Key Takeaways

- KuCoin, Gemini, and Coinbase lead with robust security and diverse staking options.

- Staking rewards offer a passive income akin to interest from traditional banking.

- Understanding staking mechanisms and platform selection is crucial for success.

- Diversifying staking across various coins and platforms reduces risk.

- Regular updates and active management of staked assets are essential.

- Future security enhancements and user interface enhancements will drive greater staking app adoption.

Greetings from the cutting edge of digital banking! Cryptocurrencies are changing how we view money. Keeping digital assets and staking are now appealing ways to make passive income.

In this blog, we explore the world of cryptocurrency staking programs. These programs guarantee to protect your coins while slowly growing your investment. Knowing which platform best meets your needs is critical. It matters regardless of your experience with cryptocurrencies or your curiosity as a newbie. We have selected the best crypto staking apps of 2024. We looked at their features, security, and potential returns.

With numerous apps available, choosing the right one can be daunting. Each app offers different features, rewards, and levels of security. Therefore, finding the best crypto staking app requires understanding the unique advantages of each option.

Come along as we explore the details of these cutting-edge platforms. This will empower you to make a more profitable and informed decision as you start your cryptocurrency journey.

Table of Contents

- Key Takeaways

- What is Crypto Staking?

- How does Crypto Staking work?

- Benefits of Crypto Staking

- Disadvantages of Crypto Staking

- Difference between Crypto Lending and staking

- Key Features to look for in a Crypto Staking App

- Factors to consider when choosing the Best Crypto Staking Apps

- Regulatory and Legal Considerations

- 10 Best Crypto Staking Apps

- Tips for Effective Crypto Staking

- Future of Crypto Staking Apps

- Conclusion

- FAQs

What is Crypto Staking?

Credits: Freepik

Through “crypto staking,” cryptocurrency owners can join blockchain network operations. They earn rewards on their holdings. Unlike the proof-of-work (PoW) used by networks such as Bitcoin, this process is vital for blockchain networks that use proof-of-stake (PoS) or other consensus methods.

Staking on proof-of-stake blockchains is locking away a portion of the money in a wallet to support network functions like network security and transaction validation. In Proof of Stake (PoS), validators are chosen to build new blocks and validate transactions based on the number of coins they possess and are prepared to “stake” as collateral, as opposed to miners solving intricate mathematical puzzles as in Proof of Work (PoW). The likelihood of being selected as a validator increases with the amount of coins invested.

By staking your coins, you are effectively contributing to the efficiency and security of a blockchain network. You get paid for staking this, usually in the form of a percentage yield that increases over time. These benefits are like interest in a regular bank savings account. The main difference is that, although they have more risk, they are usually higher in cryptocurrency.

In addition to providing holders with a passive income stream, staking helps blockchain networks remain sustainable and expandable. It is a more ecologically friendly option because it lessens the enormous amounts of energy PoW systems use.

Furthermore, it can improve the decentralization of blockchain networks since, unlike Proof of Work (PoW), where individuals with substantial processing capacity frequently control mining, more validators can engage in the process.

Moreover, it can enhance the decentralization of blockchain networks since more validators can participate in the process utilizing dedicated servers, in contrast to Proof of Work (PoW), where a few numbers of people with significant processing power typically control mining.

How does Crypto Staking work?

A key element of many contemporary blockchain networks is cryptocurrency staking, particularly those that use Proof of Stake (PoS) or one of its variations as their consensus method. Here’s a thorough explanation of how cryptocurrency staking operates:

Comprehending Proof of Stake

Blockchain networks have used Proof of Stake (PoS) as a consensus method to accomplish distributed consensus without the significant energy consumption of Proof of Work (PoW) systems. Validators, not miners, are in charge of validating transactions and adding new blocks to the blockchain in Proof of Stake (PoS) systems. The number of coins these validators commit as their stake determines which ones are selected. The underlying idea here is that the likelihood of being chosen as a validator increases with the stakes, thereby increasing responsibility. Because validators have a vested financial interest in maintaining the integrity of the network, this approach naturally promotes more network membership and security.

Getting Ready for Staking

A cryptocurrency holder must first purchase coins from a blockchain that uses a proof-of-stake (PoS) method in order to engage in staking. After purchase, these coins need to be moved into a wallet that supports staking, which serves as a place to store your coins and a mechanism to get involved in the blockchain’s staking procedure. Different blockchains may have a minimum staking threshold—the number of coins needed to start staking—that varies. This stipulation guarantees that every member makes a substantial contribution to the overall security and efficacy of the network.

Digital Assets are Locked Up

When you stake your Bitcoin, your digital assets are locked up in a staking pool. These pools can be run by third-party services that pool the currencies of various stakeholders to improve their total staking power, or the blockchain itself can directly handle them. You are essentially giving your coins to the network by locking up your assets since it uses them to verify transactions and maintain robust security protocols. The blockchain’s decentralization and continuous operation are preserved by this locked state. When you lock up your assets, you are giving the network access to your currencies. The network uses those coins to verify transactions and uphold strong security protocols on dedicated servers, which keeps the blockchain decentralised and functional.

Taking on the position of Validator

After staking your cryptocurrency, you can decide whether to take on the function of Validator yourself or assign it to another participant. Because they maintain data, handle every transaction, and append new blocks to the chain, validators are essential to the blockchain. A selection procedure that considers stakeholder size is often part of the process of becoming a validator. Higher stakes signal a more significant commitment to the network’s health and trust, which increases the possibility of selection.

Also read How To Use Blockchain as a Database for Maximum Security

Getting prizes

By processing transactions and generating new blocks, validators can earn prizes as an incentive. These incentives, usually brand-new currencies created by the blockchain, are given out by several variables such as the total amount staked, the length of the stake, and the dynamics of network staking as a whole. In addition to compensating validators for their locked assets and operational risks, this compensation structure incentivizes longer and greater stakes, promoting network security and stability.

By processing transactions and adding new blocks, validators are rewarded. Usually, this occurs on a dedicated server that maintains the blockchain’s ongoing and secure operation. These incentives, typically brand-new coins created by the blockchain, are given out per several variables, such as the total amount staked, the length of the stake, and the general dynamics of network staking.

Benefits of Crypto Staking

Staking cryptocurrency has many advantages for both users and the more extensive blockchain network. This is a thorough examination of these benefits:

Creating Passive Income

One of the most alluring advantages of crypto staking is the potential to create passive income. Staking entitles users to rewards. These rewards are usually given out regularly as extra coins or tokens. The amount depends on how much cryptocurrency they have staked. This is like getting interest from a normal bank account. But, cryptocurrencies are risky and volatile. So, the rates are often higher.

Using a dedicated server for staking can increase the consistency and predictability of obtaining these rewards, as it provides more dependable and secure handling of these transactions.

Enhanced Network Security

Staking makes a significant contribution to the blockchain’s integrity and security. The more coins staked in Proof of Stake systems, the more secure the network is. Stakers engage in network operations, risking their tokens. If they approve fraud, they may lose all or part of their stake. Because of this danger, validators must uphold the network’s integrity. They must act honorably. This improves security.

Validators are compelled by this inherent risk to uphold the integrity of the network and behave honourably. Thus, staking on a dedicated server improves the security of the blockchain network and enhances individual transactions’ security.

Energy Efficiency

Proof of Stake is much more energy-efficient than Proof of Work (PoW) systems. They use vast amounts of energy for mining operations (like mining Bitcoin). Staking aligns with global sustainability initiatives. It uses much less electricity and technology.

Further Decentralization

Staking techniques frequently make it possible for more users to become validators on the network, which encourages further decentralization. In contrast to Proof of Work (PoW) systems, which favor miners with substantial financial resources for processing power and energy, Proof of Service (PoS) systems reduce entry barriers, allowing a more comprehensive range of validators. Increasing involvement reduces the risk of centralization—where a few people dominate the entire network—.

Diminished Market Volatility

Staking can lessen market volatility by encouraging the holding of cryptocurrencies over extended periods. When significant amounts are seized for staking, a token’s circulation supply shrinks, which may result in more stable values. Because it lessens some of the severe swings in bitcoin asset prices that are frequently observed, this effect is advantageous for the market’s general health.

Governance and Voting Rights

Staking grants governance rights in some blockchain ecosystems, enabling stakeholders to take part in decision-making procedures. Stakeholders may be able to cast votes on crucial matters, like network enhancements, policy modifications, and other ideas that influence the project’s future course. By becoming involved, you can ensure that the blockchain’s development is in line with the interests of the community and empower users.

Provision of Liquidity and Yield Farming Opportunities

Through DeFi (Decentralised Finance) platforms, players in specific staking models can receive incentives for staking while also providing liquidity. Because users can participate in many DeFi applications simultaneously and receive rewards in multiple layers—a practice known as yield farming—this can be incredibly profitable.

Disadvantages of Crypto Staking

Although there are numerous advantages to crypto staking, there are also several drawbacks that users should be aware of. These disadvantages vary in importance based on the particular blockchain and its staking mechanism, and they can affect both individual stakers and the more extensive network. Here’s a thorough examination of the possible drawbacks:

Problems with Liquidity

Staking-related liquidity limitations can have a significant influence on investment plans. Staked cryptocurrencies are not just locked for a time. Their removal from the market reduces liquidity. This affects trading volumes and may increase the token’s price volatility. This might stop investors from trading or closing positions during market drops. This could cause significant unrealized losses if the market moves down.

Market Volatility Risk

Although staking lowers the amount of bitcoin in circulation over time, it exposes each staker to market volatility. Big swings in staked asset value might still come from price correlations. These correlations are with macroeconomic conditions or broader market shifts. Also, if the cryptocurrency market falls, staking benefits may lose value. This would make the initial staking decision unjustifiable.

Slashing Risks

Cutting risks is essential to deter lousy activity. But, it also puts good validators at risk of fines from uncontrollable events. A validator may face penalties, for example, if their node goes offline because of a power outage or internet problems. Another factor makes staking unpredictable. Software flaws or mishandled updates may accidentally cause breaches. These breaches cost validators money.

Complexity and Technical Requirements

Staking has significant technical requirements. These include protecting the staking environment from cyberattacks. Also, ensuring uptime around the clock. And, helping non-technical users understand complex protocols. Less committed participants may be discouraged from staking. This is due to the time-consuming and continual updates and monitoring needed to keep up with network developments.

Concentration of Power

In these networks, the amount of staked tokens determines the influence weight in consensus mechanisms. The problem of power concentration is obvious. This might result in an oligarchy-like situation where the wealthiest organizations or people control a significant portion of the network’s decisions, such as governance and protocol upgrades, excluding smaller stakeholders and possibly distorting the network to benefit a few powerful interests. The decentralized spirit of blockchain technology is at odds with this kind of centralization, which can potentially erode network trust.

Also Read: Cost-benefit Analysis of Crypto Staking Using Dedicated Servers

Difference between Crypto Lending and staking

Credits: Freepik

There are two unique ways to profit from cryptocurrency investments: crypto lending and staking. Each has its own workings, dangers, and advantages. Investors who want to tailor their strategy to risk tolerance and financial goals must know these distinctions.

Investors can lend their cryptocurrencies out through crypto lending by listing them on a platform. This is possible because of decentralized finance (DeFi) systems, which run on blockchain technology. CeFi platforms are run by businesses.

The main draw of crypto lending is the opportunity to earn income on digital assets that could otherwise be sitting idle in a wallet. Because interest rates are usually predetermined, returns may be predicted. Lending is not without danger, though, primarily the credit risk of a defaulting borrower.

Loans are often over-collateralized. Borrowers must deposit a larger value of assets than the loan amount to reduce the risk. Many platforms offer short-term lending and the option to withdraw funds when the loan ends. So, the liquidity in crypto lending is typically higher than in staking.

Conversely, in networks that employ Proof of Stake (PoS) or one of its variations, crypto staking is inextricably related to the consensus mechanism of the blockchain. Participants contribute to network security by validating transactions and generating new blocks when they stake their currencies. Crypto Rewards are given for this support. They come from transaction fees or new coins that the blockchain mints. Staking payouts are not set and can change based on many variables, such as the total amount staked on the network and the length of the staking period.

Staking has risks. One is the volatility of crypto values. It can greatly impact staked coin’s benefits and value. Also, staked assets are typically locked up for a set time. This lock reduces liquidity because they cannot be sold or exchanged until it ends.

Moreover, the operational distinctions between the two techniques are reflected in the procedures used in each. Since cryptocurrency lending mimics traditional lending procedures but in a digital format, it is comparatively simple and accessible even to individuals who are unfamiliar with cryptocurrencies. However, because it necessitates knowledge of specific network criteria, such as minimum staking thresholds and potential fines (or slashing) for failing to satisfy network standards as a validator, crypto staking frequently entails a deeper involvement with the selected blockchain network.

Key Features to look for in a Crypto Staking App

There are a few essential things to consider when selecting a cryptocurrency staking program to ensure you’re not just protecting your digital assets but also optimizing your staking earnings. The following are a few of the most crucial elements to carefully consider:

Security Measures

The foundation of any reliable cryptocurrency staking program is security. A trustworthy staking app must have basic security features. These include multi-signature wallets and two-factor authentication (2FA). But, it should also use advanced encryption to secure data transfers. To ensure that all data over the network is shielded from interception, look for apps. They use end-to-end encryption. Good staking software needs strict internal access controls. They prevent unwanted access from within. Dedication to security is also shown by regular security audits. And, by following industry standards like ISO/IEC 27001.

User Interface

A good user interface should be beautiful and practical. It should make it easy for users to move between functions and information. The dashboard gives you a quick look at your staking portfolio. It shows recent transactions and performance metrics. The user experience should be simple. Seek for applications with customizable options so you can adjust the UI layouts and notifications to your liking. Also, consider if the program offers lessons or educational materials. These may be pretty helpful for those new to cryptocurrency staking.

Supported Currencies

The diversity of supported currencies makes a more adaptable staking approach possible. Check if the program updates its products often. It adds new and upcoming coins that may yield significant profits. Some staking apps also support tokens from smaller, creative blockchain projects. They give users early access to very profitable prospects. Additionally, see if the program allows cross-chain staking, which enables you to stake distinct assets from one platform across many blockchains.

Reward Rates and Conditions

It is essential to comprehend the intricacies of reward rates and conditions. Look into if the staking software has tiers of rewards where you may earn a higher rate of return by staking more. Evaluating the incentive distribution process’s dependability and openness is also crucial. Does the app offer a consistent and lucid timetable? Do any technologies that allow you to predict your revenue potential in various staking scenarios? These characteristics can support financial planning and help control expectations.

Fees and Expenses

It’s critical to have a thorough understanding of an app’s fee schedule. Verify whether there are any unstated costs or penalties, particularly for transactions such as early withdrawals or reward transfers to different wallets. Additionally, some apps might charge performance-based or maintenance fees, which could lower their total profitability. An easily understandable and transparent cost structure that can be compared to other staking applications is a must for any good software.

Extra Tools and Features

Better tools and features can make staking much more enjoyable. Some apps, for instance, provide risk assessment tools that examine the possible return and volatility of various staking possibilities to assist you in making better selections. Integration with popular exchanges or wallets can facilitate efficient transfers between staking and trading accounts. Additionally, search for tools to automate the staking procedure under particular dates or market conditions, such as scheduled staking.

Also Read 5 Tips for Keeping Your Wallet BTC Secure and Protected

Also Read: What Is the Minimum Lockup Period for Crypto Staking?

Reputation and Community Feedback

A staking app’s reputation in the community can frequently be a barometer for long-term survival. Extensive analysis of community input can provide valuable information into how the app performs in different market scenarios. Take into account the customer service team’s response as well since efficient assistance can greatly aid troubleshooting. A dependable and user-focused platform may also be indicated by a proactive commitment to community participation through forums, frequent updates, and transparency reports.

Factors to consider when choosing the Best Crypto Staking Apps

Credits: Freepik

When choosing the best staking software, you must consider protecting your funds and potential profits.

Here is a thorough analysis of the essential variables to take into account while choosing a staking platform:

Crypto Staking Apps Factor: Security Features

To guard against internal fraud as well as external hacks, a secure staking platform is necessary. For extra asset security, use platforms that use cold storage. They should also use multi-signature wallets, encrypted communications, and two-factor authentication. This entails keeping a sizeable amount of cryptocurrency offline and out of the reach of any internet threats. Reliable outside firms should conduct frequent security audits. These audits should be seen as an extra standard for judging the platform’s security dedication. Openness to dealing with security issues strengthens reliability and trustworthiness. This includes thorough reporting and quick updates about any breaches. For maximum security and performance, some crypto staking apps offer the option to run on a dedicated server.

Crypto Staking Apps Factor: Supported Cryptocurrencies

Supporting many cryptocurrencies shows robust technology. It also shows a dedication to serving varied users. And, it expands investment prospects. The platform helps stake established and new cryptocurrencies. It lets investors diversify their stake portfolio. This cuts risk and could raise rewards. Also, check if the platform can use new currencies and tech. For example, layer-2 support or links to recent blockchains. These might give early access to profitable staking.

Crypto Staking Apps Factor: Ease of Use

The app should be simple to use and meet the requirements of both novice and seasoned investors. Using mobile devices, you can manage stakes. Automated alerts and customizing dashboards are examples of advanced features. They significantly improve user experience. Furthermore, users can become acquainted with the staking procedure without risking real money by using platforms that provide demo or simulation modes. This can be very helpful for individuals who are new to staking.

Crypto Staking Apps Factor: Rates and Reward Structure

For financial planning to be successful, the reward structure must be predictable and easy to understand. Platforms that offer comprehensive tools and calculators to assess possible returns in different circumstances are pretty valuable. Long-term investors may also be eligible for bonus awards or loyalty programs offered by specific platforms, which can increase profitability even more. Long-term staking techniques also require understanding the factors influencing reward rates, such as network modifications or alterations to tokenomics.

Crypto Staking Apps Factor: Fees

To determine the actual earnings from staking, a transparent and equitable fee structure is necessary. Specific platforms offer tiered fee structures for more prominent investors based on the amount of staked assets. Others may waive fees in exchange for utilizing particular tokens or during promotional events. It’s also a good idea to look at any potential hidden costs, such as those associated with performance or award payment frequency. With a dedicated server, your crypto staking app can handle higher transaction volumes without a slowdown.

Best Crypto Staking Apps Factor: Lock-Up Durations

The flexibility of lock-up durations may significantly impact your staking plan. Platforms with various options—from long durations to no lock-up periods—offer greater strategic freedom. It’s also critical to comprehend the conditions around early withdrawals since specific platforms may charge a fee or withhold rewards for any money taken out before the lock-up period expires. Furthermore, certain platforms may have features like recurring liquidity events or the option to utilize staked assets as collateral for loans—which might provide liquidity without requiring unstaking—that make up for lengthy lock-up periods.

Regulatory and Legal Considerations

Credits: Freepik

Comprehending the legal and regulatory environment when using crypto staking apps is critical. These factors may greatly influence how staking platforms are used, operated, and chosen. Here’s a thorough analysis of some of the most important legal and regulatory factors on crypto staking:

Regulations by Jurisdiction

The laws governing cryptocurrencies differ greatly between nations and courts. Some nations have welcomed cryptocurrencies. They have set explicit policies and regulations for their usage, including staking. Some countries might ban cryptocurrencies. They might do so altogether or with tight limits. Operators and users of staking platforms must comprehend and abide by the laws that apply to them. This can involve knowing your customer (KYC) and regulations. It also involves anti-money laundering (AML) procedures and tax reporting for gains.

Securities Law

A key legal factor is whether or not staked cryptocurrencies are categorized as securities. The classification may affect regulations about staking platforms. This includes rules about registration and disclosure. For example, if tokens are seen as securities, staking platforms may have to follow securities registration rules. This is true in some places. This classification depends on many variables. These include profit expectations and other managerial initiatives. They are often called the “Howey Test” in the United States.

Consumer Protection

Policies should also protect consumers. They should ensure that those using staking platforms are well-informed and not duped about the risks and rewards. Platforms must give clear, exact, and open explanations. They must explain their reward and staking procedures, and any associated hazards. Maintaining trust and preventing abuses in the cryptocurrency market are two benefits of ensuring these platforms abide by consumer protection regulations.

Taxation

This is still another important factor. In particular, when handled via a dedicated server, taxes play a significant role in the management of staked cryptocurrency assets and the money generated from them. Staking awards may be seen as capital gains in some jurisdictions, which could impact when the tax burden is due, or they may be classified as income in others. To maintain compliance and appropriate financial planning, users and platform administrators must be aware of the tax ramifications of staking.

Regulatory Change and Uncertainty

Staking and other aspects of the cryptocurrency regulatory environment are still developing. Because of this, users and staking platforms need to be aware of any changes to laws and regulations that may have an effect on their operations. This entails staying current on court decisions, financial regulatory agencies’ guidelines, and other legal developments.

License Requirements

Depending on the regulatory landscape, stocking platforms may need licenses to operate lawfully. These licenses come in various forms, from financial services-specific licenses to general business operating licenses. In addition to being required by law, obtaining and keeping these licenses is essential for building user trust as they search for trustworthy and compliant platforms.

10 Best Crypto Staking Apps

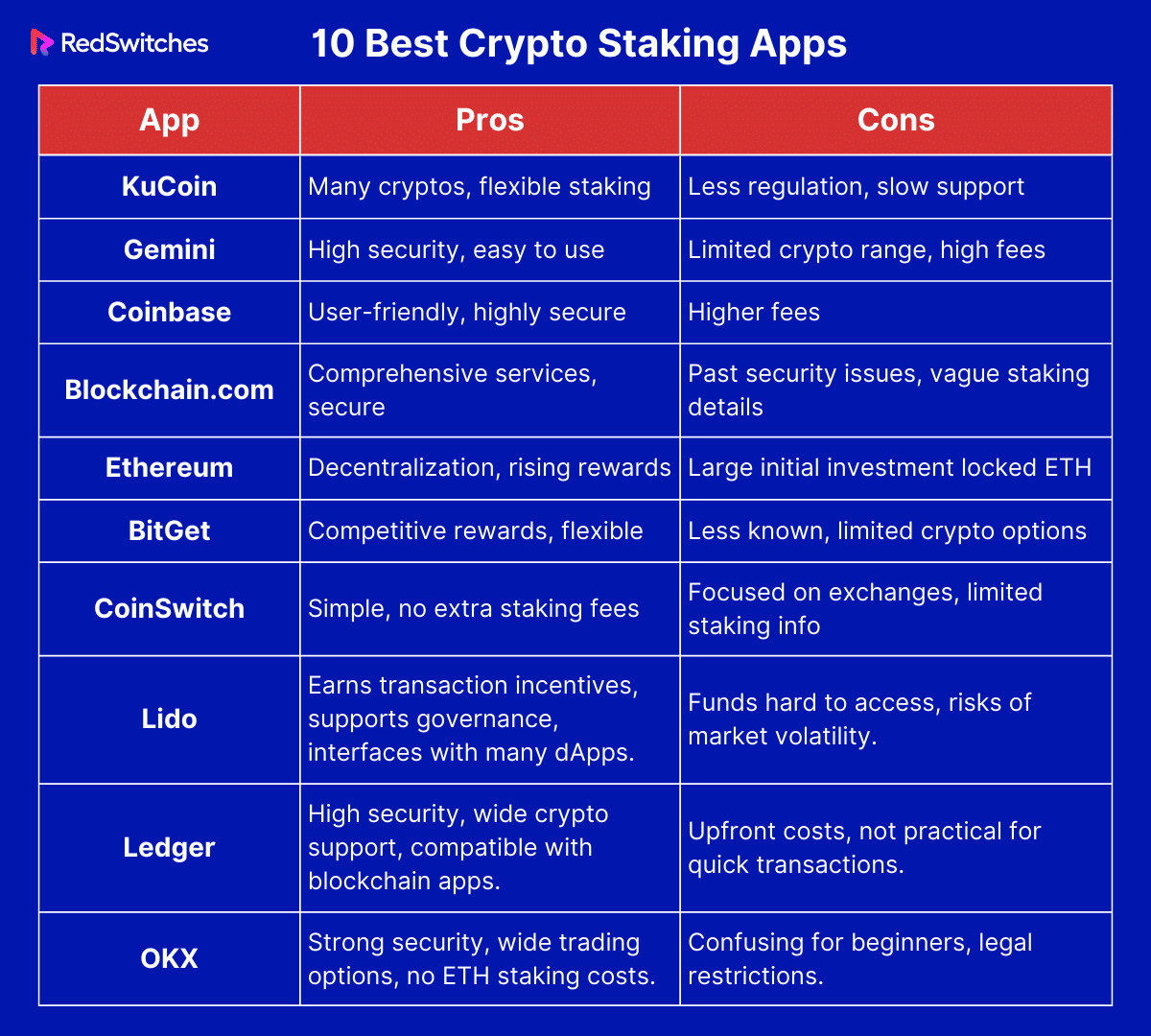

In this core section of our blog article, we will discuss the 10 best Crypto Staking Apps of 2024.

Crypto Staking Apps: KuCoin

An established cryptocurrency exchange with a large selection of cryptocurrencies for trading and staking is KuCoin. Its Pool-X platform enables users to engage in staking, where they can stake several cryptocurrencies and earn incentives. KuCoin is praised for its solid security features, extensive trading possibilities, and easy-to-use interface. Because of its cheap fees and easy entry requirements, it appeals to novice and seasoned traders.

Pros

- Numerous cryptocurrencies are accessible for staking.

- Flexible staking choices that let you take money out whenever you want.

Cons

- Less stringent regulation than exchanges established in the United States.

- Complaints about sluggish customer support responses.

Also read Web Application Security 101: What It Is, How It Works, Best Practices, & More

Crypto Staking Apps: Gemini

The Winklevoss twins launched the cryptocurrency exchange Gemini in the United States. It provides a safe environment for purchasing, selling, and staking digital assets and is governed by the New York State Department of Financial Services (NYSDFS). Gemini is renowned for its rigorous devotion to security and compliance and offers a dependable platform for Bitcoin transactions. The platform has an intuitive design that makes it appropriate for inexperienced and seasoned investors and supports a wide range of cryptocurrencies for staking.

Pros

- Heightened security and adherence to US laws.

- A platform that is easy to use and has insured assets.

Cons

- A restricted range of cryptocurrencies is available for the stake.

- Comparatively high costs for specific transactions.

Crypto Staking Apps: Coinbase

One of the biggest cryptocurrency exchanges in the world, Coinbase, provides a simple platform for purchasing, trading, and staking virtual currencies. Because of its robust security features and ease of use, newcomers really like it. With its headquarters in the United States, Coinbase abides by all relevant rules and laws and offers a secure environment for anyone interested in cryptocurrencies. The website also provides educational materials to aid users in understanding cryptocurrency trading.

Pros

- Extremely friendly interface for users.

- Strong emphasis on regulatory compliance and security.

Cons

- More costs in contrast to other platforms.

Crypto Staking Apps: Blockchain.com

Blockchain.com is a pioneer in the cryptocurrency area, providing wallet, exchange, and explorer services. Users can immediately purchase, trade, and stake cryptocurrency through this platform. It serves millions globally and is renowned for being easily accessible and flexible. Blockchain.com offers security and ease of use for managing digital assets, focusing on user control over monies and private keys.

Pros

- Offers a whole range of services, including a well-liked wallet.

- Strong user control over security and private keys.

Cons

- Historical occurrences of security lapses.

- Little details on the conditions and benefits of staking.

Crypto Staking Apps: Ethereum

Ethereum is a framework for developing decentralized apps (dApps) and being a cryptocurrency. As part of Ethereum’s proof-of-stake mechanism, implemented in Ethereum 2.0, staking entails locking up ETH to secure the network. Sponsors receive rewards in exchange for their assistance with transaction processing and network security upkeep. This type of staking is essential to upgrade the network from proof-of-work to proof-of-stake and lessen its environmental impact.

Pros

- Encourages decentralization and network security.

- Rewards that could rise as network adoption increases.

Cons

- Needs a substantial outlay of funds to stake independently.

- Ethereum is locked until more updates are released.

Crypto Staking Apps: BitGet

In addition to trading, BitGet is a lesser-known cryptocurrency exchange that provides staking services. It meets users’ needs seeking fixed and flexible staking arrangements and offers competitive staking returns. With its user-friendly and safe design, the site hopes to draw in a worldwide clientele by providing a range of cryptocurrency services, like as futures trading.

Pros

- Rewards for competitive staking.

- Provides choices for both fixed and flexible staking.

Cons

- It is not as reputable or well-known as bigger exchanges.

- Restricted list of cryptocurrencies that can be staked.

Crypto Staking Apps: CoinSwitch

CoinSwitch aggregates cryptocurrency exchanges so that users can compare and trade coins on various platforms. It emphasizes accessibility and ease of use while providing staking services as well. CoinSwitch was created for consumers looking for a simple approach to trading cryptocurrencies without having to deal with complicated platforms.

Pros

- Simple enough for new users to utilize.

- No extra costs beyond network fees for staking.

Cons

- More centered on advanced staking features than exchange services.

- Little knowledge of staking tactics.

Crypto Staking Apps: Lido

The disadvantage of many staking platforms is that your tokens become part of the protocol after you stake them, and you might not be able to use them until the lock-up period is over.

Liquid staking systems solve this problem by giving users liquid tokens for their staked currency. You can use these liquid tokens to trade and increase your income on DeFi platforms while your staked coins earn staking rewards.

Lido, an Ethereum staking app, interfaces with numerous other decentralized applications (dApps) to facilitate participation in DeFi, even though it only provides staking for a relatively limited quantity of coins. There is integration for Uniswap, Curve, Aave, 1 inch, and more than 100 more dApps.

Pros

- Earn incentives for confirming transactions to generate passive income, which is a consistent source of income.

- Take part in governance choices and contribute to network security.

Cons

- Because stalled money is locked up, accessing or exchanging it is harder.

- Validator fines and exposure to market volatility could result in the loss of a portion of staked assets.

Crypto Staking Apps: Ledger

If security is your top priority, you must have a hardware wallet, and the Ledger is the best option for staking. Ledger devices are known for being incredibly safe since they store your private keys offline, where hackers cannot access them.

Staking with a hardware wallet requires you to choose your validators, which adds a layer of complexity compared to using an exchange but gives you greater control and freedom. You can do all of this with the Ledger Live app.

Pros

- Ledger wallets offer a robust defense against internet risks like phishing and hacking since they store private keys offline.

- Supports various cryptocurrencies and is compatible with some blockchain apps and software wallets.

Cons

- Ledger and other hardware wallets have an upfront cost compared to software wallets, which could be a turnoff for some users.

- Although safe, hardware wallets may not be as practical for speedy transactions and may have a higher learning curve for new users unfamiliar with hardware.

Crypto Staking Apps: OKX

Ethereum is the only coin that can be staked conventionally on OKX. Should they stake their ETH here, staking users will be protected against slicing fines, no commission, petrol charges, or staking limits. Along with daily incentives, you will also receive a staked Ethereum token that you may exchange or sell.

Pros

- Strong security features and a large selection of trading alternatives are provided by OKX.

Cons

- Beginners may find its interface confusing, and certain areas have legal restrictions.

Let’s summarize it in a tabular format.

Tips for Effective Crypto Staking

Credits: Freepik

Crypto staking has the potential to be a profitable side gig for cryptocurrency investors. Still, it also comes with a learning curve and careful preparation to optimize profits and minimize drawbacks. Here are some thorough pointers for successful cryptocurrency staking:

Knowing the Staking Mechanism

Before you begin staking, you need to understand how staking works with different cryptocurrencies. To help a blockchain work, staking usually means locking up some of your cryptocurrency. You do this to get extra coins or tokens.

Choosing the Correct Platform

It is important to choose a trustworthy and safe platform before starting staking. The platform needs strong security to safeguard your assets. This includes cold storage and two-factor authentication. Adherence to regulatory requirements is a crucial element, as it amplifies dependability. An easy UI is an advantage, especially for staking newcomers. Access to many currencies helps you diversify your bets, spreading risk and may boost rewards.

Analysing Staking Profits vs. Risks

Consider both the possible profits and the associated risks while assessing staking choices. While higher rewards may appear alluring, it’s crucial to know why they are offered and whether they are sustainable. Because of the erratic nature of the cryptocurrency markets, your staked coins may lose a lot of value. The staked coin’s liquidity should also be considered; selling it could be difficult if it isn’t frequently traded.

Future of Crypto Staking Apps

Technology is advancing, and cryptocurrency is gaining popularity. They are also moving to proof-of-stake (PoS) protocols. This all means a bright future for cryptocurrency staking apps. Cryptocurrency-staking apps will probably change, as long as these trends persist. They will change in many key ways.

Growing Use of Proof-of-Stake (PoS)

More blockchains are adding or switching to proof-of-stake (PoS) methods. PoS uses less energy. People worry about the environmental effects of traditional PoW systems like Bitcoin. These worries are growing. Because more users are encouraged to participate in network security and governance through staking, this change supports sustainability and raises demand for staking possibilities.

Connectivity to DeFi Platforms

Staking services and decentralized finance (DeFi) have been increasingly integrated. Staking is a feature that many DeFi apps provide as a way to both secure the network and supply liquidity for other financial activities such as yield farming, lending, and borrowing. By improving staking’s usefulness and profitability, this integration may draw more users and funding to cryptocurrency staking applications.

Developments in Staking technology

More adaptable, effective, and safe staking options are anticipated with the arrival of new staking technology. Non-custodial staking services, which enable users to stake straight from their wallets without giving up control over their keys, and hybrid staking models, which combine aspects of PoW and PoS for improved security and efficiency, are examples of potential innovations.

Regulatory Clarity and Compliance

As the bitcoin market develops, more precise regulatory frameworks will probably be put in place, which will impact the functioning of staking apps. Staking platforms must adjust to local laws as additional nations define and refine legislation surrounding crypto assets. This could impact their expansion and the range of services they provide.

Enhanced Security Measures

As the value of staking apps’ security increases, security continues to be of the utmost importance. Future staking platforms will probably include more sophisticated security features, such as multi-party computation (MPC) and enhanced hardware security modules (HSMs). These improvements can help prevent theft and hacking, two major threats to cryptocurrency assets.

Enhancements to the User Experience and Accessibility

Staking apps must keep enhancing the user experience and accessibility to attract more users. This entails improving customer service, creating more educational materials, and creating easier-to-use interfaces. As stakes become more popular, it will be important to streamline the procedure and make it easier for non-technical users to understand.

Conclusion

In summary, selecting the best cryptocurrency staking tool maximizes gains and lowers risks. As the demand for Bitcoin staking rises, platforms like KuCoin, Gemini, Coinbase, and others are developing to provide safer, more convenient, and varied staking solutions. These platforms will probably become even more essential to the cryptocurrency ecosystem as investors become more environmentally sensitive and regulatory frameworks develop.

RedSwitches can help you move from investigating the top cryptocurrency staking programs to refining your digital approach easily. Their strong server solutions can improve your cryptocurrency endeavors by offering the essential framework for safe and effective trading and staking, guaranteeing the stability of your digital assets.

FAQs

Q. What crypto app to use for stake?

For staking, think about utilizing trustworthy programs like Coinbase, KuCoin, or Gemini based on your requirements for security, usability, and available cryptocurrencies.

Q. Can I stake my own crypto?

Yes, you can use a suitable wallet that supports staking or various staking services to stake your cryptocurrency directly.

Q. Can I withdraw my staked crypto?

Yes, you may often withdraw the cryptocurrency you’ve staked, although depending on the exact terms of your staking, there might be a lock-up time or penalties.

Q. What are crypto staking platforms?

Crypto staking platforms are online platforms that allow users to earn rewards by participating in the process of validating transactions on a blockchain network.

Q. How can I find the best crypto staking platform or the best platform for staking?

To find the best crypto staking platform, consider factors such as the platform’s reputation, security measures, staking rewards, user interface, and supported cryptocurrencies.

Q. Which are the best staking platforms in 2024?

In 2024, some of the best crypto-staking platforms with the highest Annual Percentage Yield (APY) include platforms like X, Y, and Z.

Q. What is APY in the context of cryptocurrency staking?

APY stands for Annual Percentage Yield, which represents the annualized rate of return users can earn from staking their cryptocurrencies on a platform.

Q. Can I stake popular cryptocurrencies like Bitcoin and Ethereum on these platforms?

Yes, many crypto staking platforms support popular cryptocurrencies like Bitcoin and Ethereum for staking, allowing users to earn passive income.

Q. Are staking rewards paid in the same cryptocurrency that I stake?

Staking rewards are typically paid in the cryptocurrency you stake on the platform, providing users with more of the same token as rewards.

Q. How does liquid staking differ from traditional staking?

Liquid staking allows users to stake their cryptocurrency while still being able to trade or utilize the assets, providing more flexibility than traditional staking, where assets are locked up.