Key Takeaways

- Crypto staking calculators help you figure out how much you could earn by staking your digital coins.

- To get accurate results, you need to give the calculator the right information: how much crypto you’ll stake, how long you’ll stake it, and the expected yield.

- Staking calculators make financial planning and investing in crypto easier.

- Always double-check the numbers you put into a calculator – wrong data means wrong results.

- Things like how much crypto is worth and network rules can change your staking returns, so keep an eye on the market.

- Look for a staking calculator that’s accurate, easy to use, works with the coins you want, and has extra features you might find helpful.

- Top Calculators: Staking Rewards, Datawallet, BitBuy , Guarda, CryptoStake, Invezz Crypto APY, Bullish Report.

- Dedicated servers keep crypto staking calculators fast, accurate, and safe.

- Pick the staking calculator that fits your needs best.

- While helpful, staking calculators have limits – use them as one tool in your overall crypto investment strategy.

Staking is a popular way to earn rewards in cryptocurrency. It is like a savings account but for digital currency. You lock up some of your coins, and in return, you get more coins over time. It’s a simple idea, but figuring out how much you’ll earn can be tricky. That’s where crypto-staking calculators come in handy. These tools help you predict your earnings by considering how many coins you stake and for how long.

Why are these calculators important? They give you a clearer picture of what to expect from staking. Knowing which cryptocurrencies might work best for you is essential with many different cryptocurrencies and staking options. For example, staking Ethereum might give you different rewards than Tezos or Cardano. A good calculator takes all this into account.

In this article, we’ll explore what a crypto staking calculator is and introduce you to some of the top calculators available. This way, you can make informed decisions and boost your crypto earnings.

Table of Contents

- Key Takeaways

- What is a Crypto Staking Calculator?

- Importance in Managing and Forecasting Staking Returns

- How Crypto Staking Calculators Work

- Benefits of Using Staking Calculators

- Drawbacks of Using Staking Calculators

- Factors Impacting Staking Returns

- Criteria for Evaluating Staking Calculators

- Top 7 Crypto Staking Calculators

- Importance Of Dedicated Servers In Crypto Staking Calculators

- How to Choose the Right Staking Calculator

- Challenges and Limitations of Using Staking Calculators

- Conclusion

- FAQs

What is a Crypto Staking Calculator?

Credits: Freepik

A crypto staking calculator is a digital tool designed for cryptocurrency investors. It helps them estimate the rewards they could earn by staking their digital assets. Staking is similar to earning interest in a savings account but with cryptocurrency. When you stake your coins, you lock them in a wallet to support the operations of a blockchain network. In return, you earn rewards, usually through additional coins.

Functionality of Staking Calculators

The main function of a crypto staking calculator is to provide potential staking reward estimates. These calculators require several pieces of information from the user:

- Amount of Crypto: The amount of cryptocurrency to stake is the total number of coins you plan to lock up.

- Staking Duration: How long you intend to keep your coins staked.

- Annual yield: The expected percentage rate of return, which can vary depending on the blockchain network.

The calculator outputs an estimated return by inputting these parameters, helping users make informed financial decisions.

Importance in Managing and Forecasting Staking Returns

Here’s a breakdown of how crypto staking calculators are important for managing and forecasting your staking returns:

Strategic Investment Planning

Crypto staking calculators are crucial for strategic investment planning. They offer a clear picture of potential returns from staking activities. This information is invaluable for investors maximizing their crypto holdings’ income. By understanding the expected returns, investors can balance their portfolios between high-risk and low-risk assets, enhancing their overall investment strategy.

Decision Support Tool

These calculators help crypto investors make choices. They show how to split investments between staking and other areas. This is key in the unpredictable crypto market. Spreading investments can reduce risks.

Financial Predictability

Staking calculators contribute to financial predictability in the often unpredictable crypto market. By providing estimates of staking returns, these tools help investors plan their financial future better. They can forecast income streams from staking, which is crucial for long-term financial planning, especially for those who rely on crypto investments as a significant income source.

User-Friendly Financial Tools

Crypto staking calculators are a breeze to use. They’re made for both beginners and pros in the crypto world. You don’t need to be a tech wizard to figure them out. This makes it easy for more people to join in on staking. And when more people stake, the whole blockchain gets stronger.

Here’s the bottom line: these calculators are helpful if you’re into staking your crypto. They give you the lowdown on what you might earn, helping you make smart choices with your digital dollars. Plus, these tools are even more valuable as the crypto scene grows. They help you cut through the complex stuff and make money in the crypto world.

Also Read Unlocking Crypto Rewards: How Long Does Crypto Staking Take?

How Crypto Staking Calculators Work

Crypto staking calculators are designed to simplify the complexity of calculating potential earnings from staking cryptocurrencies. Understanding how these tools work is crucial for anyone looking to enhance their investment strategy through staking.

Basic Mechanism

A crypto staking calculator uses the information you give to predict your earnings. These tools are usually online. You need to enter how much crypto you will stake, how long you will stake it, and the expected yearly earnings rate. Key inputs to keep in mind:

Amount to Stake

The first critical input for a staking calculator is the cryptocurrency you plan to stake. This figure is directly proportional to the potential earnings—the more you stake, the higher your potential returns.

Staking Duration

The duration of the stake significantly impacts your returns. Most calculators allow you to input the duration in days, months, or years. Longer staking periods usually translate to higher total returns, reflecting the compound nature of earning rewards over time.

Annual Yield

The annual yield or interest rate is the percentage of new coins you earn as a reward for staking your cryptocurrency. This rate varies widely among blockchain networks and is influenced by network rules and the total amount of staked coins.

Calculation Process

Once the necessary inputs are provided, the calculator uses a formula to estimate the rewards. This calculation typically factors in the compounding of earnings, which can occur monthly, quarterly, or annually, depending on the specific terms of the staking arrangement.

Outputs and Interpretation

Let’s break down the outputs provided by crypto staking calculators and how to interpret them:

Estimated Rewards

The primary output of a crypto staking calculator is the estimated staking rewards. Based on your provided inputs, this figure represents the additional cryptocurrency you might earn over the staking period.

Understanding Outputs

While the calculator provides numerical outputs, understanding these figures in the context of broader investment goals and market conditions is essential. The estimated returns are projections, not guarantees.

Importance of Accuracy

The reliability of a staking calculator depends heavily on the accuracy of the input data. Inaccurate inputs can lead to misleading outputs, which might result in poor investment decisions.

Crypto staking calculators are key for investors to understand what they might earn from staking. When you put in how much you want to stake, for how long, and the yield you expect, these tools help you make smart choices. They’re essential for anyone who wants to get better at investing in the fast-moving crypto world. With these calculators, you can boost your chances of earning more from your digital coins.

Also Read The Role of Dedicated Servers in Crypto Staking

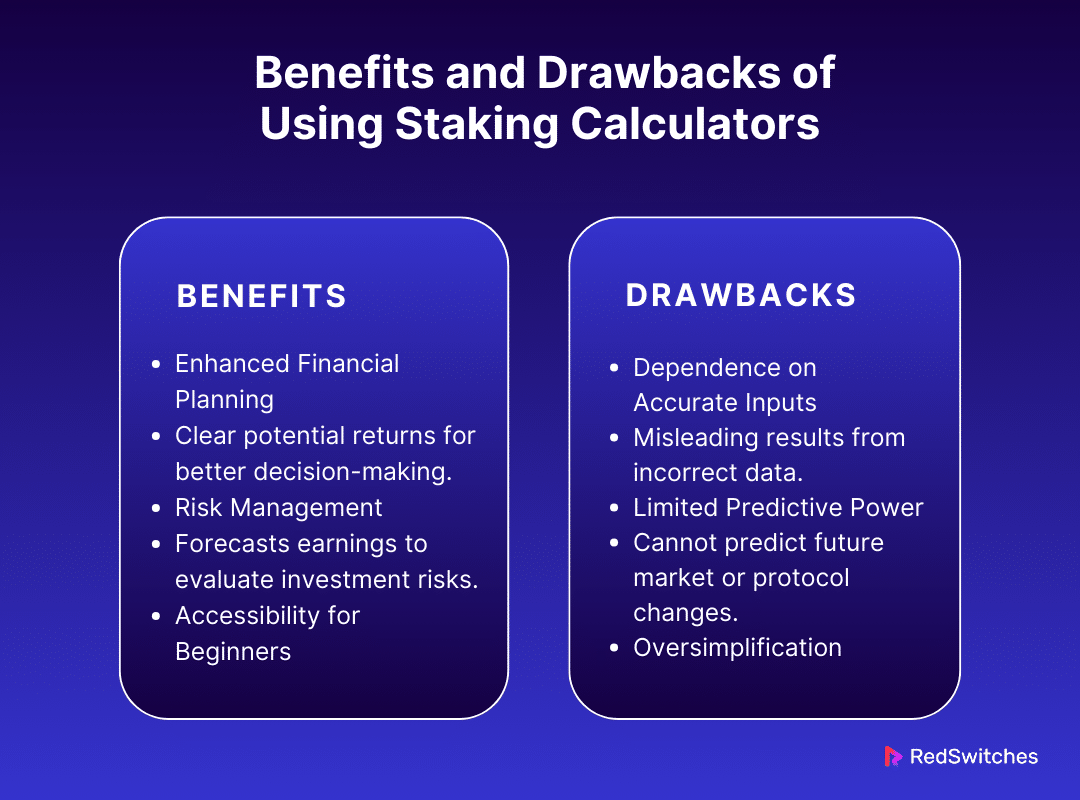

Benefits of Using Staking Calculators

Here’s a breakdown of the key benefits of using crypto staking calculators:

Enhanced Financial Planning

Crypto staking calculators enable better financial planning. They provide a clear picture of potential returns from staking investments. This helps investors decide how much to invest and for how long.

Risk Management

Staking calculators help manage investment risk by forecasting potential earnings. Based on projected returns, investors can assess the worthiness of locking in their assets for a certain period, which is crucial in the volatile world of cryptocurrency.

Accessibility for Beginners

These calculators are user-friendly, making them accessible even for those new to crypto investments. They demystify the staking process by providing straightforward calculations that outline potential gains.

Drawbacks of Using Staking Calculators

Here’s a breakdown of the drawbacks of using crypto-staking calculators:

Dependence on Accurate Inputs

The biggest drawback is their reliance on accurate input data. If the staking amount, duration, or yield information is incorrect, the calculator’s output will also be flawed. This can lead to misguided expectations and investment decisions.

Limited Predictive Power

Staking calculators do not account for future market conditions or changes in network protocols. They offer a snapshot based on current conditions, which may not hold across the entire staking period. This limited predictive power can be a significant drawback in planning long-term investments.

Oversimplification

While these tools are easy to use, they might oversimplify the complexities of crypto investments. They do not typically account for factors like price volatility, potential penalties for early withdrawal, or changes in tax regulations, which could affect actual returns.

Crypto staking calculators are helpful for anyone who wants to stake their digital coins. They help you plan your money and manage risks. Plus, they’re easy for newbies to use. But remember, they’re not perfect. You need to put in the right numbers to get good information, and they can’t predict everything. So, use them as just one part of your bigger money plan. Think about the whole market and your own goals, too.

Also Read: What Is the Minimum Lockup Period for Crypto Staking?

Here’s the summary table for the benefits and drawbacks of using crypto staking calculators:

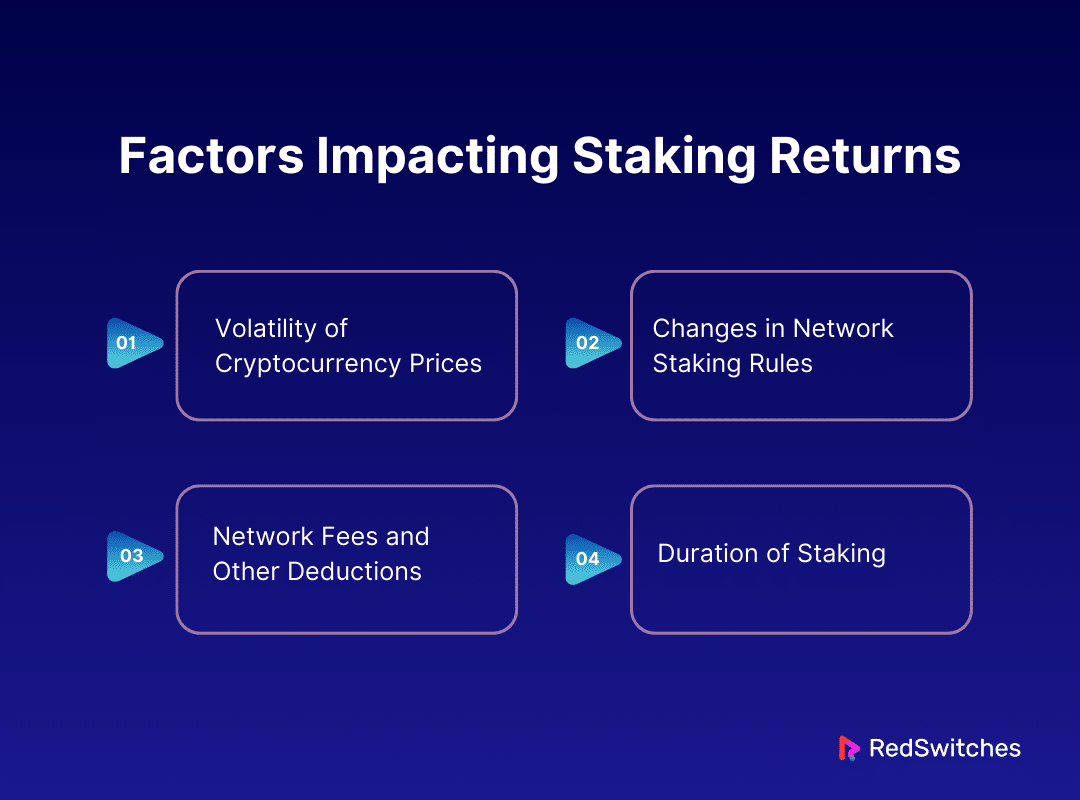

Factors Impacting Staking Returns

Understanding the factors that affect staking returns is essential for any crypto investor. This section explores key influences that can alter the profitability of staking your cryptocurrency.

Volatility of Cryptocurrency Prices

The price of cryptocurrency is inherently volatile, significantly affecting staking returns. If the value of the staked crypto falls, so does the real value of the earnings, regardless of the staking rewards accumulated. Conversely, if the price rises, the value of the returns could exceed expectations.

Changes in Network Staking Rules

Blockchain networks can change their staking rules. These changes might include adjustments to the reward algorithm or the staking requirements. Such alterations can directly impact the returns from staking. If a network lowers its reward rates, the future earnings from staking will decrease. Investors need to stay updated on these rules to manage their investments effectively.

Network Fees and Other Deductions

Staking often involves various fees and deductions. These can include transaction fees for entering or leaving a staking pool and fees deducted from rewards for pool maintenance. Additionally, some networks impose penalties for early withdrawal or failure to meet certain conditions. These fees and penalties can significantly reduce the net earnings from staking.

Duration of Staking

The duration of staking also plays a crucial role in determining returns. Longer staking periods typically offer higher returns due to the compounding of staking rewards. However, committing to a longer period means that your crypto is locked up, and you cannot use it or sell it to realize gains from price increases during that time.

Several factors influence the returns you can expect from staking cryptocurrency. The volatility of crypto prices, changes in network staking rules, associated fees and deductions, and the duration of staking all play crucial roles. By understanding these factors, investors can make more informed decisions about where, how much, and for how long to stake their cryptocurrencies.

Also Read Infrastructure Requirements for Effective Crypto Staking

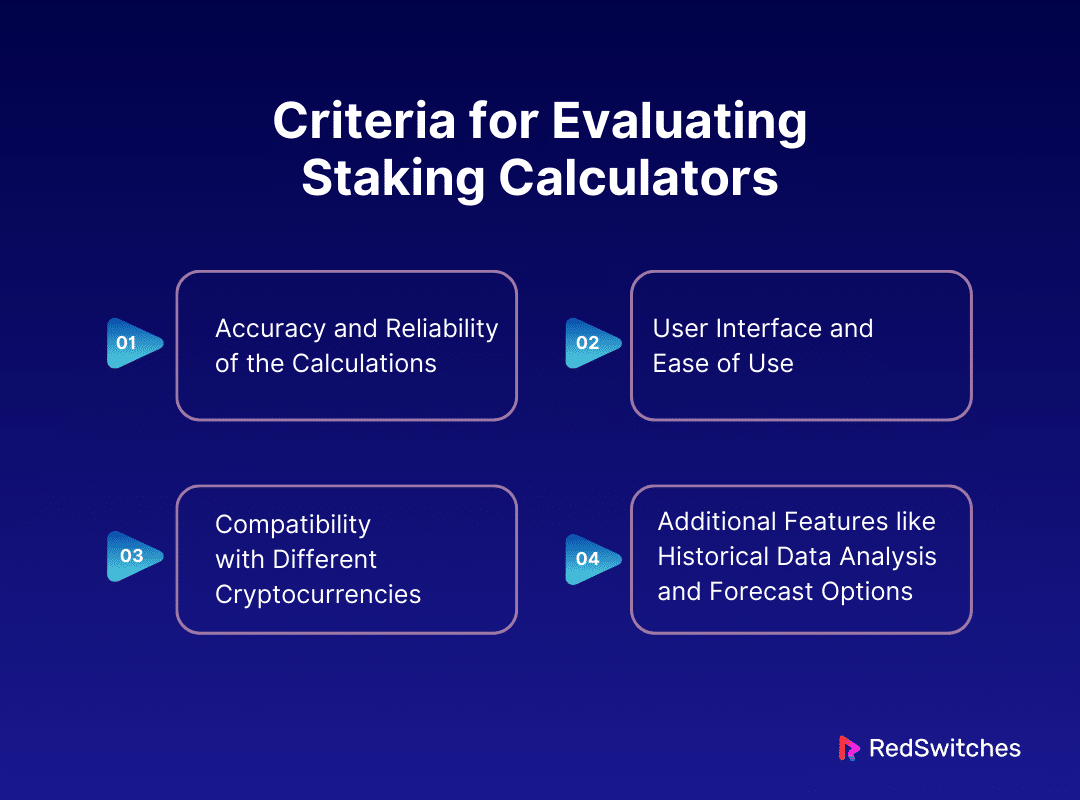

Criteria for Evaluating Staking Calculators

Choosing the right crypto staking calculator is crucial for maximizing your staking strategy. Several criteria can help you evaluate the effectiveness and suitability of these tools.

Accuracy and Reliability of the Calculations

The first criterion for a good staking calculator is the accuracy and reliability of its calculations. The calculator must provide results that closely match the outcomes, assuming the correct input data. This accuracy depends on the tool’s algorithm, which should reflect the latest staking rules and reward mechanisms of the blockchain networks it supports.

User Interface and Ease of Use

A well-designed user interface is crucial for any software tool, and staking calculators are no exception. The interface should be intuitive, making it easy for users to enter data and understand the results. A good calculator minimizes complexity and provides clear, concise information. This accessibility is essential for new investors who may not be familiar with the intricacies of staking cryptocurrencies.

Compatibility with Different Cryptocurrencies

The utility of a staking calculator also depends on its compatibility with various cryptocurrencies. Different blockchains have different staking parameters and models. A versatile calculator can handle multiple cryptocurrencies, providing broader support for users who diversify their investments across various coins. This feature is essential for those who stake on multiple platforms, as it helps streamline their calculations and comparisons.

Additional Features like Historical Data Analysis and Forecast Options

Staking calculators with extra features are super handy. They let you look back at how your crypto would have done in the past. This can give you a clue about what might happen in the future. They also have a way to guess what’s coming up in the market. This helps you plan better for what’s ahead.

When you’re picking a staking calculator, think about a few things. Is it spot on? Is it easy to use? Does it work with all kinds of crypto? What else can it do? These points matter a lot. They help you choose a calculator that you can count on. A top-notch calculator is a must-have for anyone who wants to get the most out of staking their crypto.

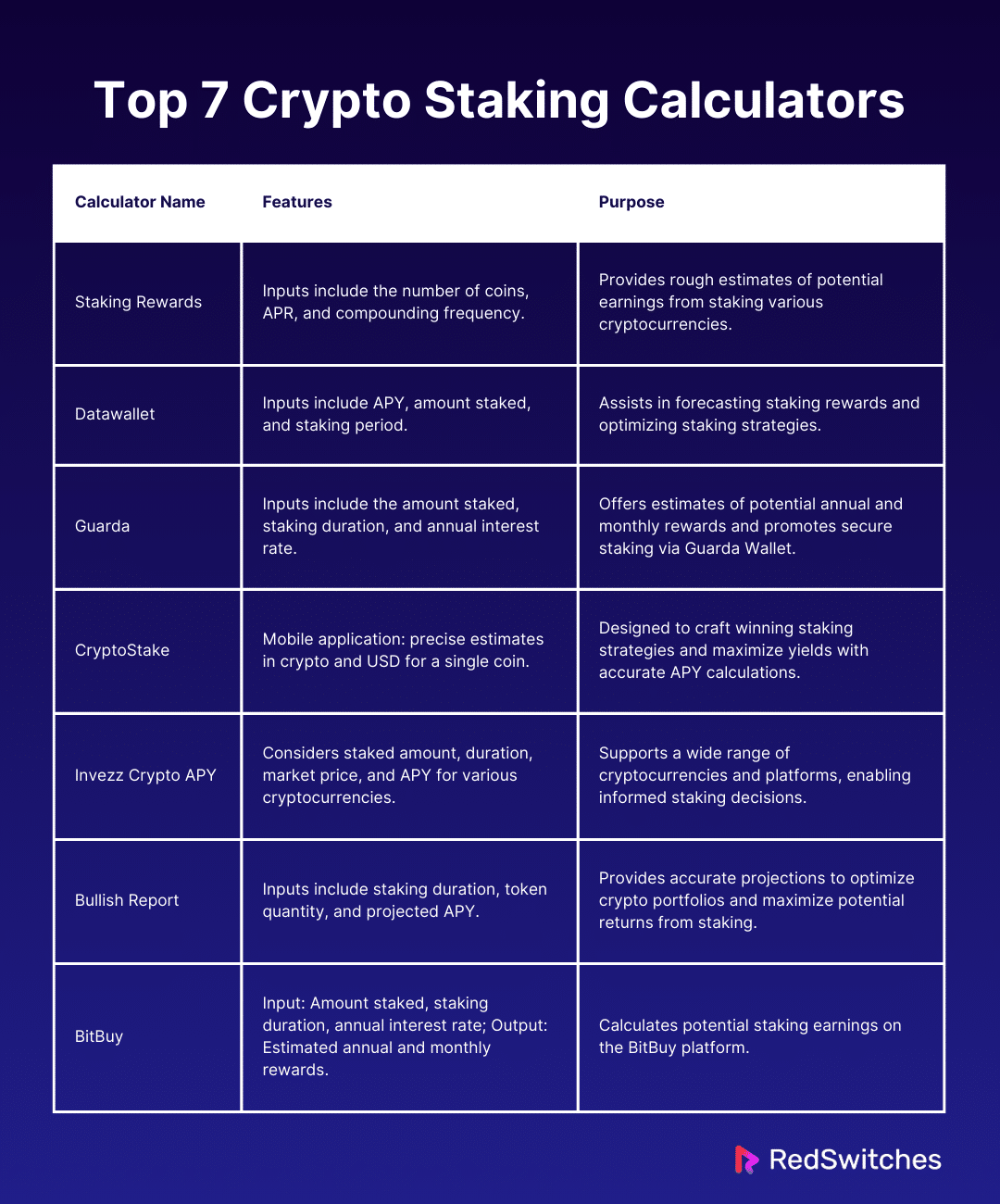

Top 7 Crypto Staking Calculators

Picking the best tools can boost your crypto staking game. Crypto staking calculators are key for anyone wanting to make the most of their crypto. They help you determine your possible earnings from staking different digital currencies in various situations.

We’re going to look at the top 7 staking calculators out there. We chose them because they’re accurate, user-friendly, and packed with features. These calculators can shed light on your investment choices, whether you’re just starting or have been staking for a while.

Also Read: Cost-benefit Analysis of Crypto Staking Using Dedicated Servers

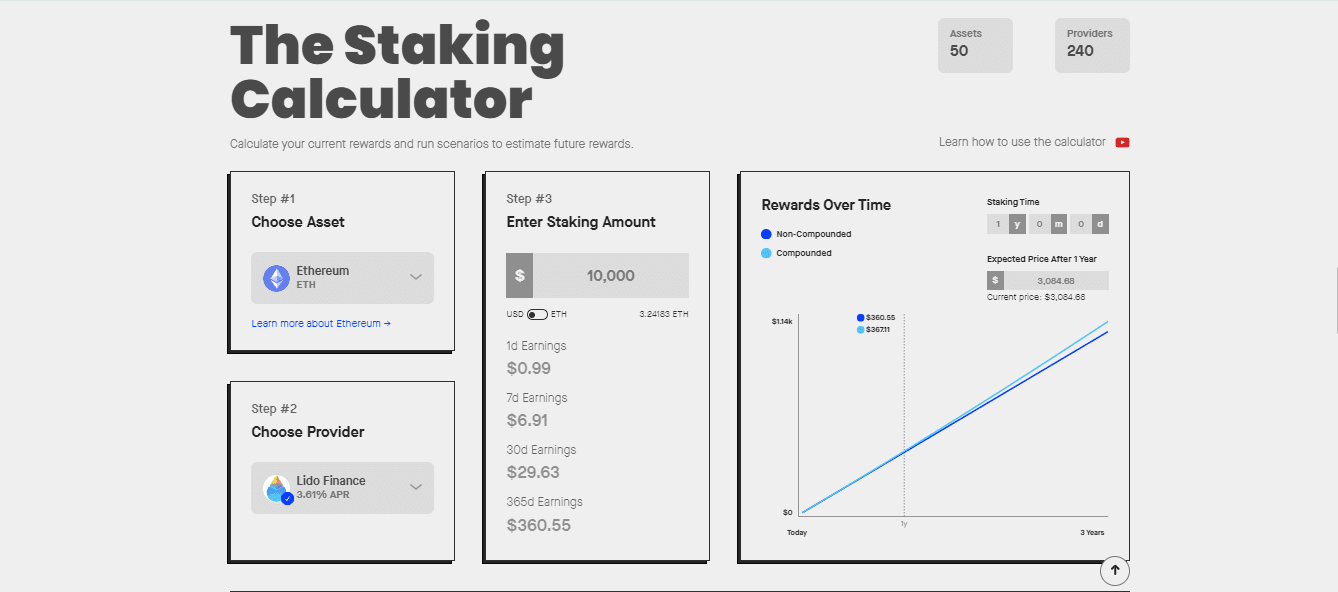

Staking Rewards

Credits: Staking Rewards

The Staking Rewards Staking Calculator is a handy tool for estimating their potential earnings from staking various cryptocurrencies. This calculator allows users to input the number of coins they plan to stake, the annual percentage rate (APR) for staking, and the compounding frequency.

With this information, the calculator estimates the daily, weekly, monthly, and yearly staking rewards. Staking rewards vary based on the cryptocurrency, so using such calculators to assess the potential profitability of staking in different projects is essential.

The Staking Rewards Staking Calculator provides rough estimates that help users decide which projects to pursue based on potential passive income generation. It’s a helpful tool for those interested in maximizing their earnings through cryptocurrency staking.

Datawallet

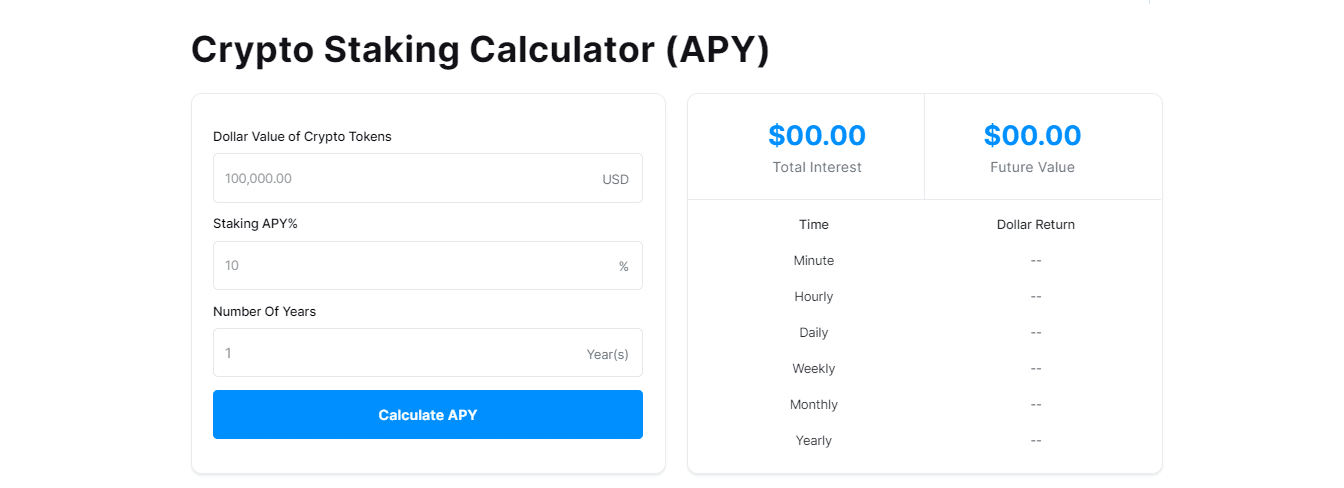

Credits: Datawallet

The Datawallet Staking Calculator is designed to help users estimate their potential earnings from staking cryptocurrencies. To calculate potential returns, users can input parameters like the Annual Percentage Yield (APY), the amount of cryptocurrency staked, and the staking period.

This calculator aims to assist individuals in maximizing their crypto earnings by providing insights into the rewards they can expect from staking activities. It simplifies forecasting staking rewards, allowing users to make informed decisions about their staking strategies based on the projected outcomes.

BitBuy

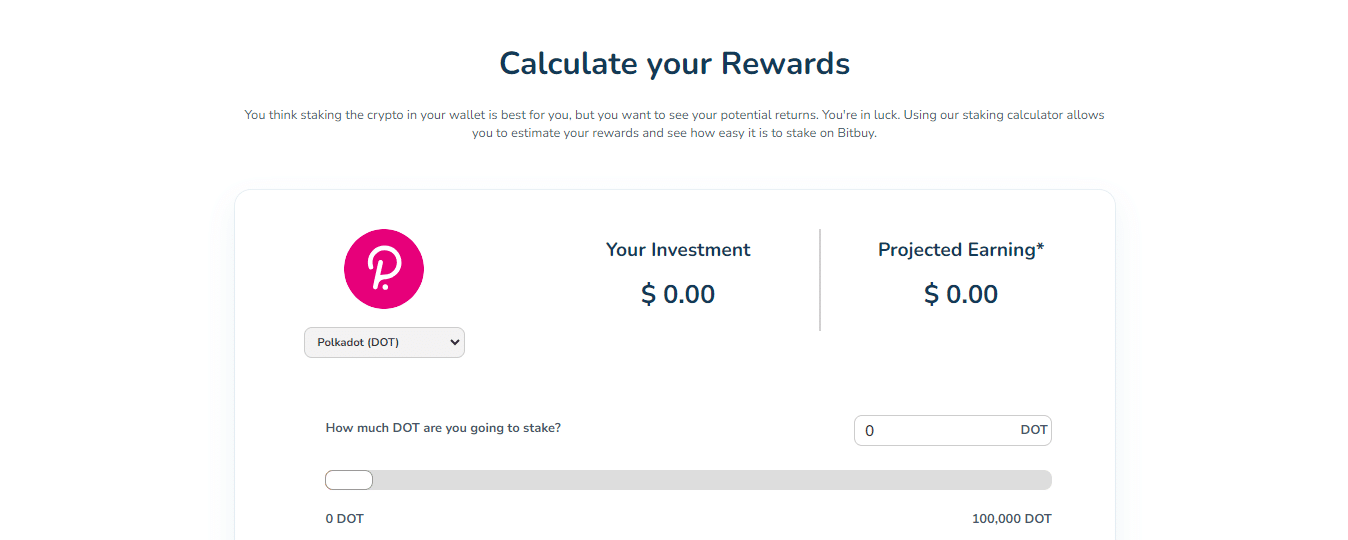

Credits: BitBuy

The BitBuy Crypto Staking Calculator is a practical tool for users on the BitBuy platform. It helps them estimate their potential staking rewards. Users can see their possible annual and monthly rewards by inputting the amount of cryptocurrency staked, the duration of the stake, and the annual interest rate. This calculator simplifies understanding what you might earn from staking different cryptocurrencies like Ethereum, Solana, and Cardano.

The calculator is user-friendly and accessible. It plays a crucial role in helping users make informed decisions about staking. Whether you’re new to cryptocurrency or have been in the market for a while, this tool shows how easy it is to start earning rewards.

The BitBuy staking calculator ensures that users can plan their activities more precisely, making it an essential feature for anyone looking to maximize their earnings from crypto investments on the BitBuy platform.

Guarda

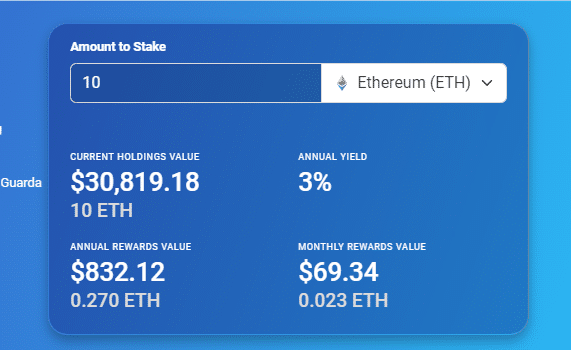

Credits: Guarda

The Guarda Staking Calculator is a valuable tool provided by Guarda Wallet that helps users estimate their staking rewards and potential earnings from various cryptocurrencies.

This calculator allows users to input parameters such as the amount of cryptocurrency staked, staking duration, and annual interest rate to calculate the expected rewards. It simplifies the process of forecasting staking rewards by providing users with an estimate of potential annual and monthly rewards based on their inputs.

The Guarda Staking Calculator also allows users to earn passive income by securely and conveniently staking their cryptocurrencies through the Guarda Wallet platform.

CryptoStake

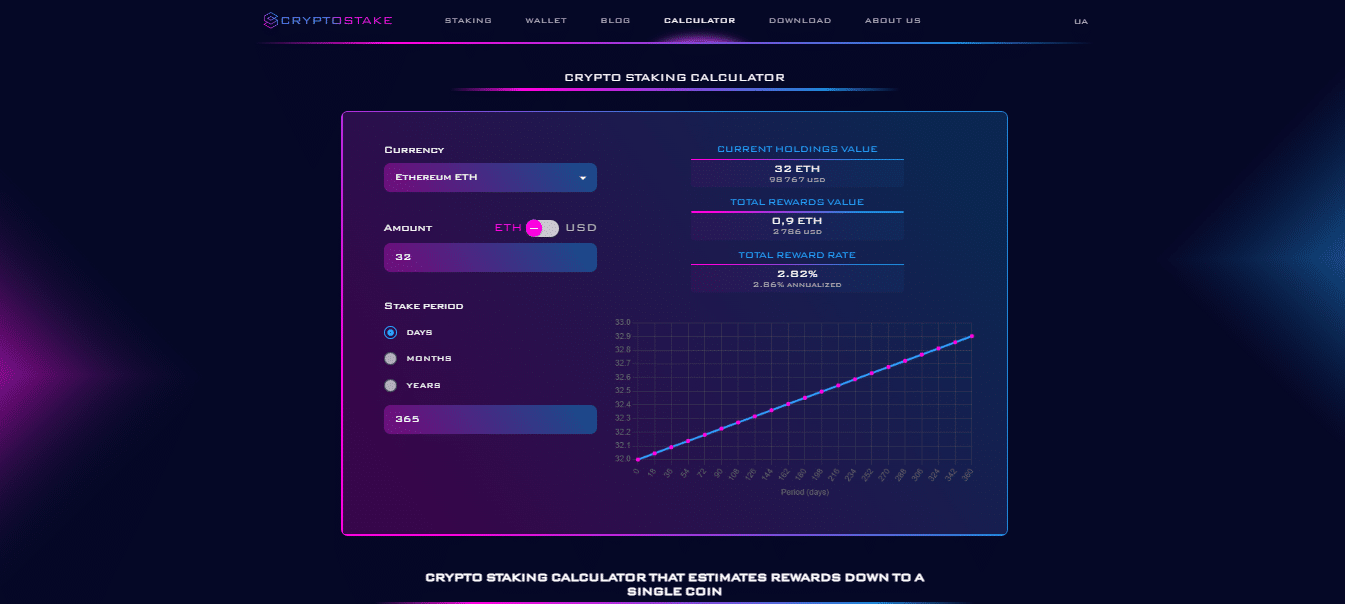

Credits: CryptoStake

The Crypto Staking Calculator at CryptoStake.com is a powerful tool for estimating rewards for a single coin. It is designed to help users craft a winning staking strategy and maximize their yields.

It provides a precise estimate of potential returns in both crypto and US dollars over a certain staking period. The calculator is a user-friendly mobile application featuring a straightforward design with a drop-down menu for selecting one of the three base staking currencies, sections to input the staked amount and staking period, and a concise table displaying the current holdings value and total reward value.

The calculator considers each blockchain’s ever-changing market conditions and unique reward allocation mechanisms, making it the most accurate APY staking calculator available. The CryptoStake staking rewards calculator is essential for anyone looking to manage their crypto investments effectively and maximize their returns.

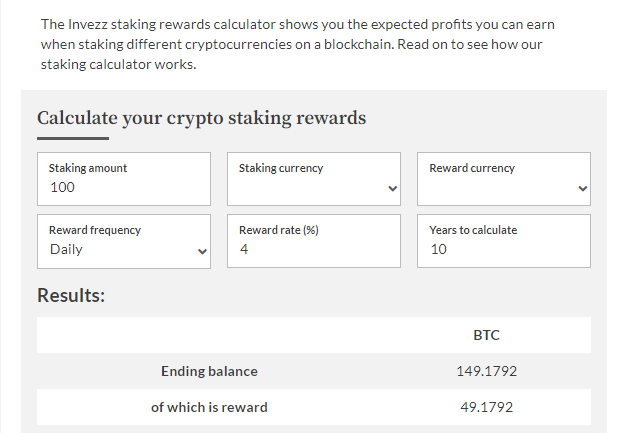

Invezz Crypto APY

Credits: Invezz Crypto APY Staking Calculator

The Invezz Crypto APY Staking Calculator is a powerful tool for estimating potential returns from staking various cryptocurrencies.

This calculator accurately estimates potential earnings by considering the staked amount, staking duration, current market price, and estimated APY. It uses a straightforward formula involving the initial investment, estimated annual percentage yield, and time horizon to calculate the total earnings from crypto staking.

It’s important to note that high APY staking rewards may come with risks, such as inflationary governance tokens and a ‘farm and dump’ dynamic. Understanding the difference between APY and APR is crucial in crypto staking.

The Invezz Crypto APY Staking Calculator is designed to be versatile and user-friendly, supporting a wide range of cryptocurrencies and platforms. This calculator allows investors to make informed decisions about their staking strategies and maximize their potential returns.

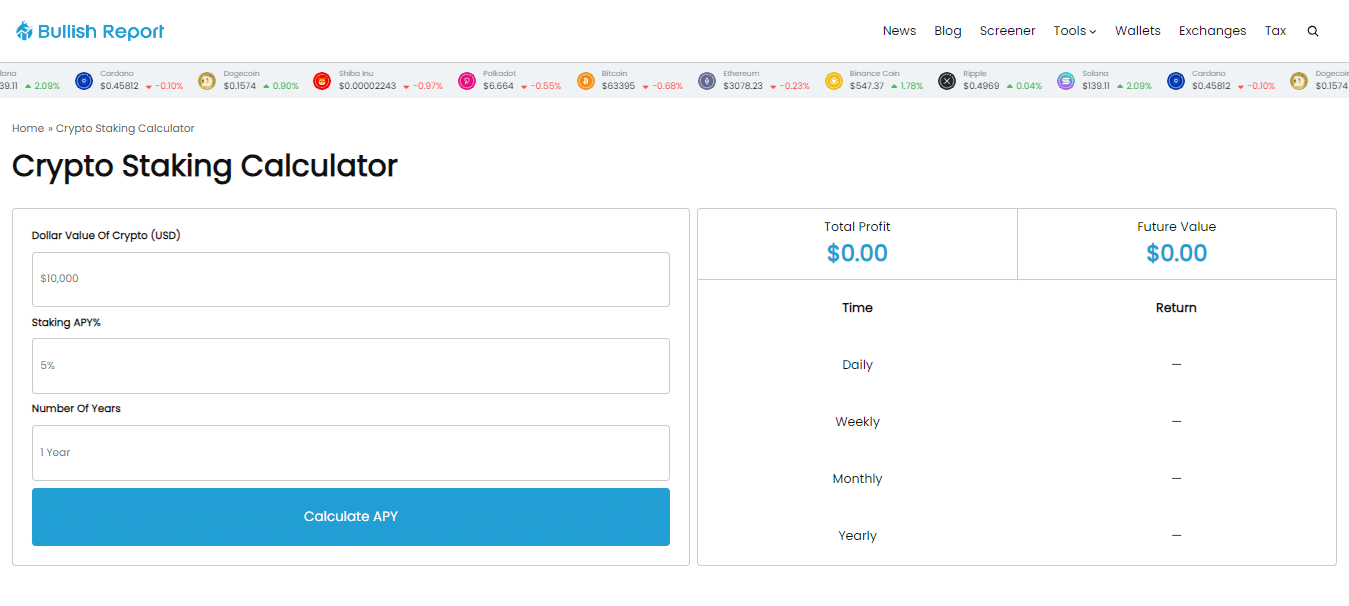

Bullish Report

Credits: Bullish Report

The Bullish Report provides a Crypto Staking Calculator that empowers cryptocurrency investors to estimate potential returns from staking activities.

This calculator is a powerful tool that allows users to input key parameters such as staking duration, token quantity, and projected annual percentage yield (APY) to gain insights into the potential rewards they may receive for participating in the staking process.

By leveraging complex algorithms, this calculator provides accurate projections, enabling investors to make informed decisions about their staking strategies. It serves as a valuable resource for novice and experienced investors looking to optimize their crypto portfolios and maximize the potential of their cryptocurrency holdings.

Here’s a concise summary table of the top 8 crypto staking calculators:

Importance Of Dedicated Servers In Crypto Staking Calculators

Credits: Freepik

Crypto staking is gaining momentum to earn passive income from cryptocurrency holdings. Staking calculators are vital tools, helping you estimate potential rewards based on various factors. Dedicated servers play a critical role in guaranteeing the accuracy and speed of these calculators.

Why Dedicated Servers Matter

- Speed and Accuracy: Staking calculators must process complex calculations in real-time. Servers offer the power and speed needed for accurate results without delays.

- Security: Dealing with valuable crypto assets demands top-tier security. Dedicated servers provide stronger security measures than shared hosting environments, protecting your data and minimizing vulnerabilities.

- Reliability: Staking rewards often depend on consistent network participation. Dedicated servers ensure your calculator is always online and working as it should, maximizing your potential earnings.

- Customizability: Dedicated servers offer more flexibility in configuring software and settings for specific blockchain networks and staking calculators. This can help optimize the calculator’s performance.

Key Considerations for Dedicated Servers

When seeking a dedicated server for your crypto staking calculator, consider these factors:

- Processor Power: Opt for a server with a powerful processor to handle the complex calculations.

- RAM: Sufficient RAM is necessary for smooth operation, particularly when dealing with multiple blockchains.

- Storage: Choose a server with ample storage space to accommodate blockchain data and the calculator software.

- Network Bandwidth: A high-bandwidth network connection ensures quick data transfer for real-time updates.

Dedicated servers are the backbone of reliable, accurate, and efficient crypto-staking calculators. As you dive into crypto staking, consider investing in a server for your calculator to maximize your staking opportunities.

How to Choose the Right Staking Calculator

Selecting the appropriate staking calculator is crucial for maximizing your cryptocurrency investments. This decision should be based on your specific staking needs and the features offered by various calculators.

Determining Your Staking Needs

The first step in choosing a staking calculator is clearly understanding your needs. Consider what you want from your investments. Are you looking for short-term gains or long-term growth? How much risk are you willing to take? Your goals will dictate the type of calculator you need. For example, if you plan to stake multiple types of cryptocurrencies, you’ll need a versatile calculator that supports different coins.

Assessing Calculator Features Against Needs

Once you have defined your staking needs, compare them against the features of available staking calculators. Look for a calculator that matches your investment strategy. Key features to consider include:

- Accuracy: Ensures the calculator provides reliable data based on current staking protocols.

- Ease of use: A user-friendly interface that allows you to input data effortlessly and understand results quickly.

- Compatibility: Supports the cryptocurrencies you are interested in staking.

- Additional features: Offers tools like historical data analysis and forecast options that can enhance your investment planning.

Choosing a calculator that meets your basic needs and provides additional functionalities that can help you make more informed decisions is important. The right staking calculator can be a powerful tool in optimizing your crypto investments, allowing you to predict returns better and plan your financial strategy.

Selecting the right staking calculator involves understanding your specific investment needs and carefully evaluating the features of different calculators to find one that aligns with your goals. Doing so can ensure you are equipped with the best tool to help manage and grow your staking investments.

Also Read Automated Staking Scripts and Tools for Server-based Nodes

Challenges and Limitations of Using Staking Calculators

While staking calculators are valuable tools for cryptocurrency investors, they have inherent challenges and limitations. Understanding these can help users employ these tools more effectively and mitigate potential risks.

Dependence on Accurate and Current Data

One major challenge is the calculator’s dependence on accurate and current data. Staking calculators rely on user-provided inputs about the amount to be staked, the staking period, and the expected annual yield. The calculator’s output will also be inaccurate if this data is outdated or incorrect. Furthermore, these tools often do not automatically update to reflect changes in blockchain protocols or market conditions, which can significantly impact the actual staking returns.

Limitations in Forecasting Long-term Returns

Staking calculators are also limited in their ability to forecast long-term returns accurately. They typically provide projections based on static conditions and fixed input parameters. However, the cryptocurrency market is highly volatile, and conditions can change rapidly. Factors such as fluctuating market prices, changes in network rewards, or adjustments to staking requirements can alter expected returns, making long-term predictions less reliable.

Potential for User Error in Data Input

One big hiccup with staking calculators is when users punch in the wrong numbers. If you mess up the amount you’re staking, how long you’re staking it, or the rewards you expect, the results can be way off. This is tough for newbies who might not understand the ins and outs of staking math. It’s super important to double-check what you enter and determine how the calculator figures things out. This way, you can trust the info it gives you.

Even with these hiccups, staking calculators are still super important. They give you insights that can help you improve your staking plan and boost your chances of making more money. But remember, these calculators aren’t perfect. You’ve got to use them wisely. Ensure your information is right and take their predictions with a grain of salt, especially for the long haul. This careful approach can help you deal with the tricky parts of crypto investing.

Conclusion

Crypto staking calculators are crucial tools for anyone involved in cryptocurrency investments. They help estimate potential earnings by considering the amount of crypto staked, the duration, and the expected yield. These calculators are essential for planning investments and understanding the possible returns from staking different cryptocurrencies. However, they rely heavily on accurate input and cannot predict long-term market changes, so they should be used cautiously.

Explore the benefits of staking with confidence and boost your earnings potential. Check out RedSwitches dedicated servers today to secure and enhance your crypto-staking activities. Maximize your returns with reliable and powerful computing solutions!

FAQs

Q. Is crypto staking still profitable?

Yes, crypto staking can still be profitable, especially with high-yield tokens, though returns depend on market conditions and specific blockchain protocols.

Q. How much can I make staking crypto?

Earnings from staking crypto vary widely based on the staked amount, the crypto’s annual yield, and the staking duration.

Q. How much can you earn by staking 32 ETH?

The earnings from staking 32 ETH depend on the current staking yield, which, as of early 2024, is around 4-5% annually, translating to approximately 1.28 to 1.6 ETH per year, minus any applicable fees.

Q. Which crypto has the highest staking rewards?

Cryptocurrencies with high staking rewards often include newer or less established coins; however, popular choices with significant rewards include Solana, Polkadot, and Algorand.

Q. What is the best passive income project in crypto?

The best passive income projects vary based on risk tolerance and market conditions. Still, DeFi platforms offering yield farming and liquidity mining, such as Yearn. Finance and Uniswap are highly regarded.

Q. What is Ethereum staking and how do I participate?

Ethereum staking is the process of locking a certain amount of cryptocurrency, specifically Ethereum (ETH), in a wallet to participate in the network’s operations and earn staking rewards. To become an Ethereum validator, you need at least 32 ETH to activate your stake in the network. This process is part of Ethereum’s consensus mechanism known as Proof of Stake (PoS), introduced in Ethereum 2.0.

Q. What are the benefits of solo staking vs. pooled staking on the Ethereum network?

Solo staking involves running your validator node with a full 32 ETH stake, giving you full control and potentially higher rewards. However, it requires technical knowledge and constant crypto management. Pooled staking, on the other hand, allows you to stake a smaller amount of ETH by joining with others. Staking services and staking platforms manage the technical aspects, making it more accessible but typically offering lower rewards due to fees.

Q. How are staking rewards calculated on the Ethereum network?

Rewards are calculated based on the current staking rewards rate, the amount of staked ETH, and the overall participation in the network. The block reward, or the rewards paid to validators for proposing and validating new blocks, is distributed among stakers. A calculator is a tool that considers factors like the simple interest rate and network conditions to estimate potential earnings.

Q. What is liquid staking, and how does it differ from traditional staking?

Liquid staking is a form of crypto staking where participants earn staking rewards without locking their cryptocurrency in a way that prevents them from trading it. Unlike traditional staking, which involves locking Ethereum in a wallet, liquid staking allows participants to receive a secondary token representing their staked ETH, which can be traded or used elsewhere. This helps maximize your crypto earnings by keeping the asset liquid.

Q. What should I consider when selecting a staking pool or staking service?

When planning on staking, especially if using a staking service or selecting a staking pool, consider the reputation, fees, and performance history of staking providers. Additionally, understand the risks, such as the potential to lose their entire stake under certain conditions and whether the rewards are calculated using a fixed or variable rate. Staking platforms often provide calculator tools to help you estimate returns and decide the best crypto strategies to maximize your earnings.