Key Takeaways

- DeFi is a Decentralized Finance system that delivers financial services using blockchain technology, often without traditional intermediaries.

- DeFi Staking involves locking digital currencies to support network operations and earn incentives in return.

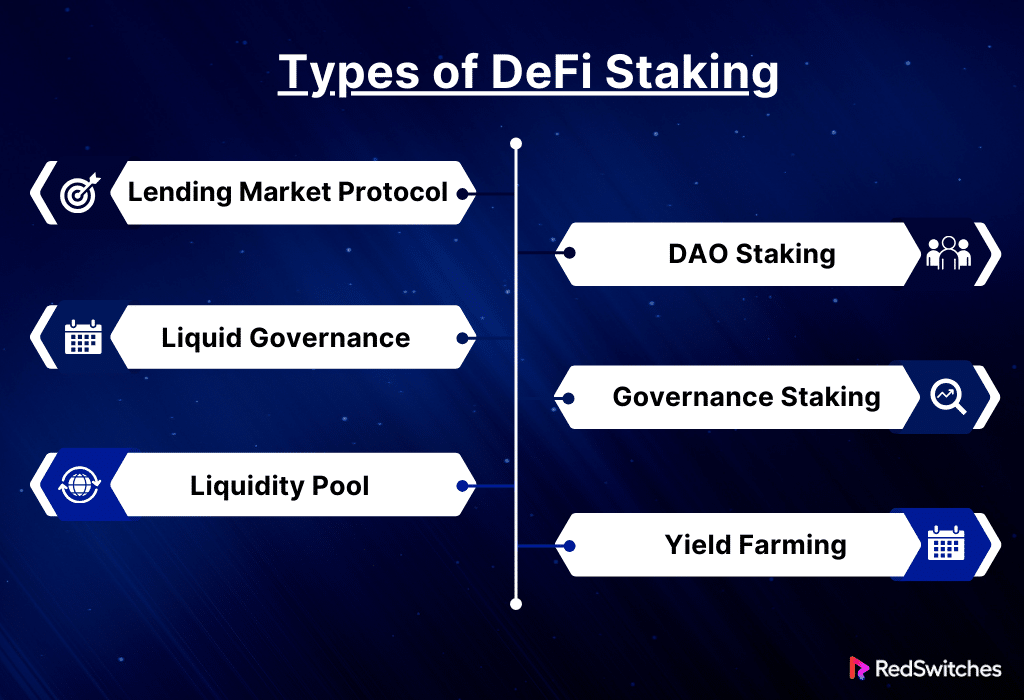

- Various types of DeFi staking include Lending Market Protocol, Liquid Governance, Liquidity Pool, and DAO Staking.

- DeFi staking working mechanisms involve users choosing a platform, depositing funds, selecting a validator, and earning staking rewards.

- Pros of DeFi staking include passive income and participation in network governance.

- Risks of DeFi staking include smart contract vulnerabilities and liquidity issues.

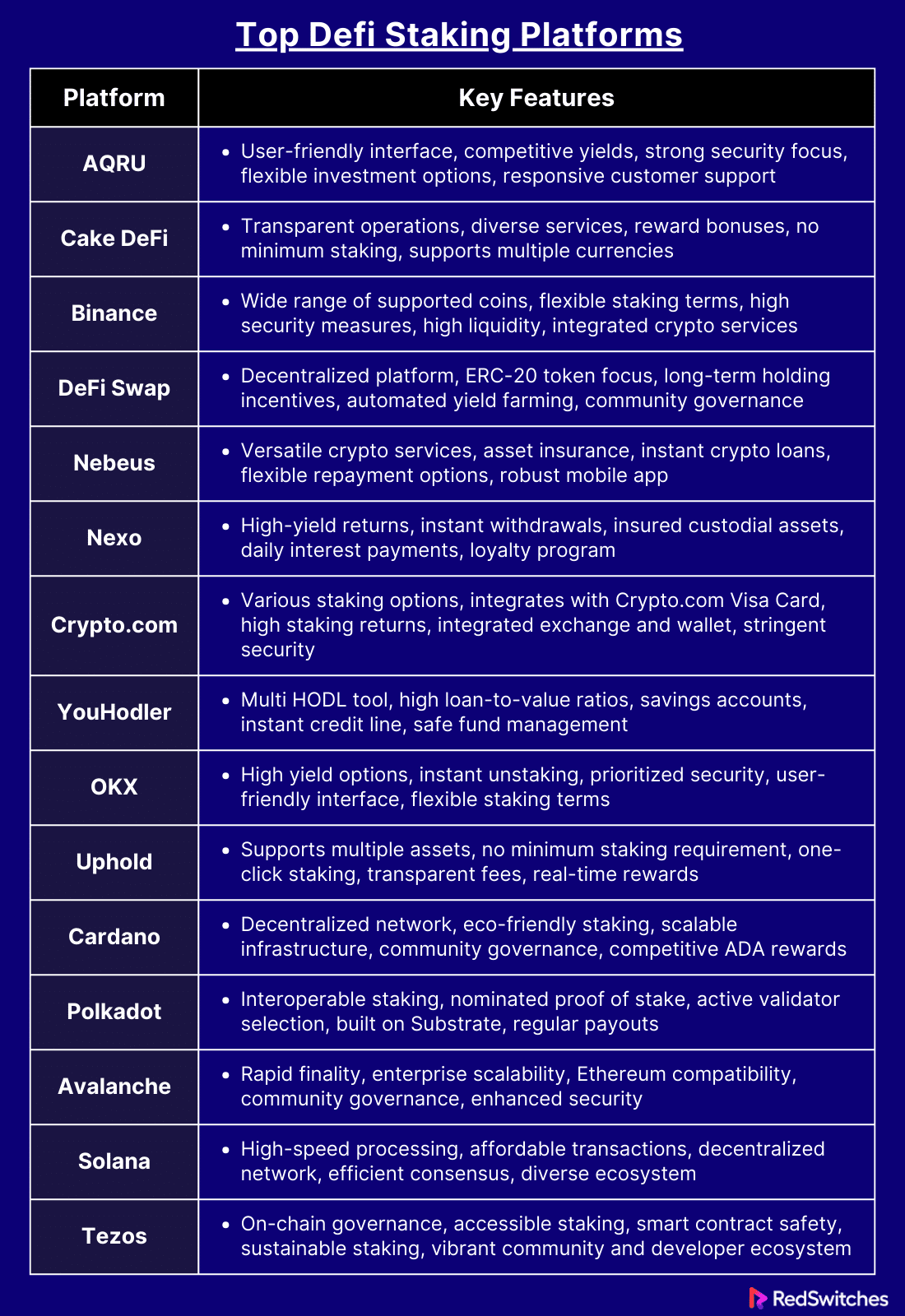

- Some top staking platforms include AQRU, CAKE DeFi, Binance, etc.

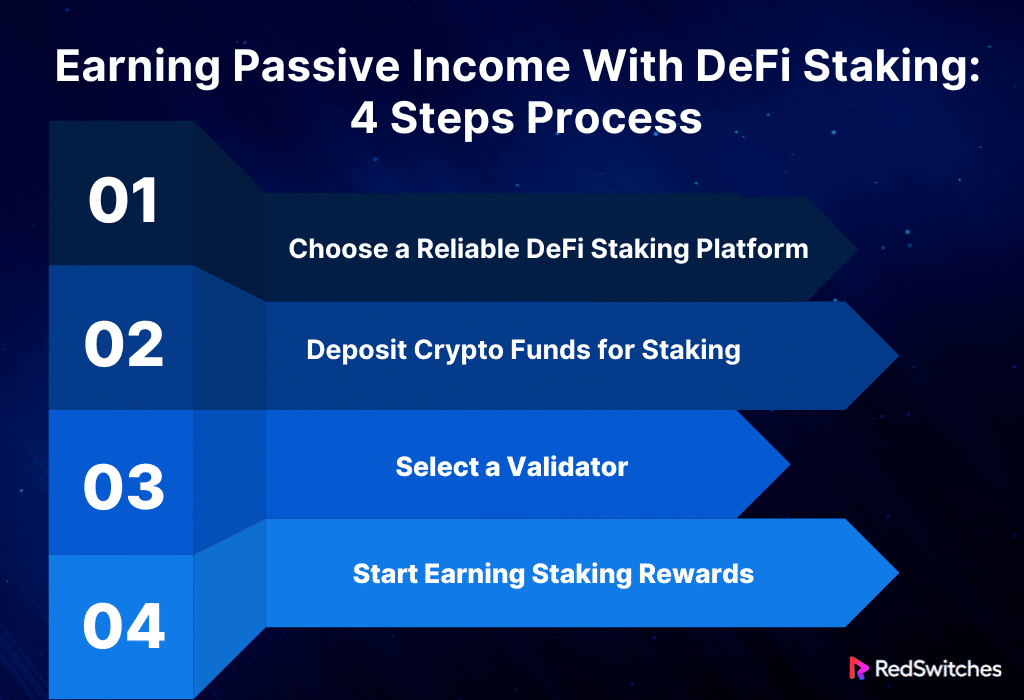

- To earn passive income via DeFi staking, you must choose a platform, deposit funds, select a validator, and start to earn rewards.

Did you know that earnings in the DeFi market are expected to reach $26,170.0 million in 2024? It is safe to say that DeFi has revolutionized how we think about financial services.

Among the various components of DeFi, staking is quite an intriguing option. With more and more individuals trusting this investment strategy, it is essential for anyone looking to test their luck with DeFi staking to understand it in depth.

This blog will discuss the mechanics of DeFi staking, its pros and cons, reliable DeFi staking platforms for 2024, and other related topics. It will provide you with a thorough understanding of this dynamic investment avenue.

Let’s dive in!

Table of Contents

- Key Takeaways

- What is DeFi?

- What is DeFi Staking?

- Types of DeFi Staking

- How Does DeFi Staking Work?

- Pros and Cons of DeFi staking

- Top DeFi Staking Platforms

- Earning Passive Income With DeFi Staking: 4 Steps Process

- Conclusion

- FAQs

What is DeFi?

DeFi (Decentralized Finance) refers to a movement in the financial space that uses blockchain technology to perform financial transactions without needing traditional intermediaries like brokers, banks, or insurance firms.

DeFi platforms function on open-source software created on blockchains (mainly Ethereum), letting anyone with internet access use financial services like lending, investing, borrowing, and trading.

DeFi aims to democratize finance by forming a more accessible and less restrictive financial system. Users interact with smart, self-executing contracts with the terms of the agreement directly mentioned in the code. This ensures transactions are completed transparently and safely.

It lowers the expenses linked with financial services and boosts their availability, creating an inclusive financial ecosystem.

Are you on the lookout for the best crypto staking platforms? Read our blog, ‘Top 10 Best Crypto Staking Platforms For Income In 2024.’

What is DeFi Staking?

So what is DeFi staking meaning? It is a concept in decentralized finance in which users lock their digital assets in a smart contract to support the operation of a blockchain network. Participants receive incentives for their staked assets, usually in the form of more digital currency. It’s quite similar to earning interest in a traditional bank savings account. The only difference is that it occurs in the blockchain ecosystem.

The popularity of DeFi staking comes from its capacity to offer users passive revenue streams while also improving the safety and effectiveness of the blockchain network. Staking their digital assets allows users to help confirm transactions or vote on crucial decisions, depending on the blockchain’s unique requirements and governance structure.

This novel approach to finance decentralizes financial services outside traditional banking and provides an appealing opportunity for asset holders to enhance their holdings without depending on established financial institutions.

Types of DeFi Staking

When stepping into the DeFi staking space, you will come across different types of DeFi staking. This can make it difficult to choose the best option for you. The best way to pick is to understand all types in detail:

Lending Market Protocol

The Lending Market Protocol is a basic form of DeFi staking. This strategy enables cryptocurrency holders to use a decentralized network to lend their assets to others. Borrowers can get loans by providing collateral that is more than the loan’s value, which protects lenders from default. Interest rates are usually regulated by supply and demand dynamics on the platform.

Lenders gain from interest payments based on the amount they have staked. This staking type is appealing because of its generally consistent profits and the ongoing liquidity of loan markets. Aave and Compound are two important platforms where consumers may participate in lending market protocols.

Liquid Governance

Liquid Governance is the process by which stakeholders use their staked tokens to govern the DeFi ecosystem. Staking, in this sense, refers to locking up tokens to gain governance rights, which may include voting on protocol changes such as fee structures and upgrades and influencing the platform’s future growth routes.

This type of staking appeals to those who want to receive rewards while influencing how the decentralized platform is managed and developed. It’s a concrete example of the democratic concepts that underpin many DeFi initiatives, with each staked token resulting in a vote in the communal decision-making process.

Liquidity Pool

Liquidity Pools are the foundation of decentralized exchanges (DEXs) such as SushiSwap. This staking strategy involves users locking their tokens inside a smart contract, which promotes trade by providing liquidity. These pools include pairings of various tokens, and when a trade is made, a portion of the transaction fees are awarded to individuals who have staked their cryptocurrencies in the pool.

The primary appeal of staking in liquidity pools is the possibility of substantial rewards, especially if trading volume is high. However, it carries risks such as temporary loss, which occurs when the price of tokens changes relative to when they were put in the pool. Despite this, liquidity pools remain popular due to their vital role in facilitating decentralization.

DAO Staking

DAO Staking involves participating in a Decentralized Autonomous Organization (DAO), a fully automated, blockchain-based form of organization or community without any central authority. Members of a DAO use their tokens to stake and gain voting rights in the organization’s decisions, such as allocating resources, changing protocols, or even deciding on new projects to fund.

The advantage of DAO Staking is not just in potential financial returns, which might come from improved efficiency and successful ventures, but also in empowering its members to steer the organization’s future. It’s a powerful way to engage with and influence projects you are invested in, creating a profoundly participatory financial environment.

Governance Staking

Governance Staking is closely linked to DAO staking. It refers to locking tokens to partake in the governance mechanisms of a certain DeFi platform or project. This may include decisions on parameter modifications (like changing interest rates), updates to the system, or directional shifts in the project’s development.

This type of staking is best for those wishing to directly impact the protocols they support, offering them a voice in a decentralized setting. It boosts the platform’s stability and safety, as those most invested in the project’s success are given a direct role in its oversight and evolution.

Yield Farming

Yield Farming involves staking or lending digital assets for fees or interest in the form of more digital currency. This staking type occurs through liquidity pools, where users temporarily offer up control of their tokens to supply liquidity for trading pairs. The returns can be notably higher than traditional staking. It usually depends on the amount of transaction fees generated by the underlying DeFi platform.

Market volatility and the complex interplay of multiple DeFi protocols are the key risks in this type of DeFi staking. They can increase losses as quickly as gains. Yield Farming provides excellent opportunities for earning for experienced investors who can tackle the complexities.

Also Read: Guide To Types Of Crypto Staking: Risks, And Platforms 2024.

How Does DeFi Staking Work?

Credits: FreePik

If you are considering trying out DeFi staking, understanding how it works is important to ensure informed decisions and maximize returns. Here’s a breakdown of the process:

The Role of Proof of Stake (PoS)

Most DeFi staking systems are based on the PoS (Proof of Stake) consensus mechanism. PoS reaches a consensus by having stakers lock a stake in the network. The stake’s size specifies its responsibility and potential incentive. PoS involves validators being picked to create new blocks and verify transactions depending on the extent of their stake and other elements, like the duration they have held their stake for.

Becoming a Validator or Delegator

To begin DeFi staking, one can either become a delegator or validator. Validators must run a node on the network, which demands considerable expertise and computational resources. They participate in the consensus process by suggesting and validating new blocks. Delegators may not have the desire or resources to run a node. Instead, they sustain validator nodes by delegating their stakes to them, receiving a percentage of the incentives in return.

Earning Rewards

The incentives for DeFi staking come from varying sources. These include transaction payments gathered from the network and sometimes added tokens minted by the protocol. The incentives are divided among validators as a reward for their participation and to delegators proportionally, depending on the value of their stake. The return rate will rely on the protocol and the total staked assets.

Unlocking Staked Assets

The lock-up period is an important part of DeFi staking. When you stake your cryptocurrency, it becomes bound in a smart contract and cannot be moved or sold until you choose to unstake it. Some protocols may specify a minimum staking duration during which your assets are unreachable. After you unstake, there may be a cooldown period before your tokens are restored.

Pros and Cons of DeFi staking

Credits: FreePik

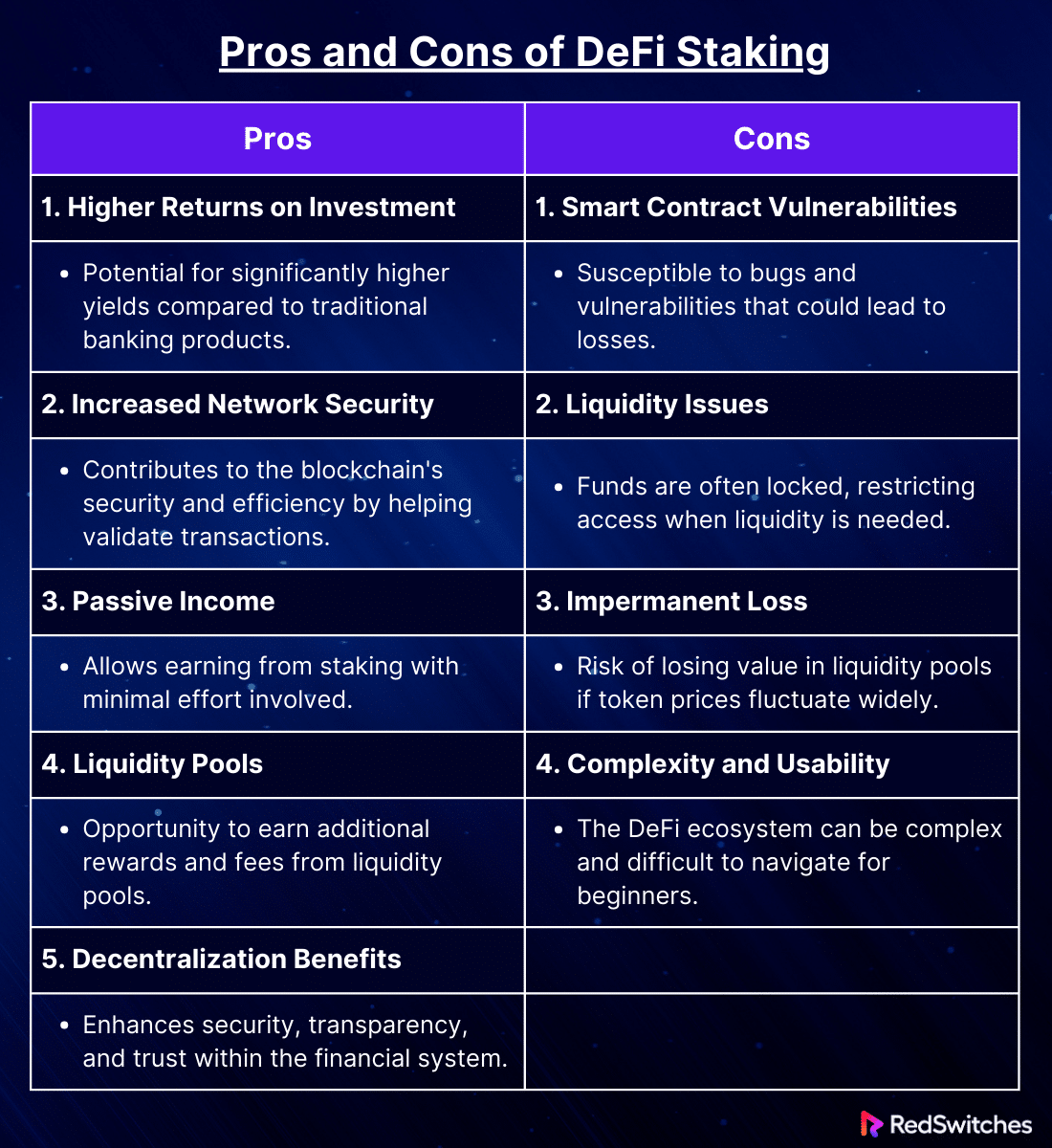

DeFi staking presents several pros and cons that participants should consider. Below, we delve deeper into these aspects to provide a more comprehensive understanding.

Pros of DeFi Staking

DeFi staking offers many benefits. Here are some pros of DeFi staking:

-

Higher Returns on Investment

DeFi staking often yields much better returns than standard financial products. This greater return results from cutting-edge technology and unique financial products inside the DeFi ecosystem, which may pass on notable rewards to stakers due to decreased overhead costs and direct incentive distribution systems.

-

Increased Network Security

By staking your digital assets, you actively contribute to the blockchain’s functional integrity. A staker verifies new transactions and blocks, secures the network, and decentralizes control, which is usually controlled by large mining pools in basic blockchain setups.

-

Passive Income

A top attraction of DeFi staking is its ability to offer passive income. It’s a hands-off investment strategy where you receive staking incentives for locking your digital assets for a certain time period. This approach fits well for individuals who wish to avoid the day-to-day fluctuations of the digital currency markets.

-

Liquidity Pools

Engaging with liquidity pools offers dual benefits. Stakers can earn transaction fees from trades within the pool and receive additional rewards from DeFi platforms. This system incentivizes the provision of liquidity, improving the overall market stability.

-

Decentralization Benefits

DeFi staking reinforces the foundational principle of decentralization in cryptocurrency. Unlike traditional centralized financial systems, it allows users to transact and interact without intermediaries, fostering a more open, transparent, and resilient financial environment.

Do you want to learn what crypto staking is? Read our in-depth guide: Stake Crypto And Earn! Dive Into Crypto Staking Basics.

Cons of DeFi Staking

Staking also comes with its risks. Here are some cons of DeFi staking:

-

Smart Contract Vulnerabilities

The codebase of smart contracts, which governs the operations on DeFi platforms, can contain bugs or be subject to exploits. If not properly audited and secured, these vulnerabilities can lead to significant financial losses for stakers.

-

Liquidity Issues

Specific DeFi staking protocols demand locking assets for preDeFined periods. This could restrict access to your funds when required. This illiquidity can be a major inconvenience, especially in volatile markets where asset values alter over short periods.

-

Impermanent Loss

In liquidity pools, if the cost of your staked tokens fluctuates dramatically from when you deposited them, you may experience temporary loss, which occurs when the dollar worth of your deposited tokens is less when withdrawn than if you had held them outside the pool.

-

Complexity and Usability

The DeFi ecosystem can be complicated and intimidating, especially to newbies. The need to keep private keys securely, understand transaction costs and deal with often inconvenient interfaces can all be substantial obstacles to entry.

Also Read: Automated Staking Scripts And Tools For Server-based Nodes.

Top DeFi Staking Platforms

The platform you choose plays an important role in the quality of your entire DeFi staking experience. Here is a list of the top platforms to help you pick the best DeFi staking platform for your individual needs:

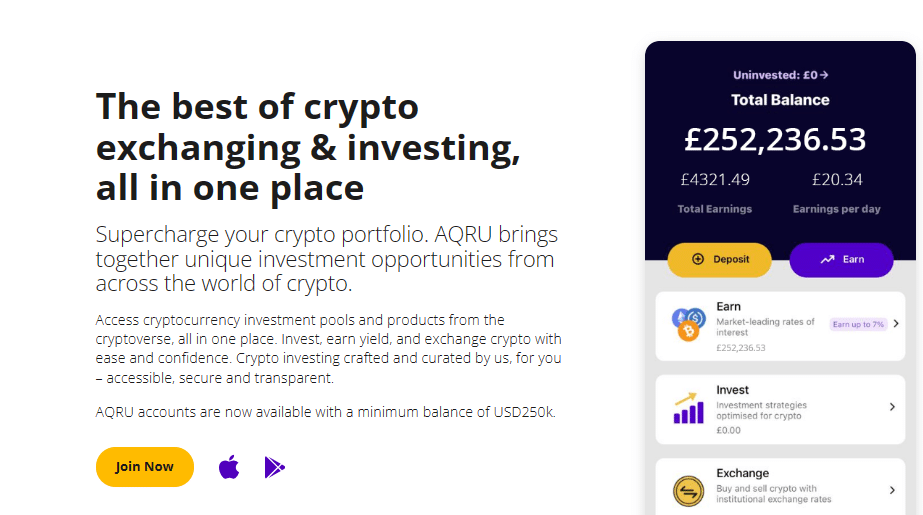

Credits: Aqru

AQRU ranks number one on our list of the leading DeFi staking platforms due to its popularity. It is an innovative platform that simplifies crypto investment, including staking. AQRU stands out among others for its user-friendly interface and simple approach to DeFi investments.

The platform delivers competitive yields on several digital currencies. AQRU also prioritizes security and compliance and offers peace of mind for those concerned about the security of their digital assets.

Key Features

- User-Friendly Interface: Designed for ease of use, making it accessible to skilled investors and novices.

- Competitive Yields: Offers good rates on staking, providing a lucrative option for making passive income.

- Security Focus: Prioritizes advanced security and regulatory compliance, ensuring the protection of digital assets.

- Flexible Options: Offers several investment choices, including staking and fixed-income products.

- Responsive Customer Support: Offers exceptional customer service with accelerated response times to help users with problems or inquiries.

Credits: Cake DeFi

Cake DeFi is well-known for its in-depth services, which enable users to profit from their digital currency investments through staking, lending, and liquidity mining. One of Cake DeFi’s key advantages is its transparent operations, which let consumers witness real-time verification of the company’s staking transactions.

This transparency fosters trust and makes people feel confident about their investments. Cake DeFi also routinely gives its consumers incentives and awards, improving their overall yield.

Key Features

- Transparent Operations: Users can view real-time proof of staking operations, boosting security and trust.

- Diverse Services: Offers lending, staking, and liquidity mining on one platform.

- Reward Bonuses: Frequent promotional bonuses and rewards to maximize user yields.

- No Minimum Staking: Enables users to stake any amount, making it available to individuals with varying investment sizes.

- Multi-Currency Support: Supports various digital currencies, offering flexibility for investors.

Credits: Binance

Binance is one of the largest global digital currency exchanges. It provides a robust staking platform noted for its high payouts and adaptability. Binance Staking supports cryptocurrencies and offers numerous staking options, including fixed and variable staking lengths.

Users may determine how long they want to lock their assets, combining freedom with maximum income creation. Binance is also recognized for its strict security procedures, which include cold storage of assets and cutting-edge protection mechanisms.

Key Features

- Wide Range of Supported Coins: Supports diverse digital currencies for staking.

- Flexible Staking Terms: Offers both flexible and locked staking options to suit various investment strategies.

- High Security: Implements advanced security efforts, like cold storage and two-factor authentication.

- High Liquidity: Offers high liquidity for effortless entry and exit.

- Integrated Services: Provides a broad ecosystem of crypto services, including loans, trading, and more.

Credits: DeFi Swap

Launched in 2020, DeFi Swap has quickly established itself as a reliable DeFi staking platform with decentralized exchange and staking services. The platform is dedicated to creating a decentralized ecosystem in which users may easily trade and stake ERC-20 tokens.

DeFi Swap provides noteworthy staking returns and encourages long-term holding, which may be especially useful during extreme market volatility. The platform also includes various DeFi features, making it a one-stop shop for consumers trying to optimize their gains in the decentralized financial arena.

Key Features

- Decentralized Platform: Runs a completely decentralized exchange, giving users more privacy and control over assets.

- ERC-20 Token Focus: Focuses on swapping and staking ERC-20 tokens.

- Long-Term Holding Incentive: Users who stake their tokens for longer will receive greater returns.

- Automated Yield Farming: Users can engage in yield farming automatically, enhancing return possibilities.

- Community Governance: Token holders can vote on governance choices that affect the platform’s evolution.

Also Read: Infrastructure Requirements For Crypto Staking In 2024.

Credits: Nebeus

Nebeus is a versatile platform that offers various services, such as swift crypto loans, exchange, and crypto staking. What distinguishes Nebeus is its dedication to security and user flexibility. It enables users to earn interest on digital currency deposits, which may be considered a type of staking.

The site supports a wide range of cryptocurrencies and provides competitive interest rates. Nebeus is intended to be user-friendly, catering to all levels of users wishing to optimize their revenues from cryptocurrency holdings.

Key Features

- Versatile Crypto Services: Provides various services such as cryptocurrency loans, crypto rentals, and staking.

- Asset insurance: Provides additional security for consumers by insuring crypto assets.

- Instant Crypto Loans: Users can immediately take out loans against their cryptocurrency assets.

- Flexible Repayment Options: Loan repayments are flexible, making them accessible to individuals with diverse financial capacities.

- Robust Mobile App: The app is user-friendly and allows customers to manage their investments and loans while on the go.

Credits: Nexo

Nexo is well-known for its platform that offers crypto staking services. It allows users to earn interest on various digital assets, including prominent cryptocurrencies and fiat currencies. The platform’s staking method is simple and user-friendly, making it popular among cryptocurrency enthusiasts.

Nexo stands out with its high-yield interest rates and the possibility to earn interest in NEXO tokens, which can boost users’ total income. The site also has a unique feature called daily dividends, which allows investors to compound their assets more often.

Key Features

- High-Yield Returns: Provides competitive interest rates on cryptocurrency staking, which may exceed 12% APY.

- Instant Withdrawals: Users can withdraw their staked funds and earn interest without delay.

- Insurance on All Custodial Assets: Offers top-tier insurance, including $375 million protection for custodial assets through relationships with renowned insurers.

- Daily Interest Payments: Interest is accumulated and paid out daily to maximize possible earnings.

- Nexo Loyalty Program: Rewards customers with better returns and lower loan rates based on their NEXO token ownership.

Credits: Crypto.com

Crypto.com is an exhaustive ecosystem that offers several services, such as trading, staking, and a wallet service. Its staking platform is especially known due to its integration with the Crypto.com Visa Card, allowing users to use their staked assets for daily purchases.

The platform supports staking different digital currencies, offering competitive prices and flexible terms. Users can select distinct staking durations, with more extended commitments yielding higher returns. Crypto.com is also praised for its impressive security measures, ensuring user assets are managed securely.

Key Features

- Staking Options: Supports a wide range of coins with varying term durations.

- Crypto.com Visa Card: Provides a visa card that allows you to spend your staked and earned cryptocurrency at real-world businesses.

- Up to 14.5% Staking Returns: Offers some of the highest staking returns available, depending on the currency and duration.

- Integrated Exchange and Wallet: Works seamlessly with Crypto.com’s exchange and digital wallet to provide a unified user experience.

- Security First Approach: Adopts strict security procedures, including as cold storage for all user coins and a dedicated security staff.

Credits: YouHolder

YouHodler is another renowned DeFi staking space player known for its innovative multi-functional platform. It enables users to stake digital currencies and engage in other financial services, like fiat conversions and crypto-backed loans.

The staking process on YouHodler is created to be highly user-friendly. It offers options for various digital currencies and attractive interest rates. YouHodler also provides a unique feature called Multi HODL, which allows users to leverage their staked assets to participate in further trading, improving potential returns.

Key Features

- Multi HODL Tool: Offers an innovative multi HODL tool that allows users to increase their cryptocurrency assets via an automated chain of loans.

- High Loan-to-Value Ratios: Provides one of the largest LTVs of up to 90%, allowing consumers to optimize their borrowing capability against their cryptocurrency holdings.

- Savings Accounts: Offers high-yield savings accounts for several cryptocurrencies.

- Instant Credit Line: Users can quickly get a credit line using their cryptocurrency as collateral without selling it.

- Safe Fund Management: Uses modern encryption to ensure fund security and compliance with Swiss regulations.

Also Read: Crypto Rewards: How Long Does Crypto Staking Take?

Credits: OKX

Previously labeled OKEx, OKX is a crypto exchange that provides countless financial services, such as DeFi staking. OKX users can stake their cryptocurrencies in exchange for incentives divided into staked cryptocurrencies.

The platform supports staking for several tokens, delivering flexibility and access to less common or newer assets. OKX is also praised for boasting an easy to navigate interface and robust security measures.

Key Features

- High Yield Options: Offers competitive staking incentives across various crypto assets.

- Instant Unstaking: Boasts liquidity options like instant unstaking capabilities.

- Security First: Prioritizes advanced security measures to safeguard user assets.

- User-Friendly Interface: Delivers a streamlined, intuitive platform for all users.

- Flexible Staking Terms: Enables users to pick from several locking periods to fit their investment strategies.

Credits: Uphold

Uphold stands out for its simplicity and broad accessibility, making it the right DeFi staking platform for those new to the digital currency industry. This website allows you to purchase, trade, and keep cryptocurrencies and provides staking opportunities.

Uphold enables staking for prominent cryptocurrencies and offers customers an intuitive interface for managing their assets. Uphold stands out because of its clear cost structure and ability to trade cryptocurrencies, precious metals, and even fiat currencies. This adaptability makes it an excellent platform for investors wishing to profit from staking.

Key Features

- Multi-Asset Support: Supports staking for several digital currencies, including newer altcoins.

- No Minimum Staking: Enables users to begin staking with any amount (There is no minimum requirement).

- One-Click Staking: Simplifies the overall staking process via a one-click feature to help users quickly stake or unstake.

- Transparent Fees: Easy to understand fee structure with zero hidden charges.

- Real-Time Rewards: Allows users to access and track staking incentives in real-time.

Credits: Cardano

Cardano is well-known for its research-driven approach to blockchain technology. It is one of the largest blockchains to implement a proof-of-stake consensus mechanism effectively. Staking on Cardano involves assigning ADA, the native coin, to a pool managed by pool managers.

The protocol automatically distributes awards based on the quantity of ADA staked and the performance of the chosen pool. Cardano’s security-centric approach is the top pick for investors who care about more than profits and want to know about the technical breakthroughs driving their staking investments.

Key Features

- Decentralized Network: Uses a secure and decentralized staking mechanism.

- Eco-Friendly Staking: Employs a proof-of-stake protocol which is energy-efficient.

- Scalable Infrastructure: Developed to manage extensive transactions and scalable staking.

- Community Governance: Stakers can partake in network decisions, impacting future development.

- ADA Rewards: Offers competitive staking incentives in ADA, its native digital currency.

Credits: Polkadot

Polkadot presents a one-of-a-kind staking model via its network of parachains (parallel blockchains) that function under its central relay chain umbrella. DOT (the native token) is used for staking, which secures the whole network and connects various parachains.

Polkadot’s staking is novel in that it allows users to choose validators they trust to help protect the network. This increases user engagement and impact, making it appealing to individuals who wish to play a more active role in the governance of the blockchain infrastructure in which they are investing.

Key Features

- Interoperable Staking: Offers staking on numerous blockchains via its impressive interoperability feature.

- Nominated Proof of Stake: Enforces an innovative staking model that improves network security.

- Active Validator Selection: Users can specify their validators, offering more control over staking.

- Substrate Technology: Built on Substrate, fostering an adaptable framework.

- Regular Payouts: Rewards are allocated regularly, securing consistent earnings for stakers.

Also Read: Cloud Server Vs Dedicated Server For Staking: Differences.

Credits: Avalanche

Avalanche is increasingly becoming a highly sought-after scalable blockchain platform for decentralized apps and customized blockchain networks. It is unique in its approach to staking, forcing validators to stake AVAX tokens to participate in the consensus process.

The incentives for staking on Avalanche are based on the validators’ uptime and commitment, supporting a stable network functioning. This platform caters to customers looking for powerful blockchain services with high transaction throughput.

Key Features

- Rapid Finality: Accelerated transaction finality due to Avalanche’s novel consensus mechanism.

- Enterprise Scalability: Incredibly scalable, sustaining thousands of transactions each second to fulfill enterprise needs.

- Ethereum Compatibility: Compatible with Ethereum assets and smart contracts, easing integration and transaction.

- Community Governance: Community-driven governance system empowering token holders.

- Improved Security: Robust security features lower the attack threat and strengthen network integrity.

Credits: Solana

Solana has established itself as a DeFi hotspot thanks to its accelerated transaction speeds and affordable fees. It uses a proof-of-history (PoH) consensus and the underlying proof-of-stake (PoS) method. This allows it to handle thousands of transactions each second.

Staking on Solana involves handing over SOL, the native coin, to one of the numerous validators, who helps protect the network and execute transactions. The staking incentives are spread out based on the amount of SOL invested and the validator’s performance. Thus, stakers must pick their validators wisely. Solana’s thriving ecosystem is brimming with DeFi projects, providing several staking possibilities to generate higher rewards.

Key Features

- High-Speed Processing: Accelerated processing with capacities of 65,000 transactions each second.

- Affordable Transactions: Low transaction expenses make it economically feasible for small to large investors.

- Decentralized Network: Censorship-resistant blockchain delivering a potent decentralized network.

- Efficient Consensus: Proof of History consensus, forming a unique and efficient way to maintain time throughout the network.

- Diverse Ecosystem: Active ecosystem with projects ranging from DeFi to NFTs, etc.

Credits: Tezos

Tezos distinguishes itself by its on-chain governance and self-amending blockchain, which allow it to evolve without the need to fork. This makes Tezos robust and secure, which is highly valued in the DeFi stage. Staking in Tezos, also known as “baking,” allows holders of the XTZ token to either actively participate as bakers or assign their tokens to a baker.

Bakers must have at least 8,000 XTZ to qualify. Tezos’ staking rewards are attractive because of their low volatility and consistent growth, which attract a conservative yet committed part of the DeFi community.

Key Features

- Governance Integration: On-chain governance allows for smooth upgrades without hard forks.

- Accessible Staking: Liquid Proof-of-Stake consensus lowering the entry barriers for stakers.

- Smart Contract Safety: Formal verification of smart contracts ensures better security and more reliability.

- Sustainable Staking: Eco-friendly staking model lowers the carbon footprint of blockchain processes.

- Community Development: Rich community and developer ecosystem promoting innovative application development.

Also Read: The Connection: Dedicated Servers In Crypto Staking.

Earning Passive Income With DeFi Staking: 4 Steps Process

So, how exactly to begin earning passive income with DeFi staking? This is a common query most beginners ask. Here is a step-by-step answer:

Step 1: Choose a Reliable DeFi Staking Platform

The first step in beginning your DeFi staking journey is to choose a trustworthy platform. This decision is crucial since it will likely dictate the quality of your DeFi staking experience. Hence, you must choose carefully. The goal is to look for reputed and established platforms within the crypto community.

Visit each platform’s website and read testimonials and user reviews. Focus on aspects like whether there were any complaints and how quickly they were tackled. Remember to visit reliable review platforms and forums like TrustPilot or Reddit for insights into user experiences and potential issues. You must also ensure the platform supports the specific digital currencies you intend to stake.

Step 2: Deposit Crypto Funds for Staking

After you’ve decided on a platform, the next step is to put cryptocurrency into your staking account. Most DeFi platforms ask that you link your digital wallet to their system. This step is easy. All you have to do is use wallet services such as MetaMask, Trust Wallet, or Ledger.

After linking your wallet, you can move cash to the staking pool. Remember the minimum staking requirements and any costs of depositing or withdrawing cash to avoid surprises later.

Step 3: Select a Validator

DeFi staking relies frequently on validators, who validate transactions and generate new blocks in blockchain networks. Your revenues heavily depend on the effectiveness and dependability of your chosen validator. Many staking systems allow you to pick your validator based on their performance history, cost structure, and other aspects.

Some systems automate this selection process, but if you have a choice, look for validators with a track record of uptime and excellent governance.

Step 4: Start Earning Staking Rewards

Once you have deposited the funds and picked a validator, you’ll begin to earn staking incentives depending on the amount of crypto you have staked and the current interest rates.

Depending on the platform’s policies, rewards can be distributed weekly, daily, or even monthly. Regularly monitoring your staking performance is important to ensure that your chosen validator continues to do well and that your returns are promising.

Conclusion

Understanding DeFi staking meaning is important for anyone who wants to engage with the latest financial technology. Selecting the right hosting solution is key for those ready to begin DeFi or boost their current operations.

RedSwitches offers numerous server solutions, including the best-dedicated server options tailored for high-performance needs. These solutions ensure your DeFi staking activities run safely, smoothly, and efficiently. So what are you waiting for? Visit the RedSwitches website today to find the perfect match for your DeFi journey.

FAQs

Q. Is DeFi staking safe?

DeFi staking carries risks, including smart contract vulnerabilities and market volatility. While measures like audits and insurance can improve safety, thorough research and consideration of risk management strategies are essential.

Q. How do you make money on DeFi staking?

You earn money through DeFi staking by receiving rewards, usually in the form of additional cryptocurrency, for your participation in supplementing the processes of a blockchain network. These rewards are usually proportional to the duration and value of your stake.

Q. What is DeFi Staking?

DeFi crypto staking involves locking digital to support the operations of a specific DeFi platform. In return, stakers earn rewards, typically in the form of additional cryptocurrency.

Q. How does DeFi Staking work?

DeFi Staking involves locking up your tokens in a staking pool or protocol to support the network’s operations. In return, you receive staking rewards.

Q. How to earn passive income with DeFi Staking?

You can earn passive income with DeFi Staking by simply staking your tokens and letting them work for you to generate staking rewards.

Q. What do DeFi Staking rewards consist of?

When you engage in DeFi Staking, you earn rewards through additional tokens, coins, or other incentives the platform provides.

Q. Are there different DeFi Staking platforms available?

Yes, various DeFiI Staking platforms offer different features and rewards to those who want to stake their tokens. The top 10 DeFi staking platforms include AQRU, CAKE DeFi, Binance, DeFi Swap, Nebeus, Nexo, Crypto.com, YouHolder, OKX, and Uphold.

Q. How does DeFi staking work?

DeFi staking involves staking tokens on a platform providing liquidity pool services. By participating in DeFi staking, you can earn rewards through the staking process.

Q. What are the types of DeFi staking?

DeFi staking includes various types, such as crypto staking, staking options, and staking programs. Each type of DeFi staking may have different staking activities associated with it.

Q. What are the benefits of DeFi staking?

DeFi staking provides an opportunity to earn staking rewards and passive income by staking tokens and participating in decentralized exchange platforms. It also allows you to earn rewards in the form of various staking options.

Q. How to stake DeFi?

To start staking DeFi, you need to select a trusted DeFi staking platform development company or service. Create an account, deposit your DeFi coins, and select the staking option that suits your investment goals to initiate the staking process. Follow the platform’s instructions to start staking.

Q. What is the future of DeFi staking?

The future of DeFi staking looks promising as it continues to attract more investors seeking passive income opportunities. DeFi staking platform development innovations are expected to enhance security and efficiency, making DeFi staking more accessible and reliable for a broader audience.

Q. What are the best DeFi staking platforms in 2024?

Some popular DeFi staking platforms include AQRU, CAKE DeFi, Binance, Nebeus, and DeFi Swap.

Q. What are the characteristics of the best DeFi staking platform?

The key characteristic that makes a DeFi staking platform ‘best’: A staking platform that supports several digital currencies. Besides that, other characteristics of the best DeFi staking platforms are that they pair with all major DeFi protocols and generally provide a wide array of staking options to cater to different investor needs. These platforms offer several digital currencies for staking and have advanced security measures.

Q. What are the risks of DeFi staking?

Like any investment, DeFi staking comes with risks, such as impermanent loss, smart contract vulnerabilities, and market volatility. To diversify risks, ensure to stake across different DeFi platforms.

Q. How does DeFi staking contribute to a platform?

By staking, users provide liquidity to DeFi platforms, enabling them to facilitate various financial transactions like lending, borrowing, and trading with improved security and efficiency.