Key Takeaways

- Stripe and Square are leading forces in digital payments, each offering unique strengths and catering to different business needs.

- Stripe is ideal for tech-savvy businesses, developers, and those needing a globally scalable payment solution.

- Square excels in its ease of use and comprehensive solutions for businesses with a physical presence.

- Stripe boasts robust developer tools and APIs for extensive customization and integration flexibility.

- Square offers an impressive array of hardware options, catering to businesses of all sizes and transaction needs.

- Both platforms prioritize security, adherence to industry standards, and fraud prevention tools to protect user data.

- Stripe has an extensive international reach, supporting over 135 currencies and businesses in more than 40 countries.

- Square is known for its quick payout times, often providing business next-day payouts.

- When deciding between Stripe and Square, consider your business model, technical resources, pricing tolerances, hardware needs, and international aspirations.

- Ultimately, the best choice is the platform that aligns seamlessly with your business’s requirements and growth vision.

Businesses, from thriving startups to massive corporations, are always searching for the most effective, safe, and user-friendly payment processing solutions in the quickly changing world of digital transactions. Square and Stripe are leading this fintech revolution. Each platform follows a different route in the market while providing extensive service offerings and cutting-edge capabilities to meet specific business demands.

In 2022, the value of the worldwide digital payment market was estimated at USD 81.03 billion, with projections indicating a growth rate (CAGR) of 20.8% annually from 2023 to 2030. Moreover, the total value of digital payment transactions globally surpassed USD 8 trillion in the same year. Amidst this explosive growth, Stripe vs Square both emerge not just as service providers but as architects shaping the future of how businesses interact with their finances and customers.

But the question that often perplexes many business owners, from the local coffee shop to the sprawling e-commerce empire, is: which platform aligns best with their operational ethos and growth trajectory? As we delve into the world of Stripe vs Square, our guide aims to unravel the intricacies of each payment gateway, offering clear, insightful comparisons that empower you to make the most informed decision for your business’s financial heartbeat.

In this comprehensive exploration, we’ll dissect crucial aspects such as transaction fees, ease of use, customer support, and integration capabilities, ensuring that by the end of this journey, you’ll emerge more knowledgeable, confident, and ready to navigate the fintech landscape with a partner that resonates with your business’s pulse.

Let’s embark on this journey of discovery, decoding the intricacies of Stripe vs Square, and unveiling the best choice for your business.

Table of Contents

- Key Takeaways

- What Is Stripe?

- What Is Square?

- Stripe vs Square: Which Payment Processor Is Better, and How to Choose

- Similarities between Square and Stripe Offers

- Square vs Stripe: Which One Is Right for Your Business?

- Conclusion

- FAQs

What Is Stripe?

Credits: Stripe

Stripe is a beacon in the digital payment landscape, heralded for its adaptability, robust infrastructure, and customer-centric approach that resonates with modern business sensibilities. Founded in 2010 by the ingenious siblings Patrick and John Collison, Stripe swiftly rose to prominence, championing the cause of streamlined online transactions. Today, it is not just a payment processing platform but a comprehensive ecosystem fostering seamless financial operations for businesses of all scales and sectors.

At its core, Stripe is designed to remove the hurdles of digital transactions. It is a favored ally for e-commerce ventures, subscription-based services, and any enterprise looking to flourish in the digital domain. With its ever-evolving suite of tools and services, Stripe ensures that businesses stay ahead of the curve, embracing the future of finance with open arms.

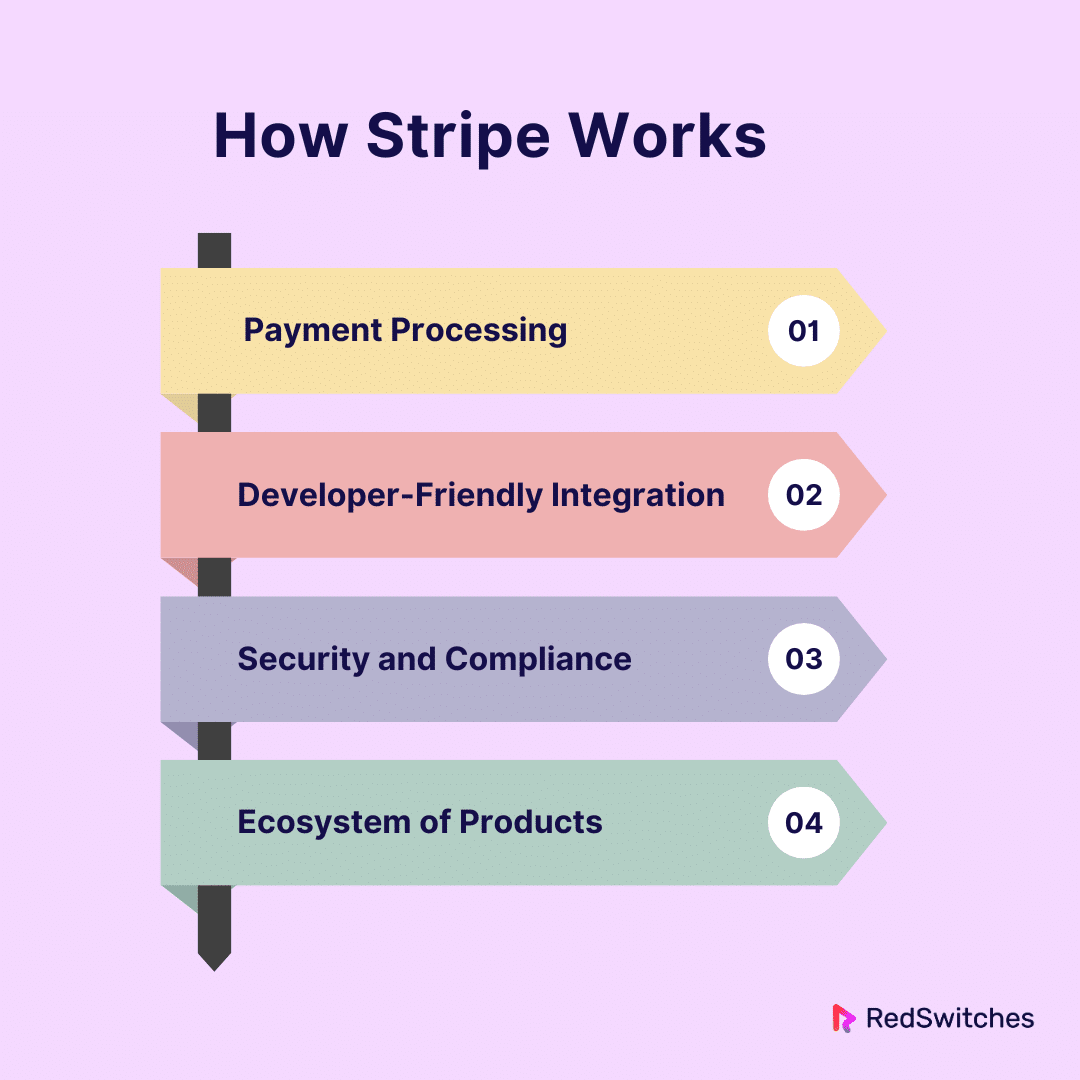

How Stripe Works

Stripe operates on simplicity, security, and scalability principles. It functions as a mediator, a digital conduit that effortlessly connects businesses, customers, and financial institutions. Here’s a breakdown of its operational model:

Payment Processing: Stripe’s prowess shines in its ability to process many payment types, including credit cards, bank transfers, and even cryptocurrency. It offers a global platform, supporting over 135 currencies and payment methods, thereby dismantling geographical and financial barriers.

Developer-Friendly Integration: Stripe prides itself on its meticulously crafted APIs (Application Programming Interfaces), which offer developers the flexibility to create custom payment solutions. Whether it’s integrating a simple checkout system on a website or weaving complex billing operations for a large enterprise, Stripe’s API is like a chameleon, adapting to the specific contours of any business requirement.

Security and Compliance: With the digital age comes the paramount importance of security. Stripe addresses this by adhering to stringent security protocols, including compliance with PCI DSS (Payment Card Industry Data Security Standard). It ensures that every transaction is not just a transaction but a fortress, safeguarded against the threats that lurk in the digital shadows.

Ecosystem of Products: Beyond payment processing, Stripe’s arsenal is brimming with tools designed to supercharge business operations. From Atlas, a toolkit for starting a global internet business, to Sigma, for custom reporting and data insights, Stripe is not just a service; it’s a strategic partner propelling businesses toward unparalleled growth.

Also Read A Guide to Website Builders with eCommerce: Top 10 Recommendations

Stripe Pros & Cons

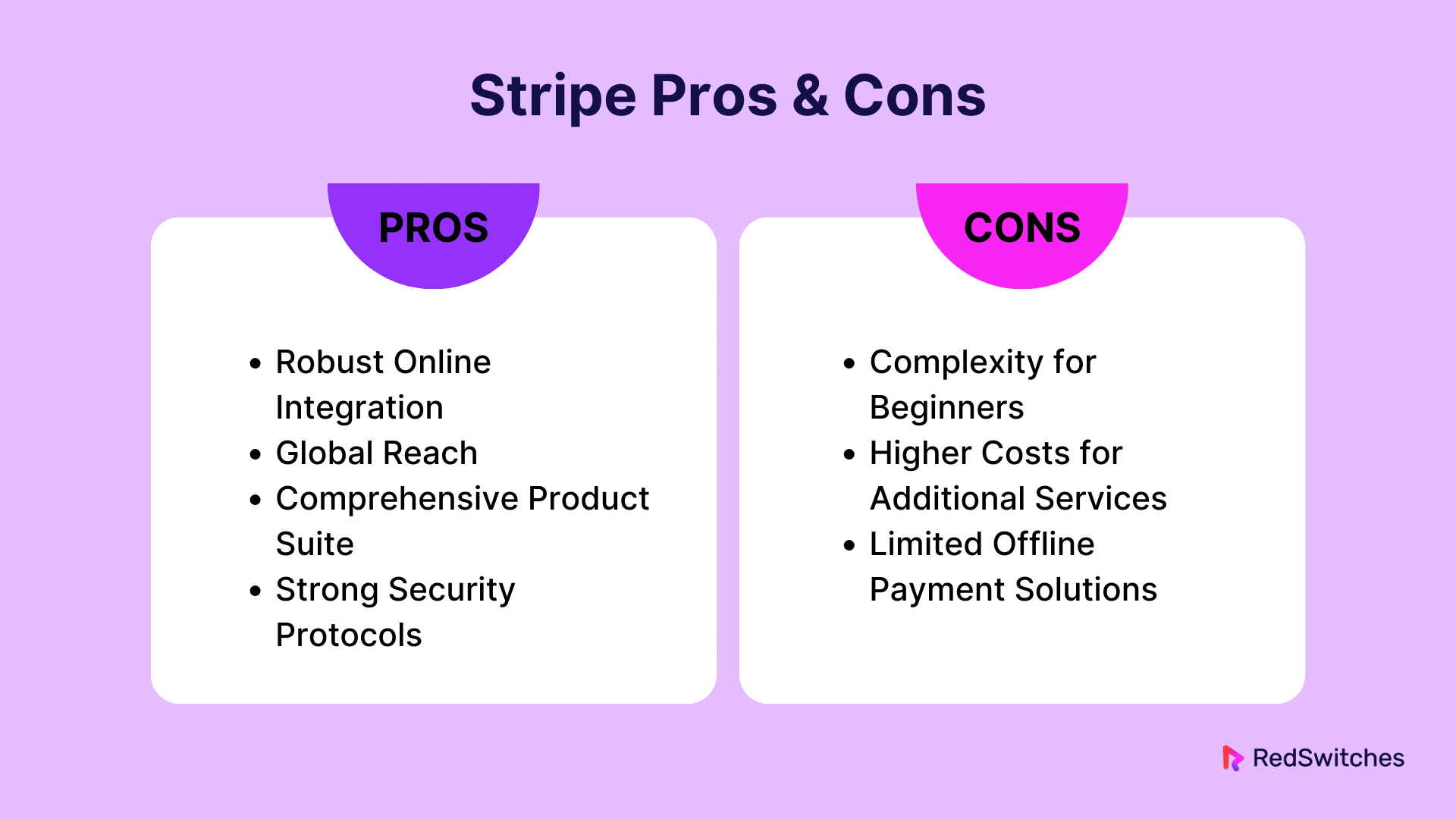

Pros:

- Robust Online Integration: Stripe’s sophisticated API is a developer’s delight, offering unparalleled customization and integration capabilities. It’s particularly beneficial for businesses that require a tailored online payment solution.

- Global Reach: With support for over 135 currencies and numerous payment methods, Stripe is a global powerhouse, ideal for businesses aiming to expand their reach across international borders.

- Comprehensive Product Suite: Stripe goes beyond mere payment processing, offering many tools for financial reporting, fraud prevention, and business management, making it a holistic platform for business growth.

- Strong Security Protocols: Security is paramount in the digital age, and Stripe’s adherence to PCI DSS compliance and its advanced fraud detection tools ensure that transactions are seamless and secure.

Cons:

- Complexity for Beginners: The very features that make Stripe a powerful tool for developers can be daunting for non-technical users or small businesses looking for a straightforward solution.

- Higher Costs for Additional Services: While Stripe’s core services are competitively priced, the costs can accumulate when you integrate additional services or tools.

- Limited Offline Payment Solutions: Unlike Square, Stripe focuses predominantly on online payments, which might not be ideal for businesses with a significant offline presence.

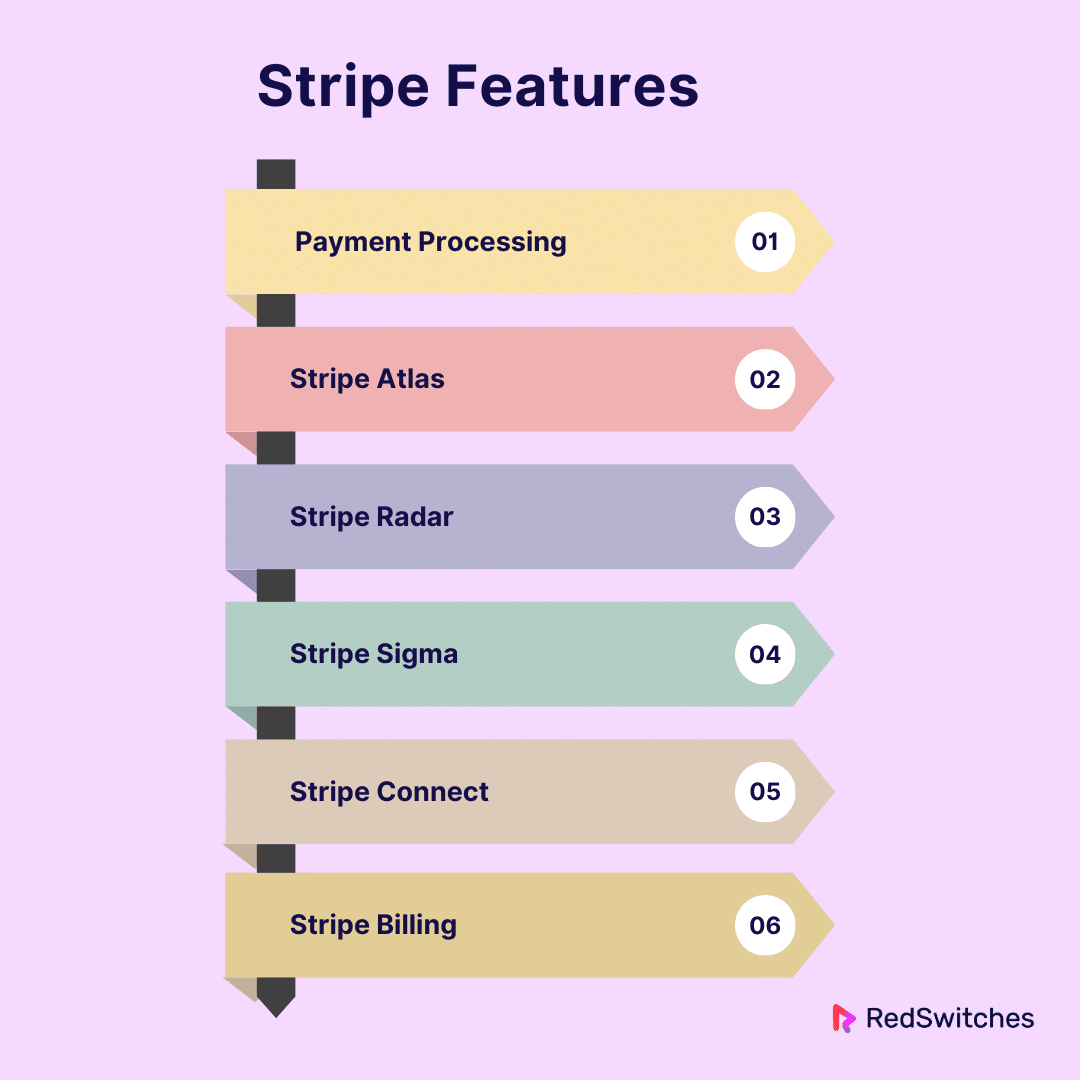

Stripe Features

Stripe’s features are meticulously engineered to cater to a wide array of business needs, ensuring that every transaction is not just a process but a seamless experience:

- Payment Processing: Stripe’s flagship service facilitates various payment types, including credit cards, bank transfers, and even cryptocurrencies.

- Stripe Atlas: An all-encompassing toolkit for starting a global internet business, providing help with everything from incorporating a company to opening a bank account.

- Stripe Radar: A robust fraud detection tool utilizing machine learning to identify and prevent fraudulent transactions, safeguarding your revenue and customer trust.

- Stripe Sigma: Provides custom reports and data insights, enabling businesses to make informed decisions based on comprehensive data analysis.

- Stripe Connect: Perfect for platforms and marketplaces, this feature simplifies the process of routing payments between multiple parties, ensuring a smooth transaction experience for all stakeholders.

- Stripe Billing: An automated invoicing and billing system that can handle everything from subscription management to one-time invoices, reducing the administrative burden and enhancing cash flow management.

What Is Square?

Credits: Square

Square, synonymous with innovation in financial technology, has etched its mark as a transformative force in the industry. Established in 2009 by tech visionaries Jack Dorsey and Jim McKelvey, Square began as a solution to a standard merchant quandary: accepting credit card payments. Today, it has blossomed into a multifaceted platform that champions the needs of businesses, big and small, with its intuitive products and services designed to simplify transactions and foster business growth.

Square’s ascent in fintech is a testament to its robust technology and commitment to making financial operations seamless and accessible. From its iconic little white card reader to a comprehensive suite of business management tools, Square stands as a beacon for businesses navigating the intricate waters of digital finance.

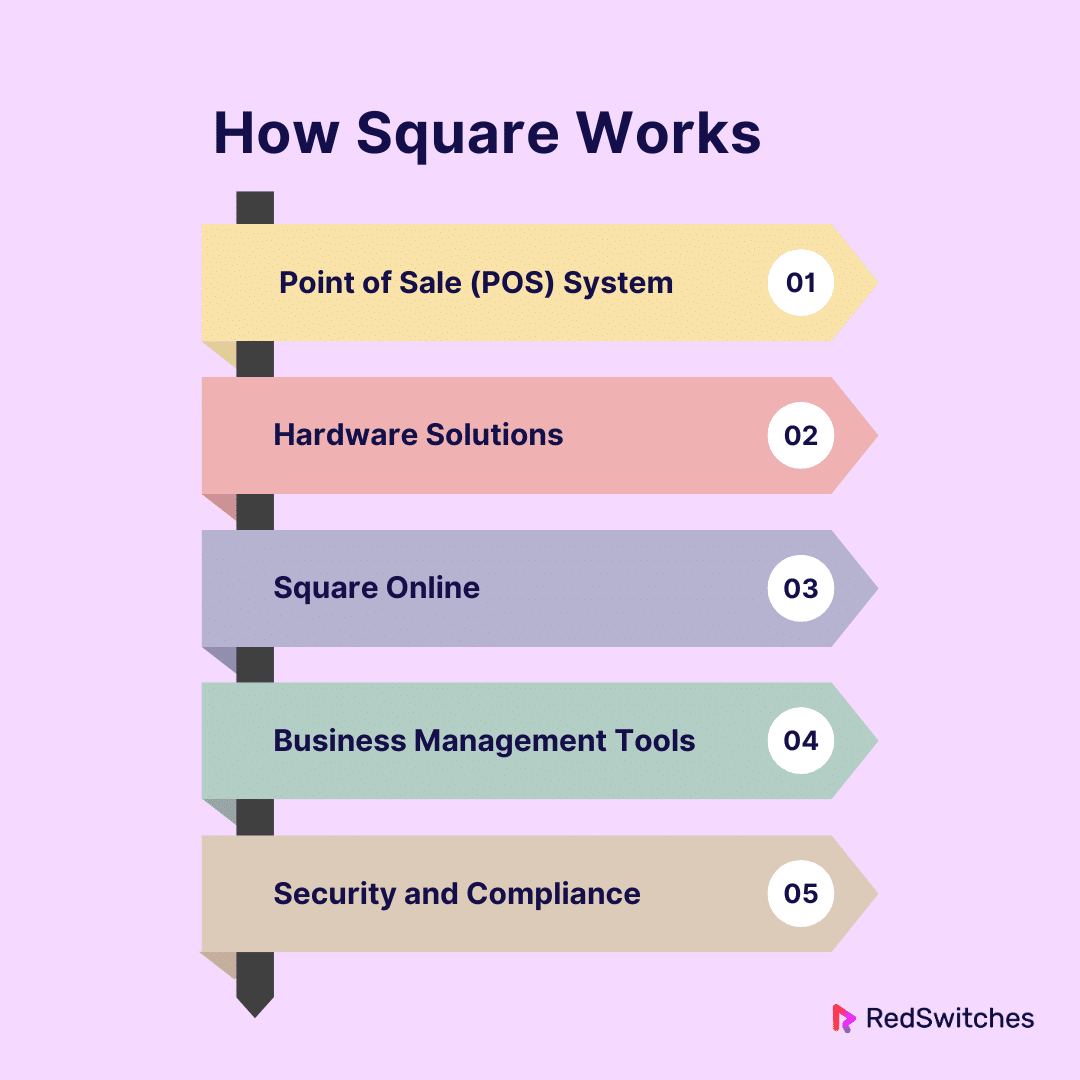

How Square Works

Square operates with a keen understanding of the needs of physical businesses, offering an ecosystem of products and services tailored to enhance customer-business interaction. Here’s how Square stands out:

Point of Sale (POS) System: At the heart of Square’s offerings is its free, user-friendly POS system. Designed for businesses of all sizes, it goes beyond payment processing, offering features for inventory management, customer engagement, and sales analytics.

Hardware Solutions: Square provides various hardware options, from simple card readers that connect to smartphones to sophisticated POS systems and registers, ensuring businesses can find the perfect fit for their operational needs.

Square Online: Recognizing the shift towards e-commerce, Square offers an integrated online store solution, allowing businesses to expand their presence from physical to digital effortlessly.

Business Management Tools: Square’s suite extends to payroll management, appointment scheduling, and even business loans, embodying a holistic approach to business operations.

Security and Compliance: Understanding the criticality of security, Square ensures that its systems comply with the latest industry standards, providing peace of mind to both businesses and their customers.

Also Read A Comprehensive Guide on How to Start an eCommerce Business

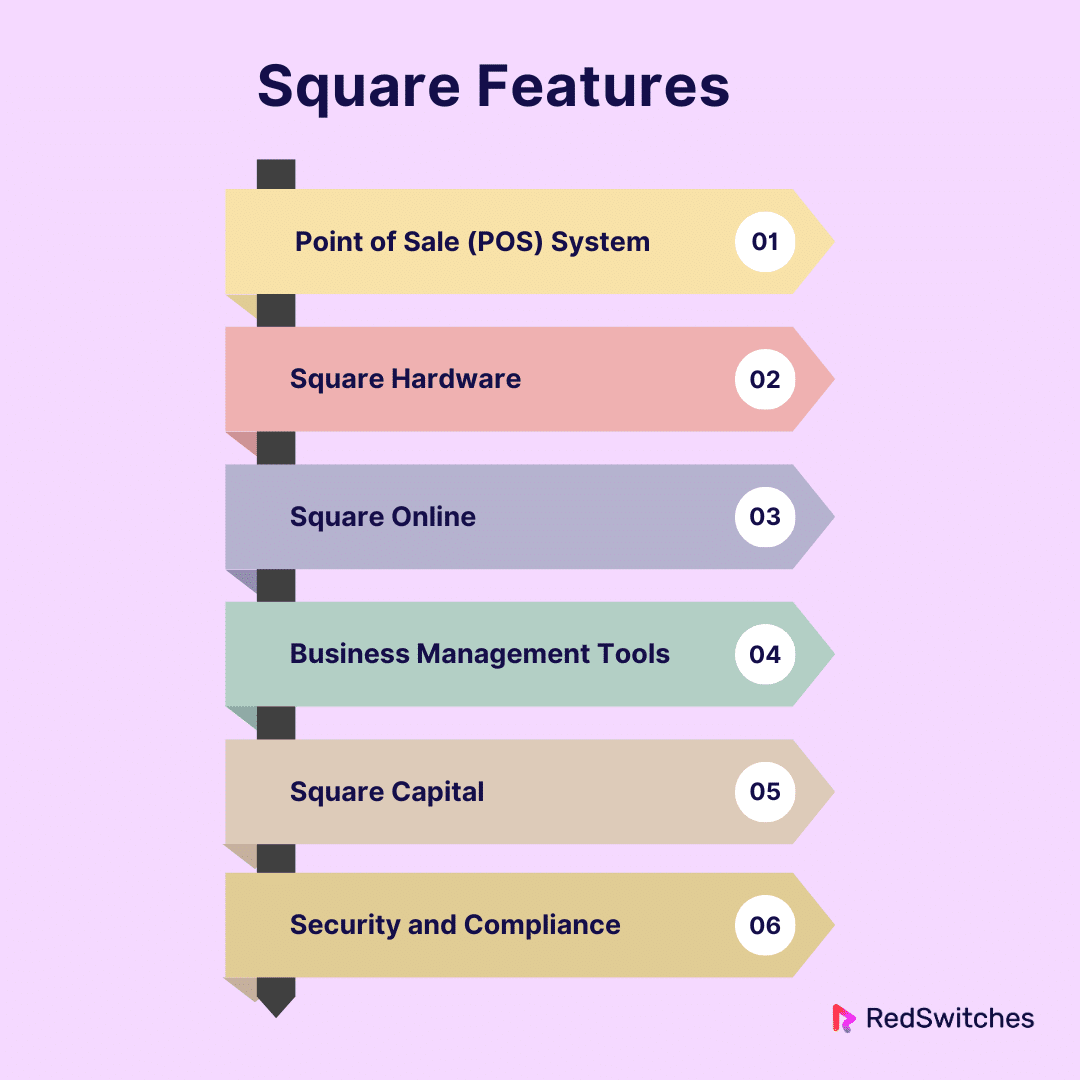

Square Features

Square’s suite of features is a testament to its commitment to empowering businesses, ensuring every transaction is not just a process but a step toward growth and efficiency. Here’s a closer look at the features that make Square a standout choice:

- Point of Sale (POS) System: Square’s POS system is renowned for its simplicity and comprehensiveness, offering features such as inventory tracking, customer directories, and sales reports, all within an intuitive interface.

- Square Hardware: From portable card readers to fully-equipped POS terminals, Square offers a range of hardware options to cater to every business’s unique needs, ensuring smooth and professional transactions.

- Square Online: This feature allows businesses to create a seamless online shopping experience, integrating e-commerce capabilities with physical store operations.

- Business Management Tools: Square provides an array of tools for appointment scheduling, employee management, and payroll processing, ensuring every facet of business operations is streamlined and efficient.

- Square Capital: Understanding businesses’ financial challenges, offers loans to eligible sellers, providing the much-needed capital to fuel growth and expansion.

- Security and Compliance: Square adheres to stringent security protocols, ensuring that every transaction is fast, convenient, and reliable.

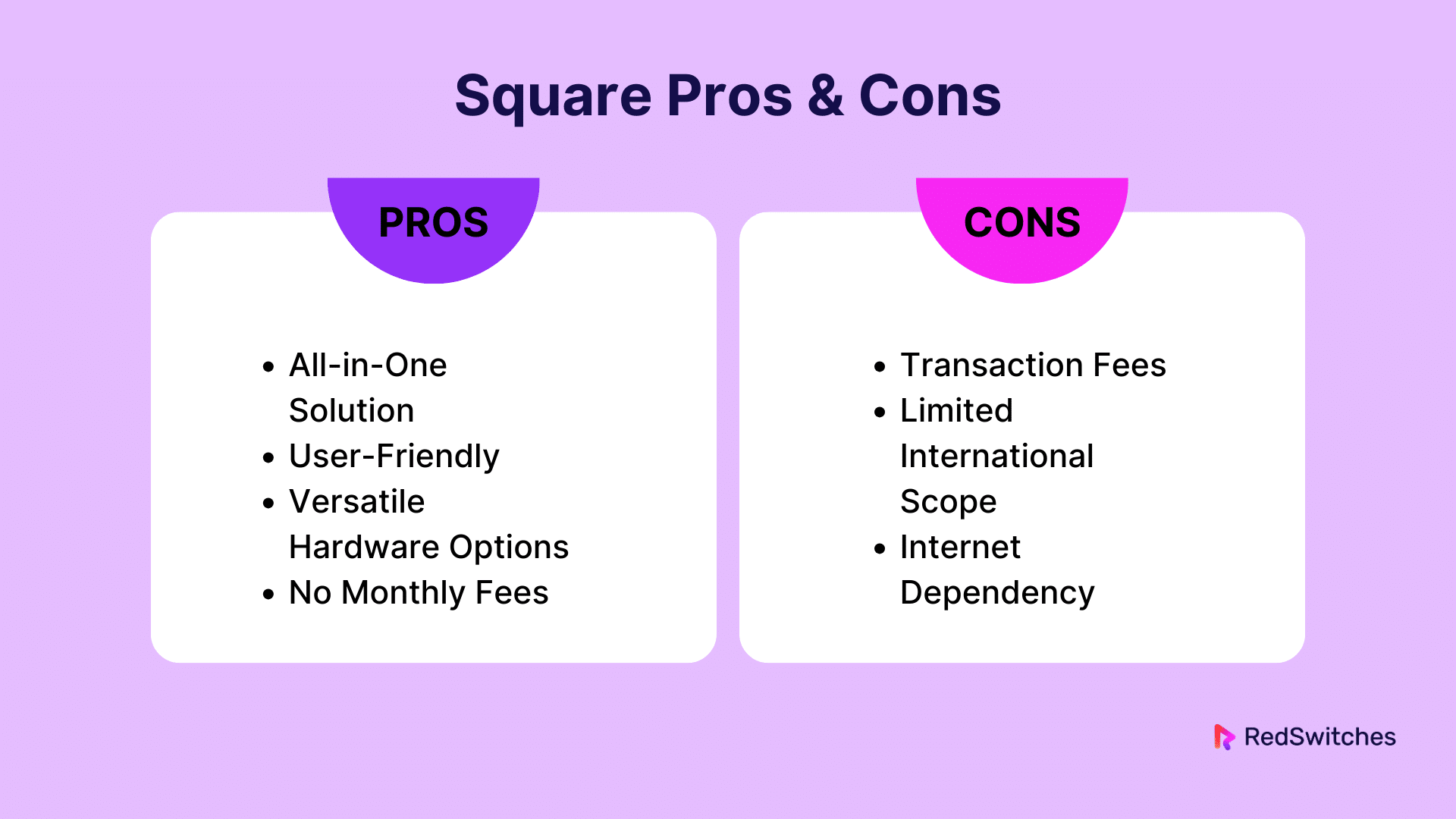

Square Pros & Cons

Pros:

- All-in-One Solution: Square is a one-stop shop for businesses, offering a comprehensive set of tools for payment processing, business management, and online sales, all integrated into a cohesive ecosystem.

- User-Friendly: Square is celebrated for its ease of use, offering intuitive interfaces and simple setup processes. It is ideal for small businesses and those less familiar with technology.

- Versatile Hardware Options: With a range of hardware solutions, Square caters to businesses of all types, ensuring that whether you’re a roving food truck or a multi-chain retail store, your transaction needs are covered.

- No Monthly Fees: Square’s transparent pricing model means no monthly fees, making it an attractive option for small businesses and startups looking to minimize overhead costs.

Cons:

- Transaction Fees: While Square offers many features and ease of use, its transaction fees can accumulate, especially for businesses processing a high volume of transactions.

- Limited International Scope: Compared to Stripe, Square has a more limited international presence, which might be a consideration for businesses aiming to expand globally.

- Internet Dependency: Square’s POS system relies on an internet connection, which could be a limitation in areas with unreliable connectivity or during network outages.

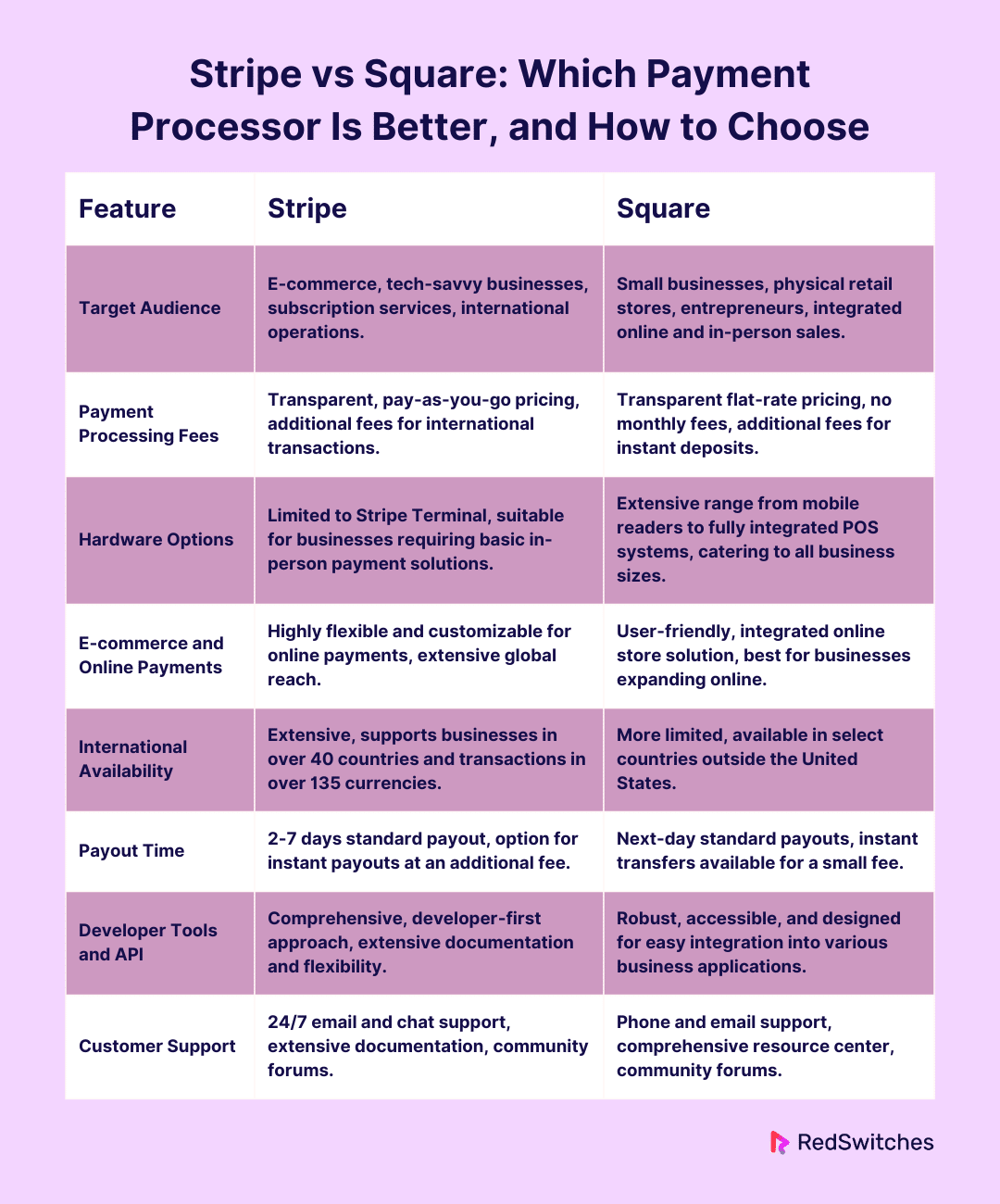

Stripe vs Square: Which Payment Processor Is Better, and How to Choose

Credits: Freepik

In the dynamic arena of digital finance, the decision between Stripe vs Square is more than a mere choice—it’s a strategic pivot that can significantly influence the trajectory of your business. Both platforms, with their robust features and distinct focus areas, offer compelling arguments for businesses seeking streamlined, efficient, and secure financial operations. Yet, the question persists: which is better, and how does one navigate this pivotal decision?

This section aims to transcend beyond the surface-level comparison and delve into the core of what makes each platform unique. We’ll navigate through a comprehensive comparison, scrutinizing the features, pricing, and the subtler, often overlooked aspects like customer support, integration capabilities, and the overall impact on your business workflow.

The choice between Stripe vs Square isn’t about picking the superior platform but about aligning with the one that mirrors your business’s ethos, operational requirements, and future aspirations. Whether you’re a tech-savvy e-commerce titan or a small cafe on the street corner, understanding the nuances of each service will empower you to make an informed, confident decision, paving the way for a prosperous business journey.

Let’s embark on this comparative exploration, dissecting the facets of Stripe vs Square to unveil the optimal choice for your unique business narrative.

Also Read 20 Best eCommerce Websites Ruling the 2024 Marketplace

Target Audience and Use Case Of Square vs Stripe

Credits: Freepik

Understanding each platform’s target audience and use case is pivotal when deliberating between Stripe vs Square. Stripe or Square both have carved their niches in the market by tailoring their services to specific business needs and operational models.

Stripe:

Stripe is the go-to choice for tech-savvy businesses, developers, and e-commerce giants. Its sophisticated API and expansive global reach make it ideal for businesses with a strong online presence or those looking to scale internationally. Stripe caters to those who crave customization, offering the tools to weave complex payment solutions into websites and applications seamlessly. Whether it’s a burgeoning online marketplace or a subscription service, Stripe positions itself as a dynamic partner capable of adapting to the intricate demands of a diverse digital audience.

Square:

On the flip side, Square is celebrated for its user-friendly design and all-in-one solutions, appealing to small business owners, brick-and-mortar shops, and entrepreneurs venturing into the digital space. Square’s intuitive POS system and its versatile hardware options make it a favored choice for businesses that emphasize in-person customer interactions. From cafes and retail stores to service-based enterprises, Square simplifies the transaction process, allowing business owners to focus more on customer experience and less on the complexities of payment processing.

Payment Processing Fees

The comparison of Stripe vs Square would be incomplete without a thorough analysis of their payment processing fees, a critical factor for any business keen on maximizing its financial efficiency.

Stripe:

Stripe’s pricing structure is transparent and straightforward, with a pay-as-you-go model that eschews monthly fees. Stripe charges a flat rate per transaction for online transactions, with additional fees for international cards and currency conversion. While Stripe’s pricing is competitive, businesses with high transaction volumes or those requiring advanced features may accumulate costs over time.

Square:

Square, mirroring its commitment to simplicity, also follows a transparent pricing model. It offers flat-rate pricing for card-present and card-not-present transactions with no monthly fees or hidden costs. Square’s inclusive approach means even small businesses can enjoy the benefits of a full-fledged payment system without worrying about exorbitant costs. However, similar to Stripe, businesses with a high volume of transactions need to be mindful of how these processing fees impact their bottom line.

Hardware Options

The availability and variety of hardware options are critical when comparing Stripe vs Square, especially for businesses that engage directly with customers in a physical setting.

Square:

Square truly shines in the hardware department, offering an impressive array of devices catering to every business type. From the sleek Square Reader for contactless and chip cards, perfect for businesses on the go, to the robust Square Register, a fully integrated POS system designed for high-volume businesses, Square understands the importance of a reliable and efficient in-person transaction experience. The hardware is aesthetically pleasing and user-friendly, ensuring businesses can provide a seamless checkout process and enhance the overall customer experience.

Stripe:

While Stripe’s primary focus is on online payments, it recognizes the need for an omnichannel presence and offers Stripe Terminal a solution for in-person payments. Stripe Terminal provides programmable card readers that can be integrated with your existing system, allowing for a customizable in-person payment experience. However, Stripe’s hardware offerings are relatively limited compared to Square, as its core strength lies in its online payment processing and developer-friendly tools.

Also Read Weebly vs WordPress: 11 Key Differences To Consider Before Building Your Website

E-commerce and Online Payments

Stripe vs Square offer robust solutions in the e-commerce and online payments arena, but their approaches cater to different business needs and preferences.

Stripe:

Stripe is a powerhouse in the e-commerce sector, offering a highly flexible and customizable platform for online payments. Its comprehensive API allows businesses to create a tailored checkout experience that aligns with their brand and operational requirements. Furthermore, Stripe supports various payment methods and currencies, making it an ideal partner for businesses with a global customer base or those looking to expand internationally. Stripe’s focus on technology and adaptability makes it a top choice for e-commerce businesses prioritizing a seamless, integrated online payment system.

Square:

Square has made significant strides in e-commerce with Square Online, a platform that allows businesses to build and manage their online stores seamlessly. While Square Online may not offer the same level of customization as Stripe, it provides a user-friendly interface and essential e-commerce features, making it an excellent option for small businesses or those just venturing into the online realm. Square’s strength lies in its ability to provide a cohesive experience, integrating in-person and online sales, thus enabling businesses to manage their entire operation under one roof.

International Availability

In today’s global market, the ability of payment processing platforms to cater to international clients is crucial. Stripe vs Square both offer international payment solutions, but their services vary in scope and scale.

Stripe:

Stripe stands out for its extensive international availability. It supports businesses in over 40 countries and allows them to accept payments in over 135 currencies. This wide reach makes Stripe an ideal partner for businesses aiming to expand their operations globally or cater to an international customer base. Stripe also offers features like automatic currency conversion and the ability to set up local payment methods, which are invaluable assets for businesses looking to provide a localized shopping experience to customers worldwide.

Square:

Square’s international presence is more limited than Stripe’s. It currently operates in a select number of countries outside the United States. However, Square provides robust tools and services within its available markets, ensuring businesses can manage their operations effectively. While Square may not be as expansive as Stripe regarding international coverage, it is continuously growing and evolving, aiming to provide more comprehensive global services.

Payout Time

Credits: Freepik

Payout time is critical for businesses, impacting cash flow and operational efficiency.

Stripe vs Square both platforms offer reliable and timely payouts, but their policies and timeframes differ.

Stripe:

Stripe offers automatic and scheduled payouts, allowing businesses to receive funds based on a schedule that suits their needs. The standard payout time for Stripe can range from 2-7 days, depending on the country and the bank involved. Stripe also provides the option for instant payouts for an additional fee, giving businesses faster access to their funds when necessary.

Square:

Square is known for its quick payout times, with the standard next-day payouts being a significant draw for many businesses. This means transactions processed before the cut-off time are typically deposited into the business’s bank account the next business day. For businesses needing even faster access to their funds, Square offers instant transfers to a linked bank account or Square Card for a small fee.

Developer Tools and API

In the digital age, the flexibility and robustness of developer tools and APIs (Application Programming Interfaces) are pivotal in shaping a business’s ability to offer a seamless and customized user experience.

Stripe:

Stripe is renowned for its developer-first approach, offering a suite of powerful APIs and developer tools that many consider the industry standard. Stripe’s comprehensive documentation, extensive libraries, and SDKs (Software Development Kits) allow developers to craft tailored payment solutions that integrate seamlessly with various business models and systems. Whether customizing the checkout experience or automating complex billing processes, Stripe’s developer tools provide the flexibility and scalability that modern businesses crave.

Square:

Square also provides a robust set of APIs and developer tools, focusing on simplifying and integrating its payment system into various business applications. Square’s developer tools are designed to be accessible, ensuring businesses can enhance their operations with custom solutions without navigating overly complex technical landscapes. From POS integrations to e-commerce solutions, Square’s APIs empower businesses to create a cohesive and efficient operational ecosystem.

Customer Support

Credits: Freepik

Customer support is the backbone of any service-oriented platform. Stripe vs Square both platforms understand the importance of timely and effective support in maintaining smooth business operations.

Stripe:

Stripe offers comprehensive support channels, including 24/7 email and chat support. It also provides a detailed knowledge base, extensive documentation, and community forums where users can seek help and share insights. While Stripe is known for its robust technical support, some users note that it could benefit from more direct phone support options, especially for urgent or complex issues.

Square:

Square is recognized for its strong customer support structure. It provides phone support, email support, and a thorough resource center that includes guides, FAQs, and community forums. Square’s hands-on approach to customer support is particularly beneficial for small businesses or those new to digital payment systems, ensuring they have the guidance needed to navigate any challenges.

Also Read Member’s Only Magic: The 12 Best WordPress Membership Plugins

This summary table concisely compares Stripe vs Square across various critical features. It serves as a quick reference to understand how each platform caters to different business needs and preferences, aiding in the decision-making process for choosing the right partner for your business operations.

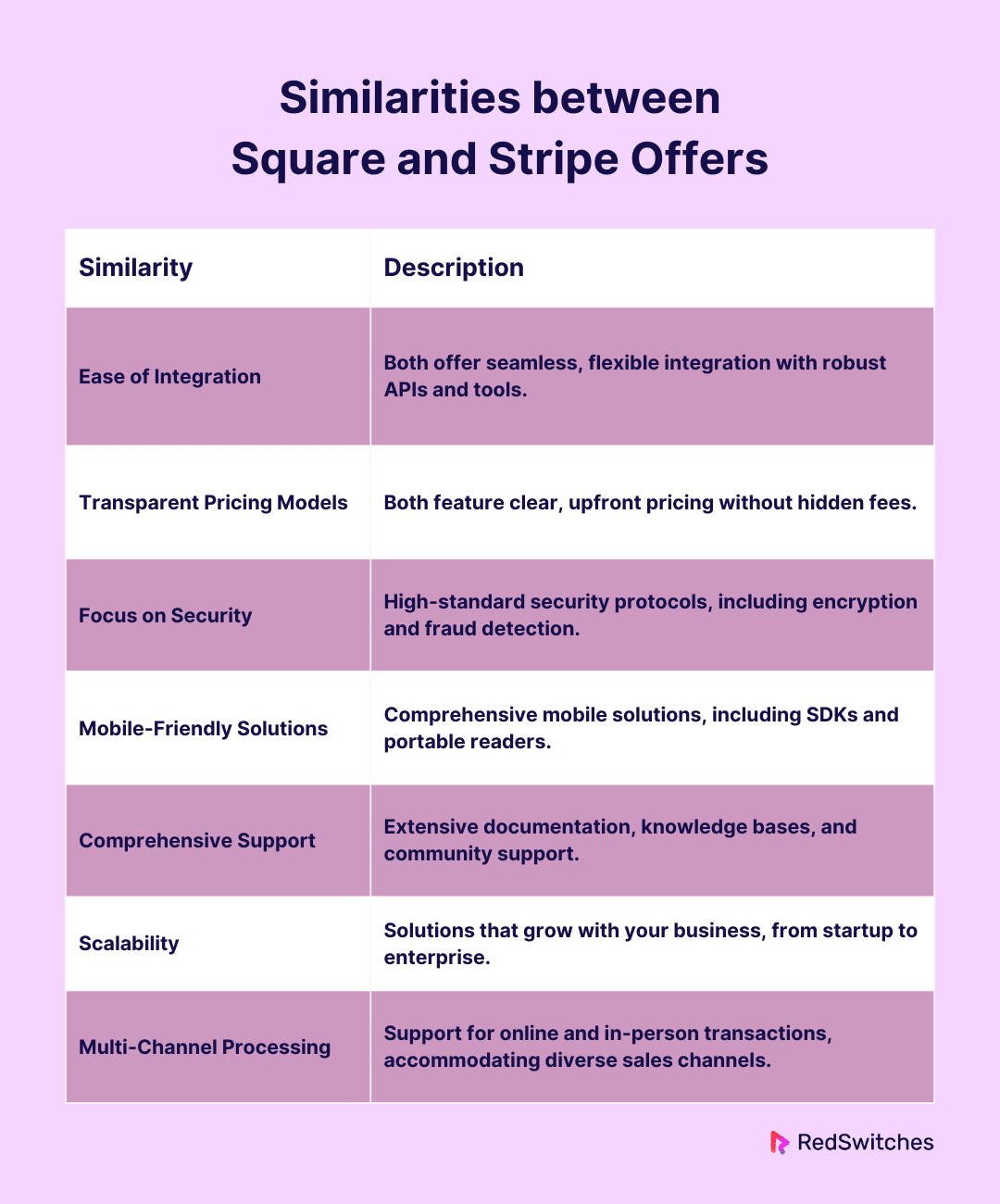

Similarities between Square and Stripe Offers

Credits: Freepik

While Stripe and Square have distinct features and cater to different business models, they also share several similarities, underscoring their commitment to providing robust, user-friendly payment processing solutions. Understanding these commonalities can help businesses grasp the foundational strengths inherent in both platforms, enabling informed decision-making. Here are the key similarities between Stripe and Square:

- Ease of Integration: Stripe and Square prioritize ease of integration. Stripe’s powerful APIs and developer tools allow extensive customization and seamless integration with various online platforms. Similarly, Square provides user-friendly solutions that effortlessly integrate with business operations, offering a range of APIs and tools for a cohesive payment experience.

- Transparent Pricing Models: Stripe and Square boast transparent, straightforward pricing models with no hidden fees. This approach particularly appeals to small businesses and startups, as it allows for predictable financial planning without worrying about unexpected costs.

- Focus on Security: Security is a paramount concern in the digital payment landscape, and both Stripe and Square take it seriously. They adhere to industry standards and implement robust security measures, including encryption and fraud detection tools, to protect sensitive financial data and build user trust.

- Mobile-Friendly Solutions: Recognizing the shift towards mobile commerce, both platforms offer mobile-friendly solutions. Stripe provides mobile SDKs for businesses to create custom mobile payment apps. At the same time, Square offers portable card readers and a mobile POS app, ensuring businesses can cater to customers on the go.

- Comprehensive Support Resources: Stripe and Square are dedicated to supporting their customers through comprehensive resources. Both platforms offer extensive documentation, knowledge bases, and community forums, allowing users to seek guidance, troubleshoot issues, and learn best practices.

- Scalability: Both platforms are designed with scalability in mind, catering to businesses of all sizes. Whether a solo entrepreneur or a large enterprise, Stripe and Square offer solutions that can grow and adapt to your evolving business needs.

- Multi-Channel Payment Processing: Stripe and Square understand the importance of multi-channel sales, offering solutions catering to online and in-person transactions. This omnichannel approach ensures businesses can provide a consistent and convenient payment experience, regardless of where their customers shop.

In summary, while Stripe vs Square have unique strengths and cater to specific business needs, they also share fundamental similarities that make them leaders in the payment processing industry. Their commitment to ease of integration, transparent pricing, robust security, mobile-friendly solutions, comprehensive support, scalability, and multi-channel payment processing underscores their dedication to empowering businesses and fostering growth in the ever-evolving digital marketplace.

This table concisely summarizes the fundamental similarities between Stripe and Square, showcasing their shared strengths in the payment processing landscape.

Also Read Joomla vs WordPress: Comparing The Top Two CMS Tools in 2024

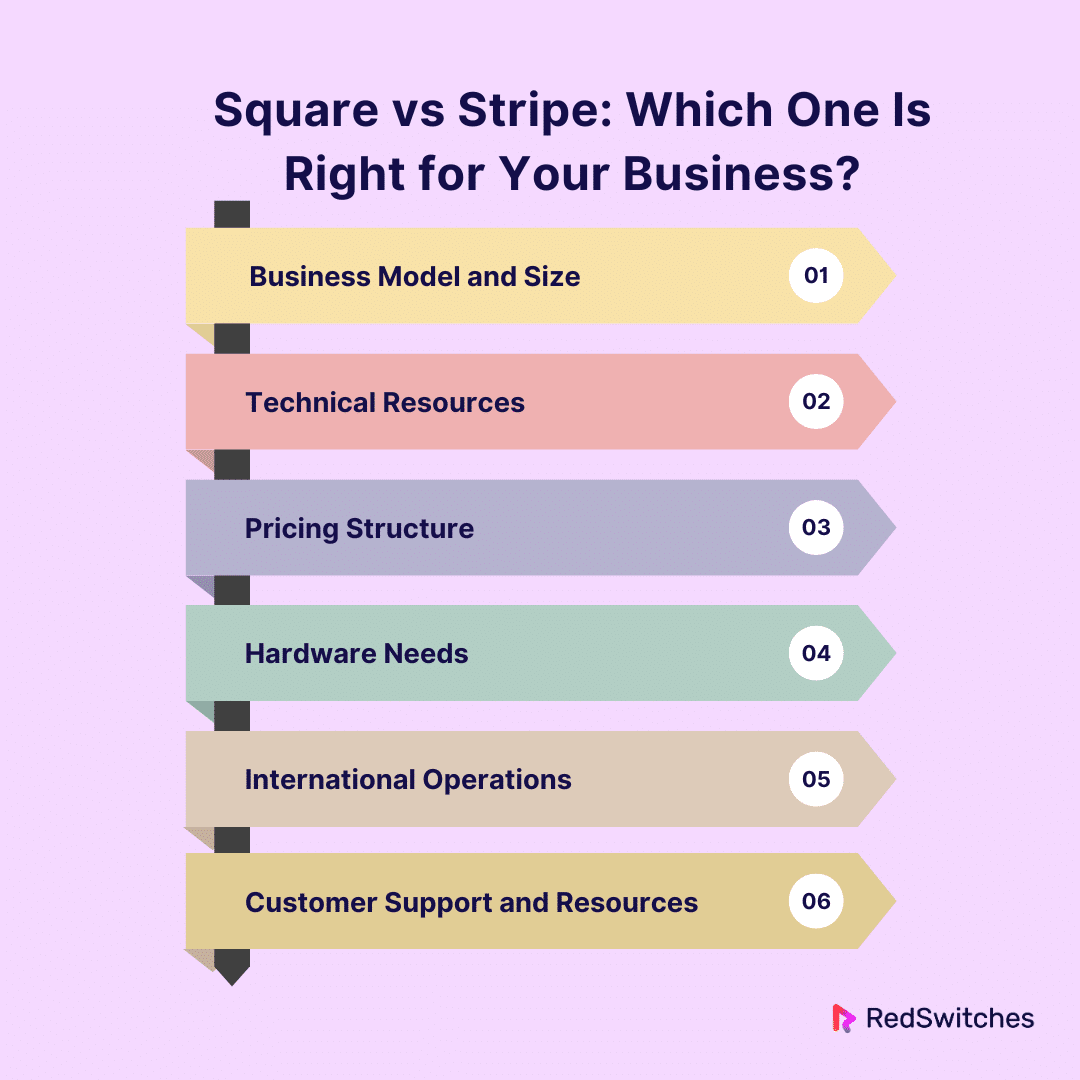

Square vs Stripe: Which One Is Right for Your Business?

Deciding between Stripe vs Square is a significant choice that hinges on understanding your business’s specific needs, operational model, and future aspirations. Both platforms offer robust features and have proven their worth in the payment processing arena, but aligning with the one that resonates most closely with your business ethos is crucial. To make this pivotal decision, consider the following factors:

Business Model and Size

If you operate primarily online, require extensive customization, or have a global customer base, Stripe’s powerful API and international support may align more with your needs.

If you run a physical store or a small to medium-sized business that values simplicity and ease of use, Square’s user-friendly POS system and comprehensive in-person payment solutions might be the ideal fit.

Technical Resources

If you have a strong technical team that can harness the power of advanced APIs and desire a high level of customization, Stripe provides the tools to create a tailored payment experience.

If you prefer a more straightforward, plug-and-play solution without requiring extensive technical setup, Square offers an intuitive platform that’s easy to implement and manage.

Pricing Structure

Consider how the pricing structure of Stripe or Square aligns with your financial model. Assess the transaction fees, additional service charges and how these costs fit into your business’s budget and transaction volume.

Hardware Needs

Square’s diverse hardware options may serve your needs more comprehensively if your business requires a robust in-person payment infrastructure.

If your in-person payment needs are minimal or you’re looking for a basic solution to complement your online operations, Stripe’s simpler hardware offerings might suffice.

International Operations

Stripe’s extensive currency and payment method support can be a decisive advantage for businesses aiming to expand globally or serve an international customer base.

If your operations are primarily domestic or in the regions where Square operates, its services can effectively cater to your business needs.

Customer Support and Resources

Evaluate each platform’s customer support and resources level. Consider the availability of support channels, the comprehensiveness of documentation, and the community ecosystem.

In the final analysis, choosing between Stripe vs Square is not about selecting the superior platform but choosing the partner that best aligns with your business’s unique narrative. By meticulously considering your business’s operational needs, technical capabilities, financial structure, and growth trajectory, you can partner with a platform that meets your current demands and supports your journey toward future success.

Also Read Drupal vs Joomla: Best Content Management System for 2024

Conclusion

Whether you find your match in Stripe’s comprehensive, developer-friendly platform, designed for the intricate dance of global e-commerce, or in Square’s intuitive, all-encompassing ecosystem, tailor-made for enriching the customer-business interaction, your choice will set the course for your business’s financial operations and customer engagement.

And while you navigate these waters, remember that the journey is as pivotal as the destination. With each transaction, each customer interaction, and each business decision, you’re not just conducting business; you’re crafting experiences, building relationships, and shaping a legacy.

Ready to take the next step and ensure your business’s transactions are in the right hands? Explore the possibilities with RedSwitches, where dedicated support, unparalleled performance, and a commitment to your business’s growth and security await. Set off on this adventure with RedSwitches and steer your business toward success and potential.

FAQs

Q. Is Square or Stripe better?

The choice between Square and Stripe depends on your business needs. Stripe is ideal for online-focused businesses needing extensive customization, while Square is preferred for its user-friendly POS system and robust in-person payment solutions.

Q. Can I use Stripe with Square?

Typically, Stripe and Square are used independently as they are separate platforms offering similar services. However, some businesses use both for different aspects of their operations, but direct integration between the two is not standard practice.

Q. Who is Square’s biggest competitor?

Stripe is often considered Square’s biggest competitor, especially in online payment processing. Other notable competitors include PayPal and traditional merchant service providers.

Q. What is better than Stripe?

“Better” is subjective and depends on specific business requirements. While Stripe is highly favored for its online payment processing and developer-friendly platform, alternatives like PayPal, Square, or Adyen might be better suited for certain business models or specific needs.

Q. What are the main differences between Stripe and Square?

Although both Stripe and Square provide payment processing services, they have different offerings. Stripe is more focused on online businesses, providing APIs and customization options, while Square is known for its easy-to-use mobile card readers and POS system tailored for small businesses.

Q. What are the transaction fees for Stripe and Square?

Stripe charges a standard fee of 2.9% + 30 cents per successful card charge for online transactions, while Square charges 2.6% + 10 cents for in-person transactions and 2.9% + 30 cents for online transactions.

Q. Which payment platforms does Stripe support compared to Square?

Stripe allows businesses to accept payments via credit card, debit card, and a wide range of other payment methods, including Apple Pay and Google Pay. Square also supports credit and debit card payments, and integrates with its payment platform, Cash App.

Q. How do the pricing structures for Square and Stripe compare?

Stripe’s pricing is more straightforward with a flat rate for online transactions, while Square’s pricing is tiered based on the type of transaction and can be more complex for businesses with various sales channels.

Q. Can both Stripe and Square be used for brick-and-mortar businesses?

Yes, Square is well-known for its POS system aimed at brick-and-mortar businesses, while Stripe is more commonly used for online transactions. However, both platforms offer solutions for in-person payments.

Q. What are the notable features of Stripe and Square?

Stripe offers a range of features including customizable payment flows, subscription management, and fraud prevention tools, while Square is known for its ease of use, inventory management, and sales reporting tools. The choice of platform would depend on the specific needs of the business.

Q. Which payment service is better suited for a small business: Stripe or Square?

Small businesses often prefer square due to its simplicity, user-friendly interface, and all-in-one POS system. Stripe, on the other hand, is favored by online businesses seeking customization and flexibility in their payment processing.

Q. What are the payment options offered by Stripe and Square?

Both Stripe and Square support a wide range of payment options including major credit and debit cards, ACH transfers, and digital wallets, ensuring that businesses can cater to various customer preferences and behaviors.

Q. How does the card reader technology of Square compare to Stripe’s offerings?

Square offers a range of card readers that are easy to set up and use, whereas Stripe can integrate with various third-party card readers and terminals, providing businesses with more choices and compatibility options.

Q. Do Stripe and Square both offer payment processing tools for online businesses?

Yes, both platforms offer payment processing tools for online businesses, but Stripe is more focused on providing a customizable payment infrastructure and APIs, while Square offers a more integrated approach with its payment platform, website plugins, and online store solutions.