Key Takeaways

- Crypto staking secures blockchain operations by locking up digital assets for rewards.

- Lockup periods for staking vary significantly across cryptocurrencies, from several days to more than a year.

- Extended lockup periods limit access to assets, impacting investment liquidity and flexibility.

- Staking provides passive income through additional coin rewards, dependent on the staked amount and lockup time.

- Staking enhances blockchain security and efficiency, which is vital for maintaining network stability.

- Staking is more energy-efficient than mining, requiring less power and being more environmentally friendly.

- Risks in staking include potential value decreases during the lockup and security vulnerabilities of the platform.

- Regulatory and market factors affect lockup durations, which should be considered when selecting staking options.

- Some networks, such as Cardano, offer flexible staking without fixed lockup periods.

- Technological and market developments might shorten lockup periods, increasing staking flexibility and accessibility.

In the dynamic world of cryptocurrency, staking has become a popular method for holders to earn rewards. It’s a process where you lock up your crypto assets to support a network’s operations. But, one question often arises: What is the minimum lockup period for staking these digital assets? This period can vary widely depending on the blockchain protocol and the staking platform. Some may require a few days, while others need months or even longer. Understanding this lockup period is crucial because it affects how long your assets will be unavailable for other transactions.

In 2023, a staggering 19.2 million ether (ETH) has been staked, marking a significant increase from the previous year. This growth highlights the increasing trust and interest in staking as a viable investment strategy.

In this article, we’ll explore the ins and outs minimum lockup period for crypto staking, the minimum lockup periods across various platforms, and what this means for your investment strategy. Whether you’re a seasoned investor or new to crypto, this guide will provide valuable insights into crypto staking.

Table Of Contents

- Key Takeaways

- What Is Crypto Staking?

- What Is the Lockup Period for Crypto Staking?

- Overview of Minimum Lockup Periods

- How to Choose a Staking Option?

- Future of Staking and Lockup Periods

- Connection Between Staking Lockup Periods And Dedicated Servers

- Conclusion

- FAQs

What Is Crypto Staking?

Credits: Freepik

Crypto staking is a process where cryptocurrency holders commit their coins to a blockchain network. This commitment helps the network operate securely and efficiently. In exchange, stakers receive rewards, usually in the form of additional coins. Staking is a crucial part of many cryptocurrencies that use the proof-of-stake model. This model is different from the proof-of-work model, which relies on mining.

Understanding the Process

In crypto staking, you lock up your cryptocurrency to support the network’s operations. Your locked coins help validate transactions and create new blocks, maintaining the blockchain’s security and integrity. The process requires a compatible wallet and a certain minimum amount of cryptocurrency.

Key Features of Crypto Staking

Here are the key features of crypto staking:

Passive Income

One of the main attractions of crypto staking is the opportunity to earn passive income. You can earn rewards by simply holding and staking your cryptocurrency, which are additional coins added to your wallet. The return rate varies by cryptocurrency but can be attractive compared to traditional banking investments.

Contribution to Network Security

Stakers contribute to the security of the cryptocurrency’s network. They provide the necessary resources to validate transactions and create new blocks by staking. This process helps prevent fraudulent activities and ensures the network runs smoothly.

Energy Efficiency

Crypto staking is more energy-efficient than crypto mining. Traditional mining requires significant computational power and electricity. Staking, however, does not require powerful hardware, making it a more sustainable and environmentally friendly option.

Reduced Volatility

Staking can help reduce a cryptocurrency’s volatility. When many coins are locked in staking, the circulating supply decreases, leading to a more stable price. However, this depends on the overall market conditions and specific tokenomics of the cryptocurrency.

Risks Involved

While staking offers many benefits, it also comes with risks. The value of the staked cryptocurrency can fluctuate widely. If the price drops significantly during the lockup period, the staker may have less value than initially invested. Additionally, there are risks related to the security of the staking platform or wallet.

Crypto staking is an appealing option for those earning passive income through cryptocurrency holdings. It supports network security and is more energy-efficient than mining. However, like any investment, it carries risks. Therefore, it’s important to carefully choose which cryptocurrency to stake by considering all the relevant factors. This will help you maximize your investment while minimizing potential downsides.

What Is the Lockup Period for Crypto Staking?

You might wonder, What is lock-up period staking? In crypto staking, the lockup period is when staked cryptocurrencies cannot be withdrawn. This period varies widely among different cryptocurrencies and is a fundamental aspect of the staking process. Understanding the lockup period is essential for anyone looking to stake cryptocurrency because it affects how long your assets will be inaccessible.

Key Features of Lockup Period for Crypto Staking

Here are the key features of the lockup period for crypto staking:

Fixed vs. Flexible Periods

Some cryptocurrencies have a fixed lockup period. This means you must commit your assets for a set duration before reaccessing them. Other networks offer flexible lockup periods, where you can choose how long to stake your coins, with different rewards depending on the duration.

Varies by Cryptocurrency

The length of the lockup period can vary significantly from one cryptocurrency to another. The network’s rules define it and can be influenced by various factors, including network security needs and the blockchain’s overall staking strategy.

Impact on Liquidity

During the lockup period, your staked assets are not liquid. This means you cannot sell or trade them until the period ends. The lockup thus directly impacts the liquidity of your assets.

General Benefits of Lockup Periods

Lockup periods in crypto staking offer significant benefits that contribute to the stability and security of blockchain networks. Here are the main advantages of having lockup periods:

Enhances Network Security

Credits: Freepik

Lockup periods enhance the network’s security. By requiring stakers to hold their cryptocurrencies for a certain time, networks ensure that participants are vested in the blockchain’s stability and security.

Stabilizes Coin Value

Lockup periods can help stabilize the value of a cryptocurrency. With fewer coins available for trading, the price is less likely to be volatile. This can attract more conservative investors looking for stable investments.

Encourages Long-Term Investment

By locking up assets, stakers are encouraged to think long-term. This aligns the interests of the stakers with those of the network, promoting an ecosystem where participants are invested in the future of the cryptocurrency.

Challenges Associated with Lockup Periods

Lockup periods in crypto staking come with several challenges that can affect investors’ flexibility and potential returns. Here are some of the main challenges associated with lockup periods:

Reduced Flexibility

The main challenge of lockup periods is the loss of flexibility. Stakers cannot react quickly to market changes by selling or trading their staked coins. This can be particularly challenging during market downturns, where the value of the locked assets might decrease significantly.

Opportunity Cost

Staking your crypto means missing out on potential other investment opportunities. The longer your assets are locked up, the greater the opportunity cost, especially if other investments could yield higher returns.

Risk of Lock-In at Low Prices

If the cryptocurrency’s market value falls during the lockup period, stakers may find themselves locked in at a loss. This can be frustrating, especially if the market does not recover quickly or better opportunities arise during the lockup period.

The lockup period is essential to crypto staking, greatly impacting your investment and experience. It helps improve network security and stabilize prices but limits how quickly you can access your money. It’s important to understand the details of the lockup period before you start staking your assets. This knowledge will allow you to make smart choices, fitting your financial goals and how much risk you’re willing to take.

Overview of Minimum Lockup Periods

In cryptocurrency staking, lockup periods represent a key factor that every staker must consider. These periods dictate how long tokens must remain staked before they can be withdrawn, influencing both the network’s stability and the staker’s liquidity.

Factors Influencing Lockup Periods

Several factors can influence the duration of lockup periods in crypto staking, impacting the network’s security and the liquidity available to investors. Here’s an overview of the key factors that affect lockup periods:

Network Security Needs

The primary reason for enforcing lockup periods is to enhance the security of the blockchain. Longer lockup periods mean that a significant amount of the cryptocurrency is held, which helps prevent malicious activities. If a large portion of tokens is locked up, it’s harder for bad actors to gather enough tokens to attack the network.

Economic Incentives

Lockup periods also align the interests of stakers with those of the network. By locking tokens, stakers show they are committed to the network’s long-term health. In return, they often receive higher rewards for longer commitments. This setup encourages stakers to think beyond short-term gains.

Regulatory Environment

The regulatory framework surrounding a cryptocurrency can also affect the lockup period. Some jurisdictions might impose specific requirements that influence staking, including the minimum or maximum duration for which tokens can be staked.

Market Conditions

Credits: Freepik

Market dynamics play a crucial role in setting lockup periods. In a volatile market, longer lockup periods can help stabilize the token’s price by reducing the circulating supply. Conversely, in stable times, shorter periods might be sufficient to maintain network security without unduly tying up investor assets.

Also Read Exploring the Best Crypto Staking Apps of 2024

Typical Duration of Lockup Periods

Lockup periods can vary significantly depending on the cryptocurrency and underlying network rules. Here is a general look at how these durations tend to be set:

Short-Term Lockups

Some networks offer staking options with lockups as short as a few days or weeks. These short-term lockups are usually for networks with many transactions or less reliant on staked tokens for security. They provide greater liquidity, allowing stakers to access their tokens relatively quickly.

Medium-Term Lockups

A medium-term lockup period might range from a few months to a year. This range often balances providing network security and offering stakers some liquidity. It’s common in networks where the price of the token is moderately volatile and a somewhat stable staker base is needed.

Long-Term Lockups

Lockup periods can extend beyond a year for networks aiming for maximum security and staker commitment. These are typical in networks still developing their infrastructure and must ensure they have enough staked capital to secure their operations over the initial years. Stakers who prioritize long-term gains over immediate access to their assets are also attracted to long-term lockups.

No Fixed Lockup

Some new networks don’t have a set lockup period, so stakers can pull out their tokens whenever they want. This makes it easier to access your funds, but it might make it harder for the network to ensure long-term security unless other plans are in place.

It’s important to understand the factors that affect lockup periods and what you might expect regarding duration when staking. Each network has its conditions based on its need for security, economic objectives, regulations, and market situations. Knowing these factors helps stakers make choices that fit their financial plans and risk level. This ensures they pick the right platform and lockup conditions for their needs.

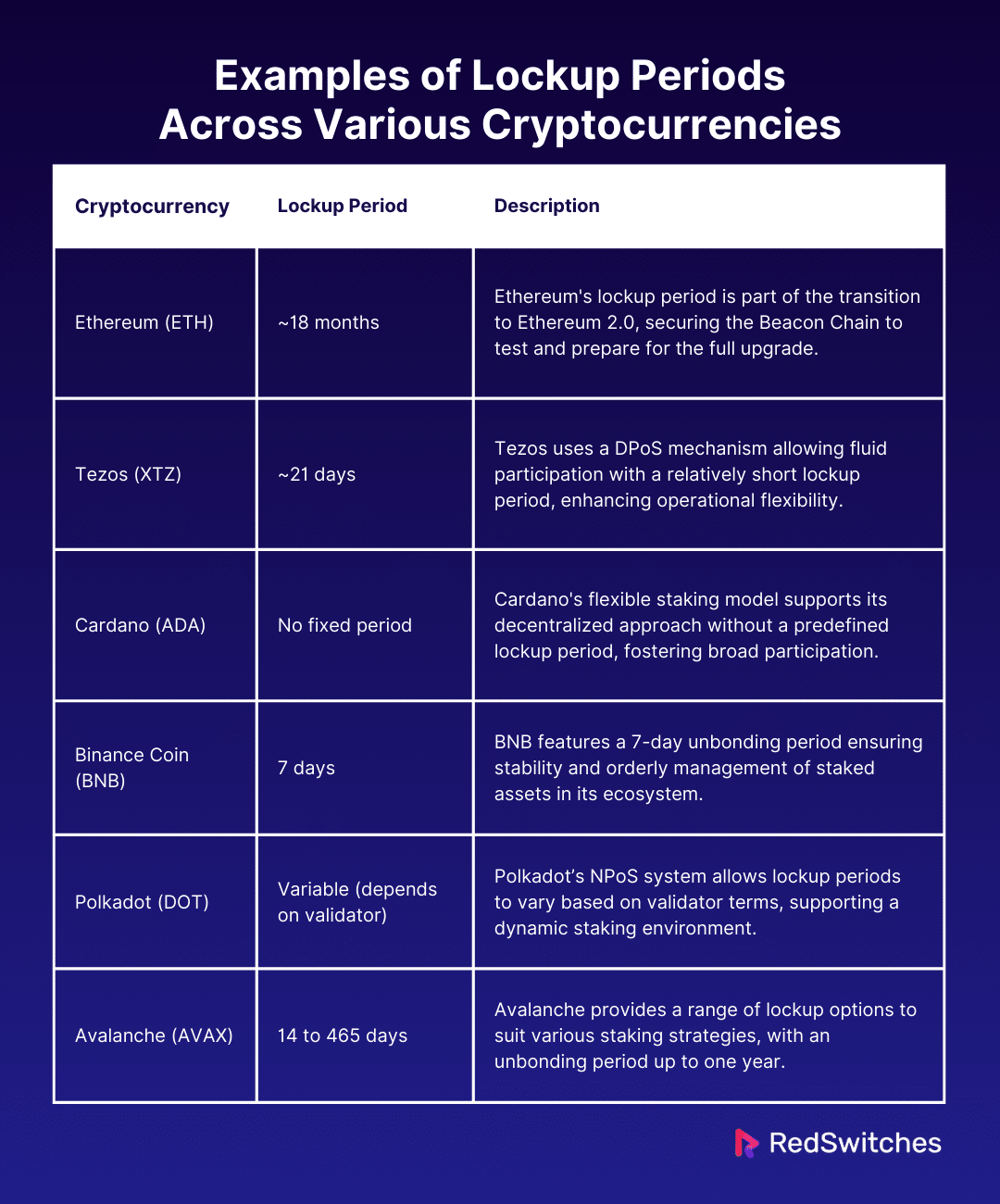

Examples of Lockup Periods Across Various Cryptocurrencies

Cryptocurrencies often use staking to secure their networks. The lockup period for staking can vary widely from one cryptocurrency to another. This section looks at the lockup periods for two popular cryptocurrencies, Ethereum (ETH), Tezos (XTZ), and others to illustrate how these periods can differ.

Ethereum (ETH)

Ethereum is transitioning to Ethereum 2.0, which includes moving from proof-of-work to proof-of-stake. This shift requires stakers to lock up their ETH for a significant period. The typical lockup period for Ethereum is about 18 months. This long duration is part of the setup to secure and govern the Beacon Chain, a new blockchain that serves as a test and a precursor to the full Ethereum 2.0 upgrade. During this period, the staked ETH cannot be transferred back to the original Ethereum blockchain or accessed or used. This extensive lockup period is crucial for ensuring the stability and security of the transition phase.

Tezos (XTZ)

In contrast, Tezos operates on a delegated proof-of-stake (DPoS) mechanism. This system allows token holders to participate in network security and governance by delegating their tokens to a validator, commonly called a “baker.” The lockup period for Tezos is much shorter, typically around 21 days. During this time, the delegated XTZ tokens are locked and cannot be traded or transferred. This shorter lockup period reflects the ongoing operational needs of the Tezos network and allows for more fluidity in token holders’ participation in staking. This flexibility makes Tezos appealing to those who wish to support network security but require more frequent access to their assets.

Cardano (ADA)

Cardano’s approach to staking is unique because it does not set a fixed lockup period. This flexibility reflects its commitment to a democratic staking model. The design aims to support decentralization and adhere to academic development principles. Stakers on the Cardano network can participate without the constraint of their assets being tied up for a predefined period. This openness encourages a broad participation base, fostering greater network security through its decentralized and equitable distribution of staking rewards.

Solana (SOL)

Solana has defined its lockup period as two epochs, typically about two to three days. This relatively short lockup period allows for agility within the Solana ecosystem. Stakers can quickly adjust their investments in response to market conditions, which is advantageous in the fast-moving cryptocurrency environment. The short duration aims to balance securing the network and providing liquidity to stakers. This system is designed to maintain high throughput and fast transaction speeds characteristic of Solana’s blockchain technology.

Binance Coin (BNB)

Binance Coin (BNB) incorporates a straightforward staking mechanism with a lockup period of 7 days. This duration, known as the unbonding period, is a crucial phase during which staked BNB tokens cannot be sold or traded. This period enhances the security of the Binance blockchain network by ensuring that tokens are not abruptly removed from staking. This stability helps maintain the integrity and functionality of the network, providing time for the orderly management of staked assets.

Polkadot (DOT)

Polkadot utilizes a Nominated Proof-of-Stake (NPoS) system, allowing users to nominate validators to participate in network security. Unlike BNB, Polkadot does not have a fixed lockup period for staking. Instead, the duration is dependent on the chosen validator’s bonding terms. This means the lockup period can vary widely, allowing users to choose validators that align with their investment timeline and risk tolerance. This model supports a dynamic and adaptable staking environment, catering to users’ diverse range of staking preferences.

Avalanche (AVAX)

Avalanche offers a variable lockup period for staking that ranges from 14 to 465 days. This range allows validators to select a lockup duration that best suits their operational and financial strategies. The lockup period is crucial for ensuring network security and governance, as it commits validators to a set duration of network support. Additionally, Avalanche’s unbonding period lasts from two weeks to one year, emphasizing the importance of commitment when participating in AVAX staking. These periods are designed to balance network stability with the flexibility needed by stakers in a volatile market environment.

Also Read Top 15 Crypto Staking Platforms for Maximum Earnings!

Here’s a concise summary table that presents the lockup periods for various cryptocurrencies:

Important Note: Lockup periods can change over time depending on network updates, governance proposals, or market conditions. It’s always best to double-check the most up-to-date information on a project’s official website.

The lockup periods highlight the varied approaches to staking within the cryptocurrency space. Binance Coin offers a brief, fixed period for quick turnover and high liquidity. In contrast, Polkadot’s flexible staking model through NPoS allows stakers to customize their engagement based on the bonding terms of different validators. Meanwhile, Avalanche provides a range of lockup options to accommodate different levels of commitment and investment strategies, from short-term engagements to longer-term stakes.

These differing strategies underscore the importance of understanding each network’s staking mechanisms and lockup periods. Such knowledge is crucial for making informed decisions that align with individual financial goals and risk profiles in the dynamic landscape of cryptocurrency investments.

How to Choose a Staking Option?

When entering the cryptocurrency world, it is crucial to understand how to select a staking option that meets your needs. A significant factor to consider is the minimum lockup period for crypto staking, which can greatly influence your investment’s flexibility and potential returns.

Assess the Minimum Lockup Period for Crypto Staking

Credits: Freepik

The minimum lockup period for crypto staking is a key consideration. This period varies significantly across different cryptocurrencies. Shorter lockup periods offer more liquidity, meaning you can access your investment sooner. Longer periods might provide higher returns but reduce your ability to react to market changes quickly. Consider how the minimum lockup period for crypto staking fits your overall investment strategy and how long you are comfortable having your assets tied up.

Evaluate Reward Rates

Different staking options offer varying rates of return on your staked crypto. Higher reward rates can be tempting, but they often come with longer minimum lockup periods for crypto staking. Weigh the potential gains against the lockup period. Ensure that the rewards justify the time your assets will be inaccessible.

Consider Network Security and Stability

The security and stability of the blockchain are vital. A secure network reduces the risk of attacks that could affect the value of your staked assets. Consider platforms known for robust security measures and stable operations. Trustworthy platforms often have reasonable minimum lockup periods for crypto staking, balancing security with staker flexibility.

Review the Staking Platform’s Reputation

Research the staking platform’s history and reputation within the crypto community. Look for platforms that are transparent in their operations and have a track record of fair dealings. The platform’s approach to setting minimum lockup periods for crypto staking should be clear and justified, reflecting their operational integrity and respect for stakers’ needs.

Understand the Terms and Conditions

Before committing your cryptocurrency, fully understand the terms associated with the staking process. This includes not just the minimum lockup period for crypto staking, but also any fees, penalties for early withdrawal, and the process to unstake your assets. Knowing these can help you avoid unexpected situations that could affect your investment.

Analyze Market Conditions

Market conditions can influence the best time to stake and the type of staking to engage in. Consider current and predicted market trends. If the market is highly volatile, a shorter minimum lockup period for crypto staking might be preferable. You might opt for a longer lockup in a stable market to accumulate more rewards.

Choosing the right staking option requires careful consideration of several factors, with the minimum lockup period for crypto staking being among the most important. Assessing this period, potential rewards, network security, platform reputation, specific terms, and market conditions will help you make an informed decision. This approach ensures that your staking choice aligns with your financial goals, risk tolerance, and liquidity needs, allowing for a more secure and potentially rewarding investment.

Also read What Is Crypto Staking Calculator and Top Crypto Staking Calculators?

Future of Staking and Lockup Periods

As cryptocurrency continues to evolve, the mechanisms of staking and the associated minimum lockup periods for crypto staking are also expected to undergo significant changes. Technological advancements, market dynamics, and regulatory frameworks will likely influence these developments.

Technological Innovations

Innovations in blockchain technology will greatly impact the minimum lockup period for crypto staking. As networks become more efficient and secure, the need for lengthy lockup periods may decrease. This could lead to more flexible staking options that still provide high levels of security but with shorter minimum lockup periods for crypto staking. Such advancements would make staking more attractive to a broader audience by enhancing liquidity and reducing the opportunity cost associated with long-term asset lockup.

Market Trends

Credits: Freepik

The cryptocurrency market is known for its rapid pace of change and volatility. As the market matures, we may see more stable coin valuations, which could lead to adjustments in the minimum lockup period for crypto staking. If the market becomes less volatile, longer lockup periods may be less necessary for maintaining network stability, potentially shortening the minimum lockup periods required for staking.

Regulatory Influences

Regulations will play a critical role in shaping the future of staking, particularly concerning the minimum lockup period for crypto staking. Regulatory bodies may set standards that dictate minimum or maximum lockup periods to protect investors and maintain market stability. Compliance with these regulations will be crucial for cryptocurrencies, possibly leading to more standardized lockup periods across different networks.

Decentralization Efforts

As blockchain networks strive for greater decentralization, the role of staking and the design of lockup periods will evolve. There is a growing trend toward reducing the minimum lockup period for crypto staking to encourage participation from a wider array of investors. This can help distribute network control more widely and prevent centralization of power among a few large stakeholders.

Staker Preferences

The preferences and behaviors of crypto investors will influence how staking models are designed, including the minimum lockup period for crypto staking. As users demand more flexibility and better liquidity, staking models may shift to accommodate these needs. This could result in a broader range of options regarding lockup periods, allowing stakers to choose based on their risk tolerance and investment timeline.

The future of staking and the minimum lockup period for crypto staking is poised for evolution driven by technological advancements, market conditions, regulatory developments, and shifts in user preferences. These changes will likely make staking more accessible and appealing to a broader audience by providing more options and flexibility. As the landscape evolves, the balance between securing network integrity and providing liquidity will be crucial in shaping the next generation of staking mechanisms.

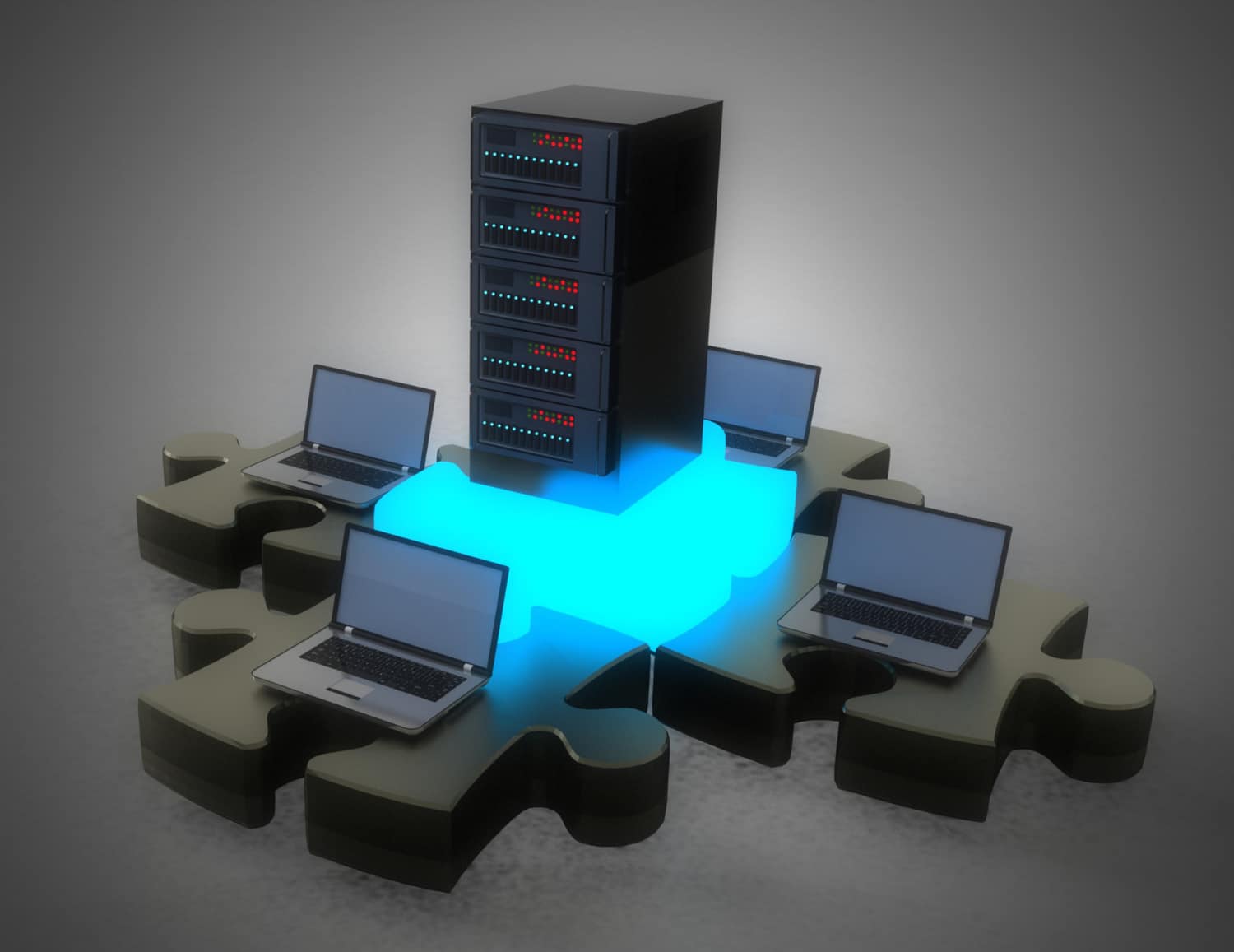

Connection Between Staking Lockup Periods And Dedicated Servers

Anyone involved in cryptocurrency staking must understand the link between staking lockup periods and the use of dedicated servers. This connection impacts the security and efficiency of staking activities, particularly concerning the minimum lockup period for crypto staking.

Role of Dedicated Servers in Crypto Staking

Dedicated servers provide the necessary infrastructure for secure and reliable staking. They host the blockchain nodes that validate transactions and create new blocks. These servers must be online and fully operational 24/7 to ensure continuous network support. Their reliability directly influences the minimum lockup period for crypto staking, as a stable network allows for more predictable and secure staking operations.

Impact on Minimum Lockup Period for Crypto Staking

Dedicated servers can affect the minimum lockup period for crypto staking in several ways. First, their stability allows networks to potentially reduce it. If a network can maintain high security and operational efficiency, it may not need to hold staker’s funds for extended periods. This can make staking more attractive by increasing liquidity and reducing the time investors’ capital is tied up.

Enhancing Network Security

Credits: Freepik

Dedicated servers enhance the security of blockchain networks, which is crucial for determining the minimum lockup period for crypto staking. High-quality servers reduce the risk of downtime and cyber-attacks, which can jeopardize the network’s integrity. By securing the network more effectively, dedicated servers support shorter lockup periods while maintaining the necessary security level.

The relationship between dedicated servers and the minimum lockup period for crypto staking is significant. Reliable and secure dedicated servers contribute to reducing the required lockup period by ensuring stable network operations and enhancing security. This can lead to more flexible and attractive staking options for investors, balancing security needs with the demand for greater liquidity in the crypto market. Understanding this connection is vital for stakeholders to optimize their staking strategies and infrastructure investments.

Conclusion

Staking and its required minimum lockup periods play key roles in the liquidity and security of blockchain networks. By knowing about different lockup periods, stakers can choose when and where to invest. They weigh the possible returns against their ability to access funds. As blockchain technology evolves, these periods may be shorter, increasing flexibility and attracting more investors.

Are you ready to enhance your staking? Redswitches dedicated servers offer the stability and security you need to boost crypto investments. Our servers allow shorter minimum lockup periods and greater efficiency, making your staking experience smoother and more profitable. Join RedSwitches today to fully leverage your cryptocurrency assets.

FAQs

Q. Is there a lock-in period for crypto staking?

Yes, there is typically a lock-in period, known as a lockup period, during which staked cryptocurrency cannot be withdrawn. This period varies by blockchain network.

Q. How long do you have to stake crypto?

The required staking duration varies depending on the cryptocurrency and the specific staking protocol. It can range from a few days to several months or even longer.

Q. What is a lockup period in staking?

A lockup period in crypto staking is the minimum time your cryptocurrency must remain staked before you can access or withdraw it. This period helps ensure network security and stability.

Q. How long is staked Ethereum locked?

For Ethereum 2.0, the staked Ethereum (ETH) is locked up until the completion of certain network upgrades, which could potentially extend beyond the initial minimum of about 18 months from when staking first began.

Q. Can you Unstake ETH at any time?

Once you have staked ETH in Ethereum 2.0, you cannot unstake it until the network reaches certain milestones that finalize the upgrade. This makes unstaking ETH currently not possible until those conditions are met.

Q. What is crypto staking?

Crypto staking involves committing your crypto holdings to support a blockchain network’s operations, earning staking rewards in return. It’s a way for crypto holders to earn passive income by locking their coins in a staking pool or via a staking service.

Q. How does staking work on a crypto exchange?

Many crypto exchanges offer staking services where users can commit their crypto directly on the exchange to participate in the staking process. The exchange handles the technical aspects, making it easier for users to earn staking rewards.

Q. What are the risks of staking crypto?

The risks of staking crypto include potential losses due to fluctuations in crypto prices, the possibility of technical issues with the staking service, and the lockup period during which the crypto is not accessible.

Q. What is a staking wallet?

A staking wallet is a crypto wallet that supports staking functionalities, allowing crypto users to store their coins and participate in staking directly from their wallets.

Q. Can I stake any amount of crypto?

Most staking programs have minimum staking requirements, meaning you must commit at least a certain amount of crypto to participate.

Q. What is liquid staking?

Liquid staking allows crypto holders to stake their assets while retaining some liquidity. This form of staking may offer a derivative token representing the staked assets, which can be traded or used elsewhere.

Q. How can I find the best crypto staking platforms?

The best crypto staking platforms can be found by researching their staking yields, security measures, user reviews, and how well they meet the minimum staking requirements and support popular staking coins.

Q. What are the benefits of pooled staking?

Pooled staking distributes the task of staking across multiple participants, reducing the risk and allowing more users to participate in staking without meeting high minimum staking amounts individually.

Q. How long is the typical staking period?

Staking timeframes can vary widely, from a few days to several years, depending on the staking service and the specific cryptocurrency involved.

Q. Why is the popularity of staking increasing?

The popularity of staking is rising because it offers crypto holders a way to earn additional income through staking rewards, enhances network security, and is generally more energy-efficient compared to traditional mining.