Key Takeaways

- Staking involves locking up cryptocurrency to support network operations and earn rewards.

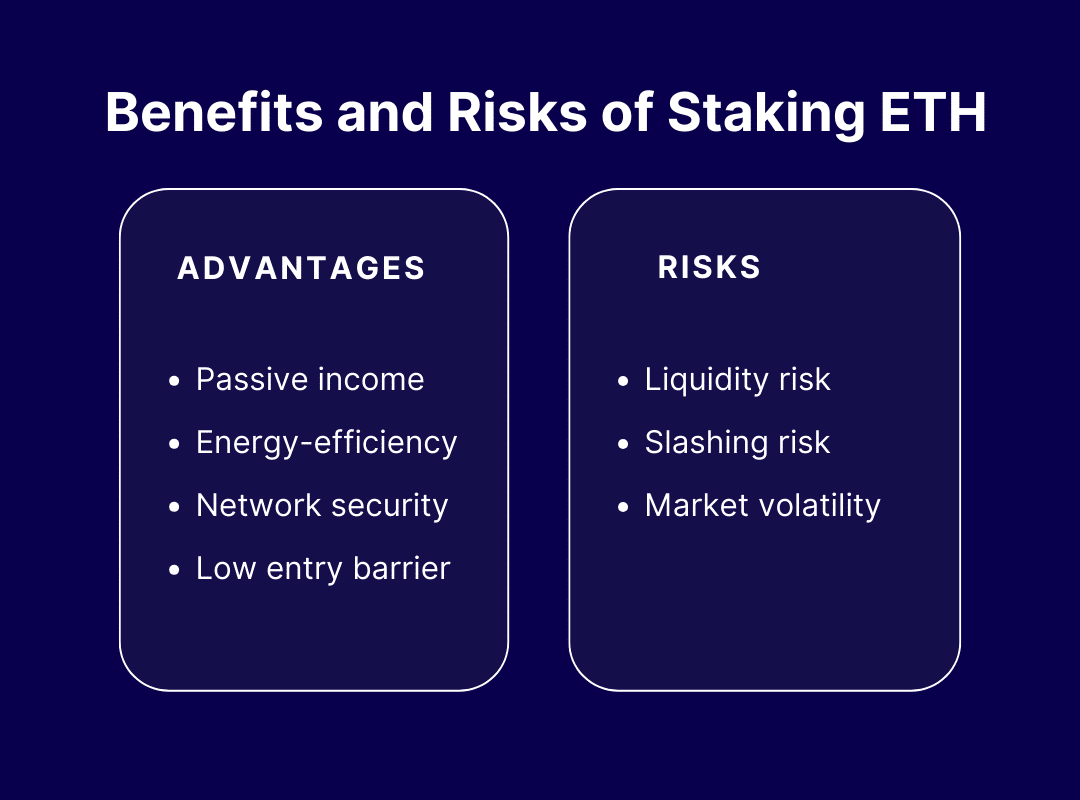

- Ethereum staking offers benefits like passive income and network security.

- Risks of Ethereum staking include potential loss of staked funds and market volatility.

- Ethereum staking methods include solo, pooled, liquid, and staking-as-a-service options.

- Factors for choosing a staking method include risk tolerance and technical expertise, liquidity, etc.

- Platforms like Lido, Coinbase, Rocket Pool, and Nexo offer Ethereum staking services.

- RedSwitches dedicated servers are highly customizable to meet the needs of every crypto enthusiast.

Did you know that there are around 122 million Ethereum tokens in circulation? This is approximately 10 times more than Bitcoin. It is safe to say that Ethereum has emerged as a leading contender in the rapidly cryptocurrency domain. The cryptocurrency took off in 2021 when a digital art composition was sold as the globe’s most costly NFT for around $69.3 million.

Staking Ethereum represents a major shift towards a more energy-efficient and scalable blockchain. It promises enhanced security and potentially profitable returns for stakeholders. This guide will take you through step by step process of how to stake Ethereum.

Table of Contents

- Key Takeaways

- What is Staking?

- Benefits of Staking ETH

- Risks of Ethereum Staking

- How to Stake Ethereum?

- Factors to Consider When Choosing a Method to Stake ETH

- Where to Stake Your Eth?

- Dedicated Servers for Crypto Staking

- Wrapping Up

- FAQs

What is Staking?

Credits: FreePik

Before we discuss how to stake Ethereum, we must go over what staking is.

Crypto staking is a procedure used in blockchain networks that employ a Proof of Stake (PoS) or similar consensus mechanism. It allows members to secure a portion of their cryptocurrency holdings as a stake in the network, which serves as a security deposit. This helps maintain the network’s integrity by preventing hostile conduct. Participants who stake their cryptocurrency are rewarded with extra tokens.

In staking, the right to validate new transactions and produce new blocks on the blockchain can often be related to the amount of bitcoin pledged. Thus, the more one invests, the greater the likelihood of being picked to authenticate fresh transactions and earn incentives. Staking helps protect the network but allows cryptocurrency holders to generate passive income without selling their holdings.

As using PoS and similar procedures expands, staking has become an important part of the cryptocurrency ecosystem. It provides a greener alternative to the energy-intensive Proof of Work (PoW) techniques used by networks like the original Bitcoin blockchain.

Also Read: What Is Staking Crypto? How To Earn Crypto Rewards.

Benefits of Staking ETH

Ethereum staking provides numerous appealing advantages for people and businesses wishing to participate in the blockchain ecosystem. Here’s why staking Ethereum might be beneficial:

Passive Income

Staking Ethereum is like depositing your money in a high-interest account with the prospect of larger returns. When you stake Ethereum, you commit your assets to the network so that it can continue to operate. In exchange, the network awards you with new Ethereum coins.

The reward rate varies, but it often provides a competitive yield compared to standard financial products. This approach offers a steady source of income and encourages long-term asset ownership, potentially leading to capital gain as the value of Ethereum rises.

Energy Efficiency

The transition to Ethereum 2.0’s proof-of-stake (PoS) method is an important milestone toward blockchain sustainability. Unlike proof-of-work (PoW), which demands tremendous processing power and energy consumption (and is frequently criticized for its environmental effect), PoS enables the network to function with far less energy.

This decrease occurs because PoS secures the network using staked tokens rather than computing effort, reducing the need for energy-intensive mining operations. This environmentally conscious solution reduces Ethereum’s carbon footprint while aligning with worldwide initiatives to reduce energy usage in digital technology.

Network Security

Staking enriches Ethereum’s security. In PoS, the likelihood of validating transactions and producing new blocks depends on the amount of Ethereum staked. The more you invest, the greater your responsibility and impact in ensuring network integrity.

Individuals with malicious intent must stake a significant amount of Ethereum to launch an attack, putting their holdings at risk. Fraudulent conduct can result in penalties and the loss of stake, so the staking mechanism naturally encourages a more secure and robust network.

Lower Entry Barrier

Ethereum staking makes blockchain activity more accessible to anyone. Unlike mining, which needs expensive hardware and a thorough grasp of the technology, staking allows consumers to participate with a considerably lower initial commitment. This openness enables a broader range of people to join and benefit from the Ethereum ecosystem. This results in a more diverse and inclusive community of participants.

The introduction of staking pools indicates that even someone with a modest quantity of Ethereum may begin staking, permitting more individuals to get involved.

Also Read: Guide To Types Of Crypto Staking: Risks, And Platforms 2024.

Risks of Ethereum Staking

While Ethereum staking offers a promising potential for earning rewards through the blockchain, it has risks. Understanding these risks is important for anyone looking to stake Ethereum. Here are the key risks of staking Ethereum:

Liquidity Risk

When you stake Ethereum, it gets held in the network, which means you won’t be able to access or sell it until the staking period ends or specific network criteria are fulfilled. This lock-up might offer a liquidity risk, particularly if you want immediate access to your assets or if market conditions change.

During significant market volatility, the inability to sell or exchange staked assets can result in lost opportunities or potential losses compared to more liquid investments.

Slashing Risk

Slashing is a punishment the blockchain network imposes when a validator acts maliciously or fails to fulfill their job properly. If you stake directly as a validator or through a cut staking pool, you may lose some of your staked Ethereum as a punishment.

This risk emphasizes the need to maintain operational integrity and follow network standards, as failures or misconfigurations can result in financial penalties.

Market Volatility

Ethereum’s value can fluctuate dramatically. The incentives for staking are often paid in Ethereum. The real fiat worth of your staking rewards might change dramatically with market values. This volatility risk might reduce the profitability of your staking investment.

The shifting value of Ethereum may influence the long-term feasibility of staking as a reliable revenue source. Thus, stakeholders must keep updated about market movements and change their tactics appropriately.

How to Stake Ethereum?

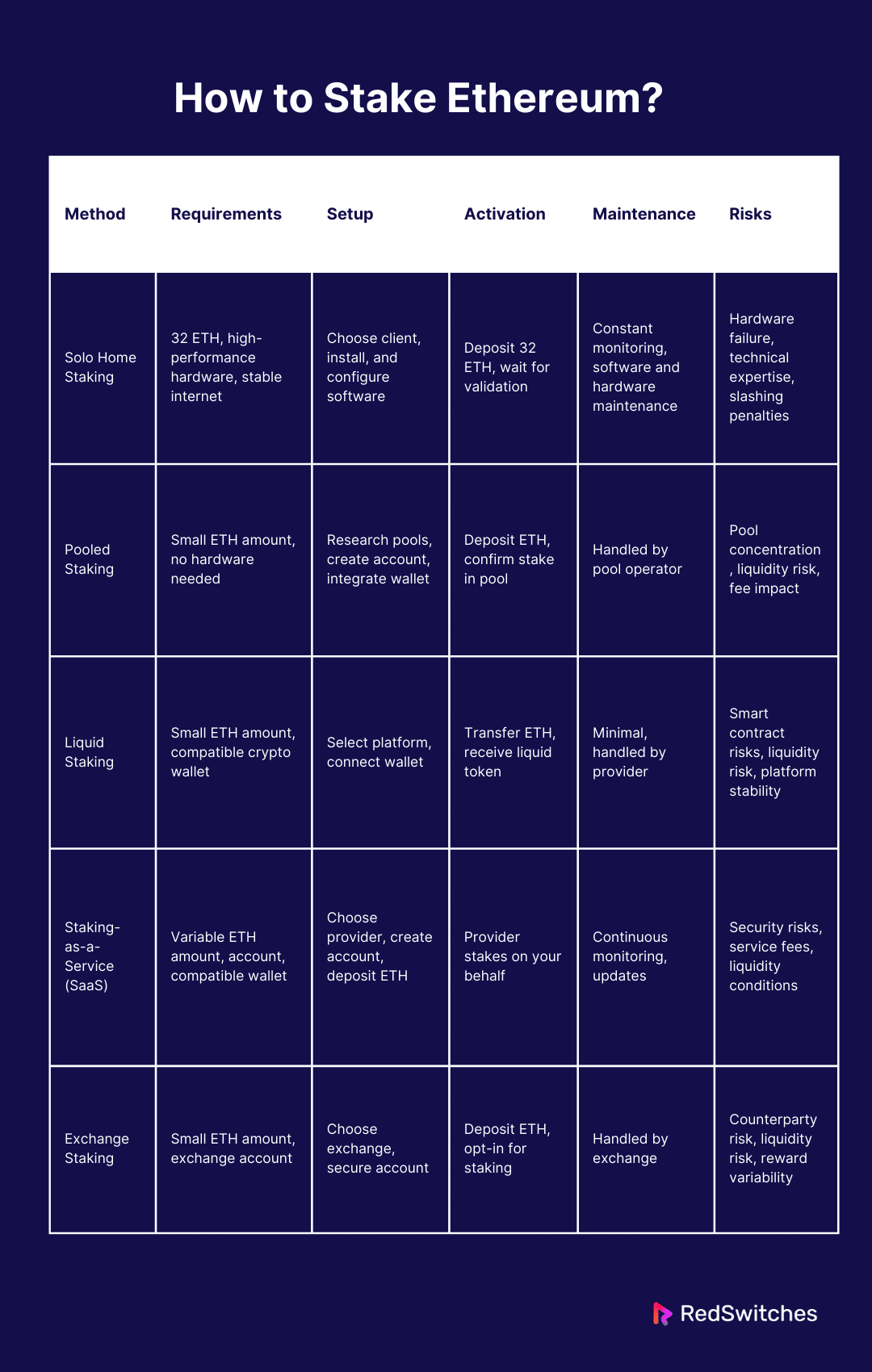

Wondering how to stake Ethereum? There are several ways. Here’s how you can start staking your ETH through different methods:

Solo Home Staking

Solo home staking involves running your own validator node. This method requires a good understanding of blockchain technology and a stable internet connection. Here’s how to do it:

Minimum Requirements

- Capital: The 32 ETH requirement is a noteworthy financial commitment, ensuring validators have a genuine stake in the network’s success.

- Hardware: A dedicated and dependable computer is required, preferably with a high-performance CPU, adequate RAM (at least 16GB), and a solid-state drive (SSD) with enough storage space to store the blockchain (several terabytes).

- Network: A reliable and fast internet connection is needed to keep in sync with the blockchain and avoid fines. A validator’s health and profitability are best maintained with an uptime of 99% or greater.

Setup

- Choosing the Client: The Ethereum client software you choose will significantly impact your staking experience. Prysm, Lighthouse, and Teku are popular due to their robustness, user support, and community trust. Each client is unique, so it’s important to investigate and choose one that matches your technical skills and support needs.

- Installation and configuration: Download and install your preferred client. This step involves synchronizing the Ethereum blockchain, which might take several days, depending on your internet speed and device configuration. Proper setting is critical for maximizing performance and security.

Activation

- Depositing ETH: To activate your validator, you must deposit exactly 32 ETH into the official Ethereum staking contract. This transaction is permanent and commits your ETH to the staking process.

- Becoming a Validator: When the network identifies and processes the deposit, your validator node will join the queue to be enabled. This waiting duration varies according to the amount of pending validators.

Maintenance and Risks

Let’s delve into its Maintenance and risks.

Maintenance

Running a validator node needs constant maintenance and monitoring to maintain proper functionality. This includes software upgrades, hardware diagnostics, and network health monitoring.

Risks

- Hardware Failure: Running your own node requires reliable hardware. Any malfunction can lead to downtime, which can affect staking rewards.

- Technical Expertise: Successfully managing a validator node demands high technical knowledge, including network and system administration.

- Slashing Penalties: The staked ETH can be penalized if a node behaves maliciously or fails to follow network consensus rules.

Pooled Staking

Credits: FreePik

Pooled staking is ideal for those with less than 32 ETH or who prefer not to run their own node. In this method, you join a pool with other stakers to stake your ETH collectively. Here’s how to do it:

Minimum Requirements

- Stake Amount: No specific stake amount is required for you to be eligible for staking. Pooled staking allows you to stake much smaller amounts, sometimes as little as 0.1 ETH.

- Hardware: There is no need for dedicated hardware since the pool operator manages the validator nodes.

- Technical Knowledge: Minimal technical knowledge is required. This makes it accessible for novices.

Setup

- Research: Begin by researching and picking a reputable staking pool. Consider factors like the pool’s fees, performance history, reputation, and security measures.

- Account Creation: Sign up and make an account with the chosen staking pool. This may involve completing KYC (Know Your Customer) procedures.

- Wallet Integration: Connect your Ethereum wallet with the staking pool platform. Ensure your wallet is compatible with the pool’s requirements.

Activation

- Deposit ETH: Transfer the ETH you wish to stake from your wallet to the pool’s address. Follow the pool’s guidelines thoroughly to ensure a successful transfer.

- Stake Confirmation: Once your deposit is received, the pool will combine it with others to form validator nodes. You’ll get a confirmation once your ETH is staked and active in the pool.

Maintenance and Risks

Let’s discuss its Maintenance and risks.

Maintenance

One advantage of pooled staking is that the pool operator maintains the validator nodes. You don’t need to worry about technical upkeep.

Risks

- Pool Concentration Risk: Large pools may control significant network portions, posing centralization risks.

- Liquidity Risk: Depending on the pool’s terms, accessing your staked ETH or rewards might be restricted, especially during lock-up periods.

- Pool Performance: The pool’s performance and fee structure can affect rewards. Ensure you understand the fee model and potential deductions from your rewards.

Also Read: 7 Best GPUs For Mining In 2024.

Liquid Staking

Liquid staking is an innovative method that allows you to stake your Ethereum while maintaining access to your capital through a liquid token. This approach offers flexibility and participation in decentralized finance (DeFi) activities without locking up your assets. Here’s how to do it:

Minimum Requirements

- ETH Amount: Liquid staking often does not require a minimum of 32 ETH. You may start with as little as you desire, making it more accessible to potential investors.

- Crypto Wallet: You will need a cryptocurrency wallet that supports Ethereum and the particular liquid staking tokens (such as stETH in Lido’s case).

- Knowledge of DeFi: A basic understanding of DeFi and smart contracts is beneficial, as liquid staking involves interacting with these elements.

Setup

- Choose a Liquid Staking Platform: Research and select a liquid staking provider, like Lido or Rocket Pool, with a strong reputation and security measures.

- Connect Your Wallet: Use your crypto wallet to connect to the chosen liquid staking platform’s website or app.

- Transfer ETH: Send the amount of Ethereum you want to stake from your wallet to the platform’s staking contract.

Activation

- Once you transfer your ETH to the liquid staking platform, it is automatically staked in their system.

- You receive a liquid token (e.g., stETH with Lido) representing your staked ETH plus accruing rewards.

Maintenance and Risks

Here is a breakdown of its Maintenance and risks.

Maintenance

Liquid staking requires little maintenance. Your staking provider handles the technical components, such as validator operations and reward distribution.

Risks

- Smart Contract Risks: As liquid staking relies on smart contracts, it’s subject to vulnerabilities or bugs in the contract code.

- Liquidity Risk: Although liquid tokens are intended to be exchanged or used in DeFi, market conditions can influence their liquidity and price.

- Platform Risk: The security and stability of the staking platform are important. Opt for platforms with a good track record and robust security measures.

Staking-as-a-Service

Credits: FreePik

Staking-as-a-service (SaaS) providers manage the technical aspects of staking. This enables you to stake your ETH without dealing with the complexity of running a validator node. Here’s how to do it:

Minimum Requirements

- Stake Amount: Many SaaS providers allow you to stake less than 32 ETH. The minimum amount varies depending on the service.

- Account Registration: You must create an account with the SaaS provider.

- Wallet: A compatible wallet to transfer your ETH to the service.

Setup

- Choose a Provider: Research and choose a reputable SaaS supplier who shares your business objectives and offers acceptable terms and conditions.

- Account Creation: Following their security rules, sign up and authenticate your account with the chosen provider.

- Deposit ETH: Move your ETH from your wallet to the account you created with the service.

Activation

- Staking Contract: Once your ETH is placed, the provider will stake it on your behalf by transferring it to the Ethereum staking contract.

- Confirmation: The service will confirm that your ETH has been staked and you are now part of the staking pool.

Maintenance and Risks

Let’s take a look at the maintenance and risks.

Maintenance

Ensuring the staking software and infrastructure are updated and operating efficiently demands continuous monitoring. You must conduct timely updates to ensure security and performance.

Risks

- Security: Ensure the SaaS supplier has strong security procedures to secure your valued assets. The risk of hacking or service failure might impact your investment.

- Service Fees: Be aware of the fees charged by the provider for their services. These fees will be deducted from your staking rewards.

- Liquidity: Consider the liquidity conditions since certain providers may impose a lock-up time during which you cannot access your staked Ethereum.

Exchange Staking

Exchange staking is a popular and easy way to stake your Ethereum (ETH), especially for those who prefer a simple and less technical approach. Here’s how to do it:

Minimum Requirements

- Ethereum Holdings: Unlike solo staking, where you need 32 ETH, exchange staking often allows you to start with a much smaller amount (0.01 ETH), depending on the exchange.

- Exchange Account: You need an account on a cryptocurrency exchange that offers ETH staking services. Ensure your account is verified to the required level to enable staking.

Setup

- Select an Exchange: Choose a reputable cryptocurrency exchange that supports Ethereum staking, like Coinbase, Binance, or Kraken. Research their staking terms, fees, and rewards rates.

- Create and Secure Your Account: If you don’t already have an account, sign up and follow the necessary verification processes. Secure your account with strong passwords, two-factor authentication (2FA), and other security measures the exchange provides.

Activation

- Deposit ETH: Transfer ETH to your exchange wallet. You can purchase it directly on the exchange if you don’t have ETH.

- Opt-In for Staking: Navigate to the staking section on the exchange’s platform and choose to stake your ETH. Follow the on-screen instructions to allocate the amount of ETH you wish to stake.

- Confirmation: After opting in, the exchange will process your staking request. This may take some time, during which your ETH will be locked for staking.

Maintenance and Risks

Now, let’s discuss the maintenance and risks associated with exchange staking.

Maintenance

One of the benefits of exchange staking is that the exchange handles all maintenance. This includes running the necessary node infrastructure, managing software updates, and ensuring network participation.

Risks

- Counterparty Risk: When you stake on an exchange, you entrust your ETH to them. Your staked assets could be at risk if the exchange faces financial difficulties, security breaches, or operational failures.

- Liquidity Risk: Staked ETH is usually locked for a period and cannot be traded or withdrawn immediately. Be aware of the terms, as some exchanges offer more flexible staking options with shorter lock-up periods.

- Reward Variability: Staking rewards can fluctuate based on network conditions and the total amount of ETH staked. Exchanges might also take a commission from your staking rewards as a fee for their services.

Are you planning on setting up a staking node on a dedicated server? Read our comprehensive guide, ‘Ultimate Guide To Node Staking On Dedicated Servers,’ for a smooth experience.

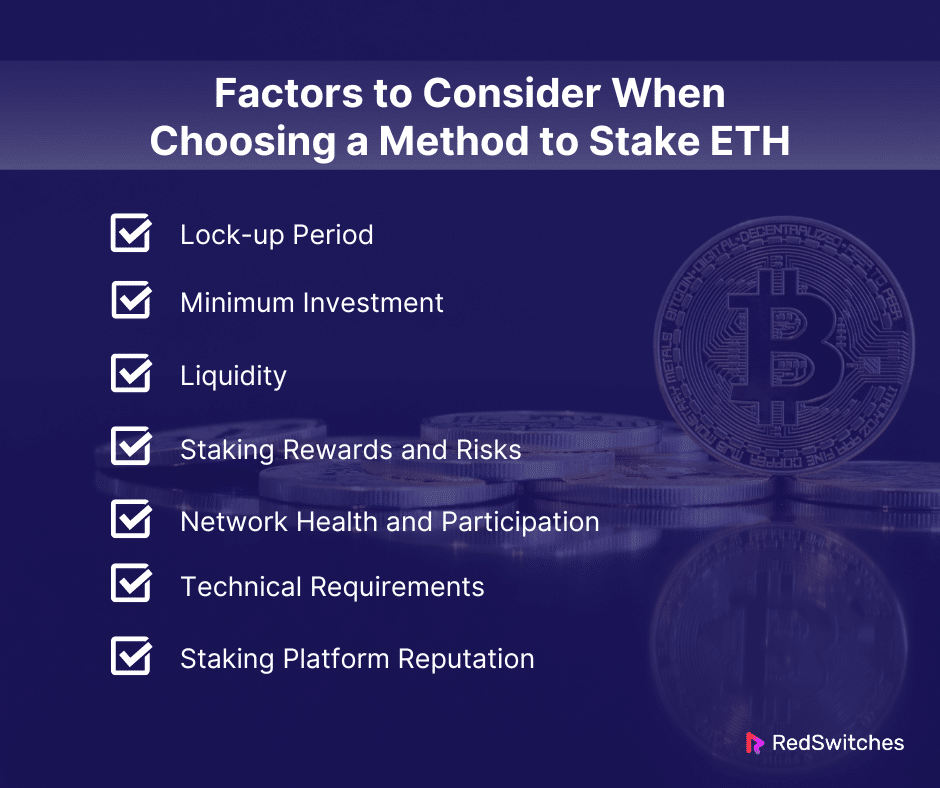

Factors to Consider When Choosing a Method to Stake ETH

Choosing the right staking method for Ethereum or any other cryptocurrency involves several critical factors. Here’s what you should consider when choosing a staking method:

Lock-up Period

Consider the duration your assets will be locked up for. Some staking methods demand you to lock your tokens for a specific period. During this period, you cannot access or trade your assets. A longer lock-up period might offer greater rewards but lowers liquidity and flexibility.

Minimum Investment

Credits: Freepik

As stated above, the different staking methods have varying minimum investment requirements. Ensure the method you choose goes with the amount of capital you wish to invest. Solo staking usually demands a greater minimum investment than pool staking.

Liquidity

Some staking methods provide greater liquidity than others. Staking systems may include features like immediate unstaking or secondary markets where staked assets may be sold, but with fines or costs. Before committing to a staking technique, consider how you will gain access to your assets.

Staking Rewards and Risks

Compare the possible advantages to the risks. Increased profits are often associated with increased risks, such as:

- Volatility of the staked asset.

- Reliability of the staking platform.

- Possibility of slashing (fines for malpractice or node outage).

Identify and understand the balance between risk and reward you are comfortable with.

Network Health and Participation

The network’s overall health and participation rate can affect your staking rewards. Networks with higher participation rates may offer reduced rewards per staker, as the reward pool is shared among more participants.

Conversely, staking on a less popular network can provide higher individual rewards but could come with greater risks.

Technical Requirements

Consider the technical needs of staking. Some staking methods may use specific technology and software, network access, and require the ability to resolve errors. Other methods often require less technical knowledge. Pick a staking method depending on how tech-savvy you are.

Staking Platform Reputation

Investigate the reputation and dependability of the staking platform or service. Look for platforms with an impressive track record, transparent processes, and great user feedback. A reliable platform may reduce the likelihood of losing funds due to fraud or mismanagement.

Also Now You Can Buy A Dedicated Server With Bitcoin At The Lowest Price.

Where to Stake Your Eth?

Credits: FreePik

With countless crypto-staking platforms available, it can be difficult to determine which to choose. Here are some of the popular crypto-staking platforms where you can stake Ethereum:

Coinbase

Coinbase is among the largest and most renowned cryptocurrency exchanges. It offers a user-friendly platform for staking Ethereum. Due to its straightforward interface and robust security measures, Coinbase is an ideal choice for beginners. By staking with Coinbase, users can gain rewards while the exchange takes care of the technical elements, like managing the staking infrastructure.

Pros

- Ease of Use: The platform is intuitive, making it simple to stake Ethereum with only a few clicks.

- Security: Coinbase provides high-level security measures. This ensures the safety of your staked assets.

- Liquidity: Users can easily access their assets, although there might be a waiting duration for unstaking.

Cons

- Fees: Coinbase bills a commission on staking rewards, which can lower the net profits for stakeholders.

Rocket Pool

Rocket Pool is a decentralized staking solution for small and large Ethereum holders. Its protocol enables users to stake Ethereum without running their own infrastructure, making it more accessible to people with little technical skills or resources.

Pros

- Decentralization: Rocket Pool’s decentralized nature ensures that the staking process is more in line with the ethos of blockchain technology.

- Accessibility: It lowers the entry barrier for staking by allowing participation with smaller amounts of Ethereum.

- Community-driven: Being part of a decentralized network offers transparency and a sense of community among participants.

Cons

- Complexity for Beginners: The platform may be more difficult to browse than user-friendly interfaces like Coinbase.

Nexo

Nexo is a complete platform that provides various services, including the option to stake Ethereum. It is noted for its security, ease of use, and ability to earn interest on numerous cryptocurrencies.

Pros

- Flexibility: Nexo offers rapid access to cash, ensuring high liquidity without locking periods.

- Interest Earnings: Besides staking, users can earn interest on their crypto holdings, increasing the potential for returns.

- Loan Services: Nexo allows users to take out loans against their staked Ethereum, providing financial flexibility.

Cons

- Centralization: Being a centralized platform, users must trust Nexo with their funds, which may not align with the decentralized ethos of some crypto purists.

Lido

Lido is Ethereum’s premier liquid staking solution, allowing users to stake ETH while maintaining liquidity. It lets stakeholders get stETH tokens in exchange for their staked ETH, which reflects the staked amount plus achieved benefits.

Pros

- Liquidity: Lido’s differentiating feature is that it provides liquidity for staked assets, letting users spend their staked ETH in various DeFi apps.

- No Minimum Stake: Users can stake any amount of Ethereum, making it unrestricted for all investment levels.

- Decentralized: Lido functions decentralizedly, allowing for transparency while decreasing the possibility of central points of failure.

Cons

- Smart Contract Risks: As with any DeFi platform, users are exposed to smart contract risks, potentially leading to loss of funds.

Dedicated Servers for Crypto Staking

Credits: FreePik

Ethereum staking can be exciting and rewarding. When beginning your journey to stake Ethereum, it is important to pick the right infrastructure to optimize your staking endeavors.

RedSwitches offers numerous hosting solutions, including the best dedicated servers developed to be highly customizable to meet the needs of every crypto enthusiast. The provider empowers you to leverage the power of robust and reliable infrastructure to boost your staking performance. So what are you waiting for?

Wrapping Up

Staking Ethereum presents a valuable opportunity for earning through blockchain technology. By understanding the various staking methods—solo, pooled, liquid, and staking-as-a-service—you can choose one that aligns with your technical skills, risk tolerance, and investment goals.

Remember, while staking offers potential rewards, it also carries risks like liquidity constraints and market volatility. Selecting a reputable platform and maintaining vigilance over your investment are crucial steps toward a successful staking experience. With the right approach, Ethereum staking can be a fruitful venture in the evolving world of cryptocurrency.

Contact us today to learn how we can help unlock the full potential of your Ethereum staking journey.

FAQs

Q. What’s the best way to stake Ethereum?

The best way to stake Ethereum is through Ethereum 2.0, where users can stake their ETH to secure the network and earn rewards. This can be done either individually or through staking pools.

Q. Is it worth staking your Ethereum?

Yes, staking Ethereum can be worth it if you are interested in earning passive income on your holdings while contributing to the network’s security, especially with Ethereum’s shift to a Proof of Stake consensus mechanism.

Q. How much Ethereum do you need to stake?

As of the latest updates, you need a minimum of 32 ETH to stake independently. However, if you’re using staking pools or services offered by exchanges, you can stake with much smaller amounts, often even fractions of an Ethereum.

Q. What is Ethereum staking?

Ethereum staking, also known as stake Ethereum or staking ETH, is the process of participating in the Ethereum network by locking up 32 ETH to secure the blockchain.

Q. How can I stake my Ethereum?

You can stake your eth tokens by either solo staking or opting for pooled staking through a staking service or staking platform.

Q. What are the benefits of Ethereum staking?

By staking your Ethereum, you can earn rewards in the form of staking rewards while contributing to the security of the Ethereum blockchain.

Q. Can I choose to stake my ETH holdings?

Yes, as an ETH holder, you have the opportunity to stake your ETH and start earning rewards through a staking protocol or staking option of your choice.

Q. How does the staking process work?

The staking process involves staking eth by locking up a certain amount of eth staked in a smart contract to become part of a staking pool or staking node.

Q. What is liquid staking, and how can I participate?

Liquid staking, such as through Lido, allows you to stake your ETH holdings and receive liquid representation of your staked assets, maximizing your ETH flexibility.

Q. Why consider participating in Ethereum staking?

Participating in the Ethereum staking network allows you to earn staking rewards based on the total amount of eth staked while helping to secure the network and earn rewards.

Q. What are the requirements to stake Ethereum?

Staking your Ethereum requires setting up a validator node on the Ethereum network and actively participating in the staking process.

Q. What is Ethereum 2.0, and How Does it Relate to Staking?

Ethereum 2.0 is an upgrade to the Ethereum network that introduces proof of stake consensus. Staking Ethereum involves participating as a validator node to secure the network and earn rewards.

Q. What is an Ethereum Validator Node?

An Ethereum validator node is a participant in the network responsible for proposing and validating new blocks. Validators stake their Ethereum to support network operations and earn rewards.

Q. How Can I Stake Ethereum to Earn Rewards?

You can stake your Ethereum by running an Ethereum node and participating in the network’s consensus mechanism. By doing so, you contribute to network security and receive staking rewards.

Q. What Are the Benefits of Ethereum Staking on Coinbase?

Staking Ethereum on Coinbase allows users to easily participate in network validation without needing technical expertise. Users can stake their ETH to earn rewards while keeping their funds on the platform.

Q. What do people earn staking Ethereum?

People earn Ethereum tokens by staking Ethereum. The earnings can vary from person to person depending on market conditions, staking amount, technical skill set, etc.