Key Takeaways

- Dedicated servers enhance staking security and control.

- Geographical diversification and failover setups boost staking reliability.

- Custom security protocols and hardware customization improve staking efficiency.

- Multi-chain staking and automation enhance reward potential and risk management.

- Partnering with reliable server providers like RedSwitches is crucial for success.

- Staking with dedicated servers allows for sophisticated, scalable investment strategies.

- Regular monitoring and adaptation to technological and market changes are essential.

Staking via dedicated servers is a great way to invest in cryptocurrencies at their leading edge. Staking techniques need to be safe and effective as digital assets continue to change the face of finance. Dedicated servers are unique because they give better uptime, more robust security, and more control. We’ll delve into sophisticated staking tactics using dedicated servers in this article, enabling you to maximize your crypto staking strategies earnings while protecting your money.

Regardless of your level of experience with cryptocurrencies, the information provided here will give you the skills you need to make staking a practical part of your overall investing plan. Stay tuned as we investigate how to maximize the potential of your digital assets.

Table Of Contents

- Key Takeaways

- What is Crypto Staking?

- How Crypto Staking Works?

- Benefits of Crypto Staking

- Factors to Consider Before Staking

- What is a Dedicated Server?

- Advanced Crypto Staking Strategies Using Dedicated Server

- Tips for Maximizing Income through Staking

- Future of Crypto Staking

- Conclusion

- FAQs

What is Crypto Staking?

Credits: Freepik

People use “crypto staking” in various blockchain networks. These networks use the proof-of-stake (PoS) consensus method. Users lock up some of their Bitcoin to enable network functions. These include transaction validation and security on the blockchain network. Staking is a popular way to generate passive income with digital assets. Participants, called “stakers,” receive extra cryptocurrency in exchange.

A number of blockchain networks use the proof-of-stake (PoS) consensus mechanism, and one such process is cryptocurrency staking. Participating blockchain network users must lock up a portion of their Bitcoin to sustain the network’s functions, including transaction validation and network security. Participants, also known as “stakers,” receive more cryptocurrency in exchange, which makes staking a well-liked way to generate passive income from digital assets.

By staking your cryptocurrency, you lock the funds in a wallet. The blockchain can then be used for minting or validation to make new blocks. Depending on several criteria, such as the amount and duration of their stake, staker selection for a new block may occur. When a staker creates a block, they can get incentives. These are usually in the form of more coins. The coins grow their holdings and possibly give them more clout in the network.

Staking is usually done with a cryptocurrency wallet or a staking pool. In a pool, stakeholders combine their resources to raise their odds of winning rewards. Incentives are typically given out by the amount of cryptocurrency each player has staked. There are hazards, though, such as the possibility that digital assets could be lost due to security lapses or a drop in asset value. Still, staking has grown in popularity. It lets cryptocurrency owners earn income passively. They can also bolster the security and stability of the blockchain.

How Crypto Staking Works?

Credits: Freepik

Staking is vital for many blockchain networks. They use the proof-of-stake (PoS) consensus. This is a thorough description of how it operates:

Proof-of-Stake (PoS)

Blockchain networks use Proof-of-Stake (PoS) to reach consensus. It protects network security. The Proof-of-Work (PoW) model needs powerful computers to solve challenging block-mining problems. In contrast, the Proof-of-Stake (PoS) model needs participants or validators. They must keep and lock an amount of the blockchain’s native cryptocurrency as a security deposit. This stake serves as collateral. It gives validators a financial incentive. They get it for upholding network integrity and accurately doing transactions. PoS provides a more scalable and green security method. It does this by cutting the need for energy-intensive mining.

Staking Crypto

A cryptocurrency that runs on a proof-of-work (PoS) system must be owned by the staker to participate in staking. Transferring a certain quantity of this coin into a blockchain wallet intended for staking is the first step in the staking process. In this process, sometimes called “staking,” a user shows their willingness to fund network functions. These functions include transaction validation. Following the guidelines established by the blockchain contributes to network security and allows stakeholders to participate in governance activities like voting on protocol upgrades or modifications.

Becoming a Validator

Users may be eligible to become validators by staking their Bitcoin, though the precise requirements may vary significantly amongst blockchain networks. The likelihood of validating transactions and proposing new blocks is often impacted by stake size; the more significant the stake, the greater the likelihood of being chosen. Specific networks use a pseudo-random selection procedure that considers variables like the staked amount and duration of the currency. Others may further decentralize the process by adding components of reputation or even assigning voting systems to select validators.

Verifying Transactions

In a proof-of-work blockchain, validators are essential in guaranteeing the legitimacy of every transaction within a block. This entails confirming the digital signatures to ensure that the transaction has not been tampered with and that the sender has enough money to finish the transaction. After successful validation, these transactions are assembled into a new block. To further strengthen security and confidence in the process, validators also need to verify that the transactions follow the guidelines set out by the blockchain protocol.

Creating New Blocks

The accountable validator builds a new block and submits it to the network after verifying transactions. After that, other nodes must verify that the newly created block satisfies all protocol requirements to be added to the blockchain. This decentralized verification procedure protects the blockchain’s integrity and aids in the prevention of fraudulent transactions.

Earning Rewards

In exchange for their work preserving the network’s functionality, validators receive rewards. These benefits are usually obtained from transaction fees that users pay and, occasionally, from a percentage of the inflationary tokens that the network issues. The rewards given to validators depend on how much of their stake they have in the transaction or block that they have successfully verified and added to the chain. As a result of this incentive program, validators are encouraged to uphold the network and act honorably, as unethical behavior might result in consequences like losing all of their staked tokens.

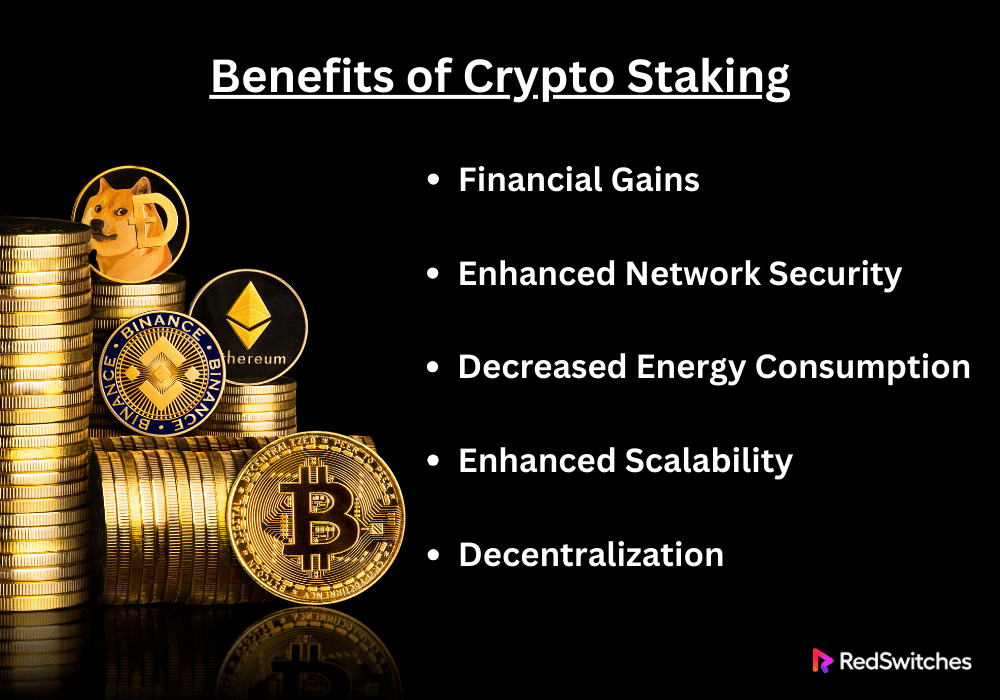

Benefits of Crypto Staking

Numerous advantages are provided by cryptocurrency staking to the network and to the participants. The following are some of the main benefits:

Financial Gains

One of the main advantages of crypto staking is the potential to generate passive income. Participants earn rewards for staking their tokens. The rewards are usually a percentage of transaction fees or of newly created currency. The number of rewards may differ based on the network’s staking rules. It depends on the amount of cryptocurrency staked and how long you hold the tokens. This income can be very alluring. It lets investors increase their holdings without more financial investments.

Enhanced Network Security

The staking process in proof-of-stake (PoS) systems improves network security. Validators are guaranteed a stake in the proper processing of transactions by being required to lock up a portion of their holdings. Validators risk harsh penalties. They may lose their staked tokens. This can happen for any activities that harm the network, such as validating fraudulent transactions. This financial commitment upholds the blockchain’s integrity and reliability while discouraging harmful activity.

Decreased Energy Consumption

Credits: Freepik

Proof-of-stake systems use much less energy than proof-of-work (PoW) systems. PoW systems demand lots of computing power and energy, as seen in Bitcoin mining. Mining equipment that is costly and energy-intensive is not necessary for staking. Instead, it depends on validators. They carry out network functions based on the amount they have staked. This greatly lowers the blockchain’s total energy use.

Enhanced Scalability

Compared to their proof-of-work predecessors, proof-of-stake blockchains may process a higher volume of transactions more quickly. PoS allows faster and more effective transaction addition to the blockchain by eliminating the need for intricate mathematical calculations during block mining. PoS blockchains are now more scalable, opening up new possibilities for daily financial services and microtransactions.

Decentralization

In contrast to PoW systems, where the expensive cost of mining equipment can be an entry barrier, staking frequently enables more individuals to participate in the validation process. Still, the degree of decentralization can vary depending on the particular architecture of the PoS protocol. Staking reduces these obstacles so that a broader range of users can participate in network choices, which could result in a blockchain network that is more democratic and decentralized.

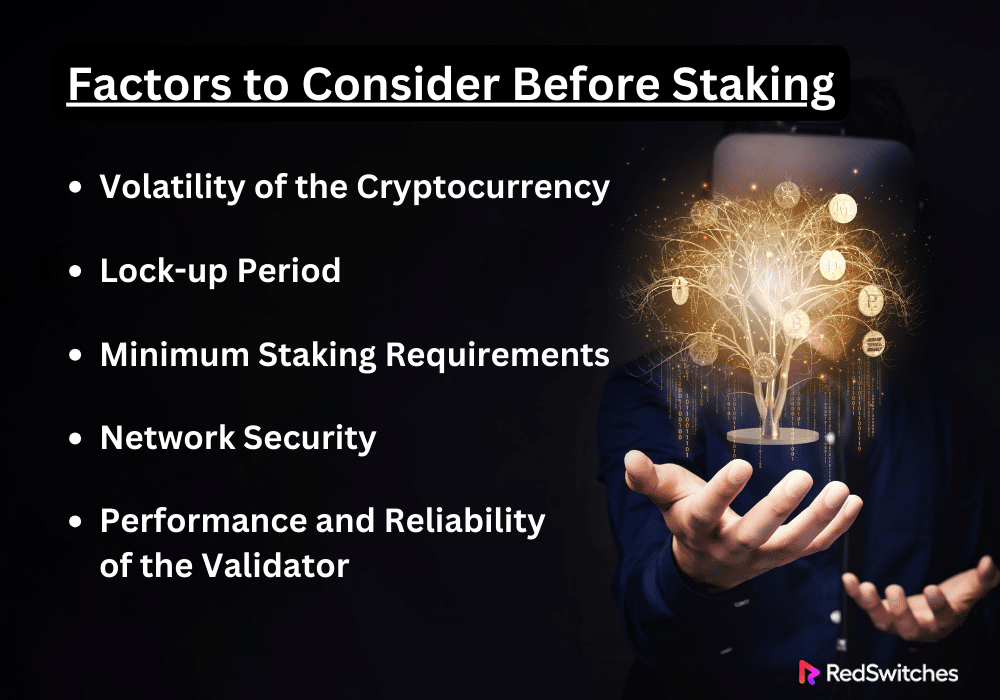

Factors to Consider Before Staking

It is important to weigh several elements that may affect the risks and potential rewards of crypto staking before deciding. Here’s a thorough examination of the critical factors to consider:

Volatility of the Cryptocurrency

Cryptocurrencies are inherently volatile. They can greatly impact staking income, as they are prone to big price changes. Investors must judge the long-term real worth of these returns. They must also consider the immediate gains in token numbers. You must carefully study market trends. Also, look at the cryptocurrency’s past stability or volatility patterns. Also, consider macroeconomic variables that may impact its price. Knowing these factors can help make intelligent decisions. They are about entering or exiting staking positions to maximize financial outcomes.

Lock-up Period

Lock-up periods for staking vary a lot between blockchains. They impose a time when your assets are not liquid. This lack of liquidity can be a severe risk when there is market turbulence or when an individual needs money. You must understand all the lock-up conditions. This includes any events that could lead to an early release or the consequences of doing so. Assess your financial status and liquidity needs first. This is important before entrusting your money to a staking contract. Such a contract could tie up your capital for a long time.

Minimum Staking Requirements

Credits: Freepik

In some networks, staking may be restricted to more prominent investors. This is due to the requirement of owning a high minimum number of tokens. You must check if the minimum stake suits your investing ability. Also, consider the risk/reward ratio it entails. Prospective investors should also check if these limits may change. The network will change them. It will do so as its staking policy responds to evolving market conditions or network requirements.

Network Security

Protecting staked assets is critical since staked token safety is directly impacted by network security. It is crucial to look into the security mechanisms that underpin the blockchain, the frequency and seriousness of previous security lapses, and how the network handles these situations. It’s also helpful to comprehend the blockchain’s security architecture, including any sophisticated cryptographic techniques or consensus improvements it uses. Stakeholder investments can be further protected by staying updated on security changes and participating in network security conversations.

Performance and Reliability of the Validator

The validator selection is essential in networks where staking entails delegation to outside parties. Metrics such as a validator’s uptime record, success rate in verifying blocks, and overall network stability contribution are crucial to take into account. In addition to producing lesser profits, underperforming validators run the danger of being penalized. To make sure that any validator’s governance methods, fee schedules, and transparency match your staking objectives and risk tolerance, it is advisable to evaluate them.

What is a Dedicated Server?

Credits: Freepik

A dedicated server is a kind of remote server entirely devoted to a person, group, or program. Shared hosting services allow many clients to share a single server’s resources. In contrast, a dedicated server is used by only one client. With this setup, the client has complete control over the server. They can pick the hardware, operating system, and configurations.

Better performance and security are the main benefits of having a dedicated server. The server will not be slowed, overburdened, or corrupted by other users. They do not share their resources.

Dedicated servers provide strong processing power, lots of RAM, and ample storage capacity. Clients can tailor the server to meet specific needs. For example, they may need to manage many transactions, build complex databases, or run resource-hungry applications. Also, data centers have high bandwidth and vital uptime. They can house dedicated servers, ensuring uninterrupted and effective operation for server-based applications.

Additionally, dedicated servers offer high security, which is crucial for companies that handle sensitive data or must adhere to legal requirements. Organizations can adopt their own security procedures and policies on a dedicated server instead of depending on the shared security policies associated with shared hosting. To strengthen defenses against cyberattacks and data breaches, this entails installing specialized firewalls, security software, and access controls.

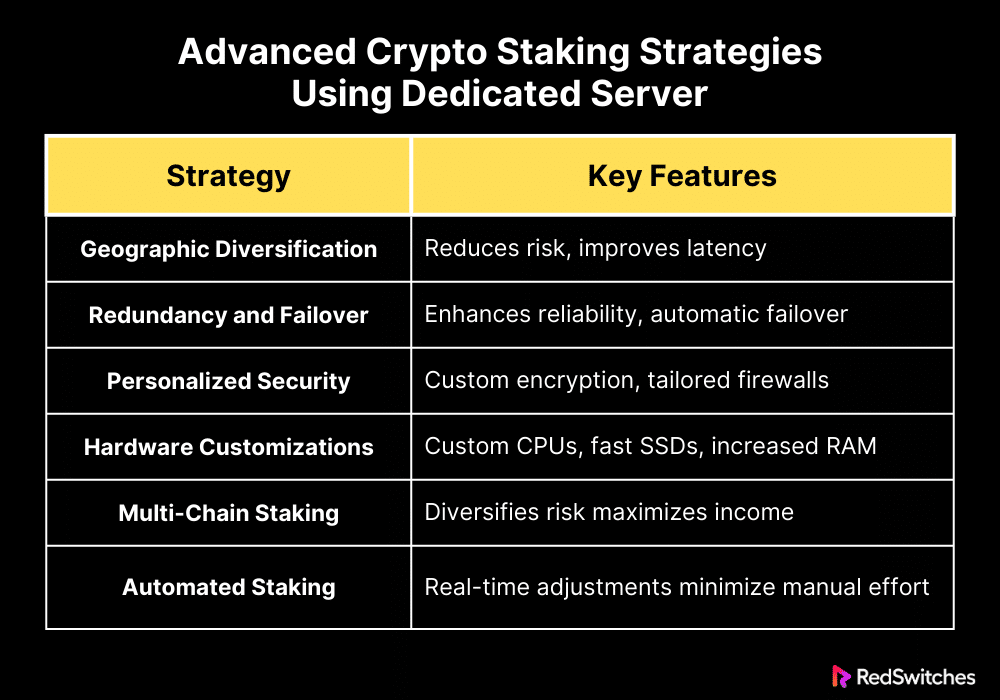

Advanced Crypto Staking Strategies Using Dedicated Server

They use the power of dedicated hardware. Advanced crypto-staking solutions with dedicated servers aim to make staking better and safer. These tactics are beneficial. They are for serious investors. The goal is to maximize profits, boost security, and gain more control over their staking activities. Here’s a thorough examination of a few sophisticated tactics:

Diversification of Server Locations Geographically

Geographically distributing server locations is one tactical benefit of employing dedicated servers. This can strengthen the staking operation’s resilience to network problems or regional outages. Staker risks can be reduced by spreading out staking activities. This should be done across multiple data centers in various regions. This reduces exposure to local power outages, political unrest, or deliberate cyberattacks. This strategy places servers closer to other network nodes. It can also reduce latency in verifying transactions. It also improves reaction times and may increase the likelihood of being chosen to validate or forge a block.

Put Redundancy and Failover Mechanisms in Place

Experienced staking enthusiasts can improve dependability. They can do this by adding redundancy and failover methods. They can do this using dedicated servers. By mirroring each other’s operations, numerous servers may be set up with low downtime so that if one goes offline, another can quickly take over. This is crucial in staking situations. Downtime might lead to penalties. Uptime affects the chance to collect rewards. Automated failover solutions can keep the network involved. They switch over instantly and without human help.

Using Personalized Security Protocols

Stakeholders can use dedicated servers. They can employ Personalized Security Protocols that beat regular security measures. It includes advanced encryption for data transmission and storage. Also, there are specially designed firewalls for certain network threats. And there are intrusion detection systems. They keep an eye out for odd activity related to cryptocurrency transactions and staking patterns. Physical security measures, like biometric access restrictions and round-the-clock surveillance, can also prevent hardware theft and tampering at data centers.

Enhancing Node Performance with Hardware Customizations

Dedicated servers allow hardware to be customized. This meets the unique needs of different blockchain protocols and staking algorithms. This may mean adding fast SSDs to speed up data access. It also means updating CPUs to faster models and adding RAM to handle more prominent blockchains or transaction volumes. The efficiency and speed of the staking process can be significantly increased by customizing the hardware of the server. This is a significant advantage in networks. Staking rewards depend on fast transactions and block validation.

Operating Simultaneous Multi-Chain Staking

Staking many cryptocurrencies helps advanced investors diversify their holdings. Dedicated servers provide the strong capacity needed to run many staking nodes at once. The nodes are from various blockchains. Capturing rewards across several networks maximizes prospective income and diversifies risk. You can monitor and adjust staking on these blockchains with efficient management software. It optimizes allocations based on performance and reward forecasts.

Automated Staking Tactics

Lastly, stakers can use automated staking tactics. They can do this by using the control and customization features of dedicated servers. These tactics use software. The software can change stake holdings based on performance measures and real-time market data. Algorithms can be trained to automatically redistribute stakes to more profitable or dependable validators, anticipate the best amounts to stake, and adapt to network changes such as revisions to consensus rules. This degree of automation reduces the need for manual oversight and adjustment while maximizing staking profits.

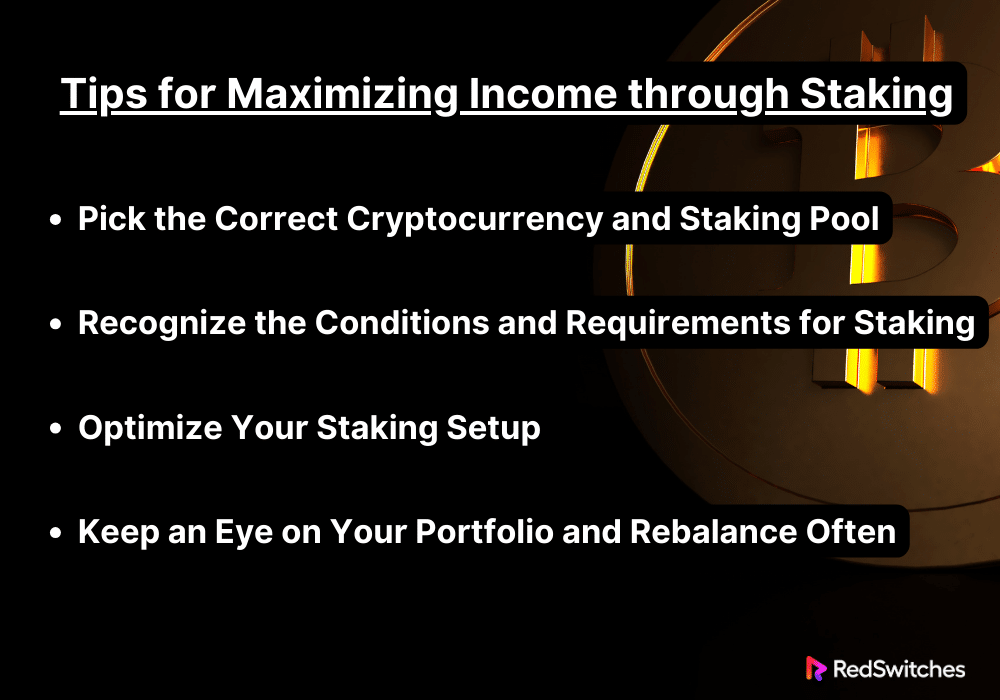

Tips for Maximizing Income through Staking

Planning strategically, choosing your staking options wisely, and maintaining your staking assets are all necessary to maximize your revenue from crypto staking. The following thorough advice will help you increase your staking rewards:

Pick the Correct Cryptocurrency and Staking Pool

The success of staking depends on the choice of cryptocurrency. Seek out cryptocurrencies with a solid track record and show promise for growth in the future. Examine the cryptocurrency’s core technology, development team, market capitalization, and community support. In addition, if you lack the resources to operate a single validator node, selecting the appropriate staking pool is crucial. Staking pools should be assessed according to their track record, payout frequency, cost structure, and dependability. It is possible to considerably boost your net earnings by choosing a trustworthy pool that charges less and has precise operations.ds:

Recognize the Conditions and Requirements for Staking

Staking rules vary across blockchain networks. They cover minimum stake sizes, lock-up times, and fines for validator downtime or malfeasance. Before you allocate your resources, be sure you comprehend these terms completely. This info will help you avoid unexpected fines or losses. It will also ensure that your staking plan follows the rules of the network.

Optimize Your Staking Setup

If you are using dedicated hardware for staking, set up your server to ensure high uptime and performance. This includes setting up your system to manage nodes well. It means choosing dependable hardware and getting a steady internet connection. Protect your server from cyberattacks with high-quality security solutions to avoid cash losses or jeopardize your staking benefits. Invest Diversely

Similarly to conventional investing, staking can benefit from diversification as a means of risk management. Consider staking various coins to diversify your risk and boost your possible revenue streams. Diversifying your holdings can also help you profit. It lets you profit from changes in interest rates, lock-up times, and staking rewards. These factors vary among different blockchains. But keep an eye on the intricacy of managing several staking agreements and be updated on the status and modifications of every blockchain system.

Keep an Eye on Your Portfolio and Rebalance Often

Staking is not a “set it and forget it” investment. It’s essential to monitor your staked assets regularly to respond promptly to changes in the market or network protocols. Periodically review your staked assets to be sure they are still contributing optimally to your portfolio. Rebalancing could entail transferring your bets to safer or more lucrative validators or alternating between cryptocurrencies when market conditions shift.

Future of Crypto Staking

Staking cryptocurrency will change a lot. This will happen as blockchain tech advances and the ecosystem around digital assets grows. The following significant factors will influence how staking in the cryptocurrency industry develops in the future:

Increased Adoption and Mainstream Integration

More people and groups are expected to start staking. They will do this to make passive income. Interest in and acceptance of cryptocurrencies are rising. PoS networks will be more secure due to this increased participation. It may also push more traditional financial systems to adopt and use staking. Banks and financial institutions could offer staking services. They could integrate these services with traditional banking products.

Technological Developments and Protocol Upgrades

Staking is expected to become more efficient and appealing as blockchain technology advances. Sharding divides the network into smaller, easy-to-manage chunks to boost blockchain scalability. It may also improve staking. This would make the process faster and more energy-efficient. Also, as staking protocols are updated and improved, security, ease of use, and speed will all increase. And, more people will join the staking ecosystem.

Regulation and Compliance

The cryptocurrency market is developing. It is anticipated that the laws for crypto assets, including staking, will become clearer and more uniform. The clear rules will likely bring in more institutions. They will also make staking safer and easier for regular users. Regulations, however, can also limit staking activities, which might impact the benefits that tokens can produce or how freely they can be staked.

Trends in Decentralization

The core tenet of blockchain technology is decentralization. Subsequent staking models may concentrate more on strengthening decentralization and resolving the issue of large stakeholders or pools controlling an excessive amount of the network. Thanks to innovations like liquid staking and non-custodial staking, smaller token holders will be able to participate without giving up their assets. This will encourage a more fair and decentralized network.

Enhanced Security Measures

Attack motivation will climb when larger sums of money are locked in staking contracts, raising the stakes (pun intended). This will spur innovation in staking protocols and security tech. They will protect assets from complex attacks like those posed by quantum threats. Anticipate the standardization of multi-layer security methods and enhanced cryptographic algorithms as standard operating procedures within staking platforms.

Conclusion

In summary, using dedicated servers for advanced crypto staking strategies is a powerful way to boost cryptocurrency profits. It also improves security and control over your digital assets. You can use dedicated hardware. It will maximize uptime and boost scalability. You can also customize security to meet your needs. We’ve seen that these tactics allow for more complex and varied investment plans. They also increase the effectiveness and reliability of your staking activities.

Working with a trusted server supplier is key. It is essential to applying these new tactics. RedSwitches is a top option because it provides comprehensive security features specifically designed for cryptocurrency staking and high-performance dedicated servers that guarantee maximum uptime.

We give you the confidence to focus on growing your staking portfolio and maximizing rewards while ensuring your staking arrangement succeeds.

FAQs

Q. What is the best way to stake crypto?

The best ways to stake cryptocurrency are to utilize a dependable staking pool or dedicated server, guarantee security and uptime, and select a cryptocurrency with a solid network and track record.

Q. Which staking is the most profitable?

The cryptocurrencies with the highest reward rates, the most robust community support, and long-term viability tend to be the most profitable for staking.

Q. Crypto Staking Strategies: How do you maximize crypto staking?

To optimize your cryptocurrency staking, use sophisticated techniques like automated rebalancing and compound staking, spread your staking over several cryptocurrencies, and periodically review and adjust your portfolio.

Q. What are the benefits of staking cryptocurrencies?

Staking cryptocurrencies offers the potential to earn passive income through rewards in the form of staking rewards, thus allowing you to maximize your earnings in the crypto space.

Q. What are the risks associated with staking?

Staking involves certain risks, such as the potential for loss if the value of the staked cryptocurrencies decreases or if the staking platform experiences technical issues.

Q. How to start staking and earn staking rewards?

To start staking and earn rewards, you typically need to stake cryptocurrencies in a staking wallet or on a staking platform that supports staking. Your rewards will depend on the staking period and the available staking opportunities.

Q. What is proof of stake, and how does it relate to staking?

Proof of Stake (PoS) is a consensus mechanism in blockchain networks where participants can stake cryptocurrencies to support the network and earn rewards. Staking is a key aspect of PoS protocols.

Q. What are the popular staking cryptocurrencies among crypto investors?

Popular staking cryptocurrencies among crypto investors include those that offer good staking rewards, passive income opportunities, and a strong staking community.

Q. What is liquid staking, and how does it differ from traditional staking?

Liquid staking involves staking assets that are easily convertible to cash or tradable tokens, providing more flexibility compared to traditional staking, where assets are often locked up for a specific period.

Q. How can staking help diversify a crypto investor’s portfolio?

Staking offers crypto investors the opportunity to earn more crypto assets while holding their investments, thus providing a way to diversify their portfolio and potentially increase their overall returns.