Key Takeaways

- Staking in Proof of Stake (PoS) systems allows holders to lock up cryptocurrency and participate in network operations like transaction validation.

- Staking pools combine resources from multiple investors, enhancing their staking power and chances of earning rewards.

- These include increased reward chances, more stable returns, reduced complexity, and enhanced network security.

- In staking pools, members delegate their cryptocurrency to a pool operator who manages the validation of transactions and distribution of rewards.

- The pool’s performance history, saturation level, operator trustworthiness, and fee structure are important factors.

- Staking pools simplify participation, making it accessible even for those without technical expertise.

- Choosing pools with robust security measures and up-to-date software is crucial for protecting staked assets.

- APY varies based on network conditions, pool performance, and the amount staked, influencing the potential returns.

- Stable server operations are critical for ensuring consistent reward payouts and maintaining investor trust.

- Effective management and regular server maintenance are essential for maximizing APY while ensuring server stability.

In the dynamic world of cryptocurrency, staking pools have become a popular way to earn rewards. These pools allow multiple stakeholders to combine resources, increasing their chances of receiving staking rewards. The Annual Percentage Yield (APY) is a key factor that attracts investors to staking pools. It represents the rate of return they can expect on their staked assets over a year.

However, not all staking pools are created equal. The stability of the servers where these pools operate plays a crucial role in ensuring consistent returns. A stable server means fewer interruptions and a more reliable income stream for investors. In 2024, the search for high-yield opportunities continues with some platforms offering APYs as high as 12%.

This article will guide you through the essentials of understanding staking pools, the significance of APY, and the importance of dedicated server stability in maximizing investment returns. Let’s get started.

Table of Contents

- Key Takeaways

- What Is Staking?

- How Does Staking Work?

- How Does a Staking Pool Work?

- Choosing a Staking Pool

- Comparison: Staking Pools vs. Solo Staking vs. Staking as a Service

- Understanding Staking Pools APY

- Importance of APY in Staking

- Factors Influencing APY

- Maximizing Returns from Staking Pools

- Significance of Server Stability in Staking Pools

- Impact of Server Instability

- Key Factors Ensuring Server Stability

- Server Stability and Pool Performance

- Evaluating Server Stability in Staking Pools

- The Broad Impact of Server Stability

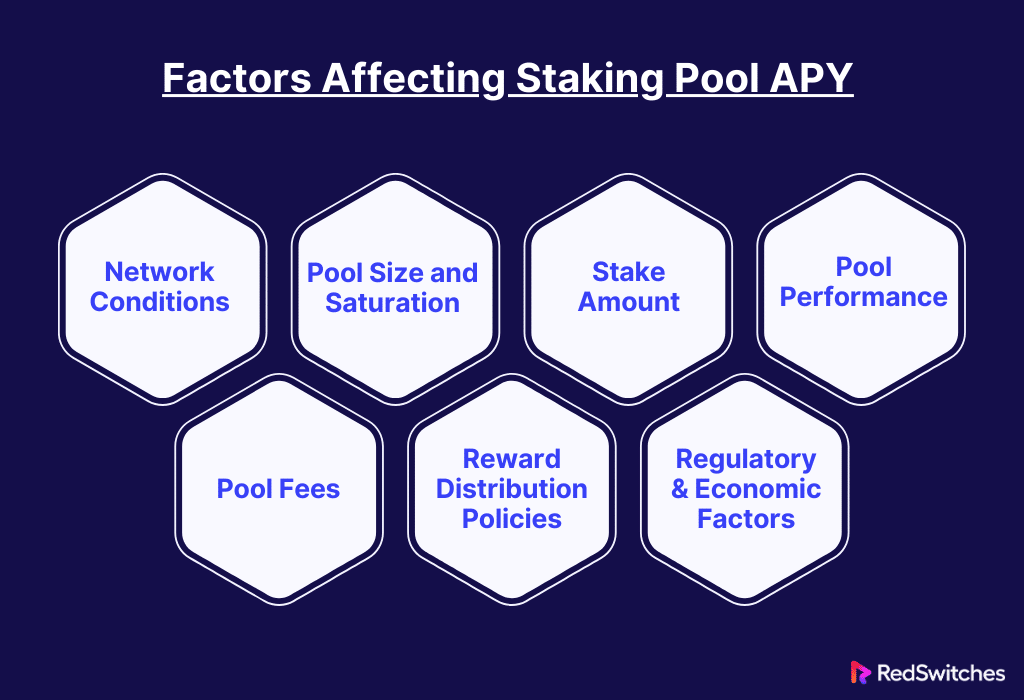

- Factors Affecting Staking Pool APY

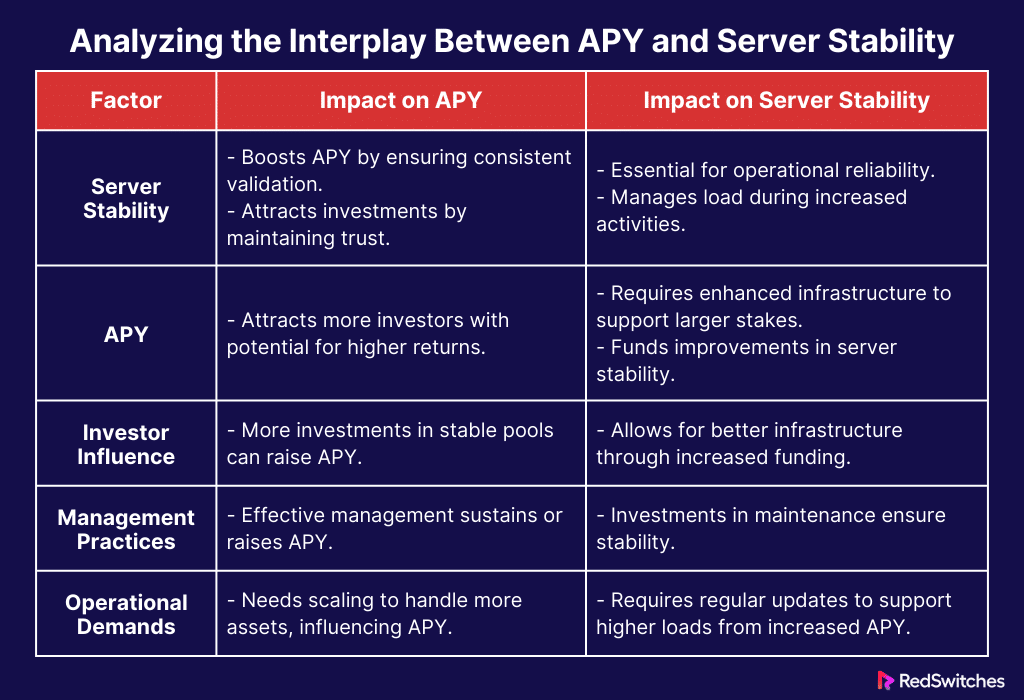

- Analyzing the Interplay Between APY and Server Stability

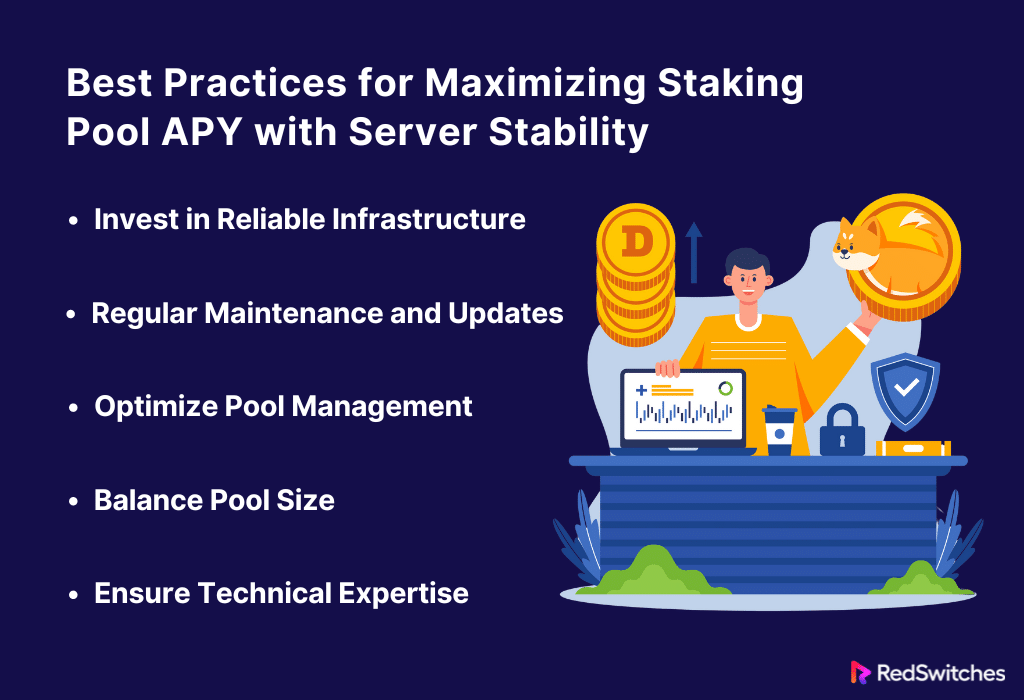

- Best Practices for Maximizing Staking Pool APY with Server Stability

- Conclusion

- FAQs

What Is Staking?

Credits: Freepik

Staking is a crucial concept in the blockchain world, especially within networks that operate on a Proof of Stake (PoS) system. Unlike the Proof of Work (PoW) system, which requires massive computational power to validate transactions and create new blocks, PoS relies on cryptocurrency ownership, or “staking”. In this system, the more cryptocurrency you hold and are willing to lock up or “stake,” the more you can participate in the network’s operations, like transaction validation and block creation.

How Does Staking Work?

Participants in a PoS system can validate block transactions according to the number of coins they hold and have committed as a stake. Essentially, the PoS algorithm chooses transaction validators based on the size of their stake, making the process more energy-efficient than PoW.

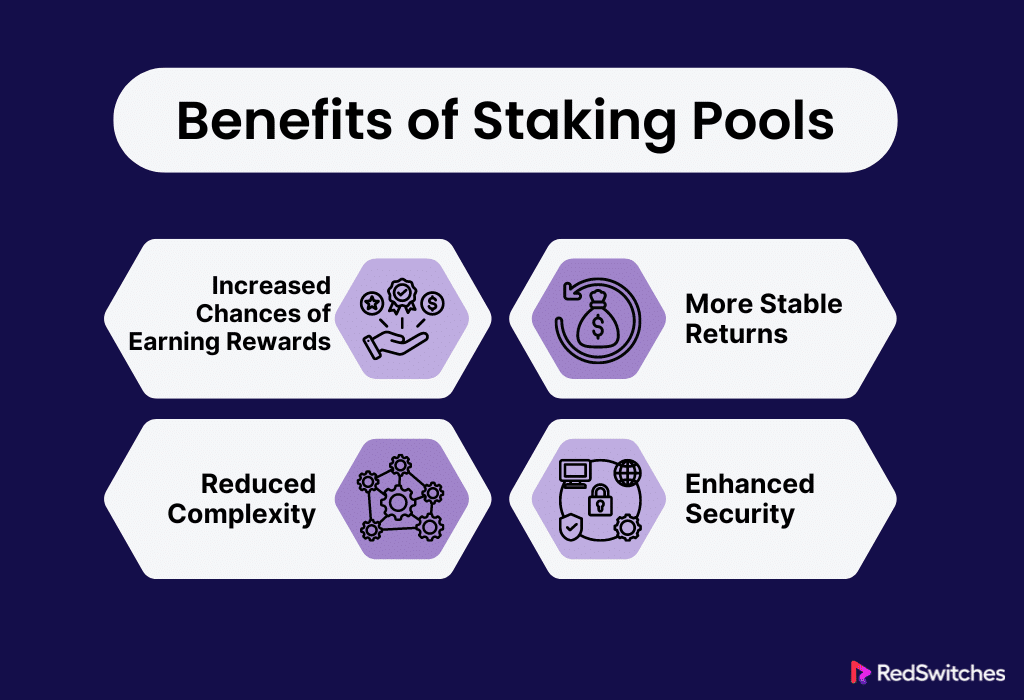

Benefits of Staking Pools

Let’s break down the key benefits of staking pools:

Increased Chances of Earning Rewards

In a PoS model, the probability of being chosen to validate transactions and earn rewards generally increases with the amount staked. However, individual cryptocurrency holders often do not have enough coins to compete with wealthier stakers. This is where staking pools come into play. By pooling their resources with others, smaller investors can increase their effective stake and thus their chances of earning validation rewards.

More Stable Returns

Staking pools often provide more predictable and stable returns. They pool the stakes of many investors, which tends to even out the variability in rewards that individual stakers might experience due to the randomness of the selection process in PoS systems.

Reduced Complexity

For many, the technical barrier to entry for staking can be high. Staking pools simplify participation by managing all the complex aspects of staking for their members. Investors don’t need to run their hardware or worry about technical maintenance, as the pool operators handle these tasks.

Enhanced Security

Staking as part of a larger pool can also enhance the network’s security. Larger staking pools can help prevent certain types of attacks on the network, as they make it more difficult for malicious actors to gain control without accumulating a significant amount of currency.

Why Consider Staking Pools?

Crypto Staking pools present a compelling option for those looking to earn from crypto holdings without selling. They provide a way to earn interest on your holdings that might otherwise be sitting idle in a wallet. The earnings come from the network rewards distributed for helping maintain the operation of the blockchain.

Staking is a passive way to earn additional income by holding cryptocurrency. It contributes to the security and efficacy of the blockchain network. Staking pools amplify this benefit by pooling resources, thereby allowing individual investors to participate in staking opportunities that would otherwise be out of reach due to the high capital required if acting alone.

How Does a Staking Pool Work?

While understanding staking pools, it is vital to understand the workings of staking pools. Here’s a breakdown of how a staking pool works:

Pooling Resources for Greater Influence

A staking pool is essentially a collaboration among cryptocurrency holders. They pool their coins to increase their collective staking power within a proof-of-stake (PoS) blockchain network. This increase in staking power improves their chances of being selected as validators. Validators are responsible for verifying transactions and maintaining the network’s security.

Operation of Staking Pools

Participants in a staking pool delegate their coins to a pool operator. This operator then uses the aggregated stakes from all members to participate in the blockchain’s validation process. Here’s how it typically functions:

- Delegation: Users delegate their cryptocurrency to the staking pool.

- Validation: The pool operator uses the combined stakes to validate transactions on the blockchain.

- Rewards Distribution: When the pool successfully validates transactions and proposes new blocks, it earns staking rewards in the native cryptocurrency. These rewards are then distributed among all pool members proportional to their contributed stake.

Choosing a Staking Pool

Selecting the right staking pool requires careful consideration. We will discuss this in detail in the next section. But here is an overview of some important factors:

- Performance History: Look for pools with a track record of successfully proposing blocks.

- Saturation: Avoid pools close to or exceeding their saturation point (usually around 60% of total network stake), as this can affect reward potential and promote network decentralization.

- Operator Trustworthiness: Ensure the pool operator is reliable and has the necessary skills to maintain node operations effectively.

Rewards and Commitment

The rewards received from staking depend on the size of the stake contributed to the pool. A larger collective stake increases the likelihood of the pool being chosen to validate transactions and propose new blocks.

Ease of Participation

Joining a staking pool can be straightforward. Most platforms allow users to start staking with just a few clicks or taps on a screen, making it accessible even for those without technical expertise.

Staking pools simplify the process of earning rewards on a PoS blockchain by allowing individual holders to contribute smaller amounts of cryptocurrency, which are pooled together to increase the entire group’s chances of receiving validation rewards. This arrangement not only enhances the chance of earning rewards but also supports the security and efficiency of the blockchain network.

Choosing a Staking Pool

Credits: Freepik

When you’re ready to start staking your cryptocurrency, understanding staking pools is crucial. Choosing the right staking pool can significantly impact your earnings and the security of your investment. Here are simple guidelines to help you make an informed decision.

Research Pool Performance

- Track Record: Check how consistently the pool has produced blocks. A consistent history suggests reliability.

- Payout Frequency: Verify how often rewards are distributed. Regular payouts are a sign of a stable pool.

Assess Pool Saturation

- Capacity Limits: Pools have a saturation point, where additional stakes do not yield higher rewards. Choose pools well below their saturation limit to maximize returns.

- Promote Decentralization: By choosing less saturated pools, you also support the broader network’s decentralization, strengthening its security.

Verify Operator Integrity

- Reputation: Research the pool operator’s reputation within the crypto community. Trustworthy operators are essential for a secure staking experience.

- Transparency: Good pools provide clear information about their operations and fees. Transparency is key to understanding staking pools and their management.

Understand Fee Structures

- Fee Percentage: Look at the percentage of rewards the pool takes as a fee. Lower fees can mean higher net earnings for you.

- Fee Justification: Some pools charge higher fees for better service, such as more secure or efficient operations. Decide if the trade-off is worth it.

Technical Security

- Security Measures: Ensure the pool uses up-to-date security practices to protect your staked assets.

- Software Integrity: Pools that use audited and open-source software offer more security, reducing the risk of software failures or fraud.

User Experience

- Ease of Use: The platform should be user-friendly, allowing easy access and management of your stake.

- Support Services: Responsive customer support is vital, especially for newcomers navigating their first staking pool experience.

By understanding staking pools through these aspects, you can choose a pool that enhances your chances of earning rewards and secures your investment. This comprehensive approach ensures that your entry into cryptocurrency staking is as profitable and safe as possible.

Also Read What Is Crypto Staking Calculator and Top Crypto Staking Calculators?

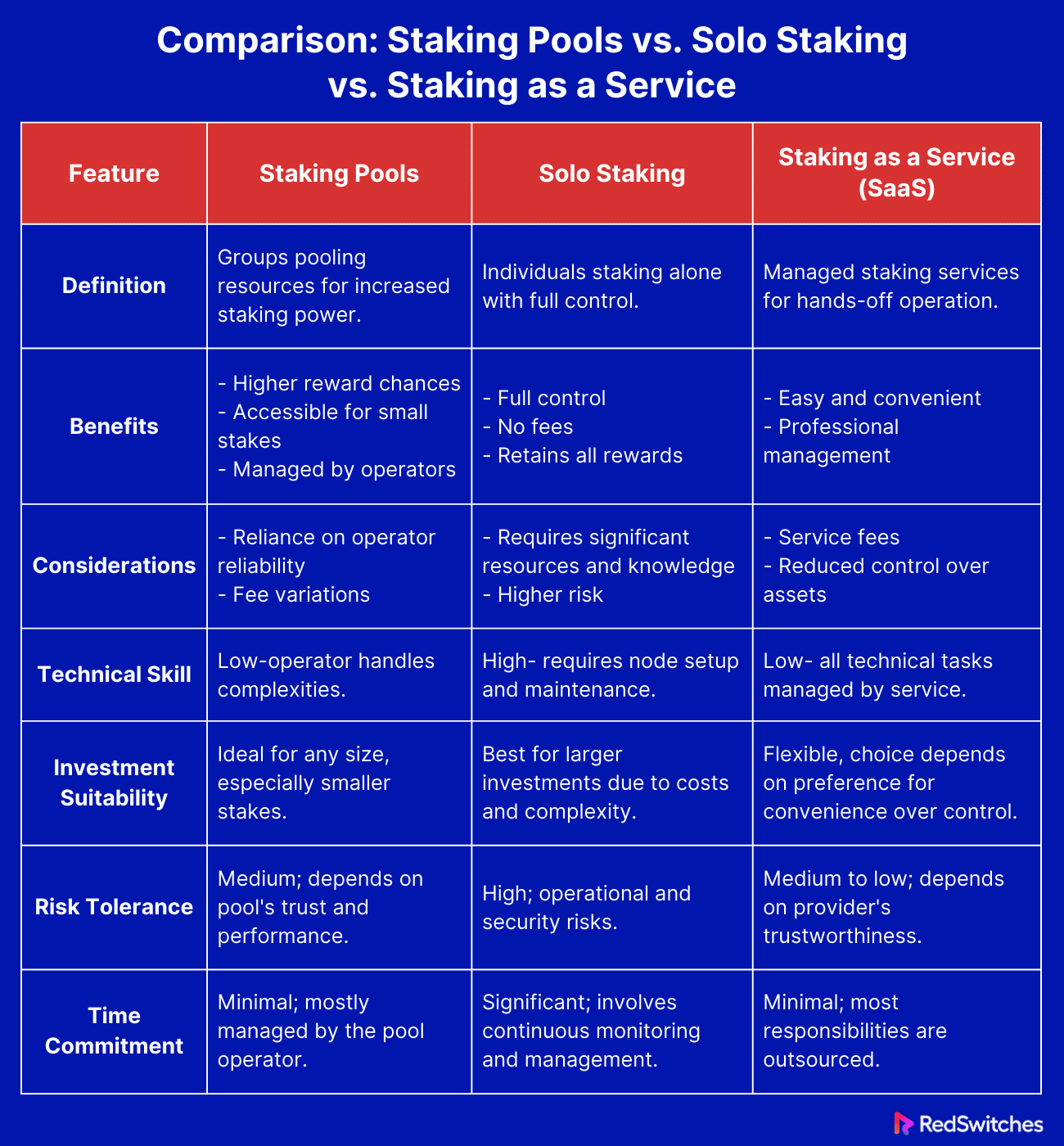

Comparison: Staking Pools vs. Solo Staking vs. Staking as a Service

Understanding staking pools, solo staking, and staking as a service (SaaS) is key to making informed decisions in cryptocurrency. Each method has its own set of benefits and considerations.

Staking Pools

A staking pool is a group of coin holders merging their resources to increase their chances of validating blocks and earning rewards.

Benefits:

- Increased Chances of Rewards: By pooling resources, participants enhance their overall staking power, improving their odds of earning rewards.

- Lower Entry Requirements: Staking pools allow individuals with fewer coins to participate and earn rewards, democratizing the process.

- Simplified Process: Pool operators handle the technical aspects, making it easier for those without technical expertise.

Considerations:

- Dependence on Pool Management: Your rewards and security depend on the competence and honesty of the pool operator.

- Variable Fees: Pools charge fees for their services, which can vary widely and affect your net earnings.

Solo Staking

Solo staking involves individuals staking their coins independently, acting as a full node.

Benefits:

- Full Control: You manage your staking, giving you complete control over your assets.

- No Fees: You retain 100% of your staking rewards without management fees.

Considerations:

- High Resource Requirements: Requires significant investment in hardware and a stable internet connection.

- Technical Expertise Needed: You must be able to set up and maintain a node.

- Greater Risk: The financial outlay and potential for loss due to mistakes or security breaches are higher.

Staking as a Service (SaaS)

SaaS providers offer staking services to coin holders who want to stake without dealing with technical details.

Benefits:

- Convenience: Provides a hands-off staking experience. The service handles all technical aspects.

- Expert Management: Professionals manage your assets, potentially increasing efficiency and rewards.

Considerations:

- Costs: Higher fees than solo staking, as you pay for the convenience and management.

- Less Control: You entrust your coins to a third party, which entails a trust risk.

Choosing the Right Option

Credits: Freepik

Factors to Consider:

- Technical Skill: Your ability to manage the technical requirements of solo staking.

- Investment Size: How much you’re willing to invest. Larger holdings might benefit more from solo staking, while smaller amounts might be better suited to pools.

- Risk Tolerance: Your comfort with the risks associated with each option, including the potential loss of staking control in SaaS or the operational risks of solo staking.

- Time Commitment: Whether you prefer to be hands-on (solo staking) or would rather have someone else manage the process (staking pools or SaaS).

Understanding staking pools, solo staking, and staking as a service is crucial as each has its distinct setup, cost, and level of user involvement. By weighing these options against your circumstances and goals, you can select the staking method that best suits your needs, maximizing your potential rewards while aligning with your comfort level and capacity for management.

Also Read How to Stake Ethereum?

Here’s the comparison table for Understanding Staking Pools, Solo Staking, and Staking as a Service (SaaS):

Also Read: What Is the Minimum Lockup Period for Crypto Staking?

Understanding Staking Pools APY

APY stands for Annual Percentage Yield. It measures the real rate of return on your investments, accounting for the effect of compounding interest over a year. In the context of cryptocurrency, understanding staking pool APY is vital. It tells you how much you can earn from staking your digital assets in a pool.

Importance of APY in Staking

APY is a key metric when participating in staking pools. It helps investors compare the profitability of various staking options. A higher APY means higher potential returns on the staked cryptocurrency. However, it’s crucial to remember that a higher APY can also mean higher risk. Factors such as market volatility can impact returns, and sometimes, high APYs are associated with unstable assets.

Factors Influencing APY

Several elements affect the APY of a staking pool:

- Blockchain Network: The underlying technology and its rules can influence returns.

- Pool Performance: The efficiency and success rate of the pool in validating transactions.

- Staked Amount: More significant amounts can affect the pool’s ability to earn and distribute rewards.

- Pool’s Fee Structure: Fees can eat into your earnings. Understanding staking pool fees is essential.

Maximizing Returns from Staking Pools

Credits: Freepik

Maximizing your earnings from a staking pool is not just about choosing the one with the highest APY. Understanding staking pool dynamics, like how often rewards are paid and the pool’s stability, can also influence your decision. It’s important to align your choice with your investment strategy and risk profile.

Significance of Server Stability in Staking Pools

Server stability is crucial in the operation of staking pools. It ensures that the network runs smoothly and efficiently. Stability means servers are consistently available and reliable without unexpected downtimes or disruptions. Maintaining stable servers cannot be overstated in the cryptocurrency world, where transactions occur round-the-clock.

Impact of Server Instability

A lack of server stability can lead to several issues in a staking pool:

- Missed Transactions: If a server goes down, it may miss transaction validations, which could have been profitable.

- Reduced Earnings: Every missed validation opportunity means potential rewards that aren’t earned.

- Lowered Trust: Investors are less likely to stake their cryptocurrency in a pool known for frequent downtimes.

Key Factors Ensuring Server Stability

Several technical and managerial factors contribute to server stability:

- Robust Hardware: Strong, reliable servers are a must. They can handle the demands of continuous blockchain transactions.

- Effective Software Management: Keeping software updated and properly configured reduces the risk of failures.

- Regular Maintenance: Scheduled checks and upgrades ensure servers operate without hitches.

- Skilled Technical Team: Experienced personnel can anticipate and mitigate issues before they affect stability.

Server Stability and Pool Performance

The performance of a staking pool heavily depends on its server’s ability to stay online and function effectively. Here’s how stability affects performance:

- Consistency in Rewards: Stable servers mean transactions are consistently validated, leading to regular rewards.

- Attractiveness to Investors: A reliable pool attracts more stakeholders, increasing its assets and ability to stake effectively.

Evaluating Server Stability in Staking Pools

Credits: Freepik

When choosing a staking pool, understanding the importance of dedicated server stability is crucial. Consider these factors:

- Uptime Guarantees: Look for pools that offer high uptime percentages.

- Past Performance: Historical data can indicate how often the pool experiences server issues.

- Technical Support: Pools with responsive and capable technical support will likely handle server issues more efficiently.

The Broad Impact of Server Stability

Server stability is not just about keeping the system running; it also impacts the security of the staked assets. Stable servers are less likely to face security breaches, which can be more common in unstable or frequently disrupted environments.

Understanding staking pool dynamics involves appreciating the significance of server stability. It’s a key factor that affects a pool’s reliability, profitability, and reputation. For investors, choosing a pool with a strong track record of dedicated server stability is essential to ensure that their investments are secure and maximize their potential returns.

Also Read A Beginner’s Guide to Setting Up a Staking Node on a Dedicated Server

Factors Affecting Staking Pool APY

Annual Percentage Yield (APY) is a crucial metric in understanding staking pools. It represents the expected rate of return on an investment over a year, accounting for compounding interest. APY can vary widely between staking pools, and understanding staking pools factors that affect it is essential for any investor.

Network Conditions

The overall health and conditions of the blockchain network play a significant role in determining the APY of staking pools. Here’s how:

- Network Traffic: Higher transaction volumes can lead to more opportunities for validators to earn transaction fees, potentially increasing APY.

- Network Stability: A stable network without many forks or disruptions usually offers more consistent rewards, positively affecting APY.

Pool Size and Saturation

The size of the staking pool and its saturation level can greatly impact APY:

- Pool Size: Larger pools might have more resources but face higher saturation, which can limit the rewards each participant earns.

- Saturation Point: When a pool reaches or exceeds its saturation point, the APY typically decreases as rewards are spread over a larger base of staked assets.

Stake Amount

The amount of crypto assets staked in the pool influences APY in two main ways:

- Total Staked Amount: Generally, pools with a larger total staked amount have more influence in the network, potentially increasing their chances of earning rewards.

- Individual Stake: Higher individual stakes can qualify for a larger share of the pool’s earnings, thus affecting the personal APY.

Pool Performance

Performance metrics of a staking pool are directly tied to its APY:

- Block Validation Success: Pools that successfully validate more blocks tend to offer higher APY due to increased reward opportunities.

- Efficiency and Reliability: Efficiently run pools with fewer operational issues provide more stable and potentially higher APYs.

Pool Fees

Fees charged by the pool operators can significantly reduce the net APY for participants:

- Management Fees: These are fees taken by the pool operators for managing the staking operations and can vary widely between pools.

- Performance Fees: Some pools charge fees based on the rewards they generate, which can also impact the final APY.

Reward Distribution Policies

How a staking pool chooses to distribute the rewards among its members can affect the individual APY:

- Fixed vs. Proportional Distribution: Some pools offer a fixed rate, while others distribute rewards based on the proportion of the stake.

- Reward Frequency: The frequency with which rewards are distributed (daily, weekly, monthly) can impact the compounding effects, thus influencing APY.

Regulatory and Economic Factors

Credits: Freepik

External factors such as changes in cryptocurrency regulations or significant shifts in the market environment can influence APY:

- Market Volatility: High volatility can affect the price of the staked assets and the perceived risk, altering the APY.

- Regulatory Changes: New laws or policies affecting cryptocurrencies can influence the operational conditions of staking pools, impacting their APY.

Understanding staking pool APY requires a comprehensive look at internal and external factors. By examining these elements, investors can make more informed decisions, aligning their investments with pools that offer favorable conditions and potential returns. As with any investment, a thorough analysis and a clear understanding of all contributing factors are key to maximizing returns while minimizing risks.

Also Read Top 15 Crypto Staking Platforms for Maximum Earnings!

Analyzing the Interplay Between APY and Server Stability

Understanding staking pools means recognizing how intertwined factors like Annual Percentage Yield (APY) and server stability are. Both are crucial in determining the attractiveness and reliability of a staking pool. This section delves into how these two elements interact and influence each other, affecting staking investments’ overall success and profitability.

APY: A Reflection of Potential Earnings

APY represents the potential return on investment in a staking pool, accounting for compounding interest over a year. It’s a vital metric for investors, indicating how much they can expect their staked assets to yield. A higher APY suggests higher potential earnings but often comes with higher risks.

Server Stability: The Backbone of Pool Operations

Server stability is essential for the continuous operation of staking pools. It ensures the pool can consistently participate in the validation process without interruptions. Stability in the server infrastructure helps maintain the security and efficiency of transactions, which is vital for the pool’s trust and reliability.

Impact of Server Stability on APY

- Reliability and Reward Consistency: Stable servers mean the pool can reliably participate in blockchain activities, directly influencing the APY. Frequent downtimes can lead to missed opportunities for earning transaction fees and rewards, reducing overall APY.

- Trust and Investment: Investors are more likely to join and remain with pools that offer stable and reliable operations, affecting the pool’s total staked assets and its ability to maintain or increase APY.

APY’s Influence on Server Stability

While APY primarily reflects the potential earnings from staking, it can indirectly influence dedicated server stability through:

- Investment Attraction: Higher APYs attract more investors, increasing the pool’s resources. These funds can be reinvested into improving server infrastructure enhancing stability.

- Operational Scaling: As more assets are staked in a pool with high APY, the demand for the server infrastructure grows. This requires the pool to scale operations effectively, maintaining stability amidst increased load.

Balancing APY and Server Stability

Balancing high APY with robust server stability is key to long-term success for any staking pool. Here’s how pools can manage this balance:

- Investing in Infrastructure: Allocating part of the earnings towards upgrading and maintaining server infrastructure ensures the pool remains competitive and stable.

- Transparent Management: Clear communication about how funds are used for server maintenance builds investor trust and stabilizes resource input.

- Regular Monitoring and Updates: Monitoring server performance and APY trends helps identify and rectify issues before they impact the pool’s overall health.

Strategic Considerations for Investors

Investors must consider APY and server stability when choosing a staking pool. Understanding staking pool dynamics helps make informed decisions that balance potential returns with operational risks. It’s advisable to look for pools that offer attractive APYs and demonstrate a strong commitment to maintaining high server stability.

The relationship between APY and server stability is dynamic and influential in the staking pool ecosystem. Understanding staking pools requires a thorough analysis of how these factors interact. A stable server attracts and retains investments, potentially increasing the APY. At the same time, a competitive APY can fund enhancements in server stability, creating a virtuous cycle that benefits pool operators and the investors.

Also read Crypto Staking Calculator: Adaptations for Server Costs

Here’s the summary table, focusing on the essential interactions between APY and server stability while understanding staking pools:

Best Practices for Maximizing Staking Pool APY with Server Stability

These best practices staking pools can maximize APY while ensuring dedicated server stability. Understanding staking pool dynamics and implementing these strategies effectively are key to achieving optimal performance and returns.

Invest in Reliable Infrastructure

Credits: Freepik

To ensure server stability, investing in robust and reliable infrastructure is essential. Stable servers are crucial for maintaining continuous operations, which supports higher APY. This includes using high-quality hardware and securing strong network connections.

Regular Maintenance and Updates

Perform regular maintenance and updates to keep servers running smoothly. This practice prevents potential downtimes and disruptions, which can impact APY. Regular updates also ensure that the staking pool remains secure against threats.

Optimize Pool Management

Effective pool management is pivotal in server stability and APY optimization. Managers should monitor performance closely to make timely decisions that enhance efficiency and profitability. Clear, transparent management helps understand staking pool operations and builds participant trust.

Balance Pool Size

Avoid exceeding the pool’s saturation point. Keeping the pool below this limit ensures that each participant’s stake contributes effectively to APY. A well-balanced pool size supports server stability by preventing overload and potential crashes.

Ensure Technical Expertise

Having a technical team with the right expertise is vital. This team is responsible for troubleshooting issues, optimizing dedicated server operations, and enhancing security measures. Their skills directly contribute to the pool’s ability to maintain high APY and stable server performance.

Conclusion

Effectively managing and understanding staking pools involves navigating various factors such as APY, server stability, pool performance, and user experience. Each element is crucial for maximizing returns and ensuring security in your digital investments. Whether new to cryptocurrency or an experienced investor, choosing the right staking pool can significantly impact your earnings and asset safety.

For those looking to secure their staking activities with reliable server stability and optimized performance, consider RedSwitches dedicated servers. These servers provide robust infrastructure, top-tier security, and high reliability, ensuring your staking operations run smoothly and efficiently. Enhance your crypto investment strategy with the tools and insights to succeed in the evolving blockchain landscape.

Ready to take your staking strategy to the next level? Explore our other blog posts for in-depth analysis of various staking pools.

FAQs

Q. How does a staking pool work?

A staking pool involves multiple cryptocurrency holders combining their assets to increase their collective staking power and chances of earning rewards from a Proof of Stake (PoS) blockchain. Participants delegate their crypto to a pool operator, who manages the process of validating transactions and earning rewards, which are then distributed among the members based on their contribution.

Q. Are staking pools worth it?

Staking pools can be worth it for individuals who want to participate in staking but lack the resources to do so effectively. They offer increased chances of earning rewards, simplified participation, and potentially more stable returns than solo staking.

Q. What are the risks of staking pool?

Risks include the pool failing to validate blocks successfully, potential mismanagement by the pool operator, and the possibility of security vulnerabilities. Additionally, there’s the market risk of cryptocurrency price fluctuations, which can affect the value of the rewards earned.

Q. How do you understand staking?

Staking involves committing your cryptocurrency to support a blockchain network’s operation, securing transactions, and creating new blocks in a PoS system. Your staked crypto acts as a “vote” towards the legitimacy of new transactions, and in return, you earn rewards proportionate to your stake.

Q. Is staking better than holding?

Staking can be better than merely holding if you want to earn additional returns on your cryptocurrency holdings. While holding crypto can yield gains through price appreciation alone, staking offers the potential to earn more through rewards for participating in network operations, albeit with some added risk and involvement.

Q. What is the staking process?

The staking process involves locking crypto tokens in a smart contract on a specific blockchain to support network operations and security. In return, participants earn rewards, which are often seen as a form of passive income.

Q. How can I participate in the staking process?

You can either stake directly with a validator or join a staking pool, where assets are pooled among pool members to increase the likelihood of earning rewards.

Q. What types of staking pools are available?

There are several types of staking pools, including public stake pools, private staking pools, and cold staking pools. These differ in terms of accessibility, control, and security features.

Q. What are the pros and cons of staking directly with a validator vs. participating in a staking pool?

Staking directly with a validator can offer more control and potentially higher rewards, but it requires more knowledge and higher risks. Participating in a staking pool reduces the entry barrier and risk, but it may result in smaller rewards and involve pool fees.

Q. How do staking pools operate to generate frequent staking rewards?

Staking pools aggregate the stakes of many investors to meet minimum staking requirements and optimize the chances of being chosen to validate transactions. Rewards are then distributed among the pool members according to their stakes.

Q. What risks are associated with staking in pools?

Risks include potential slashing due to the pool’s misconduct, smart contract vulnerabilities, and the possibility of fraud by the stake pool operator. Non-custodial staking pools may mitigate some risks by not holding the users’ keys.

Q. Can you explain the difference between custodial and non-custodial staking pools?

Custodial staking pools require you to entrust your crypto tokens to the pool’s control. In contrast, non-custodial staking pools allow you to retain control of your tokens while participating in the staking process.

Q. What advantages do staking pools offer that differ from staking directly?

Staking pools offer the advantage of pooled resources, which can lead to more frequent staking rewards and lower barriers to entry, as opposed to the higher resource requirements and expertise needed for staking directly.

Q. What role do staking pools play in the broader realm of staking?

Staking pools have emerged as critical facilitators in the staking ecosystem. They allow more participants to join the staking process and earn rewards, thus enhancing network security and stability.

Q. What should I understand about liquid staking versus pooled staking without liquid features?

Liquid staking allows participants to stake crypto tokens while retaining liquidity, typically through a secondary token representing the staked assets. Pooled staking without liquid features means assets are locked up for a period, reducing liquidity but potentially increasing reward reliability.