Key Takeaways

- APY stands for Annual Percentage Yield. This term refers to the real rate of return on an investment.

- Crypto staking APY refers to the rate of return users may earn on their digital currency assets by engaging in staking activities in decentralized networks.

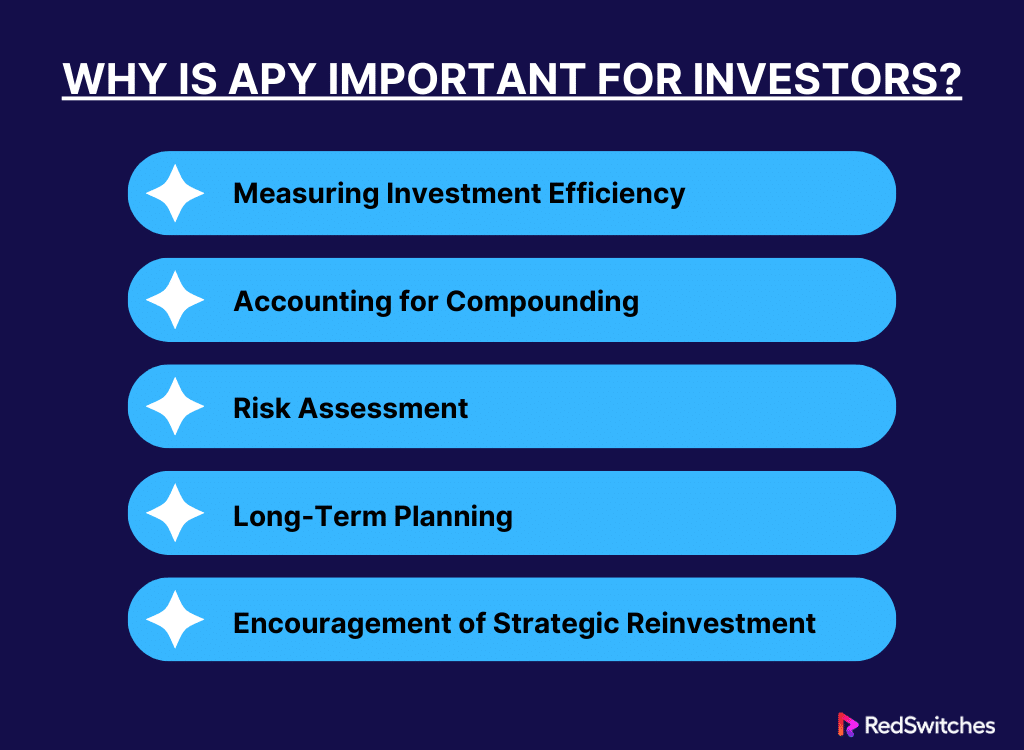

- APY is important for investors because it helps measure investment efficiency and risk assessment.

- You can calculate crypto staking APY via online calculators like Datawallet.

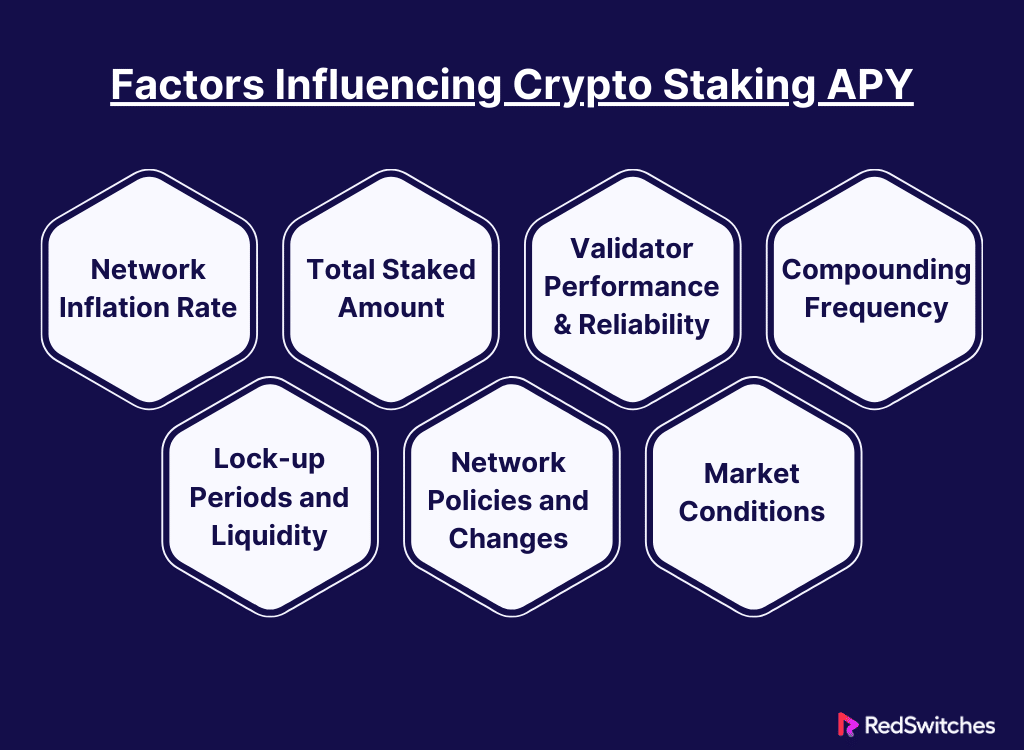

- Factors influencing crypto staking APY include the total staked amount and network inflation rate.

- Factors to consider besides APY include network security, lockup period, and minimum staking requirements.

Since the digital currency space is constantly changing, new terms and concepts catch the interest of investors and tech enthusiasts. One such term popular among those new to cryptocurrency is “Crypto Staking APY,” or Annual Percentage Yield.

This metric is important for understanding the potential earnings from cryptocurrency staking. In this process, crypto holders lock their coins to maintain a blockchain network’s functionality and security.

With the global crypto staking market poised for substantial growth and the market value of Ether (ETH) alone crossing $380 billion, understanding the significance of APY in this context is increasingly important for investors looking to optimize their returns.

Table Of Contents

- Key Takeaways

- What Does APY Stand For?

- What is Crypto Staking APY?

- Why is APY Important for Investors?

- Calculating Crypto Staking APY

- Factors Influencing Crypto Staking APY

- The Benefits of Staking Based on APY

- The Risks of Staking Based on APY

- Other Factors to Consider When Looking for Good Staking Options

- Which Cryptocurrencies and Platforms Offer the Best APY?

- Platforms for Comparing Crypto Staking APY

- Conclusion – Crypto Staking APY

- FAQs

What Does APY Stand For?

APY stands for Annual Percentage Yield. This term refers to the real rate of return on an investment. It considers the effect of compounding interest over one year. APY is a more accurate estimate of an investment’s profits than simple interest, which is computed just on the principal amount.

The term APY is often used in two contexts. The first is banking, which expresses the yield on savings accounts and certificates of deposit. The second is cryptocurrency staking, which signifies possible profits.

Do you want to learn about the best crypto staking apps in 2024? Read our blog. ‘Top 10 Best Crypto Staking Apps With Highest APY In 2024.’

What is Crypto Staking APY?

Credits: FreePik

Crypto staking APY refers to the rate of return users may earn on their digital currency assets by engaging in staking activities in decentralized networks.

The APY accurately estimates how much investors may expect to earn from their staked crypto assets. This implies that the returns are frequently reinvested to produce further earnings, and APY determines the total gains obtained by re-staking these rewards throughout the year.

Understanding APY is crucial for crypto market investors. It empowers them to compare the profitability of numerous staking opportunities and make informed decisions based on their investment objectives and risk tolerance. A higher APY equals a higher return on investment. Depending on the digital currency and the stability of its network, it can also come with higher risks.

Why is APY Important for Investors?

Wondering why APY is important for you as an investor? Here are a few reasons:

Measuring Investment Efficiency

APY is a powerful tool for gauging investment efficiency. It offers a precise, annualized return rate, enabling investors to compare different investment opportunities quickly.

APY is a standardized metric for assessing potential profitability in the volatile digital currency staking domain, where returns can differ widely across various coins and staking pools. This standardization helps investors pinpoint which options are performing well compared to the market, aiding in more informed decision-making.

Accounting for Compounding

Compounding is a significant factor in asset growth. The APY successfully reflects this dynamic by considering the interest generated on the original capital and the cumulative interest from earlier periods.

When stakes periodically produce new coins in crypto staking, the gains may be reinvested to increase the total return. APY offers a holistic view of how reinvestment might increase returns by projecting investment growth over time, which is critical for planning and strategy creation.

Risk Assessment

Credits: FreePik

Evaluating the risk linked with investing opportunities is vital. APY helps with this. A greater APY in crypto staking frequently indicates better potential rewards and more risk, increasing market volatility and exposure to unknown market dynamics.

Understanding the APY allows investors to measure the risk-reward ratio better. It can empower stakeholders to select assets appropriate for their risk tolerance and financial objectives, enabling a balanced and diverse investment portfolio.

Long-Term Planning

APY is critical for long-term financial planning. It provides investors with an anticipated yearly return, allowing them to plan for long-term investment development. This is especially useful for investors with long-term objectives like retirement planning or asset creation.

APY assists in establishing realistic financial goals and developing long-term plans, ensuring that investments align with future financial requirements and objectives.

Encouragement of Strategic Reinvestment

Understanding the annual percentage yield can substantially impact reinvestment choices. Knowing the possible profits from reinvesting staking rewards might help crypto investors make smarter and timely reinvestment decisions.

This systematic approach to investing can optimize compounding effects, potentially improving total return on investment. Reinvesting correctly allows investors to:

- Better use their earnings.

- Speed up the growth of their staked assets.

- Improve the overall efficiency of their investment portfolio.

Calculating Crypto Staking APY

Credits: FreePik

Although there is a formula for calculating crypto staking APY, the most hassle-free and quick way is to use a crypto-staking APY calculator. Below, we have mentioned both ways to calculate crypto staking APY.

Method One

Let’s take a look at the first method:

- Calculate Periodic Staking Rewards

To calculate APY, you first need to know the reward structure of your staking protocol. You’ll need to find out:

- The reward rate: What percentage of your staked cryptocurrency do you get as a reward periodically (monthly, daily, etc).

- The staking period: How often incentives are allocated.

For instance, if a blockchain proposes a 0.01% reward every day for staking its digital currency, and you stake 2,000 coins, your day-to-day reward calculation would be:

- Daily Reward: 2,000×0.0001=0.2 coins per day

- Factor in Compounding

Compounding in crypto staking is the process of reinvesting your staking earnings back into the staking pool to obtain further rewards rather than withdrawing them. The frequency of compounding has an important effect on the APY, as more frequent compounding yields higher returns.

Using the daily staking reward from the example above, the calculation must account for this higher value if you reinvest your earnings daily.

- Calculate APY

Apply the compounding interest formula to calculate the Annual Percentage Yield:

APY= (1 + Periodic Rate) Number of Periods −1

If the periodic rate is 0.0002 daily, as in the above example, and assuming you are reinvesting every day, the number of periods in a year (daily compounding) would be 365. Therefore:

APY = (1 + 0.0002) 365 −1

Method Two

While the calculation above provides an acceptable estimate, an APY calculator can help ensure accuracy. This is especially true when dealing with varied compounding periods or more complex staking schemes. Online crypto calculators can automate these calculations after you provide the required inputs.

Also Read: Optimize Crypto Returns: Top 7 Crypto Staking Calculators.

Factors Influencing Crypto Staking APY

Several factors influence the APY for crypto staking. Understanding these can help stakeholders make informed decisions. Here are a few key factors that impact crypto staking APY:

Network Inflation Rate

The inflation rate of a digital currency network has a direct influence on staking rewards. Many Proof of Stake (PoS) networks generate fresh currency as a reward for stakeholder activity. If the network experiences rapid inflation, more coins are usually issued as incentives, potentially boosting the APY.

However, while more inflation might result in larger rewards, it can devalue the coin over time. This can impact the real returns when converted to fiat currency or other digital currencies.

Total Staked Amount

The percentage of the total quantity of staked tokens also determines the APY. Generally, if a bigger percentage of the total token supply is staked, each staker’s benefit may fall as the incentives are dispersed among more players. However, if fewer tokens are staked, the incentives allocated to each staker may be larger. This can result in a higher APY.

Validator Performance and Reliability

In PoS and other consensus systems, a validator’s performance—how effectively and reliably they validate transactions and produce new blocks—affects their reward. Validators who are continuously online and actively engage in the consensus process are more likely to be rewarded. Downtime or poor performance might result in lesser profits or fines, reducing the APY. Using a dedicated server can ensure maximum uptime and optimal performance.

Compounding Frequency

The frequency with which rewards are paid out and reinvested considerably impacts the compounding effect of staking returns. Some networks provide daily or even more frequent compounding of staking payouts, which can significantly enhance the APY. Compounding may transform modest periodic rates into high yearly rewards by leveraging exponential growth.

Lock-up Periods and Liquidity

Some staking chances require cash to be locked for a particular time. Generally, the longer the lock-up time, the greater the potential APY, as lengthier commitments frequently result in more significant returns. However, stakeholders must weigh the greater APY against the potential loss of liquidity over time, which may prevent them from taking advantage of other investment possibilities.

Network Policies and Changes

Blockchain network governance decisions, such as changes in staking requirements, reward structures, or general network protocols, can all impact APYs. These modifications might respond to economic situations, network security concerns, or community votes. Keeping track of such governance actions is critical since they substantially influence staking returns.

Market Conditions

The broader digital currency market conditions and certain economic factors can impact the crypto staking APY. Due to increased staking, bull markets can experience higher network participation and reduced APYs. Bear markets may decrease staking activity, potentially improving APYs for remaining participants.

Fluctuations in the cost of the crypto asset being staked can impact the dollar-denominated worth of the earned incentives, affecting the overall profitability.

Also Read: Integrating Server Costs Into Crypto Staking Calculator.

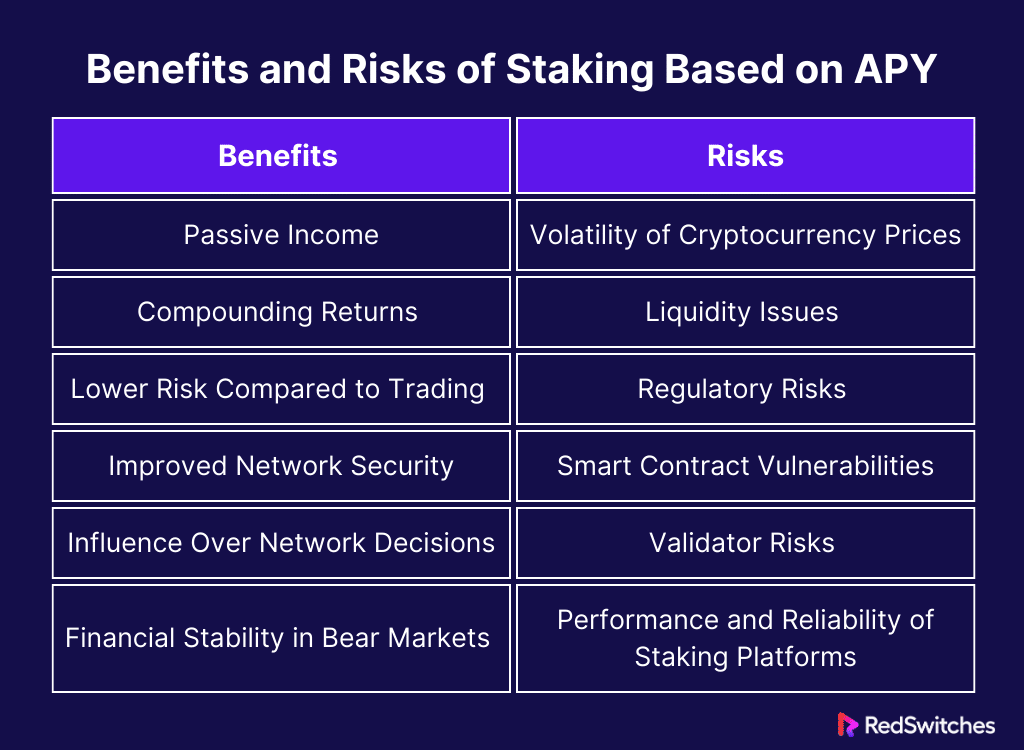

The Benefits of Staking Based on APY

Although risks exist, staking digital currencies based on the Annual Percentage Yield (APY) can also offer benefits. Here are the benefits of engaging in crypto staking based on APY:

- Passive Income

Credits: FreePik

The benefit that makes crypto staking based on APY most attractive is passive income generation. When you stake your cryptocurrency, you lock it in a wallet to facilitate a blockchain network’s workings, like transaction validation.

In return, the network rewards you with added coins or tokens at a rate specified by the APY. This APY can vary depending on the staked amount, the digital currency, and the network conditions, but it often offers a competitive rate than traditional savings accounts.

- Compounding Returns

Staking rewards can usually be compounded. You can also stake the incentives earned to earn even more rewards. This compounding effect can greatly boost total returns over time. It is quite similar to reinvesting dividends in the stock market. By constantly reinvesting your staking incentives, you can take advantage of the power of compounding to expand your investment, driven by the APY.

- Lower Risk Compared to Trading

Digital currency trading can offer considerable rewards but carries high volatility and risk. In comparison, staking yields a more predictable return centered on the APY, which does not vary as significantly as market pricing. This makes staking a safer option for people wishing to increase the value of their digital currency without being exposed to the volatile ups and downs of crypto trading.

- Improved Network Security

From a broader perspective, when you participate in staking, you contribute to the stability and safety of the blockchain network. The more stakeholders there are, the more secure and decentralized the network becomes. This security is important for the general health and trustworthiness of the network. It can help improve the value of the staked tokens as more and more stakers can trust the network with their funds.

- Influence Over Network Decisions

Many staking setups offer governance rights, which allow stakeholders to guide the blockchain project’s future path. The APY can incentivize additional stakeholders, ensuring that a larger group of token holders is encouraged to participate in governance choices. This engagement could result in more community-focused advancement for the project.

- Financial Stability in Bear Markets

Trading may carry more risks during digital currency market downturns. Staking offers a more stable source of income that is not as affected by market volatility. The benefits provided by staking, as decided by the APY, can help mitigate possible losses from collapsing asset values.

This steady stream of staking rewards serves as a financial cushion. It allows for stability even during weak markets. It emwpoers investors to achieve consistent returns, reducing the unpredictability and financial effect of market downturns.

The Risks of Staking Based on APY

Credit: FreePik

Staking digital currencies offers a great opportunity for earning passive income, especially when the APYs are good. However, depending on investment decisions only on high APY figures can have significant risks. Understanding these risks is important for anyone staking as an investment strategy. Here are a few risks involved in staking based only on APY:

1. Volatility of Cryptocurrency Prices

One of the top risks in crypto staking is the volatility of digital currency prices. The APY determined at the start of your staking period is based on the cryptocurrency’s current value.

However, if the coin’s value falls during the staking time, the real dollar worth of the rewards may fall despite the APY indicating a high yield. This can lead to a situation in which, although the amount of coins generated via interest grows, their value in terms of fiat currency declines. A dedicated server provides the computational power and resources to analyze market trends quickly, empowering you to make informed staking choices.

2. Liquidity Issues

Staking involves storing your digital currency for an agreed-upon amount of time. During this period, you are prohibited from selling or trading your staked assets, which may be problematic if you need rapid access to your cash or if market conditions shift unfavorably. This lack of liquidity may be a major disadvantage, particularly in a fast-moving market where quick response to price fluctuations is critical.

3. Regulatory Risks

The regulatory environment for cryptocurrencies is still in the development phase. It can also vary considerably by jurisdiction. Alterations in regulations may affect the staking process and incentives. For instance, specific staking incentives might become subject to new regulations or taxes that could lower the profitability of staking.

There’s also always the potential for specific digital currencies to be banned or regulated. This can impact their feasibility as staking instruments.

4. Smart Contract Vulnerabilities

There’s a risk of vulnerabilities in the agreement’s code. Staked funds may be stolen or irreversibly lost if a smart contract is abused due to a flaw or improper design. These weaknesses threaten the staked assets and any possible staking profits. It is important to only stake cryptocurrency on reputable platforms that prioritize security. A dedicated server provides an additional layer of security by giving you complete control over your staking environment.

5. Validator Risks

Validators are vital to many staking systems, particularly those that use the Proof of Stake (PoS) protocol. Validators handle the job of preserving network security and handling transactions.

If a validator fails to execute properly due to malicious activities, bad management, or technological issues, the expected rewards from staking may suffer. In some circumstances, fines (cutting) are imposed for validator misconduct or downtime, potentially reducing the overall return from staking.

6. Performance and Reliability of Staking Platforms

The platform or service used for staking also carries risk. Platform unavailability, performance difficulties, or even the staking platform’s bankruptcy may all impact your capacity to collect rewards. Using reputable, well-maintained, and trusted platforms in the community is critical to mitigate these risks.

Also Read: Crypto Rewards: How Long Does Crypto Staking Take?

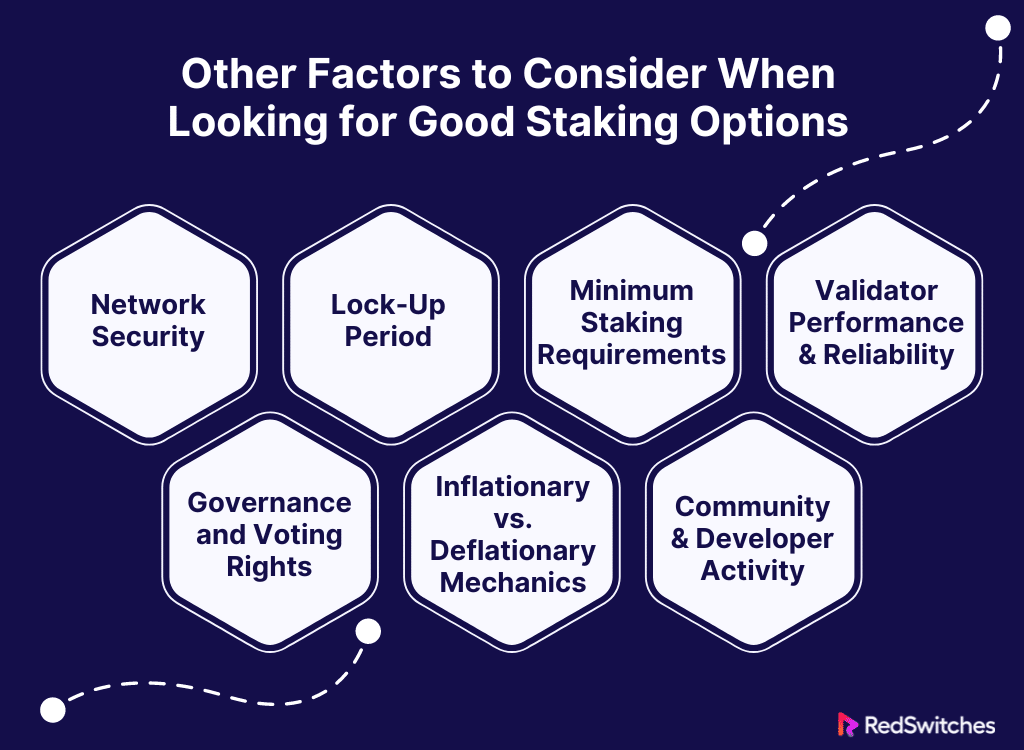

Other Factors to Consider When Looking for Good Staking Options

When evaluating staking options in cryptocurrency, several factors other than crypto staking APY play important roles in determining the best choice. Here’s an in-depth look at key considerations to help you find the best staking opportunities:

- Network Security

Blockchain security is a key concern. A secure network reduces the likelihood of attacks that threaten the integrity of staked assets. Investigate the network’s history of security breaches and understand its security processes. A blockchain that constantly improves and adapts its security mechanisms creates a safer environment for staking.

- Lock-Up Period

Liquidity refers to how quickly a digital currency can be purchased or sold on the market without impacting its price. High liquidity is required, especially if you need to enter or exit positions swiftly. Consider staking in cryptocurrencies that are commonly traded on major exchanges to guarantee that you can manage your assets effectively.

- Minimum Staking Requirements

Credits: Freepik

Check for any possible minimum stake limitations. Some networks may require an extensive minimum investment to engage in staking. This can make it expensive and unattainable for small investors. Ensure the admission criteria are within your budget and consistent with your risk tolerance.

- Validator Performance and Reliability

Validators’ performance and dependability are key in networks because they keep the blockchain running. Poor performance could lead to fines that may reduce your staking rewards. Examine the track record of validators or staking pools and select those recognized for their dependability and continuous performance.

- Governance and Voting Rights

Some staking options include governance involvement, which allows you to vote on crucial network decisions. This option is appealing if you desire more control over the network’s development. Consider if you value having a say in the network’s governance and evaluate the effectiveness of the existing governance system.

- Inflationary vs. Deflationary Mechanics

Understand the digital currency’s tokenomics. You must grasp how its supply varies over time. Inflationary tokens may introduce new currencies as staking incentives, possibly lowering their value if the rate at which new coins are introduced exceeds demand. In contrast, deflationary measures such as token burning may boost the value of a token over time.

- Community and Developer Activity

Credits: FreePik

The strength and activity of a project’s community and developers could point to a healthy and expanding ecosystem. A thriving community indicates strong support, whereas active and open growth demonstrates continuous progress and responsiveness to network demands.

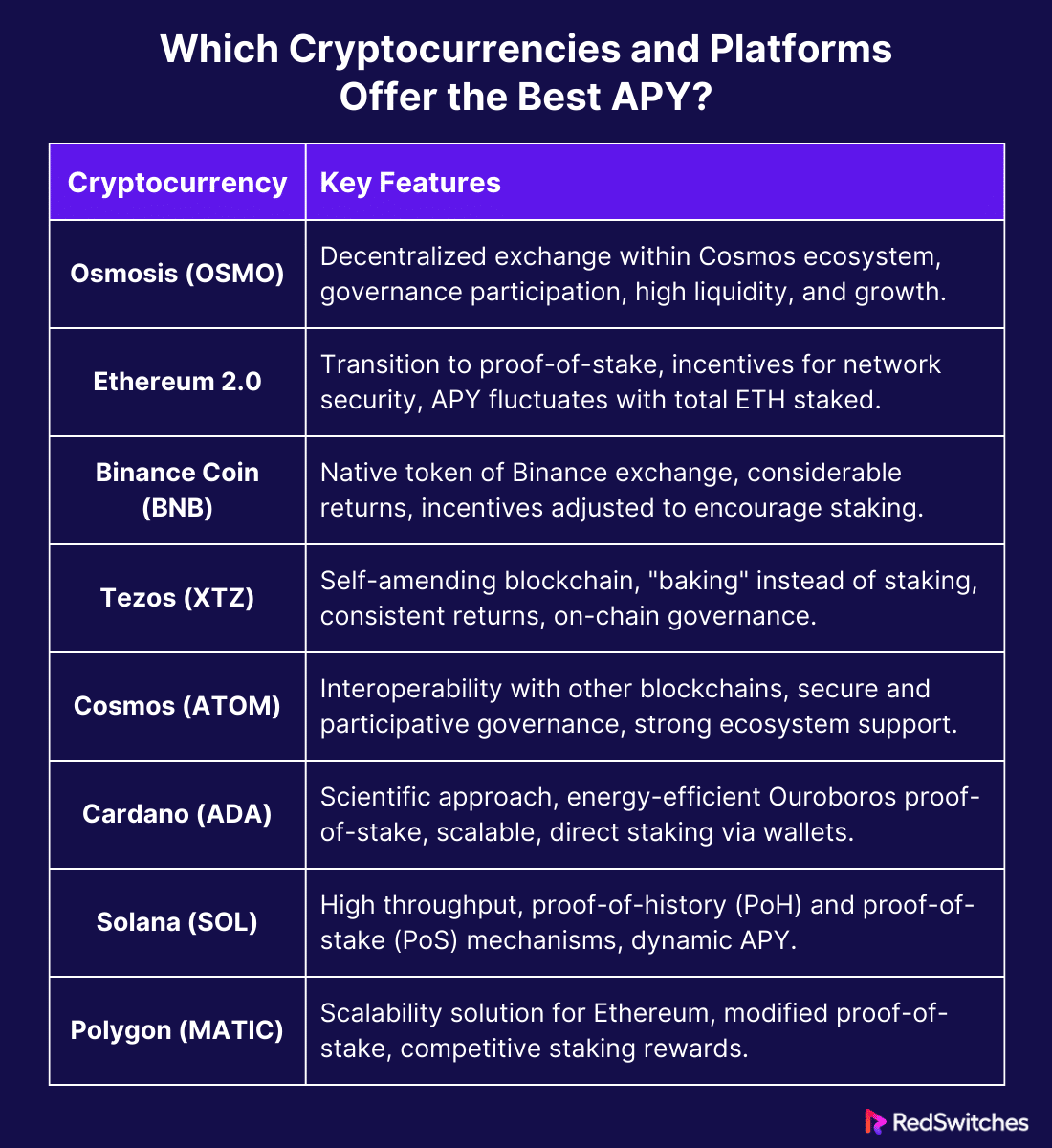

Which Cryptocurrencies and Platforms Offer the Best APY?

Digital currency staking offers numerous opportunities for earning through APY, with different currencies and platforms providing distinct advantages. Here are some of the best crypto platforms and cryptocurrencies that offer competitive crypto-staking APY:

- Osmosis (OSMO)

Osmosis is a decentralized exchange (DEX) technology designed for the Cosmos ecosystem that enables token trading across several blockchains. It’s mostly recognized for its liquidity pooling and staking capabilities. Osmosis holders can influence the network’s development by participating in its governance.

The APY for staking Osmosis may be quite high, making it a popular choice for individuals trying to maximize gains. The platform’s high APY encourages liquidity, which is essential for its operation and growth.

- Ethereum 2.0

Ethereum, one of the most well-known cryptocurrencies, has evolved into a proof-of-stake mechanism with the Ethereum 2.0 release. This modification has enabled staking directly on the Ethereum network. Stakers can receive incentives for helping to protect the network, with APYs fluctuating according to the total amount of ETH staked in the network.

Also Read: Guide To The Best Crypto Staking Platforms Of 2024.

- Binance Coin (BNB)

Binance Coin is the native token of the Binance exchange, one of the world’s leading cryptocurrency exchanges. Binance provides financial products, including staking services, on its platform. Staking BNB can result in considerable returns, with the APY depending on market circumstances and staking period.

Binance also routinely modifies staking incentives to maintain competitive APYs and encourage users to retain their assets on the exchange, increasing liquidity and stability in the trading environment.

- Tezos (XTZ)

Tezos uses a novel self-amending blockchain system and directly provides staking (often known as “baking” in the Tezos community) on its platform. Tezos has been popular among investors because of its reasonably constant returns and moderate annual percentage yields.

The technology supports on-chain governance, which is appealing to individuals who want to have a say in how the blockchain operates.

- Cosmos (ATOM)

Cosmos, noted for its compatibility with other blockchains, provides an appealing staking option through its consensus process. The APY for staking Cosmos can be highly competitive, allowing stakeholders to contribute to the security and governance of several interconnected blockchains.

- Cardano (ADA)

Cardano is renowned for its rigorous scientific philosophy and emphasis on security and sustainability. It uses a proof-of-stake technique called Ouroboros, which is intended to make the staking process as energy-efficient and scalable as feasible. Staking Cardano may be done directly using the official Cardano wallets, Daedalus and Yoroi.

- Solana (SOL)

Solana is known for its high throughput and quick transaction rates, which are attributed to its innovative proof-of-history (PoH) consensus and underlying proof-of-stake (PoS) mechanism. Solana’s dynamic APY makes it an appealing alternative for investors eager to capitalize on a fast-expanding ecosystem.

- Polygon (MATIC)

Polygon, formerly Matic Network, is a scalability solution that gives various tools to enhance transaction speed while lowering costs and complexity on blockchain networks. It uses a modified proof-of-stake system, allowing users to stake their MATIC tokens to protect the network and execute transactions.

Polygon’s staking incentives are competitive, making it an attractive alternative for cryptocurrency investors. The APY for staking MATIC varies based on the amount staked and the duration of the staking period. However, it often provides higher returns than many other staking choices.

Platforms for Comparing Crypto Staking APY

There are several online platforms to compare crypto staking APY for various cryptocurrencies. Some of the best ones include:

Conclusion – Crypto Staking APY

Understanding the meaning of crypto staking APY and its importance can help maximize returns in decentralized finance. Individuals can earn passive income by staking their digital currencies while contributing to network stability and safety. However, it’s essential to research and choose reliable platforms to mitigate risks effectively.

If you’re interested in exploring crypto staking further, RedSwitches offers dedicated servers optimized for staking. Visit our website today to discover how our dedicated servers can enhance your staking experience.

FAQs

Q. Is crypto staking profitable?

Crypto staking can be profitable, especially for those who select the right digital currencies and handle their investments wisely. Profitability depends on several factors, like market conditions, staking rewards, and the stability of the cryptocurrency.

Q. Which crypto has the highest staking rewards?

Cryptocurrencies like Ethereum, Cardano, and Solana are often noted for providing high staking rewards. However, the highest staking incentives can vary with time because of market dynamics and network policy alterations.

Q. What is the annual return of staking crypto?

The crypto staking APY (Annual Percentage Yield), can vary, ranging from a few percent to around 20% or more. It depends on the digital currency and the overall market conditions. This rate reflects the compounded interest earned on staked assets over a year.

Q. What is staking in the world of crypto?

Staking actively participates in transaction validation on a staking platform by locking crypto assets to support the network and receive rewards in return.

Q. How does staking differ from traditional cryptocurrency mining?

While traditional mining involves solving complex mathematical puzzles to validate transactions, staking relies on proof of stake, where validators are chosen to create new blocks based on the amount of stake they hold.

Q. What are some of the benefits of staking Ethereum?

Staking Ethereum offers the opportunity to earn rewards by actively participating in network validation while also contributing to the security and decentralization of the Ethereum network.

Q. Can you recommend the best crypto staking platforms for beginners?

Some of the best crypto staking platforms offer user-friendly interfaces, clear staking options, and competitive APY rates for beginners looking to stake their crypto.

Q. How can I start staking Ethereum and what is the process involved?

To start staking Ethereum, you typically need to choose a staking pool or platform, lock up a certain amount of Ethereum, and follow the specific staking protocol provided by the platform.

Q. Are there any upcoming developments in the world of staking and crypto in 2024?

In 2024, the staking and crypto world will witness major advancements. These include integrating layer 2 solutions, expanding interoperability between blockchain networks, and emerging innovative consensus mechanisms.

Q. What is a crypto exchange?

A crypto exchange is a platform for buying, selling, or trading crypto assets such as Bitcoin, Ethereum, and other cryptocurrencies.

Q. How can I stake my crypto?

Staking involves actively participating in transaction validation on a blockchain network by locking up a certain amount of crypto coins. You can stake your crypto through a stake pool or a staking platform.

Q. What is liquid staking and how does it work?

Liquid staking allows you to stake your crypto assets while still maintaining the ability to use them for other purposes, such as trading or liquidity provision. It combines the benefits of staking with the flexibility of liquidity.

Q. Which is the best staking option for me?

The best staking option depends on factors such as the staking period, the stake amount, and the staking rewards offered.

Q. How can I earn rewards through staking?

By participating in proof of stake staking mechanisms, you can earn staking rewards in the form of additional crypto coins for helping secure the blockchain network and validating transactions.

Q. Can I stake ETH and how?

Ethereum staking allows you to stake your Ethereum holdings to support the Ethereum 2.0 staking protocol and earn rewards for securing the network.