Key Takeaways

- Staking offers passive income and network support.

- Crypto lending and staking differ in mechanisms and risks.

- Staking involves locking crypto for rewards.

- Choosing platforms involves factors like security and rewards.

- Top platforms include Coinbase, Kraken, and Binance.

- Liquid staking platforms like Lido offer flexibility.

In this fast-changing world of cryptocurrencies, investors have a significant goal. It is to find creative methods to grow their digital assets. Crypto Staking is very attractive. It lets you earn rewards while making blockchain networks more secure and stable. But navigating the current environment may sometimes feel like navigating a digital maze because so many platforms compete for users’ attention. Here’s where we get involved. Our detailed guide covers the top 2024 cryptocurrency staking platforms. It makes the selection process clear and gives a list of the best options curated by professionals.

Regardless of your experience level with blockchain technology or cryptocurrency, our insights will show you how to make your investment work for you. Together, we can explore this path to utilize your digital assets fully with the Best Crypto Staking Platforms.

Table of Contents

- Key Takeaways

- What is Staking?

- What’s the Difference Between Crypto Lending and Staking?

- How does Staking Work?

- How to Make Money Using Crypto Staking?

- What Are The Benefits of Staking Crypto

- What Are The Risks Of Staking Crypto

- The Criteria for Choosing the Best Staking Platform

- Best Crypto Staking Platforms

- Future of Crypto Staking

- Conclusion

- FAQs

What is staking?

Credits: Freepik

In the world of cryptocurrencies, staking is a crucial idea. It may generate passive revenue and bring the chance to help run a blockchain network. It is closely associated with cryptocurrencies that use one or more variations of the Proof of Stake (PoS) method. People seek network security and consensus with a less energy-intensive method: Proof of Stake (PoS) and its variants. This is as opposed to the energy-intensive PoW approach used by networks like the original Bitcoin blockchain.

Staking keeps money in a Bitcoin wallet to keep a blockchain network running. A portion of the network’s tokens are locked up by participants, often known as validators or stakes, as a stake. Their stake usually influences a validator’s likelihood of being selected to add a block. Validators are rewarded for their dedication and help. They preserve the network’s integrity and get staking rewards. The prices vary. They are often given out in the same cryptocurrency that was staked. The variation depends on factors such as the total amount staked, the token lockup’s duration, and the network’s inflation rate.

Staking’s dual role is what makes it so appealing. First, investors who care about the environment will find it appealing. It is more environmentally friendly than the computationally demanding PoW. Second, it lets cryptocurrency owners generate passive income from their holdings. This lets them grow their digital assets without needing to make new token investments. This staking feature has become popular. This is because banks now offer low interest rates.

Additionally, staking is essential to the governance of many blockchain initiatives. Specific networks allow stakeholders to vote on ideas for development and upgrades. They make decisions on the project’s future course based on their stake level. As a result, investors have a say in the network’s operations and finances, democratizing the governance process.

What’s the Difference Between Crypto Lending and Staking?

Credits: Freepik

In the cryptocurrency ecosystem, crypto lending and staking are two well-known ways to make passive income. Each has specific workings and effects for investors. Both provide ways to increase digital assets without trading. But they differ in their methods, dangers, and benefits.

Crypto Lending

You lend your cryptocurrency to others or platforms. They pay interest. This is called crypto lending. Centralized crypto loan services can help. So can decentralized finance (DeFi) platforms. By lending your cryptocurrency, you give borrowers access to your assets. This is for a set time in exchange for interest. Depending on the conditions of the lending platform and the demand for the asset being lent, the interest rate may be fixed or variable.

People are drawn to cryptocurrency lending because it offers steady, predictable rates. The rates are often higher than those of regular savings accounts. But, it has dangers. These include market risk. This is the chance that the collateral’s value would drop and we’d need to sell it. There is also platform risk. This is the risk that the platform may break or be hacked.

Crypto Staking

On the other hand, staking is closely related to blockchain networks’ consensus mechanisms. This is especially true for those who use Proof of Stake (PoS) or its variations. Maintaining the network’s functionality involves validating transactions and generating new blocks. It requires locking up some of your cryptocurrency. Staker rewards come from the network in the form of more cryptocurrency for their contributions.

A portion of the staked assets may be “slashed” or lost due to malevolent activities or nonparticipation; nonetheless, the staked assets ensure the validator’s pledge to act in the best interests of the network. In contrast to crypto loans, stability benefits depend on many things. These include the total amount of bitcoin staked and the duration of staking. They do not depend on an interest rate.

Staking requires more active interaction with a cryptocurrency and its technology. It is linked to the well-being and operation of the blockchain. In addition to offering incentives, it gives users a direct means to engage in a blockchain’s security and governance.

Principal Disparities

Mechanism: Staking is a technological procedure that entails participating in the running of a blockchain network, while lending is a financial activity in which assets are given out for interest.

Risk Profile: The risks associated with lending are platform security and borrower default, whereas the risks associated with staking are asset volatility and possible slashing for breaking network rules.

Reward Structure: While staking awards are determined by network-specific variables like inflation rates and the total amount staked, lending rewards are usually interest payments depending on market demand for borrowed assets.

Governance Involvement: Staking frequently allows users to vote on network improvements and modifications, providing a degree of governance involvement uncommon in cryptocurrency loans.

Liquidity: Since loans have predetermined terms after which assets are returned, lending may occasionally provide greater liquidity. Staked assets, on the other hand, could be locked up for longer, particularly in networks with specified staking durations.

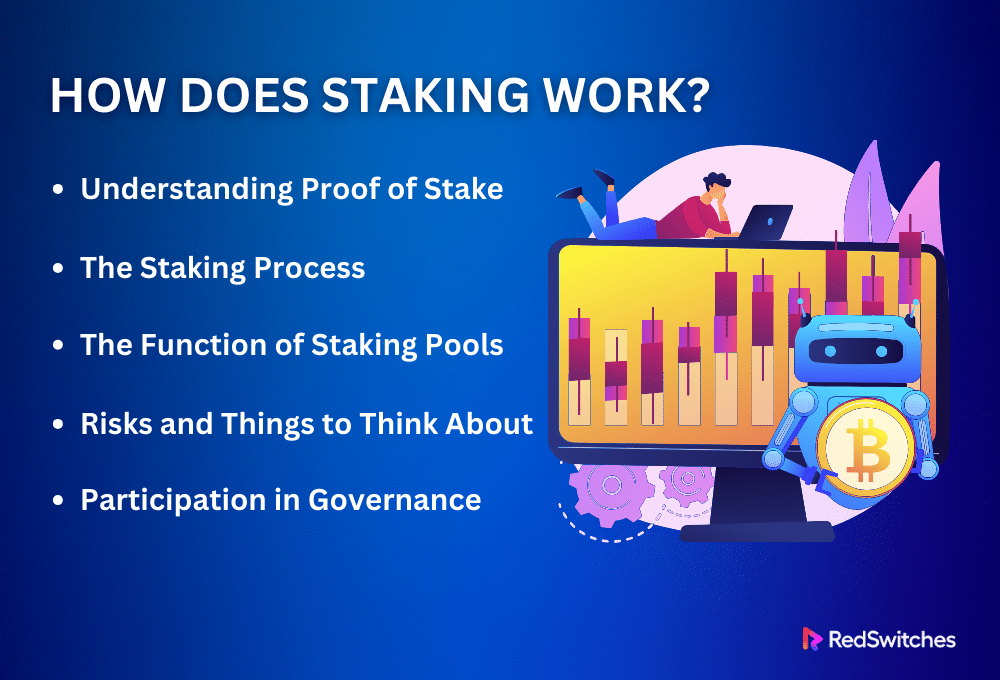

How does staking work?

Staking is a crucial procedure in blockchain networks. It uses one of the variants of the Proof of Stake (PoS) consensus mechanism. It is a technique that allows users to take part in preserving a blockchain’s operation and security and get compensated for their efforts. Here’s a thorough explanation of how staking operates:

Understanding Proof of Stake (PoS)

Some blockchain networks employ the PoS consensus process, the foundation of staking, to accomplish distributed consensus. In contrast to Proof of Work (PoW), which depends on miners resolving intricate mathematical puzzles to verify transactions and produce new blocks, Proof of Stake (PoS) is based on users, sometimes referred to as validators or stakers, locking up a portion of the network’s tokens as a stake. This stake serves as a guarantee for security and an indication of the validator’s dedication to the network.

The Staking Process

Credits: Freepik

To sustain the network’s operations, users of blockchain networks engage in a sequence of calculated steps known as staking, whereby they deliberately lock up a portion of their cryptocurrency holdings as a stake via a digital wallet or a staking pool. These users may be eligible to become validators after staking their tokens. The requirements for this position vary throughout blockchains; some may select validators randomly from the staker pool, while others base their decision on the stake amount. As validators, they ensure that all transactions follow the network’s rules by confirming transactions and creating new blocks. Validators receive rewards, typically in the form of extra tokens, in appreciation for their crucial role in maintaining network security and integrity.

The Function of Staking Pools

Staking pools have gained popularity since being a validator frequently costs many tokens, which may be out of reach for individual investors. By pooling their bets, users can increase their chances of being chosen as validators and receiving rewards. After that, the prizes are divided among the pool members, usually following each person’s unique contribution.

Risks and Things to Think About

Staking entails some risks in addition to the possibility of rewards. The market value of the cryptocurrency, which is subject to significant fluctuations, determines the value of the incentives. Additionally, there’s the chance of cutting, in which a validator commits malevolent acts or neglects to carry out their duties, losing some of the stakes. Some investors may also consider that staked tokens are frequently locked for a period during which they cannot be exchanged or sold.

Participation in Governance

Staking frequently gives players a voice in managing the blockchain network in addition to compensation. A stakeholder’s ability to vote on future network decisions, including protocol modifications or upgrades, may depend on the magnitude of their investment.

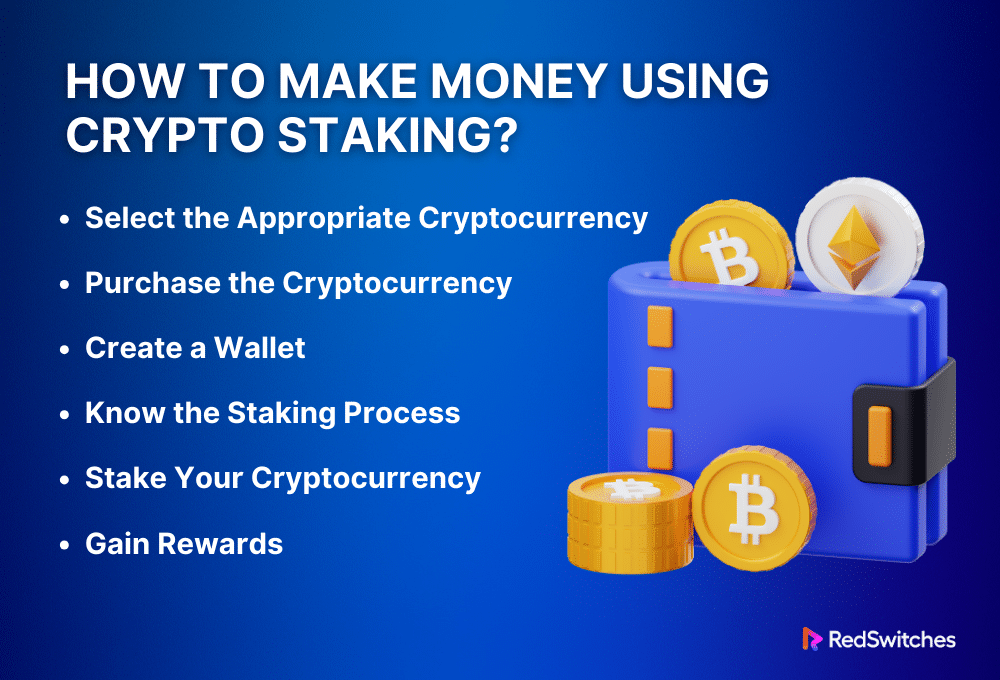

How to Make Money Using Crypto Staking?

Staking your Bitcoin holdings to support network operations is an active way to participate in blockchain networks and earn money. This is a comprehensive guide on how to profit from cryptocurrency staking:

Select the Appropriate Cryptocurrency

Choosing the right cryptocurrency to stake is critical. It maximizes profits and meets your goals. Consider the project’s legitimacy. Also, consider the size of its community and its potential for future growth. Study the staking incentives of various cryptocurrencies. Also, look at any dangers or constraints involved. Look for cryptocurrencies with a long history of steady staking payouts. They should also have a thriving ecosystem of trustworthy wallets and staking platforms.

Purchase the Cryptocurrency

Credits: Freepik

After deciding which cryptocurrency to stake, purchase the required tokens from a reliable cryptocurrency exchange. Pay attention to the exchange’s security protocols, trading volume, and liquidity. Remember to factor in any fees related to the acquisition and transfer of tokens, and make sure you acquire enough tokens to satisfy the network’s minimum staking criteria.

Create a Wallet

You must create a secure cryptocurrency wallet to store and stake your tokens safely. Select a wallet with solid security features like multi-factor authentication and cold storage options, and allow staking for your chosen coin. You may stake your tokens right from the wallet UI with some wallets’ built-in staking features. Alternatively, you might have to assign your tokens to a staking pool. In that case, ensure the wallet has this feature and take the appropriate actions to assign your tokens safely.

Know the Staking Process

Gain a complete understanding of the staking process, including the minimum stake amount, the length of the staking period, and the possible rewards before staking your Bitcoin. Examine the staking method employed by the cryptocurrency of your choice, including pure Proof of Stake (PoS), Delegated Proof of Stake (DPoS), and other variations. Learn about any dangers that come with staking, like the potential for fines to be lowered for wrongdoing on the part of validators or the prospect of losing access to funds that have been staked for the duration of the staking period.

Stake Your Cryptocurrency

After selecting a safe wallet or staking platform and being comfortable with the procedure, stake your cryptocurrency as directed by the guidelines. Depending on your chosen staking mechanism, this usually entails locking up your tokens in a smart contract or assigning them to a staking pool. To track your staking rewards and overall success, adhere to any staking restrictions, including the minimum stake size and staking time. You should also routinely examine your staked assets.

Gain Rewards

By contributing to the security and functionality of the network, you, as a staker, will receive rewards. These incentives are usually given out periodically, based on the staking protocol of the particular network. Keep an eye on your staking rewards to ensure your wallet or account is correctly credited with them. Depending on your investing plan and financial objectives, you may want to consider cashing out your rewards to realize gains or reinvesting them to compound your returns over time. To maximize your profits and reduce any associated risks, regularly review and tweak your staking strategy.

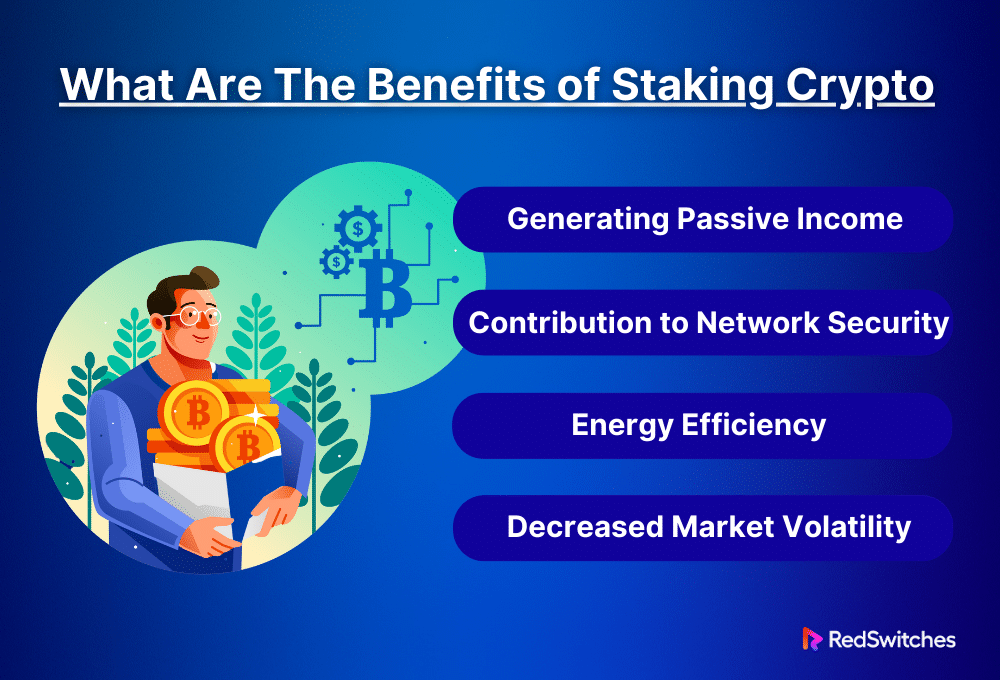

What Are The Benefits of Staking Crypto

Staking cryptocurrency provides users of the blockchain ecosystem with several decisive advantages. It’s a way to make passive income. But, it also dramatically affects how blockchain networks work and are governed. This is especially true for those that use the Proof of Stake (PoS) consensus method. These are the specific advantages of staking cryptocurrency:

Generating Passive Income

It is impossible to exaggerate the appeal of using staking to generate passive income. Participants get compensation for locking cryptocurrency. They do this to keep the network running. They often get staked cryptocurrency as payment. This process works in the creative and dynamic realm of digital assets. It’s like getting dividends or interest from financial investments. Staking can yield higher returns than savings accounts. This is especially true in a cryptocurrency market with high-interest rates. Crucially, these benefits are a product of the network’s economic model, which is frequently created to encourage sustained ownership and involvement and, therefore, match stakeholder interests with the general well-being and prosperity of the network.

Contribution to Network Security

Staking is vital. It helps make blockchain networks secure and efficient. Validators are essential. They process transactions and create new blocks using Proof of Stake. This mechanism keeps the blockchain active and secure. Validators risk losing their stake to fraud. They must stake a specific quantity of cryptocurrency as a security deposit to reduce fraud. The system provides financial incentives. They ensure that validators behave in the network’s best interests. This strengthens defenses against cyberattacks and guarantees dependable, seamless operation.

Also, read Top 15 Critical Cyber Security Challenges and How to Fix Them

Energy Efficiency

Credits: Freepik

Proof of Stake is energy efficient. This is a major benefit given the rising environmental concerns. Staking uses little energy. It’s unlike proof-of-work mining, which needs lots of electricity and special technology. It also lowers the carbon footprint of blockchain. This move towards sustainability encourages more people to join. High energy costs and the harmful environmental effects of old mining methods might have put them off.

Decreased Market Volatility

Staking locks up a part of the asset’s supply, lowering its availability for circulation and stabilizing the cryptocurrency markets. When less liquidity is available, staked assets become more resistant to the sharp price fluctuations brought on by speculative trading, which can reduce the usual price volatility associated with cryptocurrencies. In addition, the obligation to retain tokens for a specific duration promotes a longer-term investment outlook among stakeholders, augmenting market steadiness and diminishing the impact of transient speculative actions on the asset’s valuation.

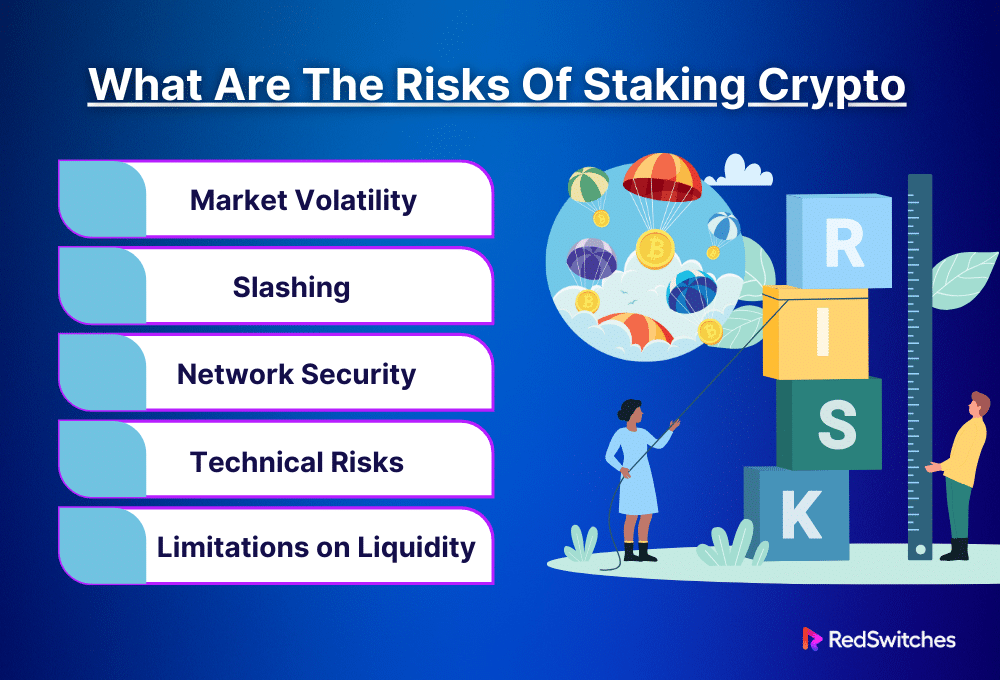

What Are The Risks Of Staking Crypto

Although there are many advantages to staking cryptocurrency, there are also risks involved that users should be aware of before proceeding. Here is a thorough examination of the main dangers connected to staking:

Market Volatility

Staking does not protect traders from the infamously volatile nature of cryptocurrency markets. Participants may lose money if the cryptocurrency price falls sharply. This is because the value of staked tokens can change. Downturns can cut staking rewards’ value. They may cause a net loss if the falling token value outweighs staking benefits.

Slashing

In a Proof of Stake (PoS) network, validators who act maliciously or neglect their responsibilities will be penalized. Validators who validate conflicting blocks or fail to validate transactions promptly risk punishment. This includes duplicate signing. Slashing usually results in losing part of the validator’s stake. This punishes dishonest or careless behavior. Cutting preserves network security. But, it risks validators’ money. Even minor errors can incur fines.

Network Security

Staking directly improves a blockchain network’s security, but it also puts the integrity of the network in danger. The network is susceptible to centralization if a small number of validators control a sizable fraction of the staked tokens. Under such circumstances, a concerted assault by a few validators may jeopardize network security and result in several types of abuse, like censorship or double-spending. Furthermore, a network may become more vulnerable to attacks by hostile actors looking to exploit its compromised security posture if stake participation declines.

Technical Risks

Staking calls for a certain degree of technical know-how and comprehension of blockchain technology. The security of each participant’s staking setup, including their digital wallet and related hardware or software, must be guaranteed. Staked assets may be lost or stolen if they are not adequately secured. Hackers may use holes in the staking infrastructure to obtain funds without authorization. Participants also need to keep current on updates and modifications to the staking protocol, since they risk fines or losing out on rewards if they don’t follow maintenance schedules or network upgrades.

Limitations on Liquidity

Staking usually entails locking up tokens for a predetermined amount, during which they cannot be freely bought or sold. Due to this lack of liquidity, the participants may find it difficult to access their money for unanticipated costs or investment possibilities. Although specific staking protocols provide ways to unstake or remove money before the staking time expires, fees or delays may be associated with these procedures, reducing liquidity. Before committing to staking, participants should carefully assess their investment horizon and liquidity demands.

The Criteria for Choosing the Best Staking Platform

Credits: Freepik

Use the best staking platform to maximize your staking earnings and guarantee the security of your staked assets. When assessing staking sites, take into account the following factors:

Supported Cryptocurrencies

It’s good to look for staking platforms. They should support many digital assets. These include well-known cryptocurrencies like Ethereum, Cardano, and Tezos. Diversification makes it more accessible. You can build a staking portfolio that fits your preferences and risk tolerance. Think about platforms that keep up with new projects and market trends. They also grow the number of cryptocurrencies they support. More comprehensive staking options improve diversification. They also offer chances to profit from changes in rewards and markets.

Staking Benefits

Look at the elements affecting reward distribution. Do this while evaluating staking benefits. Go past superficial measures, such as ROI or APY. Seek out platforms with details on reward systems. They should include info on how well validators perform. They should also cover how rewards are given out. They should also cover extra incentives or bonuses. Examine past data on staking rewards to determine how consistent and dependable the rewards have been over time. Also, consider systems that treat all participants fairly. They do this by being transparent and accountable in how they allocate rewards.

Staking conditions

These conditions greatly influence your staking experience and possible returns. Look for platforms that let you customize your staking strategy to fit your unique requirements and tastes by providing a range of flexible staking alternatives. Seek platforms that fit within your investing horizon regarding staking lengths and acceptable minimum stake sizes. The platform’s pricing structure should also be taken into account. This includes any transaction fees, withdrawal fees, and validator commission rates. Assess how these elements may affect your overall returns.

Security Measures

Considering the risks of staking, it is critical to prioritize platform security to protect your staked funds. Examine the platform’s security measures in detail, paying particular attention to reliable encryption methods, safe storage options, and preventative steps to lessen potential risks like phishing or hacking. Seek platforms that adhere to pertinent regulatory standards, conduct frequent security assessments, and use industry best practices in cybersecurity. In addition, consider platforms that provide funding for protection mechanisms or insurance coverage to lessen the impact of possible security breaches.

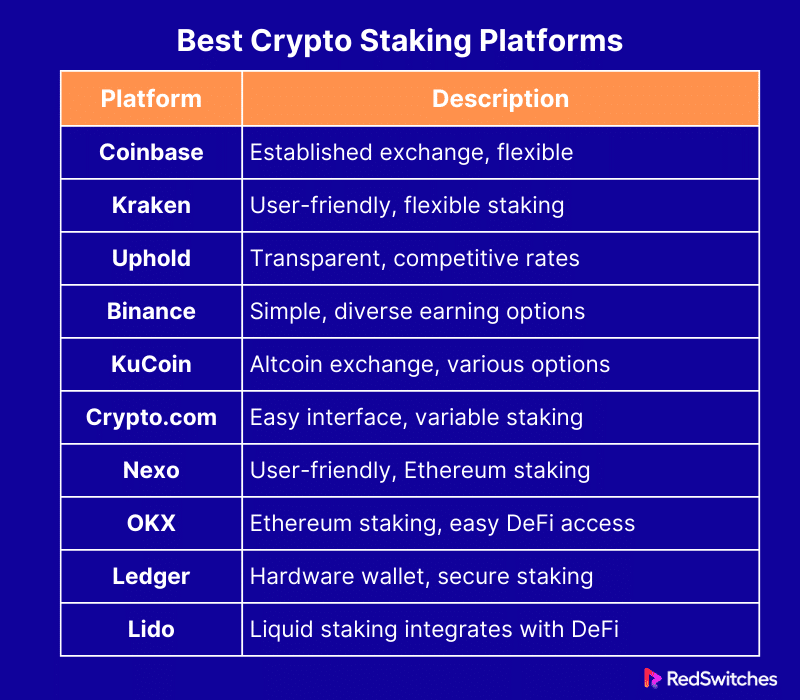

Best Crypto Staking Platforms

Credits: Freepik

Finally, in this section, we will explore the core section of our blog i.e. 10 Best Crypto Staking Platforms in detail.

Coinbase

Among the most well-known and established cryptocurrency exchanges is Coinbase. It describes itself as the most straightforward marketplace for buying and selling cryptocurrencies, and its staking services are no different. With a few clicks, you can stake cryptocurrency tokens in your account.

Flexible staking is available with Coinbase; there is no minimum lock-up period, and you can unstake anytime. However, you will have to wait for the token’s unbinding procedure to be finished in addition to Coinbase’s extra processing time, which can take up to 48 hours.

The restricted range of staking choices and the high staking commission of 25% to 35% are Coinbase’s primary drawbacks. However, this must be weighed against Coinbase’s robust security, openness, adherence to laws and regulations, broad geographic reach, and other user-friendly features like Web3 access and Learning Rewards.

Kraken

Kraken’s user-friendly software makes it appealing to novices and seasoned traders using its Pro platform. Since staking cryptocurrency merely requires three clicks from your balance, the staking service is intended to be used by everyone.

Anyone who values flexibility while staking should consider Kraken. If you choose flexible staking terms, you can unstake immediately without waiting for a lock-up or unbonding period, and you can stake quickly without having to wait for a bonding period.

Bonded staking terms offer significantly higher staking rewards, so you can choose them if you don’t mind waiting after you unstake money.

Uphold

Uphold takes excellent satisfaction in being transparent and straightforward to use. Users may complete trades on a regulated, secure platform with visible reserves with just one click. After choosing a coin and a stake amount, you must relax and start earning prizes.

Compared to other exchanges, the selection of cryptocurrencies accessible for staking is greater, and the reward rates are rather competitive. On the portfolio page, you may check your staking accounts, balances, and prizes to date, making it simple to keep track of your winnings.

Uphold will handle requests for unstaking significantly more quickly when liquidity permits, even when certain tokens are subject to an unbonding time.

Binance

While Binance only supports Ethereum on-chain staking, there are plenty of other opportunities to gain rewards. The safest and simplest option is Simple Earn, which offers a choice of flexible or fixed terms and consistent earnings on hundreds of coins.

While many alternative earning products offer far larger yields, they also involve a danger to your wealth. For individuals wishing to participate in DeFi activities without exploring dApps, Binance offers simple access to DeFi staking options.

It’s important to note that Binance does not offer the Binance Earn feature or its extensive product selection.US, but US customers can stake more than 27 cryptocurrencies on-chain and earn up to 12%.

KuCoin

Because it offers over 700 different crypto assets, many of which are unavailable on other large exchanges, KuCoin bills itself as the best altcoin exchange. With KuCoin Earn, a lot of these obscure altcoins may be used to make passive income.

KuCoin has various earning options in addition to staking, some of which come with larger risks but bigger payouts. Users have many options thanks to the large selection of coins and goods.

KuCoin’s reward rates fluctuate frequently, and the network frequently holds promotions that offer greater cryptocurrency interest rates. The primary drawback of KuCoin is its lack of regulation. Additionally, you can only access a restricted set of services if you don’t finish ID verification, which isn’t possible in the United States.

Crypto.com

Popular features of Crypto.com include its easy-to-use interface and cryptocurrency rewards cards. Furthermore, it offers a safe staking service for a respectable selection of cryptocurrencies. Users can choose between staking for a defined term or variable.

Additionally, Flash Rewards offers a greater reward rate when promotional programs are running. Additionally, 2% more prizes are given to private members, awarded in Crypto.com’s exclusive CRO tokens.

Regretfully, it can be a little challenging to understand the reward rates. The amount of CRO tokens you have locked up also affects the rate, which varies depending on the staking rules.

Nexo

Through its cryptocurrency savings accounts, Nexo offers an additional means of generating passive income in cryptocurrency, albeit only offering on-chain staking for Ethereum. The platform is incredibly user-friendly and prioritizes security with its custodial insurance, transparency, and collateral requirements.

Nexo offers various savings terms with various cryptocurrency interest rates. The percentage of NEXO tokens that users own also affects rates, and opting to receive interest payments in NEXO can result in an additional 2% interest.

OKX

The only coin that can be staked traditionally on OKX is Ethereum. Staking users will enjoy protection from slicing fines, no commission, gas costs, or staking limits should they opt to stake their ETH here. You will also get daily incentives and an ETH token that has been staked, which you can sell or trade.

Apart from ETH staking, OKX provides easy access to DeFi protocols and a variety of Simple Earn goods with greater APY Structured goods.

Ledger

A hardware wallet is necessary if security is your primary concern, and Ledger is the greatest choice for staking. Since ledger devices store your private keys offline, where they are impenetrable by hackers, they are well-recognized for being extremely safe.

You must select your validators while staking with a hardware wallet, which makes it more difficult than taking on an exchange but offers you more flexibility and control over the process. All of this is possible using the Ledger Live app.

Lido

A drawback of many staking platforms is that once you stake your tokens, they become part of the protocol, and you might not be able to do anything with them until the lock-up time is over.

Liquid staking systems address this issue by providing users with liquid tokens in exchange for their staked currencies. While your staked coins continue to earn staking incentives, you can employ these liquid tokens for trading and to generate more yield on DeFi platforms.

Even though Lido only offers staking for a very small number of coins, it integrates with many other decentralized applications (dApps) to enable participation in DeFi. Uniswap, Curve, Aave, 1 inch, and over 100 additional dApps are integrated.

Let’s summarize it in a tabular format.

Future of Crypto Staking

Credits: Freepik

In the previous section, we discussed the Best Crypto Staking Platforms. Cryptocurrency has a bright future as the staking ecosystem develops and grows. The article below examines the major themes and advancements shaping the direction of cryptocurrency staking.

Mass Adoption

More people will be able to stake. This will happen as blockchain becomes more accepted and crypto use grows. People can earn passive revenue by staking. Staking is an appealing alternative to traditional investments. It involves maintaining and validating blockchain networks. Staking platforms are now user-friendly. Staking procedures are streamlined. We expect a spike in staking use by both institutional and individual investors.

Diversification of Staking Assets

Staking assets will become more varied in the future. This will go beyond well-known cryptocurrencies like Ethereum and Tezos. More staking choices are being offered to investors. They come from up-and-coming blockchain projects and DeFi protocols. Investors customize their staking portfolios to their goals and risk tolerance. This lets them earn the most while taking few risks. They can do this by diversifying.

Interoperability and Cross-Chain Staking

Interoperability solutions and cross-chain staking protocols make the frictionless transfer of assets and staking across several blockchain networks possible. Thanks to interoperability standards being worked towards by projects like Ethereum 2.0, Polkadot, and Cosmos, tokens may be staked and moved across chains. This opens up new possibilities for liquidity and yield optimization. Through cross-chain staking, investors can use the finest staking possibilities across many blockchain ecosystems and diversify their staking activity.

Also Read: What Is the Minimum Lockup Period for Crypto Staking?

Conclusion

Several important considerations must be made while choosing the best crypto staking platforms, including supported cryptocurrencies, staking payouts, security precautions, and transparency. By considering these factors and keeping up with the most recent changes in the staking environment, investors can maximize their staking earnings while minimizing risks.

Technological improvements and increasing usage are paving the way for the future of crypto staking. We at RedSwitches offer safe, dependable, and easy staking solutions. No matter your experience level, picking the right platform is crucial. It’s key to getting the full benefits of staking and reaching your financial goals.

FAQs

Q. What is the best platform to stake cryptocurrency?

The best platform for staking cryptocurrency depends on factors like supported assets and rewards.

Q. How much can I earn from staking?

Staking earnings vary depending on the amount staked and the reward structure of the particular cryptocurrency.

Q. How to get free crypto?

Participating in airdrops, promotions, or referral schemes provided by cryptocurrency projects and platforms is frequently the route to obtaining free cryptocurrency.

Q. What are crypto-staking platforms?

Crypto staking platforms are platforms that allow users to stake their cryptocurrency holdings to earn staking rewards and passive income.

Q. How do staking rewards work on crypto platforms?

Staking rewards on crypto platforms are earned by users who lock up their cryptocurrency in a staking wallet to help secure the network and validate transactions.

Q. What is the difference between centralized and non-custodial staking platforms?

A single entity controls centralized staking platforms, while non-custodial staking platforms allow users to stake their crypto without giving up control of their private keys.

Q. Which are the best crypto staking platforms for 2024?

The best crypto staking platforms for 2024 offer off-chain staking, support staking ETH, and provide a list of the best crypto staking platforms.

Q. How can I earn passive income by staking on Best Crypto Staking Platforms?

By staking your cryptocurrency on a platform, you can earn passive income through staking rewards paid out by the network.

Q. Are there any decentralized finance (Defi) staking options available on crypto platforms?

Some crypto platforms offer Defi staking options, allowing users to stake their crypto assets in decentralized protocols for potentially higher rewards.

Q. What are the benefits of using non-custodial staking platforms?

Non-custodial staking platforms give users more control over their crypto holdings, as they do not require users to entrust their funds to a third party.

Q. How can I find the 10 best crypto staking platforms for 2024?

You can search online for a list of the best crypto-staking platforms for 2024 or read reviews and recommendations from crypto investors and experts in the field.