Key Takeaways

- Automated staking scripts make participating in blockchain networks easier by handling the staking process for users.

- These scripts enable beginners and experienced investors to earn passive income through staking without constant manual management.

- Platforms like Allnodes and MyCointainer offer user-friendly interfaces and automated staking, simplifying the staking experience.

- Dedicated servers enhance automated staking scripts’ performance, security, and reliability, offering advantages like scalability and control.

- The Solana blockchain example demonstrates the massive scale of staking and the need for efficient management tools.

- Staking rewards are subject to various factors, including market volatility, network health, and validator behavior.

- Despite automation, choosing a reliable staking platform and understanding the associated risks are crucial for participants.

- Platforms like Binance and Nexo simplify staking for cryptocurrencies like Ethereum, offering features like Auto-Staking and Smart Staking.

- Risks in automated staking include market volatility, technical errors, and regulatory uncertainties, highlighting the need for careful platform selection.

- As blockchain technology evolves, the role and importance of automated staking scripts and dedicated servers in decentralized finance are expected to grow.

In the evolving world of blockchain technology, staking has emerged as a key player. It’s a way to earn rewards by supporting a network. But, as the stakes get higher, the process becomes more complex. This is where automated staking scripts and tools come in. They make it easier for those running server-based nodes to participate in staking.

One standout example is the Solana blockchain. Here, about 70% of all SOL tokens are staked. That’s over $9 billion! This shows the massive scale of staking and the need for reliable management tools.

Our article dives into the importance of these tools. We’ll explore how they work and why they’re essential for server-based nodes. With the right setup, anyone can join the staking community. Whether you’re a seasoned pro or just starting, this guide is for you. Let’s set out on this journey to financial empowerment and blockchain support together.

Table of Contents

- Key Takeaways

- What Is Crypto Staking?

- What is Automated Crypto Staking?

- Benefits of Automated Crypto Staking

- Potential Risks Involved in Automated Crypto Staking

- What Are Automated Staking Scripts?

- Examples of Automated Staking Scripts

- The Value of Automated Staking Scripts

- Hypothetical Examples of Automated Staking Scripts

- The Role of Automated Staking Scripts in Managing Server-based Nodes

- Streamlining Operations

- Enhancing Efficiency and Accuracy

- Maximizing Rewards

- Improving Security

- Scaling Operations

- Broad Applications

- The Importance of Oversight

- Tools for Server-Based Staking

- Key Considerations for Automated Staking

- Benefits of Using Dedicated Servers for Automated Staking Scripts

- Conclusion

- FAQs

What Is Crypto Staking?

Credits: Freepik

Crypto staking is a fascinating aspect of blockchain technology. It lets people who own cryptocurrency use it to help run a blockchain network. It’s like having a savings account but with digital currency. When you stake your crypto, you lock it up for a while. This helps the network operate smoothly and securely. In return for your help, you get more cryptocurrency. It’s a way to earn rewards without having to sell your crypto.

The process is part of what we call “proof of stake.” This method ensures that all transactions on the blockchain are legitimate. People who want to help validate new transactions have to stake a certain amount of their cryptocurrency—think of it as a deposit. They earn rewards if they do their job well and validate transactions correctly. But they could lose some of their staked crypto if they make mistakes. This system encourages everyone to act honestly and carefully.

What is Automated Crypto Staking?

Credits: Freepik

Automated crypto staking is a cutting-edge method that allows cryptocurrency owners to participate in blockchain networks easily. This process uses automated staking scripts and tools to stake cryptocurrencies on behalf of the user, meaning you don’t have to do the heavy lifting. Once you set your preferences, such as which cryptocurrency to stake and for how long, the automated system takes over. It handles everything from staking your assets to distributing your rewards.

This automation is a game-changer. It makes staking accessible to more people, regardless of their technical know-how. Whether you’re a seasoned investor or new to the crypto world, automated staking scripts make it simple to earn rewards and contribute to the security and efficiency of blockchain networks.

Benefits of Automated Crypto Staking

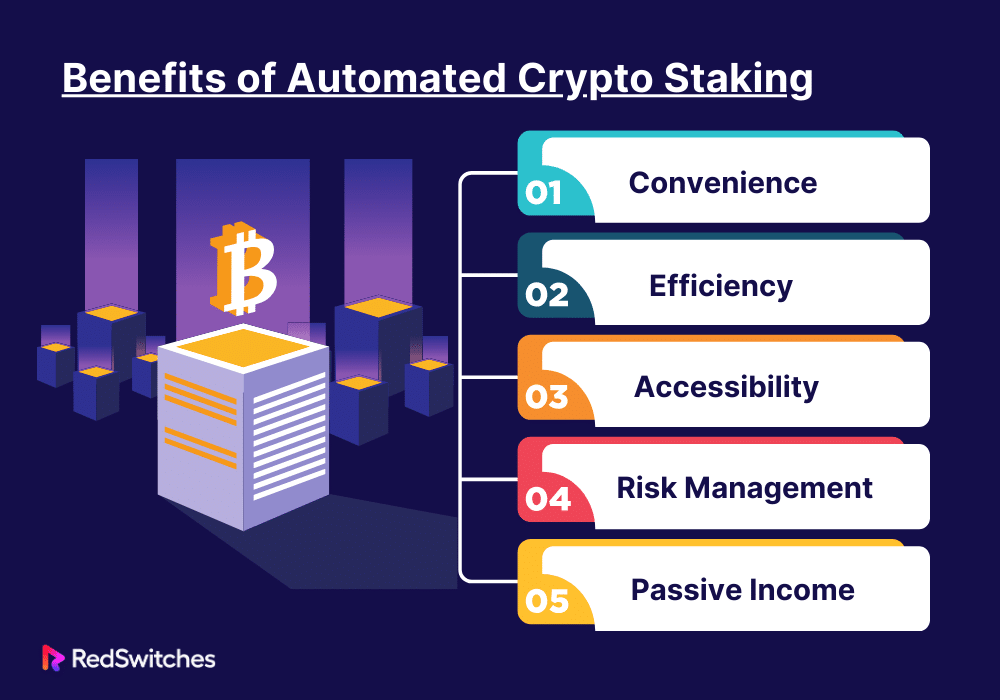

Automated crypto staking brings several advantages, making it an attractive option for crypto holders looking to maximize their investment potential.

Convenience

The convenience of automated staking cannot be overstated. It removes the need for constant monitoring and manual management of your staked assets. This means you can earn rewards passively without adjusting your stakes regularly.

Efficiency

With automated staking, you set your preferences once, and the system handles the rest. This efficiency saves you time and effort, making staking a hassle-free experience. It’s perfect for those who want to participate in staking but have other commitments.

Accessibility

Automated staking scripts open up staking to a broader audience. You don’t need in-depth knowledge or technical skills to start. You can easily begin staking through automated platforms if you can operate a digital wallet or navigate a crypto exchange.

Risk Management

These platforms often come with built-in features to help manage risks, such as fluctuations in cryptocurrency value or potential penalties. These tools provide peace of mind, allowing you to stake your assets, knowing there are measures to protect your investment.

Passive Income

Like traditional staking, automated crypto staking offers the opportunity to earn passive income. By participating in the transaction validation process, you can earn rewards in the form of additional cryptocurrency.

Also Read 5 Tips for Keeping Your Wallet BTC Secure and Protected

Potential Risks Involved in Automated Crypto Staking

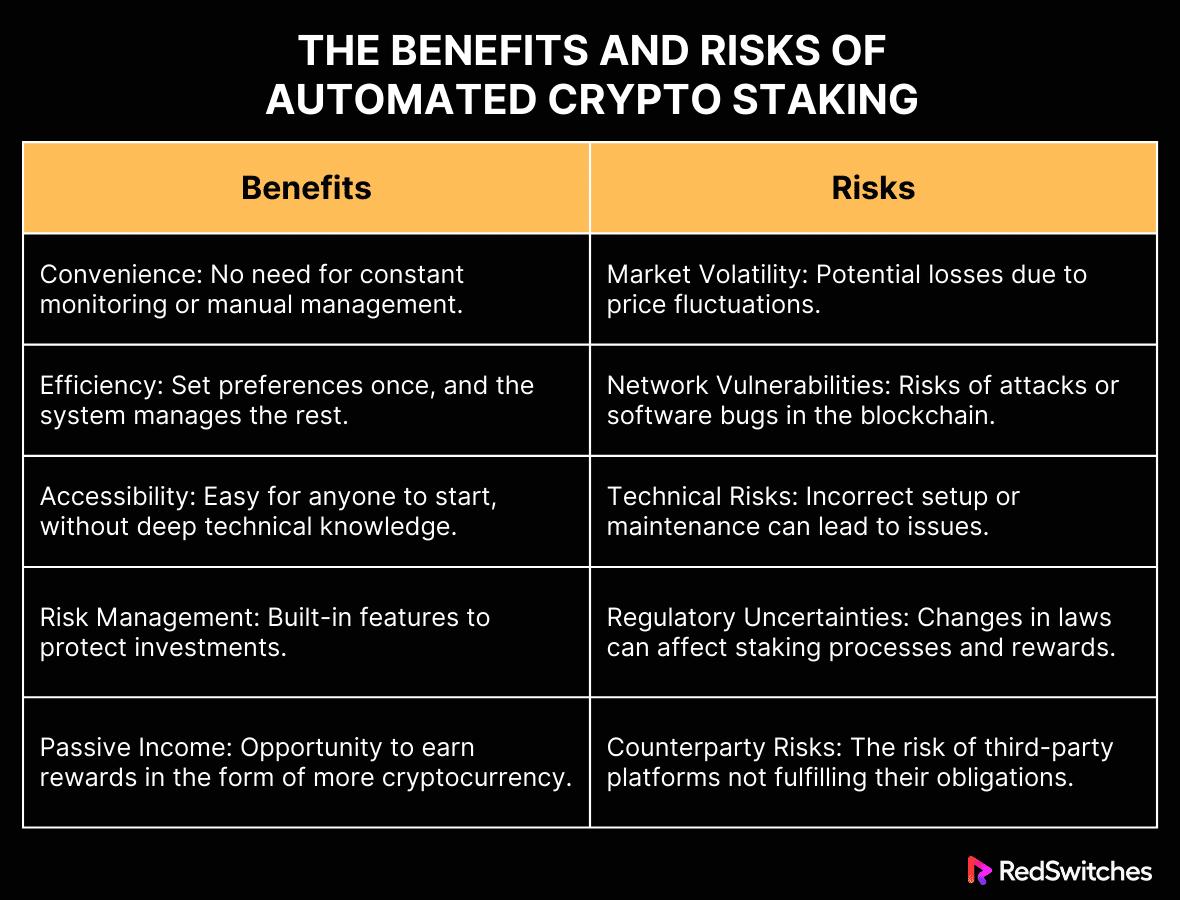

While automated crypto staking offers many benefits, it’s also important to know the potential risks involved.

Market Volatility

The value of cryptocurrencies can change rapidly. If the price of the staked cryptocurrency drops significantly during the staking period, you might end up with a loss. It’s vital to consider market trends and price volatility before staking.

Network Vulnerabilities

Participating in a blockchain’s consensus mechanism exposes you to network risks. These can range from attacks by malicious entities to software bugs. Researching and understanding the security measures of the blockchain you’re staking on is crucial.

Technical Risks

Automated staking requires a certain level of technical setup and maintenance. Incorrect configurations or failing to update your system can lead to downtime or network penalties.

Regulatory Uncertainties

The regulatory environment for cryptocurrencies is still evolving. Regulation changes can affect staking rewards or processes, so staying informed about legal developments in your region is essential.

Counterparty Risks

When using third-party platforms for automated staking, there’s a risk that these platforms may not fulfill their obligations. Choosing reputable and secure platforms is critical to mitigate this risk.

In summary, automated crypto staking simplifies and democratizes the process, making it accessible and beneficial for many crypto holders. However, it’s important to approach automated staking with an understanding of both its advantages and the risks involved. Doing so lets you make informed decisions and maximize your potential rewards while minimizing risks.

Also read Metered or Unmetered: Dedicated Server Bandwidth Needs

Here’s a comparison table highlighting the benefits and risks of automated crypto staking:

What Are Automated Staking Scripts?

Credits: Freepik

Automated staking scripts are powerful tools in the world of cryptocurrency. They automate the process of staking or locking up cryptocurrencies to support a blockchain network. These scripts operate without needing you to do things manually, which means you can earn rewards, like more cryptocurrency, without constantly monitoring your investments.

These tools can be written in various programming languages, including Python and JavaScript. They are customizable to meet different staking needs. Whether you’re taking on a small scale or managing large amounts of cryptocurrency, automated staking scripts can simplify the process.

Examples of Automated Staking Scripts

Let’s look at specific examples of automated staking scripts used in the cryptocurrency ecosystem.

Stake Auto-Compounder by Fetch.ai

One notable example is the Stake Auto-Compounder developed by Fetch.ai. This script is designed for users of the Fetch.ai blockchain. It automates staking tokens, claiming rewards, and then re-delegating those rewards back to a validator. This process is known as compounding, a way to maximize earnings over time. The script is based on CosmPy, a Python library, making it accessible for those familiar with Python.

Eris Protocol Liquid Staking Scripts

Liquid staking offers an alternative. It lets you stake your cryptocurrencies and receive a “derivative token” in return. This token represents your stake in the network and can often be used in other ways:

Another example comes from the Eris Protocol. They offer scripts for liquid staking, a process that lets users stake their cryptocurrency while retaining liquidity. These scripts help users deploy, migrate, or interact with the Eris Stake Hub smart contract. It simplifies the management of staked assets on the Eris Protocol network.

Aurora-Trisolaris-Auto-Compound-Script

Developed by James Bachini, this Python script is tailored for the Trisolaris decentralized exchange. It automates staking TRI tokens, harvesting rewards, and re-staking them using the platform’s contract. This script is handy for those looking to earn rewards through the Trisolaris exchange, showcasing the versatility of automated staking scripts across different platforms.

The Value of Automated Staking Scripts

Automated staking scripts bring convenience, efficiency, and opportunity to cryptocurrency. They allow users to participate in staking without the need for constant oversight. This is crucial in a market that operates 24/7. By automating routine tasks, these scripts allow users to focus on other aspects of their investment strategy.

Moreover, automated staking scripts can enhance earnings through mechanisms like auto-compounding. They also provide a way to engage with the blockchain that’s less resource-intensive. This is especially important for individuals who may not have the time or technical skills to manage their staking activities manually.

Automated staking scripts are a key component of modern cryptocurrency staking strategies. They offer convenience, efficiency, and potential for increased earnings. As the crypto market continues to evolve, the role of these scripts is likely to grow, making them an invaluable tool for anyone looking to maximize their staking rewards.

Also read What Is Cryptojacking: 11 Detection & Prevention Strategies

Hypothetical Examples of Automated Staking Scripts

Here are some examples of code that can be used for automated staking:

IMPORTANT DISCLAIMER: The code examples provided in this section are for illustrative purposes only. They are NOT intended for direct use and will likely cause errors or malfunctions if implemented without significant modification. Consult with a qualified developer experienced in blockchain technology before attempting to use or adapt these examples. The following code examples are strictly hypothetical and simplified to demonstrate the general concept of automated staking scripts.

Staking Dapp

This is an ERC20 standard Dapp that allows users to stake their tokens and receive rewards. It utilizes Solidity for smart contract development, React for front-end, and Hardhat for blockchain testing.

pragma solidity ^0.5.0;

contract StakingContract {

ERC20 public token;

mapping(address => uint256) public stakers;

constructor(ERC20 _token) public {

token = _token;

}

function stake(uint256 amount) public {

require(token.transferFrom(msg.sender, address(this), amount));

stakers[msg.sender] += amount;

}

function withdraw(uint256 amount) public {

require(stakers[msg.sender] >= amount);

stakers[msg.sender] -= amount;

require(token.transfer(msg.sender, amount));

}

}

Code Breakdown

Here’s a breakdown of the Solidity code you provided, its use, and the language:

Language: Solidity

Purpose:

This code defines a basic staking smart contract on a blockchain platform that supports Solidity (most likely Ethereum). Here’s how it works:

- Pragma:

- pragma solidity ^0.5.0;: Specifies that the code is written for Solidity compiler versions 0.5.0 and above.

- Contract Definition:

- contract StakingContract { … }: Declares a smart contract named StakingContract.

- State Variables:

- ERC20 public token;: Declares a public variable named token of type ERC20. This indicates that the contract will interact with an external ERC20-compliant token.

- mapping(address => uint256) public stakers;: Declares a public mapping named stakers. This mapping keeps track of the staking balance of each address.

- Constructor:

- constructor(ERC20 _token) public { … }: The constructor is executed when the contract is deployed. It does the following:

- Takes an ERC20 token address as input (_token).

- Initializes the token variable with the provided ERC20 token contract.

- Functions:

- stake(uint256 amount):

-

- require(token.transferFrom(msg.sender, address(this), amount));: This line ensures the following:

- The user who calls this function (represented by msg.sender) has approved the staking contract to transfer the specified amount of tokens from their address.

- The transfer from the user’s address to the contract’s address (address(this)) is successful.

- stakers[msg.sender] += amount;: Increments the staking balance of the user (msg.sender) by the specified amount.

- require(token.transferFrom(msg.sender, address(this), amount));: This line ensures the following:

- withdraw(uint256 amount):

-

- require(stakers[msg.sender] >= amount);: Ensures that the user has enough staked tokens to withdraw the requested amount.

- stakers[msg.sender] -= amount;: Decrements the staking balance of the user by the amount being withdrawn.

- require(token.transfer(msg.sender, amount));: Ensures that the transfer of tokens from the contract’s address back to the user’s address is successful.

This smart contract facilitates basic staking functionality:

- Staking: Users can deposit their ERC20 tokens into the contract.

- Withdrawing: Users can withdraw their staked tokens (and potentially earned rewards) later.

Important Considerations:

This is a simplified contract. Real-world staking contracts often include mechanisms for rewards, lockup periods, slashing (penalties for bad behavior), and more complex logic.

Solana Staker

This is a walkthrough of the Solana Staker Program. It uses TypeScript and is built on the Solana blockchain.

JavaScript (with Solana Web3.js library)

[import { Connection, PublicKey, Keypair } from '@solana/web3.js';

import { STAKE_PROGRAM_ID, StakeInstruction } from '@solana/web3.js';

const connection = new Connection('https://api.mainnet-beta.solana.com');

const payer = Keypair.fromSecretKey(new Uint8Array([...]));

async function stake() {

const stakeAccount = Keypair.generate();

const authorizedPubkey = payer.publicKey;

const lamports = 1000000000; // 1 SOL

const transaction = StakeInstruction.createAccountWithSeed({

fromPubkey: payer.publicKey,

stakePubkey: stakeAccount.publicKey,

basePubkey: payer.publicKey,

seed: 'my_seed',

authorizedPubkey,

lamports,

});

const signature = await connection.sendTransaction(transaction, [payer, stakeAccount]);

console.log('Stake Account created:', stakeAccount.publicKey.toBase58());

console.log('Signature:', signature);

}

stake().catch(console.error);

Code Breakdown

Here’s a breakdown of the provided code, its use, and the programming language:

Language: JavaScript (with Solana Web3.js library)

Purpose:

The code establishes a connection to the Solana blockchain and creates a new stake account. Here’s what it does step-by-step:

- Imports:

- It imports necessary modules from the Solana Web3.js library for interacting with the Solana blockchain.

- Connection Establishment:

- Creates a connection to the Solana mainnet (https://api.mainnet-beta.solana.com).

- Payer:

- Loads a Keypair (which represents a public/private key) from a secret key (Uint8Array). This keypair acts as the payer for the transaction.

- stake() Function:

- Stake Account Generation: Generates a new Keypair to represent the stake account.

- Authorized Pubkey: Sets the payer’s public key as the authorized entity to interact with the stake account.

- Transaction Creation: Constructs a transaction using the StakeInstruction.createAccountWithSeed function. This function does the following:

- Sets the funding source as the payer’s account.

- Designates the newly generated stakeAccount’s public key as the recipient.

- Uses the payer’s public key as the “base” for the seed derivation.

- Derives a seed from the string ‘my_seed.’

- Gives the payer authorization over this stake account.

- Specifies the number of lamports (1 SOL) to transfer into the stake account.

- Transaction Sending: Sends the transaction to the Solana network and signs it with both the payer and the newly generated stakeAccount keypairs.

- Output: Logs the public key of the created stake account and the transaction signature.

This code creates a stake account on the Solana blockchain, a core element of participating in Solana’s Proof of Stake consensus. By staking SOL, you can earn rewards for helping secure the network.

Please note that these examples may need modification based on your use case.

Please note: The scripts we discussed are just examples. They show what automated staking scripts could look like, and they help you understand what they could be.

These example scripts show that automated staking scripts can do more than just automate tasks. They can also help make better decisions and increase your earnings. They show that with some coding, you can customize your staking to match what you want and what’s happening in the market.

Remember, these scripts are not real. They’re meant to give you ideas. If you know how to code, you can create or change scripts. This way, you can automate your staking, adjust your investments as needed, and maximize your rewards.

Also read Maximize Transaction Security: The Essential Role of Dedicated Servers

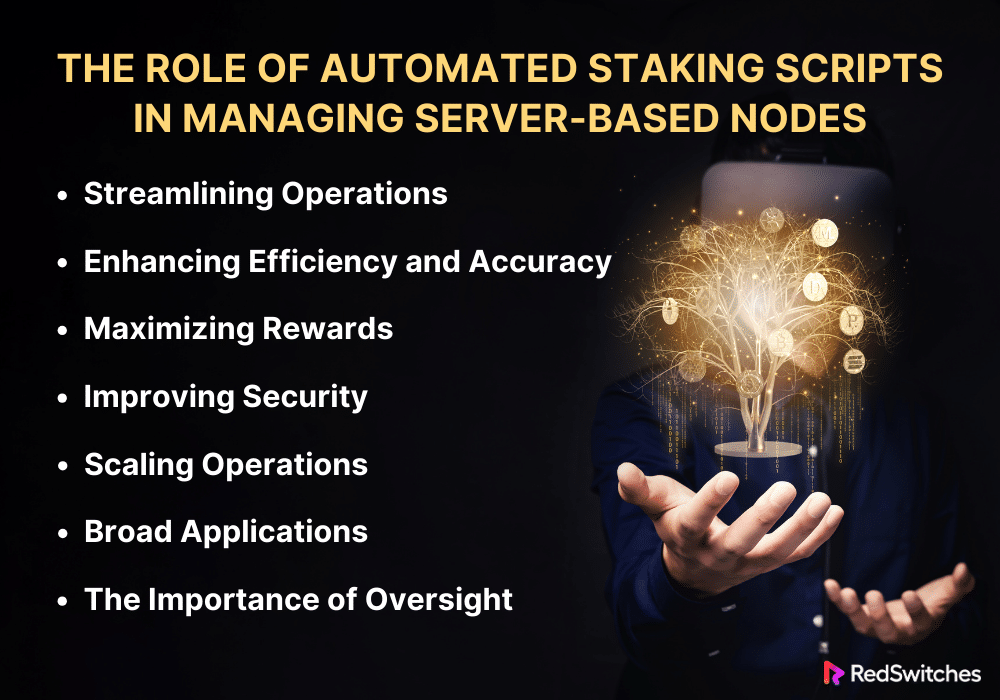

The Role of Automated Staking Scripts in Managing Server-based Nodes

Automated staking scripts have transformed how we manage server-based nodes in the cryptocurrency world. These scripts handle tasks essential for the smooth operation of blockchain networks. Let’s explore their role in detail.

Streamlining Operations

Automated staking scripts are the backbone of efficient node management. They take over repetitive tasks like generating and importing keys, starting validator clients, and making deposits. This automation saves a significant amount of time and effort. For instance, the PulseChain Validator Automated Setup Scripts on GitHub illustrate how these tools can simplify the setup of a validator node with minimal manual input.

Enhancing Efficiency and Accuracy

Automated staking scripts have a big plus: they’re quick and make fewer mistakes than people. They keep an eye on things all day and night. They make fast choices using set rules. This makes things go faster and cuts down on errors. These scripts get everything right by sticking to clear instructions, from making keys to giving out rewards.

Maximizing Rewards

Automated staking scripts are not just about maintaining the network; they’re also about optimizing returns. They can adjust staking strategies based on market conditions, aiming to maximize potential rewards. Whether it’s choosing the right time to stake or the best validator to delegate, these scripts make calculated decisions to enhance profitability.

Improving Security

Security is a top priority in the staking process, and automated scripts are critical. They can follow the best security practices, like regularly updating staking nodes’ keys, to protect against vulnerabilities. This automation adds an extra layer of security, safeguarding the staking process against potential threats.

Scaling Operations

As operations grow, manually managing multiple server-based nodes becomes daunting. Automated staking scripts excel in scalability. They can easily manage numerous nodes, making them ideal for large-scale staking operations. This scalability is crucial for staking pools, cryptocurrency exchanges, and blockchain projects that rely on a large network of validators.

Broad Applications

Automated staking scripts find their application in various scenarios. Cryptocurrency exchanges use them to manage the staking process for users, automatically calculating and distributing rewards. Staking pools rely on these scripts to handle rewards among participants efficiently. Similarly, blockchain projects and individual investors use automated scripts to manage validators and optimize returns. DeFi platforms also utilize these tools to smoothly manage liquidity pools and other staking mechanisms.

The Importance of Oversight

Automated staking scripts offer numerous benefits but require careful management and oversight. Ensuring they operate correctly and securely is crucial. Users should always do their research before choosing a staking service and be mindful of the security practices surrounding their private keys. Proper oversight and security measures are essential to fully benefit from the advantages of automated staking scripts while minimizing potential risks.

Automated staking scripts are reshaping the landscape of cryptocurrency staking. These tools make things faster, cut down on hard work, and help people earn more in the blockchain world. They help everyone, from big exchanges to single investors and DeFi platforms. With these tools, staking becomes easier and more rewarding. As blockchain keeps changing, these automated scripts will become even more important for the future of decentralized finance.

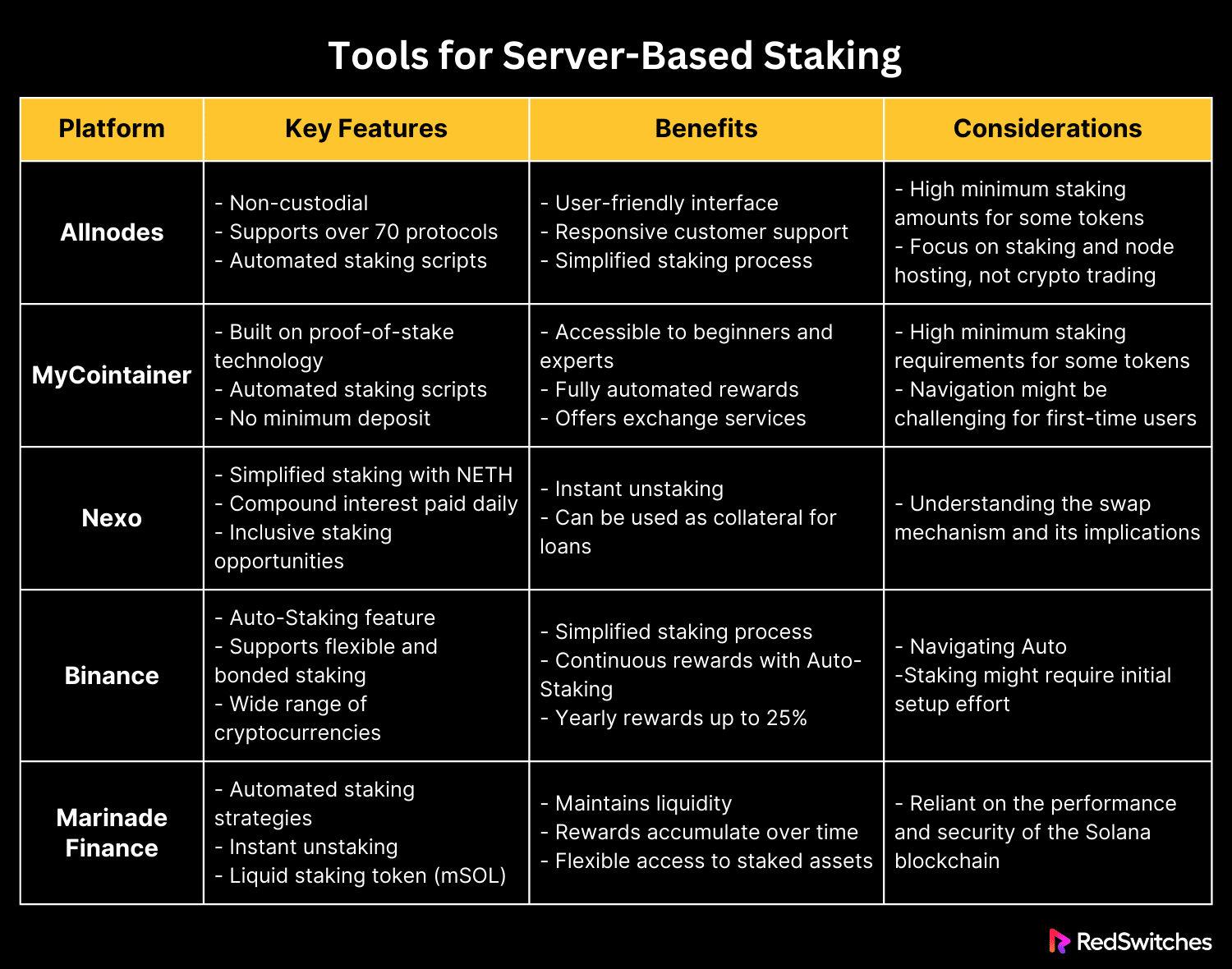

Tools for Server-Based Staking

Server-based staking is a key part of the blockchain world. It helps keep networks safe and running well. Tools can make the process easier and more rewarding for those who stake on servers. Automated staking scripts are one such tool. They handle tasks automatically, saving time and reducing mistakes.

Allnodes

Allnodes offers a seamless experience for those interested in crypto staking. This non-custodial platform supports over 70 protocols. Users can host various nodes, including Masternodes, Validator Nodes, and Full Nodes. It’s designed for individual traders and enterprise clients, offering a user-friendly interface with various pricing structures.

User Experience and Support

Allnodes prioritize user experience. Its interface is straightforward, catering to users at different expertise levels. Customer support is a standout feature, known for being responsive and helpful. This is crucial for both new and seasoned users, ensuring they can easily navigate staking processes.

Automated Staking Process

One of Allnodes’ key features is its automated staking scripts. These scripts simplify the staking process, making it accessible to a wider audience. For instance, staking Crypto.org Chain tokens involves a few simple steps in the platform’s “Earn” tab. This automation helps users participate in staking without manual complications.

Considerations

While Allnodes simplifies staking, potential users should note a few points. Some tokens require high minimum staking amounts, which may not suit everyone. Additionally, the platform focuses on staking and node hosting, not crypto trading. New users may initially find the platform overwhelming, highlighting the importance of utilizing its customer support.

MyCointainer

MyCointainer is another powerful platform that leverages automated staking scripts to benefit users. It’s built on proof-of-stake technology, allowing users to profit through staking. Designed for beginners and experienced investors, MyCointainer eliminates the complexity often associated with crypto staking.

Simplifying Staking

The platform’s process is straightforward. Users select a cryptocurrency asset, transfer the staking amount to the platform’s wallet, and then receive profits automatically. This approach makes staking accessible to anyone, regardless of experience level. MyCointainer supports a wide range of PoS assets, with no minimum or maximum deposit amount, making it flexible for different investment strategies.

Rewards and Exchange Services

Credits: Freepik

Staking on MyCointainer is fully automated, directly reflecting rewards on the user’s dashboard. This ease of use is a significant draw for users looking to earn passive income without constant monitoring. In addition to staking, MyCointainer offers exchange services, allowing users to swap coins using fiat money or Bitcoin. This dual functionality enhances its appeal as a comprehensive crypto platform.

Considerations

Users should be aware that, similar to Allnodes, some tokens on MyCointainer may have high minimum staking requirements. The platform aims to be user-friendly, but first-time users might still find navigation challenging. Secure handling of private keys is emphasized, reminding users of the importance of security in crypto staking.

Also Read A Guide to the Best GPUs for Mining Bitcoin, Ethereum, and More

Nexo

Nexo, a comprehensive financial platform for cryptocurrencies, introduces Ethereum Smart Staking through an innovative feature. This service simplifies staking Ethereum (ETH), enhancing users’ accessibility and efficiency.

Simplified Staking with NETH

Nexo’s unique approach allows users to swap ETH for Nexo Staked Ethereum (NETH) on a 1:1 basis. NETH represents the user’s stake in Ethereum’s validation process, facilitated by Nexo’s dedicated servers. This swap mechanism streamlines the staking process, making it straightforward for users to participate in Ethereum’s network validation.

Rewards and Flexibility

Staking through Nexo generates compound interest, paid daily and directly to the user’s savings wallet. This structure rewards users consistently, offering a compelling incentive for participation. Moreover, Nexo’s platform eliminates the need to pay gas fees, removing one of the significant barriers to staking Ethereum.

Nexo also offers unparalleled flexibility in staking. Users can instantly unstake by swapping NETH back to ETH, enabling access to their assets without delay. Additionally, NETH can serve as collateral for loans, providing users with liquidity without ending their staking.

Inclusive Staking Opportunities

Nexo levels the playing field for all its users. Regardless of the amount staked or the user’s loyalty tier within the platform, the same attractive APY applies. This inclusivity ensures that all users can benefit equally from staking on Nexo regardless of investment size or loyalty status.

Binance

Binance, a giant in the cryptocurrency exchange sphere, has made staking accessible and straightforward for its vast user base. With the introduction of an Auto-Staking feature, the platform enhances the ease of earning staking rewards.

Simplified Staking Process

The process to start earning staking rewards on Binance is user-friendly:

Select a Cryptocurrency Asset

Users can deposit one of the many assets eligible for staking into their Binance account.

Stake Your Asset

Users can select what they wish to stake from the assets in their spot wallet.

Earn Rewards

Binance distributes rewards to users twice a week, based on the assets they have staked.

Binance supports a wide array of cryptocurrencies for both flexible and bonded staking. This includes popular choices like Algorand (ALGO), Cardano (ADA), and Ethereum (ETH), among others. The platform offers yearly rewards ranging from 0.1% to 25%, varying by cryptocurrency.

Auto-Staking for Continuous Rewards

The Auto-Staking feature on Binance is designed for users who prefer a “set and forget” approach to staking. It automates the re-subscription to staking products, ensuring users don’t miss out on continuous reward opportunities due to forgetting to manually re-subscribe. This feature underscores the convenience and user-centric design of Binance’s staking services.

Marinade Finance

Marinade Finance operates on the Solana blockchain, offering a liquid staking protocol that automates the staking process for SOL token holders. It introduces an innovative approach to staking, allowing users to earn rewards and maintain liquidity.

Automated Staking Strategies

Here’s how users can leverage Marinade Finance for staking:

Stake Your SOL

Users stake their SOL tokens using Marinade’s automated strategies and receive “marinated” SOL (mSOL), representing the staked SOL.

Earn Rewards

The mSOL token is a liquid staking token that accumulates rewards over time. As the Marinade stake pool generates rewards, the value of mSOL increases, directly enhancing the rewards for the staker.

Instant Unstaking

Marinade Finance allows instant unstaking of mSOL tokens at the end of each Solana epoch, offering flexibility and access to SOL without fees.

Marinade Finance simplifies staking without sacrificing liquidity. This is crucial for users who wish to participate in the DeFi ecosystem or need quick access to their staked assets.

Also Read 7 Types of Staking Explained: Your Go-To Crypto Staking Guide for 2024

Here’s a summary table comparing the features, benefits, and considerations of the mentioned platforms:

Key Considerations for Automated Staking

Important: Always do your research and carefully assess your risk tolerance before participating in any form of staking, even with the help of automation tools.

- Decision-Making Remains Key: While automated staking scripts streamline the process, you must choose a reliable platform and the cryptocurrency you want to stake. Research is crucial for understanding each option’s potential risks and rewards.

- Rewards are Not Guaranteed: Automated staking improves your chances of earning rewards, but those rewards depend on factors like the performance of the cryptocurrency, the overall network health, and the behavior of validators. Market fluctuations and unforeseen technical issues can impact your returns.

- Risks Persist: Automated tools reduce the chance of manual errors but don’t eliminate the inherent risks of staking. These include potential smart contract vulnerabilities in platforms, the possibility of penalties (‘slashing’) for validator misbehavior, and the temporary illiquidity of your assets due to lock-up periods.

- Minimums and Restrictions: Some platforms or cryptocurrencies may have minimum staking requirements that could limit your participation. Additionally, lock-up periods where you cannot access your staked funds are common, so factor this into your investment strategy.

Benefits of Using Dedicated Servers for Automated Staking Scripts

Using dedicated servers for automated staking scripts offers several advantages. These benefits make the staking process more efficient, secure, and profitable. Let’s explore these advantages.

Improved Performance

Dedicated servers provide better performance for automated staking scripts. These servers can handle the high demands of staking activities without slowing down. This means your staking operations run smoothly around the clock. Improved performance ensures that your staking scripts operate without delays, maximizing your chances of earning rewards.

Enhanced Security

Security is crucial in the world of cryptocurrency. Dedicated servers offer enhanced security for your staking operations. They are less prone to attacks than shared hosting environments. With a dedicated server, you have full control over security settings. This control lets you protect your staked assets and rewards from cyber threats.

Greater Control

With a dedicated server, you have complete control over your staking environment. You can customize the server settings to meet your specific staking needs. This level of control is not possible with shared servers. You can optimize your server for the best performance of your automated staking scripts.

Reliability

Dedicated servers are more reliable than shared servers. They provide stable and consistent performance for your staking scripts. This reliability is vital for ensuring that your staking operations are always running. It reduces the risk of downtime, which can lead to missed staking opportunities.

Scalability

As your staking needs grow, dedicated servers allow you to scale up your operations easily. Upgrade your server resources to handle more staking scripts or support additional cryptocurrencies. This scalability ensures that your staking operations can grow with your ambitions.

Using dedicated servers for automated staking scripts offers significant benefits. From improved performance and enhanced security to greater control, reliability, and scalability, dedicated servers provide a solid foundation for successful staking. They enable you to optimize your staking strategies and maximize your potential rewards in the ever-evolving world of cryptocurrency.

Conclusion

Automated staking scripts and dedicated servers are changing how we stake in blockchain. They offer a simpler, safer, and more efficient way to earn rewards. With platforms like Allnodes and MyCointainer, staking is now accessible to everyone. As blockchain grows, these tools will become more important. They help users manage their stakes better and earn more.

Looking to maximize your staking rewards? Consider using a dedicated server from RedSwitches. Their servers are perfect for running automated staking scripts. With top-notch performance and security, you can stake with confidence. Check out RedSwitches today for your staking needs.

FAQs

Q. What is auto staking?

Auto staking is an automated process where your cryptocurrencies are staked without manual intervention, ensuring continuous staking and earning of rewards based on your holdings.

Q. Does Coinbase automatically stake?

Yes, Coinbase offers automatic staking for certain cryptocurrencies. When you hold these eligible assets in your Coinbase account, you can earn staking rewards without any additional action.

Q. Does staking pay daily?

Staking rewards can vary by platform and cryptocurrency. Some platforms distribute rewards daily, while others may do so weekly, monthly, or based on specific network protocols.

Q. What are the two types of staking?

The two main types of staking are delegated staking, where you delegate your coins to a validator who stakes on your behalf, and direct staking, where you participate in the staking process directly with your own node.

Q. Which staking is the most profitable?

The profitability of staking depends on several factors including the chosen cryptocurrency, staking platform, market conditions, and the staking model (delegated vs. direct). Generally, researching and choosing coins with higher annual yield percentages and stable networks can lead to more profitable staking outcomes.

Q. How do I stake my crypto tokens in a staking pool?

To stake your crypto tokens in a staking pool, you first need to transfer your tokens to a compatible wallet that interacts with the blockchain ecosystem you’re participating in. Through the wallet’s interface, you can join a staking pool by choosing the amount of crypto to stake and executing the transaction via a smart contract. This process allows you to contribute your tokens to a collective pool to earn staking rewards.

Q. Can I automate the collection of staking rewards in DeFi projects on Ethereum?

Yes, you can automate the collection of staking rewards in DeFi projects on Ethereum using a script that interacts with the smart contract of the DeFi project. By configuring the script to execute transactions on your behalf, it can claim your staking rewards automatically and deposit them into your wallet, ensuring you regularly collect your earnings without manual intervention.

Q. What’s the difference between staking on a blockchain like Ethereum and participating in a DeFi ecosystem?

Staking on Ethereum means locking up tokens to help run and secure the network for rewards. In DeFi, you can do more, like staking in pools, lending, borrowing, and trading on decentralized exchanges. Smart contracts automate these activities, making staking just one way to participate and earn in DeFi.

Q. What is yield farming, and how can it benefit me?

Yield farming is a process in blockchain technology that allows users to earn rewards by providing liquidity to a decentralized finance (DeFi) platform. By automating yield farming, you could potentially increase your profitability through smart contracts that harvest rewards for you.

Q. Can I automate yield farming?

Yes, you can automate yield farming using scripts written in programming languages like Python or Node.js. These scripts can automate the process of staking and harvesting rewards, enhancing efficiency and profitability.

Q. What are NFTs, and how do they relate to yield farming?

NFTs (Non-Fungible Tokens) are unique digital assets on a blockchain network. While primarily known for representing digital art, NFTs can also be staked in certain yield farming protocols to earn rewards, integrating the worlds of NFTs and yield farming.

Q. What should I consider before starting the staking process?

Before starting the staking process, it’s crucial to research and select a reputable blockchain platform with robust security features. Understand the staking period, the process of staking, and how to delegate your stake to a validator to ensure maximum rewards and security for your assets.

Q. How does automating the staking process work?

Automating the staking process involves using scripts or software that manage your stake on a blockchain network. These tools can delegate your stake to validators, manage your liquidity, and harvest rewards automatically. They often utilize open-source code and can be customized through a command-line interface.

Q. Why is Cosmos mentioned frequently in discussions about staking and yield farming?

Cosmos is a popular blockchain platform known for its ability to decentralize and compound earnings through staking and yield farming. It offers advanced features that integrate well with automated tools, enhancing accessibility and efficiency for participants in the network.

Q. What are some best practices for securing my digital assets while participating in yield farming or staking?

Always keep your private key secure and never share it with anyone. Use blockchain platforms with strong security features and ensure any scripts or tools you use for automating yield farming or staking are from reputable sources with open-source code for transparency.