Selecting the appropriate payment gateway is essential for companies looking to conduct smooth financial transactions in the ever-changing world of online commerce. This thorough comparison examines the ongoing conflict between Stripe and PayPal, two industry titans.

Understanding the subtleties of these payment options is essential for business owners and merchants alike as eCommerce develops.

In this comparison between PayPal and Stripe, we’ll delve into their features, functions, and unique offerings in payment gateways. We aim to equip you with the insights necessary for an informed decision that aligns with your growth objectives and your company’s needs.

Let’s explore the ultimate showdown of Stripe vs Paypal.

Table Of Contents

- What is Stripe?

- What is Paypal?

- Stripe vs Paypal: The Comparison

- Stripe vs Paypal: Ease of Use

- Stripe vs Paypal: Costs and Fees

- Stripe vs Paypal: Recurring Payments

- Stripe vs PayPal: Pay Later Options

- Stripe vs PayPal: Customizability

- Stripe vs PayPal: International Payments

- Stripe vs PayPal: Currencies and Transfer Type Supported

- Stripe vs PayPal: Hardware Features

- Stripe vs PayPal: Software Features

- Stripe vs PayPal: API

- Stripe vs PayPal: AppUser Interface

- Stripe vs PayPal: Customer Service

- Stripe vs PayPal: Trustworthiness

- What Is Best For My Business Needs: PayPal Or Stripe?

- Conclusion

- FAQs

What is Stripe?

Credits: Stripe

Imagine you’re an aspiring baker launching an online cupcake shop called “Sweet Escapes.” You integrate Stripe into your website to sweeten the deal for your customers.

As a baker, you concentrate on perfecting your recipes, and Stripe takes care of the intricate payment processing. Customers may easily choose their cupcakes, provide payment information, and there you go! Stripe’s technology securely processes the payment.

Stripe is a payment service provider that helps retailers take payments with debit and credit cards and other methods. Since most of its unique features primarily focus on online sales, its payment processing solution, Stripe Payments, is best suited for companies conducting most of their business online.

How does Stripe Work?

Credits: Freepik

Stripe uses the following six steps to handle payments:

- The client gives their card details over the phone or in person.

- These card credentials are sent to Stripe’s payment gateway, where they are encrypted.

- The acquirer, a bank that handles the transaction on the merchant’s behalf, receives the information from Stripe. Stripe acts as the merchant in this step, with the business owner acting as a sub-merchant. This eliminates the need for Stripe users to create a merchant account, which can be time-consuming.

- The payment is made to the cardholder’s issuing bank via a credit card network like Visa or Mastercard.

- The transaction is approved or denied by the issuing bank.

- This signal leaves the issuing bank and travels via the card network to the acquirer. From there, it passes through the gateway and reaches the customer, who receives a notification indicating whether the payment was approved or denied.

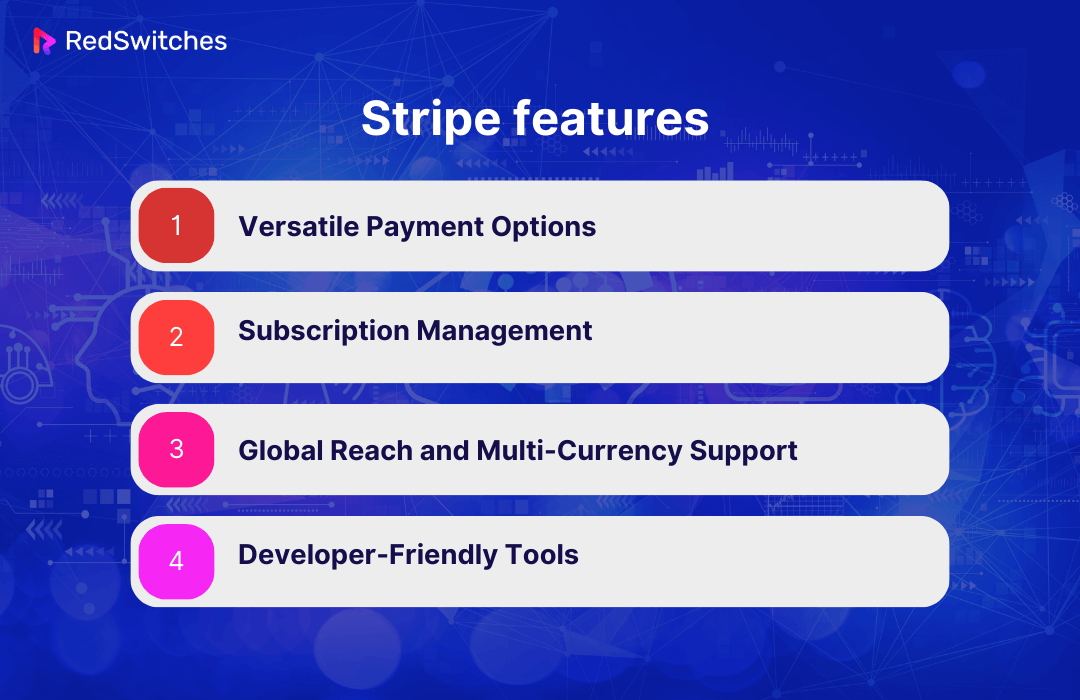

Stripe Features Overview

Now, let’s briefly look at the Key features of Stripe.

Versatile Payment Options

Stripe offers businesses flexibility and caters to a wide range of client preferences by supporting many payment ways, including digital wallets, debit cards, major credit cards, and alternative payment methods.

Subscription Management

Stripe makes it simple for businesses to manage and bill consumers regularly for memberships, services, or subscriptions by automating recurring billing for subscription-based services.

Global Reach and Multi-Currency Support

Stripe helps companies take payments abroad without the hassle of currency translation, serving many international clients. It does this by supporting several currencies and operating a global network.

Credits: Freepik

Developer-Friendly Tools

Stripe provides developers with flexible and customizable tools, like webhooks and well-documented APIs, that make incorporating payment features into websites and applications accessible.

How much do websites cost to develop In 2024? Check it out now!

Additional Stripe Services

After discussing the pros and cons of Stripe, we will now discuss the additional Stripe services.

Stripe Connect

Marketplace Integration: Stripe Connect simplifies setting up and running online markets, facilitating smooth buyer-seller transactions, and managing the complexities of rewards and payments.

Stripe Radar

Fraud Protection: To protect enterprises from possible financial losses, this sophisticated fraud protection technology uses machine learning and customized algorithms to detect and stop fraudulent transactions.

Stripe Sigma

Tailored Analytics: Stripe Sigma gives companies the power to query their data in a way that makes it possible to create unique SQL queries that provide a wealth of information about consumer behavior, transaction trends, and overall financial performance.

Explore this exciting yet short overview of SQL with basic commands to know it better.

Stripe Billing

Subscription Management: Stripe Billing provides a comprehensive solution for managing subscription plans, invoicing, and revenue recognition, which goes beyond essential subscription services and makes it easier for businesses to handle complex billing scenarios.

Stripe Pros and Cons

Let’s explore its various pros and cons to get a better understanding of how it fits into the digital payment landscape.

Credits: Freepik

Pros

First, let’s discuss the pros of Stripe.

User-Friendly Interface

Setting up and managing online payment procedures is made simple for companies of all sizes by Stripe’s intuitive and user-friendly interface. Moreover, the developer-friendly interface and thoroughly described APIs make integration easier.

Flexible Payment Methods

Stripe accepts payment methods like credit cards, cryptocurrencies, and digital wallets like Apple Pay and Google Pay. This adaptability enables companies to satisfy a wide range of client demands.

High-end Security Measures

Stripe values security highly. The platform uses cutting-edge security measures, such as two-factor authentication and encryption, to guarantee that the client’s financial information is handled with the highest level of protection.

Global Reach and Currency Support

Stripe enables businesses to take payments from clients worldwide and supports numerous currencies, facilitating global transactions. Its worldwide reach benefits companies that serve a global clientele.

Here’s our exciting guide to GraphQL vs REST: which API is best for your application? Be sure to check out this unmissable comparison and leverage the best!

Cons

Now, let’s discuss the cons of Stripe.

Transaction Fees

Despite having transparent pricing, Stripe charges transaction fees for each payment processed. These fees can add up and affect total costs for companies with high transaction volumes.

Payout Timing

Stripe’s standard payout period is seven days, which might not be ideal for companies wanting faster capital access. Companies requiring prompt payouts could have to look at alternative solutions or utilize expensive services like Instant Payouts.

Concerns about Account Stability

Several users have reported experiencing account freezes or holds, which can be very concerning for companies that depend on consistent cash flow. Although Stripe uses these precautions for security, businesses may experience inconveniences as a result.

Limited Phone Assistance

Although Stripe provides help via email and chat, there isn’t much phone assistance. This restriction may be prohibitive in emergencies for businesses that prefer or require immediate assistance by phone.

Stripe Costs

Fees for using Stripe to handle payments for in-person or online purchases start at 5 cents per transaction plus 2.7% of the total transaction amount; for online purchases, the price is 30 cents per transaction plus 2.9%.

All cards and digital wallets—Visa, Mastercard, Maestro, American Express, Discover, JCB, Apple Pay, and Google Pay—have the same prices. There are also integrations available for other international payment systems like Giropay.

What is Paypal?

Credits: Paypal

PayPal is an online money transfer platform facilitating payments between parties. It has a mobile app and a website. Clients of PayPal open an account and link it to a credit card, checking account, or both.

PayPal acts as a middleman so that users can send and receive money online or in person after verifying identity and financial verification. PayPal is accepted by millions of minor and major retailers, both online and offline.

Additionally, PayPal provides debit and credit cards bearing the PayPal name.

How does PayPal Work?

Let’s understand PayPal’s working procedure.

Establishing an Account

First, users register for a PayPal account by entering their financial and personal details. This account, connected to their bank account or credit/debit cards, is a safe digital wallet.

Payment Beginning

PayPal is the payment method users select for online transactions. Rather than providing credit card information, users access their PayPal account and choose their preferred funding method.

Credits: Freepik

Transaction Authorization

PayPal securely authorizes the transaction, guaranteeing the user’s financial information privacy by either charging the associated credit/debit card or taking money out of the linked bank account.

Notification to Recipient

PayPal notifies the recipient (the merchant or the individual) of the payment. The payer’s identity and payment information are now hidden, improving transaction security.

Money Transfer

PayPal moves money from the payer’s account to the recipient’s. The recipient can then use the money for other online purchases or transfer it to their associated bank account.

Protection During Purchase

PayPal gives customers additional assurance by offering purchase protection. Users may be eligible for refunds if there are problems with the purchase, which adds to a safe and reliable online payment experience.

Paypal Features Overview

In this blog section, we will explore the critical features of PayPal.

Online Payments

PayPal is an online payment platform that enables users to transfer or receive money securely using credit cards, linked bank accounts, or money from their PayPal balance.

Protection of Buyers and Sellers

PayPal’s buyer and seller protection programs offer protection for both parties. Buyers can dispute transactions, and sellers are shielded from some types of fraud.

Convenient Mobile App

With the PayPal mobile app, users can send and receive money, manage their accounts, and make payments while on the go. This mobile convenience improves the user experience overall, particularly for individuals who choose mobile transactions.

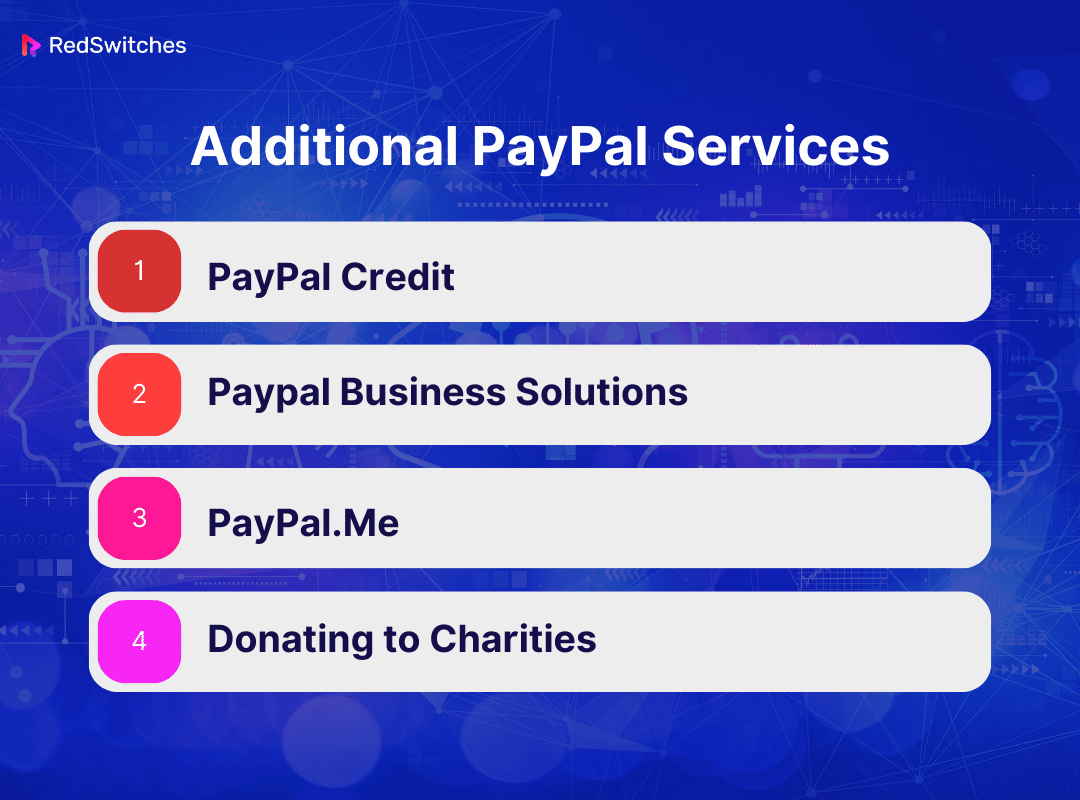

Additional PayPal Services

PayPal Credit

A credit service provided by PayPal enables qualified users to make purchases and advance payments. This service offers flexibility and can increase people’s and enterprises’ purchasing power.

Paypal Business Solutions

PayPal offers various business solutions, such as tools for online and retail businesses, invoicing, and payment processing. With this package of services, businesses can effectively handle their financial operations.

PayPal.Me

PayPal.Me enables users to establish customized payment links, which simplify payments for friends, family, or clients without requiring them to disclose sensitive financial information.

Donating to Charities

PayPal provides individuals and charity organizations with facilities to gather donations and raise money. This tool makes it easy and safe for people to support causes that are important to them.

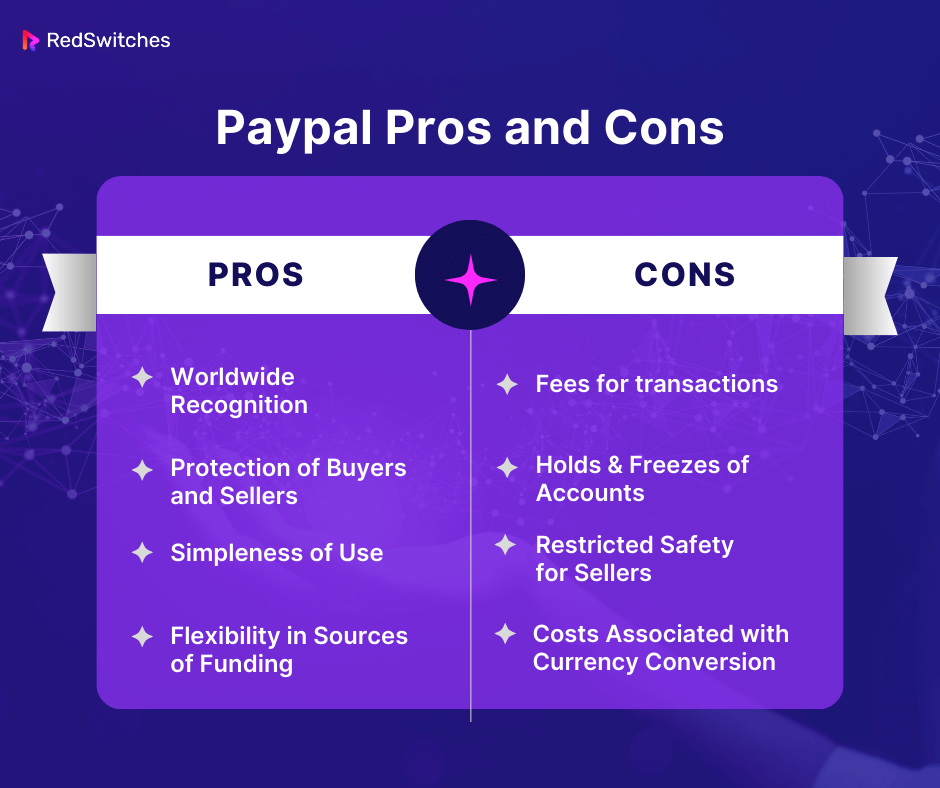

Paypal Pros and Cons

Lets dive deep into the World of paypal by unveiling the pros and cons:

Let us now discuss the merits and demerits of Paypal.

Pros

First, let’s discuss the pros of Paypal.

Worldwide Recognition

Due to its widespread acceptance worldwide, PayPal is a practical payment option for cross-border online transactions, enabling users to send and receive money from other countries.

Protection of Buyers and Sellers

PayPal provides strong buyer and seller protection programs. Transaction security increases since sellers are shielded from fraudulent activity, and buyers can challenge transactions if they have problems.

Simplicity of Use

PayPal is renowned for having an intuitive user interface that simplifies sending and receiving money for both people and companies. The extensive acceptance of the platform can be attributed to its simplicity.

Flexibility in Funding Sources

Users can link bank accounts, credit cards, debit cards, and other funding sources to their PayPal accounts. This flexibility allows users to select their preferred payment method for transactions.

Cons

Now, let’s discuss the cons of Paypal.

Fees for Transactions

Certain transaction types incur fees from PayPal that can pile up, especially for companies with large sales volumes. The fees could change depending on the kind of transaction and the currency.

Holds & Freezes of Accounts

PayPal has reportedly frozen certain users’ accounts or placed freezes on their money, particularly in cases with odd transaction patterns or security concerns. Users who depend on a consistent flow of income may find this inconvenient.

Restricted Safety for Sellers

PayPal provides seller security. However, it may not cover all transactions or situations. In certain situations, sellers may encounter difficulties, especially when dealing with intangible items or services where proving delivery can be more difficult.

Costs Associated with Currency Conversion

PayPal charges currency conversion fees that may be more expensive for users conducting overseas transactions than if they used rates from other banking institutions. Users should be aware of these expenses when working with foreign currencies.

Explore this comprehensive guide on Web Security Gateways: Primary Features, Benefits, How It Works & more.

Paypal Costs

The payment type being processed and the international or domestic nature of the transaction determines PayPal’s transaction fees. Rates range from 2.29% to 3.49%, with an extra fixed fee for commercial PayPal checkout, invoicing, Venmo, and other business transactions. There is also a fixed fee for QR code transactions valued at over $10.

No additional fixed fee is charged when paying with American Express through PayPal guest checkout; the 3.5% fee is applied instead.

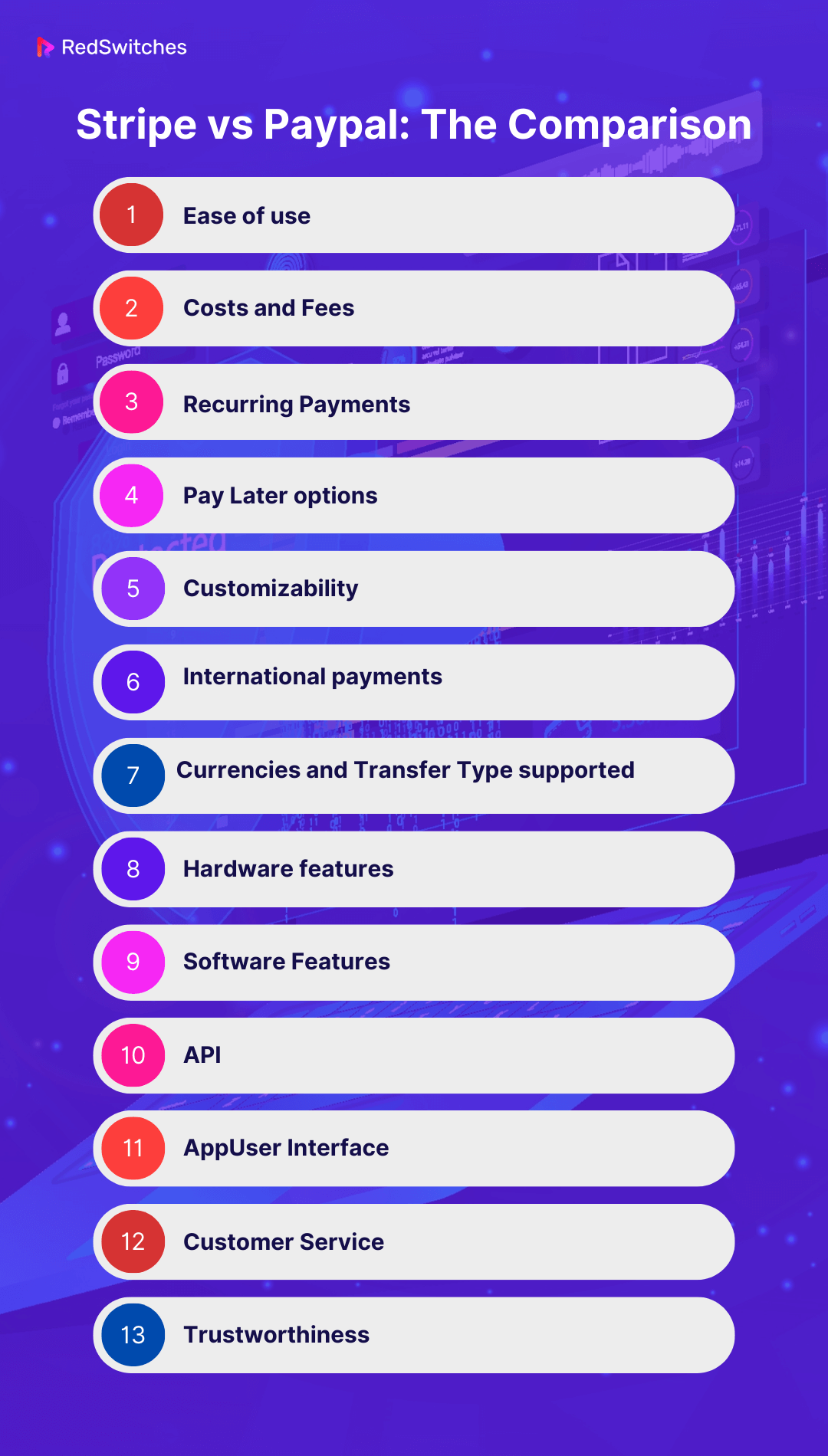

Stripe vs Paypal: The Comparison

In the dynamic world of online transactions, two giants stand out: Stripe vs PayPal. Each platform offers unique features, catering to different needs in the e-commerce space. This comparison delves into the strengths and weaknesses of both, helping you make an informed decision in choosing the right payment processing partner for your business.

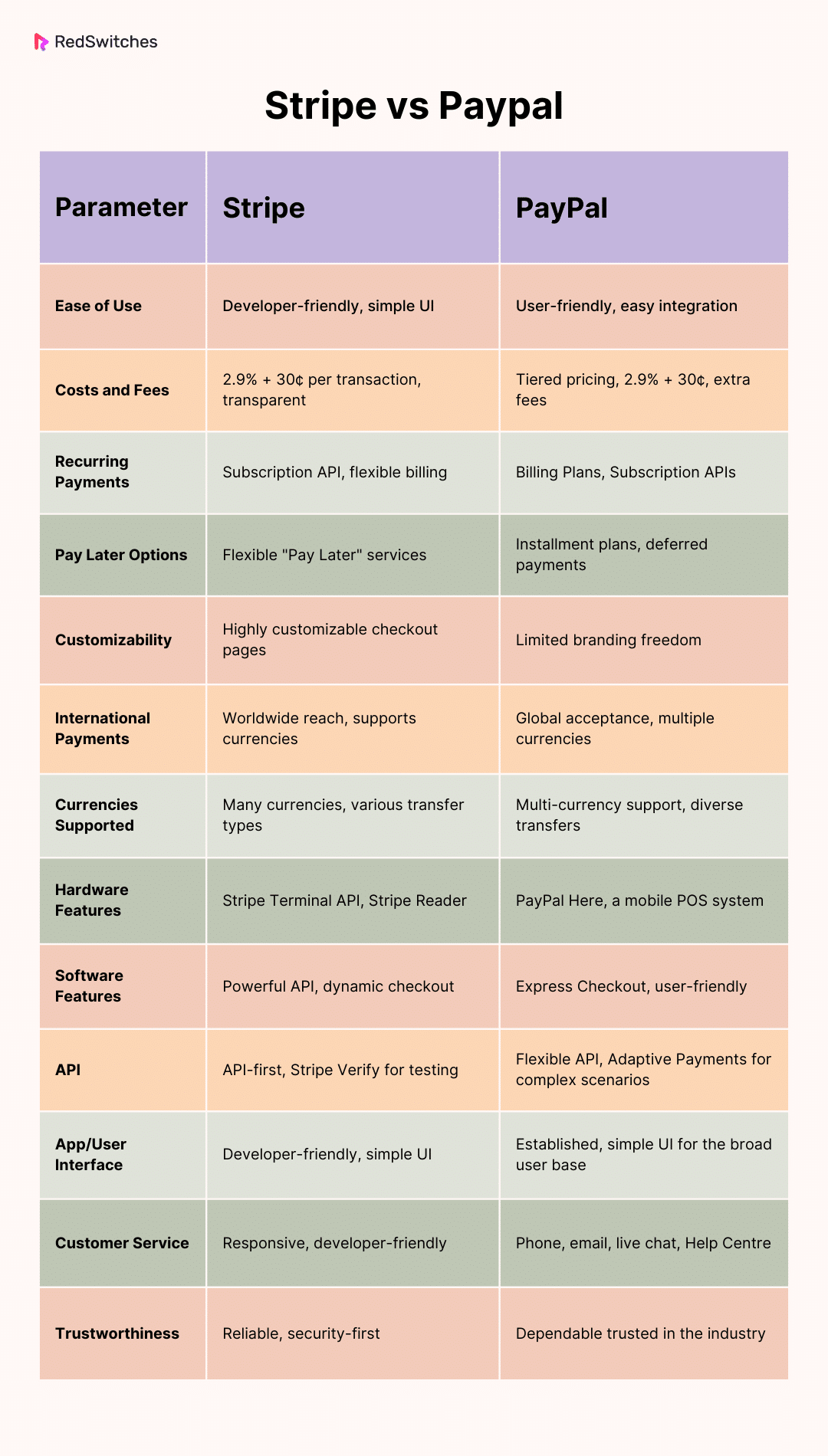

Stripe vs Paypal: Ease of Use

Let us understand the Stripe vs Paypal argument concerning user-friendliness.

Stripe

Stripe, often praised for its developer-friendly nature, offers clear APIs and ample documentation. The user interface is simple and meets the needs of merchants seeking an easy integration procedure. The initial setup could be tricky for non-technical users, but the learning curve is usually not too steep.

PayPal

PayPal stands out for its user-friendly interface, making it easy for anyone to set up an account and integrate it into a website. The platform offers a variety of plugins and integrations for popular eCommerce platforms, further enhancing its user accessibility.

Stripe vs Paypal: Costs and Fees

In this section of our Stripe vs PayPal argument, we will compare both the cost and fees, i.e., stripe fees vs PayPal.

Stripe

With a transparent price structure, Stripe charges a fixed fee of 2.9% + 30¢ for each completed transaction. The lack of setup fees or monthly costs makes the cost structure simpler. However, businesses that deal with foreign exchange or currency conversions might have to pay extra costs.

PayPal

PayPal has a tiered pricing structure with different costs associated with it. In line with Stripe, the typical transaction cost is 2.9% + 30. Features like chargebacks, currency conversions, and sophisticated fraud protection may incur extra costs.

Credits: Freepik

Stripe vs Paypal: Recurring Payments

Let’s explore the recurring payments aspect of the Stripe versus PayPal debate.

Stripe

Stripe shines in handling recurring payments through its Subscription API. It empowers businesses to set up and manage subscriptions with flexibility in billing intervals and subscription management. The robust system caters to a variety of subscription-based models.

PayPal

With its recurring solid payment system made possible by its Billing Plans and Subscription APIs, PayPal complements Stripe. It’s a flexible alternative that allows merchants to customize trial durations, billing cycles, and subscription plans to suit their unique requirements.

Stripe vs PayPal: Pay Later Options

Users tend to pay later for their convenience. Let’s understand Stripe vs PayPal concerning Pay Later options.

Stripe

Stripe wants to provide its customers flexibility regarding “Pay Later” options. The platform’s pay-later services enable businesses to accommodate clients who prefer deferred payments or installment plans. This functionality improves the client experience in general and may raise conversion rates.

PayPal

PayPal’s “Pay Later” feature gives users various flexible payment options, including setting up installment plans or postponing payments. Customers’ shopping experiences are improved by this feature, which may lead to a rise in conversion rates. PayPal’s dedication to providing a variety of payment methods is in line with the changing needs and tastes of contemporary customers.

Stripe vs PayPal: Customizability

In this part, we will understand the Customizability aspect of our Stripe vs Paypal debate.

Stripe

Stripe’s high degree of customizability is one of its best qualities. Companies can modify checkout pages and add branded components to the payment process to align the payment experience with their corporate identity. This adaptability is especially desirable for companies that value a distinctive and seamless customer experience.

PayPal

PayPal allows for some branding freedom but not as much as other systems. To a limited extent, businesses can personalize checkout pages by adding logos. PayPal offers businesses the opportunity to uphold a unified brand representation during the payment process despite its customization choices not being as comprehensive as those of its competitors.

Stripe vs PayPal: International Payments

We’ll delve into the comparison between Stripe vs PayPal regarding International Payments.

Stripe

Stripe is renowned for its worldwide reach, enabling companies to take payments from clients worldwide. It quickly enables international transactions by offering support for numerous currencies and a smooth currency conversion process. This makes it a desirable option for companies aiming to grow internationally or with a varied clientele.

PayPal

PayPal is well-known for its international acceptability, enabling companies to take payments from clients worldwide. The platform makes it easier to perform international transactions by supporting several currencies. Due to its broad international reach, PayPal is a desirable choice for companies looking to expand internationally.

Stripe vs PayPal: Currencies and Transfer Type Supported

Understanding the differences in Currencies and Transfer Type Supported between Stripe vs PayPal is crucial in this discussion.

Stripe

Stripe accommodates businesses operating in many markets by supporting currencies and international payments. Additionally, the platform provides a variety of transfer kinds so that companies can select the best way to get payments. This adaptability helps companies with various currency and transfer requirements have a more seamless financial workflow.

PayPal

PayPal caters to companies that operate globally by offering support for various currencies. Additionally, the platform offers a range of transfer alternatives so businesses can select the best way to receive payments. Because of its adaptability, PayPal is a popular choice for companies with various currency and transfer requirements.

Stripe vs PayPal: Hardware Features

Let’s dissect the argument of Hardware Features when it comes to Stripe vs PayPal.

Stripe

Stripe provides hardware solutions for companies wishing to expand their capabilities to in-person transactions. Stripe is best known for its reliable online payment processing. Developers can create a unified system for online and offline payments by integrating Stripe with compatible card readers with the Stripe Terminal API. Furthermore, Stripe offers the Stripe Reader, a portable card reader.

Thanks to this device’s contactless and chip card payment capabilities, businesses may collect payments in person. The Stripe Terminal API and related hardware aim to give companies operating in various environments a smooth and integrated payment experience.

Paypal

PayPal offers a product called PayPal Here in recognition of the value of in-person transactions. This mobile point-of-sale system has a card reader to process contactless, magstripe, and chip and PIN card transactions. PayPal Here is ideal for various industries, including retail, events, and services, as it enables businesses to take payments while on the road.

Furthermore, PayPal offers businesses flexibility by integrating with third-party devices, allowing them to select hardware that complements their unique requirements and infrastructure.

Stripe vs PayPal: Software Features

Let’s delve into understanding the Software Features comparison between Stripe vs PayPal.

Stripe

Stripe distinguishes itself with powerful software capabilities and an approach focused on developers. A developer-focused API that enables complex customization and smooth platform interaction lies at the heart of its products.

Stripe’s robust features for handling recurring payments, billing cycles, and accommodating subscription changes make it an excellent choice for organisations primarily relying on subscription models.

Businesses may create a unique and user-friendly payment interface with a dynamic checkout feature, which improves the overall consumer experience.

PayPal

PayPal is a well-known online payment company that provides a range of software capabilities for user security and convenience. It is a widely recognized and approved payment method offering users a smooth and consistent experience in various locations. By streamlining the online payment process, the Express Checkout function lowers friction and may even boost business conversion rates.

Stripe vs PayPal: API

Let’s dissect the Stripe vs PayPal debate, focusing on how API is.

Stripe

Stripe sets itself apart with an API focused on developers and has grown to be a signature feature of the service. With its API-first architecture and thorough documentation, the API gives developers great flexibility and customization. It has many capabilities, including webhooks for real-time updates, and handles many tasks, including managing subscriptions and processing payments.

One of its main advantages is the availability of Stripe verify, a robust testing environment that enables developers to replicate transactions and extensively verify their integration before going live. Because of this, companies with technical teams looking for a smooth and adaptable payment integration experience will find Stripe’s API especially appealing.

API

Besides being flexible, PayPal’s API serves many customers, including small and large businesses. It supports several integration techniques, supporting a range of development situations with REST and traditional APIs among them. Marketplace platforms benefit from the unique feature of the Adaptive Payments API, which allows businesses to design more complicated payment situations, including parallel and chained payments.

Stripe vs PayPal: AppUser Interface

UI is essential for app users; good UI is critical, especially for new users. Let us understand whose UI is better in our Stripe vs PayPal argument.

Stripe

Stripe prioritizes a user interface (UI) that is simple to use and meets the needs of both non-technical users and developers. The Dashboard offers organizations a centralized location to monitor metrics, handle transactions, and access essential functions.

Technical teams may set up and customize payment solutions with ease because of the developer-friendly design, which makes it easy to browse through various parts. The user interface (UI) is renowned for its simplicity, providing a smooth experience for consumers to monitor and control their payment processes effectively.

PayPal

With its extensive user base and established presence, PayPal offers a simple and accessible app user experience. With its simple appearance, the PayPal app makes it easy for users to send and receive money, handle transactions, and check their balances.

It serves a broad spectrum of users, from individuals to companies. Thus, the user interface is usable by various people. The design prioritizes simplicity so users can easily access account information and complete transactions.

Stripe vs PayPal: Customer Service

Let’s explore the debate between Stripe and PayPal in terms of Customer Service.

Stripe

Stripe’s customer care is highly regarded for being responsive and developer-friendly. Although their team mainly offers email assistance, they have a reputation for quickly resolving technical issues. To help customers find answers to frequently asked questions, the platform also provides a comprehensive knowledge base, documentation, and community forums.

Stripe provides premium support solutions, such as specialized account management and faster response times, for organizations with more complicated needs or higher transaction volumes.

PayPal

With a large user base, PayPal offers customer service by phone, email, and live chat, among other channels. It provides a thorough Help Centre with articles, frequently asked questions, and community forums so users may look up information independently.

Furthermore, PayPal offers a specialized Resolution Centre for resolving disputes. However, due to the size of its user base, PayPal occasionally experiences slower response times. In the event of a disagreement, PayPal provides additional help through its buyer and seller protection programs.

Stripe vs PayPal: Trustworthiness

Which is more trustworthy for customers? Let’s look at the trustworthiness parameter in our Stripe vs Paypal argument.

Stripe

Stripe has made a name for itself as a reliable payment processor by putting compliance and security first. The platform uses robust security measures to protect sensitive financial data while adhering to industry norms. Its track record of dependability and dedication to safeguarding user data contributes to the platform’s overall credibility for consumers and enterprises.

PayPal

Being a prominent participant in the online payment space, PayPal has built a solid reputation for dependability and credibility. The platform follows industry standards and places a high priority on security measures to safeguard user data. It is widely known and trusted by users, which helps maintain its reputation as a safe and dependable payment option for consumers and companies.

In this interview with WordPress expert Warren Laine Naida, you’ll learn much about WordPress!

Let’s summarize it in a tabular format.

What Is Best For My Business Needs: PayPal Or Stripe?

The choice between PayPal and Stripe for your business depends on various factors, such as your specific business needs, the type of products or services you offer, your target audience, and your preferences. Here, we will discuss when to choose whom according to your business preferences in the Stripe vs Paypal argument.

Choose Stripe for your business if:

- Your business strongly emphasizes customization, and you have a development team that can use a more flexible API. Stripe is known for being developer-friendly. It offers extensive customization options for a tailored payment experience.

- Your business relies heavily on subscription models. Stripe’s subscription management features are robust. It provides easy tools for handling recurring payments, billing cycles, and subscription changes.

- Cost-effectiveness is crucial, and Stripe’s transparent fee structure may be beneficial.

- Your business seeks to leverage cutting-edge payment solutions and features. In this scenario, Stripe may be more aligned with your goals.

- Your business is susceptible to chargeback disputes, so Stripe’s approach to handling and preventing chargebacks may be more favorable for you.

Choose PayPal for your business if:

- Your business operates globally, and you need a payment solution that is widely accepted and recognized internationally. PayPal is available in numerous countries, making it suitable for businesses with a diverse customer base.

- You prioritize a user-friendly and easily accessible platform. PayPal is known for its simplicity and ease of use, making it a suitable choice for businesses that want a straightforward payment process for both customers and merchants.

- You need a quick and hassle-free integration process. PayPal offers plugins and integrations for various eCommerce platforms, making it easy for businesses to set up and accept payments swiftly.

- Offering robust buyer protection features is essential for your business. PayPal is known for its buyer-friendly policies, which can attract customers who value additional security and dispute resolution mechanisms.

Conclusion

The long-lasting debate of Stripe vs PayPal is not a one-size-fits-all one in the ever-changing world of online payments. Following a thorough analysis of both platforms, including a comparison of their benefits and drawbacks, a close look at important features, and a close look at pricing models, it is clear that each service has advantages suited to certain company requirements.

Whichever platform best suits your needs—global reach and brand recognition for PayPal, developer-friendly customization, and subscription management for Stripe—the choice ultimately comes down to matching your particular needs with its advantages.

As you work through this decision-making process, keep RedSwitches‘ smooth integration in mind. As part of our dedication to providing robust dedicated servers hosting solutions, We guarantee dependable and safe hosting services, which enhance your selection of payment gateway.

FAQs

Q. Is it better to use Stripe or PayPal?

Your company’s needs will determine which of the two, Stripe and PayPal are best for you. PayPal might be better if the convenience of use and worldwide reach are your top priorities. Stripe is frequently recommended for customization and subscription management.

Q. Does Stripe charge a fee?

Yes, transaction fees are assessed by Stripe when payments are processed. The location, amount of transactions, and kind of card used are some variables that affect the fees.

Q. Is it free to use PayPal?

For private purchases, PayPal is typically free to use. However, business transactions include costs, which vary based on the type of transaction and currency. This is particularly true for online sales and receiving payments.

Q. Is there a monthly fee for a PayPal account?

Although there isn’t a monthly price for a basic account with PayPal, there may be one for particular business solutions or advanced capabilities. There’s no monthly cost required for everyday use.

Q. What is the difference between Stripe and PayPal?

Stripe and PayPal are both online payment processing services, but they differ in their fee structures, integrations, and funding timelines. Stripe is known for its developer-friendly API and customizable payment forms, while PayPal offers more comprehensive solutions for small businesses and in-person payments.

Q. Is Stripe better than PayPal for small businesses?

It depends on your specific business needs. Stripe is often favored by tech-savvy business owners and e-commerce sites due to its flexible API and lower processing fees. On the other hand, PayPal is suitable for small businesses that want a simple and easy-to-use payment gateway with a wide range of integrations and support for in-person payments.

Q. Can I accept credit card payments with both Stripe and PayPal?

Yes, both Stripe and PayPal allow you to accept credit card payments. However, their processing fees, funding timelines, and additional features may vary, so it’s important to compare the details to determine which processor is right for your business.

Q. What are the processing fees for Stripe and PayPal?

Stripe and PayPal have different fee structures. Stripe charges a flat rate per transaction, whereas PayPal’s fees can vary based on transaction volume and payment method. Additionally, PayPal offers different plans such as PayPal Payments Pro and PayPal Payments Pro ACH to cater to various business needs.

Q. Does Stripe support in-person payments?

Yes, Stripe supports in-person payments through its integration with card readers and mobile devices. This feature is especially beneficial for businesses that have both online and physical retail operations.

Q. How does PayPal compare to Stripe in terms of chargeback fees?

PayPal and Stripe have different chargeback fee structures. It’s important to review and understand the chargeback policies of each service, as they can impact your business’s bottom line when dealing with disputed transactions.

Q. What is the significance of Stripe API and PayPal Business Account?

The Stripe API is highly customizable and allows businesses to integrate payment processing directly into their websites or applications. On the other hand, a PayPal Business Account provides access to a wide range of tools and features for managing online payments, including invoicing, reporting, and customer management.

Q. Which processor is cheaper, Stripe or PayPal?

The overall cost of using Stripe or PayPal depends on your business’s transaction volume, average payment size, and specific needs. It’s recommended to compare the processing fees, additional services, and funding timelines to determine which option is more cost-effective for your business.

Q. Does Stripe allow seamless integration into e-commerce sites?

Yes, Stripe allows businesses to seamlessly integrate its payment processing into e-commerce sites. This feature streamlines the checkout process for customers and provides a secure and convenient payment experience.

Q. What is the difference between PayPal Zettle and Stripe Checkout?

PayPal Zettle is designed for in-person payments and small businesses that require a mobile point-of-sale solution, while Stripe Checkout is a customizable payment form used primarily for online transactions. Understanding the specific needs of your business, whether in-person or online, will help determine which solution is more suitable.