Staking is one of the most dynamic and lucrative opportunities for digital asset owners. It has gained significant popularity among investors, with over 56% of crypto investors claiming they have staked their crypto. One key reason behind its popularity is its ability to offer a unique blend of participation, security, and reward within the blockchain ecosystem.

As cryptocurrencies continue to receive mainstream acceptance, understanding the different types of crypto staking becomes crucial. This blog explores the various types of crypto staking, each with unique technical expertise requirements and risk tolerance levels, helping you make informed decisions in your crypto journey.

Let’s begin!

Table of Contents

- Staking Crypto Meaning

- How Does Staking Work?

- What are the Different Types of Crypto Staking?

- Summary Table: Types of Crypto Staking

- Top 3 Benefits of Crypto Staking

- What Are the Risks Involved in Staking?

- Bonus: What Are the Best Coins to Stake?

- Conclusion – Types of Crypto Staking

- FAQs

Staking Crypto Meaning

Credits: FreePik

Before we dive into the types of crypto staking, it is important to understand what does staking in crypto mean.

So, what is staking in crypto? Crypto staking is a process used in various blockchain networks, where participants can earn rewards by holding and locking their cryptocurrency in a wallet to support the operations of a blockchain network.

It’s fundamental to the proof-of-stake (PoS) mechanism, an alternative to the energy-intensive proof-of-work (PoW) system used by networks like Bitcoin. In staking, users ‘stake’ their crypto assets by committing them to the network to validate transactions, secure the blockchain, and create new blocks.

In return for their contribution, stakers receive rewards – often as additional cryptocurrency. This helps maintain the network’s security and integrity but allows stakers to earn passive income. The process is less resource-intensive than mining and offers a greener alternative to PoW systems, making it a popular choice in the evolving landscape of cryptocurrency.

Now that we have discussed what is staking with crypto, let’s move on to exploring how does crypto staking work.

Are you looking for the best GPUs for mining? Read our informative piece ‘7 Best GPUs For Mining In 2023.’

How Does Staking Work?

Before diving into the types of crypto staking, one must get an idea of how does staking crypto work. Below is a breakdown of how staking works:

Proof of Stake (PoS) Consensus Mechanism

Credits: FreePik

In PoS, unlike the Proof of Work (PoW) system, validators (equivalent to miners in PoW) are chosen to develop new blocks and validate transactions according to the amount of coins they hold and ‘stake’ as collateral. This process demands substantially less energy compared to PoW.

Staking Coins

To participate in staking, a user locks a certain amount of the network’s native cryptocurrency in a wallet. The specifics can vary from one blockchain to another, but the more you stake, the higher your chances of being picked as a validator.

Becoming a Validator

Validators verify transactions and maintain the blockchain’s integrity. In some networks, validators are chosen randomly, but the probability of being chosen often increases with the amount staked. Other networks might have specific criteria for validators.

Staking Pools

Individual users with fewer coins can join staking pools, where stakeholders combine their coins to increase their chances of being chosen as validators. Rewards are then shared among pool members, proportional to their contribution.

Crypto Staking Rewards

Validators receive rewards for their work, usually through transaction fees or new coins. The reward mechanism varies between blockchains. Some offer a fixed rate, while others might have a reward structure based on factors like the total amount of staked coins.

Risks and Considerations

Staking comes with its risks, such as the potential decrease in the value of the staked coins. Some networks also penalize validators for going offline or validating fraudulent transactions, which can lead to losing a portion of their stake.

Keep reading below to learn more about the rewards and risks of staking.

Unstacking and Liquidity

There’s often a locking period for staked coins, during which you cannot trade them. After this period, you can ‘unstake’ your coins. Some blockchains also offer “liquid staking” solutions, allowing users to stake assets while retaining some liquidity.

Cryptoacking can be a severe threat. Read our blog, ‘What Is Cryptojacking & How To Prevent It?’ to learn more.

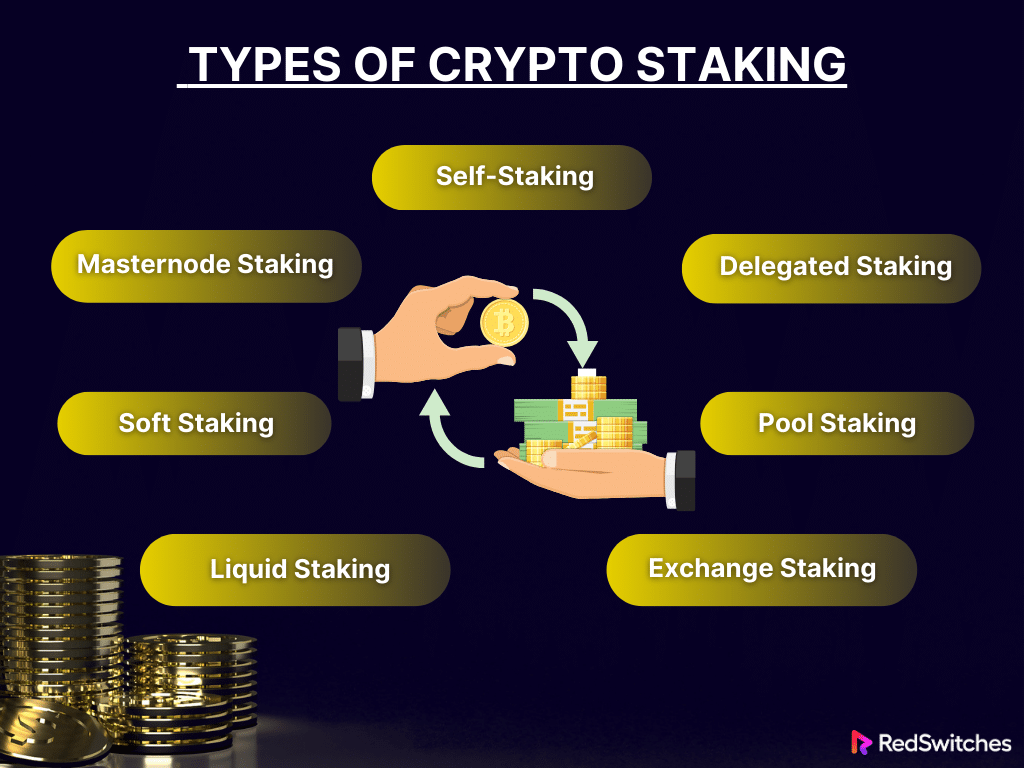

What are the Different Types of Crypto Staking?

Understanding the types of staking in crypto is crucial because each type offers varying risk, reward, and commitment levels. For investors, this knowledge allows for informed decisions aligned with their investment goals, technical expertise, and risk tolerance. Below are the seven most common types of crypto staking:

Self-staking

Self-staking in cryptocurrency refers to the process where an individual stakes their digital assets directly on a blockchain network that uses a Proof of Stake (PoS) protocol. This method involves setting up and maintaining a node, securing the staked assets, and actively participating in the network’s consensus mechanism.

The staker commits their coins as a stake and, in return, gets the chance to validate transactions, create new blocks, and earn staking rewards. This approach offers greater control over the staking process and potentially higher rewards. It also comes with several responsibilities and risks, such as ensuring continuous node operation and security against potential breaches.

Technical Expertise (High)

Self-staking is among the types of crypto staking that require high technical expertise. It demands an in-depth understanding of blockchain technology and proficiency in managing the specific cryptocurrency network on which you’re staking. This includes knowledge of how to store your crypto assets securely, understanding the network’s staking rules, and the ability to run a node if necessary.

Risk Tolerance (Medium to High)

In self-staking, the entire responsibility for the security and operation of your staked assets falls on you. Any technical errors, like a misconfigured node or security breaches, can lead to considerable losses. It requires a higher risk tolerance, as you need to be prepared to manage and mitigate these risks effectively.

Delegated Staking

Delegated staking is a process in cryptocurrency systems where coin holders delegate their staking power to a validator or a node rather than participate directly in the staking process.

This approach is especially beneficial for those who lack the technical expertise or resources to run a node. By delegating their coins, holders can still participate in the network’s consensus mechanism and earn staking rewards, while the chosen validators handle the technical aspects of validating transactions and maintaining the blockchain.

Technical Expertise (Low to Medium)

Delegated staking is among the crypto staking types that require low to medium technical expertise. With delegated staking, you entrust your staking operations to a third-party validator or node.

This option is ideal for those who may not have the technical expertise or time to engage in self-staking. By delegating, you benefit from the technical skills of experienced validators without needing to understand the intricate details of node operation or staking mechanisms.

Risk Tolerance (Medium)

While delegated staking relieves you of the technical management burden, it introduces the risk associated with the performance and reliability of the validator you choose. The key risk here is that the validator may act maliciously or incompetently, leading to penalties or losses.

Selecting reputable validators and monitoring their performance carefully is important. The overall risk is lower than other types of crypto staking, like self-staking, since you are not directly responsible for the technical operations.

Credits: FreePik

Pool Staking

Pool staking represents a collaborative approach to cryptocurrency staking. In this model, numerous stakers combine their digital assets to form a staking pool. This pooling of resources significantly enhances their collective probability of being chosen to validate new blocks in the blockchain, thereby earning staking rewards.

It’s particularly beneficial for individuals who possess smaller amounts of cryptocurrency, as it allows them to participate in the staking process without meeting the higher asset thresholds required for solo staking.

Technical Expertise (Low to Medium)

Pool staking is suitable for individuals looking for types of crypto staking that require low to medium expertise. Participants in a staking pool are not required to have in-depth knowledge of the underlying blockchain technology or the technical nuances of running a node.

The pool operator typically manages the technical aspects, including setting up and maintaining the infrastructure needed for effective staking. This makes pool staking an accessible option for those less technically inclined but who still wish to participate in the staking ecosystem.

Risk Tolerance (Moderate)

The risk tolerance for pool staking is moderate. While pooling resources reduces the entry barrier and technical challenges, it introduces certain risks. One of the primary risks is associated with the pool fees, which may vary and impact the overall rewards earned from staking.

The reliability and trustworthiness of the pool operator are crucial. There’s a risk that the operator might mismanage the pool or act maliciously. Therefore, participants must conduct thorough research and pick reputed staking pools with a good track record of reliability and fair management.

Exchange Staking

Exchange staking is a process where cryptocurrency holders stake their digital assets through a cryptocurrency exchange platform. This staking method is appealing due to its convenience and ease of use. The exchange platform takes on the responsibility of handling all the technical requirements for staking, including selecting validators and managing staking nodes.

Technical Expertise (Low)

Exchange staking is among the best types of crypto staking for beginners. The technical expertise required for exchange staking is relatively low. Since the cryptocurrency exchange manages all technical aspects of the staking process, individual users do not need technical skills related to blockchain technology or node management. The user-friendly interface of most exchanges simplifies the process, making it accessible even to those new to cryptocurrencies.

Risk Tolerance (Variable)

The risk tolerance associated with exchange staking can be variable and largely depends on the security and reliability of the chosen exchange. While staking through an exchange is convenient, it does carry certain risks. The primary risk involves the security of the exchange itself; in the event of a security breach or hack, users could potentially lose their staked assets.

The stability and business continuity of the exchange are important factors. If an exchange faces operational issues or goes out of business, it could impact the users’ ability to access or recover their staked assets. Users must select well-established and reputable exchanges with robust security measures.

Liquid Staking

Liquid staking represents an innovative approach in the crypto currency staking landscape. It allows participants to stake their digital assets and earn staking rewards without sacrificing liquidity. In this system, when users stake their cryptocurrency, they receive a corresponding amount of liquid tokens.

These tokens act as a stand-in for the staked assets and can be freely traded or used in various decentralized finance (DeFi) applications. This approach seamlessly blends the benefits of staking with the flexibility of liquid markets, enabling users to participate in other investment opportunities without un-staking their assets.

Technical Expertise (Moderate)

Liquid staking is among the types of crypto staking suitable for users with mid-level experience. Engaging in liquid staking requires moderate technical expertise. Users must not only grasp the fundamental concepts of staking mechanisms but also have a solid understanding of the intricacies of DeFi protocols.

This includes comprehending yield farming, liquidity pools, and the role of different tokens within these ecosystems. Familiarity with the specific platforms used for liquid staking is crucial, as these platforms may involve complex smart contracts and additional token types, each with its own set of features and risks.

Risk Tolerance (Moderate to High)

The risk tolerance for liquid staking is moderate to high. While it offers greater flexibility and liquidity than traditional staking methods, it also introduces unique risks. These include potential vulnerabilities in smart contracts, which malicious actors could exploit.

The liquid tokens received as a representation of the staked assets might face devaluation or volatility, impacting the overall return on investment. Participants in liquid staking need to be vigilant and informed about these risks.

Masternode Staking

Masternode staking is a more advanced and involved form requiring significant commitment and resources. A masternode is a powerful server on a blockchain network, requiring a sizable amount of a specific cryptocurrency as collateral.

By running a masternode, participants support the network’s infrastructure, performing critical functions such as validating transactions, participating in governance, or enabling specific services like instant transactions or private transfers. In return for their service and investment, masternode operators receive staking rewards, often in the form of the cryptocurrency they are helping to secure.

Technical Expertise (High)

Masternode may not be among the types of crypto staking suited for beginners since it demands high technical expertise. It involves setting up, securing, and maintaining a server, which requires knowledge of network protocols, server management, and cybersecurity measures. This is a more hands-on approach to staking, with participants needing to ensure their masternode is always online and functioning correctly to receive rewards and maintain their collateral’s security.

Risk Tolerance (High)

The risk associated with masternode staking is high. The substantial initial investment poses a significant financial risk, especially considering the volatile nature of cryptocurrency markets. Operational risks are related to maintaining the server and ensuring network security. The value of the staked cryptocurrency can fluctuate widely, affecting both potential earnings and the value of the collateral.

Soft Staking

Soft staking offers a more user-friendly and flexible approach to crypto staking. Cryptocurrency exchanges commonly provide it and do not require users to lock their assets for a fixed period. This method allows participants to earn staking rewards while keeping their cryptocurrencies in an exchange wallet. The key advantage here is the ability to trade or move these assets at short notice, providing a balance between earning passive income and maintaining trading liquidity.

Technical Expertise (Low to Moderate)

The technical expertise required for soft staking is relatively low to moderate. It is designed to be accessible and straightforward, primarily involving basic operations within a cryptocurrency exchange platform. Users need to understand how to navigate the exchange, opt into the staking program, and manage their assets within the platform. This makes soft staking an attractive option for those new to staking or who prefer a hands-off approach.

Risk Tolerance (Moderate)

Soft staking is categorized among the types of crypto staking with moderate risk tolerance. While it eliminates the need for technical know-how associated with running nodes or understanding complex DeFi protocols, it introduces risks related to the security and stability of the exchange itself. Users are reliant on the exchange’s security measures to protect their assets.

If the exchange faces operational issues or security breaches, there is a risk of losing staked assets. The rewards for soft staking might be lower than those available through more active staking methods, reflecting its lower risk and effort profile.

Also Read: Automated Staking Scripts and Tools for Server-based Nodes

Also Read: What Is the Minimum Lockup Period for Crypto Staking?

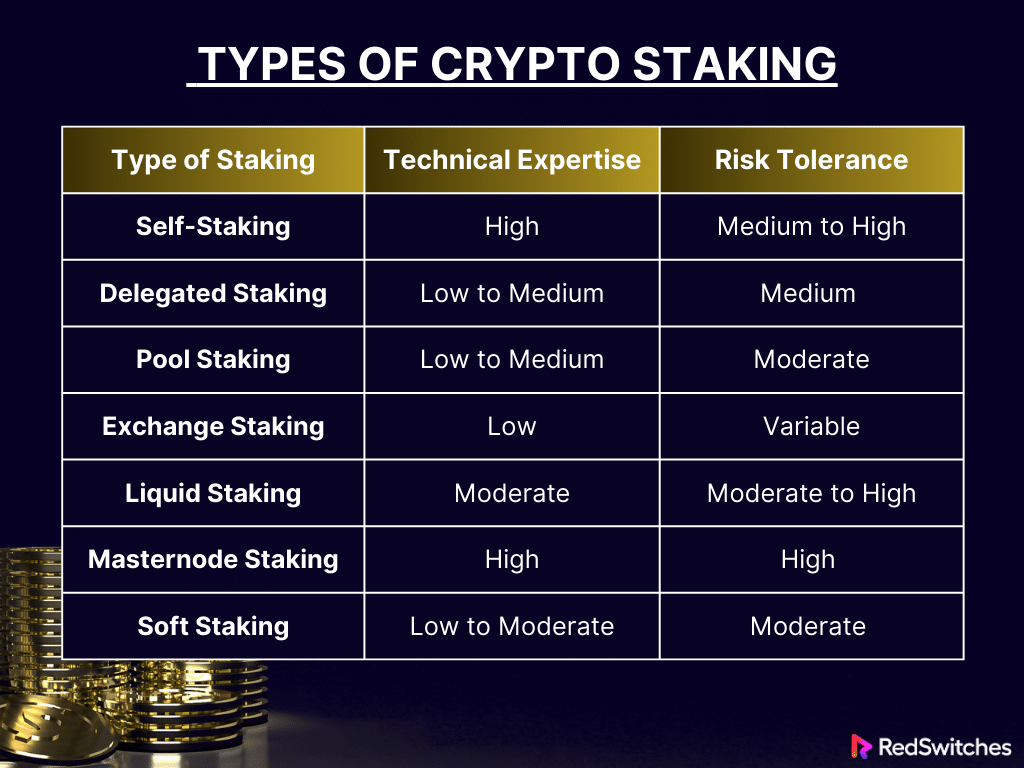

Summary Table: Types of Crypto Staking

Below is the summary table for the types of crypto staking, stating the technical expertise requirements and risk tolerance for each crypto staking type.

Now that we have discussed the types of crypto staking, let’s go over the top three benefits of staking crypto.

Also Read: Switch To RedSwitches If You Got Banned From Hetzner Network.

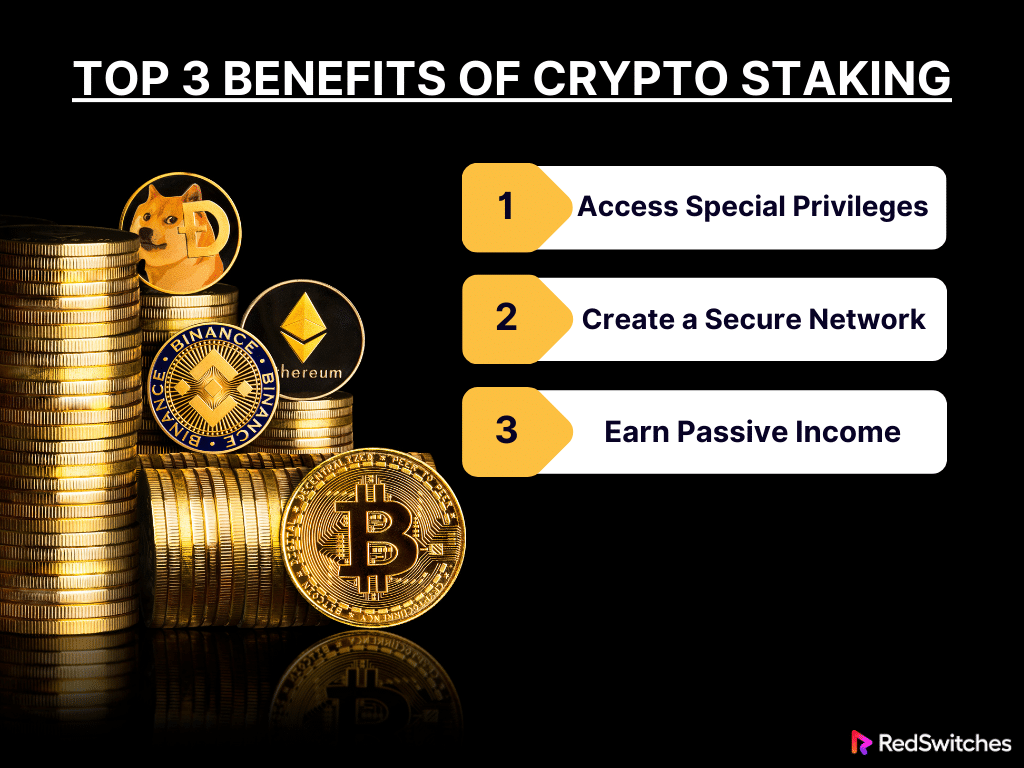

Top 3 Benefits of Crypto Staking

Below are the top three benefits of crypto staking:

Access Special Privileges

Exclusive Participation in Governance

One of the standout features of crypto staking is the opportunity it provides for stakers to play a crucial role in the governance of blockchain projects. Participants typically gain voting rights by staking their tokens, granting them a voice in important decisions. This can include voting on proposed protocol upgrades, changes in governance policies, and other strategic directions of the project.

Entry to Private Sales and Events

Staking often opens the door to exclusive opportunities within the crypto space. Many projects offer stakers early access to private sales, ICOs (Initial Coin Offerings), or airdrops. This privileged access can be incredibly valuable, providing a chance to invest in promising ventures at an early stage, often at a preferential rate.

Enhanced User Experience

A more tangible day-to-day benefit of staking is the enhanced user experience on many platforms. This can manifest in various forms, such as reduced transaction fees, higher transaction speeds, and priority customer support. For frequent platform users, these advantages can significantly improve the overall experience, making transactions smoother and more cost-effective.

Create a Secure Network

Contribution to Network Health

Crypto staking plays a vital role in ensuring the health and security of blockchain networks. By staking their tokens, users contribute to the overall stability and security of the network. Their staked assets act as a ‘vote’ for trustworthy validators responsible for maintaining the blockchain’s integrity.

The more widespread the participation in staking, the more decentralized the network becomes. This decentralization is crucial for safeguarding the network against attacks and manipulation, ensuring that no single entity has disproportionate control over the network.

Incentivizing Honest Behavior

Staking mechanisms are designed to promote honest behavior among participants. Many staking systems incorporate penalties, such as slashing (the forfeiture of a portion of the staked tokens), for validators who act maliciously or negligently. This system of rewards and penalties incentivizes validators to act in the network’s best interest, maintaining its integrity and ensuring reliable transaction processing.

Enhanced Transaction Validation Process

In proof-of-stake (PoS) and similar consensus mechanisms, validators are chosen based on the cryptocurrency amount they are willing to stake as collateral. This staking-based validation process is more energy-efficient and generally faster than the proof-of-work (PoW) mechanisms used in networks like Bitcoin.

Credits: FreePik

Earn Passive Income

Regular Staking Rewards

The most direct and tangible benefit of crypto staking is the ability to earn passive income. Stakers get rewards, usually in the form of additional cryptocurrency, for their contribution to the network. These rewards provide a steady source of income, which can be more predictable and stable compared to other forms of crypto investments like trading.

For many users, these staking rewards are a way to grow their holdings without the need for active trading or speculation. The simplicity and predictability of staking rewards make it attractive for those looking to benefit from the crypto market’s potential without engaging in its volatility.

Compounding Interest

The power of compounding plays a significant role in the appeal of staking rewards. Stakers can exponentially grow their holdings over time by reinvesting their rewards. This compounding effect can significantly increase the value of an individual’s investment, creating a snowball effect that can substantially enhance the long-term return on investment. This aspect of staking is particularly attractive to long-term investors looking to maximize their assets’ growth over time.

Low Entry Barrier to Investment

Compared to other methods of crypto investment, including mining or active trading, staking often presents a lower barrier to entry. It generally requires less technical expertise and lower upfront costs, making it accessible to a broader range of investors.

This inclusivity is crucial for democratizing financial opportunities within the crypto space.

Credits: FreePik

What Are the Risks Involved in Staking?

It is common for newcomers to question, ‘is staking crypto risk free.’ However, it is important to understand that nothing is risk-free in the cryptocurrency world. Below are some of the top risks involved in staking:

1. Liquidity Risk

Extended Asset Immobilization

When you choose to stake your cryptocurrencies, you’re committing them for a predetermined period, which can range from days to months or even longer in some cases. This immobilization means your assets are frozen and cannot be accessed for any other use during this period.

Impact on Financial Planning

This lack of liquidity can be particularly challenging if you need to access these funds unexpectedly for urgent financial needs. In the fast-paced world of cryptocurrencies, being unable to move assets can lead to missed opportunities or an inability to respond to market downturns.

Impact of Volatile Markets

Cryptocurrency markets are known for their extreme volatility. If the market experiences a downturn, you won’t have the option to liquidate your staked assets to cut losses. This could result in your assets losing more value than the rewards you earn from staking.

Opportunity Cost

You might miss lucrative investment opportunities by having your crypto assets tied up in staking. The crypto market is dynamic, with new tokens and investment platforms emerging regularly. The inability to invest in these opportunities can lead to significant opportunity costs.

2. Market Risk

Susceptibility to Market Fluctuations

The value of cryptocurrencies is highly unpredictable. The assets you have staked are exposed to the same market risks as any other crypto investment. This inherent volatility means the value of your staked assets can fluctuate widely.

Price Fluctuation Risks

If the market trends downward, the value of your staked assets can decrease. This devaluation might lead to a scenario where the cumulative value of your staking rewards is considerably less than the loss in your asset’s market value.

Long-Term Market Trends

Cryptocurrency markets can experience prolonged bearish phases. If you’re locked into staking during such a period, the depreciation in your staked asset’s value can outweigh the benefits of the staking rewards. This can lead to a net loss in your investment.

3. Loss of Your Assets

Validator Performance Risks

Choosing a reliable and trustworthy validator is crucial in networks that use validators. If the validator behaves dishonestly or fails to fulfill their duties, it could lead to penalties. These penalties can result in losing a portion or even the entirety of your staked assets.

Security of Staking Platforms

Many staking processes involve third-party platforms or require interaction with smart contracts. The security of these platforms and contracts is critical. If they are compromised or have underlying vulnerabilities, your staked assets are at risk of theft or loss.

Slashing Penalties

Certain staking protocols include slashing mechanisms to penalize validators for misconduct or non-performance. If your staked assets are associated with a validator who violates network rules, a portion of those assets can be slashed as a penalty, leading to direct financial loss.

Also Read: Wallet BTC: 5 Ways To Keep Your Bitcoin Secure.

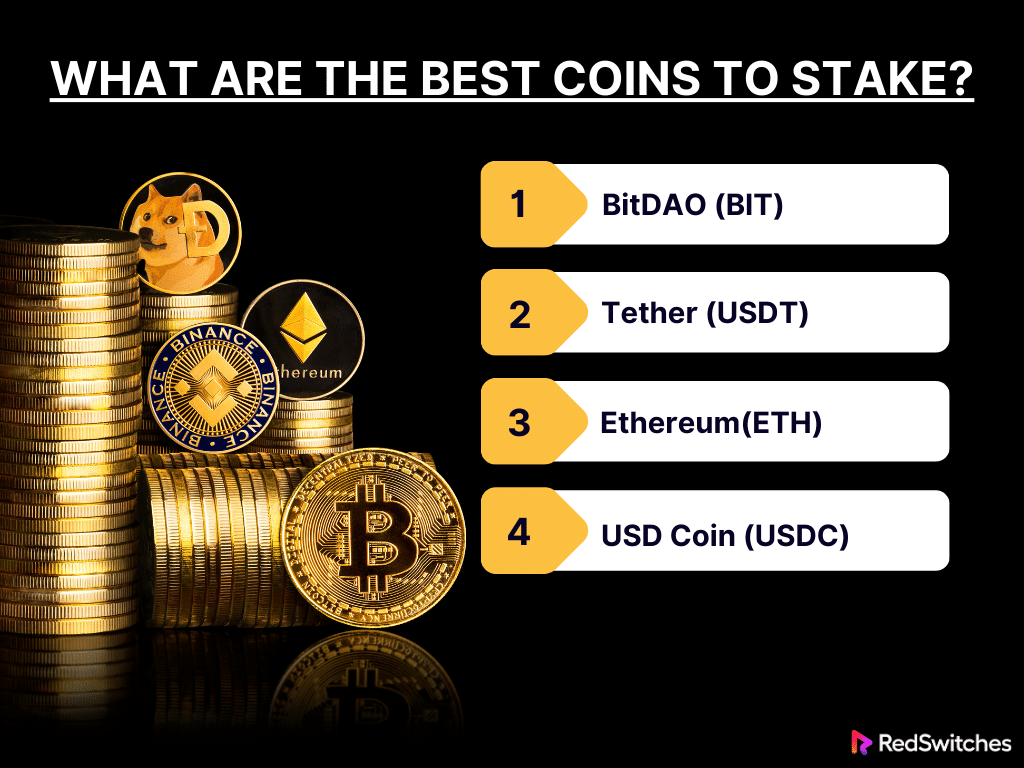

Bonus: What Are the Best Coins to Stake?

Choosing the best coins for staking involves considering various factors, such as the coin’s stability, staking rewards, and the overall health and prospects of the blockchain project. Below are the top coins to stake:

1. BitDAO (BIT)

BitDAO is one of the world’s largest decentralized autonomous organizations (DAOs), focusing on blockchain projects and DeFi ecosystems. It aims to support DeFi’s growth, research, and liquidity.

Staking BIT can be interesting due to its focus on DeFi and community governance. Stakers may have a say in DAO decisions, and the growth of the DeFi sector could positively influence BIT.

2. Tether (USDT)

Tether is a stablecoin. This means its value is pegged to a fiat currency, in this case, the US Dollar. This pegging typically reduces volatility compared to other cryptocurrencies.

Staking stablecoins like USDT can offer lower risk in terms of price volatility. However, the returns might be lower compared to more volatile assets. Staking USDT could be a strategy for earning interest on idle fiat-equivalent assets.

3. Ethereum(ETH)

Credits: FreePik

Did you know that as of April 30, 2023, an all-time high of approximately 19.2 million ether has been staked? This shows a 24.2% boost from the last few months of 2022 – which showed 15.9 million ether staked. These numbers prove how Ethereum is a major player in the crypto world. Staking ETH could offer significant rewards, but it’s important to note the risks, including the lock-up period and the network’s ongoing development.

4. USD Coin (USDC)

USD Coin is a stablecoin pegged to the US Dollar, offering low volatility. USDC staking provides a low-risk option for those looking to earn interest on their stablecoins. The returns are generally lower than more volatile cryptocurrencies but offer a stable income stream.

Conclusion – Types of Crypto Staking

As we explore the different types of crypto staking, it’s clear that each method offers distinct advantages and challenges. Whether you’re a seasoned crypto enthusiast or new to the space, understanding the technical expertise requirements and risk tolerance of the different types of crypto staking can help you decide which type is best suited for you.

For those looking to dive deeper and leverage these staking opportunities, RedSwitches emerges as a reliable and innovative service provider. Offering robust hosting solutions that cater to a wide range of needs in the crypto domain, we empower users to engage with crypto staking more securely and efficiently.

Our state-of-the-art infrastructure and dedicated support ensure that your crypto journey, whether it involves self-staking, pool staking, or any other method, is backed by a solid foundation. Get in touch with us today to learn more.

FAQs

Q. What are the options for staking?

The options for types of crypto staking include Self-Staking, Delegated Staking, Pool Staking, Exchange Staking, Liquid Staking, Masternode Staking, and Soft Staking.

Q. What is the principle of staking?

The principle of staking in cryptocurrency involves holding and locking a certain amount of cryptocurrency to support the operations and security of a blockchain network. In return for contributing to network health and transaction validation, stakers receive rewards, often as additional cryptocurrency.

Q. What is the basic of crypto staking?

The basic idea of crypto staking is to commit one’s digital assets to a blockchain network to validate transactions and maintain network security. It’s an alternative to mining and is often used in Proof of Stake (PoS) or similar consensus mechanisms, offering a way to earn passive income through staking rewards.

Q. What is crypto staking?

Crypto staking is a process of actively participating in transaction validation on a proof-of-stake (PoS) blockchain. It involves holding funds in a cryptocurrency wallet to support the operations of a blockchain network and receive rewards in return.

Q. What are the different types of staking?

The different types of staking include cold staking, liquid staking, custodial staking, and DeFi staking. Each type offers unique features and benefits for crypto investors looking to stake their assets.

Q. How can I start staking my crypto?

To start staking your crypto, you can choose a staking platform or crypto exchange that offers staking services. Once you have selected a platform, you can follow their guidelines to begin staking your crypto assets.

Q. What are the risks of crypto staking?

The risks of crypto staking include potential loss of staked assets, security vulnerabilities, and market volatility. It’s important for stakers to be aware of these risks and take necessary precautions.

Q. What is the future of crypto staking?

The future of crypto staking looks promising, with innovations such as liquid staking protocols and the integration of staking services into decentralized finance (DeFi) platforms. Staking is expected to play a significant role in the growth and development of the crypto ecosystem.

Q. How do staking returns work?

Staking returns, also known as staking rewards, are generated by participating in the validation process of a blockchain network. The returns are typically distributed in the form of additional cryptocurrency tokens or rewards for contributing to the network’s security and operations.

Q. What is DeFi staking?

DeFi staking refers to staking activities within decentralized finance platforms, where users can earn rewards by participating in various staking protocols and liquidity pools. DeFi staking provides opportunities for users to engage with the DeFi ecosystem and generate returns on their crypto holdings.

Q. How can staking contribute to a crypto investor’s portfolio?

Staking can contribute to a crypto investor’s portfolio by providing a means to earn passive income through staking rewards. Additionally, staking can offer exposure to different types of staking assets and contribute to the diversification of a crypto portfolio.

Q. What are the benefits of liquid staking?

Liquid staking protocols offer the benefit of allowing stakers to access liquidity and trade their staked assets while still earning staking rewards. This flexibility in accessing staked funds distinguishes liquid staking from other staking methods.

Q. How do crypto investors stake their assets?

Crypto investors can stake their assets by choosing a staking platform or service provider, selecting the assets they want to stake, and following the staking process outlined by the platform. Staking enables investors to earn rewards while supporting the functionality of blockchain networks.