

Q. What is staking, and how does it work?

Staking is a procedure used in several cryptocurrencies as an aspect of the Proof of Stake (PoS) consensus mechanism. Participants must stake their financial assets in a wallet to be chosen randomly by the network to validate transactions, produce new blocks, and maintain the blockchain.

Q. How does staking reward work?

Staking reward is earned by staking a certain amount of crypto assets in a staking pool or through a staking service. The reward rate can vary based on factors such as the duration of the staking period and the performance of the staking provider.

Q. What are the benefits of crypto staking?

Crypto staking offers the opportunity to earn passive income through staking rewards. It also helps strengthen the blockchain network by incentivizing users to validate transactions.

Q. How can I start staking my crypto?

To start staking, you typically need a crypto wallet supporting staking. You also must be eligible for staking based on the requirements of the staking platform or staking pool you choose.

Q. What cryptocurrencies can I stake?

You can stake cryptocurrencies, like Ethereum, Cardano, and others, on staking platforms like Coinbase and Kraken.

Q. Is staking a secure way to earn rewards?

Staking is generally considered a secure way to earn rewards as it involves contributing to the security and efficiency of the blockchain network while earning staking rewards in return.

Q. Is staking similar to liquid staking?

Liquid staking refers to the process of staking your crypto assets while still being able to trade or transfer them. While there are similarities, staking, and liquid staking have slightly different mechanisms and benefits.

Q. Can I stake cryptocurrency on any exchange?

Not all crypto exchanges offer staking services. You must ensure that the exchange you choose supports staking for the cryptocurrency you want to stake.

Q. Which cryptocurrency has the best staking rewards?

Currently, as per experts, Cosmos and Osmosis have some of the highest staking rewards. However, since the digital currency space is constantly changing, the digital currencies offering the best staking rewards are constantly changing.