Key Takeaways

- Cryptocurrency is a digital or virtual form of money secured by cryptography, making it difficult to counterfeit.

- Staking Crypto involves locking up cryptocurrency to support the operations of a blockchain network and earn rewards.

- Proof-of-stake (PoS) blockchains use staking for security; in contrast, older cryptocurrencies may use the energy-intensive Proof-of-Work (PoW) system.

- Staking offers a way to earn passive income on cryptocurrency holdings while contributing to the network’s security.

- Staking pools allow individuals to combine their resources, increasing their chances of earning rewards.

- Before deciding to stake, research the cryptocurrency, potential rewards, and risks is essential.

- The staking process involves choosing a coin, acquiring it, selecting a platform, and depositing your tokens.

- Staked crypto may be locked up for a period, and rewards can vary depending on the coin and platform.

- Exchanges, wallets, and staking pools offer different levels of convenience, control, and potential fees.

- Crypto staking suits those with a long-term investment mindset and a willingness to research and manage their staked assets.

Imagine earning passive income just by holding your favorite cryptocurrency. That’s the idea behind staking! It’s like a high-interest savings account for your crypto, where you help secure a blockchain network and get rewarded in return.

Consider a dedicated server as the central component of this procedure. You can ‘lock’ up your cryptocurrency as an expression of your commitment to the network by storing it in a specific wallet and maybe even operating a dedicated server. Your chances of winning rewards increase with the amount you wager. Imagine getting paid to add the next page to a communal ledger when you are chosen to do so!

Solana and Cardano are just two examples – as of December 2023, a whopping 70% of their coins were staked! This shows how popular staking is becoming within the crypto world.

Are you new to crypto and wondering, “What does staking crypto mean?” Don’t worry. We’ll break down the basics of staking—how it works, the risks, and what to consider before diving in.

Table of Contents

- Key Takeaways

- What is Crypto?

- What is Crypto Staking?

- How Crypto Staking Works

- Step-by-Step Guide on How To Stake Crypto?

- Staking on Exchanges vs. Wallets vs. Pools

- Staking Strategies: Best Practices to Consider Before Staking

- The Selective World of Crypto Staking: Not for Everyone

- To Stake or Not to Stake: Navigating the Crypto Waters

- Conclusion: Navigating the Staking Landscape

- FAQs

What is Crypto?

Credits: Freepik

Cryptocurrency, often called crypto, is a form of digital or virtual currency. Unlike traditional money, it exists only online. Cryptos use cryptography for security, making them hard to counterfeit. Because of this security, crypto transactions are generally considered very secure. Another key feature of cryptocurrencies is their decentralized nature. They typically use a technology called blockchain. A blockchain is a distributed ledger spread across many computers. This setup ensures that no single entity controls the currency. Instead, it’s managed by a network of its users.

What is Crypto Staking?

Staking Crypto is where you lock up some cryptocurrency to support a blockchain network. It’s similar to putting money in a savings account. When you stake your crypto, you lend it to the network, which helps the network operate securely and efficiently. You earn rewards in return for your contribution, usually through additional cryptocurrency. Staking is an attractive option for those seeking passive income from their crypto holdings.

Staking’s Role in Blockchain Networks

Staking plays a crucial role in the functionality and security of specific blockchain networks. Specifically, it’s a critical network component that uses a consensus mechanism called Proof of Stake (PoS). In these networks, staking crypto helps validate transactions and create new blocks on the blockchain. By staking, participants contribute to the network’s security. They make it harder for any single party to take control. Attacking a PoS network would require ownership of most of the staked cryptocurrency, which is costly and impractical.

Proof of Stake (PoS) vs. Proof of Work (PoW)

Distinguishing between Proof of Stake (PoS) and Proof of Work (PoW) is essential to understanding staking. Blockchain networks use consensus mechanisms to confirm transactions and add new blocks to the blockchain.

Proof of Work (PoW)

Proof of Work is the original consensus mechanism used by Bitcoin. In PoW, miners solve complex mathematical problems to validate transactions and create new blocks. This process requires significant computational power and energy. The first miner to solve the problem gets to add the block to the blockchain and earns rewards in the form of cryptocurrency.

While energy consumption is a significant concern, efforts are underway to make PoW mining more sustainable through renewable energy sources and more efficient hardware.

Proof of Stake (PoS)

Proof of Stake offers a different approach. Instead of using computational work, it selects validators based on the amount of cryptocurrency they are willing to “stake” or lock up as collateral. The more crypto a user stakes, the higher their chance of being chosen to validate transactions and add new blocks. This method is seen as more energy-efficient than PoW because it doesn’t require extensive computational work.

Staking is vital within specific crypto networks, offering a more energy-efficient alternative to traditional mining. Understanding crypto, how staking works and the differences between PoS and PoW can help individuals better navigate the crypto space. Whether looking to secure the network, earn rewards, or both, staking provides a valuable opportunity for cryptocurrency holders.

Also read Evaluating Dedicated Server Specifications: A Buyer’s Guide

How Crypto Staking Works

Credits: Freepik

Staking Crypto is a vital concept in the cryptocurrency world. It offers users a way to earn rewards on their holdings. This section will delve into the staking process, staking pools, and staking rewards, using clear and simple language to ensure it’s accessible to all readers.

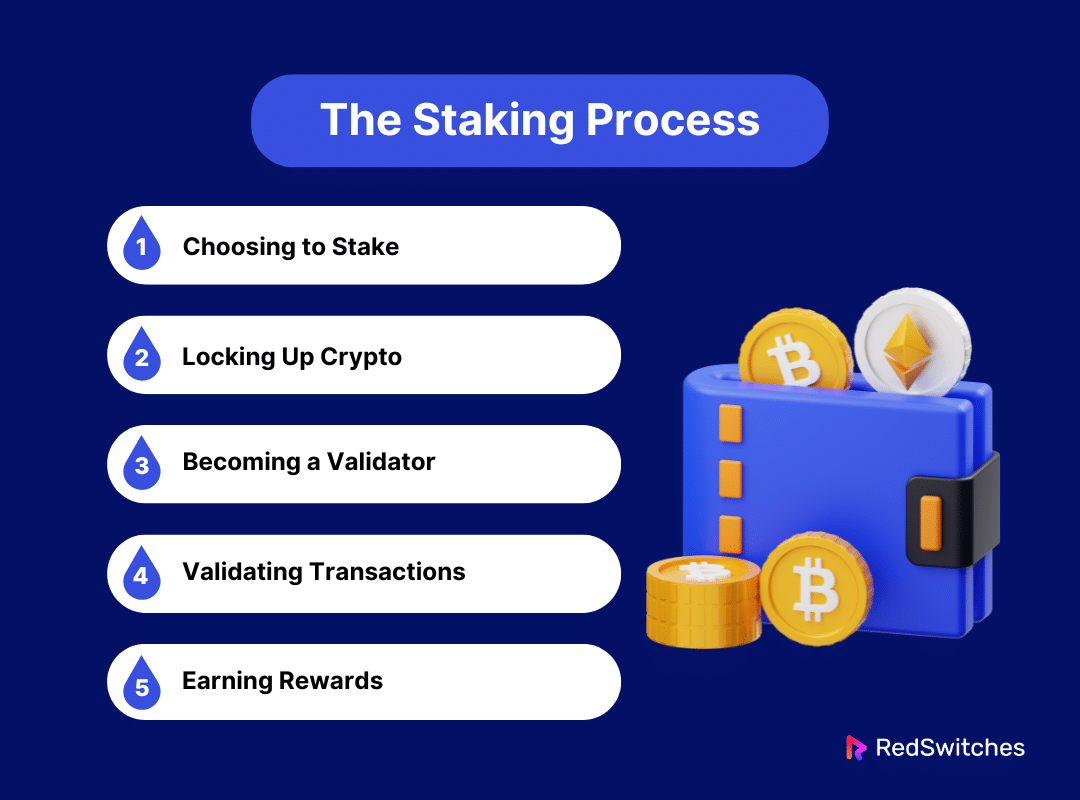

The Staking Process

Staking is a feature of cryptocurrencies that uses a Proof of Stake (PoS) consensus mechanism. Users can stake their cryptocurrencies to participate in network security and consensus instead of competing in computational challenges like in Proof of Work (PoW).

Here’s how it generally works:

- Choosing to Stake: First, you stake some of your cryptocurrency. Crypto must support staking.

- Locking Up Crypto: By staking, you lock up your crypto for a set period. This means you can’t sell or trade it during this time.

- Becoming a Validator: Your staked crypto helps the network select you as a validator. Validators are crucial in confirming transactions and adding new blocks to the blockchain.

- Validating Transactions: If chosen, you will validate transactions. This involves verifying their legitimacy and proposing new blocks to the blockchain.

- Earning Rewards: You earn rewards for your efforts and for providing security to the network. These rewards are usually in the form of additional cryptocurrency.

In the coming sections, we will discuss a step-by-step guide on how to stake crypto in detail.

Also Read: Cost-benefit Analysis of Crypto Staking Using Dedicated Servers

Staking Pools

Only some have the resources or desire to run a full node for staking. This is where staking pools come into play. A staking pool allows multiple users to combine their staking power, increasing their chances of being chosen as validators. Running a node often requires technical knowledge and constant uptime, which can be a barrier for some.

Staking pools are managed by one or a few participants, who run the node and take care of the technical aspects. Participants in the pool then share in the rewards proportional to their contribution. Major exchanges like Binance, Coinbase, and Kraken offer staking services, making it easy for users to join staking pools without much technical know-how.

Staking Rewards

The main attraction of staking is the rewards. These rewards are a form of passive income earned over time as new blocks are added to the blockchain. The rate of rewards varies depending on several factors:

- Amount Staked: Generally, the more you stake, the higher your potential rewards.

- Network Rules: Each blockchain has its own rules for reward distribution. Some might offer a fixed rate, while others adjust rewards based on the total amount of staked crypto.

- Length of Time: Often, the longer you’re willing to lock up your crypto, the higher your rewards.

Rewards are typically given in the same type of cryptocurrency that you stake. For example, if you stake a token that offers a 5% reward rate over a month, and you stake 100 tokens, you would earn 5 additional tokens at the end of the staking period.

While this is true for many popular staking assets, some platforms or blockchains offer rewards in a different cryptocurrency or a governance token. Researching the specific reward mechanism of a project before staking is essential.

Staking crypto is not only a way to earn passive income but also contributes to the security and efficiency of the blockchain network. It is an energy-efficient alternative to traditional Proof of Work (PoW) blockchain mining. Users support blockchain’s decentralized nature by participating in staking, helping secure the network against attacks, and contributing to its ongoing operation and governance.

The enhanced security features of dedicated servers protect against attacks and unauthorized access, safeguarding staked assets. Moreover, customizing dedicated server configurations allows for optimized blockchain performance, ensuring transactions are processed efficiently.

Also Read: Automated Staking Scripts and Tools for Server-based Nodes

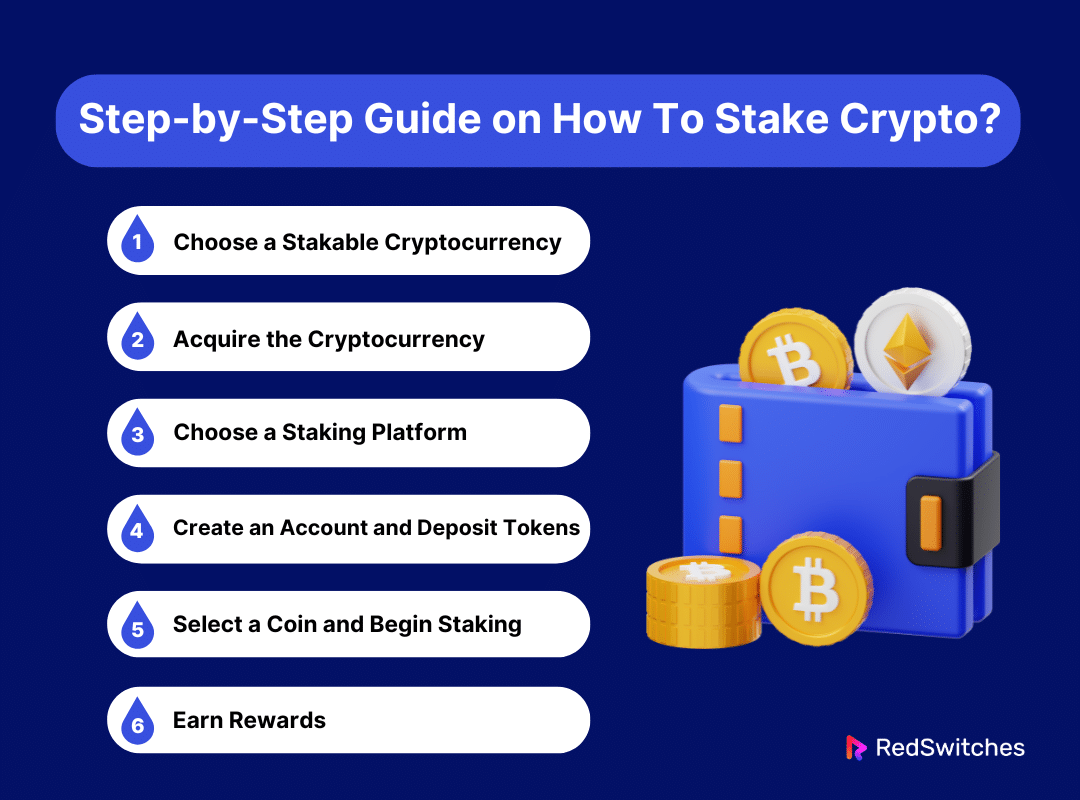

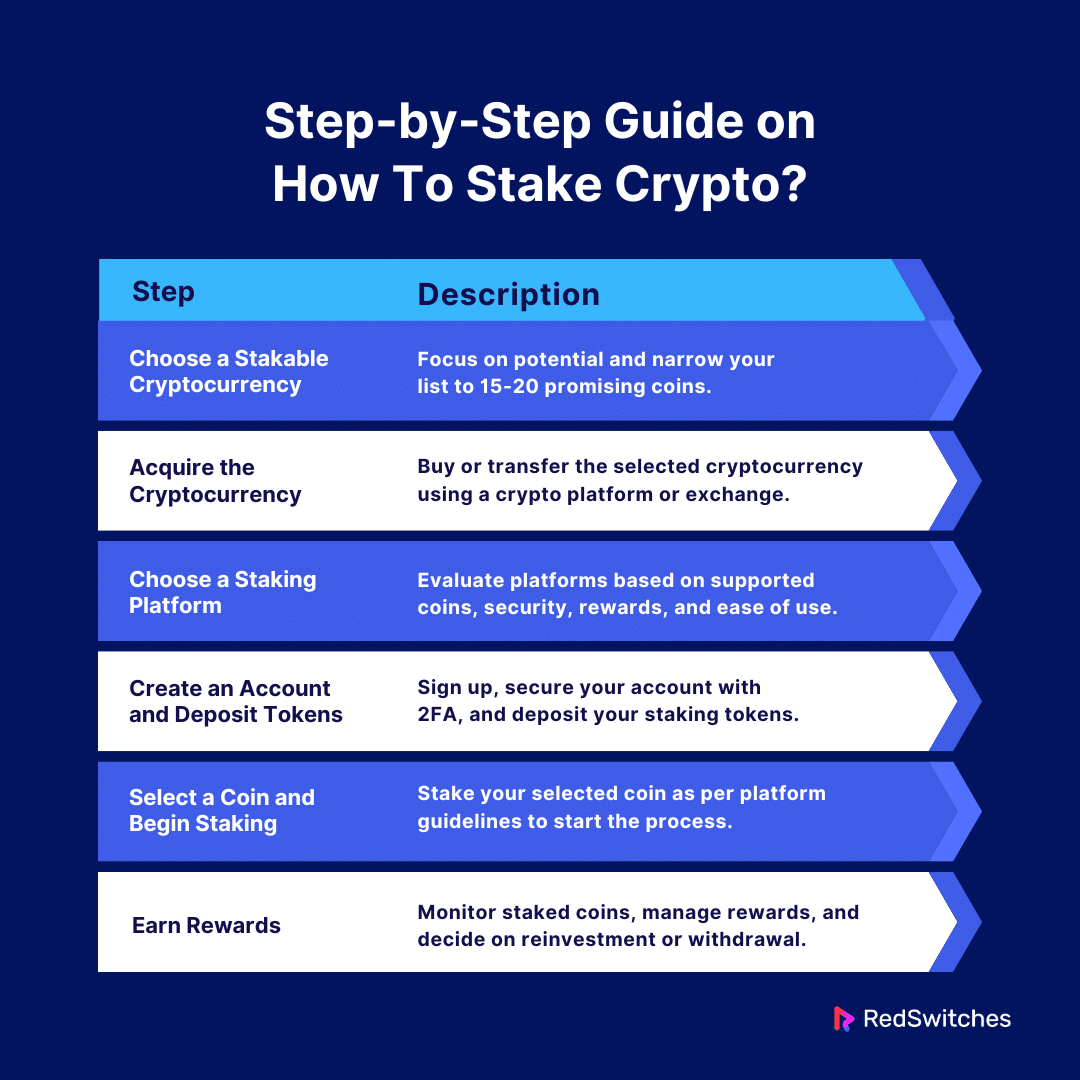

Step-by-Step Guide on How To Stake Crypto?

Diving into the world of crypto staking can be exciting and rewarding. It’s a way to earn passive income on your crypto holdings by contributing to the security and efficiency of blockchain networks. But how do you start?

Whether you’re a beginner or a seasoned pro looking to refine your staking strategy, our step-by-step guide is here to help. We’ll break down the process of staking crypto into simple, manageable steps, ensuring you have all the knowledge needed to begin earning rewards through staking. Let’s demystify the staking process together, making it accessible and straightforward for everyone.

Choose a Stakable Cryptocurrency

Credits: Freepik

Choosing the right cryptocurrency for staking is your first step on this journey. This choice matters greatly because not all cryptocurrencies are equal, especially regarding staking.

- Understand Proof of Stake (PoS): Before diving in, know that staking is unique to blockchains that use the Proof of Stake (PoS) mechanism. This system lets users participate in maintaining the network by staking their crypto. In simple terms, it’s like being part of a lottery. The more you stake, the better your chances of being chosen to validate transactions and earn rewards.

- Research Stakable Cryptocurrencies: Not all cryptocurrencies can be staked. Some popular ones that allow staking include Ethereum, Cardano, Solana, and Algorand. Each has its own rules and rewards systems. It’s like choosing a team; you want to pick one with a good track record and game plan.

- Evaluate Potential Returns: The rewards can vary a lot. Some cryptocurrencies offer more generous rewards than others. However, remember that high rewards might come with high risks. It’s a balancing act between potential gains and the stability of your investment.

- Consider the Risks: Staking isn’t free of risks. The value of your staked crypto can go up or down. Also, there’s something called “slashing,” a penalty for any misbehavior in the network. Think of it as a fine for not playing by the rules.

- Check Wallet and Exchange Support: Ensure your wallet or exchange supports your cryptocurrency. Popular platforms like MetaMask, Ledger, and Trust Wallet are good starting places. It’s like ensuring your car has the correct fuel type before you start a journey.

- Decide on the Amount to Stake: How much you stake affects your rewards and risks. More staked crypto means higher potential rewards but also more at stake.

Choosing a stakable cryptocurrency requires careful consideration. Assess the potential returns, understand the risks, and ensure compatibility with your wallet or exchange. It’s all about doing your homework and making an informed decision.

Acquire the Cryptocurrency

After picking a cryptocurrency to stake, the next step is acquiring it. This process is straightforward but essential.

- Choose a Cryptocurrency: Decide which crypto you want to acquire. There are many options, so pick one that aligns with your staking goals.

- Choose a Platform: You’ll need a platform to buy your crypto, like Coinbase, Binance, or Gemini. These are marketplaces where you can buy, sell and trade cryptocurrencies.

- Create an Account: Sign up on your chosen platform. This step usually requires some personal information for verification purposes. Think of it as getting a club membership card.

- Deposit Funds: To buy crypto, you must first deposit money into your account. Most platforms accept bank transfers, credit cards, or other cryptocurrencies for this.

- Buy Cryptocurrency: With funds in your account, you can now buy the cryptocurrency of your choice. Platforms typically make this process very user-friendly.

- Secure Your Cryptocurrency: After purchasing, transferring your crypto to a secure wallet is crucial. This is like moving your money from a cashier’s desk to a safe.

Acquiring and securing your cryptocurrency are essential steps in staking. Choose your platform carefully, ensure your account is secure, and always transfer your crypto to a personal wallet for safety. Doing your research and proceeding cautiously can significantly impact your staking success.

Also Read: What Is the Minimum Lockup Period for Crypto Staking?

Choose a Staking Platform

After selecting a cryptocurrency, the next critical step is choosing the right platform for staking. This decision is pivotal because your staking experience depends on the platform’s reliability, security, and the rewards it offers.

- Supported Cryptocurrencies: Ensure the platform supports the cryptocurrency you wish to stake. Different platforms cater to different coins, impacting your choice.

- Reputation and Security: Opt for platforms known for their robust security measures and positive reputation. Look for features like two-factor authentication, cold storage solutions, and encryption. This step is akin to choosing a bank to safeguard your money.

- Rewards and Terms: Investigate the platform’s rewards system, including the annual percentage yield (APY), staking duration, and any penalties for early unstaking. It’s like comparing interest rates and terms of various savings accounts.

- Educational Resources and Community Support: A platform with a solid educational foundation and a supportive community can be invaluable, especially for beginners. Learning from and sharing knowledge with others on the same journey is beneficial.

- Additional Features and Customer Service: Evaluate any extra features the platform may offer, such as a user-friendly mobile app or governance participation opportunities. Good customer service is also crucial for resolving any issues you may encounter.

- Regulatory Compliance and User Experience: Choose a platform that adheres to regulatory standards to ensure a safer staking environment. A well-designed user interface enhances your staking experience, making it straightforward and enjoyable.

You can choose a staking platform that aligns with your goals and preferences by carefully considering these aspects. However, always conduct thorough research and compare multiple platforms before deciding.

Create an Account and Deposit Tokens

Credits: Freepik

Once you’ve chosen a staking platform, you must create an account and deposit your tokens for staking. This process is similar across most platforms, but following each step carefully is essential to ensure your assets are secure.

- Sign Up for an Account: Navigate to the platform’s website and sign up for an account. This step typically involves providing personal information and agreeing to the platform’s terms and conditions. Think of it as opening a new bank account for your digital assets.

- Secure Your Account: After signing up, set up two-factor authentication (2FA) and create a robust and unique password. These security measures are like locking your door and setting an alarm for your digital asset house.

- Deposit Tokens: With your account set up and secured, you can deposit the tokens you wish to stake. This usually involves transferring tokens from your wallet to your account on the staking platform, akin to depositing money into a savings account.

- Buy Tokens (Optional): If you don’t already own the tokens you want to stake, some platforms offer the option to buy them directly. This can typically be done with fiat currency (USD, EUR, etc.) or other cryptocurrencies. It’s a convenient way to get started if you’re new to cryptocurrency.

Creating an account and depositing tokens are crucial steps in beginning your staking journey. By following these steps carefully and ensuring your account is secure, you can start earning rewards through staking. Remember, staking involves locking up your tokens, which cannot be sold or traded. Always be mindful of the risks involved, including the potential fluctuation in the tokens you’re staking.

Select a Coin and Begin Staking

Staking cryptocurrency can be a lucrative way to earn passive income, but the process begins with selecting the right coin. The journey to staking starts with a simple but critical choice.

Let’s break down this process into manageable steps.

- Focus on Potential: When choosing a coin for staking, look for potential. This doesn’t mean picking the most popular or expensive coins but finding those with solid projects and a strong community behind them. It’s like choosing a seed to plant; you want one that promises to grow.

- Narrow Your List: Start with a list of 15-20 coins. Concentrating on a smaller number allows you to closely understand and monitor their performance. It’s easier to become familiar with a few projects than to spread your attention too thin across many.

- Stay Informed: Keep your list of coins updated. Remove those no longer meeting your criteria and add new ones with promising futures. Markets evolve, and so should your staking portfolio. It’s akin to pruning a garden for the best growth.

- Understand the Coin: Before staking, get to know the coin. What problem does it solve? How strong is its community? What’s its staking return? This knowledge is foundational. You’re investing money and trust in the project’s future.

Earn Rewards

Credits: Freepik

After selecting your coin and beginning the staking process, the next phase is earning rewards. This stage requires patience, strategy, and a bit of savvy. Dedicated servers offer a robust and secure foundation for crypto staking. Providing the reliability and uptime essential for maximizing staking rewards.

- Stake Your Coins: Once you’ve chosen a coin, stake it according to the platform’s guidelines. This often involves locking up your coins in a wallet for a period. Think of it as putting your money in a time-lock safe where it starts to earn interest.

- Monitor and Manage: Keep an eye on your staked coins. Some platforms allow you to add more coins to your stake, enhancing potential returns. Regular monitoring ensures you’re on top of any changes or opportunities to increase your rewards.

- Understand the Rewards: Staking rewards can vary widely. They may come as additional coins, interest, or voting rights within the project’s ecosystem. Knowing how your rewards are calculated and distributed is vital to maximizing your staking benefits.

- Reinvest or Withdraw: Decide whether to reinvest your staking rewards or withdraw them. Reinvesting can compound your earnings over time while withdrawing provides immediate benefits. It’s a balance between growing your stake and enjoying your profits.

- Stay Updated: Keep abreast of news related to your staked coin. Changes in the project, updates to the staking protocol, or shifts in market dynamics can affect your rewards. Staying informed allows you to make timely decisions.

You can earn significant rewards by carefully selecting a coin and actively managing your stake. Staking is not just about locking away your cryptocurrency; it’s an active investment in the future of the project you believe in. With patience and attention, staking can be a fruitful component of your crypto portfolio, offering financial returns and a deeper engagement with the blockchain projects you support.

Also Read 5 Tips for Keeping Your Wallet BTC Secure and Protected

Here’s a summary table for the step-by-step guide on how to stake crypto:

Staking on Exchanges vs. Wallets vs. Pools

When entering the realm of cryptocurrency, deciding where to stake your assets—be it on exchanges, in wallets, or through pools—is a critical choice. Each option offers its own set of advantages and considerations. Let’s delve into the distinctions to help you make an informed decision.

Staking on Exchanges

What It Is: Exchanges are platforms where you can buy, sell, and stake cryptocurrencies. They are often centralized, meaning a single company operates them.

Pros:

- Convenience: Staking through an exchange is straightforward. You can buy, hold, and stake your cryptocurrencies all in one place.

- Ease of Use: Exchanges provide a user-friendly interface, making it simple for beginners to start staking without much technical know-how.

- Support and Security: Reputable exchanges offer customer support and have security measures to protect your assets.

Cons:

- Less Control: Your crypto is in the hands of the exchange, meaning you rely on their security and integrity.

- Vulnerability: Centralized platforms can be targets for hacks, posing a risk to your staked assets.

Staking in Decentralized Wallets

What It Is: Decentralized wallets, like MetaMask or Trust Wallet, allow you to store and manage your cryptocurrencies independently from centralized exchanges.

Pros:

- Control: You have complete control over your assets, including the private keys.

- Security: Keeping your crypto in a decentralized wallet is generally safer from hacks than on an exchange.

- Flexibility: You can interact with various decentralized applications (dApps), opening up more staking opportunities.

Cons:

- Complexity: Requires a higher level of understanding to manage your assets securely.

- Responsibility: You’re solely responsible for your wallet’s security, including safeguarding your private keys.

Staking Through Pools

What It Is: Staking pools allow multiple stakeholders to combine their assets to increase their chances of earning rewards, which is particularly useful for coins like Ethereum and Cardano.

Pros:

- Accessibility: Pools lower the entry barrier, allowing you to stake with smaller amounts.

- Efficiency: Pools offer a way to earn rewards without needing personal, high-maintenance hardware or extensive knowledge.

- Community: Joining a pool can provide a sense of community and shared risk, reducing the individual’s burden.

Cons:

- Fees: Pools take some of the rewards as fees for their services.

- Trust: You need to trust the pool’s operators to act in the best interest of its members.

Making the Choice

The decision between exchanges, wallets, and pools depends on your priorities: convenience, control, security, and the amount you wish to stake. If you’re looking for simplicity and direct support, an exchange might be your path. A decentralized wallet is preferable for those valuing security and control over their assets. Meanwhile, pools are excellent for individuals seeking to stake smaller amounts or those looking to join forces with others in the crypto community.

Also Read Crypto Industry Looking For New Options As Hetzner Bans Crypto Hosting

Staking Strategies: Best Practices to Consider Before Staking

Staking has emerged as a popular way to earn passive income in cryptocurrency. It involves locking digital assets in a blockchain network to support operations and security. While staking can offer attractive rewards, it’s essential to understand the risks and strategies for choosing the right assets. Here’s a closer look.

Risks Involved in Staking

Before diving into staking, it’s crucial to be aware of the potential risks:

- Market Volatility: The cryptocurrency market is known for its sharp price fluctuations. A significant drop in staked asset value can offset the staking rewards.

- Lock-Up Periods: Many staking protocols require your assets to be locked up for a minimum duration. During this time, you cannot sell or trade your assets, which could be problematic if you need immediate access to your funds or want to take advantage of market movements.

- Unstaking Waiting Periods: Even after the lock-up period has ended, there may be a waiting period before you can withdraw your assets. This delay varies across different blockchains.

- Counterparty Risk: If the validator node you’re staking with fails to perform correctly, you risk missing out on expected rewards. In worse cases, you might face slashing penalties, losing some of your staked assets. With dedicated servers, stakers can run their validator nodes without the performance issues plaguing shared hosting environments.

- Omission of Slashing: Omission of slashing is crucial in crypto staking. It means avoiding penalties for mistakes or downtime. In Proof of Stake networks, validators can face slashing if they act against the network’s rules. This could mean losing a part of their staked crypto. To avoid slashing, validators must strictly ensure their systems are reliable and follow the network’s guidelines. Staying updated with protocol changes and maintaining secure, uninterrupted operations are key. By doing so, validators protect their investments and keep earning rewards. It’s all about being responsible and attentive to your role in the network.

- Technical and Centralization Risks: Technical glitches or concentrated control among a few validators can pose significant risks to your staked assets.

Choosing the Right Digital Assets for Staking

Credits: Freepik

Selecting which digital assets to stake requires careful consideration. Here are some strategies to help you make informed decisions:

- Research the Cryptocurrency: Understand the fundamentals of the cryptocurrency you plan to stake. Look for assets with strong development teams, clear use cases, and active community support.

- Assess the Staking Returns: Compare the potential returns from staking various assets. Higher returns come with higher risks, so balance the potential rewards against the risks you’re willing to take.

- Understand the Terms: Familiarize yourself with the staking terms, including lock-up periods, minimum staking requirements, and unstaking processes. Choose assets whose terms align with your investment strategy and liquidity needs.

- Consider Diversification: Diversifying your staking portfolio can help mitigate risks. Staking multiple assets across different blockchains can spread out your risk exposure.

- Stay Informed: Follow the latest news and developments related to the assets you’re staking. Changes in protocol, governance decisions, or market dynamics can affect the staking landscape.

Staking offers a compelling way to engage with the cryptocurrency market beyond just trading. By understanding the risks and carefully selecting digital assets, you can develop a staking strategy that aligns with your financial goals and risk tolerance. Always remember, that the key to successful staking lies in thorough research and ongoing vigilance.

Also Read What Is Cryptojacking: 11 Detection & Prevention Strategies

The Selective World of Crypto Staking: Not for Everyone

In cryptocurrencies’ vast and varied landscape, staking has emerged as a compelling way to earn passive income. However, this opportunity is only sometimes available across all digital currencies. The key to this exclusivity lies in the underlying technology of these digital assets, specifically the consensus mechanism they employ. Let’s dive into why staking is an exclusive club in the crypto world.

Understanding Consensus Mechanisms

At the heart of every cryptocurrency is a consensus mechanism, a set of rules that dictates how transactions are verified and added to the blockchain. This mechanism is crucial for maintaining the cryptocurrency’s decentralized integrity, ensuring all transactions are agreed upon without a central authority.

The Power-Hungry Pioneer: Proof of Work

Many of the earliest and most well-known cryptocurrencies, such as Bitcoin and the original Ethereum (now transitioning), operate on a Proof of Work (PoW) system. In PoW, miners solve complex mathematical puzzles to validate transactions and mine new blocks. This process requires substantial computational power and, by extension, significant energy consumption. The environmental impact and scalability issues of PoW have led to the exploration of more sustainable alternatives.

The Eco-Friendly Challenger: Proof of Stake

Enter Proof of Stake (PoS), a newer consensus mechanism that aims to address the energy-intensive nature of PoW. In PoS, validating transactions and creating new blocks is handled by validators who “stake” a certain amount of cryptocurrency as collateral. Instead of competing in a computational race, validators are chosen to confirm transactions based on the amount they stake and other factors, significantly reducing energy use.

Why Staking Is Exclusive

Staking is inherently linked to the PoS consensus mechanism. Since only cryptocurrencies that operate on PoS (or its variations like Delegated Proof of Stake) can be staked, this limits staking to a subset of the digital currency world.

Major cryptocurrencies like Ethereum (transitioning to PoS with Ethereum 2.0, Cardano, Solana, and Polkadot support staking, offering holders a chance to earn rewards by participating in the network’s security and operations.

While staking is essential to PoS, it’s important to remember that PoS functions as a consensus mechanism. Its main goal is to provide a secure and energy-efficient way for a decentralized network to validate transactions and reach agreements.

The Practicalities of Staking

Staking is not just an eco-friendly alternative to mining; it’s also a way for cryptocurrency holders to earn passive income. By staking their coins, participants can receive rewards, usually in the form of additional coins or interest, in exchange for their role in validating transactions.

However, it’s important to note that staking, like any investment, carries risks, including market volatility and lock-up periods that limit access to your assets.

Only some cryptocurrencies offer staking due to their foundational technology—the consensus mechanism. As the crypto world evolves, the shift towards more sustainable and scalable solutions like PoS has made staking an attractive option for investors looking to contribute to network security while earning rewards.

However, this opportunity is exclusive to currencies that embrace these newer, energy-efficient protocols, marking a clear distinction in the capabilities and responsibilities of digital asset holders.

Also, Explore the pinnacle of web hosting and dedicated server management with Bitcoin for a secure and seamless experience

To Stake or Not to Stake: Navigating the Crypto Waters

Credits: Freepik

Deciding whether to stake your cryptocurrency can feel like navigating through uncharted waters. It’s a choice that requires careful consideration, weighing the potential rewards against the inherent risks. Let’s break down the circumstances that might sway your decision in either direction, helping you to chart a course that aligns with your investment strategy and risk tolerance.

When Staking Calls Your Name

- Eco-Conscious Investing: If you’re drawn to the greener pastures of low-energy consumption, staking is your ally. Participating in networks that use Proof of Stake (PoS) supports a more sustainable approach to blockchain security and operation.

- Earning Passive Income: The allure of earning rewards for holding onto your cryptocurrency is strong. Staking offers a way to grow your holdings without the complexities and energy demands of mining.

- Long-Term Holding Strategy: If your investment philosophy is to hold cryptocurrencies long-term, staking can enhance your strategy by earning additional tokens during the holding period.

- Supporting the Network: Staking isn’t just about personal gain; it’s also about contributing to the security and functionality of the blockchain network. Your stake helps validate transactions, making the network more resilient against attacks.

When to Hold Off on Staking

- Need for Liquidity: Staking often comes with lock-up periods during which your assets are inaccessible. If you anticipate needing quick access to your funds, the liquidity constraints of staking might be a deterrent.

- Market Volatility Concerns: The cryptocurrency market is known for its rapid price fluctuations. If a significant drop in value occurs, the rewards earned from staking may not compensate for the loss in your investment’s worth.

- Risk Aversion: For more risk-averse investors, the risks of staking, including potential losses from validator penalties (slashing) and technical failures, might outweigh the potential rewards.

- Complexity and Responsibility: Managing staked assets, choosing validators, and understanding the technicalities of the staking process require a level of commitment and expertise that some investors might need more time to be ready for.

Charting Your Course

Deciding to stake your crypto is a personal decision that hinges on your investment goals, risk tolerance, and interest in engaging more deeply with blockchain technology. While the rewards can be appealing, it’s crucial to navigate these waters with a clear understanding of both the potential gains and the risks involved. Remember, the right choice is the one that aligns with your financial goals and comfort level in the ever-evolving crypto landscape.

Conclusion: Navigating the Staking Landscape

Staking crypto isn’t just about sitting back and watching your assets grow. It’s your chance to participate actively in the revolutionary blockchain world! You’ll earn rewards, strengthen the networks you believe in, and help build a greener digital future. Of course, like any investment, it’s important to understand the risks involved. Whether you choose an exchange, wallet, or a staking pool, make a choice that aligns with your goals and puts you in control of your crypto journey.

The importance of reliability, security, and performance in crypto staking cannot be overstated. This is where RedSwitches comes in. Don’t just stake crypto – power your earnings! Redswitches dedicated servers give you the reliability, security, and performance to maximize your staking rewards. Upgrade your staking game today and experience the difference a dedicated server makes.

FAQs

Q. Is it worth staking crypto?

Yes, staking crypto can be worth it if you want to earn passive income on your cryptocurrency holdings, especially with coins supporting Proof of Stake (PoS). However, it’s essential to consider your assets’ associated risks and lock-up period.

Q. What is staking crypto?

Staking in crypto involves holding a certain amount of cryptocurrency in a wallet to support the operations of a blockchain network. In return for contributing to the network’s security and functionality, stakers receive rewards, often in the form of additional cryptocurrency.

Q. Which crypto is best for staking?

Cryptocurrencies like Ethereum (after its move to PoS), Cardano, Solana, and Polkadot are popular choices for staking due to their strong networks and potential for rewards. The “best” crypto for staking depends on investment goals and risk tolerance.

Q. Is crypto staking still profitable?

Yes, staking crypto can still be profitable, particularly with the right cryptocurrency and staking platform choice. However, profitability depends on several factors, including the staking rewards, the volatility of the cryptocurrency market, and the specific terms of the staking arrangement.

Q. Is there a downside to staking crypto?

The downside to staking crypto includes the risk of market volatility, which can diminish the value of your staked assets, lock-up periods that restrict access to your assets, and potential technical risks associated with specific blockchain networks or staking platforms.

Q. What is staking in the context of cryptocurrency?

Stake refers to the act of participating in a network by holding a certain amount of a digital asset to support blockchain operations. In return, you may receive staking rewards as passive income.

Q. How does crypto staking work?

Crypto staking involves locking up a certain amount of crypto within a staking pool or as a validator on a blockchain network to validate transactions and earn rewards in the form of additional cryptocurrency.

Q. What are the benefits of staking cryptocurrency?

Staking crypto assets can offer benefits such as earning rewards, passive income, and participation in a blockchain network’s consensus mechanism.

Q. How can I start staking my cryptocurrency?

To stake your crypto, you can use a staking platform offered by a crypto exchange or explore options to earn interest and crypto rewards through services like Coinbase that <b>offer staking.

Q. What is the staking process like?

The staking process typically involves selecting a staking program, understanding the staking yields and staking period, and securing your staked cryptocurrency. In contrast, crypto staking is a way of contributing to the network.

Q. Are there any risks associated with staking crypto?

While staking can be a means of earning crypto and has benefits, it also comes with potential risks, such as the requirement to understand the underlying consensus mechanisms and network security.

Q. What is a Crypto Wallet, and Why Do Crypto Holders Need One?

A crypto wallet is vital for securely managing cryptocurrencies, enabling users to conduct transactions and access their holdings. It’s essential for engaging in the broader crypto ecosystem, from trading on exchanges to participating in mining and earning rewards.

Q. How Does Liquid Staking Benefit Crypto Investors?

Liquid staking allows crypto investors to earn rewards without locking up their assets, providing liquidity through a representative token. This enhances investment flexibility and allows for continued participation in the market.

Q. What Are the Risks of Crypto Mining, and How Can Investors Mitigate Them?

Crypto mining has challenges, such as high operational costs and environmental concerns. Investors should consider these risks, explore diversified crypto earning methods like staking, and stay updated on regulations affecting mining’s environmental impact.