Key Takeaways

- Staking pools enable participants to earn rewards by pooling resources, lowering the entry barriers to staking.

- When choosing a staking pool, consider its reputation, fees, performance, and supported cryptocurrencies for optimal results.

- Technological advances and increased blockchain adoption predict a robust future for staking pools.

- Regulatory developments will likely enhance the safety and reliability of staking pools, boosting investor confidence.

- Integration with DeFi platforms may offer stakers greater flexibility and potential investment returns.

- The competitive landscape will drive staking pools to innovate and improve services continually.

In the exciting world of staking cryptocurrencies, you can boost your returns by picking the right staking pool. Selecting the proper staking pool has become essential for optimizing profits and lowering risks as the digital asset ecosystem changes.

This blog delves into staking pools and provides a clear map to help you turn your crypto into a passive income machine. You may have little experience with cryptocurrency or interest in it. Our analysis of 2024’s best staking pools will give you all the knowledge you need to make wise choices.

Come learn how to increase the value of your cryptocurrency holdings with profitable and secure staking methods.

Table of Contents

- Key Takeaways

- What are Staking Pools?

- How Do Staking Pools Work?

- Benefits of Using Staking Pools

- How to Choose the Best Crypto Staking Pool for Beginners

- Best Staking Pools of 2024

- How to Join a Staking Pool?

- Future of Staking Pools

- Conclusion

- FAQs

What are Staking Pools?

Credits: Freepik

A notion from the field of cryptocurrencies, notably from Proof of Stake (PoS) blockchain networks, is staking pools. Bitcoin uses the energy-intensive Proof of Work (PoW) mechanism. In contrast, proof-stake (PoS) picks validators for block creation and transaction verification. It does this based on the amount of network money they own and are willing to “stake” as collateral. This staking system rewards validators with more cryptocurrency. It also makes the blockchain more secure and effective.

On other networks, though, the minimum quantity of coins needed for staking can be high. This makes it hard for smaller holders to join in staking. Staking pools are helpful in situations like this. Several cryptocurrency owners can pool their resources in a staking pool. It will improve their chances of being picked as validators. Participants do not have to meet the higher individual requirements when they pool their assets. They gain the benefits of staking, like getting transaction fees and block rewards based on their contribution to the pool.

Staking pools are usually run by pool operators. They handle the technical operations and upkeep of the infrastructure needed for staking. They work like a mutual fund in traditional finance. These operators charge a fee for their services, which is frequently a portion of the benefits received. By lowering the barrier to entry, this configuration not only democratizes the earning potential of staking but also simplifies things for individual stakeholders.

How Do Staking Pools Work?

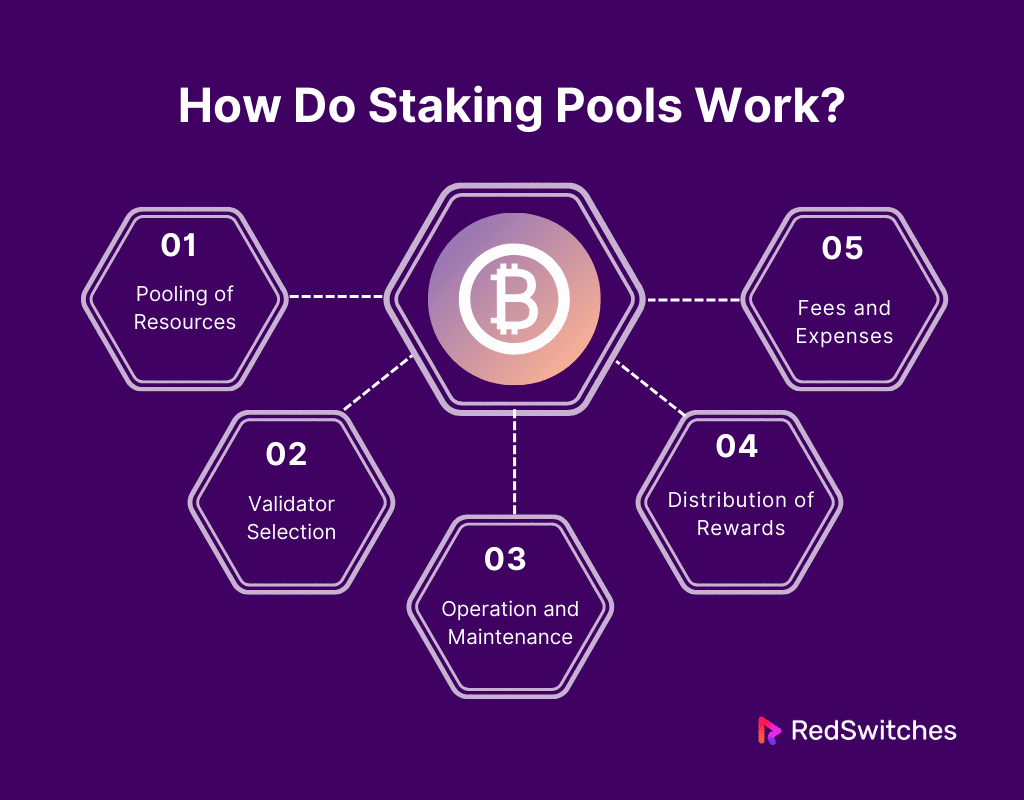

In order to improve their chances of being chosen as validators on a Proof of Stake (PoS) blockchain network, staking pools aggregate the resources of several coin holders. Smaller bitcoin holders can now take part in the staking process and earn benefits that would otherwise demand a much greater individual commitment thanks to this procedure. This is a thorough explanation of how staking pools work:

Pooling of Resources

Members of a staking pool add their coins or tokens to a collective pool. The pool acts as a single staking entity on the blockchain. Because of this combination, the pool can meet or exceed the blockchain’s minimum staking requirements. These requirements might be too high for individual stakers. This is especially true on networks with high entry barriers. The pool’s ledger system carefully documents each participant’s contribution, guaranteeing that they maintain proportionate ownership and are qualified to earn a matching percentage of the benefits. This group strategy increases the earning possibilities for smaller investors while democratizing participation.

Validator Selection

Selecting validators is essential for network security in Proof of Stake (PoS) systems. Usually, validators are selected according to the amount of stake they have. Through resource pooling, the staking pool increases its chances of being chosen as a validator in the network’s consensus process by accumulating a sizable aggregate stake. After being chosen, the pool’s duties include verifying transactions and upholding the integrity of the blockchain. This function is essential to the operation and security of the blockchain. The reputation of the pool and the confidence of its users are directly impacted by the veracity and correctness of its validation activities.

Operation and Maintenance

Maintaining a staking pool calls for a robust infrastructure, a substantial amount of technical know-how, and a financial commitment. The person in charge of the technical aspects of the pool is the operator, who could be a dedicated firm or an individual specialist. This includes keeping the infrastructure secure, updating software, managing nodes, and guaranteeing continuous operation with little downtime. These tasks are essential because any network penalties resulting from outages or operational mistakes could impact the prizes given to pool participants. The infrastructure’s quality and the operator’s experience are crucial for the pool to be successful and reliable.

Distribution of Rewards

A staking pool receives rewards in the form of extra cryptocurrency if it successfully engages in the blockchain’s consensus mechanism by either founding a new block or validating transactions. After careful calculation, the pool’s participants receive these awards based on their contributions to their respective stakes. Any costs deducted by the pool operator for their services are not included in this payout. Fairness and openness in the award distribution are guaranteed by the automated nature of the entire procedure and its stringent adherence to pre-established guidelines.

Fees and Expenses

The pool operator charges typically a fee for its services to pay for operational expenses and offset the risk involved in managing the pool. Fees vary significantly between different staking pools and might be set as a fixed service charge or as a proportion of the profits gained. Participants should carefully weigh these costs when selecting a pool because they significantly impact net returns. Members must assess not just the cost structure but also the past performance and dependability of the pool operator, as efficient management can offset higher fees.

Benefits of Using Staking Pools

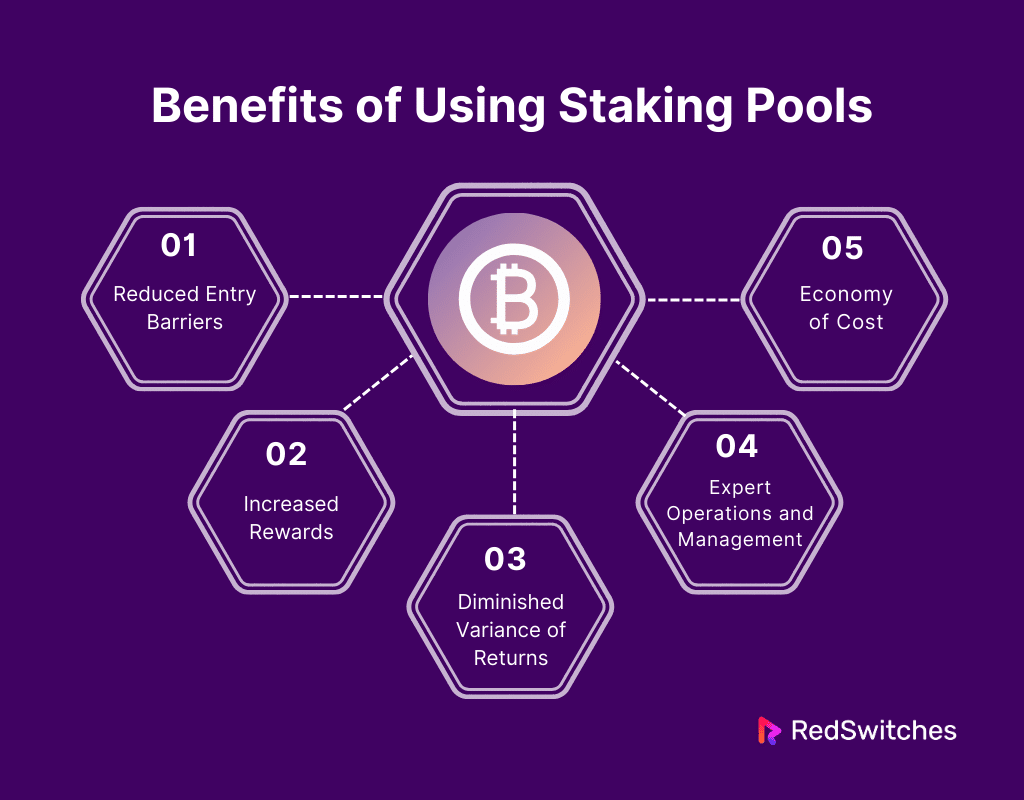

Staking pools have many advantages. They are accommodating for those who lack the means or knowledge to stake on their own. Here’s a thorough analysis of the benefits of staking pools:

Reduced Entry Barriers

Staking pools considerably reduce the entrance barriers for engaging in staking operations. Private investors may find the high minimum investment required by several cryptocurrencies to be unaffordable. They need this investment to become a validator. By pooling resources with other investors, individuals can participate in staking with significantly less capital. Thanks to this access democratization, more people can now stake and earn on blockchains. This expands the community’s earning potential.

Increased Rewards

In many proof-of-stake (PoS) systems, a stakeholder’s chance of being selected to validate transactions and add new blocks is linked to their stake level. Participants in a pool raise the total stake under control by pooling their holdings, which increases the pool’s probability of being selected as a validator. Pools validate more often than a lone staker with less stake. So, this means more consistency and maybe more significant rewards.

Diminished Variance of Returns

If you stake on your own, the returns could vary greatly. A single staker can go for extended periods without being selected as a validator, leading to erratic profits. Staking pools offset this by pooling large stakes. This encourages more involvement in the consensus process. So, it leads to more frequent payouts. Dividing up these benefits among pool participants reduces the risk of solo staking. It also creates a more steady income.

Expert Operations and Management

It can be challenging for anyone without tech experience to run a staking node. Doing so demands tech know-how and ongoing management. Operators are skilled in maintaining the infrastructure for efficient staking. They oversee staking pools. This entails keeping nodes online at all times, updating as needed, and protecting the infrastructure from potential online attacks. Professional management relieves individual stakeholders of technical management’s load while maintaining maximum performance and security.

Economy of Cost

It may also be less expensive to join a staking pool than to stake alone. Large initial and recurring expenditures may be associated with setting up and maintaining a node, including those related to hardware, electricity, and possibly extra charges for software and improved security features. By distributing these expenses among numerous members, pool administrators lessen the financial load on each individual. Furthermore, by participating in the staking process more skillfully, pools can maximize returns on investment due to their increased capacity for scaled operations.

How to Choose the Best Crypto Staking Pool for Beginners

To boost profits and cut risks, novices must pick the top cryptocurrency staking pool. For those new to cryptocurrency staking, the guide will help you choose the best staking pools.

Examine the Pool’s Standing

Start by looking at the staking pool’s reputation in great detail. Look for user reviews and endorsements. Find comments on forums, social media, and specialized cryptocurrency review websites. Robust security procedures, timely payments, and a stable track record show dependability. They all show a pool is trustworthy for staking. It’s also good to find out how long the pool has been open, as this usually translates into stability, experience, and reliability. Also, look into any past problems the pool may have had, like security breaches. See how they dealt with those issues. This can show their crisis management and dedication to user safety.

Recognize the Fee Schedule

Examine the pool’s pricing schedule in detail. For their services, most staking pools want a percentage of the staking profits; however, these fees might differ significantly. While comparing fee costs between pools is vital, knowing what these fees cover is just as important. Although lower costs could be alluring, they could also compromise security or service quality. Assess the fee structure’s openness and the pool’s ability to announce charge modifications promptly. Having this knowledge will enable you to make an informed choice and ensure that no unstated expenses could reduce your earning potential.

Examine the Size and Saturation of the Pool

Credits: Freepik

The pool’s size might have a significant influence on your possible profits. A bigger pool might be more likely to be selected for transaction validation, which could result in incentives that are given out more consistently. There is a catch, though: in some networks, like Cardano or Polkadot, diminishing benefits per participant might result from a pool becoming saturated once it hits a certain threshold. As a result, choosing a pool of the ideal size is essential—big enough to allow for regular validation process participation but not so big as to cause saturation and lower individual returns. Additionally, keep a frequent eye on the pool’s growth to ensure it stays within a healthy range.

Review Supported Cryptocurrencies

Examine the list of supported cryptocurrencies to ensure the pool accepts the one you want to stake. Certain pools focus on particular cryptocurrencies, while others offer services for a broad range of cryptocurrencies. For specific coins, a specialized pool may provide more knowledge, devoted assistance, and customized services, which could result in higher staking results. Furthermore, find out whether the pool intends to accept additional cryptocurrencies. This could provide your investing strategy more flexibility.

Examine the Security Measures Taken by the Pool

The pool has put in place crucial security measures to safeguard the assets it oversees. Security is of the utmost importance in any crypto-related activity. Examine the pool’s digital security procedures, including encrypted communications, secure servers, and multi-factor authentication.

Additionally, search for operational security standards, including transparent security protocols and frequent internal and external audits. It’s also a good idea to know how the pool prevents internal fraud and poor management. A pool that prioritizes security and takes preventative measures can considerably reduce the hazards connected with cryptocurrency staking.

Analyze the Performance of the Pool

A staking pool’s past performance is a crucial determinant of its dependability and effectiveness. To begin with, see how long the pool’s systems and services have been up and running. This is known as the uptime of the pool. A high uptime of nearly 100% is essential since it guarantees that the pool is always open for users to join in consensus and receive prizes. Examine the pool’s operational efficiency, including how well it manages its resources and stakes to maximize earnings and reduce losses or fines.

Best Staking Pools of 2024

Credits: Freepik

In this core section of our blog, we will explore the 10 best staking pools of 2024.

Stakefish

Stakefish is a well-known company that provides staking services and supports many popular cryptocurrencies. It is well-known for its technological proficiency, reliability, and security. Stakefish offers simple ways to help new and seasoned stakers who want to get paid for their cryptocurrency holdings.

Pros

- Allows for the support of several cryptocurrencies and gives users flexibility.

- Renowned for having a high uptime, which guarantees steady staking gains.

- Offers users comprehensive educational materials.

Cons

- The fee structure may be more expensive than in certain other staking pools.

- Some of the individualized customer service elements found in smaller pools are absent.

SwissBorg

SwissBorg focuses on the customer. They have a reputation for offering many tools and features. These help users manage their cryptocurrency assets well. Its platform combines staking with broad wealth management options. This makes it an excellent choice for anyone seeking a feature-rich financial app.

Pros

- Combines staking with additional financial services in an all-encompassing manner.

- Provides a platform that is easy to use and has good instructional content.

- Offers a community app for interaction and education.

Cons

- Restricted to a smaller number of coins for staking.

- The emphasis on money management might be too much for those merely interested in staking.

InfStones

InfStones is a leading platform for staking digital assets. It provides scalable and dependable solutions, primarily to enterprise clients. It can handle large operations. So, it’s a perfect fit for institutions and advanced users who need enterprise-grade infrastructure.

Pros

- Able to manage large stake quantities with dependability comparable to a corporation.

- Improved security measures designed to safeguard valuable digital assets.

- Offers APIs for easy integration with current business processes, enabling adaptability and customization.

Cons

- Its complex platform might be more difficult for novice stakers or individual investors to use or understand.

- The complex features and tools are for large businesses. They may not fit the needs or skills of individuals or retail investors.

Kraken

Kraken is a powerful tool for customers. They wish to trade and stake their Bitcoin. It combines the features of a large cryptocurrency exchange with strong staking. It is well known worldwide for its robust liquidity pools and security features. Kraken integrates staking services. Users can switch between trading and earning passive revenue on Kraken.

Pros

- A reputable, safe platform that prioritizes the security of its users.

- It lets you switch between trading and staking easily. This improves investment management and user experience.

- Attracts customers with various portfolios by supporting a wide range of coins for staking.

Cons

- The staking rewards available may not be as competitive as those on platforms just for staking.

Guarda Wallet

The wallet is multipurpose. It has built-in staking features. Guarda Wallet lets customers manage and stake their cryptocurrency from the wallet UI. Guarda Wallet lowers transaction costs. It does this by removing the need to move assets between platforms. This also reduces security concerns.

Pros

- Simplifies cryptocurrency management and staking by combining them onto a single platform.

- Options for flexible staking that don’t require a minimum amount, making it available to more people.

Cons

- Since it is a multifunction wallet, staking may not be as optimized as on a platform dedicated to staking.

- Despite being extensive, the user interface’s many features and functionalities might be daunting.

Everstake

Renowned for its extensive support of many Proof of Stake (PoS) cryptocurrencies and dedication to optimizing staking profits, Everstake is a well-known provider of staking services. Users are informed about their investments and the performance of their staked assets through frequent updates and a robust and precise platform architecture. There is also active community involvement.

Pros

- Gives consumers a wide variety of PoS cryptocurrency options when staking.

- Upholds a high standard of transparency and actively engages the community, fostering trust and offering stakeholders plenty of help.

- Known for its competitive staking payouts, which are constantly adjusted to account for shifting market conditions.

Cons

- The extensive functionality and variety of options may be intimidating for those new to staking.

- Some users might find that customer service’s response times are too late.

P2P Validators

P2P Validators is widely recognized for prioritizing security and endorsing a decentralized staking methodology encompassing several blockchain protocols. Users who prioritize security above all else and those who want to spread their cryptocurrency staking across various tokens will find this platform particularly appealing.

Pros

- Strong emphasis on safe and decentralized staking, drawing in customers who value security above anything else while using cryptocurrencies.

- Enables substantial portfolio diversity by supporting a broad variety of blockchain technologies.

- Regularly releases fresh, cutting-edge staking products, maintaining the platform’s competitiveness and vibrancy.

Cons

- The many choices and sophisticated features may be too much for novices.

- Because of its emphasis on security and technical functionality could require a longer learning curve than more straightforward staking services.

Figment

Leading staking service provider Figment specializes in providing cutting-edge technical infrastructure, especially for companies and developers wishing to include staking in their apps. Figment simplifies integrating staking services into various business models by providing a comprehensive range of tools and APIs.

Pros

- Provides cutting-edge APIs and integration tools highly suited to developers and technical users.

- Gives excellent developer support, including practical help and thorough documentation.

- Renowned for their technical expertise and dependability, which is essential for companies that rely on uninterrupted staking services.

Cons

- Its services’ technical complexity can make them unsuitable for non-technical individual stakeholders.

- Its emphasis on developer tools and infrastructure may not be sufficient for users seeking easy-to-use staking solutions.

Stake DAO

With Stake DAO, users can participate in collective staking tactics overseen by a decentralized autonomous organization (DAO) on a singular decentralized platform. Thanks to this democratic approach, stakeholders can actively engage in decision-making processes concerning pooled resources and staking methods. The platform’s cutting-edge financial solutions give users more ways to maximize their yields and gain from cutting-edge staking tactics.

Pros

- Encourages a community-driven strategy that improves transparency and participant involvement by having DAO members oversee staking methods.

- Gives access to a wide range of yield-optimizing tactics, attracting the interest of knowledgeable investors.

Cons

- The platform requires users to be familiar with the basics of decentralized finance to take full advantage of its features.

- Better suited for people accustomed to handling intricate cryptocurrency financial tactics, which can turn off new users.

Blockdaemon

Blockdaemon is a well-established blockchain infrastructure platform primarily serving institutional and professional clients. It provides safe and scalable blockchain solutions, such as staking services that efficiently manage high-demand situations.

Pros

- Provides scalable solutions adaptable to a company’s needs, making them perfect for companies looking to build their blockchain operations.

- Focuses on offering enterprise-level, secure services that satisfy the exacting standards of institutions and professional investors.

Cons

- Retail investors may not need or can access its advanced, professional-grade services.

- Because its emphasis on serving professionals and businesses might not be as appealing to casual or novice investors who would instead use a more straightforward, more user-friendly platform.

Let’s summarize it in a tabular format.

How to Join a Staking Pool?

By joining a staking pool, you can lessen some of the difficulties and resource requirements associated with solo staking, while still earning passive income using bitcoins. Here’s a comprehensive how-to instruction for joining a staking pool:

Select the Proper Cryptocurrency

Selecting the cryptocurrency you wish to stake is the first step toward joining a staking pool. Since staking depends on the blockchain’s consensus process, not all cryptocurrencies support it. Pay particular attention to those that employ Proof of Stake (PoS) or one of its offshoots, like Delegated Proof of Stake (DPoS).

Examine Staking Pools

After deciding on a cryptocurrency, consider possible staking pools that will accept it. Consider the pool’s standing, cost, past performance, frequency of payouts, and minimal staking requirements. Also, examine the pool’s security features to safeguard your investment.

Make a Digital Wallet

You must make a digital wallet that supports the cryptocurrency you intend to stake if you don’t already have one. Make that the wallet works with the staking pool you have selected. It’s possible that certain well-known wallets already have staking platform integration, making setup and administration simpler.

Get Cryptocurrency

Buy or transfer the necessary quantity of cryptocurrency to your digital wallet. The minimum staking requirements of the staking pool and any individual investment choices you make based on your financial circumstances will determine how much you need.

Join the Staking Pool

Joining a staking pool usually involves moving your Bitcoin from your wallet to the pool. However, the exact procedure varies significantly depending on the pool. You may usually accomplish this directly through the wallet interface or by following the guidelines on the staking pool’s website. To protect your staking, adhere to the technique exactly as described.

Stake Your Cryptocurrency

After transferring your cryptocurrency, you must formally stake it with the pool. To lock in your stake, you may need to either follow the platform’s instructions or, in the case of decentralized staking pools, interact with the pool’s smart contract. This action usually commits your tokens, making them unavailable for use or trade for a predetermined amount of time.

Monitor Your Investment

After staking your tokens in a staking pool, check in on your investment occasionally. Track changes impacting your staking, such as adjustments to the staking pool or the related blockchain network. You should also check for any earnings distributions. Most pools have a dashboard or reporting tool where you can view the awards you’ve earned and other pertinent data.

Also Read: What Is the Minimum Lockup Period for Crypto Staking?

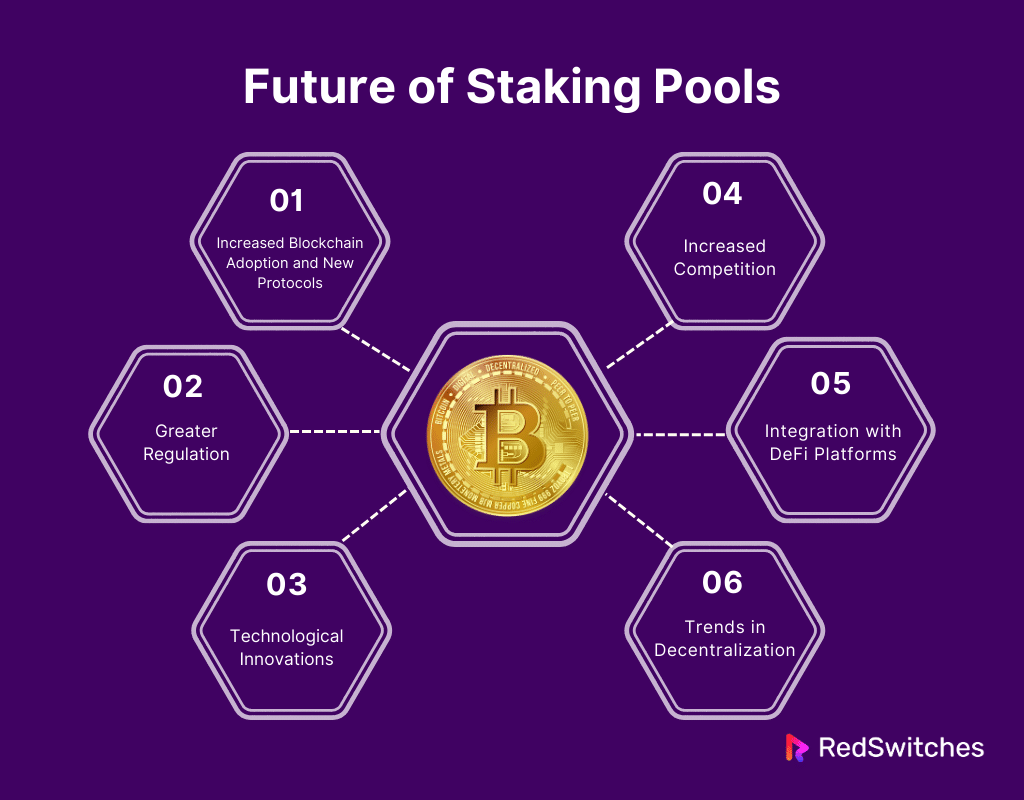

Future of Staking Pools

Staking pools have a bright future. This is because of continuous blockchain improvements and the growing use of Proof of Stake (PoS) methods. Here is an in-depth analysis of a few big trends and advancements. They will likely influence how staking pools develop.

Increased Blockchain Adoption and New Protocols

PoS consensus is more scalable and efficient than PoW. So, more cryptocurrencies are expected to switch to or start using PoS. This will happen as blockchain tech grows and gains traction in many industries. As a result of this shift, staking pools will become more in demand. They offer a more convenient way for regular investors to join in blockchain security and governance.

Greater Regulation

The cryptocurrency sector is developing. We expect more regulation, especially for financial services and goods like staking pools. Regulations might enforce security standards. They would also standardize procedures and improve consumer protection. This would raise public confidence and stake participation. Enough rules could increase staking services. They would meet the needs of customers who must follow laws.

Technological Innovations

Technological developments enhance stake pools. They make them more secure, effective, and useful. They will likely be good for the staking sector. These include: more advanced staking algorithms. They also include better reward systems. They also include increased governance. These increase pool transparency and fairness. Staking pools may also benefit from blockchain interoperability. It would let them work on other networks and be more useful.

Trends in Decentralization

There is a significant push in the Bitcoin community for increased decentralization to avoid the drawbacks of centralized finance. This might result in more decentralized staking pools, where community consensus rather than a central authority governs operations and decision-making. These models can potentially improve security and draw in consumers who value decentralization in their cryptocurrency activities.

Integration with DeFi Platforms

Staking pools and decentralized finance (DeFi) platforms are probably going to become more connected. Staker chances to use their staked assets in lending, borrowing, yield farming, and other financial activities may increase due to this integration, saving them from having to unstake their assets. Staking pools may become even more alluring if these synergies increase the liquidity of staked assets and provide stakers with larger profits.

Increased Competition

As the number of staking pools increases, the market will see an increase in competition. Higher security requirements, more affordable prices, and improved customer service are just a few innovative service options that this competition is likely to spur. Stocking pools must set themselves apart to draw and keep customers with improved performance or value-added services.

Conclusion

Staking pools present an alluring way for cryptocurrency owners to increase the security and effectiveness of blockchain networks while earning passive revenue. By learning how to select and join the correct staking pool, people can greatly increase their investment returns without the hassles of solo staking. Staking pools are projected to become an increasingly vital component of the Bitcoin ecosystem as the blockchain landscape develops.

RedSwitches offers scalable and stable hosting solutions for those looking to extend their digital infrastructure for blockchain projects or staking activities. Our solutions guarantee excellent performance and dependability. Let RedSwitches handle the technological architecture. We’ll manage your staking pool, assist with your projects, and optimize your blockchain operations.

FAQs

Q. Which platform is best for staking?

Your needs will determine which platform is best for you to stake on; popular options include Stake DAO for cutting-edge decentralized solutions and Kraken for security and ease of usage.

Q. What is the safest staking platform?

Reputability and safety are closely related to staking platforms; systems with strong security protocols like Kraken and Blockdaemon are well-liked.

Q. Is crypto staking worth it?

Even though there are risks associated with cryptocurrency staking, such as market volatility and liquidity restrictions, it can be worthwhile if done carefully. It provides a means of generating passive income while enhancing blockchain security.

Q. What is crypto staking, and why is it popular?

Crypto staking is actively participating in transaction validation on a proof-of-stake (PoS) blockchain network by holding cryptocurrencies in a wallet. It is popular because it allows holders to earn staking rewards for helping secure the network.

Q. How does staking differ from traditional mining?

Staking involves holding a certain amount of cryptocurrency to support network operations and validate transactions, while mining requires solving complex mathematical problems to validate transactions. Staking is considered more energy-efficient compared to mining.

Q. What are the benefits of staking in a pool?

Staking in a pool allows participants to combine their resources and increase their chances of earning rewards more frequently. It is a more consistent way to earn rewards compared to solo staking.

Q. How do I choose the best crypto staking pool?

When selecting a staking pool, consider factors such as the staking reward percentage, the reputation of the pool operator, the fees involved, security measures, and the supported tokens. Researching and comparing different pools can help you make an informed decision.

Q. What is liquid staking, and how does it work?

Liquid staking is a process where staked assets are converted into a liquid form that can be used for trading or other purposes while still earning staking rewards. This allows users to access the value of their assets without having to unstake them.

Q. Can I stake ETH directly, or do I need to use a staking pool?

You can stake ETH directly by running a validator node or through a staking pool, where assets are pooled together with other participants in a collective effort to secure the network and earn rewards.

Q. What are some popular crypto staking reward pools for Ethereum staking in 2024?

Some of the top staking pools for Ethereum in 2024 include Rocket Pool, Solana Staking, Liquid Staking Protocol, and DeFi Staking providers. Each pool offers different features and rewards, so research and comparison is recommended before choosing one.

Q. How can I start staking my crypto assets?

To start staking your crypto assets, you need to have the minimum required amount of tokens, choose a staking provider or pool, follow their instructions for staking, and monitor your rewards regularly. Be aware of the risks and rewards involved in staking.