Key Takeaways

- Polygon, formerly Matic Network, is a Layer-2 scaling solution for Ethereum, enhancing transaction speed and reducing costs.

- It uses a Proof of Stake (PoS) consensus mechanism where validators stake MATIC tokens to validate transactions and earn rewards.

- Polygon features Commit Chains to increase transaction throughput, supporting potentially thousands of chains for scalability.

- MATIC, Polygon’s native token, is used for transaction fees, staking, and governance within the network.

- Staking MATIC on Polygon can be done through exchanges, directly on the blockchain, or via liquid staking, each with different pros and cons.

- Staking directly on MetaMask involves setting up the wallet, depositing MATIC, delegating to validators, and monitoring staking rewards.

- Validators’ credibility, uptime, commission rates, and staking amounts are crucial factors for effective MATIC staking.

- The risks of staking include slashing penalties for validator misbehavior, while the rewards include transaction fees and potential MATIC value appreciation.

- Exiting the staking process has an unlocking period for security, varying from 3-4 days for stMATIC to 9 days on the Polygon network.

- Dedicated servers for staking MATIC offer enhanced security, performance, reliability, and scalability, supporting efficient operations.

Polygon MATIC staking is a popular way to earn passive income while supporting the Polygon network. Polygon operates alongside Ethereum, enhancing its capability by processing transactions faster and at a lower cost. As a scalable solution, it plays a crucial role in the broad Ethereum landscape.

Staking involves locking up MATIC tokens, which helps secure the network. In return, stakers receive rewards. This process supports network operations and allows token holders to earn a return on their investment.

The interest in MATIC staking is significant. Currently, about $3.6 billion worth of MATIC tokens are staked. This large amount shows that many people trust and participate in the network. Staking MATIC can be a smart way to grow your digital assets while contributing to Polygon’s security and efficiency.

Table of Contents

- Key Takeaways

- Basics of Staking

- Understanding Polygon

- Understanding MATIC: Polygon’s Native Token

- How to Stake MATIC on Polygon

- Step-by-Step Guide: Staking MATIC on MetaMask

- Staking MATIC with Other Wallets

- Factors to Consider When Staking MATIC

- Risks and Rewards of Staking MATIC

- Unlocking Period and Exiting the Staking Process

- Advantages of Dedicated Server While Staking MATIC

- Conclusion

- FAQs

Basics of Staking

Credits: Freepik

Staking in the context of cryptocurrencies refers to a process where you lock up a portion of your crypto holdings to support the functioning of a blockchain network. Here’s how it works:

- Staking Rewards: If a cryptocurrency allows staking (examples include Ethereum, Tezos, Cosmos, Solana, and Cardano), you can stake some of your holdings. By doing so, you earn rewards over time. Your crypto earns rewards while staked because the blockchain puts it to work.

- Proof of Stake (PoS): Cryptocurrencies that allow staking use a consensus mechanism called PoS. Unlike traditional systems with banks or payment processors, PoS ensures all transactions are verified and secured. When you stake your crypto, it becomes part of this process.

- Efficiency and Lower Costs: PoS reduces costs by not requiring energy-intensive mining. Instead, transactions are validated by people who stake their tokens.

General Benefits of Staking for Token Holders

Staking is a powerful tool for cryptocurrency holders. It allows them to earn rewards simply by holding and locking their tokens in the network. One of the primary benefits of staking is the ability to earn passive income. Holders can receive regular payouts by staking tokens, like earning interest in a savings account.

Another advantage is increased token value. As more tokens are staked and removed from circulation, the supply decreases. If demand stays the same or increases, this can lead to a rise in token prices. Thus, staking can potentially enhance the overall value of a holder’s investment over time.

Staking also often grants holders certain rights within the blockchain ecosystem. These can include voting rights on network decisions or proposals. This involvement helps token holders engage more deeply with the project’s community and development.

Role of Staking in Network Security and Consensus

Staking is crucial for maintaining the security of a blockchain network. When tokenholders stake their cryptocurrencies, they contribute to the network’s operational stability. This process involves participants locking up their tokens to validate transactions. In return, they get rewards.

In networks using a Proof of Stake (PoS) model, validators are chosen based on the cryptocurrency they hold and are willing to lock or “stake.” This means the more participants’ stakes, the higher their chances of being chosen to validate transactions. It’s a responsibility that comes with the potential for earnings.

These validators play a critical role. They help maintain the integrity and accuracy of the transactions recorded on the blockchain. By doing so, they prevent fraudulent activities such as double-spending.

Staking also supports the consensus mechanism, which is essential for the agreement on the state of the blockchain. Without consensus, there would be no agreement on which transactions are valid and which are not. Staking incentivizes validators to act honestly. If they approve fraudulent transactions, they risk losing their staked tokens. This risk of loss ensures that validators work to maintain the network’s security.

Understanding Polygon

Credits: Polygon

Polygon, originally known as Matic Network, is a cutting-edge Layer-2 scaling solution for Ethereum. It aims to tackle some of the most pressing issues the Ethereum network faces today—mainly high transaction fees and slow processing times. Polygon enhances Ethereum by allowing it to process transactions quickly and cheaply while improving the overall user experience.

This platform is designed for developers. It offers tools that make building scalable decentralized applications (dApps) easier, helping with user experience and security. Polygon stands out because it maintains compatibility with Ethereum’s existing ecosystem. This means developers can seamlessly migrate their projects without starting from scratch.

Polygon’s Consensus Mechanism and Scalability

Polygon utilizes a Proof of Stake (PoS) staking blockchain as its core consensus model. In this model, validators stake their MATIC tokens as a security deposit. They do this to participate in network operations like validating transactions or adding new blocks to the blockchain. Validators are chosen based on the amount of MATIC they stake. The more MATIC they stake, the higher their chances of being chosen. This method is less resource-intensive than Ethereum’s original Proof of Work (PoW) system.

Validators on Polygon are crucial for maintaining the network’s integrity. They verify transactions and, in return, earn transaction fees and new MATIC tokens. This incentivizes them to maintain honest and efficient practices. If they act maliciously, they risk losing their staked MATIC.

Commit Chains for Increased Transaction Throughput

One of Polygon’s standout features is its use of Commit Chains. These are transaction networks that operate alongside the main Ethereum blockchain. Commit Chains gather batches of transactions, verify them, and then return this confirmed data to the main chain. This process dramatically increases transaction speed and reduces costs.

Polygon’s Commit Chains are designed to support potentially thousands of different chains. This structure aims to scale up to manage millions of transactions per second. Such capability would vastly surpass Ethereum’s current capacity.

Layer 2 Scaling Solutions for Ethereum

At present, Polygon mainly employs Commit Chain connectivity to boost transaction speeds. However, plans are in place to integrate other Layer-2 solutions, such as Optimistic Rollups. These rollups handle transactions off-chain but report back to Ethereum to finalize transactions. This method promises further improvements in speed and cost.

Interoperability and Future Goals

Polygon is not just focused on improving Ethereum. It aims to become a multi-chain system. This system would support various blockchains and allow for seamless cross-chain interoperability. Such capability would enable different blockchains to communicate and share information more efficiently. This could revolutionize how blockchains interact, making them more versatile and powerful.

Polygon’s vision extends to eventually supporting other blockchain networks, broadening its impact across the crypto ecosystem. Polygon hopes to facilitate a more connected and functional blockchain environment by improving interoperability.

Understanding MATIC: Polygon’s Native Token

MATIC is the native cryptocurrency token of the Polygon network. It was originally launched under the same name when the platform was called Matic Network. As a crucial element of the Polygon ecosystem, MATIC serves multiple functions, primarily revolving around network governance, staking, and fee payment.

Functions of MATIC:

- Transaction Fees: MATIC pays transaction fees within the Polygon network. This use is similar to how Ethereum uses gas. Transactions include simple transfers, smart contract operations, and decentralized application (dApp) interactions.

- Staking: MATIC is staked by validators participating in the network’s consensus mechanism. Staking involves locking up a certain amount of MATIC to support network operations and security.

- Governance: MATIC holders can participate in governance decisions, influencing the future direction and development of the Polygon ecosystem. This includes voting on proposed changes or upgrades to the platform.

The integration of MATIC into the network’s operations ensures its intrinsic value, tying the token’s utility directly to the overall health and functionality of the Polygon network. By holding MATIC, users are directly engaged with the ecosystem through staking to secure the network or participating in governance.

Importance of MATIC in Transaction Processing and Governance on the Polygon Network

MATIC is pivotal in the Polygon network’s transaction processing and governance aspects. Its design and integration into these systems underscore its critical importance to the network’s operation and management.

Transaction Processing:

- Facilitating Transactions: MATIC is used to pay transaction fees on the Polygon network, facilitating everything from simple transfers to complex dApp interactions. This usage helps manage network congestion and compensates validators for processing transactions.

- Incentivizing Validators: Validators stake MATIC to help secure the network and process transactions. In return, they receive rewards in MATIC, aligning their interests with the network’s health and security.

- Scalability: Using MATIC for transactions, Polygon can significantly lower transaction costs than Ethereum. This efficiency makes it more scalable and accessible, especially for developers and users who require fast and economical transaction processing.

Governance:

- Decentralized Decision-Making: MATIC holders have the right to vote on governance proposals. This process empowers the community to shape the development and policy-making of the Polygon network, promoting a decentralized and user-led governance structure.

- Network Upgrades: Governance decisions that involve MATIC voting can direct crucial network upgrades or modifications. These decisions impact Polygon’s scalability, security, and interoperability features, illustrating MATIC’s role in strategic development.

- Community Engagement: The governance model encourages a proactive community. Holders of MATIC are incentivized to participate in network governance, fostering a robust and engaged community aligned with Polygon’s long-term success.

MATIC’s dual role in transaction processing and governance secures its utility and demand and integrates it deeply into the operational and managerial fabric of the Polygon network. This integration ensures that MATIC remains at the core of its economic and governance activities as Polygon grows and evolves, essential for the network’s functionality and progression.

Also Read Top 15 Crypto Staking Platforms for Maximum Earnings!

How to Stake MATIC on Polygon

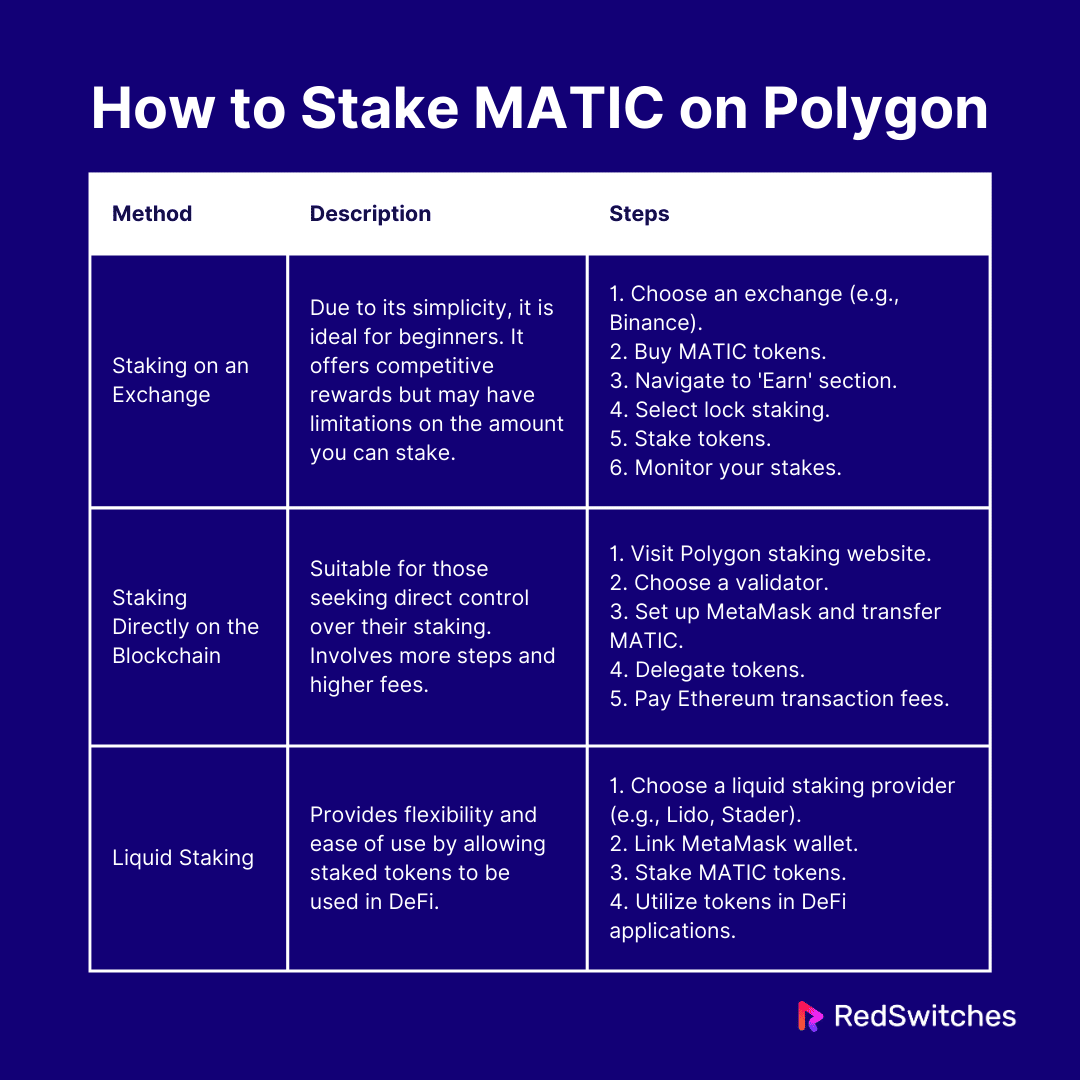

Polygon Matic staking is a method to earn passive income by holding Matic tokens. There are three main ways to stake Matic tokens: through an exchange, directly on the blockchain, and via liquid staking. Each method has its pros and cons. Here, we provide a step-by-step guide to help you choose the best option for staking Polygon Matic.

Staking on an Exchange

Credits: Freepik

Staking on an exchange is ideal for beginners because it is simple. You can start staking your Matic tokens on platforms like Binance. Here are the steps to follow:

- Choose an Exchange: Find an exchange that supports Polygon Matic staking, such as Binance.

- Buy Matic Tokens: Purchase Matic tokens on the exchange. Ensure you get them for low fees.

- Navigate to Earn Section: Go to the ‘Earn’ section on the exchange.

- Select Lock Staking: Choose the lock staking option to stake your Matic tokens.

- Stake Your Tokens: Decide how much Matic you want to stake. Confirm and lock your tokens for a set period.

- Monitor Your Stakes: Check the polygon matic staking apy (annual percentage yield). It can be as high as 21.5% for a 90-day lock period.

Remember, staking on an exchange is easy and offers competitive rewards. However, the amount you can stake may be limited.

Staking Directly on the Blockchain

For those who prefer direct control over their staking, staking on the blockchain is the way to go. This method involves interacting with the Polygon network directly. Here are the steps to stake directly:

- Visit the Polygon Staking Website: Go to the official Polygon staking site.

- Choose a Validator: Review and select a validator. Look for validators with low commission rates and a good track record.

- Set Up a MetaMask Wallet: Download and install MetaMask. Transfer your Matic tokens to this wallet.

- Delegate Your Tokens: Use your MetaMask to delegate tokens to your chosen validator.

- Pay Transaction Fees: Be prepared to pay fees in Ethereum for the transactions.

Staking directly on the blockchain gives you more control but involves higher fees and more steps.

Liquid Staking

Credits: Freepik

Liquid staking offers flexibility by allowing you to use your staked tokens in decentralized finance (DeFi). Here is how to engage in liquid staking:

- Choose a Liquid Staking Provider: Services like Lido or Stader offer liquid staking for Polygon Matic.

- Link Your MetaMask Wallet: Connect your MetaMask wallet to the liquid staking provider’s platform.

- Stake Your Matic Tokens: Transfer your Matic tokens for staking. In return, you’ll receive a liquid staking token, such as StMatic or MaticX.

- Utilize Your Tokens in DeFi: You can earn additional income by using the liquid staking tokens in various DeFi applications.

Liquid staking provides a liquid token, making it easy to trade or use while still earning staking rewards.

Choosing the right method for Polygon Matic staking depends on your comfort level with technology and financial goals. Staking on an exchange is easiest, while blockchain offers more control. Liquid staking strikes a balance by providing flexibility and ease of use. Whatever method you choose, Polygon Matic staking can be a valuable tool for generating passive income.

Here is a summary table outlining the main methods for staking MATIC on the Polygon network, along with the steps involved for each method:

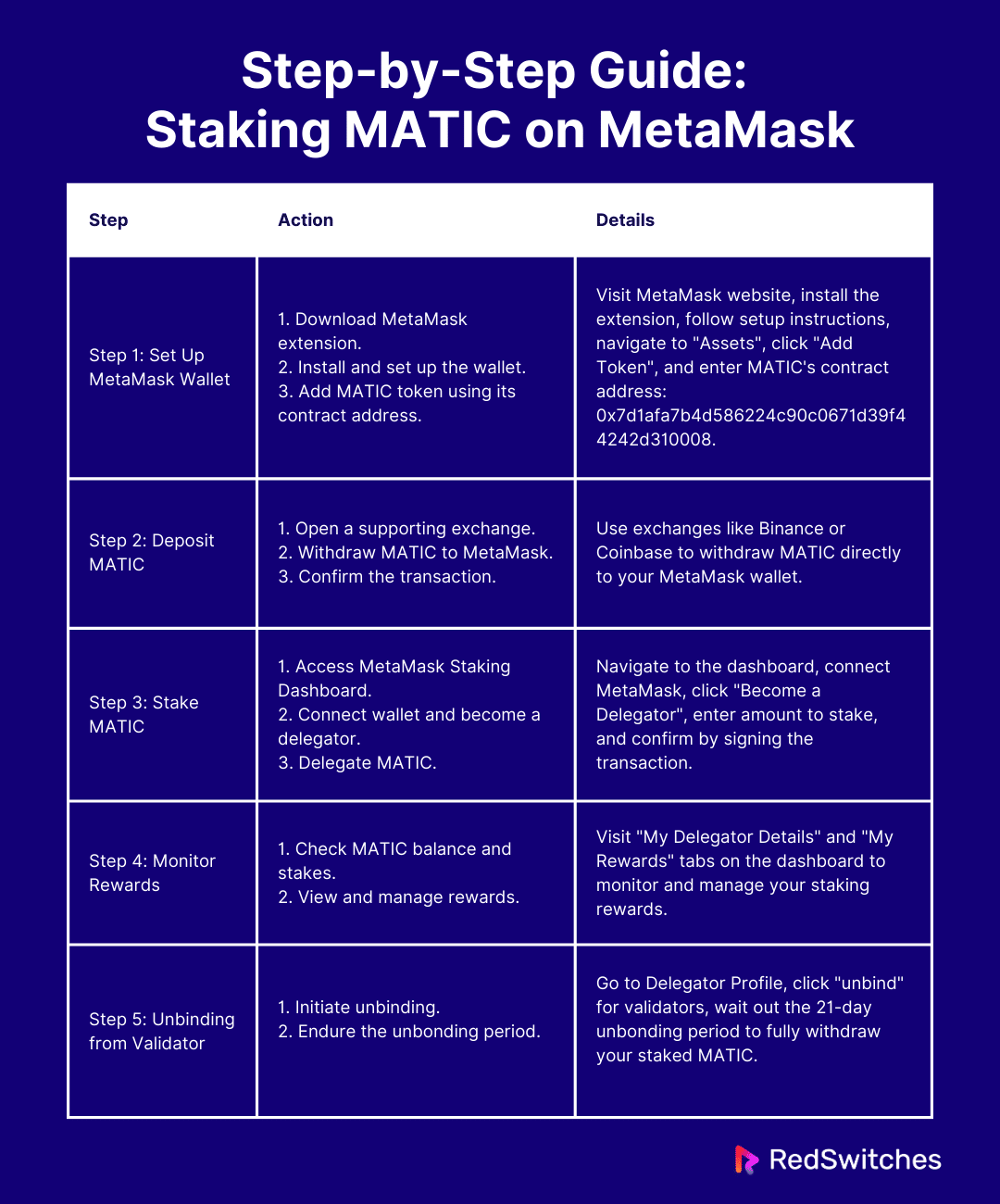

Step-by-Step Guide: Staking MATIC on MetaMask

Staking MATIC on MetaMask involves several steps. Follow this guide to ensure a smooth staking process:

Step 1: Set up a MetaMask Wallet

- Visit the MetaMask website and download the MetaMask extension for your browser.

- Install and set up the MetaMask wallet, following the on-screen instructions.

- Once set up, navigate to the “Assets” tab in your MetaMask wallet.

- Click “Add Token” and paste the MATIC token contract address: 0x7d1afa7b4d586224c90c0671d39f44242d310008.

Step 2: Deposit MATIC to Your MetaMask Wallet

- Open a cryptocurrency exchange that supports MATIC, such as Binance or Coinbase.

- Withdraw MATIC to your MetaMask wallet.

- Confirm the transaction in your MetaMask wallet.

Step 3: Stake MATIC on MetaMask

- Navigate to the MetaMask Staking Dashboard.

- Connect your MetaMask wallet to the dashboard.

- Click “Become a Delegator” and follow the on-screen instructions to fill in your staking information.

- Enter the amount of MATIC you wish to stake and click “Delegate Now”.

- Sign the transaction in your MetaMask wallet.

- Wait for 12 block confirmations for your transaction to reflect on your dashboard.

Step 4: Monitor Your Staking Rewards

- Head to the “My Delegator Details” tab on the MetaMask Staking Dashboard.

- Check your MATIC balance, MATIC stake, and other details.

- Go to the “My Rewards” tab to see your delegation rewards.

- You can withdraw your rewards or restake them for the selected validator.

Step 5: Unbinding from a Validator

If you wish to withdraw your stake, go to the Delegator Profile page at the left side of the staking dashboard.

- Click the “unbind” option for every validator you have staked with.

- After unbinding, there is a 21-day “unbonding period” that Matic Network has to prevent any malicious behavior on the network.

- Your staking rewards will be credited to your account.

- Your staked tokens will be locked for 21 days and can be withdrawn after the “unbonding period” ends.

Here is a concise summary table outlining the step-by-step guide for staking MATIC on MetaMask:

Also Read What Is Staking Rewards?

Staking MATIC with Other Wallets

Credits: Freepik

To engage in Polygon MATIC staking, you can use various digital wallets beyond MetaMask. Trust Wallet, Coinbase Wallet, and polygon matic staking Ledger are popular options. Each offers different features but the basic process for staking MATIC remains similar.

Setting Up the Wallet

- Download and install your chosen wallet.

- Create a new wallet, securely noting down your recovery phrase.

- Ensure the wallet supports the Polygon network.

Adding MATIC to Your Wallet

- Transfer MATIC from an exchange or another wallet to your wallet’s address, ensuring the transfer is on the Polygon network to avoid high fees.

Connecting to a Staking Platform

- Visit the official Polygon staking dashboard or a trusted third-party platform.

- Connect your wallet using the platform’s wallet connection options.

Selecting Staking Options

Choosing the right validator is a crucial step in the Polygon MATIC staking process. Validators are responsible for processing transactions and securing the network.

Choosing a Validator

- Review the list of available validators on the Polygon staking dashboard.

- Consider each validator’s uptime, commission rates, and performance history.

- Select a validator that aligns with your staking goals and risk tolerance.

Staking Your MATIC

- Decide on the amount of MATIC you want to stake.

- Follow the platform’s instructions to delegate your MATIC to your chosen validator.

- Confirm the transaction, considering that you may need a small amount of ETH for the transaction fee on the Ethereum network.

Third-party Interfaces like Binance, Nexo, and Exodus Wallet

For those who prefer an all-in-one solution, platforms like Binance, Nexo, and Exodus Wallet offer integrated trading services, including Polygon MATIC staking.

Using Binance for Staking

- Log in to your Binance account and navigate to the staking section.

- Find MATIC among the available cryptocurrencies to stake.

- Review the terms and potential yields. Binance often offers different staking options, from flexible to locked staking with varying APYs.

- Choose an option and stake your MATIC directly within the platform.

Staking on Nexo

- Access your Nexo account and go to the ‘Earn Interest’ section.

- Select MATIC from the list of cryptocurrencies.

- Choose to add MATIC to your Nexo wallet for staking. Nexo allows you to earn interest, which is compounded and paid out daily.

- Review and accept the staking terms.

Using Exodus Wallet for Staking

- Open your Exodus Wallet and navigate to the staking section.

- Find and select MATIC from the list of supported assets for staking.

- Exodus will display the available staking options, including expected returns and any applicable fees.

- Initiate the staking process by following the on-screen instructions to delegate your MATIC.

Staking through third-party interfaces can offer added convenience, as these platforms manage the technical aspects of staking and often provide enhanced security features. However, knowing any additional fees or terms that may apply when using these platforms for Polygon MATIC staking is important. Always ensure that your chosen platform is reputable and provides adequate security for your digital assets.

Also Read: What Is the Minimum Lockup Period for Crypto Staking?

Factors to Consider When Staking MATIC

When engaging in Polygon MATIC staking, several key factors should influence your decision on where and how to stake your tokens. Each factor impacts the potential return and risk associated with staking MATIC.

Validator Credibility

The credibility of a validator is crucial in Polygon MATIC staking. Validators play a significant role in the network by processing transactions and maintaining blockchain security.

Points to Consider:

- History and Reputation: Look for validators with a proven track record and positive reviews from other stakers.

- Community Trust: Validators who are active in the community and transparent about their operations tend to be more reliable.

Choosing a credible validator is important because it reduces the risk of slashing, where part of your staked MATIC could be lost due to validator misbehavior.

Uptime and Reliability

Uptime measures how consistently a validator is online and performing its duties. High uptime is essential for effective staking.

Key Aspects:

- Network Participation: Ensure the validator consistently participates in the network. High participation rates often indicate stable and reliable performance.

- Technical Infrastructure: Validators with robust infrastructure are less likely to face downtime that could affect your staking rewards.

Reliability in performance protects your staking investment and ensures a steady flow of staking rewards.

Commission Rates

Commission rates directly affect the earnings from Polygon MATIC staking. Validators charge a commission for their services, which is deducted from the rewards earned by stakers.

Understanding Commissions:

- Rate Comparison: Compare commission rates between different validators. Lower rates can mean more rewards, but this should not be the only factor considered.

- Balance Between Rate and Service: A slightly higher commission is sometimes justifiable if the validator offers better service or security.

Choosing the right commission rate involves balancing cost and the validator’s service quality.

Stake Amount

The amount of MATIC you choose to stake can significantly impact your staking experience.

Considerations for Staking Amount:

- Minimum Requirements: Some validators require a minimum stake amount. Make sure you meet these requirements.

- Risk Management: Only stake an amount you are comfortable with, especially considering the potential risks involved in staking.

- Impact on Rewards: Generally, the more you stake, the more you might earn in rewards. However, spreading your stake across multiple validators can diversify risks.

Deciding on the amount to stake involves evaluating your financial situation and risk tolerance.

Engaging in Polygon MATIC staking requires careful consideration of various factors. Validator credibility, uptime and reliability, commission rates, and the amount of MATIC you stake are crucial in determining your staking efforts’ success. By thoroughly evaluating these factors, you can make informed decisions that optimize your returns and minimize risks in Polygon MATIC staking.

Risks and Rewards of Staking MATIC

Credits: Freepik

Staking MATIC on the Polygon network offers both potential rewards and certain risks. Understanding these can help investors make more informed decisions about their staking activities.

Slashing and Penalties

One of the primary risks in Polygon MATIC staking involves slashing. Slashing occurs if the validator you have chosen to delegate your MATIC to acts dishonestly or incompetently. In such cases, a portion of the staked MATIC could be lost as a penalty.

Key Points on Slashing:

- Validator Behavior: If a validator misbehaves, they can be slashed, but their stakers can also lose some of their invested MATIC.

- Security Measures: It’s crucial to select reputable validators with a good track record to minimize this risk.

Rewards Distribution

The rewards from staking MATIC are a significant attraction for many investors. These rewards are derived from the operations that validators perform on the network, such as processing transactions and securing the blockchain.

Understanding Rewards:

- Reward Calculation: The amount of rewards you receive depends on several factors, including the amount of MATIC staked and the overall efficiency of the validator.

- Reward Frequency: Rewards are typically calculated based on the number of transactions the validator processes and the total stake delegated to them.

Potential Increase in MATIC Value

Beyond the direct staking rewards, there is also the potential for an increase in the value of MATIC itself. By participating in Polygon MATIC staking, you help secure the network, which can enhance the overall stability and reputation of Polygon. This, in turn, might increase the demand and value of MATIC.

Factors Influencing MATIC Value:

- Network Growth: As more applications and services are built on Polygon, the increased use can drive up MATIC’s demand.

- Network Security: Effective security through staking helps build trust in the Polygon network, potentially attracting more users and investors.

Mitigating Risks

To mitigate the risks associated with Polygon MATIC staking:

- Choose Validators Wisely: Research and select validators with a strong reputation and a record of reliable behavior.

- Stay Informed: Keep up-to-date with changes in the Polygon network and the broader market conditions.

- Diversify: Consider spreading your staking investments across multiple validators to reduce potential losses.

While polygon matic staking rewards are attractive, including earning additional MATIC and contributing to the network’s security, it also comes with risks such as slashing and the impact of validator behavior. Careful consideration and management of these factors are essential for anyone looking to stake MATIC effectively.

Unlocking Period and Exiting the Staking Process

Understanding the unlocking period and how to exit the staking process is crucial for managing your investments effectively when engaging in Polygon MATIC staking.

Unlocking Period for Staked MATIC

The unlocking period is a specific time frame during which staked MATIC tokens remain locked even after you decide to unstake them. This period is necessary for security reasons and helps ensure the stability of the staking process on the Polygon network.

Details of the Unlocking Period

- stMATIC Unlocking Period: Once you initiate unstaking, stMATIC tokens generally take about 3-4 days to become available, depending on network conditions.

- Polygon Network Unstaking Delay: For MATIC tokens staked directly on the Polygon network, there is a mandatory nine-day waiting period before the tokens can be withdrawn. This delay is part of the network’s protocol to prevent abrupt changes in the total staked amount, which could affect network security.

Exiting the Staking Process

Exiting the staking process involves several steps that must be carefully followed to ensure that your assets are safely and effectively unstaked and reclaimed.

Steps to Unstake MATIC:

- Navigate to Dashboard: Go to the staking dashboard, such as Lido for Polygon.

- Select Unstake: Find and click on the “Unstake” option.

- Specify Amount: Enter the amount of stMATIC you wish to unstake.

- Unlock Tokens: Choose the “Unlock Token” action to begin the process of unlocking your staked assets.

- Confirm Transaction: A confirmation pop-up will appear in your wallet. Approve the transaction to proceed with the unstaking.

Redeeming stMATIC:

- After the unlocking period, you are free to fully unstake your assets.

- If you decide to trade your stMATIC, you can do so on both centralized exchanges (like Coinbase, Binance, or Gate.io) and decentralized exchanges (such as Uniswap on Ethereum or Quickswap on Polygon).

Important Considerations:

- Always understand the staking terms of any platform or wallet you use for Polygon MATIC staking.

- Be aware of the conditions and requirements for unstaking and redeeming MATIC to avoid surprises regarding access to your funds.

Understanding the unlocking period and the steps to exit Polygon MATIC staking is essential for effective portfolio management. These measures are designed to protect both the individual staker and the overall integrity of the Polygon network, ensuring that staking remains a secure and beneficial activity for all participants.

Also Read Future of Cryptocurrency: Staking vs. Mining

Advantages of Dedicated Server While Staking MATIC

Using a dedicated server for Polygon MATIC staking offers several advantages that can enhance the security and efficiency of your staking operations. Here are the key benefits of using a dedicated server when engaging in Polygon MATIC staking.

Enhanced Security

A dedicated server provides a controlled and secure environment for Polygon MATIC staking. Unlike shared hosting, a dedicated server is solely used by one client, significantly reducing the risk of unauthorized access and data breaches.

Security Features:

- Isolated Environment: Your staking operations are isolated from other users, minimizing the risk of cross-contamination from other servers or applications.

- Advanced Control: You have complete control over the server’s security settings, allowing for customized firewalls, security protocols, and more.

Improved Performance

Dedicated servers generally offer better performance compared to shared hosting or personal computers. This is crucial for maintaining the high availability and responsiveness required for effective staking on the Polygon network.

Performance Enhancements:

- Higher Uptime: Dedicated servers can provide greater uptime, ensuring that your staking operations are not interrupted by downtime or maintenance issues.

- Faster Processing: With more powerful processing capabilities, dedicated servers can handle transactions and blockchain interactions more quickly and efficiently.

Greater Reliability

The reliability of your staking operation is vital. A dedicated server can offer the stability needed to ensure that your Polygon MATIC staking is consistently operational.

Reliability Factors:

- Dedicated Resources: You have access to dedicated resources, such as CPU, RAM, and bandwidth, which means that your server’s performance is not affected by the demands of other users.

- Regular Maintenance: Service providers often include maintenance and support in their dedicated server packages, helping to keep your server in optimal condition.

Scalability

As your staking needs grow, a dedicated server can easily be upgraded to accommodate increased demands without disrupting existing operations.

Scalability Options:

- Customizable Setup: You can upgrade hardware or adjust configurations to meet the growing needs of your Polygon MATIC staking activities.

- Flexibility: Adding more storage, increasing bandwidth, or upgrading CPUs can be done with minimal downtime, providing flexibility as your staking operation expands.

Using a dedicated server for Polygon MATIC staking thus offers significant advantages in terms of security, performance, reliability, and scalability. These benefits collectively ensure a more robust and efficient staking environment, helping you maximize your returns and maintain the integrity of your staking activities on the Polygon network.

Conclusion

Polygon MATIC staking offers crypto fans a great chance to earn passive income and help with network security and growth. You can stake MATIC using personal wallets like MetaMask or dedicated servers for better results. Staking supports the Polygon network and could also raise the value of MATIC, giving a double benefit to those involved. Investors can increase their gains by carefully choosing validators and understanding staking terms while reducing risks.

Want to improve your Polygon MATIC staking? Check out the dedicated servers from RedSwitches. They boost your staking with top-notch security, outstanding performance, and dependability. With our scalable solutions, you can increase your staking rewards. Join RedSwitches now and take your staking to the next level!

FAQs

Q. What is the staking reward for Polygon MATIC?

The staking reward for Polygon MATIC varies but typically ranges around 5-20% Annual Percentage Yield (APY), depending on the validator’s fees and network conditions.

Q. Is staking Polygon worth it?

Staking Polygon can be worth it if you want to earn passive income while contributing to network security. However, it’s important to consider the potential risks, such as slashing and validator performance.

Q. What is the benefit of staking MATIC?

Benefits of staking MATIC include earning staking rewards, participating in network governance, helping secure the network, and potentially increasing the value of your holdings as demand for the network grows.

Q. How much can you make staking MATIC?

Earnings from staking MATIC depend on several factors including the amount staked, the APY offered, and the duration of staking. It’s possible to earn a significant return, especially if network usage and the price of MATIC increase over time.

Q. Can you make a living staking crypto?

Making a living staking crypto is possible but risky and depends heavily on the amount of capital invested, the stability of the chosen cryptocurrencies, and market conditions. It’s more commonly an additional income stream rather than a primary source of income.

Q. What is staking on Polygon and how can I start?

Staking on Polygon involves locking up your MATIC tokens to support the network’s operations and security. First, you must stake your MATIC by delegating your tokens to a validator node through a staking calculator on platforms like Polygon Wallet. This process helps you earn rewards based on the amount of MATIC staked and the reward rate offered.

Q. How do I choose a validator node to maximize my rewards on Polygon?

Choosing the right validator node is crucial to maximizing your rewards. Consider factors like the validator’s performance, fee structure, and uptime. A reliable validator with a high uptime and reasonable fees can offer better staking rewards. Before making your decision, you can use a staking calculator to estimate rewards from different validators.

Q. What are the risks of staking MATIC on the Polygon blockchain?

Staking on any blockchain, including Polygon, involves risks such as slashing, where a portion of the staked MATIC might be forfeited if the validator node behaves dishonestly or incompetently. There’s also the risk of validator downtime, which can affect your earnings. Always research and choose reputable validators to mitigate these risks.

Q. Can I use hardware wallets like Ledger to stake my MATIC?

Yes, you can use a hardware wallet such as a Ledger device to stake your MATIC securely. Hardware wallets offer enhanced security by storing your tokens offline. Use the Ledger Live app to connect your Ledger hardware wallet with the Polygon web wallet, enabling you to delegate your tokens to a validator safely.

Q. How and when can I claim my staking rewards on Polygon?

Polygon rewards are distributed periodically and can be claimed through your crypto wallet interface. The frequency of distribution may vary based on the validator’s policies. To claim your rewards, navigate to the staking section of your wallet, select the validator, and choose to claim or reinvest them. Remember that claiming rewards might involve transaction fees on the Polygon chain.