Key Takeaways

- Crypto staking involves securing a blockchain network and earning incentives.

- Servers play an important part in crypto staking by validating transactions and maintaining the network.

- A crypto staking calculator helps calculate the potential incentives from staking.

- Benefits of using a calculator include predicting earnings and comparing different staking options.

- Popular staking calculators include Staking Rewards, DataWallet’s Crypto Staking Calculator, and Guarda Wallet.

- Adapting calculators for server costs boosts accuracy in profit projections.

- The right server selection is important for efficient and profitable staking.

- RedSwitches offers servers for crypto staking to help maximize your crypto earnings.

Did you know that by the end of 2021, around 300 million people globally owned some cryptocurrency? In 2024, cryptocurrency has become a common component of almost every other individual’s investment portfolio.

Today, with the rise of PoS blockchains, crypto staking has gained immense popularity. Its appeal lies in its ability to be a slightly less risky alternative to crypto trading.

When considering crypto staking, it can be easy to ignore the costs, especially server expenses. Usually, when considering staking a cryptocurrency, an individual may turn to a crypto staking calculator to calculate the potential rewards.

However, it is important to factor in other costs, like server expenses, to ensure these rewards are worthwhile after all these costs are deducted.

This blog will explain the necessary adaptations of a crypto staking calculator to include server-related expenses. These adaptations can help investors make well-informed decisions.

Table of Contents

- Key Takeaways

- Understanding Cryptocurrency Staking

- The Role of Servers in Crypto Staking

- What is a Crypto Staking Calculator?

- Top 3: Best Crypto Staking Rewards Calculator

- Adapting the Crypto Staking Calculator for Server Costs

- Benefits of an Adapted Crypto Staking Calculator for Server Costs

- Choosing the Right Server for Crypto Staking

- Conclusion

- FAQs

Understanding Cryptocurrency Staking

Credits: FreePik

Before we discuss the necessary adaptations of a crypto staking calculator to include server-related expenses, we must discuss crypto staking.

Crypto staking involves locking a certain portion of your cryptocurrency to participate in the processes of a blockchain network that employs a Proof of Stake (PoS) protocol. In return for contributing your assets to supplement the network’s operations and security, you earn incentives, usually tokens or coins.

Here is how crypto staking works:

- Validation of Transactions: PoS networks depend on stakers to validate transactions. Crypto owners stake their digital currencies by storing them in a wallet, aiding the network in establishing consensus and validating new transactions.

- Selection Process: Validators are picked based on the quantity of coins invested and the duration of their stake. The more coins you stake and for how long, the more likely you are to be picked as a validator and earn incentives.

- Rewards: As a validator, you will receive incentives based on transaction fees from the blocks you validate, including other blockchain-defined standards.

Are you wondering how long crypto taking takes? Read our detailed blog, ‘Crypto Rewards: How Long Does Crypto Staking Take?’.

The Role of Servers in Crypto Staking

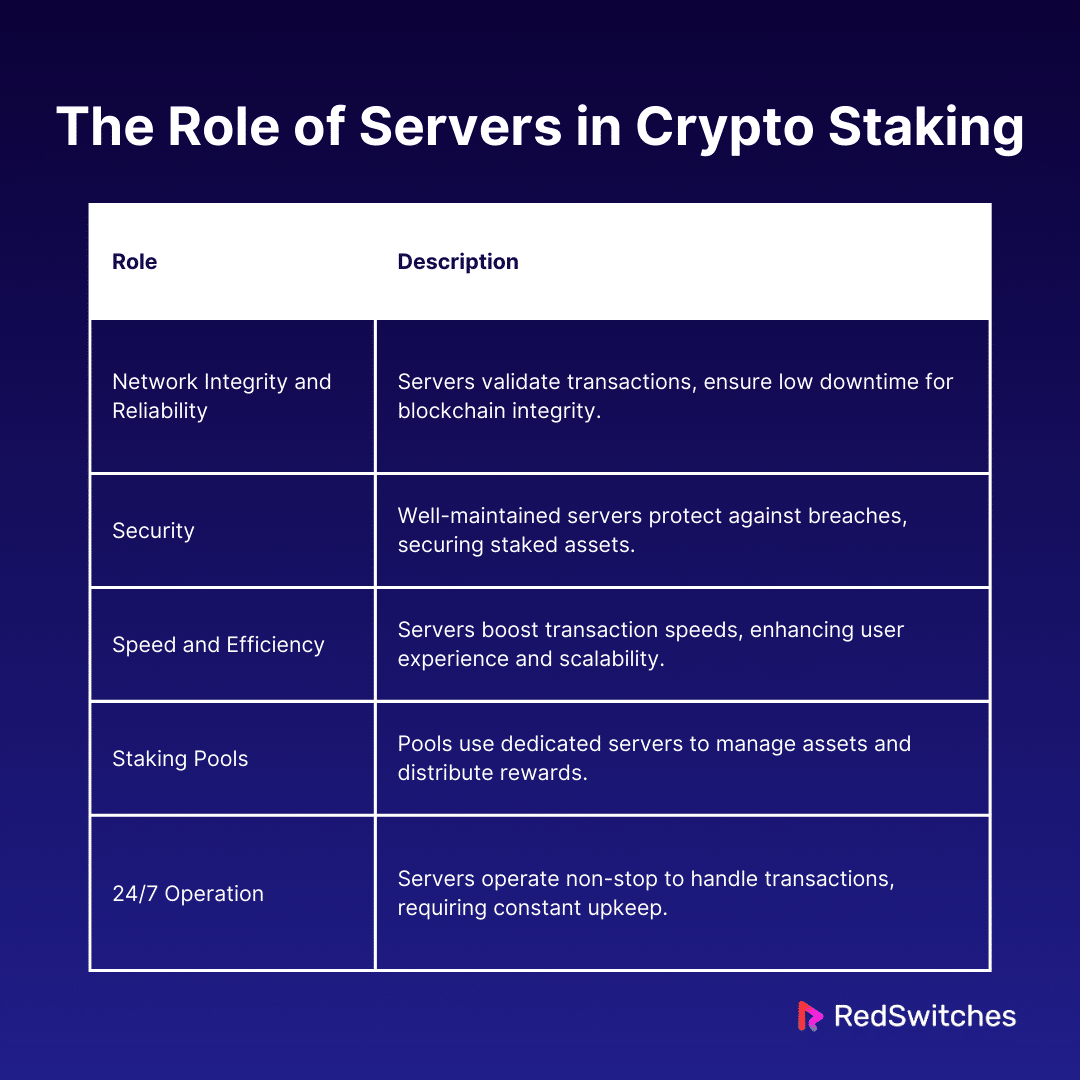

Although the concept of staking is simple – lock up digital assets to sustain network operations and get incentives- the infrastructure supporting it, mainly servers is important. Here, we discuss the important role of servers in crypto staking:

1. Network Integrity and Reliability

Servers are essential to the function of PoS blockchain networks. They run the network nodes that validate transactions and create further blocks. High-performance servers enable these processes to occur without interruption. Reliable servers lower the chance of downtime, which is crucial for ensuring the integrity and continued function of the blockchain.

2. Security

A server is among the key factors determining a blockchain network’s security. Servers that are well-maintained and guarded against cyber threats are much less susceptible to breaches that could compromise the whole network. Since stakers contribute to network security through their staked assets, securing servers is important to safeguard these investments from all malicious entities.

3. Speed and Efficiency

Transaction validation speed is another important factor influenced by a server’s performance. Efficient servers can process transactions accurately, improving the user experience by lowering wait durations for confirmations. This speed is essential in networks with considerable volumes of transactions. It ensures the blockchain stays efficient and scalable.

4. Staking Pools

Many individual stakeholders do not run their own dedicated servers because of the expense and technical knowledge necessary. Instead, they use staking pools, which pool their assets to achieve the minimum staking criteria and share in transaction processing.

These pools are maintained on dedicated servers that manage the total staking power of many people, distributing payouts equally among them. These dedicated servers’ performance and dependability are linked to the staking pool’s success and profitability.

5. 24/7 Operation

Blockchain networks are functional 24/7, requiring consistent and ongoing server operation. Servers must always be operational to ensure the network is always online and can handle transactions. This demands quality hardware and constant monitoring and maintenance to manage any problems.

Also Read: Stake Crypto And Earn! Dive Into Crypto Staking Basics.

What is a Crypto Staking Calculator?

A crypto staking calculator helps you estimate how much staking rewards you will earn if you stake a certain cryptocurrency for a certain time. Here are a few purposes a crypto staking calculator serves:

1. Calculate Earnings

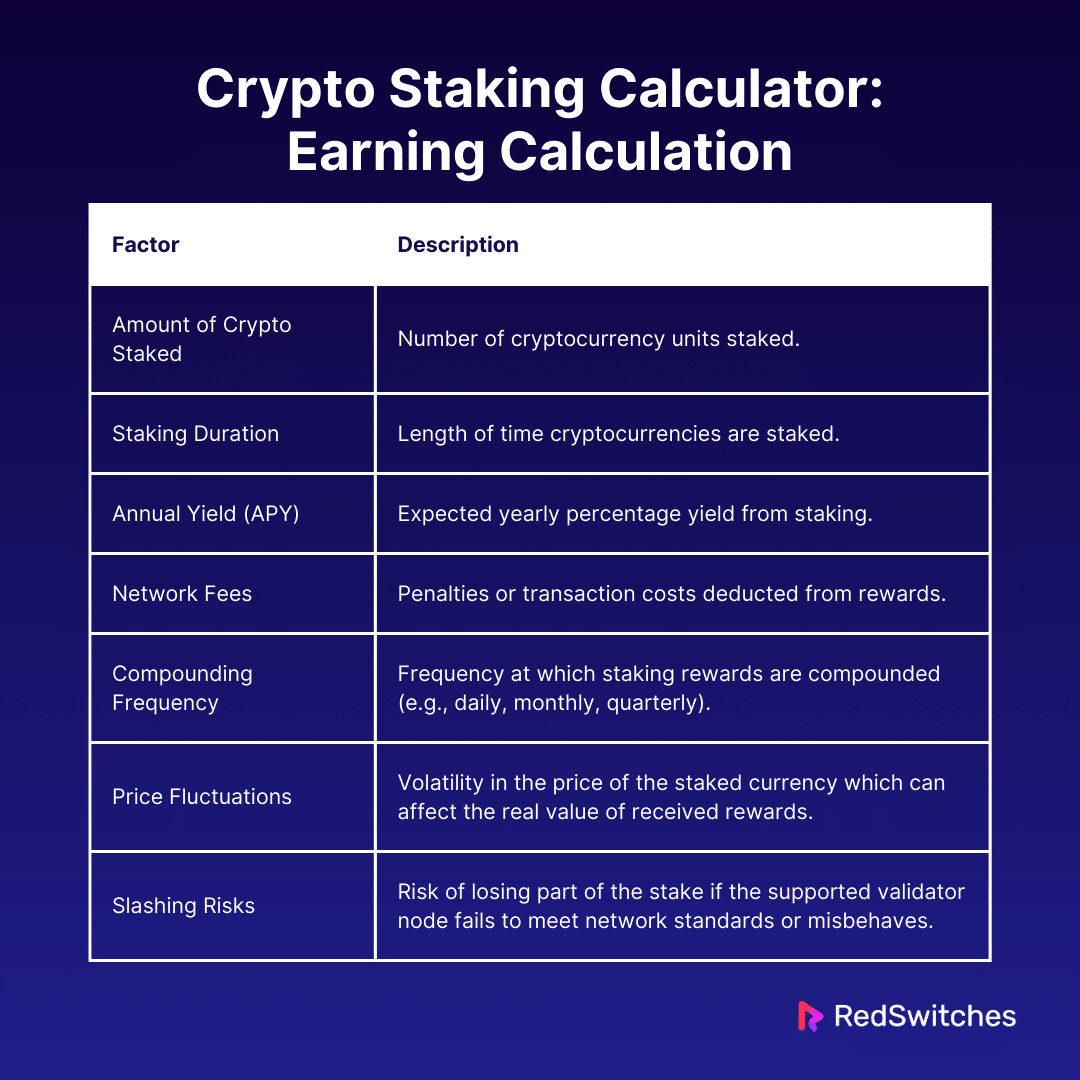

As discussed above, the key function of a crypto staking calculator is to estimate the amount you can earn by staking their cryptocurrencies. This tool considers numerous variables to offer a personalized forecast. These include:

- Amount of Crypto Staked: This is the number of cryptocurrency units you plan on taking. Remember, the higher your staking amount, the larger the potential rewards.

- Staking Duration: The duration you plan to keep your cryptocurrencies staked. Longer staking periods can offer higher incentives thanks to the compounding effects of reinvestment of the staking incentives.

- Annual Yield (APY): The expected yearly percentage yield or interest rate for staking investments over a year. This rate varies significantly among cryptocurrencies and staking systems.

- Network Fees: These include penalties or transaction costs that may be cut from the staking rewards. High network fees can considerably impact the net gain from staking.

- Compounding Frequency: Some calculators enable you to define how frequently your staking rewards are compounded (monthly, daily, quarterly). Compounding more often can greatly increase your returns with time.

- Price Fluctuations: Although not all calculators can directly account for this, the price volatility of the staked digital currency can affect the actual value of the incentives received. A price increase can boost returns, whereas a drop can lower them.

- Slashing Risks: In some networks, stakers may face slashing penalties if the validator node they support doesn’t meet network requirements or acts maliciously. This risk factor can also impact the anticipated returns and is critical for estimating the risk-adjusted return on staking.

2. Informed Decision-Making

By predicting potential returns, the calculator helps investors make more informed decisions about whether to stake their crypto, how much to stake, and for how long. Based on the expected profitability, it can influence the choice of staking pool or network.

How Does It Work?

So, how does a crypto staking calculator work? Although different crypto-staking calculators may have varying functions, they usually work similarly. Here is a breakdown of a typical staking calculator working mechanism:

Input Requirements

To use a crypto staking calculator, you must navigate to the calculator page and input:

- Amount of Crypto: The total cryptocurrency units you want to stake.

- Staking Duration: The period you wish to keep your crypto staked.

- Annual Yield: The expected annual percentage yield (APY) from staking (can vary based on the staking pool or network).

- Network Fees: Any fees that may be cut from the staking incentives.

Calculation Process

Once you fulfill the required inputs, the crypto staking calculator uses a formula to estimate the returns. This formula considers the compound interest effect if the rewards are reinvested. It offers a clearer estimate of the potential earnings. The crypto staking formula is:

Final Amount = Initial Stake × (1 + APY) Number of Years − Fees

Where:

- Final Amount is the crypto amount you’ll be left with at the end of the staking period, including your initial stake and earned rewards.

- Initial Stake is the cryptocurrency you put into the staking pool.

- APY (Annual Percentage Yield) reflects the rate of return (ROI) you make on the staking investment ( expressed in the form of a decimal).

- Number of Years is the chosen duration for the stake (expressed in years). If staking for a period lower than a year, this will become a fraction (e.g., for 6 months, it would be 0.5 years).

- Fees include any maintenance or transaction costs charged by the staking platform.

Adjustable Variables

Many staking calculators enable users to adjust variables, including staking incentives or APYs, to determine how changes in these factors could impact their returns. This feature is handy for evaluating risk and potential reward scenarios in various market conditions.

Benefits of Using a Crypto Staking Calculator

Here are a few benefits of staking calculators stakers can enjoy:

1. Simplicity + Accessibility

A crypto staking calculator simplifies complex calculations, allowing even inexperienced investors to grasp and assess the prospective rewards of staking their crypto asset.

2. Strategy Planning

Investors can use a crypto staking calculator tool to design their strategy efficiently. They can experiment with different settings to determine the optimal action plan for maximizing returns.

3. Risk Assessment

Understanding possible returns and comparing them against risks, like price volatility and lock-up periods, enables stakeholders to manage their investments more effectively. Knowing the degree of risks offers peace of mind. It also empowers stakeholders to create plans to manage these risks efficiently.

Also Read: Guide To Types Of Crypto Staking: Risks, And Platforms 2024.

Top 3: Best Crypto Staking Rewards Calculator

Several crypto staking calculators can help you conveniently calculate the potential rewards on your stake. Some of the best crypto staking calculators available today include:

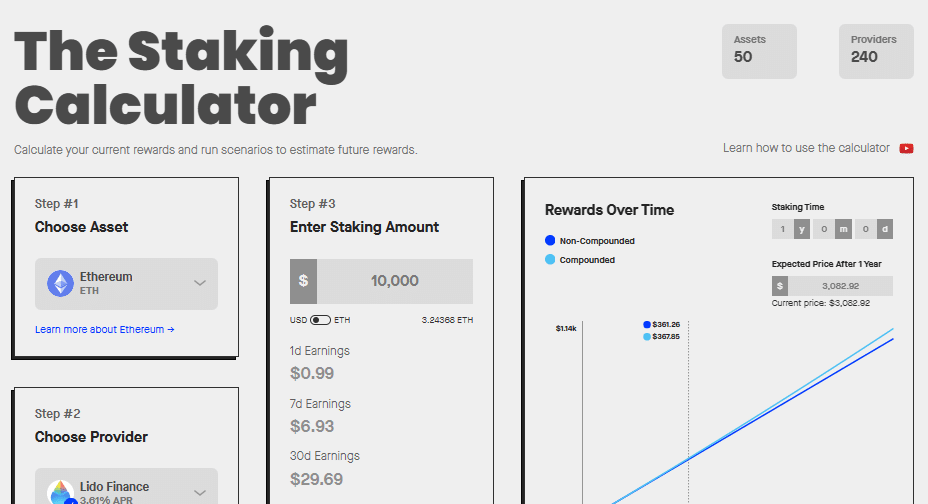

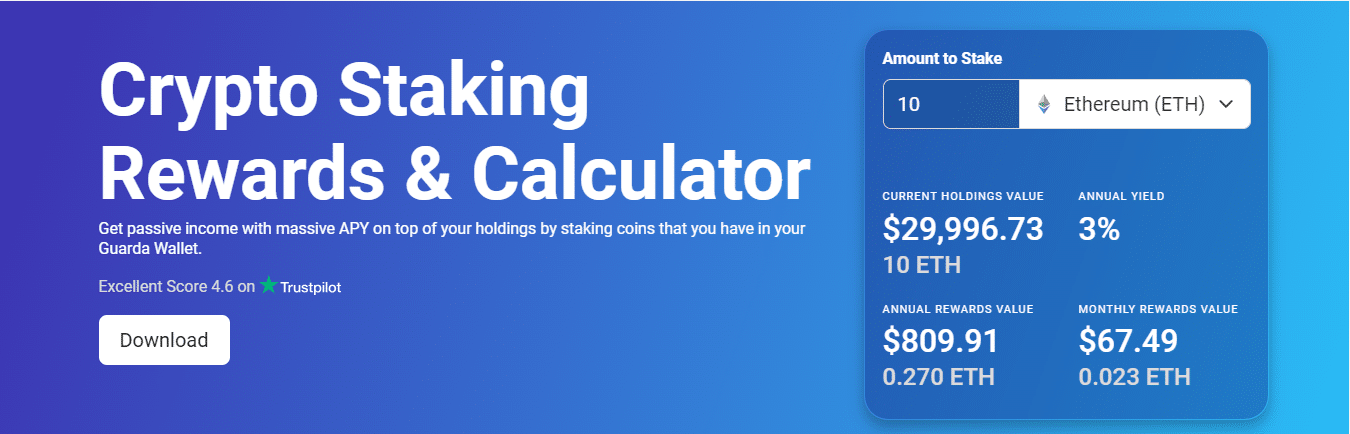

Staking Rewards

Credits: Staking Rewards

Staking Rewards is the most comprehensive resource for cryptocurrency staking information. It enables users to estimate potential staking rewards according to the latest reward rate and offers ample data on various cryptocurrencies. Key features include:

- Custom Calculations: Users can input different variables, like the amount of cryptocurrency to stake, the time of the stake, and the anticipated APY.

- Comprehensive Database: It offers the latest information on digital currencies and their staking options.

- Risk and Pool Analysis: The platform provides insights into the risk factors of various staking pools. Depending on risk appetite and reward expectations, it empowers users to pick the best staking pool.

- Educational Resources: It also acts as an educational hub, offering guides and articles on the specifics of staking and how to boost returns.

Guarda Wallet

Credits: Guarda Wallet

Guarda Wallet offers a safe and integrated environment for managing digital currency. Its built-in staking calculator improves the overall utility of the wallet. Key features include:

- Smooth Integration: The staking calculator is integrated within the wallet, streamlining the process from storage to staking.

- Direct Management: Users can easily manage their assets and estimate staking returns without switching between various platforms.

- Security First: With advanced security measures, Guarda ensures that all staking activities and calculations are safe. This offers users peace of mind.

- User-Friendly Interface: The wallet’s design and features are customized to accommodate both advanced users and newcomers, making it simple to navigate and use.

Also Read: What Is the Minimum Lockup Period for Crypto Staking?

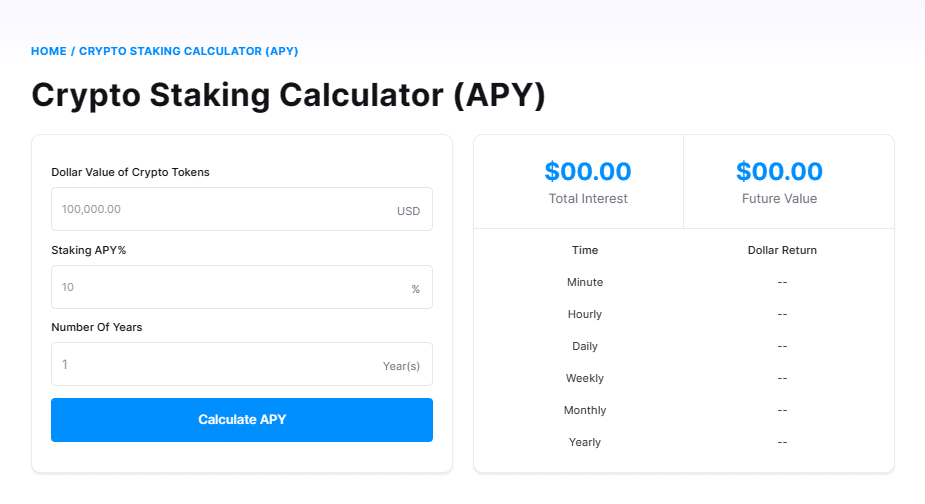

DataWallet’s Crypto Staking Calculator

Credits: DataWallet

DataWallet offers an impressive crypto staking calculator that stands out for its integration with data-driven insights and user-centric features. Here are some of the key features:

- Data-Driven Calculations: DataWallet uses data analytics to give users accurate predictions about potential staking returns. Based on market trends, staking holders can access detailed projections.

- User-Friendly Interface: The calculator’s design focuses on usability. It ensures that both newcomers and experienced crypto enthusiasts can easily operate the tool.

- Customization Options: Users can tailor calculations to fit their needs by adjusting the staking amount, duration, and expected annual percentage yield (APY). This flexibility allows stakers to explore various scenarios and better plan their staking strategies.

- Integrated Educational Resources: DataWallet includes educational resources linked to the calculator. These resources help users understand the nuances of staking and the variables that impact their earnings.

- Security and Privacy: DataWallet ensures that state-of-the-art security measures protect all data fed to the staking calculator. This helps build trust and ensures a secure environment for users to manage their investments.

Also Read: Infrastructure Requirements For Crypto Staking In 2024.

Adapting the Crypto Staking Calculator for Server Costs

Before we discuss how to adapt the crypto-taking calculator for server costs, let’s go over why it is important:

Realistic Profit Calculations

Including server-related expenses in the calculation ensures that all operational expenses are accounted for. This results in a more accurate reflection of the actual net earnings from staking. It provides a proper estimate of the costs involved.

Adapting server costs into a crypto staking calculator also helps avoid unrealistic expectations.

Staking calculators lacking server costs might often prompt users to overestimate returns. By incorporating these costs, stakers get a realistic earnings estimate. It helps prevent surprises due to unforeseen expenses.

Better Financial Planning

Understanding the full financial impact of returns and the associated costs supplements informed decision-making. This is especially important when server costs fluctuate based on network demand and other external factors.

Stakers may also better budget and estimate their financial outlays and returns by understanding all costs. This helps to maintain a healthy balance between investment input and profit output, which is critical for long-term stake sustainability.

Improved Strategy Development

By knowing the true cost of staking, including the often-high server expenses, investors can strategically determine how much capital to assign to different staking pools or digital currencies, optimizing their potential returns.

Besides that, including server costs helps stakers better grasp the risk-reward ratio. Knowing the exact expense required for staking makes assessing whether the risk level is acceptable compared to the potential returns easier.

Increased Transparency

Transparency is important when it comes to investment decisions. A staking calculator with server costs offers clear visibility into where funds are going. It offers peace of mind by fostering trust in the staking process and helps prevent conflicts or misunderstandings around expenses and returns.

Adapting the Calculator

Here is how you can adapt the crypto staking calculator for server costs:

- Identify Server Costs: Write down all relevant server-related expenses. Consider everything from electricity and cooling to hardware and maintenance. If using a data center, this might also include rental expenses.

- Adjust the Formula: You must adjust the above formula to subtract the total server expenses from the gross staking rewards to get the net profit.

Also Read: The Connection: Dedicated Servers In Crypto Staking.

Also Read: Cost-benefit Analysis of Crypto Staking Using Dedicated Servers

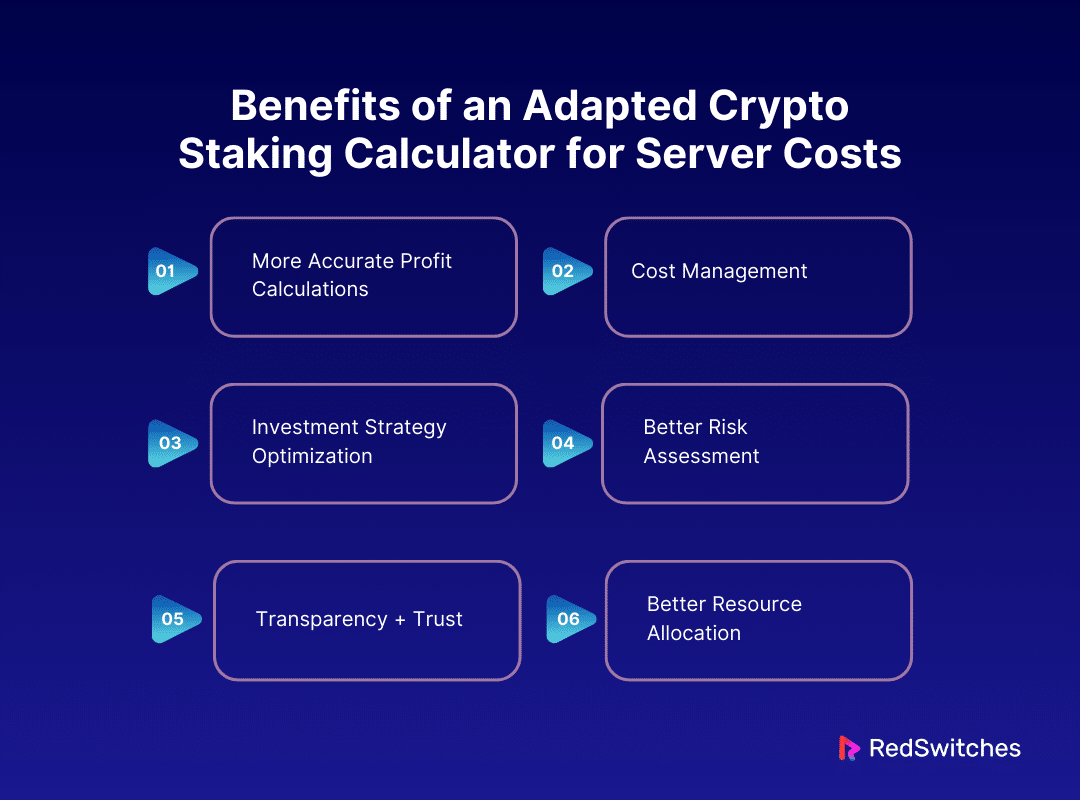

Benefits of an Adapted Crypto Staking Calculator for Server Costs

An adapted crypto staking calculator that includes server costs offers many advantages, making it an excellent tool for anyone involved in staking digital currencies. Here are the top advantages of using a crypto staking calculator:

More Accurate Profit Calculations

Users can obtain a more accurate understanding of their net returns by adding server costs to the staking calculator. This allows for better financial planning and decision-making. After accounting for all costs, staking calculators allow users to fully grasp their investments’ profitability.

Cost Management

Understanding the complete financial impact of server costs on staking returns empowers users to manage their expenses better. This is especially helpful for those who run their own nodes or use private staking services. It allows them to tweak their setups to balance performance and cost.

Investment Strategy Optimization

Understanding the costs and returns enables stakers to make well-informed decisions about how much and where to stake. This strategic insight is important for boosting returns and managing risks, especially in a highly volatile market like cryptocurrency.

Better Risk Assessment

Including server expenses in the calculation provides a more detailed risk assessment. Stakers can determine whether the potential rewards justify the costs and risks involved, including the ongoing costs of maintaining or renting server space.

Transparency + Trust

For staking pool users, using a crypto staking calculator that accounts for server costs brings added transparency to the staking process. It fosters trust in the staking provider by clearly showing how much of the staking returns are consumed by overheads, enhancing the overall transparency of the service.

Better Resource Allocation

Accurately accounting for server costs allows stewards to allocate their computing and financial resources better. This ensures that the returns justify investments in server infrastructure and results in a more efficient capital allocation.

Also Read: Ultimate Guide To Node Staking On Dedicated Servers.

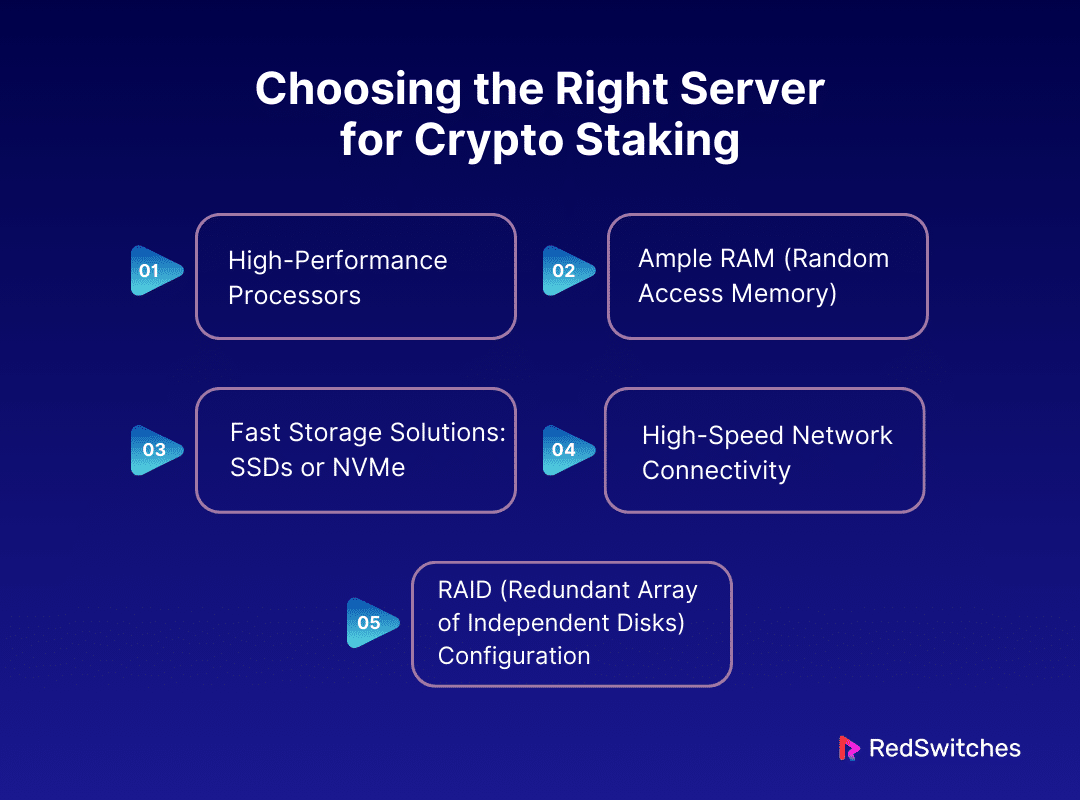

Choosing the Right Server for Crypto Staking

Choosing the right server for crypto staking is a critical decision that can significantly influence the efficiency and profitability of your staking operations. Given the demands of blockchain technology and the need for continuous, reliable service, investing in a high-configuration server is essential. Here’s a detailed overview of the key characteristics to consider when selecting a server for crypto staking.

High-Performance Processors

The processor does it all. It executes transactions. It runs the blockchain software efficiently. It does so much more. When picking a server for crypto staking, try to choose one with high-performance capabilities. Some expert-recommended examples include:

- AMD EPYC 7302P: €229.00

- Intel Gold 5118: €449.00

- AMD EPYC 7402: €639.00

- AMD Ryzen 9 5950X: €249.00

These servers are designed to handle complex calculations and multiple tasks simultaneously without lagging. They ensure your node can participate in the blockchain network without experiencing delays. They improve your chances of earning staking rewards.

Note! You can browse all the above servers and more on the RedSwitches website.

Ample RAM (Random Access Memory)

RAM is essential for properly running any server, but it is essential in crypto staking, where transactions must be handled rapidly and consistently. Ample RAM allows the server to process several transactions and activities at once, avoiding bottlenecks and increasing overall efficiency. It contributes to the speed of transaction validation and communication with other nodes in the network.

Fast Storage Solutions: SSDs or NVMe

Credits: FreePik

The speed at which data is accessed and written is crucial for a setup dedicated to crypto staking. Solid-state drives (SSDs) or even speedier NVMe (Non-Volatile Memory Express) storage options deliver fast data access times and low latency, contributing to the rapid processing of blockchain transactions.

Compared to traditional hard drives, these storage types considerably speed up the time it takes to access and write data. They help maintain the pace with the constant flow of blockchain operations.

High-Speed Network Connectivity

For crypto staking, a server must continually connect to the blockchain network and communicate with other staking nodes. High-speed network connectivity is critical to ensuring effortless and uninterrupted data delivery. This connectivity reduces the chance of missing out on verifying transactions, which may diminish staking rewards.

RAID (Redundant Array of Independent Disks) Configuration

A RAID configuration stores the same data in different places on several hard disks or SSDs. This configuration offers data redundancy and boosts fault tolerance by safeguarding against data loss in case of a disk failure. A RAID setup may protect your investments and keep the server functioning even if one or several disks fail during digital currency staking, ensuring uptime and data integrity.

Also Read: Mastering Crypto Staking Rewards with Dedicated Servers

Conclusion

Anyone planning to stake crypto should understand the necessary adaptations of a crypto staking calculator to include server-related expenses. Choosing the right crypto hosting solution is critical to making sound decisions and managing these costs effectively.

RedSwitches offers several dedicated hosting services that balance performance with cost efficiency. In addition to quality servers, we offer expertise to support your crypto-staking needs. So what are you waiting for? Contact us today for the ideal server solution that aligns with your financial strategies and staking requirements.

FAQs

Q. How much can I make staking crypto?

The amount you can make from staking crypto may vary depending on the amount staked, the chosen cryptocurrency, the network’s staking yield (APY), and the staking duration. Depending on these factors, returns can range from a few percent annually to much higher rates.

Q. What is the most profitable staking crypto?

The profitability of staking cryptos can change due to network changes and market conditions. High-yield options often come with higher risks. When picking a cryptocurrency to stake, you must research and consider both the potential returns and the security and stability of the blockchain network.

Q. What is staking?

Staking refers to actively participating in transaction validation on a blockchain network by locking a particular amount of token as collateral to support the network’s operations and earn rewards in return.

Q. How can I calculate staking rewards?

To calculate your staking rewards, you can use a crypto staking calculator or a staking rewards calculator that considers factors such as the amount of crypto asset staked, the apy or apr offered, and the staking duration.

Q. What is APY in staking?

APY represents the annual percentage yield and the effective annual rate of return earned through staking a particular cryptocurrency or crypto asset over a given period.

Q. How do I start staking Ethereum?

To start Ethereum staking (ETH staking), you need to become a validator on the Ethereum 2.0 network by locking up your ETH in a staking pool or using a staking service provided by a staking platform.

Q. What are the potential returns from staking?

The potential returns from staking depend on factors such as the staking validator chosen, the staking period involved, and the reward rate offered by the blockchain network, which can vary based on market conditions.

Q. Is staking a user-friendly process?

Many platforms and services have made staking a more user-friendly process by offering intuitive interfaces, built-in staking calculators, and several other features.

Q. How does staking pool work?

A staking pool is a collective investment vehicle in which multiple users combine their crypto assets to increase their chances of being chosen as validators and receive staking rewards more frequently.

Q. How can I calculate my APY for staking?

You can use a crypto calculator or an APY staking calculator to estimate your APY staking and project your potential earnings from staking your crypto assets.

Q. Is Solana a suitable network for staking?

Solana is known for its high APY and fast transactions, making it an attractive option for staking. Staking on Solana also offers competitive annual yield rates, which can appeal to investors looking to earn incentives via staking.

Q. What is the amount of ETH staking coins required to start staking?

The minimum amount of ETH staking coins required for staking on the Ethereum network is 32 ETH. This is the threshold of becoming a solo validator and earning staking rewards.

Q. How can I engage in solo staking Cardano?

To engage in solo staking Cardano, you need to run your own node. This involves holding a certain minimum amount of Cardano (ADA) in your wallet and setting up a staking server that remains online and operational to support the network.

Q. What are the benefits for Ethereum validators stake in the network?

Ethereum validators stake in the network to help secure it and validate transactions. In return, they receive rewards. These rewards compensate for their efforts and the resources spent, such as server costs.

Q. How are rewards from staking based on the current conditions calculated?

Rewards from staking based on current market conditions are calculated using various factors, such as the total amount staked, network rate, and transaction fees within the network. A crypto staking calculator can provide a personalized estimate based on these dynamic conditions.

Q. What are the expected estimated annual Ethereum staking returns?

The estimated annual Ethereum staking returns vary, typically from 4% to 10% APY. These returns depend on the total number of ETH staked in the network and the overall network activity.