Key Takeaways

- Staking replaces energy-intensive mining and rewards you for holding specific cryptocurrencies.

- The more you stake, the higher your chance of becoming a validator and earning rewards.

- Staking pools let smaller investors participate in the validation process.

- Staking durations can range from very short to long-term, depending on the specific blockchain.

- Some platforms offer more flexibility with staking periods than others.

- Staking rewards are subject to factors like the amount, yield rate, and lock-up periods.

- Choose your blockchain wisely, as staking durations, rewards, and risks vary.

- Consider factors like lock-ups and penalties when deciding on a staking platform.

- Balance reward potential with the volatility risks of cryptocurrency markets.

- Re-staking your rewards can compound your earnings over time.

Did you know you can earn rewards just for holding certain cryptocurrencies? Here’s how staking works, staking has emerged as a key method for holders to earn rewards. It’s like earning interest in a traditional bank but with digital currency.

When you stake crypto, you lock it up to support a blockchain network. In return, you get rewards. This process can vary in time. Staking crypto through a crypto wallet or on a cryptocurrency exchange allows users to earn rewards while contributing to the network’s security directly from their digital wallets or exchange accounts.

A recent report showed that the first quarter of 2024 witnessed a significant resurgence in the popularity of staking cryptocurrencies, rebounding from an 18-month low period. Market excitement reignited in the last quarter of 2023, fueled by optimistic expectations for approving Bitcoin ETFs in January.

This optimism propelled the total value of the cryptocurrency market to $1.8 trillion, a 54% increase from the previous quarter and a 214% rise from the year before. This marked the highest market capitalization since the peak of the bull market cycle in early 2021 or late 2020.

This shows how popular staking has become. But how long does it take? This article will explore the staking process. We will look at different blockchains and how they handle staking. Our goal is to give you a clear understanding of what to expect when you stake your crypto. So, let’s dive in and learn about the time it takes to stake crypto and how it can benefit you.

Table of Contents

- Key Takeaways

- Fundamentals of Staking Crypto

- Estimated Time Duration Of Staking Crypto

- How Long Does Staking Crypto Take? Key Factors To Determine

- Staking Timeframes Across Different Blockchain Staking Platforms

- Understanding Rewards and Risks Of Staking Crypto

- Maximizing Crypto Staking Outcomes

- Conclusion

- FAQs

Fundamentals of Staking Crypto

Credits: Freepik

In cryptocurrency, two primary mechanisms ensure the integrity and functionality of blockchain networks: Proof of Stake (PoS) and Proof of Work (PoW). These systems are the backbone of cryptocurrencies like Bitcoin, Ethereum, and others, validating transactions and securing their networks. Understanding these mechanisms is crucial for anyone venturing into crypto staking.

Understanding Staking Work: Proof of Stake (PoS) vs. Proof of Work (PoW)

In cryptocurrencies, Proof of Work (PoW) and Proof of Stake (PoS) are the primary mechanisms used to validate transactions, add new blocks to the blockchain, and maintain network security. Let’s break down their key differences:

Proof of Work (PoW)

- Mechanism: PoW systems like Bitcoin rely on miners who compete to solve complex mathematical problems. The first miner to solve a problem gets to add the next block to the blockchain and earns rewards.

- Energy Consumption: This process is highly energy-intensive, requiring specialized hardware and vast amounts of electricity.

- Security: PoW is considered very secure. To attack the network, a malicious actor must control more than 50% of the total computational power, which is very costly and difficult.

Proof of Stake (PoS)

- Mechanism: PoS systems like Ethereum (soon) and Cardano select validators based on the amount of cryptocurrency they hold and are willing to “stake” (or lock up) as collateral. The more you stake, the higher your chances are of being chosen to validate transactions and earn rewards.

- Energy Efficiency: PoS is significantly more energy-efficient than PoW as it doesn’t require power-hungry computations.

- Security: PoS aims for a similar level of security as PoW but relies on different mechanisms. Attacks are disincentivized by potentially losing your staked cryptocurrency if you act maliciously.

Core Insights:

- PoS aims to address the energy consumption concerns of PoW systems.

- Both mechanisms provide ways to achieve decentralization and security in blockchain networks.

- The choice between PoW and PoS often involves trade-offs between established security (PoW) and increased scalability/efficiency (PoS)

Also read A Guide to the Best GPUs for Mining Bitcoin, Ethereum, and More

The Concept of Validators and How They Are Chosen

In a Proof of Stake system, validators play a critical role. They are responsible for validating incoming transactions, ensuring their legitimacy, and bundling them into blocks. Being a validator isn’t just open to anyone, though. To become one, a participant must stake a certain amount of cryptocurrency as a security deposit. The specific amount varies from one blockchain to another.

The process of choosing validators varies across different blockchain networks. Generally, it involves a combination of the amount of crypto staked and other factors, such as the duration of staking. Some networks might add elements of randomness to ensure fairness and security.

The key takeaway is that staking a higher amount increases your chances of being selected as a validator, granting you the opportunity to earn rewards for your contributions to the network’s security and operations.

Also Read: Automated Staking Scripts and Tools for Server-based Nodes

Understanding Staking Pools

Credits: Freepik

Crypto Staking pools allow individuals to participate in Proof of Stake (PoS) blockchains even if they don’t have enough cryptocurrency to meet the minimum staking requirements to become a solo validator. Here’s how they work:

- Combining Resources: Staking pools allow participants to pool their cryptocurrency, effectively increasing their collective stake.

- Increased Validator Chances: This larger combined stake increases the pool’s chances of being selected to validate transactions and add blocks to the blockchain.

- Reward Distribution: When the pool earns rewards, they are distributed to participants proportionally to their contribution to the pool’s total stake.

- Reduced Barriers: Staking pools lower the entry barrier for participation, making staking accessible to those with smaller amounts of cryptocurrency.

Key Considerations When Choosing a Staking Pool:

- Fees: Staking pools often charge a fee for their services, which will cut into your rewards. Compare fees across pools.

- Reliability: Choose a pool with a proven track record of consistent uptime and performance to ensure you maximize rewards.

- Security: Opt for staking pools prioritizing security measures to protect your staked assets.

- Minimum Stake: Some pools might have their minimum staking requirements.

- Flexibility: Consider lock-up periods (if any) or if you can access your staked assets quickly if needed.

Important Note: Even when using a staking pool, you are not guaranteed to become a validator. Your rewards depend on the pool’s performance and the overall rules of the blockchain network.

Also Read: Cost-benefit Analysis of Crypto Staking Using Dedicated Servers

Estimated Time Duration Of Staking Crypto

The world of crypto staking offers diverse opportunities for earning rewards. Yet, one question stands out: “What is the Time taken to stake crypto?” The answer varies, reflecting the flexible nature of blockchain technologies and the strategies of different platforms.

Staking crypto duration varies widely, ranging from a day to a year, depending on the blockchain network’s requirements. Using a dedicated server for staking can enhance the process, offering reliable uptime and optimal performance. This section aims to clarify the expected time duration of staking crypto, providing a clearer picture for investors.

Understanding Staking Periods

Staking periods can greatly differ, ranging from as short as a day to several months or more. Platforms like Crypto.com highlight the flexibility in staking, with no minimum period or fixed term required. Your staked assets earn rewards soon after activation, showing the platform’s streamlined approach.

On the other hand, Binance indicates a processing time of up to three business days, showcasing how operational specifics can influence the start of earning rewards.

Choosing Your Staking Term

The duration of your staking commitment often rests in your hands, influenced by your investment strategy. For those seeking quick flexibility, short-term staking could last just a day.

Conversely, long-term staking locks in funds for months to a year or longer, potentially offering higher rewards for the increased lock-up time. This choice allows stakers to align their crypto engagements with their financial goals and risk tolerance.

Rewards Calculation

Credits: Freepik

The rewards from staking are calculated using a specific formula:

A=P*(1+r/365)^(365*t)

Where A is the total earnings, P is the initial investment, r is the annual percentage yield, and t is the time horizon. This formula helps investors estimate potential earnings, providing a quantitative basis for staking decisions.

Daily Compounding

The core concept is compound interest. In staking, your earned rewards are added back into the staking pool. This means subsequent rewards are generated not only from your initial investment but also from your previously earned rewards.

The (1 + r/365) part of the formula calculates the daily interest rate. The exponent (365*t) applies the daily compounding over the entire staking period.

Important Considerations

- APY Fluctuations: The annual percentage yield (APY) can change due to network conditions or validator performance. The formula assumes a consistent APY.

- Staking Pools: Some staking mechanisms might have specific rules or fees that slightly influence the rewards calculation.

Warm-up and Lock-up Periods

Some protocols introduce a warm-up period, during which rewards are not yet accrued. Additionally, lock-up periods might be enforced, delaying access to staked funds upon deciding to unstake. These periods are crucial for planning, affecting when and how your assets can be moved.

Crypto staking presents a dynamic investment opportunity, with durations varying by platform

and user choice. Understanding these nuances enables investors to make informed decisions, balancing their desire for rewards with their need for flexibility.

Whether opting for short-term agility or long-term commitment, the crypto staking landscape offers varied paths to earning potential. Dedicated servers ensure that your staking operation runs smoothly, without interruptions, maximizing potential rewards.

Also Read: What Is the Minimum Lockup Period for Crypto Staking?

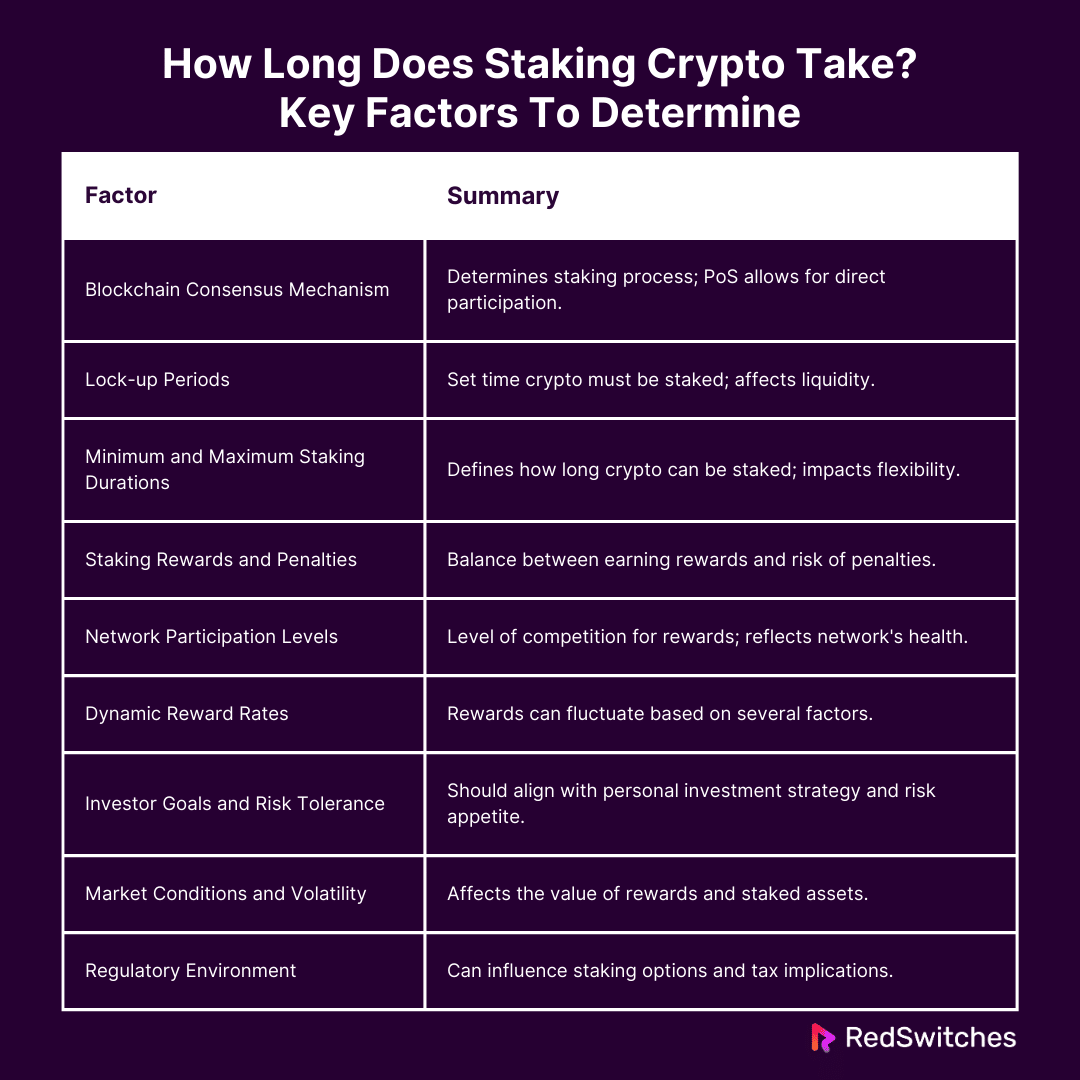

How Long Does Staking Crypto Take? Key Factors To Determine

Crypto staking represents a vital part of blockchain technology. It’s a way for users to earn rewards by supporting a network. Yet, how long one must stake crypto varies widely. This variation depends on several factors. Understanding these can help stakers make informed decisions. Let’s explore the primary elements that define staking durations in cryptocurrency.

Blockchain Consensus Mechanism

At the heart of staking duration lies the blockchain’s consensus mechanism. This rulebook governs how transactions are verified and added to the blockchain. Two main types dominate: Proof of Work (PoW) and Proof of Stake (PoS). PoW, used by Bitcoin, requires miners to solve complex equations, which doesn’t directly involve staking. PoS, on the other hand, is where crypto staking truly comes into play.

Networks using PoS, such as Ethereum 2.0, allow users to stake their cryptocurrencies to participate in transaction validation. The type of consensus mechanism a blockchain uses can significantly influence the staking process, including how long tokens need to be staked to secure the network.

Lock-up Periods

Credits: Freepik

A lock-up period is when your crypto must be staked before you can withdraw it without penalties. These periods vary greatly across different blockchain networks. Some may require a few days, while others might lock in stakes for months or even years. The lock-up period ensures the network remains secure and validators are committed to their role.

Understanding the lock-up requirements is crucial for stakers. It impacts how long their assets will be tied up and unavailable for other uses. Dedicated servers offer the robustness needed for long-term staking, where crypto is locked up to secure the network and earn rewards.

Minimum and Maximum Staking Durations

The flexibility or rigidity of staking durations can greatly influence one’s decision to stake. Some blockchains set a minimum staking duration, during which your crypto must remain staked to earn rewards or participate in network validation.

There can also be maximum durations, after which the staked assets must be withdrawn or restaked. These time frames are designed to balance the need for network security with the flexibility desired by stakers.

Knowing the minimum and maximum durations is essential for anyone looking to get involved in crypto staking. It helps in planning the staking strategy and understanding the commitment required.

Also Read Metered or Unmetered: Dedicated Server Bandwidth Needs

Staking Rewards and Penalties

A significant motivator for participating in crypto staking is the potential to earn rewards. These rewards are often a share of the transaction fees or new coins added to the blockchain.

However, there’s another side to this: penalties. Penalties can be imposed for various reasons, such as validators not performing their duties or attempting to approve fraudulent transactions.

The balance between rewards and penalties is a critical aspect of crypto staking. It ensures validators are motivated to act in the network’s best interest. For stakers, understanding this balance is key to maximizing rewards while minimizing risks.

Network Participation Levels

The level of participation in a network’s staking system can directly affect individual rewards. High participation levels mean more competition for validating transactions and, consequently, for earning rewards.

Conversely, lower participation might increase one’s chances of being selected to validate transactions, potentially leading to higher rewards.

However, it could also indicate a less secure or popular network, which comes with its own risks. For individuals involved in crypto staking, gauging the network’s overall participation can provide insights into potential reward timelines, the network’s health, and security.

Dynamic Reward Rates

Credits: Freepik

The rates at which rewards are distributed in crypto staking can vary. This dynamic nature is often influenced by several factors, including the total amount of crypto staked on the network, inflation rates of the cryptocurrency, and the specific policies set by the blockchain.

Some networks adjust reward rates to control inflation or respond to network participation changes. For stakers, this means the returns on staked crypto can fluctuate. Staying informed about how reward rates are determined and what might cause them to change is crucial for anyone looking to maximize their staking outcome in minimum time.

Investor Goals and Risk Tolerance

Aligning with one’s investment goals and understanding risk tolerance is crucial in crypto staking. Staking offers a way to earn passive income, making it attractive for long-term investors. However, the degree of risk varies. Some might prefer staking in well-established networks with a predictable return timeframe, while others may seek higher rewards in newer, potentially riskier projects.

Your goals should guide your staking decisions, whether it’s steady income, supporting a favorite blockchain, or exploring new opportunities. Similarly, knowing how much risk you’re willing to tolerate can help determine which staking opportunities are right for you. Balancing these aspects is key to a satisfying crypto-staking experience.

Market Conditions and Volatility

The crypto market is known for its volatility. This can significantly affect staking rewards. When the market is up, the value of rewards can increase, and the timeline could stretch, making staking more lucrative.

However, the opposite can happen during downturns, potentially decreasing the value of staked assets and earned rewards. Market conditions can change rapidly, influenced by global economic factors, investor sentiment, and regulatory news.

Stakers must stay informed about market trends and be prepared for fluctuations. Understanding how market conditions and volatility impact staking can help investors make more informed decisions and adapt their strategies as needed.

Regulatory Environment

The regulatory environment for cryptocurrencies is evolving. Regulations can affect crypto staking directly and indirectly. For example, stricter regulations may impact how staking rewards are taxed or which cryptocurrencies can be staked.

In some regions, regulatory changes have led to adjustments in offering staking services. Awareness of the regulatory landscape is important for anyone involved in crypto staking. It can influence decisions on where and how to stake, and understanding regulatory trends can help stakers navigate potential challenges and opportunities in the crypto space.

Crypto staking is an exciting opportunity for investors to earn rewards and participate in the blockchain ecosystem. However, it’s important to consider the above factors. These elements can significantly influence the staking experience and potential outcomes timelines. This holistic approach to crypto staking can help investors maximize their rewards and contribute positively to the growth and security of blockchain networks.

Also Read Mastering Dedicated Server Scalability for Business Growth

Here’s a summary table of the key factors affecting staking duration:

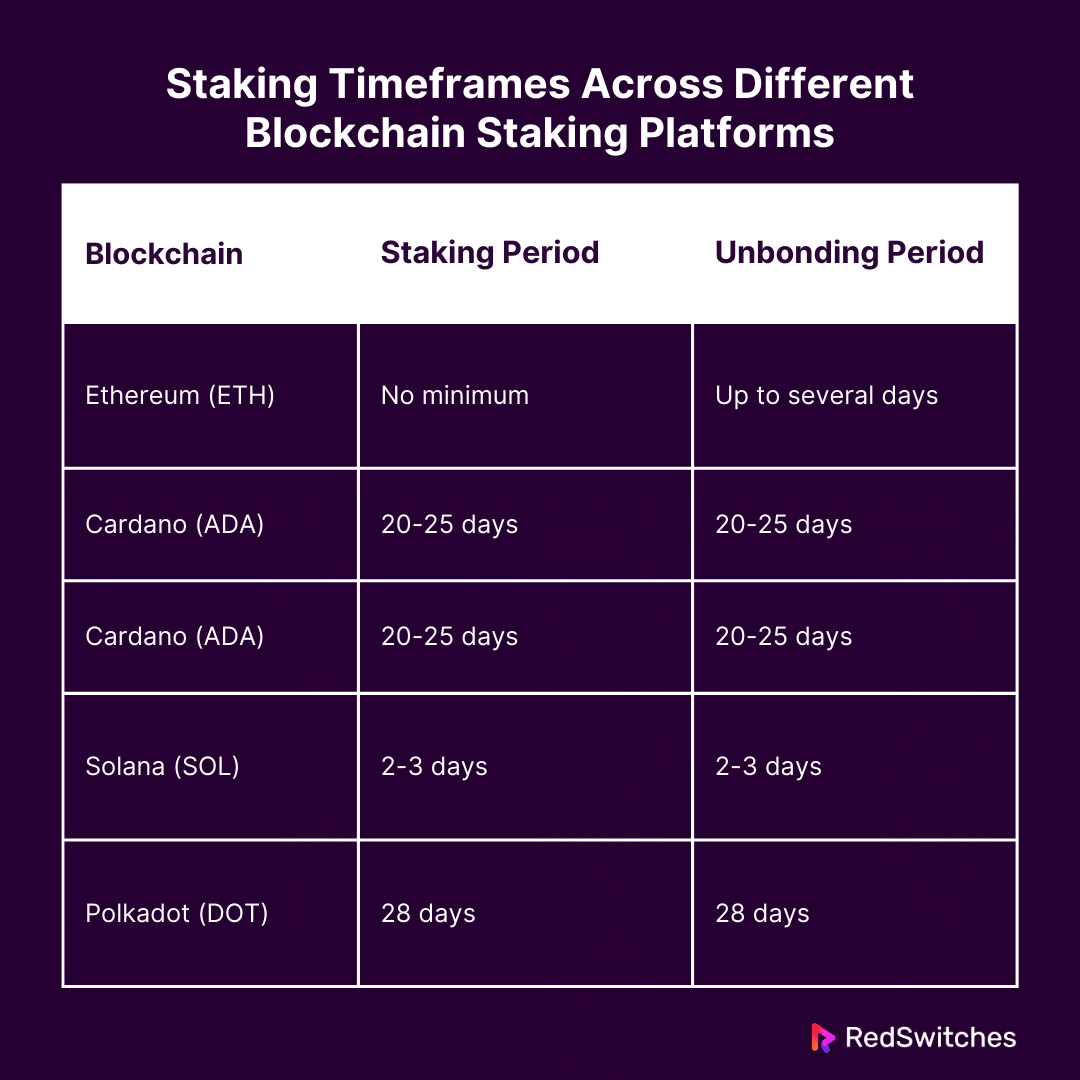

Staking Timeframes Across Different Blockchain Staking Platforms

Crypto staking is a dynamic element of the blockchain ecosystem, allowing users to earn rewards for participating in network operations. However, the staking timeframes—how long your crypto must be staked to start earning rewards and the period required to unstake—vary significantly across different blockchains. This variability can influence investors’ decisions on where to stake their digital assets.

Let’s explore the estimated staking timeframes for Ethereum, Cardano, Solana, and Polkadot to understand how each blockchain approaches staking. Some networks impose a minimum staking duration to ensure network security, which can be efficiently managed on a dedicated server.

Ethereum (ETH) Staking Period

Ethereum, a leading blockchain network, has transitioned to a Proof of Stake (PoS) consensus mechanism. Notably, Ethereum does not enforce a minimum staking period. This flexibility allows stakers to participate in network security without a fixed commitment.

However, those who choose to stake solo may find that rewards take time to accumulate. The process of unstaking, or the unbonding period, can take several days. This timeframe is crucial for stakers to consider, especially if they require liquidity.

Cardano (ADA) Staking Period

Cardano sets a staking period of approximately 20-25 days. This period is essential for validators to integrate into the network and earn rewards fully.

The unbonding period, when it takes to withdraw staked assets, mirrors the staking duration at around 20-25 days.

This relatively short timeframe compared to other blockchains makes Cardano an attractive option for those seeking quicker access to staked funds.

Solana (SOL) Staking Period

Solana features a staking and unbonding period of approximately 2-3 days, one of the shortest in the blockchain space. This rapid turnover appeals to investors looking for flexibility and swift reward realization. The quick unbonding period also means that liquidity is less of an issue than blockchains with longer staking requirements.

Polkadot (DOT) Staking Period

Polkadot requires a longer staking period of 28 days to ensure network security and stability. The exact duration applies to the unbonding period. This longer commitment might suit investors with a long-term strategy who are less concerned about short-term liquidity.

The staking timeframes for Ethereum, Cardano, Solana, and Polkadot highlight the diversity in blockchain technologies and staking mechanisms. These timeframes are subject to change based on network conditions and updates, so it’s advisable to consult official sources for the most current information.

Understanding these differences is crucial for crypto investors looking to stake their assets, as it affects both reward potential and asset liquidity. Each blockchain offers unique opportunities and challenges in crypto staking, catering to various investor preferences and strategies.

Also Read 5 Tips for Keeping Your Wallet BTC Secure and Protected

Here’s the updated summary table for the staking and unbonding periods across different blockchains without the notes:

Understanding Rewards and Risks Of Staking Crypto

In crypto staking, understanding the balance between rewards and risks is essential. This section delves into how rewards are calculated, the timing of their payouts, and the risks involved in staking. By grasping these concepts, stakers can make informed decisions and better navigate the complexities of the crypto world.

How Rewards Are Calculated and Distributed?

The calculation and distribution of rewards in crypto staking hinge on several key factors, including the amount of crypto staked, the network’s inflation rate, and the total number of participants in the staking pool. Typically, the more you stake, the higher the potential reward.

However, this isn’t just about quantity. The network’s rules also play a crucial role. Some networks may offer a fixed reward rate, while others adjust rewards based on the total staked assets or the current inflation rate.

Distribution methods vary as well. Occasionally, rewards are distributed automatically and regularly directly into your staking wallet. In others, you might need to claim your rewards manually. Understanding the specific calculation and distribution mechanisms of the blockchain you are staking on is crucial for maximizing your rewards.

Timing to Earn Rewards And Payouts

The timing of staking reward payouts can significantly impact your staking strategy. Some networks offer daily payouts, while others might distribute rewards weekly, monthly, or based on certain milestones or cycles. Payout frequency often depends on the block production time of the specific blockchain. This timing is dictated by the blockchain’s governance and operational rules.

For stakers, knowing when to expect rewards allows for better financial planning and management. It also helps decide which networks align best with your investment goals and cash flow needs. Being aware of the payout schedule is essential for anyone engaged in crypto staking, as it influences financial outcomes and participation strategies.

Risks Involved in Crypto Staking Work

While crypto staking offers the potential for rewards, it’s not without its risks. One notable risk is slashing, a penalty for validators who act maliciously or fail to fulfill their validation duties. Slashing can result in a significant portion of the staked assets being lost as a penalty.

Liquidity issues represent another risk. When your crypto is staked, it’s locked up for a period, making it inaccessible for selling or trading. This lock-up can be problematic if you need immediate access to your funds or if the market conditions change unfavorably.

Moreover, the volatile nature of the crypto market adds an inherent risk to staking. The value of your staked assets and rewards can fluctuate wildly, impacting the actual value of your staking returns.

Understanding the risks associated with crypto staking is crucial to understanding the potential rewards. Being informed about reward calculation and distribution mechanisms, the timing of payouts, and the risks involved allows stalkers to make decisions that align with their risk tolerance and investment objectives. Navigating these complexities wisely can lead to a more rewarding and secure staking experience.

Maximizing Crypto Staking Outcomes

Crypto staking can be a lucrative avenue for earning passive income through digital assets. To maximize the outcomes of your staking efforts, it’s crucial to understand the strategies and considerations that can influence your returns. This section explores effective methods for selecting staking pools, deciding between long-term and short-term staking, and the benefits of re-staking rewards.

Strategies for Selecting Staking Pools

Credits: Freepik

Choosing the right staking pool is essential for optimizing your staking rewards. A staking pool with a strong reliability and performance track record is more likely to offer consistent returns.

Look for low-fee pools, as high fees can significantly affect your earnings. Additionally, consider the pool’s size. While larger pools might offer more regular rewards, smaller pools may offer higher payout rates per stake due to lower overall participation.

It’s also wise to assess the pool’s security practices to protect your assets against theft or loss. The security features of dedicated servers add an extra layer of protection for staked assets. Which is crucial for peace of mind in crypto staking.

Considerations for Long-term vs. Short-term Staking Cryptocurrencies

Choosing between long-term and short-term staking depends on your financial goals and risk tolerance. Long-term staking often comes with higher rewards, as many networks incentivize the commitment to support the network over extended periods. This approach suits those looking to maximize their earnings and who are comfortable with locking in their assets.

On the other hand, short-term staking offers more flexibility, allowing you to adapt to market changes and withdraw your assets with shorter notice. This might be preferable for those looking to balance staking with other investment opportunities. The flexibility of dedicated servers supports various staking strategies, whether for short-term gains or long-term investments.

Re-staking Rewards to Compound Earnings

One of the most effective strategies for maximizing staking outcomes is re-staking your rewards. You can compound your returns over time by reinvesting your earnings from staking.

This strategy leverages the power of compound interest, potentially significantly increasing your total earnings. It’s a powerful way to grow your staked assets exponentially, especially for long-term stakers.

Regularly re-staking your rewards keeps your investment growing and can lead to much larger payouts in the future. Thanks to the servers’ high-performance capabilities, stakers can benefit from faster and more consistent payouts when using dedicated servers.

Maximizing your staking outcomes requires a strategic approach, including careful selection of staking pools, a clear understanding of your investment timeframe, and the effective use of compounding by re-staking rewards.

By considering these factors, you can optimize your crypto staking efforts, potentially increasing your passive income and contributing to the security and efficiency of blockchain networks. Whether you’re new to crypto staking or looking to refine your strategy, these tips can help you navigate the complexities of staking and achieve better financial results.

Conclusion

Crypto staking offers a unique way to earn rewards by supporting blockchain networks. With the flexibility to choose between short-term or long-term crypto assets staking and the opportunity to participate through staking pools, it caters to various investor needs.

The rewards can be significant and influenced by many factors, including blockchain mechanics and market conditions. Yet, staking also comes with risks, such as liquidity issues and market volatility. Investors can maximize their staking outcomes by understanding these dynamics and making informed choices.

Looking to maximize your crypto staking? Consider leveraging the power of RedSwitches’ dedicated servers. With top-tier security and performance, our servers provide a reliable infrastructure to optimize your staking strategy and enhance your earning potential. Visit us today and take the first step towards maximizing your crypto investments.

FAQs

Q. How long do you stake crypto?

The staking duration can vary widely depending on the blockchain and your strategy. It can range from a day to several months or even longer, based on the specific requirements of the staking pool or blockchain network.

Q. Do you get your crypto back after staking?

Yes, you get your staked crypto back after the staking period or when you choose to unstake. However, depending on the blockchain’s rules, this might involve a waiting period (unbonding period).

Q. Is crypto staking still profitable?

Crypto staking can be profitable, offering rewards for participating in network security. However, profitability depends on various factors, including the staked blockchain’s performance, market conditions, and the staking terms.

Q. How often is staking paid out?

The frequency of staking payouts varies by network. Some offer daily payouts, while others might do so weekly, monthly, or based on certain cycles. It’s important to check the specific blockchain or staking pool’s policy.

Q. Is crypto staking worth it?

Staking can be worth it for those looking to earn passive income from their crypto holdings, especially if they are bullish on the long-term prospects of the staked cryptocurrency. However, weighing the potential rewards against the risks like market volatility and lock-up periods is essential.

Q. What are the benefits of staking crypto?

Crypto staking is the process by which crypto holders lock up their cryptocurrencies to support the operation and security of a blockchain network, earning staking rewards in return.

Staking crypto strengthens the security and efficiency of the blockchain network. Participating in the consensus mechanism, stakeholders help validate transactions and maintain the network’s integrity, contributing to a more stable and trustworthy digital ecosystem.

Q. How do you stake crypto?

To stake crypto, you typically need to own a digital asset that uses a Proof of Stake consensus mechanism, choose a staking platform or crypto exchange that supports staking, and decide the amount you wish to stake.

Q. What are staking rewards?

Staking rewards are the earnings received by crypto investors for staking their digital assets to help validate transactions on a blockchain network, acting as a form of passive income.

Q. Which platforms offer staking services?

Many crypto platforms, including major exchanges like Coinbase, offer staking services allowing users to stake cryptocurrencies directly through their platform and earn rewards.

Q. Can you earn passive income through staking?

Yes, by staking your crypto on a blockchain that uses a Proof of Stake consensus mechanism, you can earn passive income in the form of staking rewards.

Q. What risks are associated with staking crypto?

The risks of staking include the potential loss of value in the staked cryptocurrency due to market volatility, and on some platforms, staked assets may be locked for a period, adding liquidity risk.

Q. What is a staking pool?

A staking pool is a collection of crypto assets pooled together by multiple crypto investors to increase their chances of validating transactions and receiving rewards on a blockchain network.

Q. How does liquid staking differ from traditional staking?

Liquid staking allows stakeholders to participate in the staking process without locking their assets, offering them liquidity by issuing a secondary token representing the staked asset that can be traded.

Q. What should you consider before starting to stake cryptocurrencies?

Before you start staking, consider the staking requirements, the platform’s reputation, the staking period, the expected staking yields, and the risks of staking crypto.

Q. How can you find the best crypto staking platforms?

To find the best crypto staking platforms, research platforms that support staking for the cryptocurrencies you own, compare staking yields, check for staking program terms, and read reviews from other users.