Key Takeaways

- In cloud computing, CapEx refers to the initial investment cost required.

- OpEx in cloud computing involves ongoing operational costs that a business incurs.

- Understanding the difference between OpEx and CapEx is essential for effective budgeting.

- The distinctions between CapEx and OpEx in cloud computing significantly affect budgeting and planning processes.

- Investing in CapEx reduces immediate liquidity due to the upfront expenditure.

- OpEx impacts cash flow as it entails regular expenses over time.

- Deciding whether to choose CapEx or OpEx depends on an organization’s strategy and available resources.

Welcome to the world of finance, where capital expenses (CapEx) and operating expenses (OpEx) play a crucial role. The CapEx vs OpEx debate is vital for any business, as it can significantly impact financial health.

Choosing between capital and operating expenses affects everything from tax benefits to cash flow management, ultimately impacting a company’s ability to invest, grow, and adapt in a competitive market. Understanding the implications of each choice helps businesses make smarter investments and maintain financial stability.

In this article, we will simplify and explain these two important financial concepts. We’ll cover the top ten differences between CapEx and OpEx, shedding light on how they affect your business’s financial planning and overall success. Join us as we dive into the details and clear up the confusion around CapEx and OpEx.

Table Of Contents

- Key Takeaways

- What is CapEx in Cloud Computing?

- What is OpEx in Cloud Computing?

- Why You Need To Understand CapEx vs OpEx

- Key Differences Between CapEx and OpEx in Cloud Computing

- CapEx vs OpEx: Scaling

- Capex vs OpEx: ROI

- CapEx vs OpEx: Costs in IT

- CapEx vs OpEx: Paid for

- CapEx vs OpEx: Amount Paid

- CapEx vs OpEx: Ownership and Responsibility

- CapEx vs OpEx: Accounting Treatment

- CapEx vs OpEx: Taxation Treatment

- CapEx vs OpEx: Innovation and Adaptability

- CapEx vs OpEx: Financing

- CapEx vs OpEx Cloud: Which Is Right For You?

- How do capital expenditures affect cash flow?

- Conclusion

- FAQs

What is CapEx in Cloud Computing?

Credits: Freepik

CapEx in cloud computing is similar to the conventional CapEx approach we discussed briefly earlier. In this case, capital expenditures are specific to cloud technology and refer to the company’s expenses to buy long-lasting assets. These assets continue to benefit the business well beyond the current tax year.

They are usually big, one-time purchases that will belong exclusively to the company upon transaction completion. Because these are expensive and important purchases, they need careful approval and detailed planning before buying.

A company’s ability to recoup its capital expenditures (CapEx) investment may be delayed. For instance, an organization will still need to furnish the space even after completing the real estate purchase of a data center. Therefore, they will not be able to utilize the asset right now.

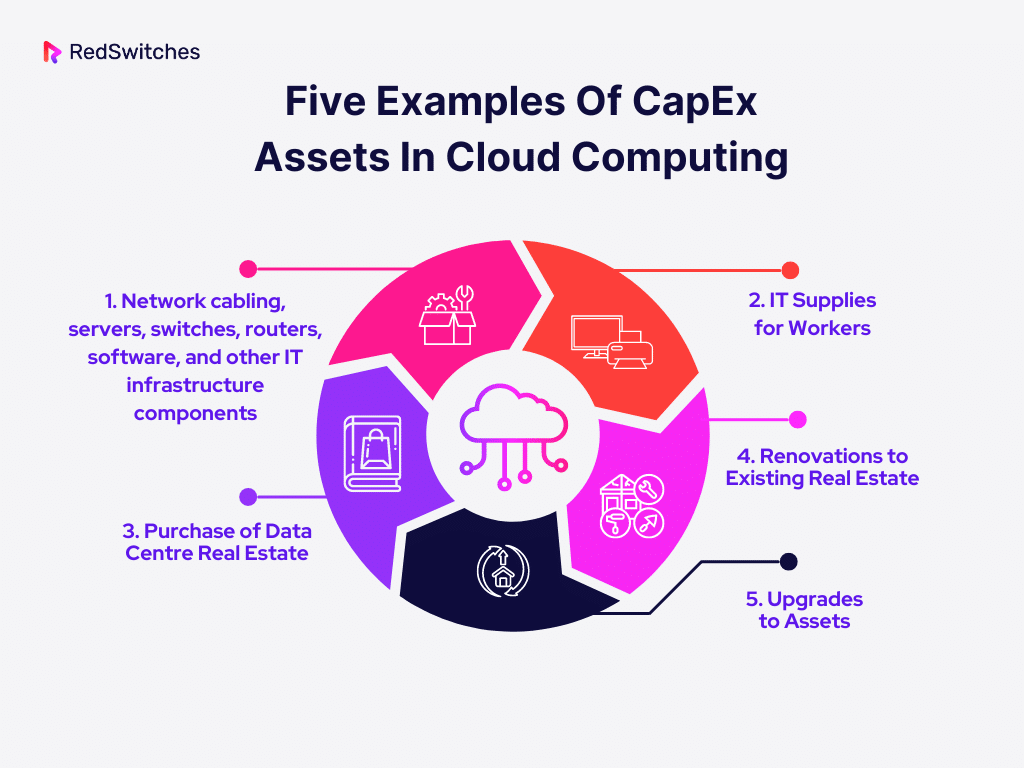

Five Examples Of CapEx Assets In Cloud Computing

In this section of our blog, we will understand five examples of CapEx assets in cloud computing.

Network Cabling, Server Switches, Routers, Software, And Other IT Infrastructure Components

Strong IT infrastructure is the foundation of the cloud computing world. Purchases of servers, switches, routers, software licenses, and network cabling are all considered capital expenses. These fundamental components enable scalability and efficiency in delivering services, serving as the technological cornerstone around which cloud services are constructed.

IT Supplies for Workers

CapEx ensures workers have the resources to perform their jobs well. This covers computers, tablets, laptops, and other gadgets necessary for daily tasks. Investing in employee IT equipment upfront maximizes productivity and preserves a competitive advantage in cloud computing.

Purchase of Data Centre Real Estate

Purchasing property is a significant capital outlay for constructing data centers. A long-term commitment to the cloud computing landscape can be seen in constructing or acquiring buildings to house servers and other essential infrastructure, offering a physical location to guarantee data security, redundancy, and uninterrupted operation.

Renovations to Existing Real Estate

Capital Expenditure (CapEx) goes beyond initial acquisitions to encompass enhancements and renovations to existing real estate. It is imperative to upgrade facilities to comply with ever-changing compliance requirements and technology standards. Upgrades to power infrastructure, cooling systems, and physical security measures might be necessary to meet cloud computing requirements.

Here’s our comprehensive overview of IT architecture’s definition, types, and strategies. It’s an unmissable guide for those who want to thrive in the IT industry!

Upgrades to Assets

Being at the forefront of technology, cloud computing requires constant progress to remain competitive. Capital expenditures are set aside for modernizing servers and other current assets to ensure they can handle cloud services’ increasing performance requirements. These updates maintain the ability to manage growing workloads, security, and efficiency.

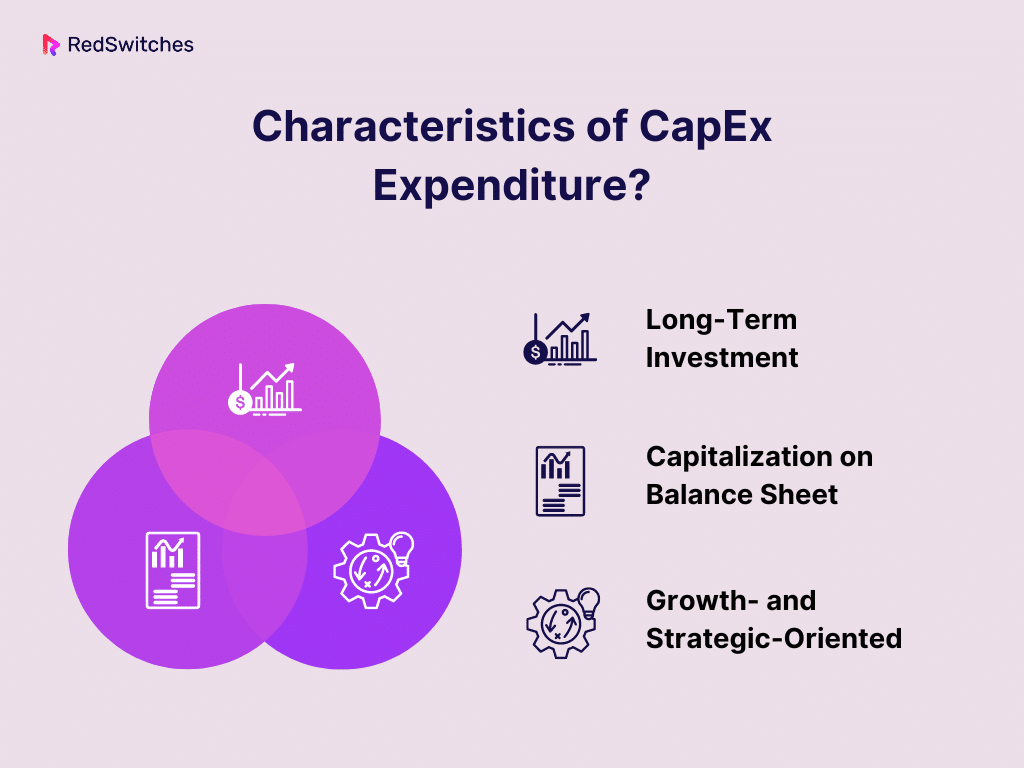

What are the Characteristics of CapEx Expenditure?

Now, we will understand the characteristics of CapEx expenditure.

Long-Term Investment

Capital expenditures (CapEx) usually entail significant, long-lasting investments that offer a company long-term advantages. These costs are intended to purchase or modernize assets that ensure the business’s long-term operating capability and enhance effectiveness.

One example is acquiring property, plant, and equipment (PP&E) such as structures, vehicles, or technological infrastructure.

Capitalization on Balance Sheet

Capital expenses are capitalized on the balance sheet rather than immediately expensed. This indicates that the asset’s cost is dispersed throughout its helpful life via depreciation.

Growth and Strategic Oriented

Capital expenditures, also known as CapEx, are investments that focus on a company’s growth and strategic goals. These expenses are about big projects that help the company grow stronger and more competitive.

For instance, they might spend money on opening up new markets, increasing how much they can produce, or updating their technology to stay ahead. All these actions align with the company’s plans for long-term success and expansion.

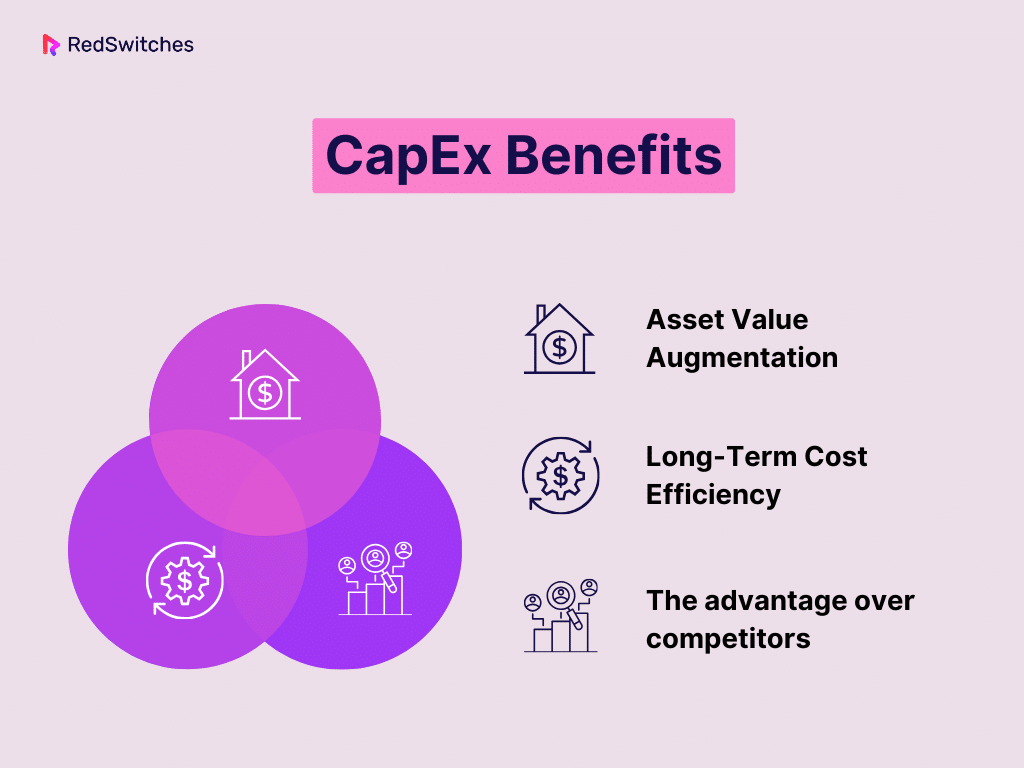

CapEx Benefits

After dealing with its characteristics, we will learn the advantages of CapEx here.

Asset Value Augmentation

Investments in capital equipment help a business’s asset value to increase. CapEx expenditures raise a company’s property, plant, and equipment (PP&E) total value by purchasing new assets or renovating old ones, which has a favorable effect on the balance sheet.

Long-Term Cost Efficiency

Capital expenditures frequently lead to long-term cost efficiency, notwithstanding the initial cash outlay. Investments in cutting-edge, efficient technology, infrastructure, and equipment throughout an asset’s useful life can result in lower maintenance costs, increased productivity, and decreased operating costs.

The Advantage Over Competitors

Strategic capital expenditures help companies maintain market competitiveness. Businesses can obtain a competitive edge, set themselves apart from rivals, and establish themselves as industry leaders by investing in state-of-the-art technology, increasing manufacturing capacity, or streamlining operating procedures.

Explore these web hosting blogs, crafted by expert web hosts of RedSwitches!

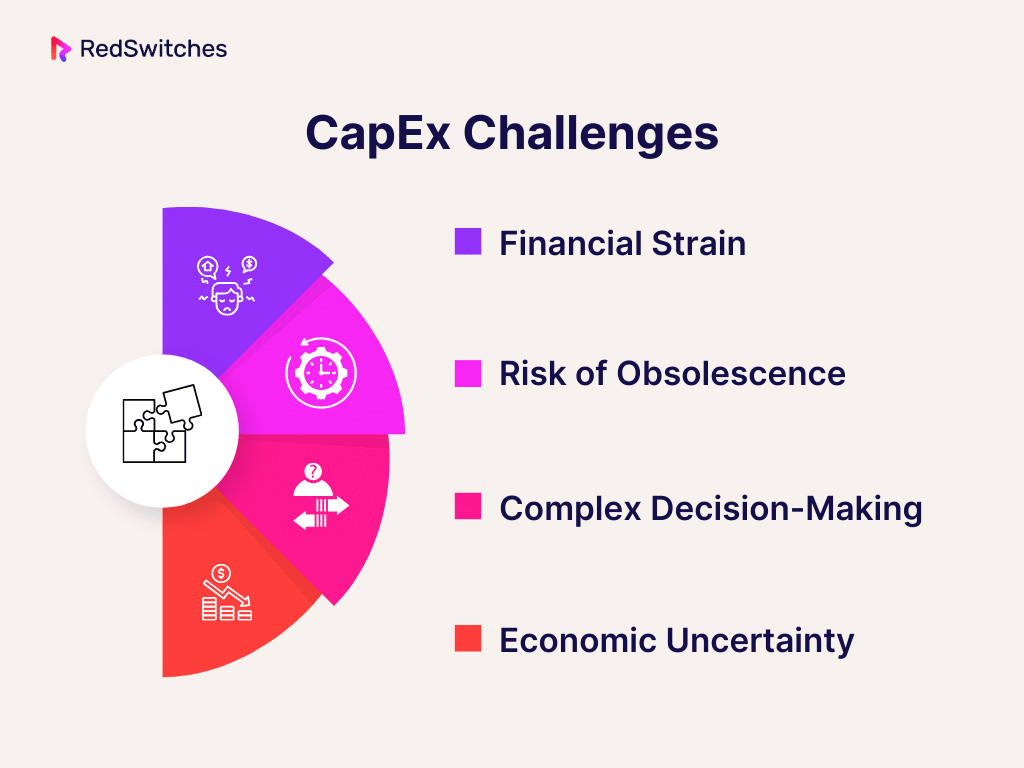

CapEx Challenges

Now, it’s time to discuss the risks or challenges associated with CapEx.

Financial Strain

A company’s finances are heavily burdened when it undertakes capital expenditures, which frequently call for significant upfront commitments. Managing cash flow and securing funding for these significant initiatives can be challenging, particularly for small or financially strapped businesses. Balancing necessary investments while maintaining financial security can be challenging.

Risk of Obsolescence

In quickly changing industries, there’s a chance that assets or technology purchased with capital expenditures (CapEx) will age more quickly than expected. This problem is especially important in information technology, where things are developing quickly.

Complex Decision-Making

Making capital expenditure decisions is a complicated process that requires careful evaluation of the risks and long-term benefits. Choosing the appropriate projects, estimating future cash flows, and accurately determining the return on investment (ROI) might be challenging.

Economic Uncertainty

Economic conditions, including interest rates, inflation, and market volatility, can strongly impact the viability and profitability of capital projects. Uncertain economic conditions may discourage businesses from entering into long-term agreements, which could result in the postponement or cancellation of scheduled capital expenditures.

What is OpEx in Cloud Computing?

Credits: Freepik

OpEx in cloud computing is comparable to an old-fashioned OpEx plan. All operating costs, however, support multitenant, private, hybrid, and public cloud initiatives—just like capital expenditures do. OpEx purchases are usually pay-as-you-go or subscription-based instead of centered around a sizable, upfront expense. This way, the service provider owns the OpEx assets instead of just the company that uses them.

Furthermore, these assets may typically be employed immediately (or soon after the contract is signed). In contrast, capital equipment (CapEx) assets may require time to pay for themselves after the first expenditure.

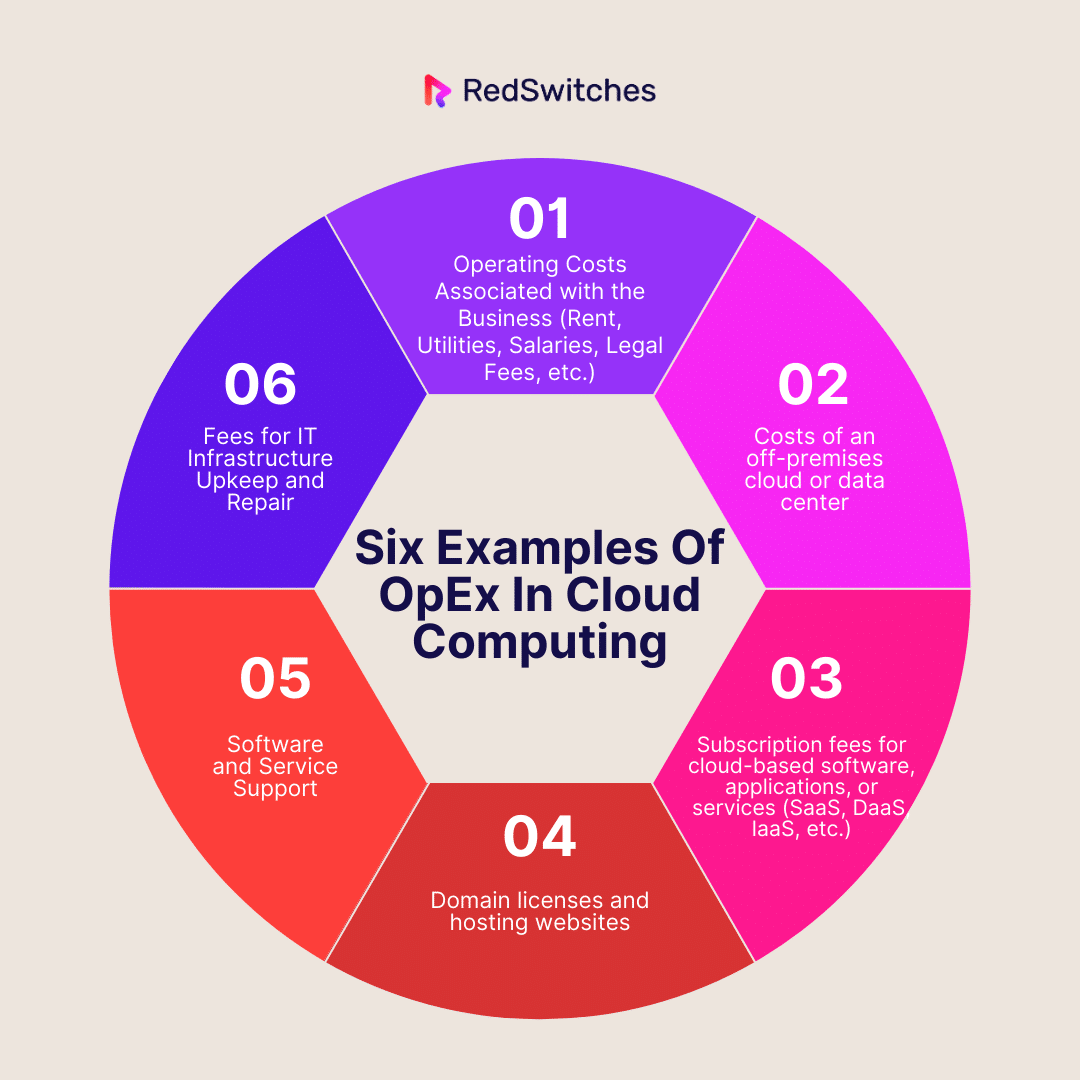

Six Examples Of OpEx in Cloud Computing

Let’s learn about some examples of OpEx for better understanding.

Operating Costs Associated with the Business

Operating expenses (OpEx) refer to a range of business-related costs necessary for daily operations in cloud computing. This covers utilities, office rent, employee salaries, marketing charges, and legal fees. Although these expenses are not directly related to the cloud infrastructure, they are essential to the general running of the company and help foster an atmosphere that supports cloud-based activities.

Costs of an Off-premises Cloud or Data Center

The continuous costs of hosting and maintaining the physical infrastructure are included in the operating expenses of data centers and off-premises cloud computing facilities. This covers costs incurred by the facility provider for operations, such as utility bills and data center leases.

Subscription Fees for Cloud-based Software, Applications, or Services

Operating expenses include subscription fees for cloud-based software, apps, or services. Cloud service paradigms such as Infrastructure as a Service (IaaS), Desktop as a Service (DaaS), Software as a Service (SaaS), and others can be included in this. To access and use these services, businesses must pay regular membership fees; these recurring expenses are classified as operating expenses.

Domain Licenses and Hosting Websites

Web hosting and domain-related costs are included in operating expenses for companies with an online presence. Recurring operating expenses include cloud-based web hosting services, domain registration fees, and associated charges for keeping an online presence.

Software and Service Support

Operating expenses cover the ongoing costs of maintaining and supporting software and cloud services. This includes paying for updates, fixes, and getting help from service providers. Businesses need these services to keep their software working well, safe, and sound for everyday work.

Fees for IT Infrastructure Upkeep and Repair

The servers and networking hardware that comprise cloud-based IT infrastructure must be maintained regularly and occasionally repaired. Operating expenses are the related charges for the upkeep and repairs of this infrastructure. The performance and dependability of the cloud infrastructure supporting the company’s digital operations depend on these costs.

Explore this link to learn how much a server cost.

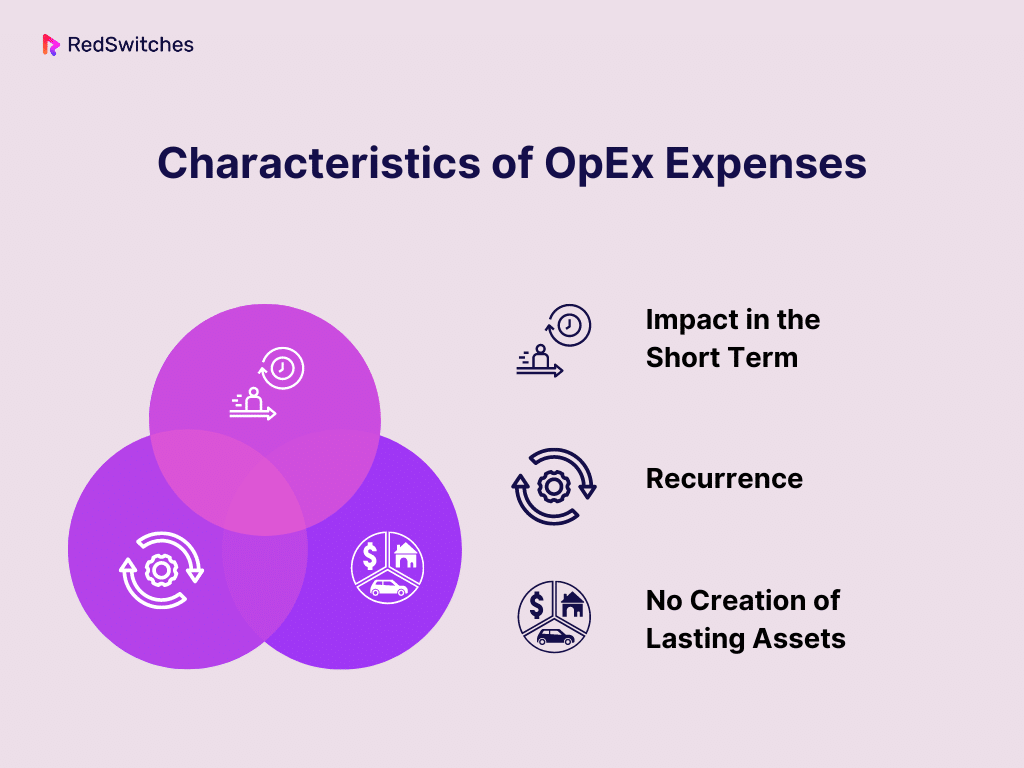

What are the Characteristics of OpEx Expenses?

Before moving into the core debate of CapEx vs OpEx, let’s understand the characteristics of

OpEx expenses.

Impact in the Short Term

Operating expenses (OpEx) usually have an instantaneous effect on the income statement, influencing the short-term profitability of the business. OpEx is recognized as an immediate cost when incurred, in contrast to capital expenditures (CapEx), which are capitalized and depreciated over time.

Recurrence

Throughout the usual business operations, operating expenses come up regularly. A few examples are rent, utilities, salary, and subscription costs for continuous services. These costs are recurring, which emphasizes how important they are to the continuation of regular corporate operations.

No Creation of Lasting Assets

OpEx does not create lasting assets, unlike CapEx, which entails constructing or acquiring long-term assets. Instead, it represents the expenses incurred when continuing corporate operations with current resources or services. The goal of OpEx is to keep operations running at their current level.

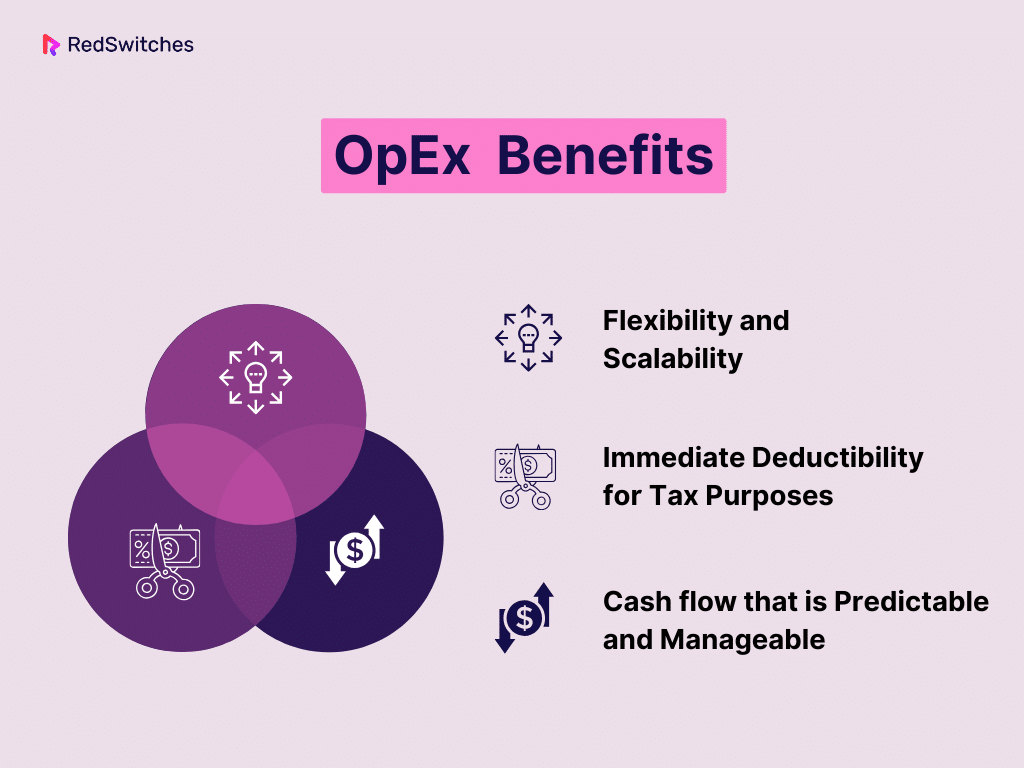

OpEx Benefits

Now, let’s understand the benefits of OpEx.

Flexibility and Scalability

Operating expenses (OpEx) provide enterprises with great flexibility in the ever-changing world of cloud computing and subscription-based services. Without making long-term expenditures, businesses can use OpEx to scale operations up or down in response to changing needs. This adaptability is especially helpful when market conditions are changing quickly.

Immediate Deductibility for Tax Purposes

For tax purposes, operating expenses are usually entirely deductible in the year they are incurred. This allows for immediate deductibility. Businesses benefit monetarily from this instant deductibility because it lowers taxable income for the current reporting period. This can improve cash flow and offer a quicker tax benefit than capital expenditures.

Cash Flow That is Predictable And Manageable

Since operating expenses are usually regular and predictable, firms can better plan and control their cash flow. Organizations can predict costs, budget appropriately, and preserve financial stability when these expenditures are made regularly. This predictability is essential for daily operational management and short-term financial planning.

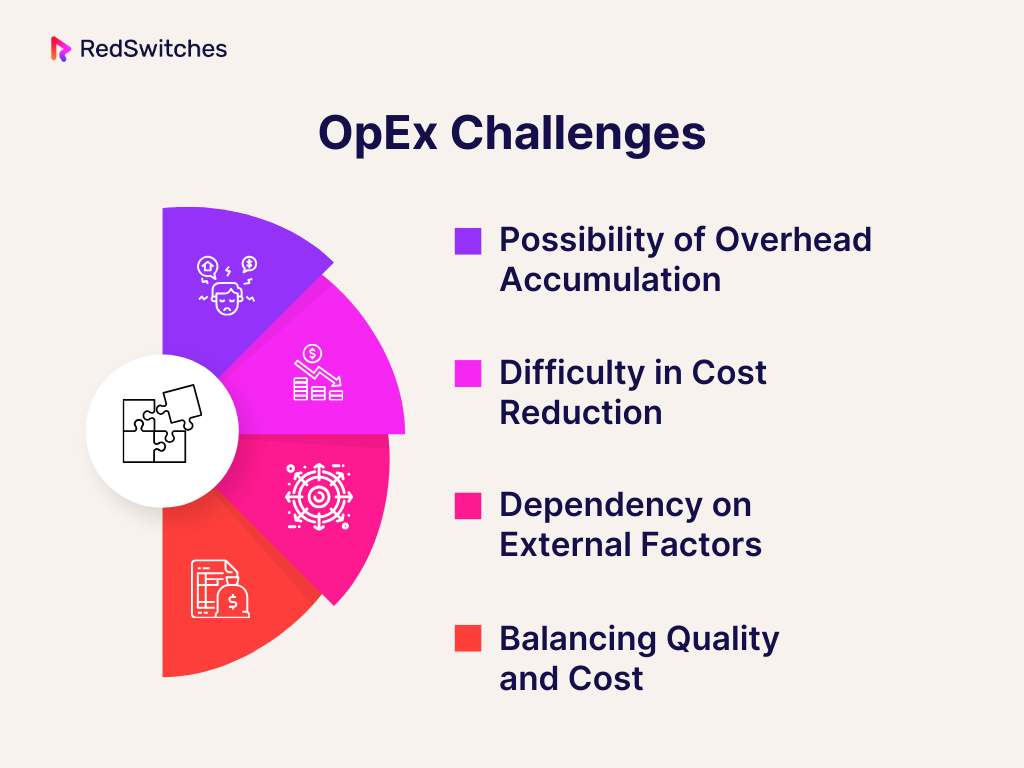

OpEx Challenges

Now, we will discuss the shortcomings of OpEx.

Possibility of Overhead Accumulation

One of the difficulties with operating expenses (OpEx) is the possibility of overhead costs building up. Businesses may unintentionally accrue excessive running costs over time, lowering their profitability. Effective cost control and regular assessments are crucial to finding and fixing wasteful or duplicate spending.

Difficulty in Cost Reduction

Cutting operating expenses can be difficult, unlike capital expenditures, which are sometimes more arbitrary and require careful planning. Some expenses, including rent, utilities, and salaries, could not be negotiable at all or might be fixed. As a result, it could be challenging for companies to react to shifting economic conditions by cutting expenses fast and dramatically.

Dependency on External Factors

Variations in the price of goods and services, market circumstances, and inflation are just a few external factors that frequently affect operating expenses. When these external factors cause unanticipated increases in operating costs, which affect overall financial performance, businesses may find it challenging to manage their OpEx.

Balancing Quality and Cost

Maintaining the quality of goods and services while controlling costs is a difficult balance that must be struck while managing operating expenses. Businesses may find it difficult to avoid making concessions that could harm the caliber of their goods or services, customer satisfaction, and overall competitiveness in an attempt to cut costs.

Don’t miss out on this all-in-one guide on how to start an eCommerce business!

Why You Need To Understand CapEx vs OpEx

The most apparent question striking in your mind is the need to understand CapEx and OpEx. Let’s discuss it through three examples.

Example #1

You can buy new data storage systems if you need more space to host your data. Whether you fund it with cash or borrow money, it will be a capital expenditure.

On the other hand, renting more virtual storage qualifies as an operational expense since it is continuous.

Example #2

Capital expenditures are incurred when servers, PCs, and networking equipment are purchased from a vendor and installed in a data center. However, using a cloud provider like AWS to rent virtual machines, computation capacity, and associated infrastructure adds to operating costs.

Example #3

Operating expenses include general upkeep and repairs to already-existing fixed assets, such as structures and machinery. However, if the upgrades increase the asset’s usable life, the costs become capital expenditures.

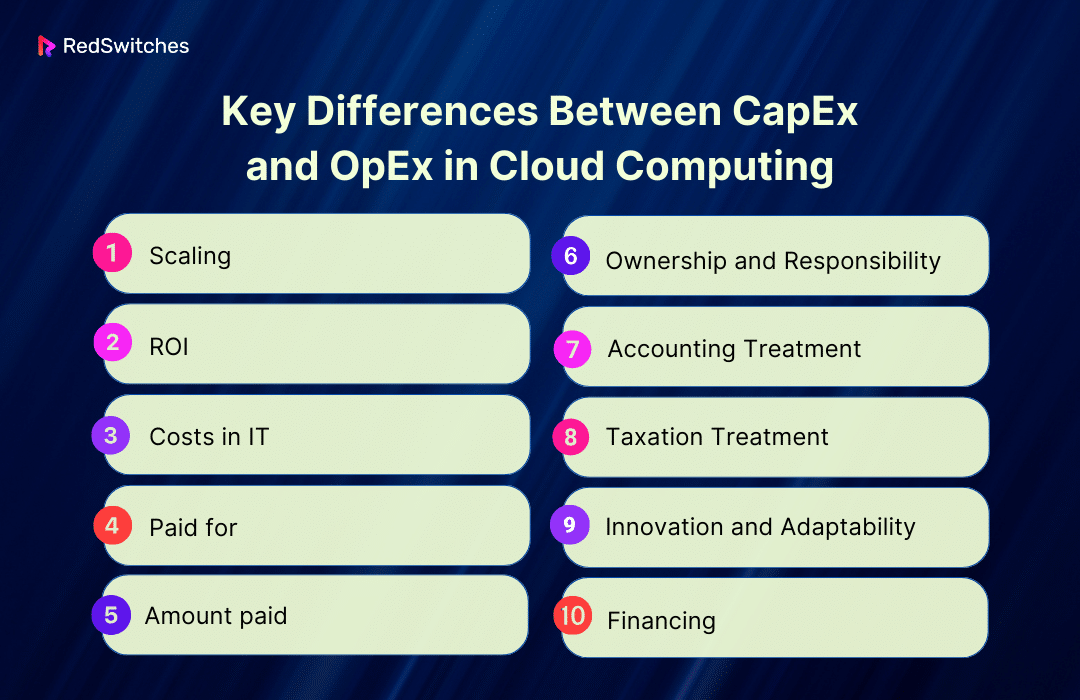

Key Differences Between CapEx and OpEx in Cloud Computing

In this section of our blog, we will understand the core part of our blog i.e. CapEx vs OpEx key differences, in detail. Let’s start.

CapEx vs OpEx: Scaling

The first point of difference in our CapEx vs OpEx debate is scaling.

CapEx

CapEx scaling is the process of investing up front. It’s for long-term assets that may support growth or rising demand. Companies scale via capital expenditures (CapEx). They may invest in new buildings, sophisticated equipment, or more servers. CapEx scaling often requires a big upfront investment. But, it offers a strong platform for future growth.

OpEx

We use a more flexible and gradual strategy. This is used when growing with operational expenditures (OpEx). OpEx scaling is changing current operating expenditures. It does so to meet short-term demands without making long-term investments. For instance, businesses can quickly scale their operations in cloud computing. They adjust subscription levels for software, cloud services, and other resources. They can scale up or down.

Capex vs OpEx: ROI

The following parameter in the CapEx vs OpEx argument is ROI.

CapEx

Investment return (ROI) and capital spending (CapEx) are linked, but this link grows over time. CapEx means spending much upfront on assets, hoping they pay off later. To find the ROI for CapEx, we look at the extra money made, costs saved, or other financial benefits from the investment.

OpEx

On the other hand, operating expenses (OpEx) support a quicker and more palpable return on investment. The benefits of OpEx are felt quickly since they are recurring expenses closely related to daily operations. This is especially true for financial commitments like marketing campaigns, where outlays produce instant exposure, client interaction, and possible income.

CapEx vs OpEx: Costs in IT

The next point of difference in our CapEx vs OpEx debate is Costs in IT.

CapEx

CapEx in IT usually involves big, one-time investments in assets. The assets will eventually be appreciated. CapEx might include buying servers. It could also include networking gear and data storage infrastructure for an on-site data center. On the balance sheet, these expenses are capitalized and gradually discounted.

OpEx

In information technology, operating expenditures, or OpEx, are the continuous costs that keep IT operations running smoothly. This covers the price of software subscriptions, maintenance agreements, cloud service fees, and the salary of IT staff. In the income statement, OpEx is usually shown as an immediate expense in the IT industry.

CapEx vs OpEx: Paid for

Let’s discuss the difference in our CapEx vs OpEx debate regarding paid for.

CapEx

Finance arrangements or upfront contributions are usually used to cover capital expenditures. A sizable upfront payment is frequently required when a company invests in long-term assets like real estate, machinery, or infrastructure. This payment may be made with loans, readily accessible funds, or a mix. Depreciation is then used to distribute the CapEx costs over the asset’s useful life.

OpEx

Paying for continuous, daily expenses in everyday business operations is known as operating expenditures or OpEx. Usually, these expenses are covered during the time when they are incurred. OpEx payments pay for various operating costs, including rent, utilities, personnel compensation, and other consumables.

CapEx vs OpEx: Amount Paid

Let’s discuss the difference in our CapEx vs OpEx debate regarding Amount Paid.

CapEx

CapEx is large upfront payments or financing for long-term asset growth, upgrade, or purchase. It is usually paid for upfront and is a substantial venture expense. Over the asset’s useful life, this expense is capitalized on the balance sheet and depreciated.

OpEx

Operating expenditures, or OpEx, are the continuous, recurring payments made to a corporation to meet its daily operating requirements. OpEx payments are recurring, meaning they usually happen more frequently—monthly or yearly, for example. These contributions cover essential costs such as rent, utilities, salaries, and other consumables. OpEx payments affect the income statement for the period they occur since they are seen as immediate expenses.

It’s a read-worthy article on paying for a Dedicated Server with Bitcoin.

CapEx vs OpEx: Ownership and Responsibility

This section will discuss the ownership and responsibility parameters in the CapEx vs OpEx debate.

CapEx

As the buyer of long-term assets, the organization bears ownership and accountability in the case of capital expenditures (CapEx). A business takes ownership of capital assets when it invests in things like real estate, machinery, or infrastructure. The organization bears the duty for the upkeep, depreciation, and optimal operation of these assets throughout their useful lives.

OpEx

Ownership and accountability for operating expenses (OpEx) typically rest with suppliers or service providers. The outside providers retain ownership of the services or resources when a business pays operational costs like utility bills, software licensing fees, or subscription fees for cloud services.

CapEx vs OpEx: Accounting Treatment

This section will discuss the Accounting Treatment parameters in the CapEx vs OpEx debate.

CapEx

Compared to operating expenses (OpEx), accounting handles capital expenditures (CapEx) differently. On the balance sheet, the expenses related to capital expenditures are capitalized. This indicates that instead of appearing as an immediate expense on the income statement, the expense is listed as an asset.

OpEx

On the income statement, operating expenditures (OpEx) are promptly expensed in the period they are incurred. To determine net income, these expenses are subtracted from revenue. This gives a clearer picture of the costs related to regular business operations. OpEx is seen as an ordinary business expense and immediately affects the company’s profitability for the specified accounting period.

CapEx vs OpEx: Taxation Treatment

This section will discuss the Taxation Treatment parameters in the CapEx vs OpEx debate.

CapEx

Regarding taxes, capital expenditures (CapEx) are handled differently than operating expenses (OpEx). Most of the time, CapEx expenses are not entirely deductible in the year they are incurred. Instead, these expenses are frequently depreciated over the asset’s useful life. In the following years, the depreciation expense is deducted from taxable income.

OpEx

For tax reasons, operating expenses (OpEx) are typically completely deductible in the year they are incurred. Generally speaking, businesses are permitted to deduct all their operational costs from their taxable revenue in the year they are incurred or paid.

CapEx vs OpEx: Innovation and Adaptability

This section will discuss the Innovation and Adaptability parameters in the CapEx vs OpEx debate.

Capital Expenditures (CapEx)

In a fast-paced business climate, Capital Expenditures (CapEx) are essential for stimulating innovation and improving a company’s flexibility. Businesses frequently use capital expenditures (CapEx) to fund significant investments in R&D, innovative technology, and game-changing initiatives. These large initial outlays are intended to acquire resources to advance the company, spur innovation, and preserve a competitive advantage.

Operating Expenditures (OpEx)

In contrast, operating expenses (OpEx) primarily concern a company’s daily operating needs. OpEx is typically linked with maintaining current procedures rather than fostering innovation, even if they are necessary for maintaining continuing activities. These costs support the ongoing operation of the business and include things like rent, utilities, salaries, and supplies.

CapEx vs OpEx: Financing

Let’s understand the CapEx vs OpEx difference concerning financing.

Capital Expenditure (CapEx)

Because capital expenditures are large upfront commitments, financing them needs significant thought and preparation. Companies that want to fund capital expenditure projects (CapEx) frequently look at some financing options, such as debt financing, retained earnings, equity financing, and government grants or subsidies. Debt finance entails taking out loans or issuing bonds, whereas equity financing involves selling ownership holdings to raise money.

Operational Costs (OpEx)

Financing operating expenses is more frequent and urgent in overseeing a company’s finances. Usually, companies rely on the operating cash flow from their daily operations to pay for continuous costs like rent, utilities, and membership dues. However, businesses may resort to solutions like working capital loans and trade credit discussions when short-term finance is required.

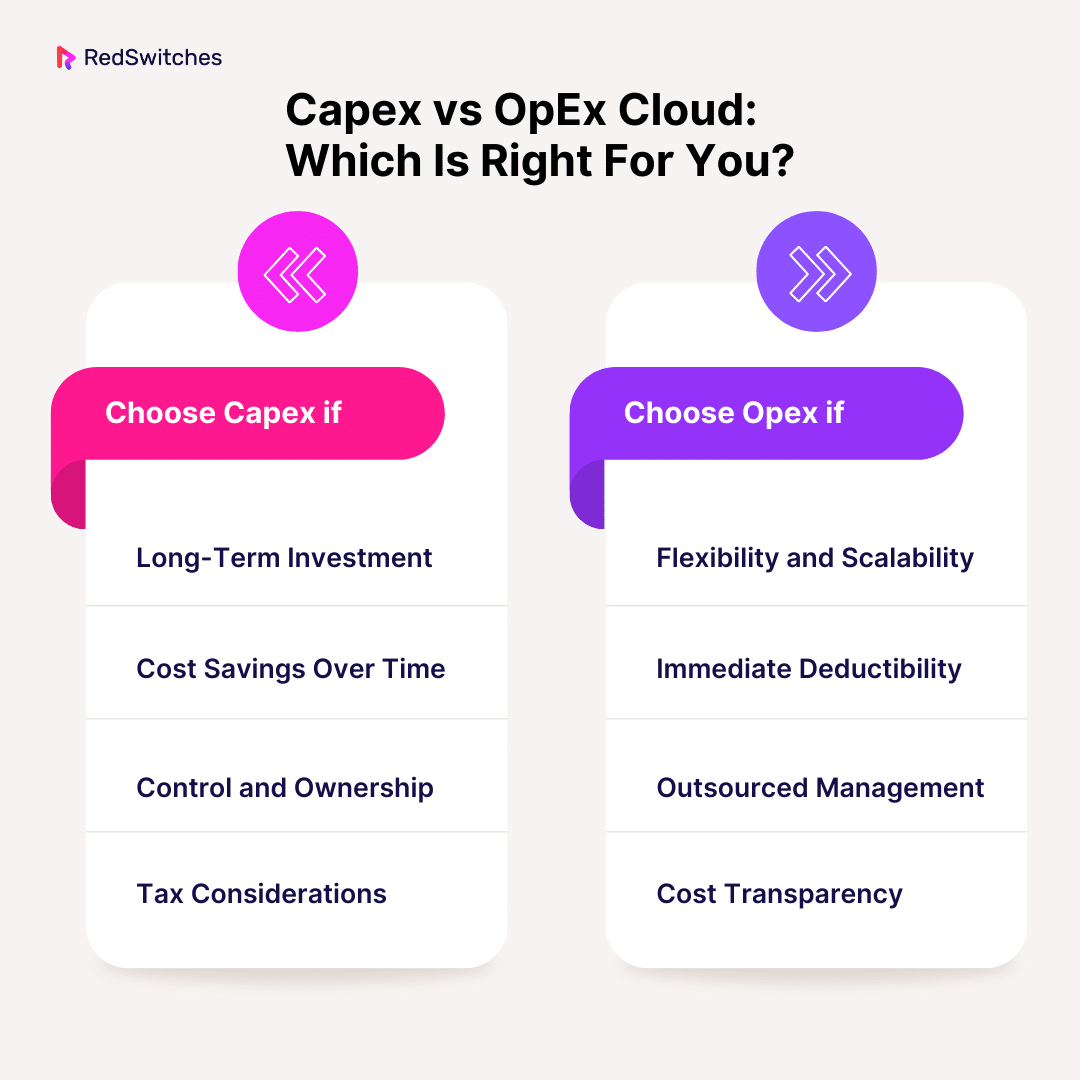

CapEx vs OpEx Cloud: Which Is Right For You?

We discussed the key differences to understand the CapEx vs OpEx debate. Now, let’s find your best choice.

Choose CapEx if:

- Long-Term Investment: Selecting CapEx is advised if your company has a steady and predictable workload and you can make thoughtful, long-term investments in infrastructure. This is especially important if you know exactly how many resources you will require over the long term.

- Cost Savings Over Time: Capital Equipment Purchasing (CapEx) may be the best option if you can make significant upfront investments to realize cost savings over the asset’s useful life. This is typical when constructing or growing physical infrastructure, like a data center or proprietary software.

- Control and Ownership: CapEx enables ownership and direct management if your company values control over its IT infrastructure and assets. This is important when internal control over the complete technological stack is required due to unique security or compliance needs.

- Tax Considerations: Depreciation on capital expenditures often provides tax advantages over several years. CapEx might make sense for your tax plan if your company can stretch out tax deductions for a sizable initial investment.

Choose OpEx if:

- Flexibility and Scalability: OpEx is a more flexible option if your company operates in a dynamic environment with varying workloads. In the cloud, the pay-as-you-go approach makes it simple to scale resources up or down in response to urgent demands.

- Immediate Deductibility: OpEx enables instant deductibility from income for taxation purposes. For immediate tax benefits, an OpEx model is preferable if your company prioritizes being able to deduct expenses in the current fiscal year.

- Outsourced Management: OpEx is the best option if your company would rather concentrate on its core skills than handle IT infrastructure management. Cloud services frequently include outsourced security, upgrades, and maintenance, freeing up your team to focus on critical projects.

- Cost Transparency: Budgeting and financial planning are made more accessible by OpEx’s evident and predictable operational costs. An OpEx model is more appropriate if transparency is essential to your company and you wish to avoid significant, erratic upfront investments.

How do capital expenditures affect cash flow?

CapEx directly impacts cash flow. It does so mostly through the investment activities column of the cash flow statement. A business makes capital expenditures when it invests in long-term assets. These assets include things like real estate, machinery, or infrastructure.

The cash outflow related to these expenses decreases the company’s total cash balance. Capital expenditures have advantages. They pay off over a long time because the assets they buy will generate future revenue or cost savings. But, the impact on the cash flow statement is immediate.

Managing capital spending well requires balancing the need for key investments and the need for cash to maintain a good cash flow.

Conclusion

In short, choosing between capital expenditures (CapEx) and operational expenditures (OpEx) in the cloud is crucial. It requires careful evaluation of each company’s needs and goals. We examined the complexities of managing IT investments. We investigated both financial models’ definitions, advantages, and drawbacks. We examined the 10 main differences in our CapEx vs OpEx cloud computing debate. This showed the complex factors affecting this choice.

The flexibility of OpEx and the long-term investment potential of CapEx are key. Organizations must consider them as they navigate the ever-changing world of cloud computing. RedSwitches stands out as a partner in this fast-moving field. They use a deep understanding of financial models to offer custom solutions.

FAQs

Q. CapEx vs OpEx: What is the difference between CapEx and OpEx?

CapEx requires big upfront investments in long-term assets. OpEx is for ongoing, day-to-day operational expenses. CapEx creates assets, and OpEx covers business activities.

Q. CapEx vs OpEx: Are laptops CapEx or OpEx?

Laptops are usually CapEx when bought as part of a long-term IT investment. But, they can be OpEx if leased or expensed for short-term use.

Q. CapEx vs Opex: Is Azure CapEx or OpEx?

Microsoft Azure is an OpEx. It uses a pay-as-you-go model. Users pay for cloud services based on usage. This provides flexibility and scalability without big upfront costs.

Q. Is R&D CapEx or OpEx?

R&D expenses are usually treated as OpEx. They are ongoing costs for innovation and product development. They are not for creating long-term assets.

Q. Is R&D CapEx or OpEx?

R&D expenses are usually treated as OpEx. They are ongoing costs for innovation and product development. They are not for creating long-term assets.

Q. What is the difference between CapEx and OpEx?

CapEx refers to expenses to buy or upgrade physical assets like property, plant, or equipment. The benefits are expected over several years. OpEx, however, is for day-to-day expenses. They are needed for a business to function.

Q. How do CapEx and OpEx impact financial statements?

CapEx is typically reflected on the balance sheet as an asset and depreciated over time, while OpEx is recorded on the income statement as expenses incurred during a specific period.

Q. What are some examples of CapEx projects?

Examples of capital expenditures include purchasing new machinery, constructing a new building, or investing in software development.

Q. Can you provide examples of operating expenses included in OpEx?

Operating expenses (OpEx) encompass day-to-day costs such as rent, utilities, salaries, and advertising expenses necessary for ongoing business operations.

Q. How are CapEx and OpEx distinguished in financial reporting?

Capital expenditures are considered long-term investments with benefits realized over time, while operating expenses are essential for day-to-day operations and are incurred regularly.

Q. What are the implications of CapEx and OpEx on financial performance?

CapEx spending can impact profitability in the long term by enhancing operational efficiency and productivity, while OpEx directly affects short-term financial results.

Q. Why is it essential to understand the difference between CapEx and OpEx?

Understanding the distinction between capital and operational expenditures is crucial for making informed financial decisions, managing resources effectively, and evaluating the financial health of a business.