Key Takeaways

- Dedicated servers boost security by protecting against online threats and unwanted access.

- They maintain stability by reducing downtimes and performance issues, which is crucial for staking.

- Servers increase efficiency by processing transactions and validations quickly.

- They reduce delays in communication, ensuring transactions are confirmed faster.

- Servers allow growth by providing scalable solutions that don’t compromise on performance.

- They help meet regulatory standards, making compliance with laws and regulations easier.

- Customizable features let users adjust server settings to meet specific needs.

- Managed by professionals, these servers operate at their best and resolve issues swiftly.

- Robust backup and recovery systems keep staking data safe from loss.

- Control and customization let users optimize their setup for better security and performance.

Crypto staking is like earning interest on your digital fortune. You lock up your coins to help secure a blockchain network, and in return, you get rewards. It’s an attractive way to grow your crypto holdings—but it’s not without risk. Hackers, technical slip-ups, and even simple price drops can threaten your staked assets.

This is where dedicated servers step in. Think of them as your staking fortress. A server is a computer all yours, designed with security and power in mind. It shields your staking activities from the dangers of the broader internet. With a server, you could be staking more safely and potentially earning bigger rewards.

Let’s dive into the risks in crypto staking and why servers offer a safer solution.

Table Of Contents

- Key Takeaways

- What is Crypto Staking?

- What Is a Dedicated Server?

- Navigating the Risks in Crypto Staking

- Mitigating Risks in Crypto Staking With Dedicated Servers

- Technical Implementation of Dedicated Servers for Staking

- Conclusion

- FAQs

What is Crypto Staking?

Credits: Freepik

Before discussing what are the risks in crypto staking, it’s crucial to understand what crypto staking is.

Crypto staking involves locking up a portion of your cryptocurrency to help validate transactions and secure a blockchain network. This network operates on a concept called Proof-of-Stake (PoS), where your staked coins act like voting power. The more coins you stake, the higher the chance you’ll be chosen to add a new block of transactions to the blockchain. In return for your contribution, you earn rewards in the form of more cryptocurrency.

Features of Crypto Staking

Let’s dive deeper into each of these key features of crypto staking:

Passive Income

Imagine your cryptocurrency working for you, even when you’re not actively trading it. Staking offers a way to generate returns on your holdings without constant buying and selling. The rewards you earn are akin to interest payments, adding to your initial staked amount and allowing your crypto assets to grow over time.

Supporting the Network

Proof-of-Stake blockchains rely on stakers to keep them running smoothly. By staking your coins, you participate in the network’s decision-making process. Your commitment helps ensure the security and resilience of the blockchain, protecting everyone’s transactions.

Potential for High Returns

Staking rewards can vary significantly across different cryptocurrencies and networks. However, the returns can sometimes be substantial, exceeding traditional savings accounts or fixed deposit rates. It’s crucial to remember, though, that crypto markets can be volatile, and the value of your earned rewards will fluctuate with the price of the staked cryptocurrency.

Lock-up Periods

When you stake, you agree to keep your coins ‘locked’ for a predetermined period. This time frame differs across various blockchains. The lock-up aims to incentivize long-term commitment to the network’s health and discourage actions that might harm it. During the lock-up period, you may not be able to access or trade your staked coins fully.

Technical Aspects

Becoming a validator on a Proof-of-Stake blockchain usually requires some technical understanding. You’ll need to set up and run a validator node, a computer that constantly communicates with the network. This involves software installation, hardware considerations, and ongoing maintenance to ensure optimal performance and security.

Benefits of Crypto Staking

Crypto staking shines as an appealing option for many crypto holders. Let’s explore why:

Earning Potential

The most immediate benefit is the chance to grow your crypto holdings. Instead of letting your coins gather virtual dust in a wallet, staking puts them to work. You can significantly increase your assets with some blockchains offering attractive staking rewards.

Simplicity (Compared to Mining)

Staking offers a more accessible way to contribute to a blockchain network compared to the complex world of crypto mining. You don’t need specialized, expensive hardware, and the energy consumption is far lower. This makes staking an attractive option for a broader range of crypto enthusiasts.

Supporting Blockchain Networks

By staking your coins, you become an active participant in securing and strengthening the blockchain you believe in. This supports decentralization, improves network resilience, and boosts the overall trustworthiness of the cryptocurrency.

Potential for Increased Coin Value

Staking can increase a coin’s value because it often involves locking up a portion of the circulating supply. As more coins are staked, the available supply on exchanges may decrease. This basic economics principle of supply and demand can lead to higher prices in the long run.

Long-Term Investment Strategy

Staking aligns well with a buy-and-hold mentality towards cryptocurrency investments. If you plan to hold your coins for an extended period, staking turns that idle time into an opportunity to generate additional returns.

Important Considerations

While staking boasts several advantages, there are essential points to consider before diving in:

- Market volatility: Even with staking rewards, your investment is subject to the inherent price fluctuations of cryptocurrencies.

- Lock-up periods: Committing your coins for a set duration can reduce your flexibility if you need to sell quickly.

- Technical requirements: Running a validator node requires a minimal level of technical knowledge in some cases. However, various staking services can simplify the process.

Overall, crypto staking offers a significant way for crypto holders to earn passive income, support decentralized technologies, and potentially contribute to the growth of their chosen crypto investments.

What Is a Dedicated Server?

Credits: Freepik

A reliable dedicated hosted server is a physical computer entirely rented by a single user, organization, or application. Unlike shared hosting environments, where multiple clients share a server’s resources, a dedicated hosted server offers exclusive control and full utilization of its hardware.

Features of Dedicated Hosted Servers

Dedicated hosted servers aren’t just a fancy upgrade; they provide a powerful foundation for demanding operations. Think of them as the ultimate toolkit for unlocking security, performance, and complete control of your online presence. Let’s explore the cornerstone features that make dedicated hosted servers a compelling choice:

Complete Isolation

With a dedicated hosted server, you have a physical machine entirely to yourself. This isolation translates to several benefits:

- Enhanced Security: Your data and applications are safeguarded from the actions of other users on a shared system, minimizing the risk of security breaches or interference.

- Improved Performance: You won’t experience slowdowns or resource contention caused by other customers’ activities on the same server.

Full Customization

Dedicated hosted servers offer unmatched control over your hosting environment. You have root-level access, meaning you can:

- Choose Your Operating System: For your specific applications and requirements, select the ideal OS (Linux, Windows, etc.).

- Install Any Software: You are not limited to pre-approved software packages. Install the tools, libraries, and applications you need without restriction.

- Fine-tune Configurations: Optimize server settings for security, performance, and application compatibility.

Dedicated Resources

All the hardware capabilities are yours to harness:

- Powerful Processors (CPUs): Multi-core CPUs ensure fast and efficient processing of your workloads.

- Ample Memory (RAM): Generous RAM prevents performance bottlenecks, especially when running memory-intensive applications.

- Scalable Storage: Based on your storage needs, you can choose between traditional hard disk drives (HDDs) or ultra-fast solid state drives (SSDs) and upgrade as required.

- Unthrottled Bandwidth: Enjoy high-speed network connectivity without sharing bandwidth with other users.

Reliability and Uptime

Reputable data centers housing dedicated hosted servers implement measures to ensure maximum uptime:

- Redundant Power Supplies: Power failures are mitigated, keeping your server online.

- Backup Generators: Additional backup systems protect against extended outages.

- High-Quality Network Infrastructure: Reliable connectivity minimizes downtime due to network issues.

Dedicated IP Address

A unique IP address is essential for:

- Domain Name Management: Link your domain name directly to your dedicated hosted server.

- Certain Applications: Functions like email servers or VPN gateways often require a dedicated IP.

Important Note: Features and levels of customization can vary slightly between different dedicated hosted server providers. It’s good practice to compare offerings and choose the provider that best matches your needs.

Benefits of Using a Dedicated Hosted Server

A dedicated hosted server stands tall in web hosting, offering many benefits that cater to various needs. From enhanced performance to heightened security, here are the top advantages of utilizing a dedicated hosted server for your online endeavors.

Improved Performance and Reliability

Dedicated hosted servers provide exclusive access to resources. This setup means your website or applications can run more smoothly and load faster. Since no other client shares your resources, such as CPU, RAM, or data storage, your operations are highly reliable. This reliability is crucial for high-traffic websites and critical applications.

Enhanced Security

Using a dedicated hosted server boosts security. Since you’re not sharing the server with others, your risk of exposing your data to other potentially harmful websites is minimal. This separation is essential for businesses handling sensitive transactions over SSL or FTP.

Customization and Control

Dedicated hosted servers allow full customization to fit your specific needs. You have full root and admin access, meaning you can install programs and perform custom configurations. This level of control is essential for businesses with special software requirements.

Unique IP Address

Each dedicated hosted server has its unique IP address. With shared hosting, if one website is a spam or an adult site, your website could share the same IP address, which could cause reputational damage and affect your website’s SEO rankings. With a dedicated hosted server, your unique IP protects your website from such risks.

No Overhead for Purchasing or Maintaining Equipment

If a company chooses a dedicated hosting provider, it can enjoy the benefits of having the server without managing the physical equipment itself. This situation can be a significant cost saver, as it eliminates the need for upfront investments in hardware and ongoing costs for upkeep and maintenance.

Scalability

Dedicated hosted servers offer scalability to meet your business needs. As your business grows, you can upgrade your server’s hardware to accommodate increasing traffic and more complex applications without migrating to a new server setup.

Also Read Infrastructure Requirements for Effective Crypto Staking

Navigating the Risks in Crypto Staking

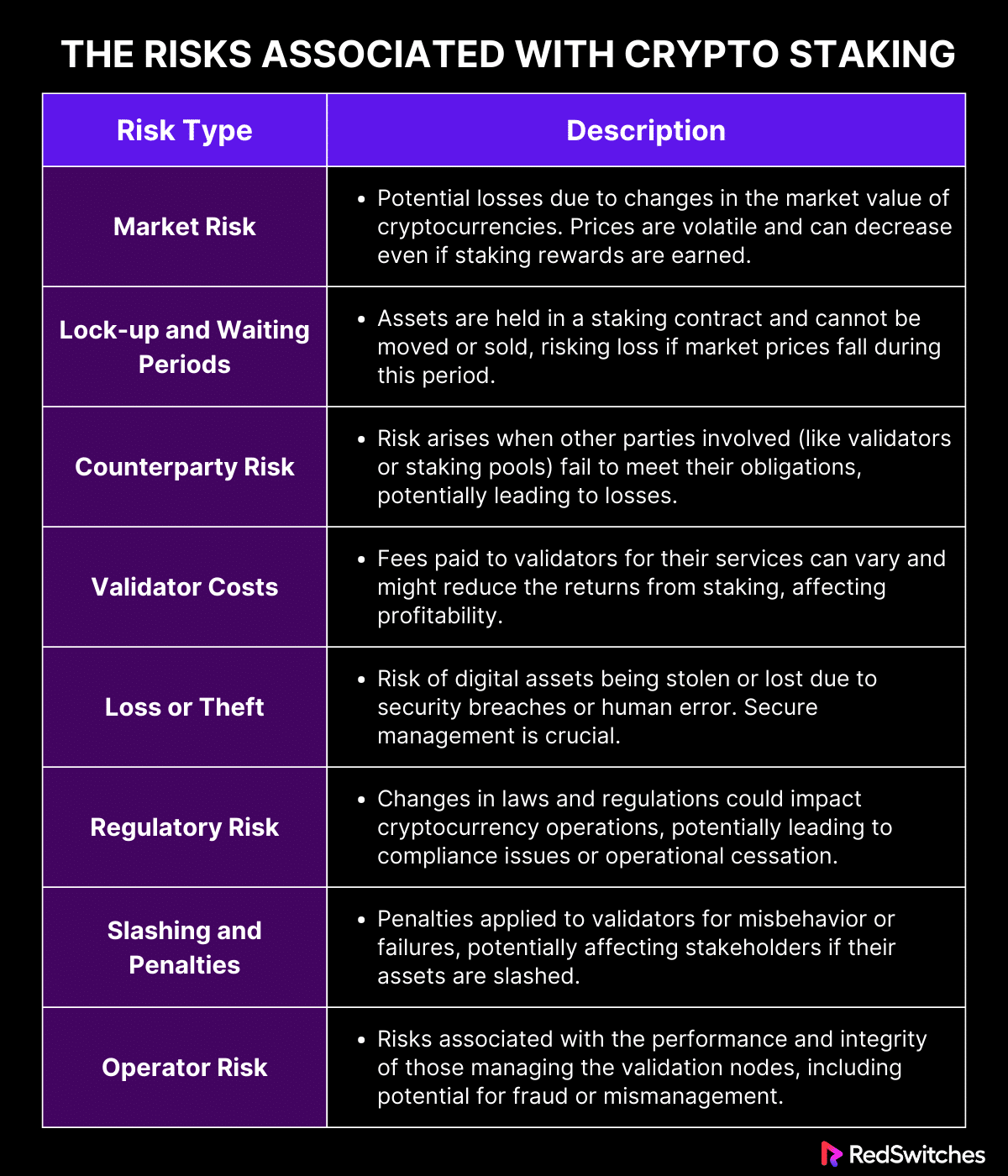

Staking your cryptocurrency may seem like a fantastic way to earn rewards, but it’s crucial to tread carefully. Like any investment, there are attached risks in crypto staking that could turn your profits into losses. Before you lock up your coins, let’s shed light on the potential dangers lurking in the staking landscape.

Market Risk

Investing in blockchain technology can be lucrative, but awareness of the risks in crypto staking is essential. Market risk is a significant concern in crypto staking. It refers to the uncertainty and potential losses due to changes in the market value of cryptocurrencies. The prices of digital assets are highly volatile. This means they can change quickly and unpredictably. When you stake cryptocurrency, you hope the price will stay stable or increase. However, the market can move against your expectations.

If the cryptocurrency’s market value falls, you might have a lower total value than when you started, even if you receive staking rewards. For example, if you earn a 5% annual return from staking, but the value of the cryptocurrency drops by 10% during the same period, you would face a net loss.

It is crucial to consider this risk because it can affect your investment significantly. The unpredictable nature of cryptocurrency prices makes it hard to guarantee profit from staking alone. You should be prepared to lose money due to market movements.

Lock-up and Waiting Periods

Enhance your knowledge of blockchain investments by exploring the risks in crypto staking. Lock-up and waiting periods are other risks associated with crypto staking. These terms refer to when your crypto assets are held in a staking contract and cannot be moved or sold. During the lock-up period, you cannot access your staked assets to sell them or use them for any other purpose.

This can be risky if the market prices fall significantly during the lock-up period. You would not be able to sell your assets to avoid losses. Some staking arrangements also have waiting periods for withdrawing your staked assets after the lock-up period has ended. This delay can further complicate your ability to respond to market changes.

Lock-up periods vary between different staking options and can be as short as a few days or as long as several years. The specific terms depend on the blockchain and the staking agreement. You need to be aware of these periods because they affect how quickly you react to market changes.

Counterparty Risk

Counterparty risk is an important risk to consider in crypto staking. It occurs when the other party in an agreement fails to meet their obligations. This risk is present in crypto staking when you rely on validators or staking pools. If these parties fail to perform as expected, it can lead to losses.

This risk is higher in crypto staking because it often involves new and sometimes untested technologies. Validators are crucial to the process. They are responsible for maintaining the network and validating transactions. If they fail to do their job, it can disrupt the entire staking process.

Furthermore, some staking platforms might be less reliable than others. They could be vulnerable to hacks, fraud, or mismanagement. If the platform managing your staked assets fails, you might lose your investment. This is why it’s important to choose trustworthy platforms and validators with a good track record.

Validator Costs

Credits: Freepik

Validator costs are fees paid to validators for their services in staking. These costs can reduce the returns you get from staking your crypto assets. Understanding these costs is essential because they vary widely depending on the blockchain and your chosen validators.

Validators charge fees to cover their operational costs. These include the costs of running servers and other equipment needed to validate transactions on the blockchain. The fees can be fixed or a percentage of the staking rewards. In some cases, they might also include performance-based fees.

Validator costs can significantly impact your returns. High fees can affect your profits, especially if the staking rewards are low. It’s important to compare the fees different validators charge before deciding where to stake your crypto assets.

Also Read Mastering the Pillars of Blockchain: A Deep Dive into Validator Nodes and Staking

Loss or Theft

Credits: Freepik

Loss or theft is a significant risk when it comes to crypto staking. This risk involves the potential for your digital assets to be stolen or lost due to various factors. When you stake cryptocurrencies, you usually transfer your assets to a staking pool or a validator’s wallet, which exposes your assets to security risks.

Theft can occur if hackers access the staking platform or the validator’s systems. Cybersecurity breaches are common in the crypto world. They can lead to substantial financial losses. Even highly secure platforms can be vulnerable to sophisticated cyber-attacks.

Human error can also cause asset losses. This includes sending assets to the wrong address or losing access to the wallet where your assets are stored. Mistakes in handling wallet keys or credentials can lead to irreversible losses.

To mitigate these risks in crypto staking, it is crucial to use reputable staking services with robust security measures. Always double-check addresses before sending cryptocurrencies and keep your private keys secure. Using hardware wallets for storing private keys can also enhance security.

Regulatory Risk

Regulatory risk deals with uncertainties and possible financial losses due to changes in laws that affect cryptocurrency and staking. Cryptocurrencies are in a quickly changing regulatory setting, and each country has its own rules and attitudes.

Laws can shift fast and have a big impact on the crypto market. For example, a new law could put strict rules on crypto exchanges or staking platforms. This might lead to higher costs or even force these operations to shut down in some places.

Additionally, regulatory actions can change the value of cryptocurrencies. News about strict regulations or legal issues can make the market unstable and cause prices to drop. This affects the profits from staking.

It’s crucial to keep up with the regulatory environment in the areas where you’re involved in crypto activities. Knowing about possible regulation changes can help you make smarter investment choices and lessen the risks associated with crypto staking.

Slashing and Penalties

For anyone new to digital currencies, comprehending the risks in crypto staking is a critical first step. Slashing and penalties are important risks to consider in crypto staking. These terms refer to the punishments applied to validators when they fail to act correctly or maliciously. When you stake your cryptocurrencies, you trust validators to maintain the network’s integrity and security.

Slashing occurs if a validator acts against the network’s rules. This could include actions like double signing or downtime. As a penalty, some of the staked cryptocurrencies might be taken away. This affects not only the validator but also the stakeholders who have delegated their tokens to the validator.

The main reason for slashing is to ensure that validators have a financial incentive to act in the network’s best interests. However, it introduces a risk for stakeholders. If the validator you are staked with is penalized, you could lose some of your staked assets.

To reduce this risk, it is important to choose validators with a good track record and reliable operational history. Look for validators with high uptime scores and robust security practices.

Operator Risk

Navigating through the complexities of cryptocurrency requires a solid grasp of the risks in crypto staking. Operator risk is associated with the individuals or entities that run the validation nodes in a staking arrangement. These operators can be crucial to the staking process because they manage the day-to-day operations that ensure the blockchain remains secure and transactions are processed efficiently.

The risk arises if these operators fail to manage their responsibilities effectively. This could be due to a lack of skill, poor management, or malicious intentions. Such failures can lead to network downtimes or security breaches, which might compromise the staked assets.

Additionally, the operator’s actions could lead to financial losses if they mismanage the funds or engage in fraud. This risk is particularly pronounced in smaller or less reputable staking pools where oversight might be less stringent.

To mitigate operator risk, stakeholders should conduct thorough due diligence before choosing a staking pool or validator. This includes reviewing the operator’s reputation, past performance, security measures, and operational transparency. Choosing operators with a strong track record and clear governance structures can help minimize this risk.

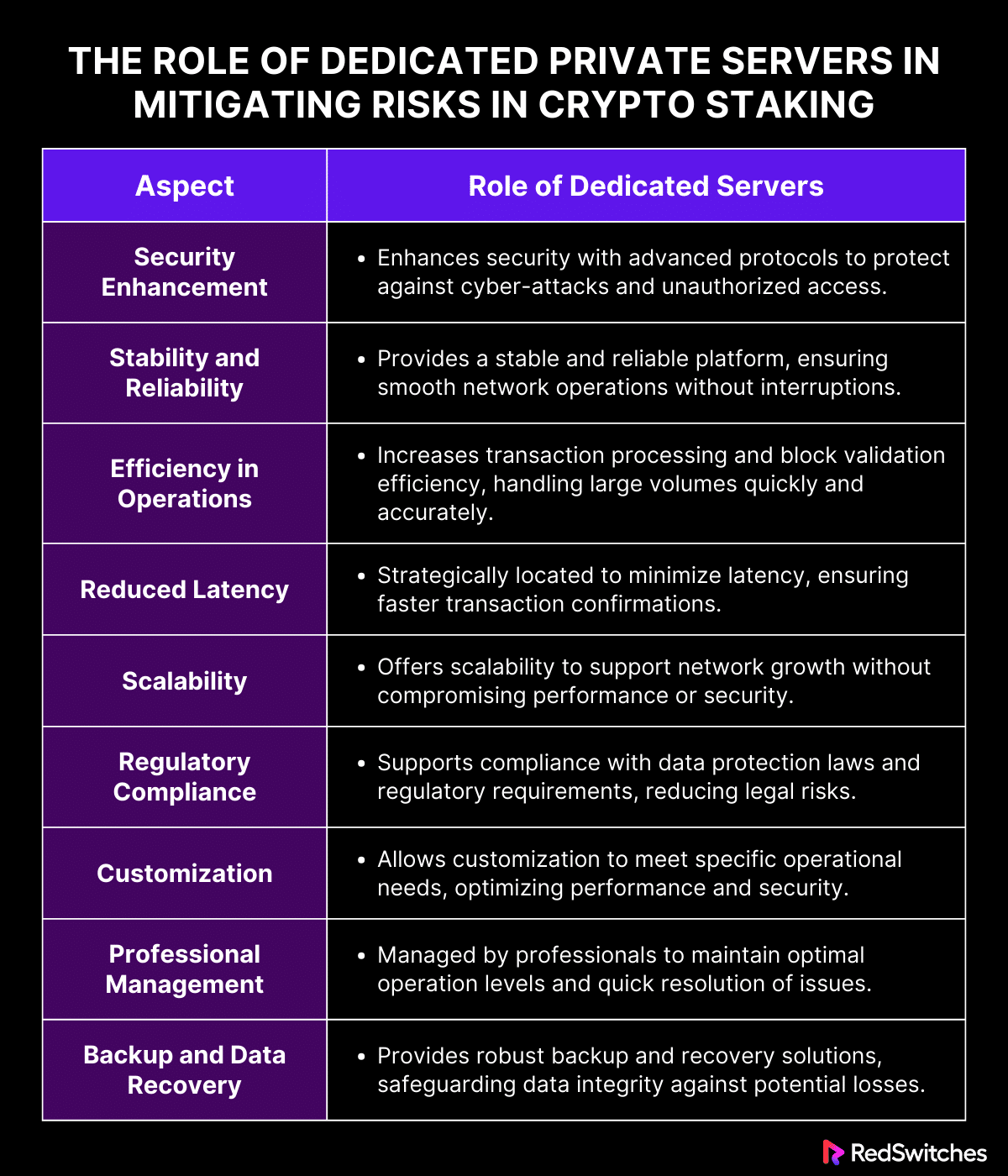

Mitigating Risks in Crypto Staking With Dedicated Servers

Optimizing your crypto investments involves mitigating the risks in crypto staking. Dedicated hosted servers play a crucial role in enhancing the security and stability of crypto staking. They mitigate risks associated with the staking process by providing a controlled environment. Here is how servers address these risks:

Security Enhancement

Dedicated hosted servers offer enhanced security features vital in protecting staked assets. They are equipped with advanced security protocols that help shield the network from cyber-attacks and unauthorized access. This is critical because the integrity of staking depends heavily on the assets’ security.

Stability and Reliability

Credits: Freepik

Dedicated private servers provide a stable and reliable platform for staking operations. They ensure the network runs smoothly without interruptions, essential for maintaining continuous operations. Stability is key to avoiding potential losses arising from downtime or performance issues.

Efficiency in Operations

Dedicated private servers significantly improve transaction processing and block validation efficiency. These servers have powerful processing capabilities that can handle large volumes of transactions quickly and accurately. This efficiency reduces the risk of errors and delays in the staking process, which can affect the returns on staked assets.

Reduced Latency

Dedicated private servers are often strategically located to minimize network communication latency. Lower latency leads to faster transaction confirmations. Which is crucial in maintaining the timeliness and relevance of staking operations, particularly in volatile market conditions.

Scalability

As the staking network grows, the need for scalable solutions becomes critical. Dedicated private servers provide scalability, which allows the staking infrastructure to expand without compromising performance or security. This scalability is crucial for accommodating an increasing number of transactions and participants in the network.

Regulatory Compliance

With the increasing focus on regulatory compliance in the crypto industry, dedicated private servers can help meet these requirements. They can be configured to support compliance with data protection laws, transaction reporting, and other regulatory requirements. This is important for avoiding legal penalties and enhancing the credibility of the staking platform.

Also Read What Is Crypto Staking Calculator and Top Crypto Staking Calculators?

Customization

Dedicated private servers offer the flexibility to be customized according to specific needs. This means that staking platforms can optimize their server environments to match operational requirements. Customization includes setting firewalls, configuring software, and adjusting storage resources to maximize performance and security.

Professional Management

Professional teams with expertise in system security and maintenance often manage dedicated private servers. This professional management ensures that the servers always operate optimally and that potential issues are resolved quickly. Expert oversight helps prevent technical problems that could lead to staking losses.

Backup and Data Recovery

Credits: Freepik

Servers offer strong backup and data recovery options. These are key for keeping staking data safe from losses caused by hardware or software issues. Good backup strategies help maintain data integrity, which is vital for the trustworthiness of the staking process.

Dedicated private servers play a crucial role in reducing risks in crypto staking. They boost security, increase reliability and efficiency, support growth, and ensure compliance with regulations. These servers form a strong foundation that keeps the staking environment secure and stable. Using such servers can greatly lower the risks tied to managing digital assets.

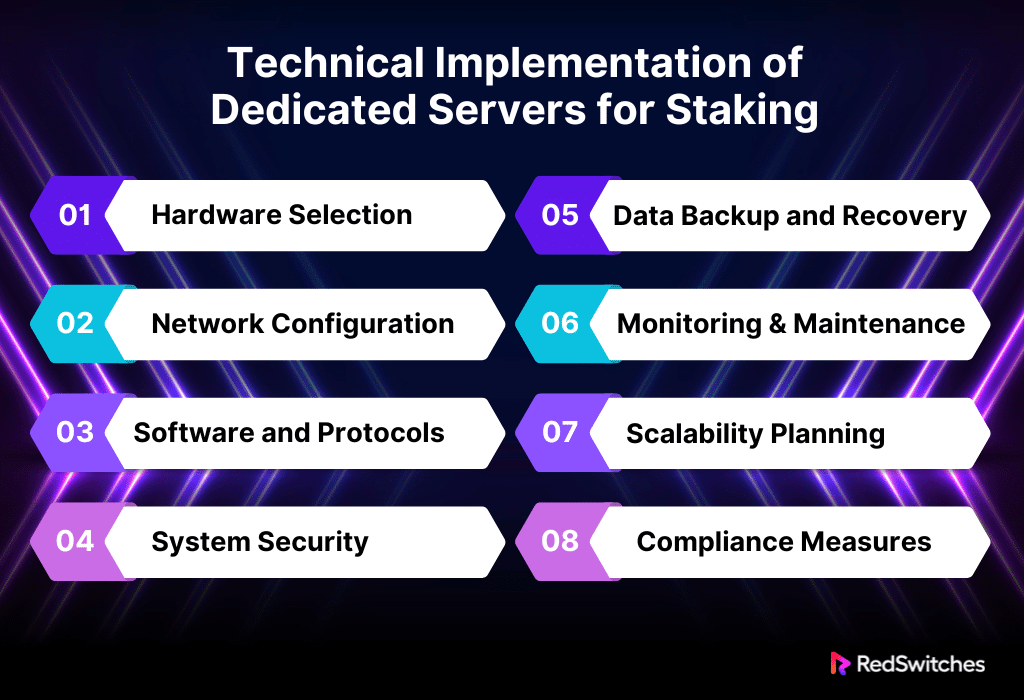

Technical Implementation of Dedicated Servers for Staking

Implementing dedicated private servers for crypto staking involves several technical steps. These steps ensure the servers are optimized for security, performance, and reliability. Here’s a breakdown of the key components:

Hardware Selection

Choosing the right hardware is critical. Dedicated private servers for staking require robust processors, high-speed memory, and ample storage. This hardware supports the intensive computational demands of blockchain transactions and staking processes.

Network Configuration

The network setup is crucial for maintaining fast and secure communications between nodes. Configuring servers involves setting up a private network that minimizes external threats. Firewalls and intrusion detection systems are also implemented to enhance security.

Software and Protocols

Installing and configuring the necessary software is a key step. This includes the blockchain protocol software that manages the staking process. The software must be regularly updated to protect against vulnerabilities. Encryption protocols are also installed to secure data transmissions.

System Security

Security measures are paramount. This includes installing antivirus software and regularly scanning for malware. System security also involves setting up multi-factor authentication and strict access controls to prevent unauthorized access.

Data Backup and Recovery

Implementing robust data backup and recovery processes is essential. Regular backups are scheduled, and data is stored in multiple locations to prevent loss. Recovery tests are conducted to ensure that data can be quickly restored in case of a failure.

Monitoring and Maintenance

Credits: Freepik

Continuous monitoring of the server’s performance and security is necessary. This includes tracking system health, resource usage, and potential security breaches. Regular maintenance checks are performed to ensure the hardware and software function optimally.

Scalability Planning

As the staking network grows, the server infrastructure must scale accordingly. This involves planning for additional hardware and network resources. Scalability ensures the system can handle increased transaction volumes without degradation in performance.

Compliance Measures

Technical measures address regulatory compliance. This includes logging transactions and maintaining records according to legal requirements. Compliance software may be used to automate these processes and ensure they meet industry standards.

Each component plays a vital role in the technical implementation of servers for staking. By carefully addressing these areas, stakeholders can ensure that their staking operations are secure, efficient, and capable of supporting the demands of a growing blockchain network.

Also Read: Mastering Backup and Recovery Strategies for Staked Assets on Servers

Conclusion

Dedicated servers are key for better security, efficiency, and reliability in crypto staking. They build a strong base that meets staking needs and cuts down risks. By quickly processing many transactions, following regulations, and offering solutions that can grow, servers make sure staking operations work well in a safe and stable setting. They are essential in reducing risks from market changes, security issues, and operational problems in the ever-changing world of cryptocurrency staking.

Are you ready to improve the reliability and efficiency of your staking operations? Check out RedSwitches’ dedicated servers today. Enhance your crypto staking with our top-notch solutions, which promise the utmost security and performance. Join us now and advance your staking efforts to a higher level!

FAQs

Q. Is staking crypto worth the risk?

Staking crypto can be worth the risk for those looking to earn rewards on their holdings, as it provides a way to generate passive income through interest-like payments from validating transactions. However, the value of these rewards can fluctuate due to market volatility, and there are risks like lock-up periods and potential loss of funds.

Q. What are the risks of staking rewards?

The main risks include price volatility, which can diminish the real value of the rewards if the cryptocurrency’s price falls, and lock-up periods that prevent access to your funds for a duration, possibly resulting in missed opportunities elsewhere. There’s also the risk of poor performance or dishonesty from validators.

Q. Can staked crypto be stolen?

Yes, staked crypto can be stolen, especially if the staking platform or wallet where the cryptocurrencies are held is hacked. Ensuring the security of the platform and using strong security measures for wallets are crucial to mitigate this risk.

Q. What is the risk of staking a smart contract?

Staking in a smart contract poses risks, such as bugs or vulnerabilities in the contract code that could be exploited, leading to financial losses. To minimize this risk, it’s important to stake with well-audited and reputable smart contracts.

Q. What is the downside to staking Ethereum?

The downside to staking Ethereum, especially as it transitions to Ethereum 2.0, includes the need for a considerable amount of ETH to become a validator, long lock-up periods during which your ETH cannot be accessed or sold, and potential penalties for downtime or malfunctions in validator software.

Q. What is crypto staking, and how does it work?

Crypto staking is a process where crypto investors lock up their staked tokens to participate in maintaining the operations of a blockchain network through a consensus mechanism like Proof of Stake. Doing this, they help validate transactions and secure the network, earning crypto rewards in return.

Q. What are the main benefits and risks of staking in crypto?

The benefits include earning staking returns, which provide a way to make passive income from crypto holdings. However, the risks involved in staking include liquidity risk, slashing risk, and the inherent volatility of crypto prices, which can affect the value of the staked tokens.

Q. How can I start staking my crypto?

To start staking, you must choose a platform or validator and transfer your tokens to a staking pool. Most cryptocurrency exchanges and some crypto wallets offer staking options. It’s important to understand the specific staking process, the staking period required, and any associated risks.

Q. What should I consider when choosing where to stake my crypto?

When selecting a platform for staking, consider the security of the platform, the potential staking returns, the liquidity of your staked tokens (especially if you might need to withdraw your crypto quickly), and any fees involved. Understanding the risks associated with the specific form of staking you are considering.

Q. Can I participate in staking without owning a lot of crypto?

Smaller investors can participate in staking without a large amount of crypto by joining a staking pool. In a pool, many users delegate their staking power to a staking pool operator, which allows them to contribute smaller amounts of crypto and still benefit from staking rewards.